Ask any DeFi user who’s tried to move funds from Ethereum to Polygon or swap assets between Binance Smart Chain and Arbitrum: cross-chain transactions can be a UX nightmare. Juggling multiple wallets, tracking gas balances across networks, and worrying about security risks are just some of the headaches that have kept mainstream users at bay. Enter unified crypto wallets – a new breed of multi-chain wallet solutions designed to make chain abstraction a reality and finally put seamless DeFi user experience within reach.

Why Cross-Chain Complexity Holds DeFi Back

The promise of decentralized finance is borderless, permissionless access to financial tools. But ironically, fragmentation between blockchains has created walled gardens that force users into convoluted workflows. For example, if you want to chase yield opportunities on different chains or escape high fees on congested networks, you often need:

- Separate wallets for each network

- Manual bridging (with risky third-party services)

- Constantly swapping native tokens just to pay gas fees

- A spreadsheet just to keep track of all your assets

This patchwork approach doesn’t scale. It’s no wonder multi-chain support has become a top priority for wallet developers and DeFi innovators alike (source). The next wave of adoption hinges on making these pain points invisible.

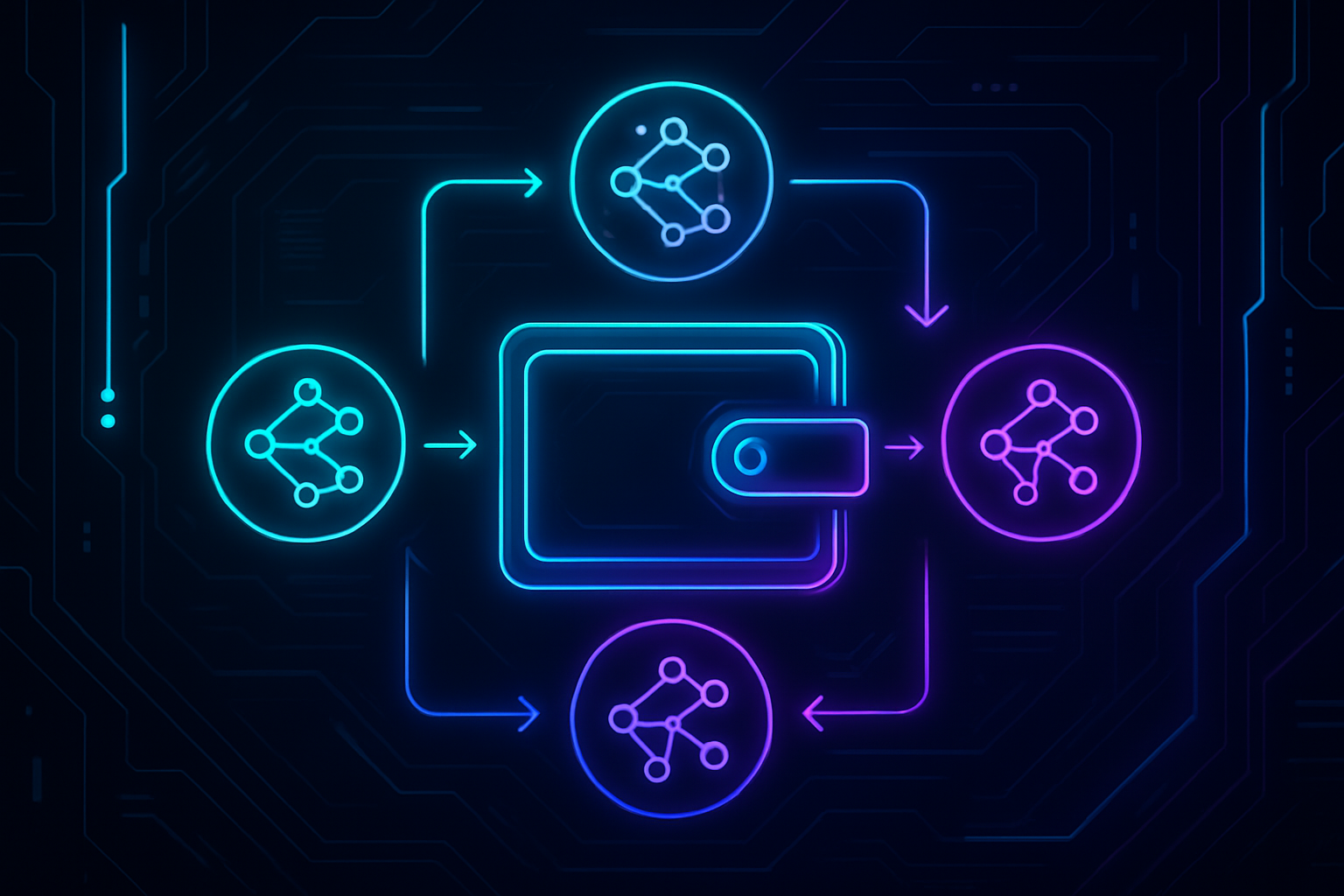

The Unified Wallet Revolution: Chain Abstraction in Action

Unified wallets are transforming how users interact with decentralized applications by offering a single interface for all things crypto, regardless of chain. Here’s what makes them such a game-changer:

Key Features of Unified Crypto Wallets for Cross-Chain DeFi

-

Cross-Chain Asset Management: Unified wallets let users view and manage digital assets across multiple blockchains (like Ethereum, Binance Smart Chain, and Polygon) from a single interface, eliminating the need for multiple wallets and streamlining asset tracking.

-

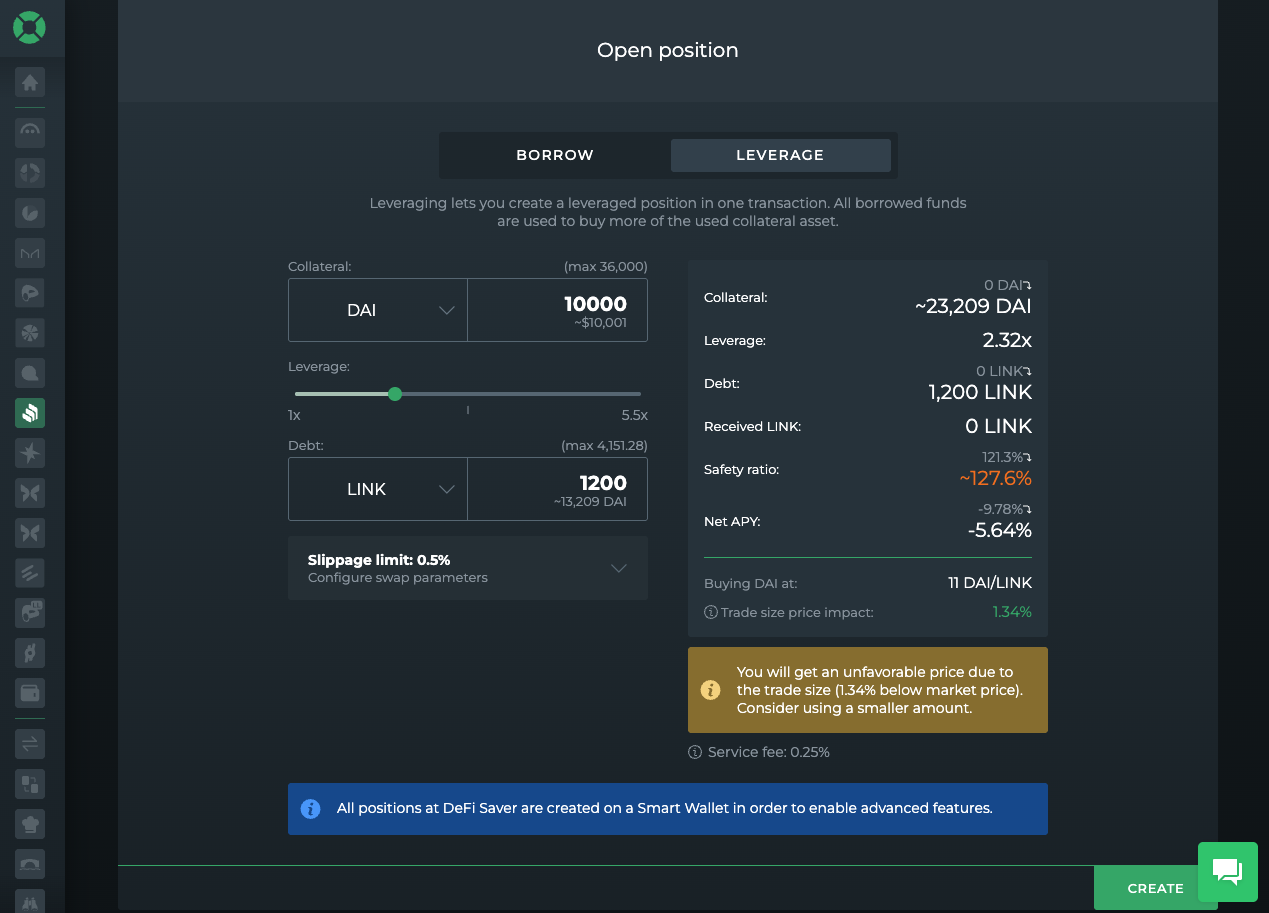

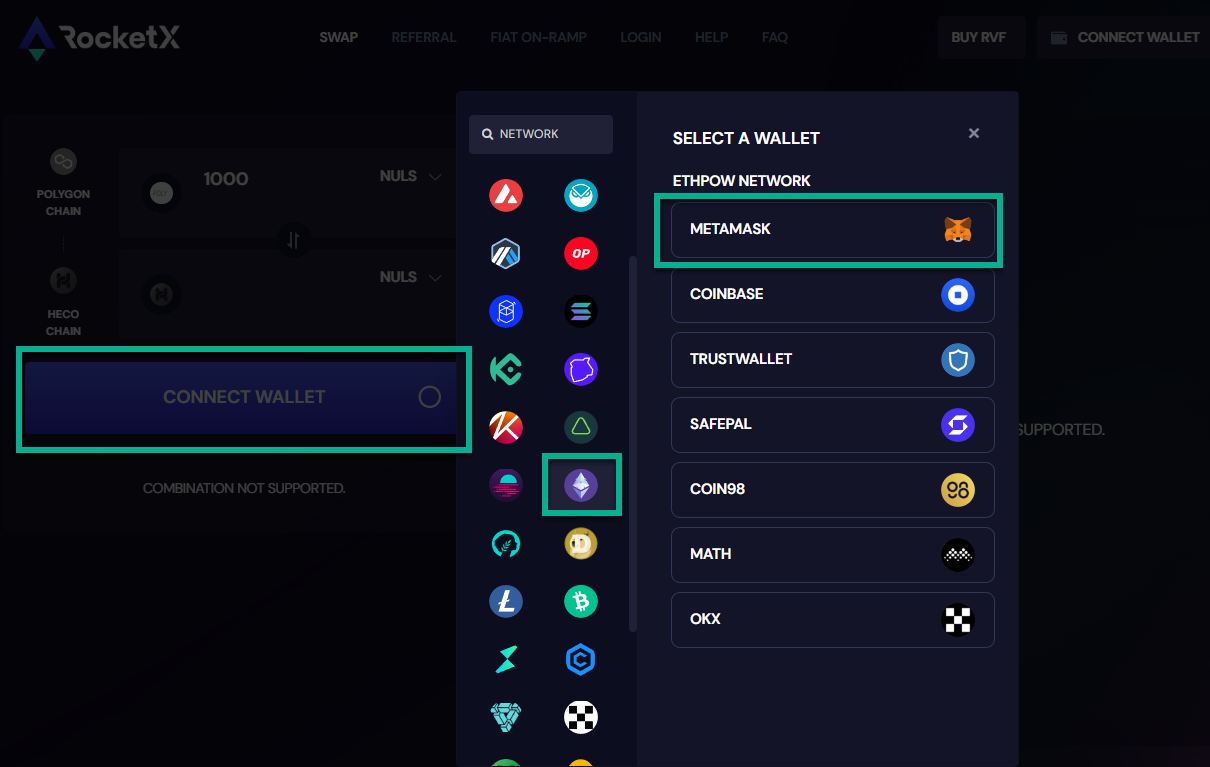

Integrated Swaps and Bridging: These wallets offer built-in on-chain swapping and cross-chain bridging, allowing seamless transfers of assets between different networks without third-party services. Smart routing ensures cost-effective and efficient transactions.

-

Gas Fee Optimization: Unified wallets can automate gas fee management, recommending optimal fees based on network conditions and sometimes allowing users to pay fees in any token, removing the need to hold multiple native tokens.

-

Unified Account Management: Features like Super Accounts or Universal Accounts enable users to manage assets and transact across several chains using a single account, simplifying balances and the overall user experience.

-

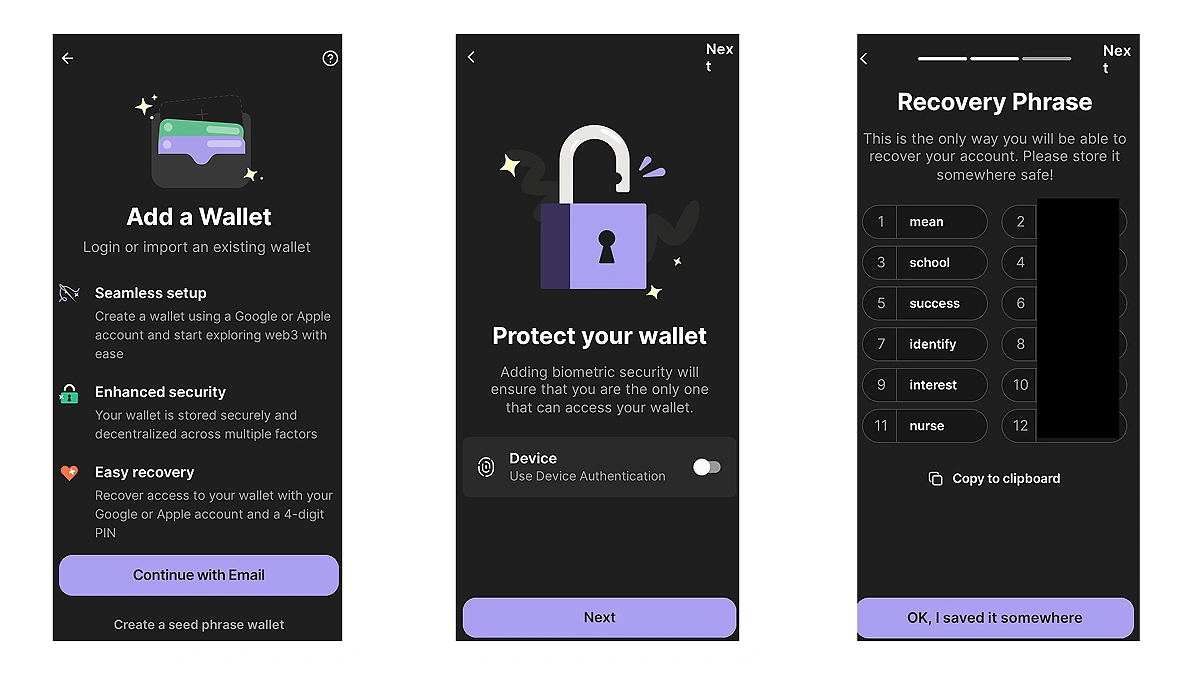

Enhanced Security with MPC: Advanced security protocols such as Multi-Party Computation (MPC) ensure private keys are never fully exposed, providing robust, enterprise-grade key management while maintaining user control.

-

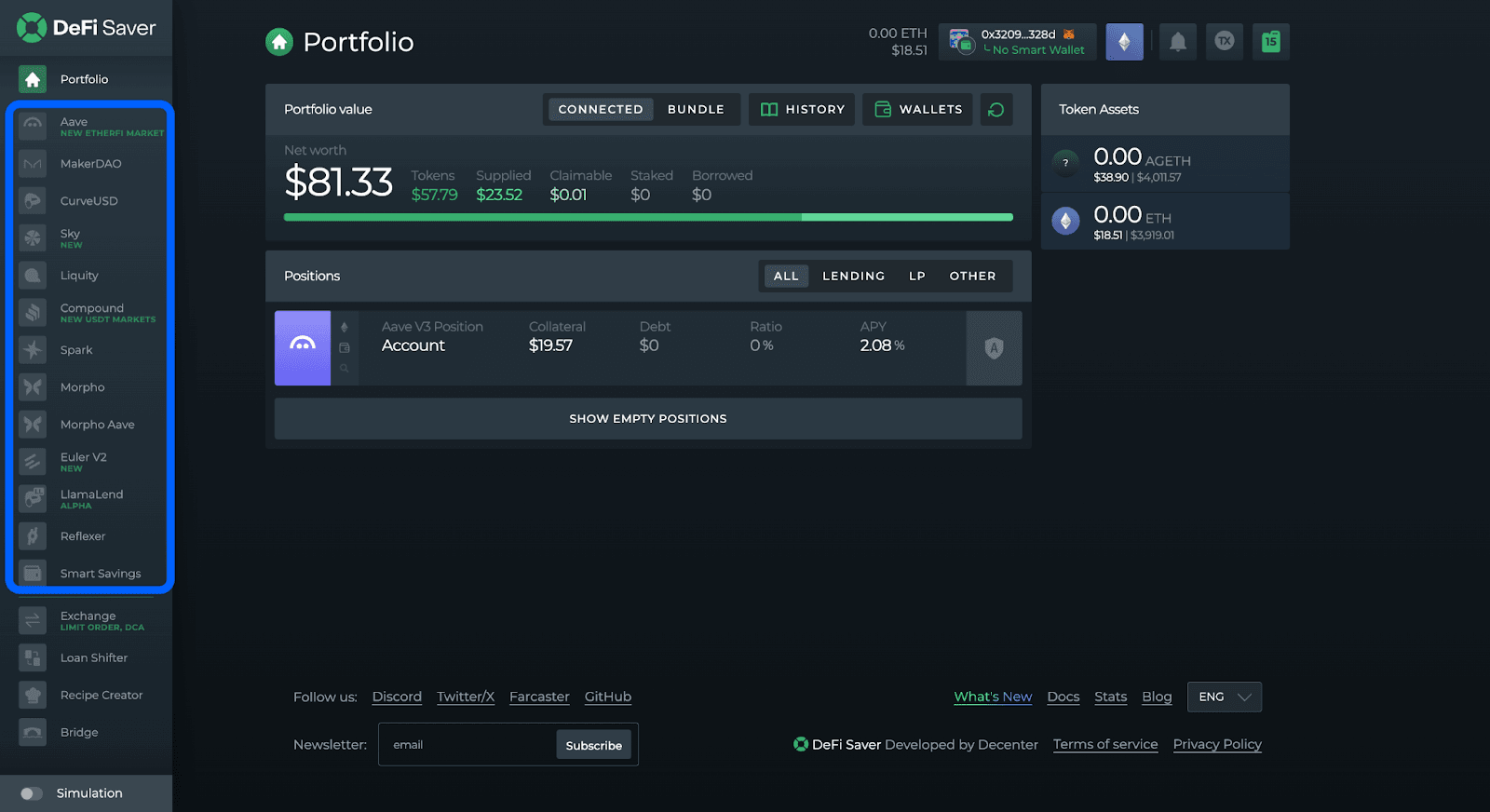

Unified Portfolio View: Platforms like 1inch Portfolio allow users to connect multiple wallets across various blockchains, offering a consolidated, real-time view of all assets in one place.

The best unified wallets consolidate asset management across dozens of chains (think Ethereum, Binance Smart Chain, Polygon, and more) so users can view their entire portfolio in one place. No more logging in and out or copy-pasting addresses between apps.

Integrated swaps and bridging are another huge leap forward. With smart routing algorithms built-in, users can move tokens between networks without ever leaving the wallet, often at the lowest possible cost thanks to real-time fee optimization (source). Some platforms even let you pay transaction fees in any token you hold, eliminating the need to stockpile native coins just for gas.

Real-World Examples: Unified Wallets You Can Use Today

The theory is exciting, but what does this look like in practice? Let’s spotlight some leading unified wallet implementations shaking up the market:

- PUM Exchange’s Unified Multi-Chain Wallet: Supports over 30 blockchains with integrated swaps, bridge routing, and automated fee optimization (details here).

- zkCross Network’s Super Accounts: Lets users manage assets across EVM and non-EVM chains from a single account, no more juggling multiple wallets (learn more).

- 1inch Portfolio: Offers a cohesive view by connecting multiple wallets from different blockchains into one portfolio with real-time tracking (see how it works).

This shift toward chain abstraction is already making DeFi safer and simpler for everyone, not just power users. In the next section, we’ll dig deeper into security enhancements like Multi-Party Computation (MPC), user control features such as universal accounts, and how unified wallet design is setting new standards for accessibility in Web3.

Security, Universal Accounts, and the Future of DeFi UX

One of the most significant breakthroughs in unified wallet technology is the integration of Multi-Party Computation (MPC) and advanced key management. Unlike traditional wallets that store private keys in a single location, MPC splits cryptographic secrets across multiple devices or parties. This means your assets remain secure even if one device is compromised. For DeFi users, this delivers enterprise-grade security without sacrificing self-custody or ease of use, a critical leap for mainstream adoption.

Universal Accounts are another innovation redefining cross-chain usability. Instead of maintaining separate addresses and balances on every blockchain, users interact with a single account that abstracts away the network layer. Imagine being able to swap tokens from Ethereum to Polygon or deposit into a lending pool on Binance Smart Chain, all with one click and no manual bridging. This is already possible with solutions like zkCross Network’s Super Accounts and is quickly becoming an industry standard (source).

The impact? Users spend less time troubleshooting errors, hunting for gas tokens, or worrying about which wallet to use for which dApp. Instead, they can focus on what matters: exploring protocols, earning yield, and participating in new DeFi opportunities as soon as they arise.

Why Unified Wallets Are Key to DeFi’s Next Growth Phase

The shift toward chain abstraction isn’t just a technical upgrade, it’s a fundamental change in how people access decentralized finance. By removing friction at every step, unified wallets lower the barrier for newcomers while empowering existing users to do more with less hassle. The result is an ecosystem where moving assets between blockchains feels as natural as sending an email.

Top 5 Benefits Unified Wallets Offer DeFi Users

-

Seamless Cross-Chain Asset Management: Unified wallets let users view and manage their digital assets across multiple blockchains—like Ethereum, BNB Smart Chain, and Polygon—within a single interface. This eliminates the hassle of juggling multiple wallets and simplifies portfolio tracking. Example: PUM Exchange’s Unified Multi-Chain Wallet

-

Integrated Swaps and Bridging: Users can swap and transfer assets between different blockchains directly within the wallet, thanks to built-in swapping and cross-chain bridging features. Smart routing ensures transactions are cost-effective and efficient. Example: PUM Exchange

-

Gas Fee Optimization: Unified wallets help users save on transaction costs by recommending optimal gas fees based on real-time network conditions. Some even allow paying fees with any token, removing the need to hold specific native tokens for each chain. Example: Universal Accounts

-

Unified Account Management: Advanced features like Super Accounts or Universal Accounts let users manage assets and transact across multiple chains using just one account, unifying balances and streamlining the experience. Example: zkCross Network’s Super Accounts

-

Enhanced Security: Cutting-edge security measures, such as Multi-Party Computation (MPC), protect users’ private keys by ensuring they’re never fully exposed or stored in one place—offering enterprise-grade protection without sacrificing user control. Example: PUM Exchange

This transformation is already visible in projects like PUM Exchange’s Unified Multi-Chain Wallet and 1inch Portfolio (details here, see how it works). Their success isn’t just about supporting more blockchains, it’s about delivering real utility through design choices that prioritize user experience above all else.

What Comes Next?

The road ahead for unified crypto wallets will likely see deeper integration with cross-chain aggregators, enhanced privacy features, and even broader protocol support. As standards mature and more dApps embrace chain abstraction principles, we’ll see seamless asset movement become table stakes rather than a luxury.

For developers and builders, now is the time to double down on interoperability and UX research, because the wallets that master simplicity will be the ones onboarding millions into Web3 finance.