Decentralized finance (DeFi) users have long faced a daunting user experience when moving assets across different blockchains. Managing multiple wallets, navigating bridges, and juggling various interfaces has made seamless cross-chain DeFi a distant dream for many. Enter the unified wallet cross-chain swaps revolution: a new generation of crypto wallets is finally making frictionless asset management possible, empowering users to swap and manage tokens across networks through a single, intuitive interface.

Why Cross-Chain Complexity Was Holding DeFi Back

The growth of DeFi has brought unparalleled innovation but also significant fragmentation. Each blockchain operates as its own silo, with unique addresses, standards, and liquidity pools. Historically, if you wanted to swap ETH for BNB or move stablecoins from Polygon to Arbitrum, you’d need to use third-party bridges or centralized exchanges, each step introducing risk and complexity.

This fragmentation not only deters new users but also increases operational risk for seasoned investors. Managing multiple seed phrases, tracking balances across wallets, and worrying about bridge exploits are pain points that have slowed mainstream DeFi onboarding. As highlighted in PancakeSwap’s recent integration with Across Protocol, the demand for seamless cross-chain swaps is surging as users seek simpler alternatives.

The Unified Wallet Solution: One Interface, Many Chains

Unified wallets are rapidly becoming the gold standard for seamless cross-chain DeFi. These wallets aggregate support for multiple blockchains, EVM chains like Ethereum and BNB Chain as well as non-EVM ecosystems such as Bitcoin and Cosmos, into a single platform. Users can now execute swaps between chains without ever leaving the wallet interface or risking funds on insecure bridges.

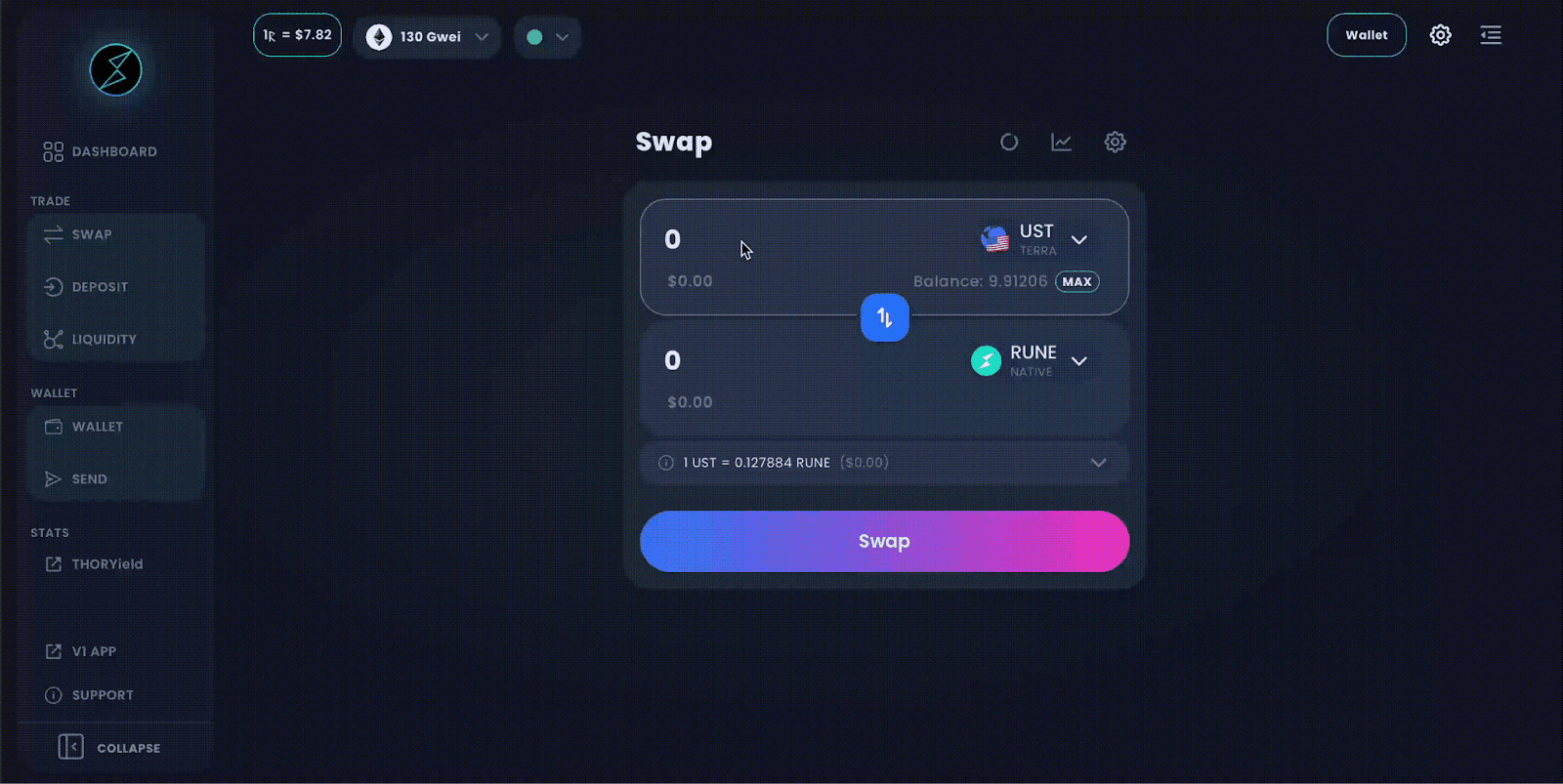

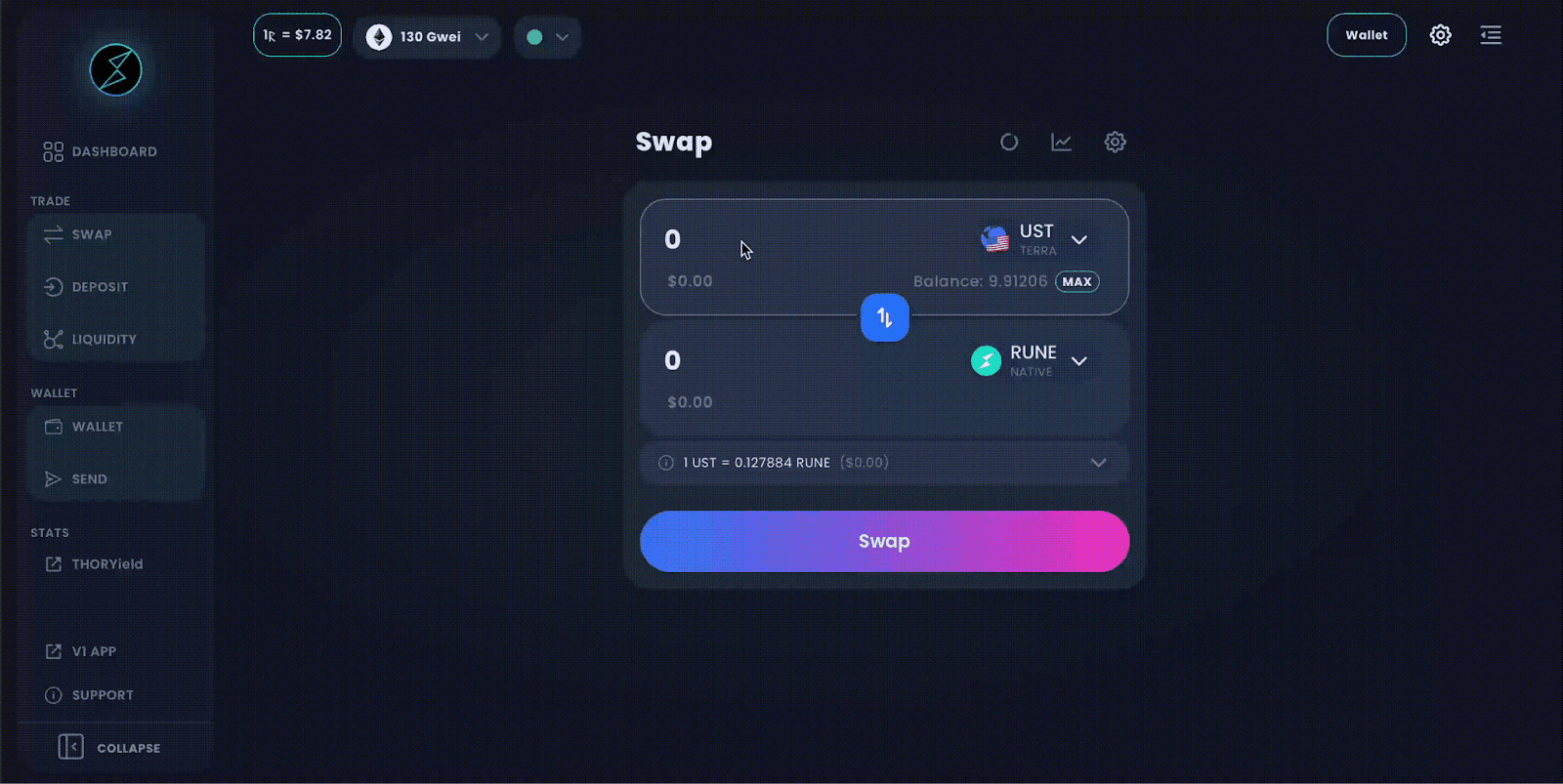

For example, the Crypto. com DeFi Wallet has introduced cross-chain token swaps powered by Stargate. This lets users swap tokens across seven EVM-compatible chains in seconds, all within one app. No more copying addresses between wallets or waiting anxiously for bridge confirmations. Similarly, ShapeShift’s integration with THORChain enables native Bitcoin swaps directly from hardware devices without KYC or added fees (source). The result is a dramatic reduction in both user friction and counterparty risk.

How Unified Wallets Power Effortless Swaps

The magic behind unified wallet cross-chain swaps lies in deep protocol integrations and liquidity aggregation. Instead of forcing users to interact with multiple apps or bridges, these wallets tap into protocols like Across Protocol or Stargate under the hood to route transactions efficiently and securely.

Top Unified Wallets for Seamless Cross-Chain Swaps

-

Crypto.com DeFi Wallet — Offers integrated cross-chain token swaps powered by Stargate, allowing users to swap assets across seven EVM-compatible blockchains within a single, user-friendly interface.

-

PancakeSwap — Provides one-click cross-chain swaps using Across Protocol, enabling seamless asset exchanges between BNB Chain, Arbitrum, and Base directly from the wallet’s swap page.

-

ShapeShift — Pioneered trustless cross-chain swaps for major assets like BTC, ETH, and LTC via THORChain, supporting hardware wallet integration and no added commissions or KYC requirements.

-

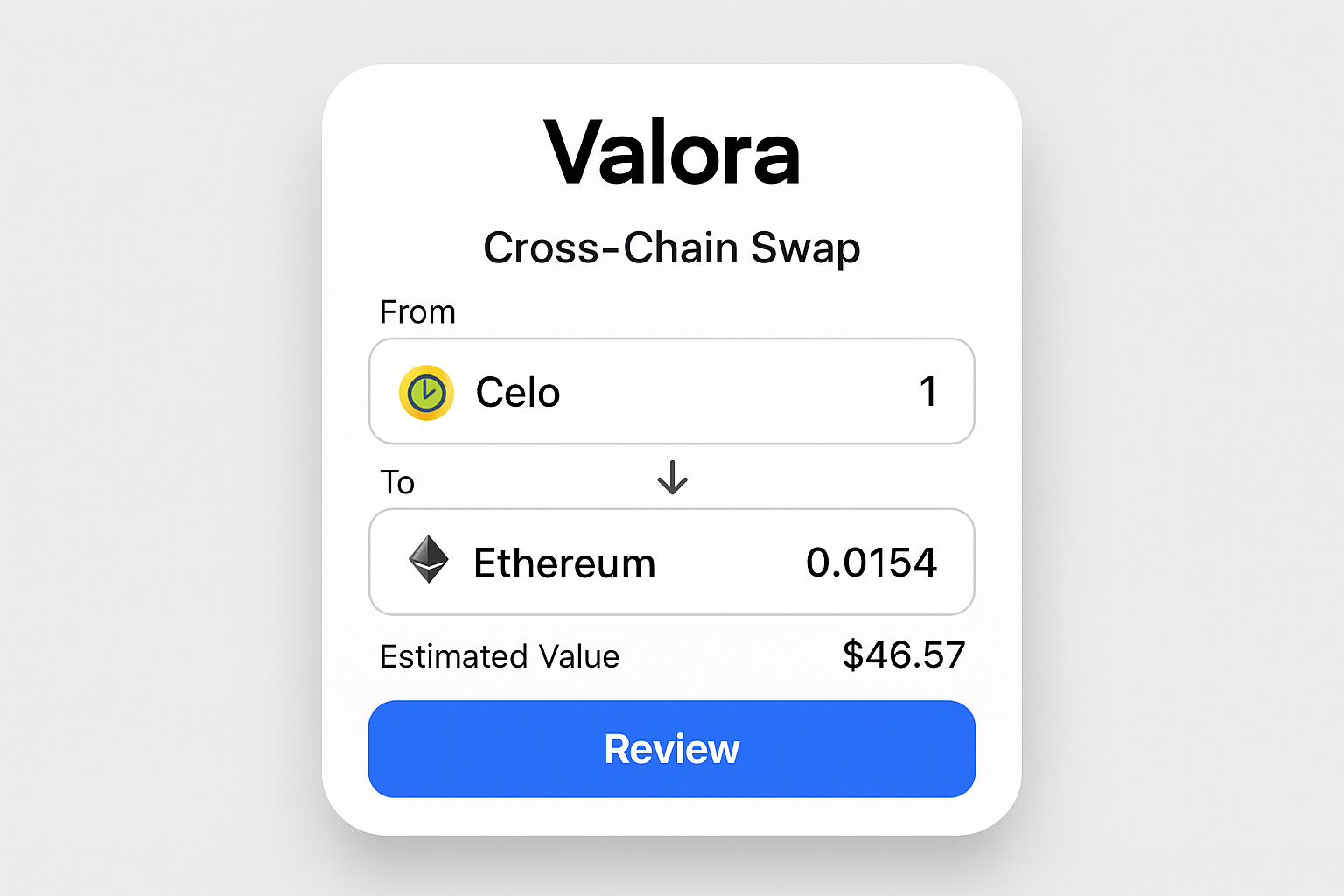

Valora — Enhanced its swap experience to include cross-chain swaps across leading blockchains such as Celo, Ethereum, Arbitrum, and Base, streamlining multi-chain asset management for users.

-

Rango Exchange — Acts as a cross-chain swap aggregator, connecting multiple wallets and blockchains to enable users to swap tokens across diverse networks through a single platform.

This approach brings several strategic advantages:

- Simplified UX: Users interact with one familiar interface regardless of which blockchain they’re using.

- Reduced Security Risks: No more copy-pasting addresses between apps or exposing private keys repeatedly.

- Time Savings: Swaps settle faster since bridging and swapping are handled in one step within the wallet.

- Ecosystem Growth: Developers can build on SDKs like SwapKit (see details) to integrate multi-chain functionality into their dApps quickly.

This convergence of liquidity and user experience means that even complex operations, like swapping native BTC for ERC-20 tokens, can be performed trustlessly in seconds rather than minutes or hours.

With friction minimized, unified wallets are setting a new benchmark for crypto wallet UX. The ability to manage, swap, and track assets across chains in real time is empowering not just seasoned DeFi users but also accelerating onboarding for newcomers. Wallets like Valora and PancakeSwap now enable direct swaps between major blockchains such as Celo, Ethereum, Arbitrum, and Base, no more wrapping tokens or navigating opaque bridges. This ease of use is a catalyst for broader DeFi participation and liquidity growth.

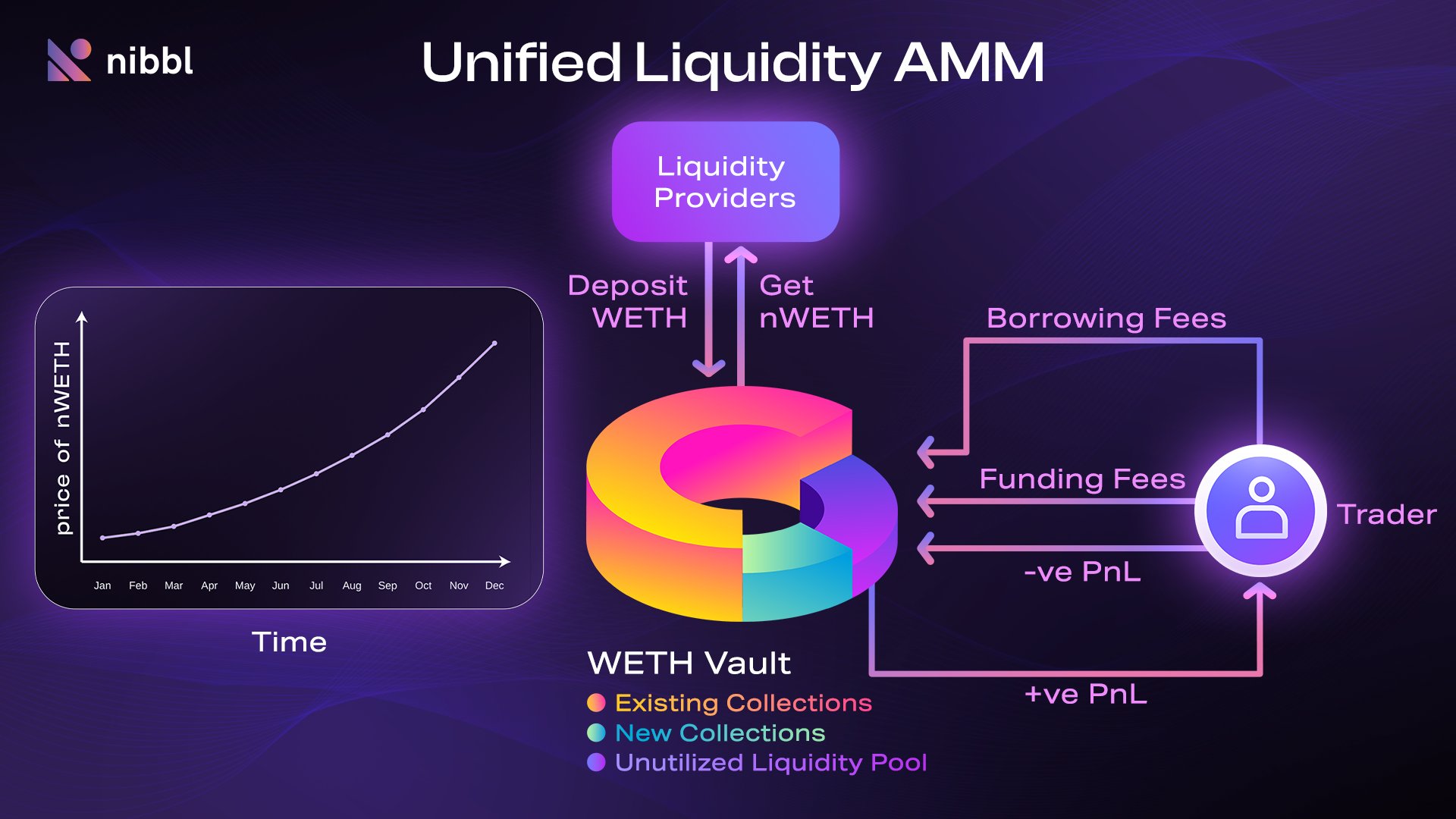

Unified Liquidity: The Next Frontier

A major force behind this evolution is liquidity aggregation. Rather than fragmenting liquidity across isolated pools on different chains, unified wallets aggregate access to multiple pools at once. Protocols like Across and Stargate facilitate this by securely routing swaps through the most efficient pathways, often sourcing liquidity from several networks simultaneously. This not only enhances price efficiency but also reduces slippage, a critical advantage for high-volume traders and institutional users.

- Enhanced security: Assets remain secure on their native chains while interacting with external liquidity pools.

- Lower gas fees: Advanced routing minimizes transaction costs by choosing optimal paths across networks.

- Transparency: Users see real-time quotes and settlement times before confirming swaps.

This model is already in action on platforms like PancakeSwap, where one-click cross-chain swaps have become a core feature (see coverage). Similarly, Valora’s recent upgrades allow users to interact with multiple ecosystems without ever leaving the app interface, demonstrating how seamless cross-chain DeFi can finally be realized at scale.

Key Benefits of Unified Wallets for Cross-Chain DeFi Onboarding

-

Seamless Cross-Chain Swaps: Unified wallets like Crypto.com DeFi Wallet and PancakeSwap integrate cross-chain swap features, allowing users to exchange assets across multiple blockchains in a single transaction, eliminating the need for external bridges or multiple wallets.

-

Unified Asset Management: Users can manage tokens from different blockchains—such as Ethereum, BNB Chain, and Arbitrum—within one wallet interface, reducing complexity and streamlining portfolio oversight.

-

Enhanced Security: By consolidating blockchain interactions, unified wallets minimize the risks associated with juggling multiple wallets and third-party bridges. For example, ShapeShift enables trustless cross-chain swaps via hardware wallets, protecting user assets and privacy.

-

Improved User Experience: Unified wallets offer intuitive interfaces for cross-chain DeFi activities, making onboarding easier for new users and reducing the learning curve associated with managing multiple platforms.

-

Access to Unified Liquidity: Protocols like Euclid Protocol and liquidity aggregators enable users to tap into liquidity pools across chains, improving swap rates and reducing slippage.

-

Developer Ecosystem Support: Tools such as SwapKit empower developers to build and integrate cross-chain functionalities, accelerating innovation and expanding the DeFi ecosystem.

Strategic Implications for Developers and Investors

The rise of unified wallets isn’t just a UX improvement, it’s a strategic shift in the DeFi landscape. For developers, SDKs like SwapKit unlock rapid integration of multi-chain functionality into dApps without rebuilding from scratch (more here). This accelerates innovation cycles and lowers barriers to entry for new projects. For investors, unified wallets offer better portfolio visibility and risk management tools across fragmented ecosystems, no more spreadsheet juggling or blind spots between chains.

As more protocols adopt these standards, expect to see even tighter integrations with hardware wallets and institutional-grade custody solutions. Unified wallet cross-chain swaps are laying the groundwork for the next phase of DeFi’s evolution: an open financial system where assets flow freely across networks without trade-offs between security, speed, or user experience.