Decentralized finance (DeFi) has witnessed explosive growth, but this expansion across multiple blockchains has introduced a persistent hurdle: cross-chain UX friction. For users and developers alike, the need to juggle multiple wallets, manage complex bridging processes, and monitor fragmented balances creates unnecessary cognitive load and operational risk. The emergence of unified wallet solutions is rapidly transforming this landscape by offering seamless interoperability and significantly enhancing the DeFi user experience.

The Problem: Fragmented DeFi Experiences Across Chains

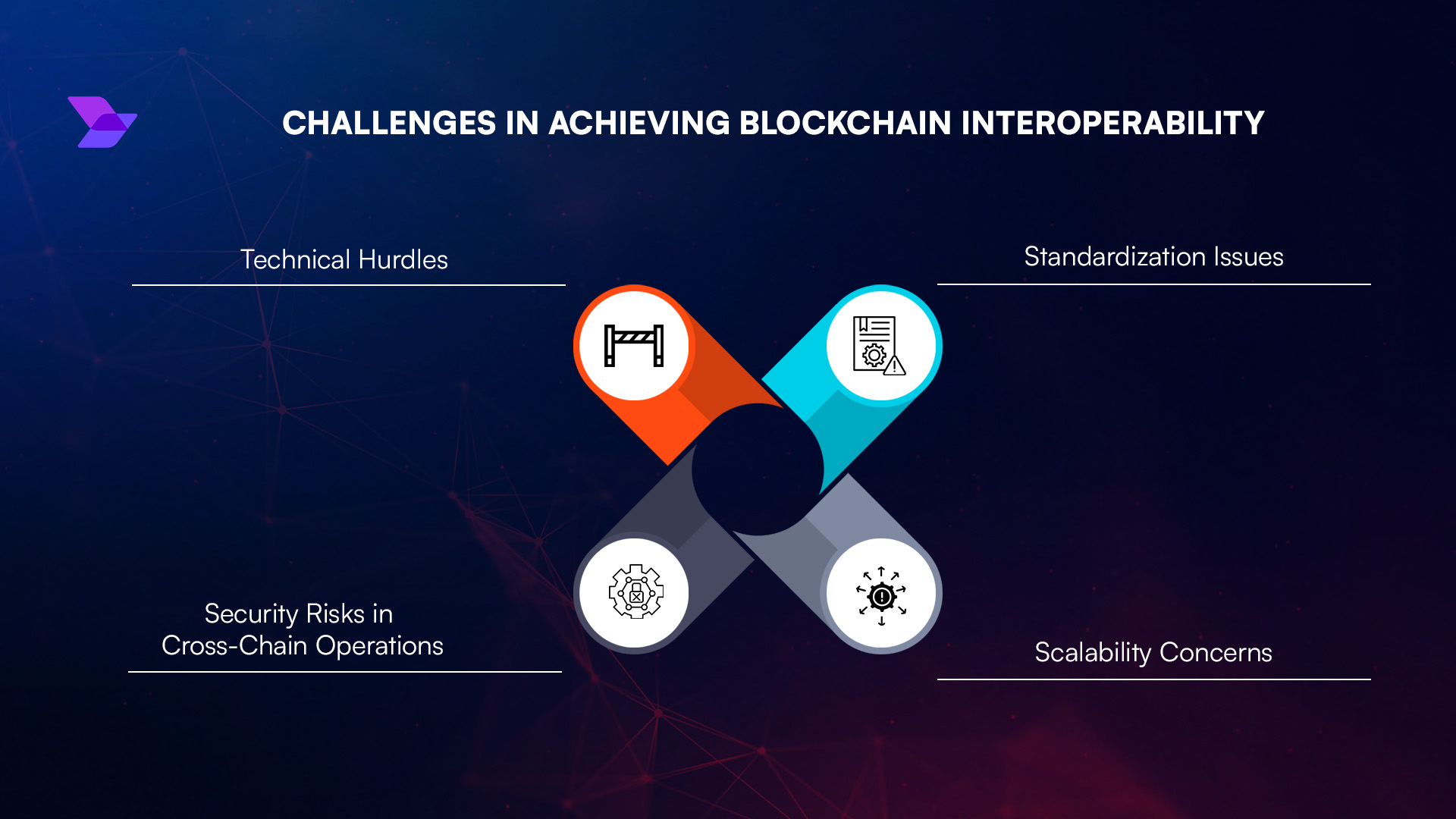

Historically, interacting with DeFi across chains meant maintaining several wallets, one for each network. This fragmentation led to inefficiencies such as manual asset bridging, repeated wallet configuration, and exposure to potential errors or security lapses. Even seasoned users found themselves toggling between interfaces to track their holdings or execute simple actions like swaps or lending.

This complexity is not merely an inconvenience; it is a barrier to mainstream adoption. According to research from Nadcab Labs and Rango Exchange, the lack of unified access discourages new entrants and limits protocol composability. These frictions are compounded as more Layer-1s and Layer-2s enter the market, each with distinct standards for identity management, transaction signing, and asset representation.

Unified Wallets: Chain Abstraction in Action

Unified wallets address these challenges through chain abstraction, where the complexities of different blockchains are hidden behind a single intuitive interface. Solutions like Zerion Wallet now support over 50 EVM-compatible networks, allowing users to oversee their multi-chain portfolios without switching apps or manually bridging assets. The result is a consolidated view of balances, streamlined cross-chain swaps, and one-click access to dApps regardless of underlying infrastructure.

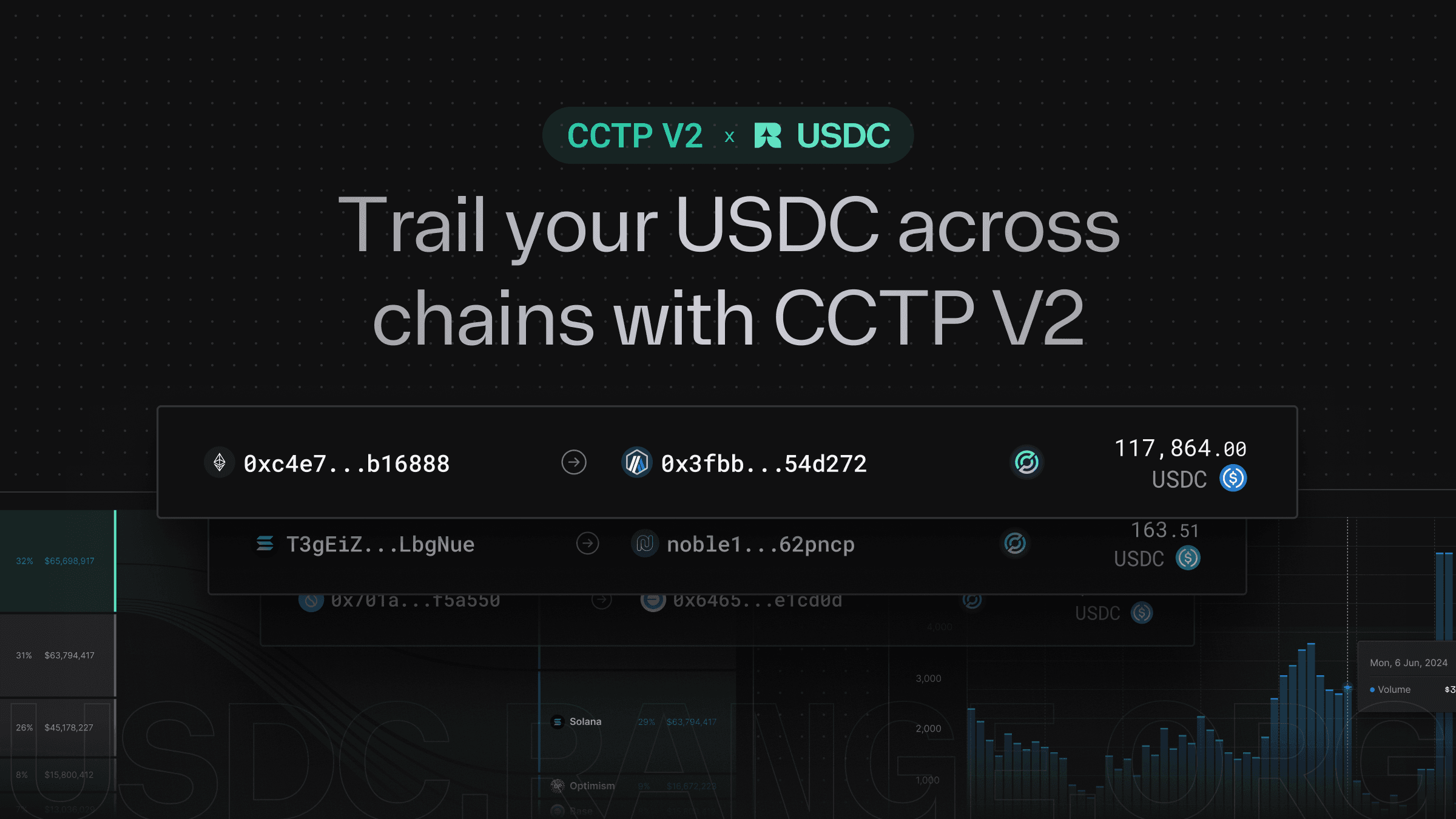

The latest innovation in this space is exemplified by Circle’s Gateway product, a unified USDC balance that enables instant cross-chain liquidity across supported networks in less than 500 milliseconds. Unlike traditional bridges that require users to lock tokens on one chain before minting on another (often taking minutes or hours), Circle Gateway abstracts away these steps entirely. For power users managing liquidity on exchanges or payment service providers (PSPs), this means near-instant settlement and reduced operational risk.

Design Strategies Driving Seamless Cross-Chain UX

The most effective unified wallets leverage several design strategies:

- Automatic network routing: Transactions are intelligently routed through the most efficient blockchain based on fees, speed, and liquidity conditions.

- Unified data presentation: Users see aggregate balances across all connected chains, no more toggling between tabs or apps.

- Simplified bridging flows: Bridging is handled in the background with clear progress indicators; users initiate actions without needing to understand technical details about wrapped tokens or relayers.

- User-centric onboarding: Embedded identity management reduces friction for new users while maintaining robust security standards.

This focus on abstraction enables even non-technical participants to access sophisticated DeFi services with confidence, a key step toward mass adoption. As noted by Halaska Studio’s UX research, clear feedback mechanisms and automated network switching are essential for reducing user error rates in multichain environments.

The Role of Cross-Chain Protocols and Standards

The evolution of cross-chain protocols, such as Uniswap Labs’ collaboration with Across on shared intent standards, further accelerates interoperability. By standardizing how intents (user actions) are specified and executed across networks, these protocols reduce reliance on centralized fillers while expanding access to competitive routing options. This not only improves capital efficiency but also fosters trust in cross-chain operations, a critical factor as DeFi scales globally.

Another significant milestone in the unified wallet movement is the aggregation of cross-chain liquidity. Products like Circle Gateway enable instant access to unified USDC balances across multiple chains, compressing settlement times from minutes to under 500 milliseconds. This breakthrough is particularly impactful for high-frequency traders, payment service providers, and protocols that require real-time capital mobility. The ability to tap into a single liquidity pool, without manual bridging, removes friction for both institutional and retail users, and sets a new benchmark for DeFi interoperability.

Unified wallet solutions are also transforming the way developers think about onboarding and user retention. By abstracting away network-specific details, these wallets allow dApp builders to focus on core product value rather than technical support or multi-network compatibility headaches. For example, embedded identity management and secure authentication flows are now standard features, ensuring that users can interact with dozens of blockchains using a single set of credentials, without sacrificing security or privacy.

Emerging Leaders in Multi-Chain Wallet Design

The competitive landscape for multi-chain wallets is rapidly evolving, with projects like Zerion, Rango Exchange, and Dynamic pioneering user-first design. Each offers unique approaches to chain abstraction:

Top Unified Wallet Providers Revolutionizing DeFi UX

-

Zerion Wallet: Supports 50+ EVM-compatible blockchains, enabling seamless cross-chain swaps, unified portfolio tracking, and direct dApp access—all from a single, intuitive interface.

-

Rango Exchange Wallet: Specializes in multi-chain swaps and cross-chain bridging, letting users interact with diverse DeFi protocols and manage assets across numerous blockchains via one wallet.

-

Circle Gateway: Introduces a unified USDC balance with instant cross-chain liquidity, allowing onramps, exchanges, and custodians to access and move USDC across supported chains in under 500 milliseconds.

-

Dynamic Wallet: Offers embedded, developer-friendly unified wallets with secure authentication and seamless cross-chain experiences, tailored for scalable DeFi bridges and dApp integrations.

-

MetaMask Portfolio: Expands the classic MetaMask experience with multi-chain asset management, portfolio tracking, and unified DeFi access, simplifying interactions across Ethereum, Polygon, BNB Chain, and more.

These wallets provide not only cross-chain swaps but also consolidated portfolio views, gas fee optimization tools, and integrated access to leading DeFi protocols, all within a single app. As highlighted by recent reviews from Debut Infotech and Blockchain App Factory, security remains paramount; leading solutions employ advanced encryption methods and non-custodial architectures to ensure user funds remain safe even as assets traverse multiple networks.

What’s Next? AI-Powered UX and Composable DeFi

The next frontier in chain abstraction will likely leverage artificial intelligence to further streamline the DeFi user experience. Early prototypes already use AI-driven intent routing to suggest optimal transaction paths across chains based on real-time fees, liquidity depth, and historical success rates. As this technology matures, expect even more seamless access to cross-chain DeFi opportunities, potentially enabling one-click participation in complex strategies like omnichain lending or yield optimization without requiring users to understand underlying mechanics.

This rapid pace of innovation underscores why unified wallet solutions are quickly becoming foundational infrastructure for the decentralized economy. By reducing cognitive load and operational risk while expanding access to global liquidity pools, these tools are not just solving today’s UX frictions, they’re redefining what’s possible in permissionless finance.