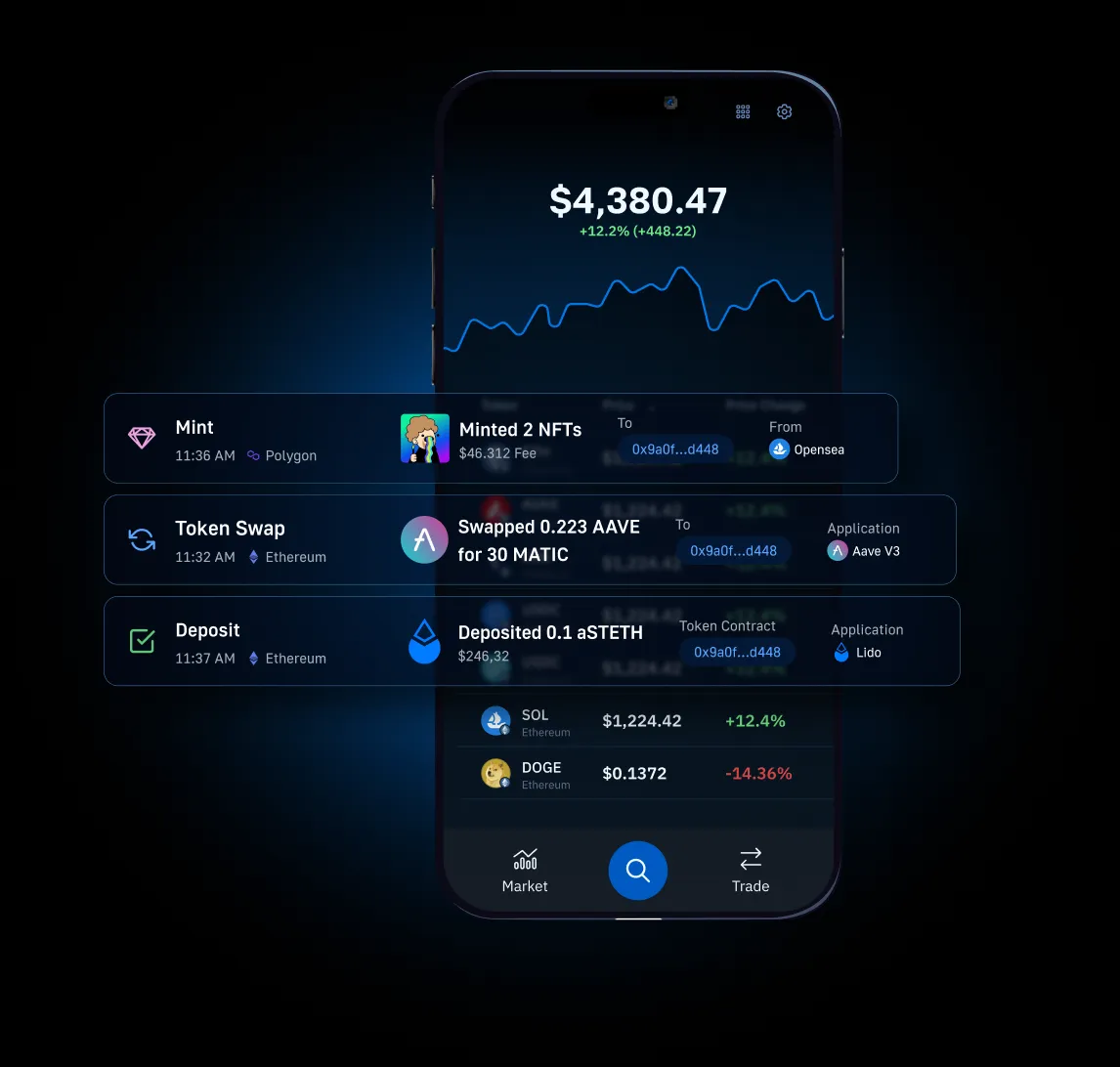

DeFi is moving fast, and users are demanding more than just access to protocols on a single chain. The real game-changer? Unified wallets that deliver a seamless cross-chain UX, letting users manage assets and execute swaps across EVM chains, Solana, Cosmos, and more, all from one intuitive interface. The days of juggling multiple wallets and remembering endless seed phrases are over. Now, with unified wallet cross-chain solutions, DeFi finally feels as fluid as Web2 fintech.

Why Cross-Chain UX Is the Next Frontier in DeFi

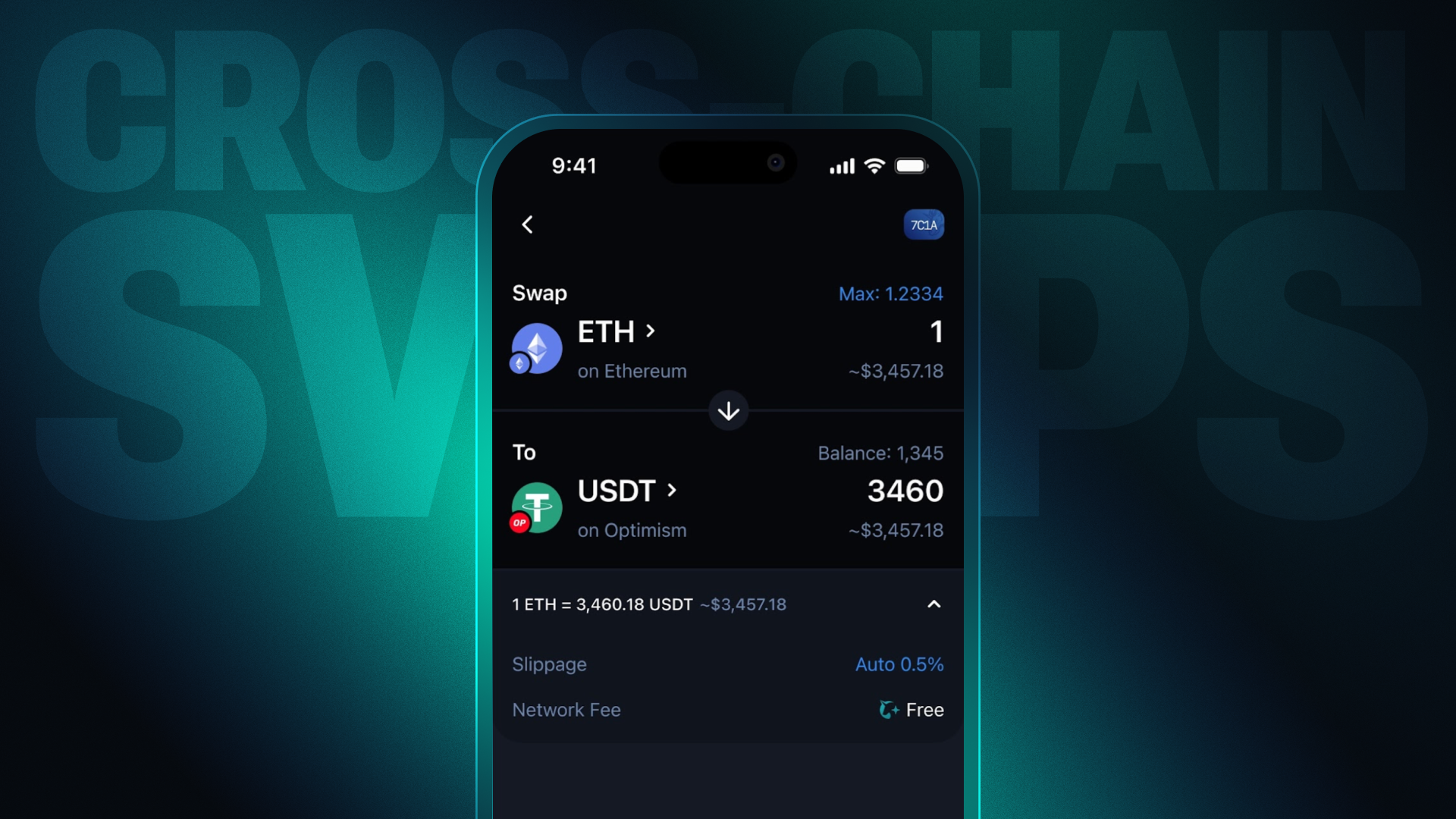

The DeFi ecosystem is no longer siloed. Major platforms like 1inch have pioneered direct swaps between Solana and 12 and EVM chains, no bridges, no third-party risk, just pure self-custody and MEV protection. This is a massive leap for anyone who’s ever felt the pain of moving assets between networks or paid sky-high bridge fees. Cross-chain asset management is now a reality: users can swap SOL for ETH without leaving their wallet or worrying about security gaps.

This isn’t just about convenience; it’s about unlocking liquidity and opportunity across the entire crypto landscape. Imagine tracking your Bitcoin, swapping Polygon tokens for Solana NFTs, or providing liquidity on Cosmos, all without switching tabs or wallets. Unified wallets abstract away technical hurdles so you can focus on trading, yield farming, or exploring new protocols with zero friction.

How Unified Wallets Work: Under the Hood

The magic lies in integration. Unified wallets like Unify and PUM Exchange aggregate multiple blockchains into one secure interface. Here’s what sets them apart:

Top Features of Modern Unified Cross-Chain Wallets

-

Seamless Cross-Chain Swaps: Instantly swap assets between major networks like Solana and 12+ EVM chains with platforms such as 1inch, all without risky bridges or third-party tools.

-

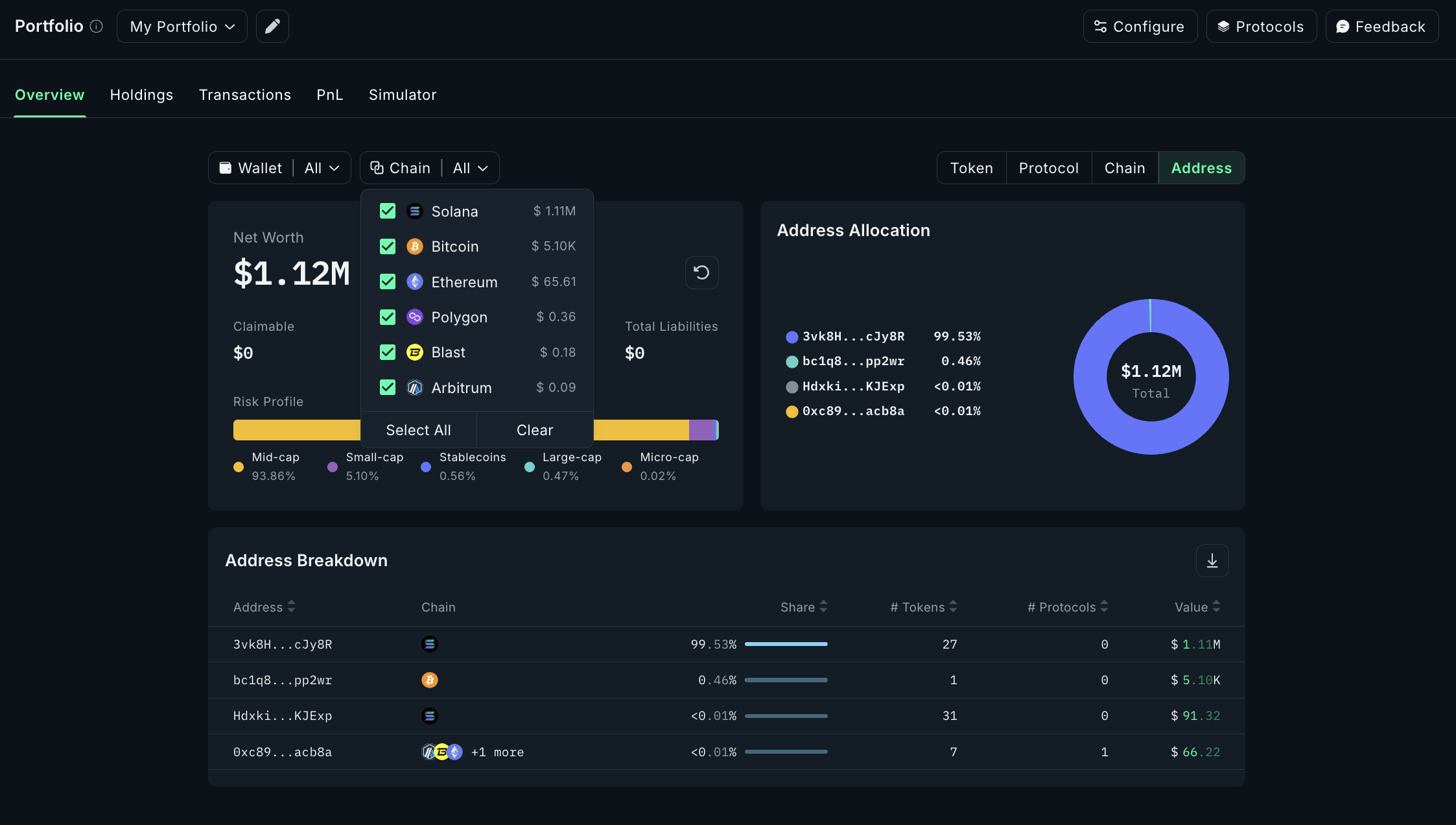

All-in-One Asset Management: Manage tokens, NFTs, and DeFi positions across multiple blockchains from a single wallet, as seen with Unify and PUM Exchange Unified Multi-Chain Wallet.

-

Self-Custody & Enhanced Security: Retain full control of your private keys and assets, reducing risks tied to centralized exchanges or multiple wallets. Leading wallets like 1inch and PUM Exchange emphasize self-custodial design.

-

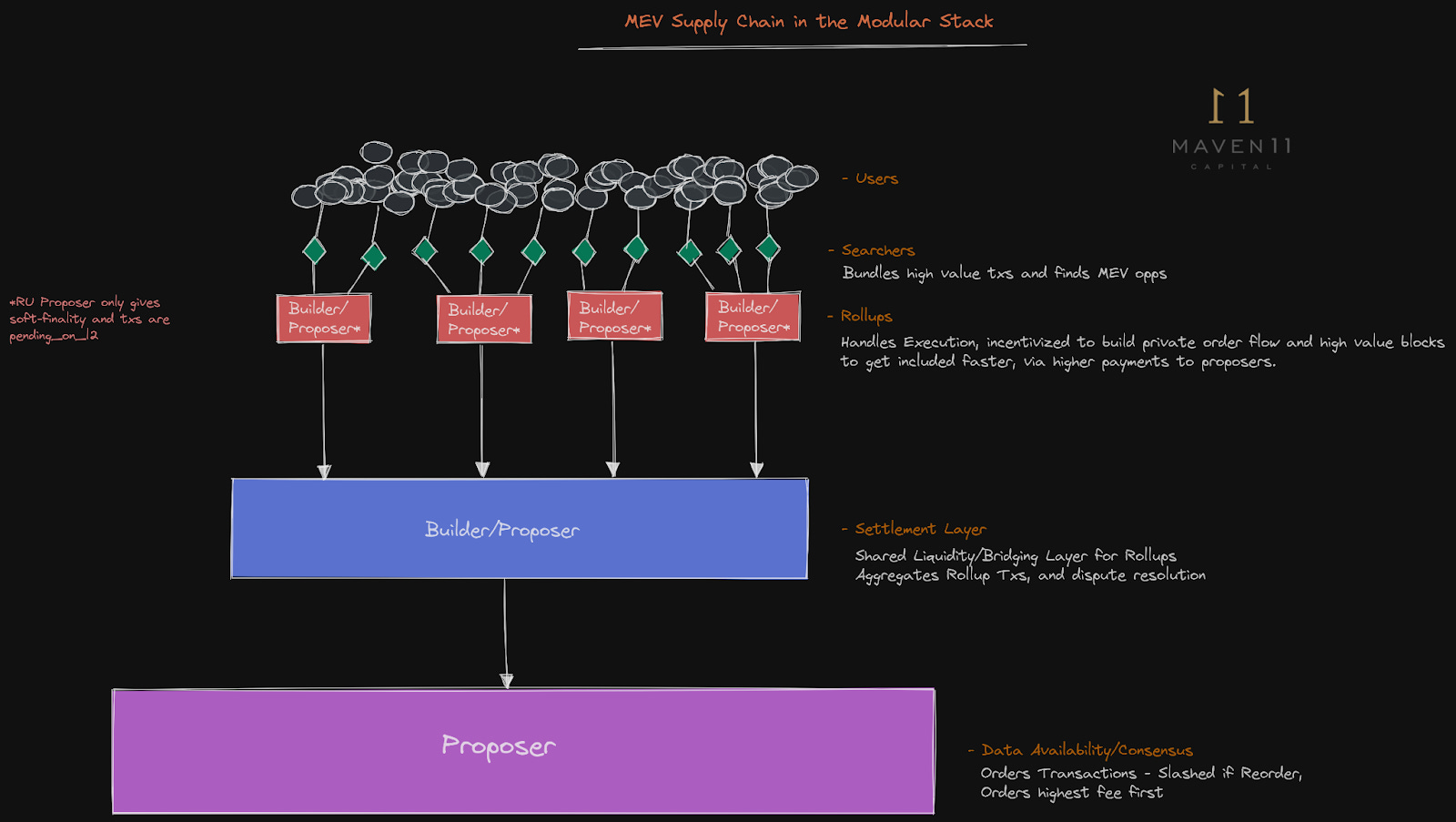

MEV Protection & Trustless Transactions: Benefit from built-in MEV (Miner Extractable Value) protection and trustless swap protocols, minimizing transaction risks and maximizing value—features highlighted by the latest 1inch Solana-EVM integration.

-

Automated Gas Fee Optimization: Save on transaction costs with smart gas fee recommendations and automation, ensuring cost-effective swaps and transfers across supported blockchains.

-

Comprehensive Network Support: Access and interact with assets on 30+ leading blockchains—including Ethereum, Solana, Cosmos, and more—directly from unified wallets like PUM Exchange and Unify.

- Universal Asset View: See all your holdings, tokens and NFTs, from every supported chain in one place.

- Native Cross-Chain Swaps: Swap assets directly between chains using protocols like 1inch’s bridge-free solution.

- Automated Gas Optimization: Get real-time fee recommendations for cost-effective transactions.

- Simplified Key Management: One set of credentials secures your entire portfolio.

- Dapp Compatibility: Connect to any dapp across supported networks without manual switching.

This architecture isn’t just theoretical, it’s live today. For example, PUM Exchange’s multi-chain wallet supports 30 and networks with integrated swapping and bridging tools built right in. No more copy-pasting addresses or hunting down RPC endpoints; everything happens within a single UI designed for speed and clarity.

The future isn’t multi-wallet, it’s unified wallet cross-chain by default.

EVM, Solana Interoperability Gets Real

The most exciting development? Direct interoperability between non-EVM chains like Solana and the broader EVM universe. Until recently, bridging assets from Solana to Ethereum meant navigating risky third-party bridges or wrapping tokens, often with delays or security trade-offs. Now, thanks to innovations from 1inch and others, users can perform trustless swaps between SOL and ETH (and beyond) straight from their unified wallet interface, no external bridge required.

This breakthrough delivers on three fronts: speed (trades settle in seconds), safety (self-custodial MEV protection), and simplicity (no technical hoops). It marks a crucial step toward true seamless DeFi user experience, and it’s already driving higher adoption among both pro traders and newcomers alike.

Main Benefits Driving User Adoption

Top Reasons DeFi Users Are Switching to Unified Cross-Chain Wallets

-

Effortless Cross-Chain Swaps: Platforms like 1inch now enable direct swaps between Solana and 12+ EVM chains without bridges, eliminating complex steps and reducing transaction risks.

-

All Assets, One Interface: Unified wallets such as Unify and PUM Exchange consolidate tokens and NFTs from multiple blockchains, letting users manage everything in a single, intuitive dashboard.

-

Enhanced Security: By reducing the need for multiple wallets and private keys, unified wallets lower the risk of user error and phishing attacks, improving overall asset safety.

-

Frictionless Cross-Chain Transactions: Integrated swap and bridge features allow users to move assets between chains instantly, without relying on risky third-party tools or manual transfers.

-

Automated Gas Fee Optimization: Advanced wallets recommend the most cost-efficient gas fees based on real-time network congestion, saving users money on every transaction.

-

Comprehensive Token and NFT Support: Leading unified wallets support a wide range of tokens and NFTs across EVM chains, Solana, Cosmos, and more, enabling true portfolio management.

-

MEV Protection and Trustless Swaps: Solutions like 1inch offer MEV-protected, trustless swaps, giving users confidence that their transactions are secure and fairly executed.

If you’re still using separate wallets for each chain or relying on clunky bridges, you’re missing out on the new standard in DeFi UX. Unified wallets not only save time but also reduce exposure to phishing risks by centralizing your key management under robust security frameworks. Plus, features like automated gas fee optimization ensure you’re never overpaying on network costs, a critical edge when trading volatile markets where every second counts.

Unified wallet cross-chain solutions are rapidly becoming the backbone for anyone serious about DeFi. As protocols like 1inch continue to break down barriers between EVM and Solana, the user experience is finally catching up to the innovation happening under the hood. The ability to execute swaps, manage NFTs, and track yields across multiple chains without friction is not just a competitive advantage, it’s the new baseline for what users expect.

What Developers and Power Users Need to Know

If you’re building or trading in this new environment, there are key considerations that set unified wallets apart:

Pro Tips for Maximizing Unified Wallet Cross-Chain Tech

-

Leverage 1inch for Bridge-Free Solana-EVM Swaps: Use 1inch to swap assets directly between Solana and 12+ EVM chains without traditional bridges. Enjoy MEV protection and self-custody for secure, efficient trades.

-

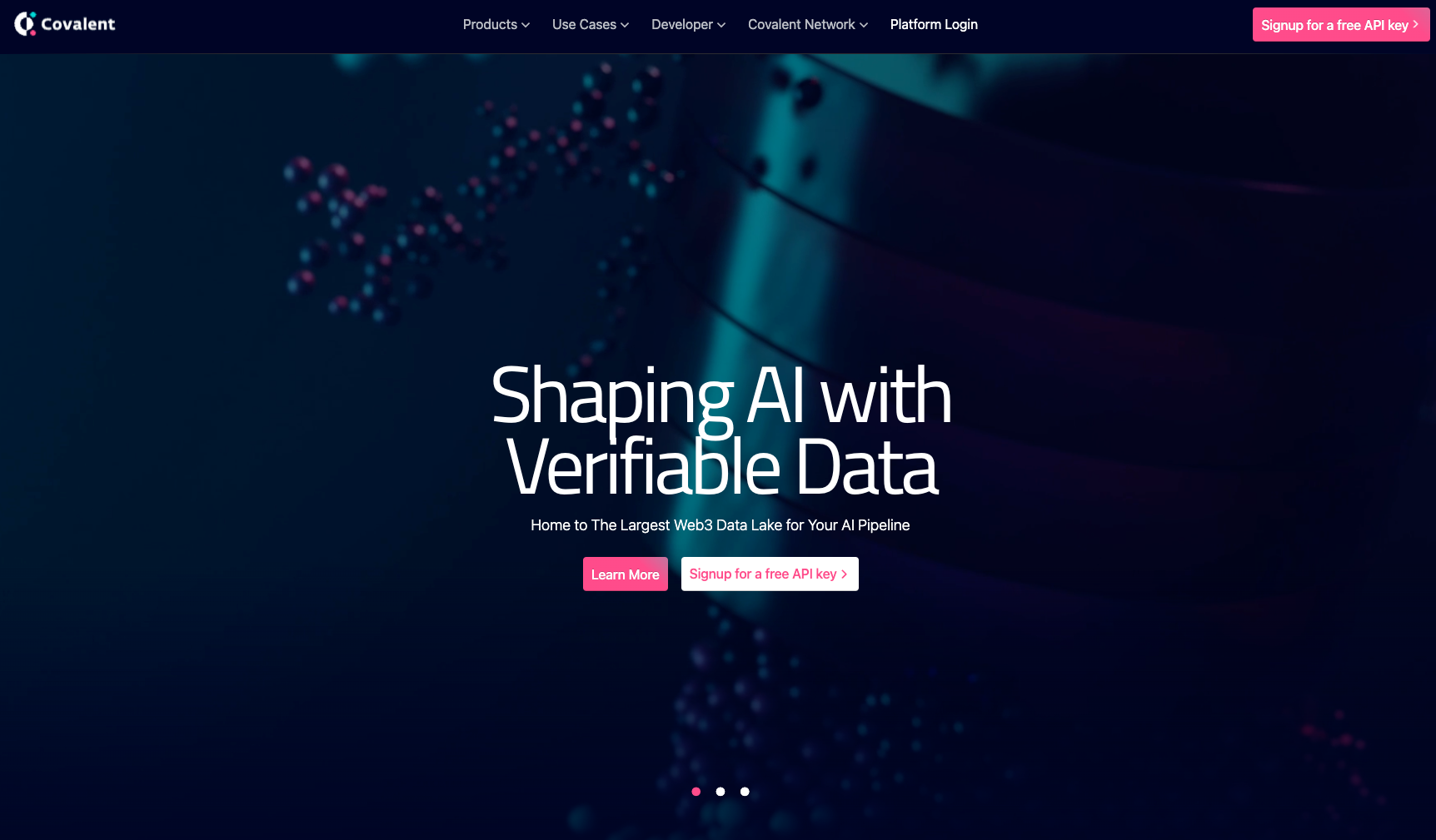

Integrate Moralis APIs for Unified On-Chain Data: Developers can streamline wallet and portfolio apps by using Moralis cross-chain APIs, providing fast, reliable data across all major networks.

-

Adopt Unify Wallet for Multi-Chain Asset Management: Unify Wallet lets users manage assets from EVM chains and Cosmos in a single interface, simplifying key management and boosting security.

-

Utilize PUM Exchange’s Unified Multi-Chain Wallet: PUM Exchange offers a wallet supporting 30+ blockchains with integrated cross-chain swaps and bridging—ideal for power users and developers.

-

Optimize Gas Fees with Automated Tools: Choose unified wallets that feature automated gas fee optimization to ensure cost-effective cross-chain transactions, especially during peak network congestion.

-

Prioritize Security with Self-Custodial Solutions: Always select wallets like 1inch and Unify that are fully self-custodial, minimizing third-party risk and keeping your private keys under your control.

- APIs and SDKs: Modern unified wallets provide robust APIs that let developers integrate cross-chain functionality into dapps with minimal overhead.

- Security First: Centralized key management doesn’t mean centralized risk, advanced encryption and self-custody are non-negotiable.

- Real-Time Data: Platforms like Moralis deliver precise on-chain data feeds so your wallet or dapp always reflects live balances and transactions across networks.

- User Education: As complexity fades, onboarding becomes smoother. But transparency about how swaps, bridging, and custody work remains essential for trust.

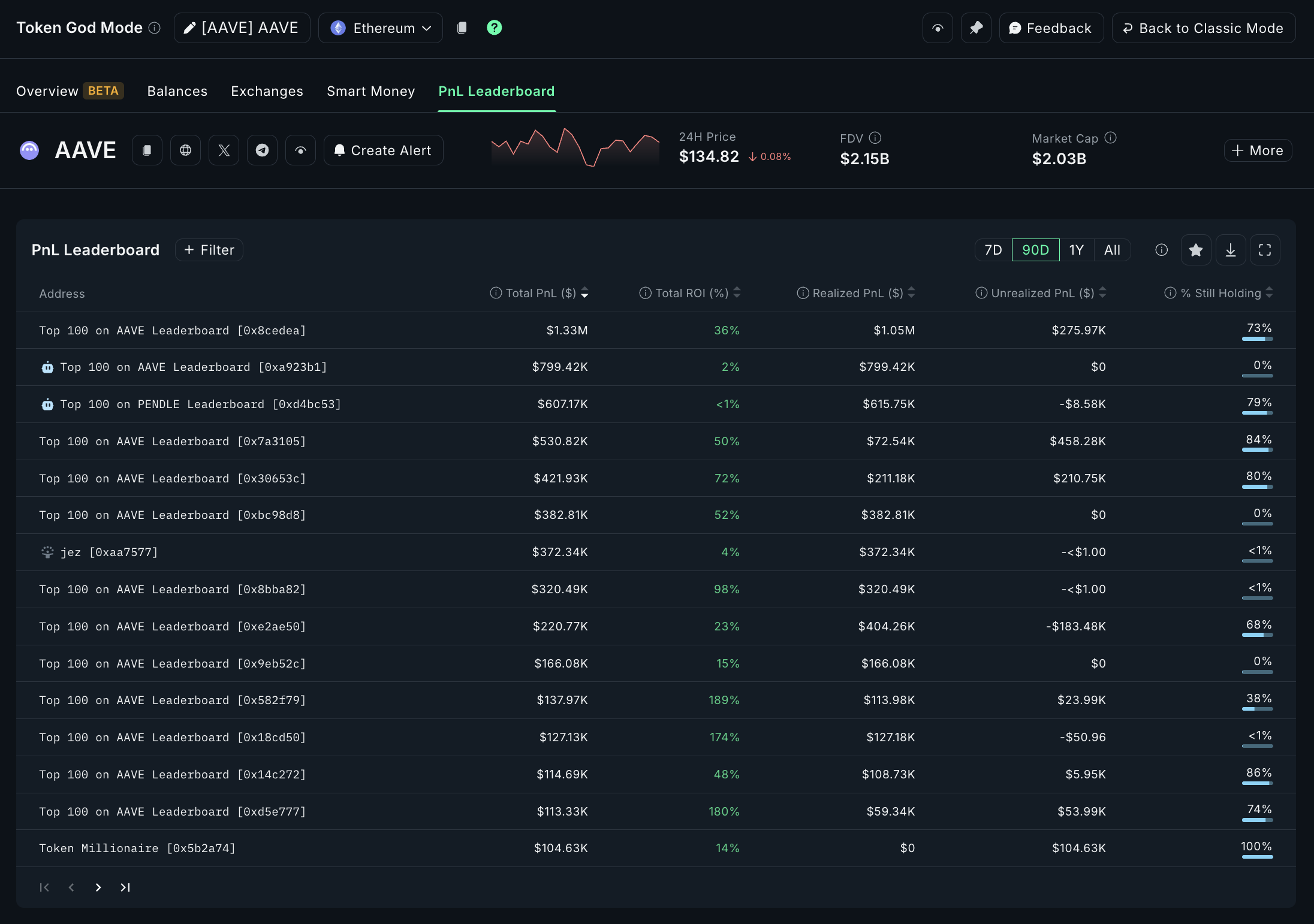

The biggest takeaway? Cross-chain asset management isn’t just for whales or devs anymore. With EVM-Solana interoperability now accessible in a few clicks, everyone from NFT collectors to yield farmers can capitalize on liquidity wherever it lives. This is a direct response to user demand for fluidity, safety, and control, without sacrificing speed or cost-efficiency.

Unlocking New DeFi Use Cases

The implications go far beyond simple swaps. Unified wallets enable advanced strategies like cross-chain arbitrage, multi-network yield optimization, and seamless NFT transfers between ecosystems. For example, you could spot an arbitrage opportunity between Solana DEXs and an EVM-based AMM, and execute instantly from one dashboard. Or move your assets into a Cosmos staking protocol without ever leaving your wallet UI.

This level of composability is what will drive the next wave of DeFi growth. As more protocols embrace chain abstraction UX patterns, expect even deeper integrations, from real-time portfolio analytics to automated tax reporting, all powered by unified infrastructure.

The days of chain maximalism are numbered; interoperability is king in 2025’s DeFi landscape.

Ready to Experience Seamless Cross-Chain DeFi?

If you want to dive deeper into how unified wallets simplify complex swaps and transactions, or if you’re ready to upgrade your own DeFi toolkit, check out our guides on how unified wallets simplify cross-chain swaps for DeFi users or cross-chain transaction workflows.

The bottom line: as chain abstraction becomes standard across DeFi apps, users gain unprecedented freedom to move capital at will, no more silos, no more friction. Unified wallets aren’t just improving UX; they’re rewriting what’s possible in crypto asset management for everyone from day traders to protocol builders.