In the rapidly evolving world of decentralized finance (DeFi), the proliferation of blockchains and protocols has created both opportunity and complexity. Users want access to the best yields, assets, and dApps across ecosystems like Ethereum, Solana, BNB Chain, and Bitcoin. Yet until recently, managing assets and executing transactions across these networks required juggling multiple wallets, interfaces, and bridge solutions, introducing friction, risk, and a steep learning curve for all but the most dedicated power users.

Why Cross-Chain Complexity Holds DeFi Back

Each blockchain operates with its own set of rules: unique token standards (ERC-20 vs SPL vs BEP-20), native gas currencies, wallet formats, and transaction mechanics. For example, sending USDC from Ethereum to Solana involves bridging protocols that may require manual approval steps or even separate browser extensions. This fragmentation leads to user errors, lost funds due to incorrect network selection, double spending risks when wallets aren’t synchronized in real time (see more), and missed opportunities as users avoid platforms they don’t fully understand.

For developers building DeFi apps or liquidity protocols like CrossCurve MetaLayer, where unified cross-chain liquidity is paramount, these hurdles limit adoption. The need for seamless interoperability has never been clearer.

The Rise of Unified Wallet Solutions

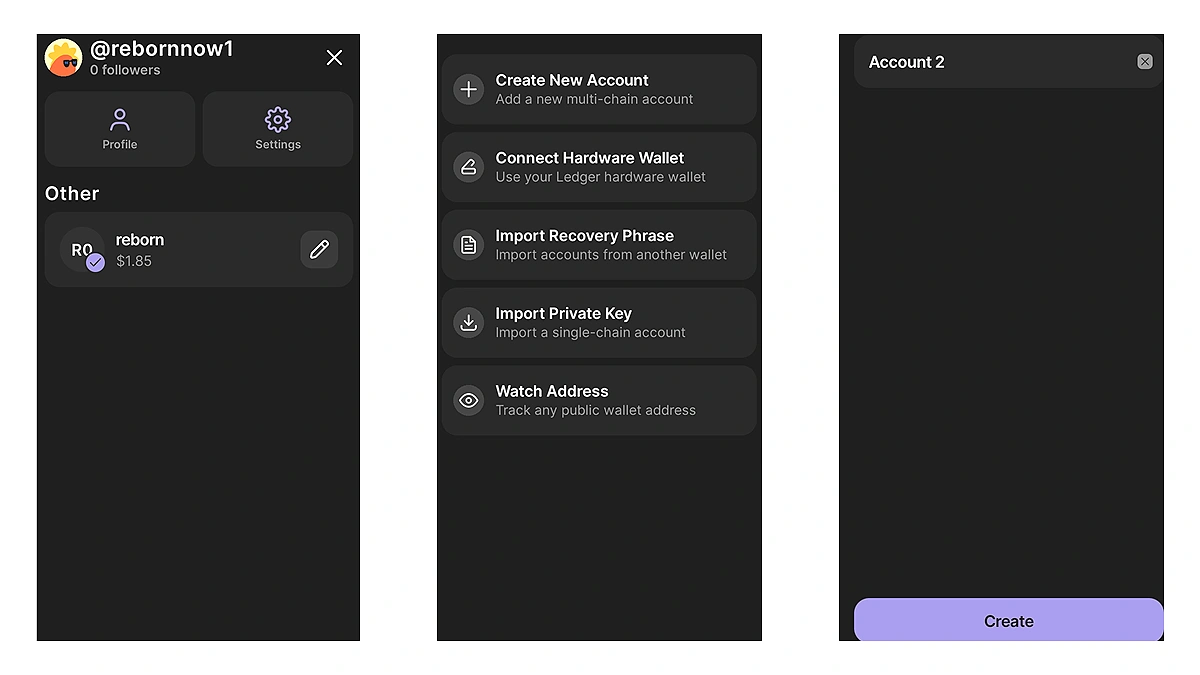

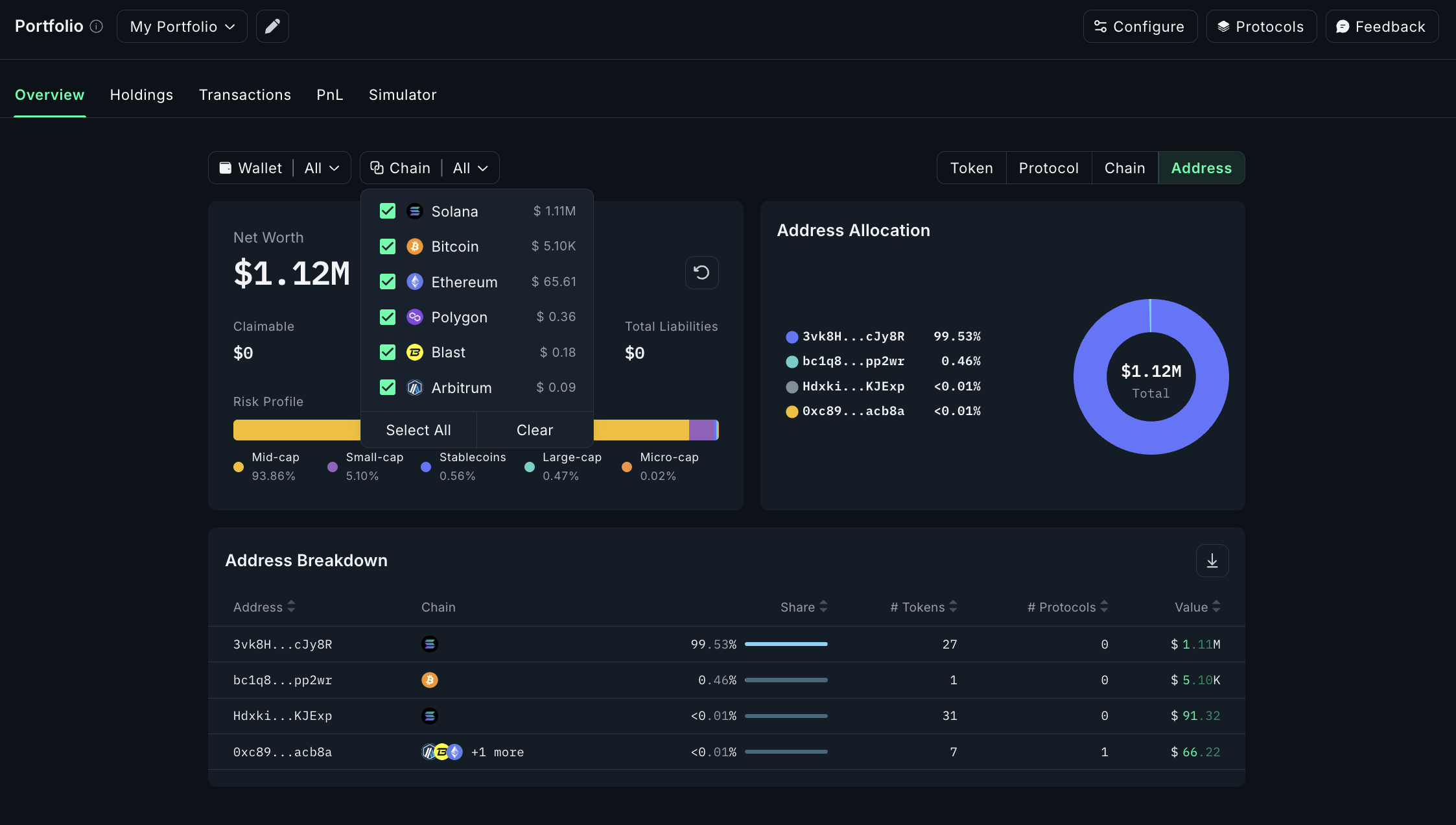

Unified wallet solutions are emerging as the answer to DeFi’s multi-chain UX challenge. These next-generation wallets provide a single interface for managing assets across dozens of blockchains without requiring users to switch tabs or remember different seed phrases. For instance, PUM Exchange’s unified multi-chain wallet now supports over 30 chains in one dashboard, Ethereum, BNB Chain, Solana, Bitcoin among them, empowering users to view balances and execute transactions with unprecedented simplicity.

Key features driving this transformation include:

- Cross-Chain Asset Management: Instantly view and organize digital assets from multiple networks in one place.

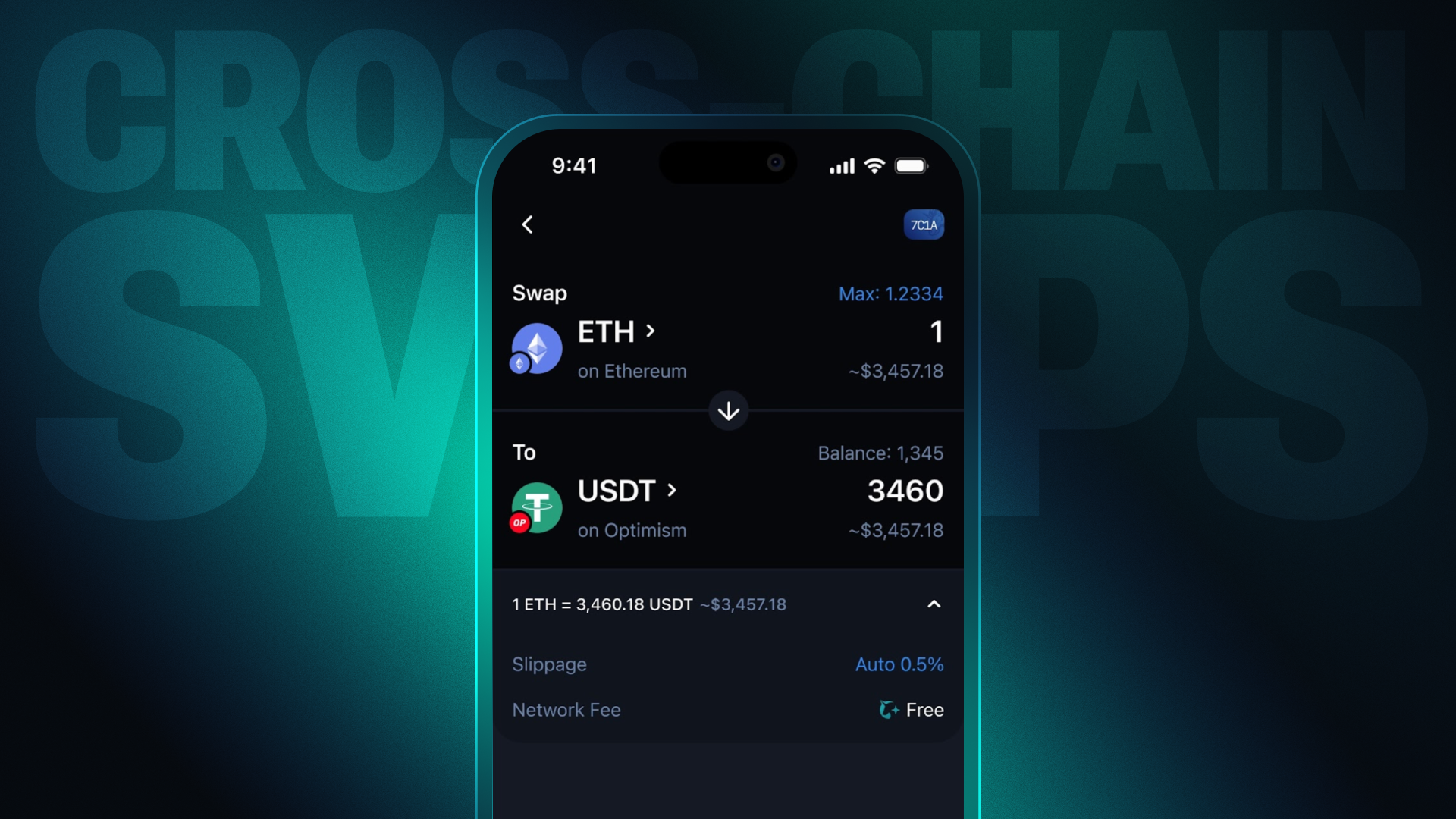

- Integrated Swaps and Bridge Routing: Swap tokens or move funds between chains using smart routing algorithms that optimize for speed and cost efficiency.

- Security by Design: Advanced technologies like Multi-Party Computation (MPC) ensure private keys are never fully exposed, even during cross-chain operations, combining self-custody with enterprise-grade protection.

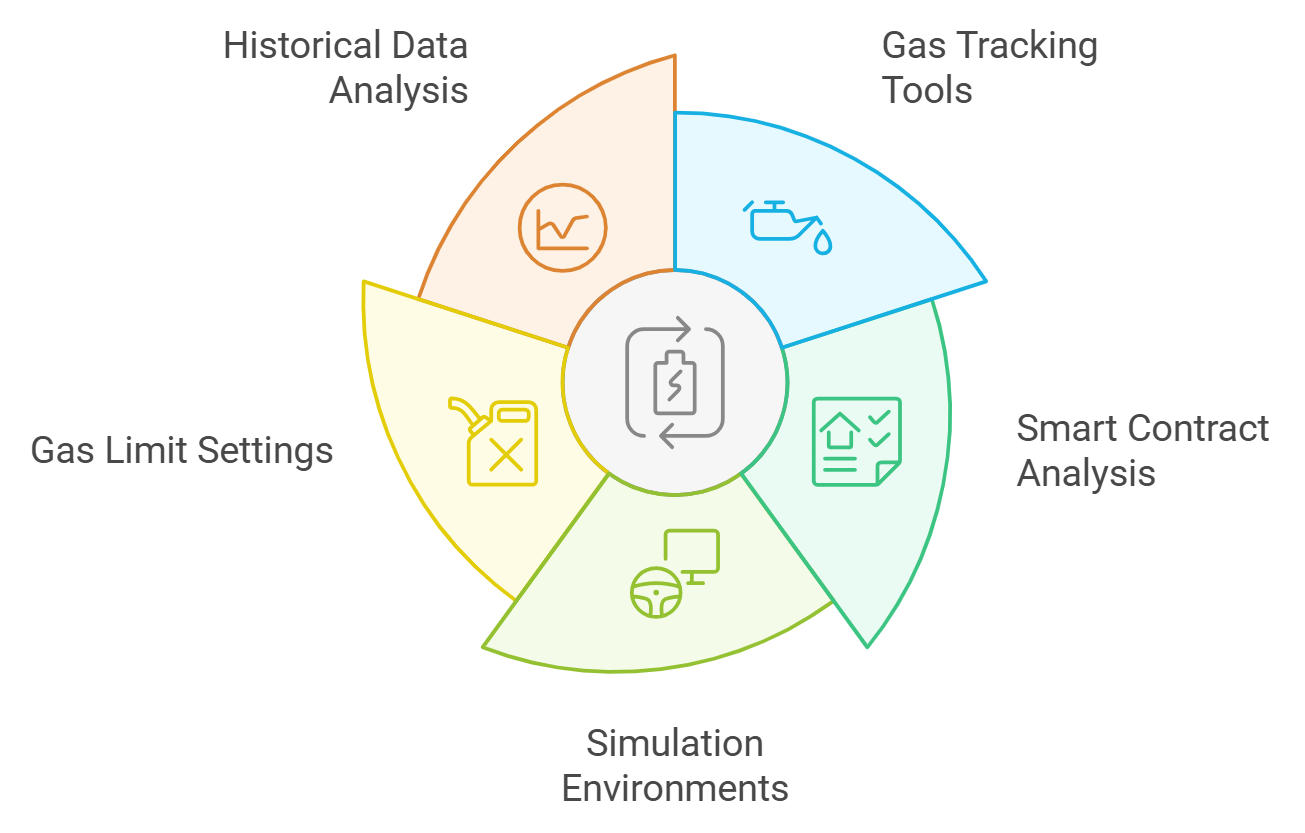

- Automated Gas Fee Optimization: Wallets suggest optimal gas fees based on real-time network congestion so users avoid failed or overpriced transactions.

- NFT and Token Compatibility: Support for major NFT standards (ERC-721/1155/SPL) allows direct viewing and transfer of NFTs across networks without leaving the wallet interface.

User Experience: From Friction to Flow

The impact on user experience is profound. Instead of navigating fragmented apps or risking costly mistakes when bridging assets manually, users interact with a single dashboard that abstracts away underlying complexity. For example, swapping ETH on Ethereum for SOL on Solana becomes as simple as a few clicks, the wallet handles bridge routing behind the scenes using integrated protocols like those pioneered by PUM Exchange or 1inch’s cross-chain Swap API.

This streamlined UX not only reduces onboarding friction for newcomers but also increases transaction volume by making it easier for experienced traders to move capital where it’s needed most. As highlighted by research from Nadcab Labs and Nansen’s multi-chain tracking tools, institutional players are also recognizing the value: secure MPC-powered wallets like FORDEFI are enabling compliant asset management at scale while preserving self-custody principles.

The Security Imperative in Multi-Chain Wallets

Simplifying cross-chain activity must not come at the expense of security, a lesson learned from early bridge exploits and phishing attacks targeting multi-wallet users. Unified wallets address this through layered defenses: MPC ensures no single party ever controls a full private key; biometric authentication adds another barrier; robust validation protects against chain-specific attack vectors identified in recent studies by Turnkey Security Labs. These advances are crucial as DeFi matures into an ecosystem where billions in value flow seamlessly across chains every day.

Another crucial element is real-time wallet synchronization. Without accurate, up-to-date reflection of cross-chain transactions, users risk double spending or missing critical updates, a gap that unified wallets are closing with advanced back-end infrastructure and instant notification systems. This not only builds trust but also greatly reduces the cognitive load on users, who can now focus on strategy rather than troubleshooting technical pitfalls.

Expanding DeFi Horizons: Interoperability and Innovation

The rise of unified wallet solutions is catalyzing a new wave of DeFi interoperability. Developers can now build dApps that leverage liquidity from multiple networks without forcing users to leave their preferred wallet environment. Protocols like zkLink’s multi-chain L2 network are pioneering this approach, allowing for pooled liquidity and composable products that were previously siloed by chain-specific limitations.

For users, this means broader access to yield opportunities, NFT marketplaces, and decentralized exchanges, regardless of where those assets or protocols originate. The ability to seamlessly swap, lend, or stake assets across chains in a single workflow is fundamentally changing how both retail and institutional participants engage with DeFi.

Top Unified Wallet Features Transforming DeFi in 2025

-

Cross-Chain Asset Management: Seamlessly manage and organize digital assets across multiple blockchains—like Ethereum, BNB Chain, Solana, and Bitcoin—within a single interface. PUM Exchange’s unified wallet supports over 30 networks for streamlined portfolio control.

-

Integrated Swaps & Native Bridge Routing: Instantly swap and bridge assets across chains with smart routing that finds the fastest and most cost-effective paths. 1inch’s cross-chain Swap API and PUM Exchange both offer this feature, eliminating the need for third-party bridges.

-

Advanced Security with MPC: Protect private keys using Multi-Party Computation (MPC), ensuring no single point of failure. FORDEFI and many unified wallets now use this enterprise-grade security for both individuals and institutions.

-

Automated Gas Fee Optimization: Unified wallets analyze real-time network congestion and recommend optimal gas fees, reducing failed transactions and saving users money—especially on busy chains like Ethereum and Solana.

-

Multi-Chain NFT & Token Support: View, transfer, and manage NFTs (ERC-721, ERC-1155, SPL) and tokens from multiple networks in one place. Leading wallets like PUM Exchange and zkLink ensure broad compatibility for diverse digital assets.

As highlighted by recent upgrades from platforms like 1inch and PUM Exchange, innovation is accelerating. Features such as gasless swaps (where fees are abstracted away or paid in the user’s preferred token), dynamic bridge selection for optimal routing, and integrated compliance checks for institutional adoption are quickly becoming standard.

Challenges and What’s Next for Unified Wallets

Despite rapid progress, challenges remain. Security risks persist as attackers target cross-chain bridges and exploit vulnerabilities unique to multi-network architectures. Continuous research into MPC protocols and smart contract auditing, combined with transparent bug bounty programs, is essential for maintaining user trust as value flows increase.

User education is another major frontier. Even the most intuitive wallets benefit from clear onboarding guides and contextual help so users understand what happens behind the scenes during complex operations like atomic swaps or NFT bridging. Community-driven feedback loops will play a pivotal role in refining UX standards across the industry.

The Path Forward: Unifying the Multi-Chain Future

The future of DeFi depends on reducing friction at every layer, from protocol design to user interface. Unified wallet solutions represent a foundational leap toward this goal by merging security, usability, and interoperability into a single platform experience. As more projects adopt these standards and integrate advanced features like automated fee optimization or real-time NFT management, users will gain unprecedented control over their digital assets.

This trend aligns with broader efforts to make blockchain UX as invisible as possible while maximizing choice and flexibility. Whether you’re a developer building the next cross-chain protocol or an everyday user seeking one-click access to global liquidity pools, unified wallets are rapidly becoming indispensable tools in the decentralized economy.

If you’re interested in learning more about how these innovations are shaping DeFi’s next chapter, including practical guides on using unified wallets, explore our resources at How Unified Wallets Simplify Cross-Chain Transactions for DeFi Users.