For decentralized finance (DeFi) users, managing assets across multiple blockchains has historically been a source of friction and inefficiency. Traditional wallets forced users to juggle separate interfaces for each network, complicating cross-chain transactions and fragmenting the DeFi user experience. In 2025, unified wallets are changing this paradigm by providing a single, consolidated gateway for all major blockchains, streamlining asset management and cross-chain operations with unprecedented efficiency.

The Fragmentation Problem: Why Cross-Chain Transactions Were Painful

Before the emergence of unified wallets, DeFi users faced significant hurdles when interacting with protocols or trading assets on different chains. Each blockchain – whether Ethereum, Solana, BNB Chain, or others – required its own wallet setup, private key management, and interface navigation. Simple tasks like swapping tokens between networks or tracking portfolio balances demanded manual bridge usage or third-party integrations.

This fragmentation created several pain points:

- Complex User Workflows: Users had to manage multiple seed phrases and wallet applications.

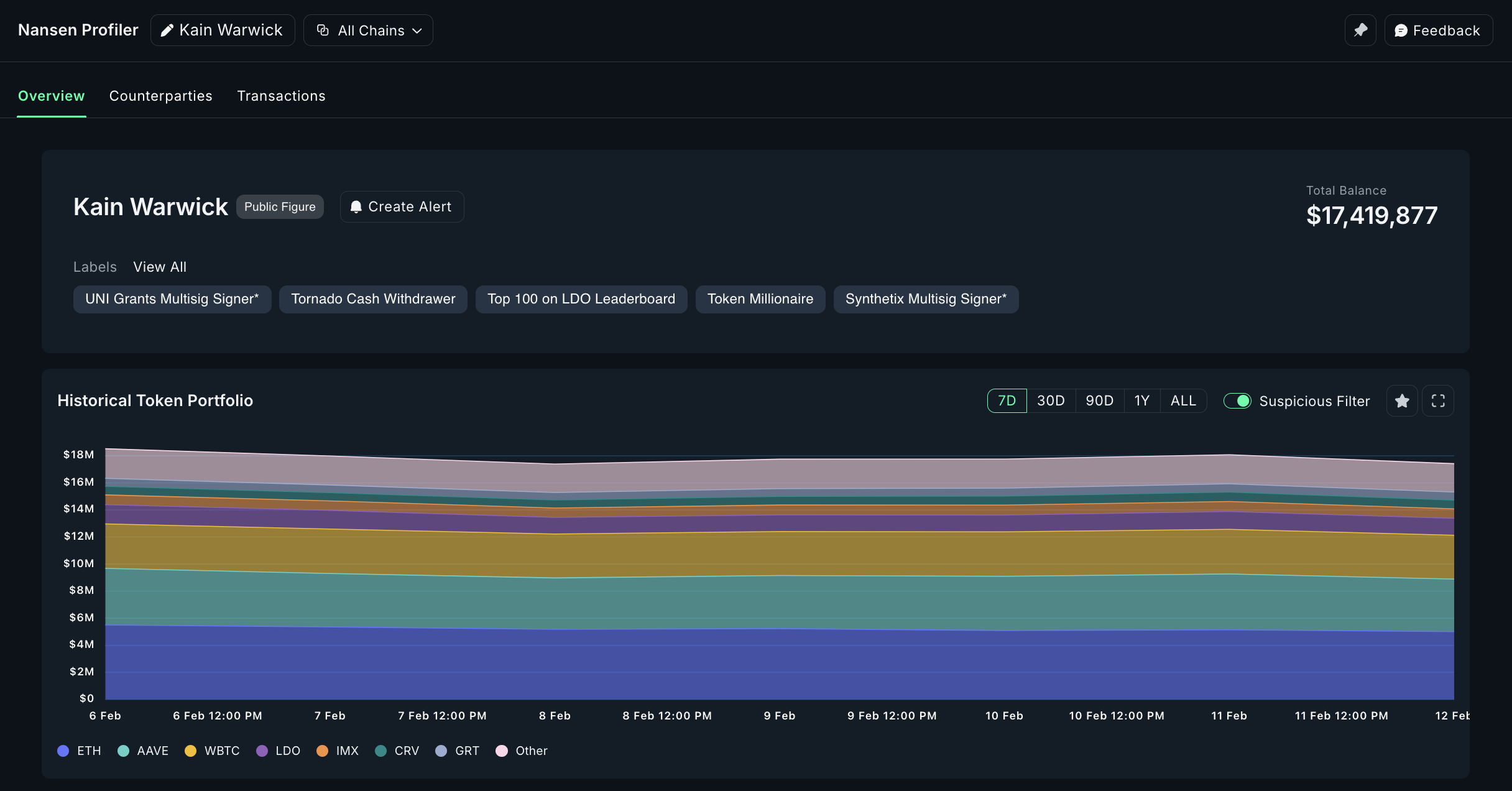

- Inefficient Asset Tracking: Monitoring total holdings required aggregating balances from disparate sources.

- High Risk of Error: Manual bridging increased the likelihood of sending assets to the wrong address or chain.

- Costly Transactions: Lack of fee optimization often resulted in overpaying for gas or failed swaps during network congestion.

This complexity not only deterred new entrants but also limited experienced DeFi users from fully leveraging opportunities across ecosystems. As adoption grew and more capital flowed into multi-chain protocols, the need for seamless cross-chain interoperability became critical.

Unified Wallets: Core Features Driving Simplicity

The latest generation of unified wallets addresses these challenges with an integrated approach to chain abstraction and multi-chain asset management. Here’s how leading solutions are advancing the DeFi user experience:

- Cross-Chain Asset Management: Platforms like PUM Exchange now support native asset recognition across more than 30 blockchains in one interface. Users can view consolidated balances for Ethereum, BNB Chain, Arbitrum, Optimism, Solana, Polygon, Tron, Bitcoin, and more – eliminating the need to check multiple apps.

- Integrated Swaps and Native Bridge Routing: Unified wallets such as Zypto enable direct cross-chain swaps within their app environment. This removes dependency on external bridges or browser extensions while reducing transaction steps and risk exposure.

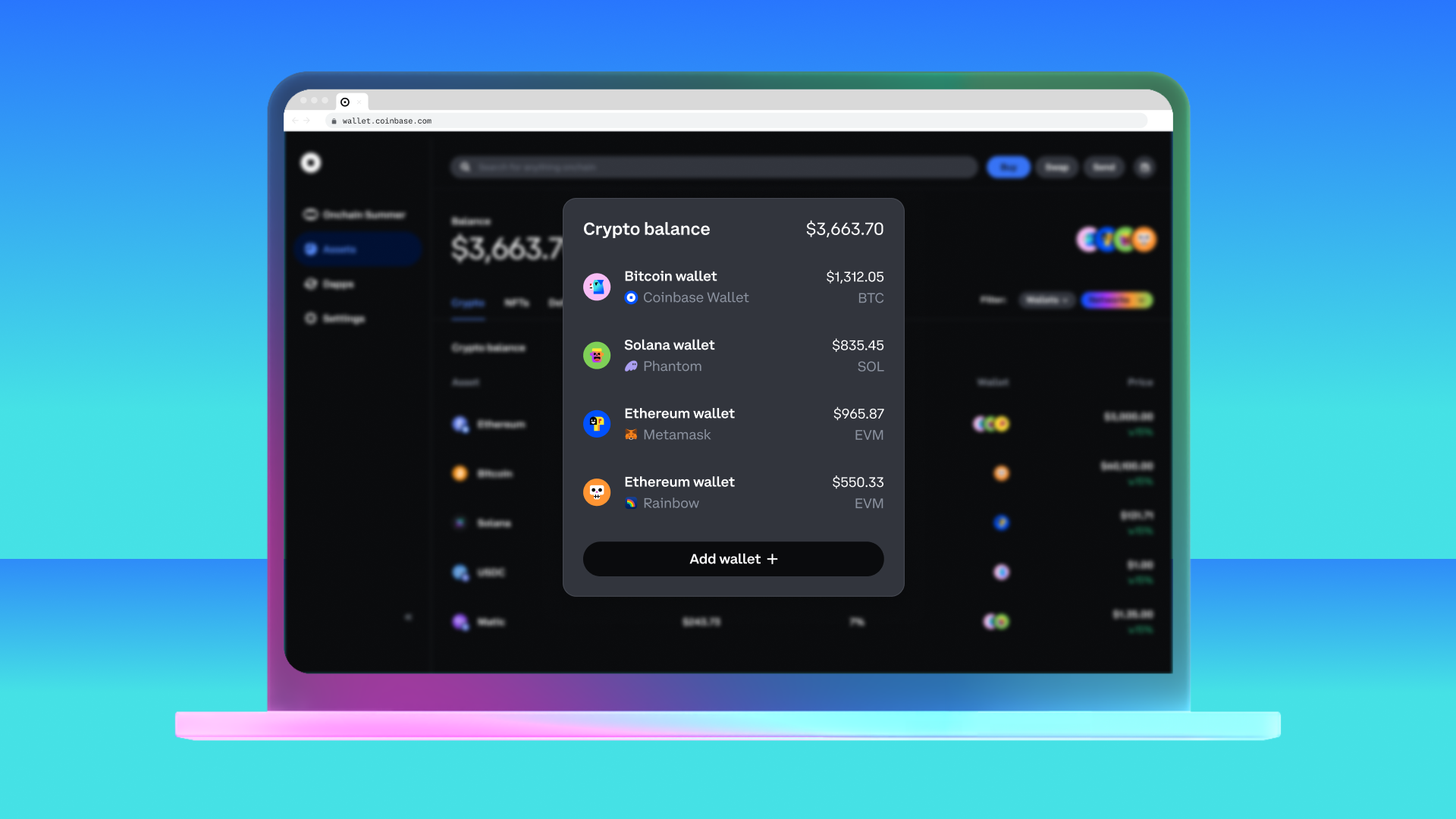

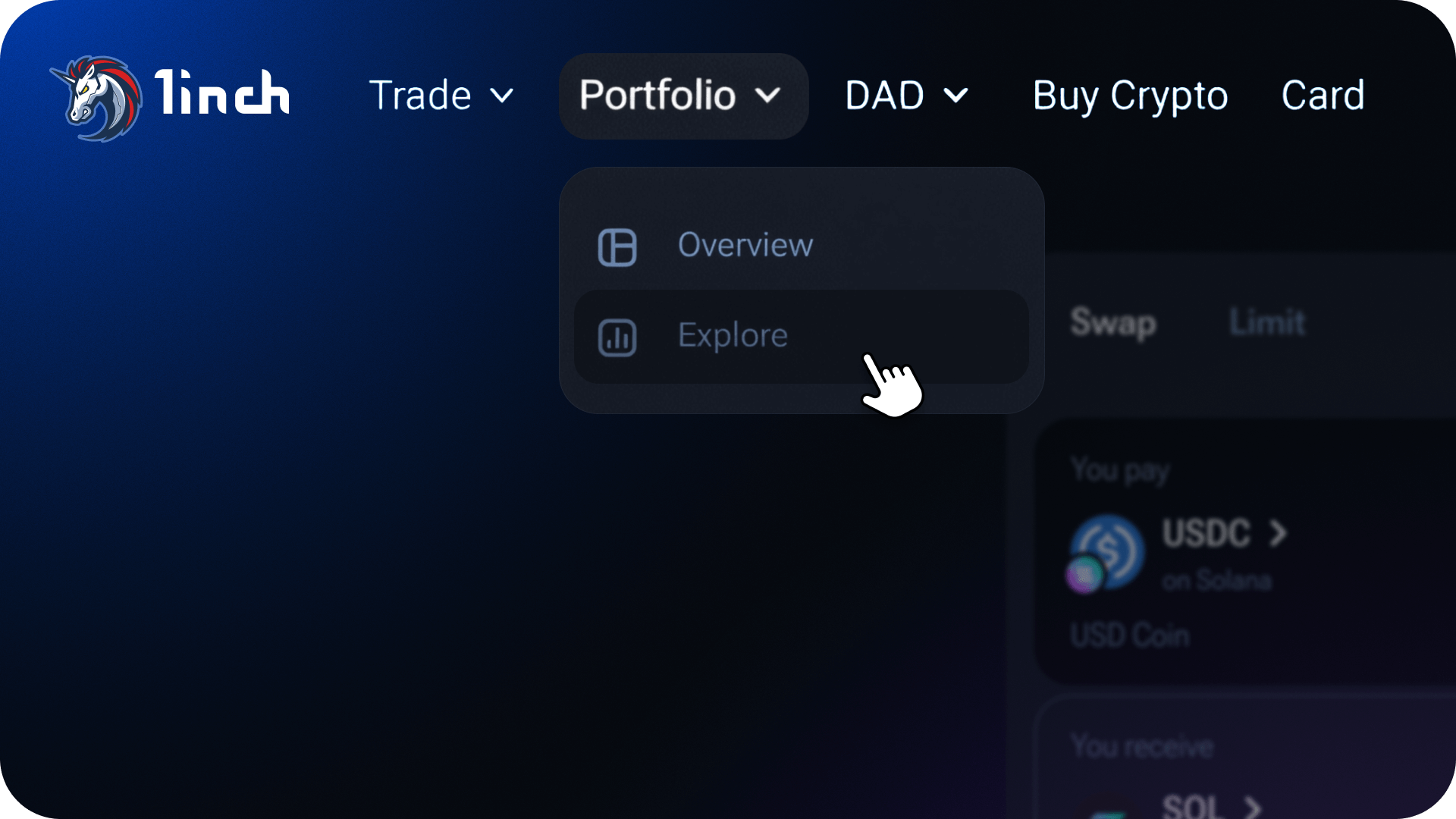

- Cohesive Portfolio Views: The new 1inch Portfolio feature allows up to ten wallets from different chains to be connected simultaneously. Users get a single dashboard displaying all assets and liabilities without switching contexts.

- Security Through Self-Custody and MPC: Advanced security models like Multi-Party Computation (MPC) ensure that private keys are never fully exposed or stored in one place. This institutional-grade protection gives users confidence that they retain full control over their funds while benefiting from streamlined access.

- Automated Gas Fee Optimization: Some unified wallets dynamically recommend optimal gas fees based on real-time network congestion data (especially valuable on volatile chains like Ethereum and Solana). This reduces failed transactions and unnecessary spending – directly improving cost efficiency for DeFi operations.

The result is a platform that abstracts away blockchain-specific complexities while preserving user sovereignty over private keys and transaction approvals. For an in-depth look at how these features work together in practice, see our analysis at How Unified Wallets Simplify Cross-Chain Transactions for DeFi Users.

Tangible Benefits for DeFi Participants

The impact of unified wallets extends beyond mere convenience; it fundamentally enhances key metrics that matter most to DeFi participants:

- Simplified User Experience: One login grants access to all networks – no more switching tabs or re-entering passwords/seed phrases across platforms.

- Enhanced Liquidity Access: By aggregating liquidity pools from multiple chains into a single interface, users gain access to better pricing and more trading pairs without hopping between DEXs or bridges.

- Improved Security Posture: With self-custody options fortified by MPC technology and institution-level safeguards, users minimize attack vectors associated with centralized exchanges or fragmented key storage.

- Cost Efficiency and Transaction Success Rates: Automated gas fee optimization ensures transactions are both economical and less prone to failure during periods of high demand – especially important as network activity surges around major protocol launches or market events.

This evolution in wallet architecture is not just theoretical; it is already being adopted by leading exchanges and protocol developers aiming to unify the fractured landscape of blockchain-based finance. For further insights on how these changes are shaping the broader ecosystem see our related coverage at How Unified Wallets Enable Seamless Cross-Chain UX for DeFi Users.

Unified wallets are also catalyzing a shift in how users interact with decentralized applications (dApps). Rather than forcing users to connect disparate wallets to each dApp or protocol, unified solutions enable seamless, one-click authentication and cross-chain execution. This dramatically lowers the barrier for onboarding new users and empowers sophisticated DeFi strategies that span multiple blockchains, without the operational drag of fragmented tooling.

Real-World DeFi Tasks Simplified by Unified Wallets

-

Managing Multi-Chain Portfolios: Unified wallets like PUM Exchange allow users to view and manage assets across over 30 blockchains (e.g., Ethereum, BNB Chain, Solana, Polygon) from a single interface, providing a consolidated portfolio overview.

-

Performing Cross-Chain Swaps: Platforms such as Zypto Wallet enable direct cross-chain token swaps within the app, eliminating the need for third-party bridges or browser extensions.

-

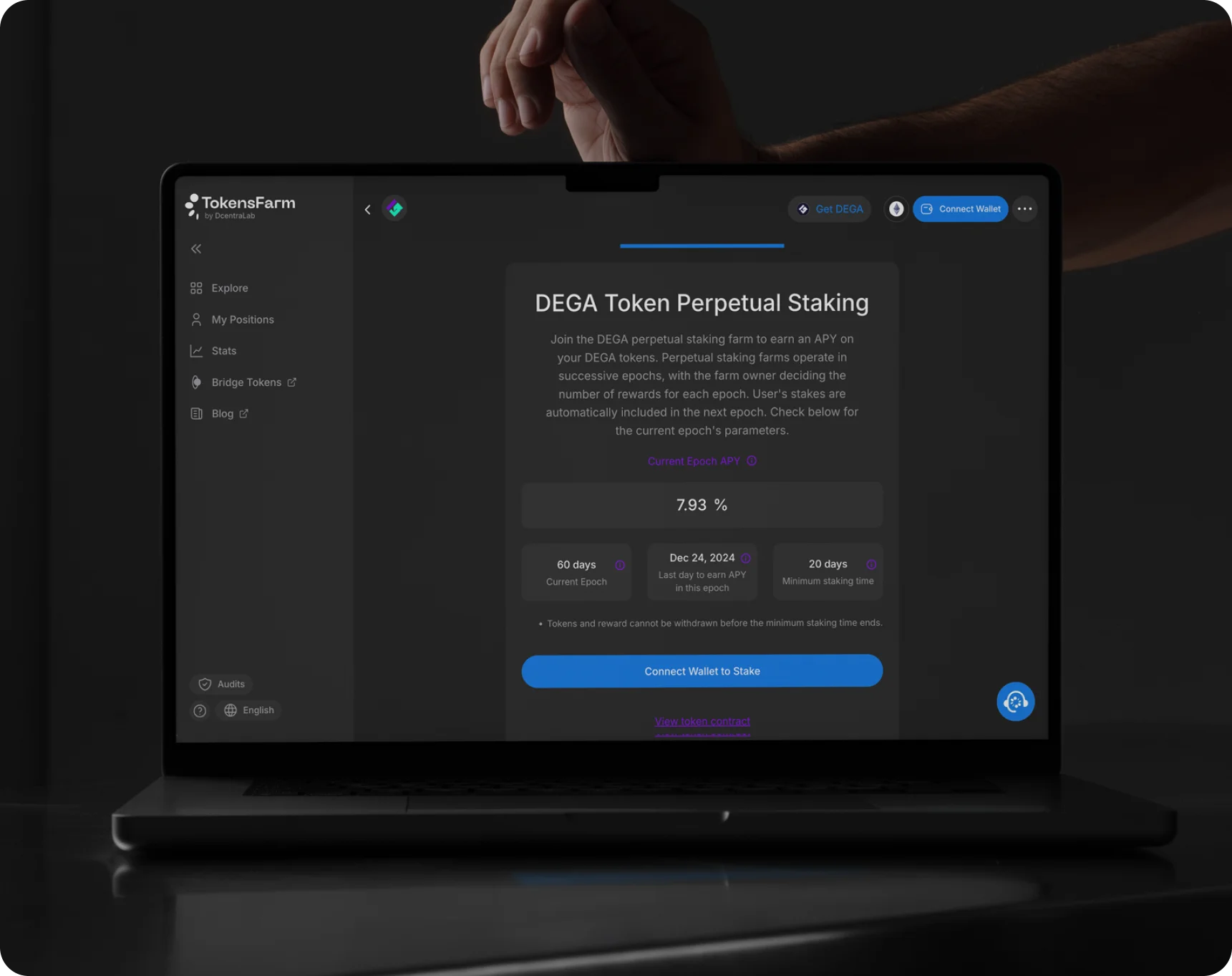

Staking and Yield Farming Across Networks: Unified wallets integrate with DeFi protocols on multiple chains, allowing users to stake tokens or participate in yield farming (e.g., on Ethereum, Arbitrum, or BNB Chain) without switching wallets or interfaces.

-

Optimizing Gas Fees Automatically: Advanced unified wallets, such as PUM Exchange, offer automated gas fee optimization, recommending the most cost-effective transaction fees based on real-time network congestion.

-

Tracking and Managing NFTs Cross-Chain: Some unified wallets support NFT management across different blockchains, allowing users to view, transfer, and organize NFTs (e.g., on Ethereum and Polygon) in one place.

-

Aggregating DeFi Protocol Access: Features like 1inch Portfolio let users connect multiple wallets and interact with various DeFi protocols across chains, streamlining lending, borrowing, and trading activities.

-

Enhancing Security with Self-Custody: Unified wallets often employ Multi-Party Computation (MPC) and other advanced security measures, ensuring users retain control and security of their assets across all supported blockchains.

Liquidity aggregation is a particularly notable advantage. By tapping into pools across Ethereum, Solana, BNB Chain, and others simultaneously, traders can source the best prices and deepest liquidity for swaps or yield farming. This not only improves execution quality but also increases capital efficiency, a key metric for both retail and institutional participants seeking alpha in competitive markets.

Security remains paramount as cross-chain interoperability expands. The adoption of Multi-Party Computation (MPC) and hardware isolation ensures that even as users interact with dozens of protocols across chains, their private keys remain uncompromised. Unified wallets have set new standards by integrating these security features natively, providing peace of mind without sacrificing usability or speed.

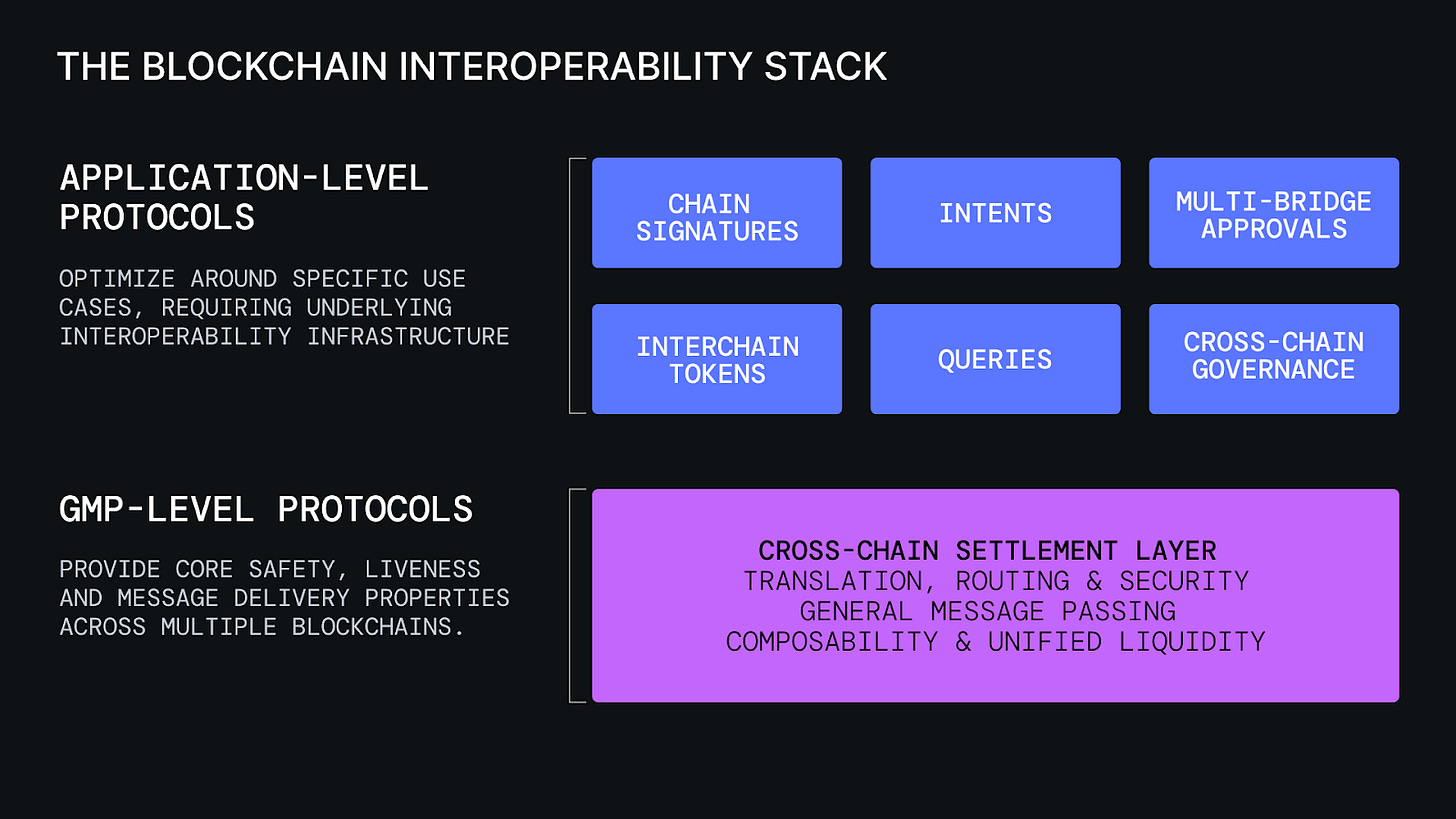

The Role of Chain Abstraction in Future-Proofing DeFi

The concept of chain abstraction is at the core of unified wallet innovation. By abstracting away individual blockchain quirks, transaction formats, gas fee models, consensus mechanisms, wallets can present a standardized interface that works identically regardless of the underlying network. Emerging standards like ERC-7683 (“intents”) further this trend by letting users specify desired outcomes rather than technical steps, pushing complexity to the protocol layer and away from end-users.

This architecture is critical as new blockchains and Layer 2 networks proliferate. Users want assurance that their wallet will remain compatible as ecosystems evolve. Unified wallets designed around chain abstraction principles are inherently more resilient to future changes, ensuring long-term utility without constant user retraining or migration hassles.

For developers and enterprises building on DeFi infrastructure, this means faster integration cycles and reduced maintenance overhead. Unified wallet SDKs now offer plug-and-play support for major chains out-of-the-box, accelerating time-to-market for cross-chain dApps while maintaining robust security controls.

What’s Next? Trends Shaping Unified Wallet Adoption

The next wave of unified wallet innovation will likely focus on deeper integration with traditional finance rails (fiat on/off ramps), broader NFT support across chains, and advanced portfolio analytics powered by AI-driven insights. As regulatory clarity improves globally, expect to see institutional-grade features like compliance modules and multi-user access controls become standard in leading solutions.

User expectations are also rising: frictionless staking across networks, instant bridging without third-party risk exposure, and holistic dashboards that combine DeFi positions with NFT holdings are quickly becoming table stakes rather than premium features.

The journey toward true blockchain interoperability is far from over, but unified wallets have already delivered significant progress in abstracting away complexity while enhancing security and performance. As adoption accelerates through 2025 and beyond, these solutions will remain at the heart of a more accessible and efficient decentralized finance ecosystem.