In 2024, the decentralized finance (DeFi) landscape underwent a fundamental shift as unified wallet cross-chain solutions became mainstream. For years, users juggled multiple wallets and navigated a tangled web of bridges to move assets across blockchains. Today’s seamless multi-chain wallet technologies are rewriting that playbook, offering a single, intuitive interface for all assets and activities, regardless of network. This transformation is not just technical; it’s dramatically improving the cross-chain DeFi UX and lowering the barrier to entry for millions of users.

From Fragmentation to Fluidity: The Rise of Unified Wallets

Historically, DeFi participation meant managing separate wallets for every blockchain, Ethereum, BNB Chain, Polygon, Solana, and beyond. Each chain had its own address format, private key management quirks, and unique dApp ecosystems. Bridging assets required complex transactions and often exposed users to security risks or high fees.

The emergence of unified wallets in 2024 changed this paradigm. Solutions like zkCross Network’s Super Accounts enabled users to consolidate balances from all EVM and non-EVM chains into a single dashboard. Suddenly, transferring funds between networks became as simple as a single click, no more manual swaps or multiple seed phrases.

PUM Exchange’s Unified Multi-Chain Wallet took this further by supporting over 30 blockchains with native bridge routing and on-chain swapping directly within the wallet interface. Meanwhile, 1inch’s cross-chain swaps eliminated the need for external bridges entirely by using Fusion and technology to enable direct asset exchanges across Layer 1s and Layer 2s without extra gas fees.

User-Centric Design Meets Advanced Interoperability

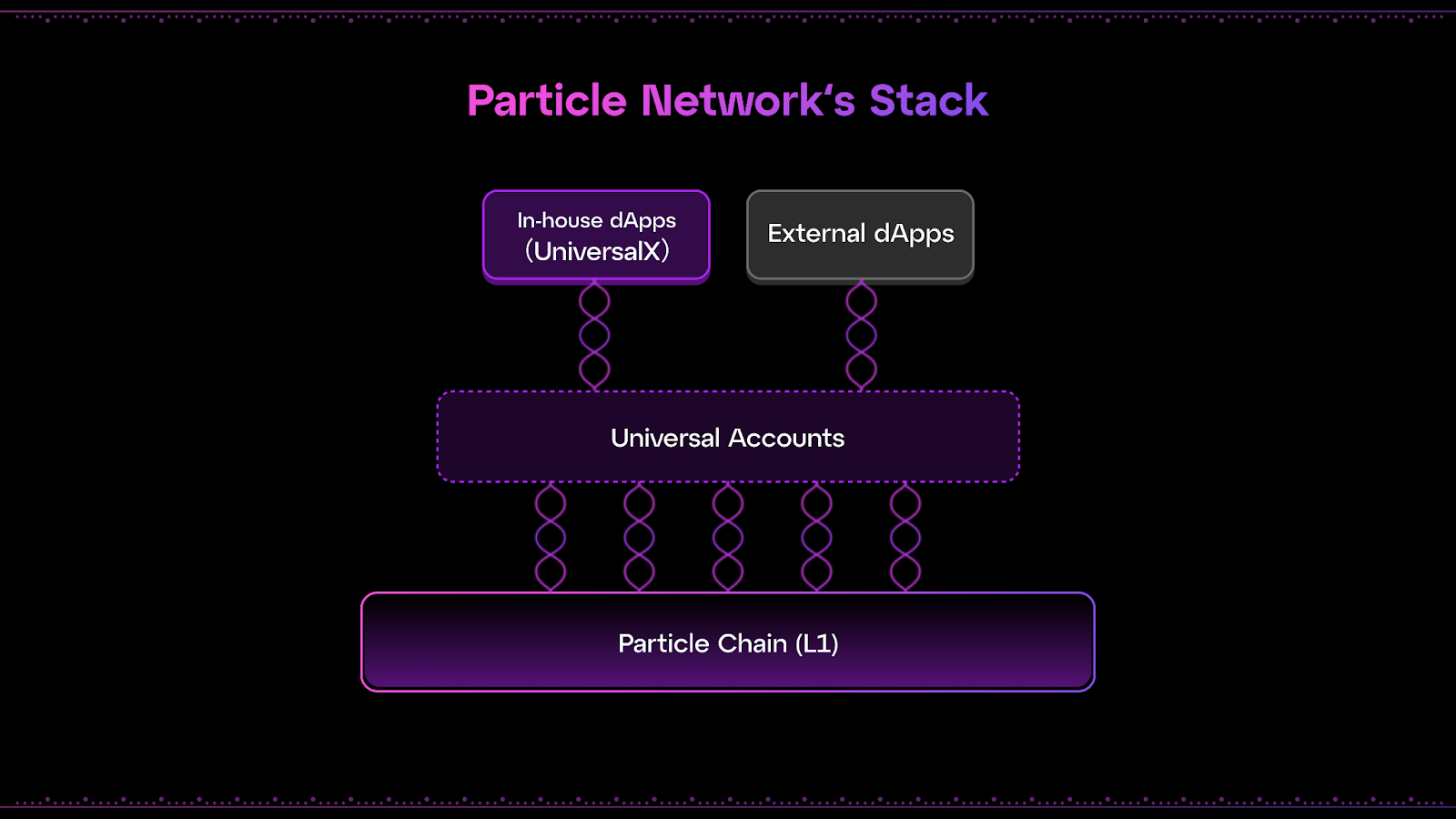

This new wave of DeFi wallet aggregation is powered by both backend innovation and frontend simplicity. Universal Accounts by Particle Network aggregate holdings from disparate chains into a single balance, enhancing liquidity utilization while making portfolio management effortless for users.

The user experience is now defined by:

Key Benefits of Unified Wallets in Cross-Chain DeFi

-

Simplified Asset Management: Unified wallets like PUM Exchange’s Unified Multi-Chain Wallet and Particle Network’s Universal Accounts offer a consolidated view of assets across multiple blockchains, eliminating the need to juggle separate wallets for each network.

-

Seamless Cross-Chain Transactions: Solutions such as 1inch Cross-Chain Swaps and zkCross Network’s Super Accounts enable users to execute transactions across different blockchains with a single click, removing the complexity of manual bridging and token swaps.

-

Improved Liquidity Utilization: By aggregating balances from various networks, unified wallets like Particle Network’s Universal Accounts allow users to maximize liquidity and participate in DeFi opportunities without fragmentation.

-

Enhanced Security and Accessibility: Advanced security features such as Multi-Party Computation (MPC) and user-friendly interfaces in wallets like PUM Exchange’s and 1inch make DeFi safer and more approachable for both new and experienced users.

-

Streamlined dApp Interactions: Unified wallets provide direct access to decentralized applications (dApps) across multiple chains from a single interface, simplifying user engagement and expanding the DeFi ecosystem’s reach.

Behind the scenes, intent-based execution DeFi systems interpret user actions (like “swap X token for Y on any chain”) and automatically route transactions through optimal paths, often abstracting away bridging steps entirely. Users no longer need to understand which network their tokens reside on or worry about cross-chain gas fee simplification; it’s all handled invisibly by the wallet.

Security and Accessibility: Opening DeFi to the Masses

The democratization of DeFi hinges on usability and security. Unified wallets are leading here too by integrating Multi-Party Computation (MPC) for private key protection and offering robust recovery options that don’t sacrifice decentralization principles. These advances make self-custody viable even for less technical users, a critical factor as crypto adoption broadens globally.

The impact is measurable: according to recent reports, over 1.28 million wallets claimed ZRO during ForceField Digital’s interoperability campaign in mid-2024, a testament to growing demand for streamlined experiences.

Breaking Down Barriers Across Blockchains

The real promise of seamless multi-chain wallets goes beyond convenience; it unlocks new financial opportunities previously gated by technical friction. Whether you’re accessing omnichain money markets like Radiant Capital or trading Bitcoin-backed assets on ALEX’s V2 platform with a single BTC wallet, these innovations are making decentralized finance truly borderless.

Unified wallet cross-chain solutions are also catalyzing a shift in how users perceive and interact with DeFi platforms. Instead of thinking in terms of isolated chains, users now experience a unified digital economy where assets, dApps, and liquidity move freely. This convergence is driving higher engagement and retention across DeFi protocols, as the friction of onboarding and transacting has been dramatically reduced.

Importantly, these developments are not just theoretical or limited to early adopters. The surge in wallet aggregation features has led to a tangible increase in on-chain activity. For instance, platforms like 1inch have reported exponential growth in cross-chain transaction volumes as their intent-based execution models remove the need for manual bridge navigation and fee calculations. Users can swap, lend, or stake assets across any supported network with a few taps, no technical background required.

What’s Next: From Wallet Aggregation to Full-Stack Chain Abstraction

The trajectory for seamless multi-chain wallet technology points toward even deeper chain abstraction. As protocols like Particle Network and zkCross push the boundaries with universal accounts and super accounts, we are witnessing the early stages of full-stack chain abstraction, where not only assets but also identity, reputation, and transaction history become portable across ecosystems.

One emerging trend is the integration of fiat onramps and NFT management directly within unified wallets. This makes it possible for users to participate in DeFi lending markets or access NFT collections without ever leaving their primary wallet app. Coupled with advanced security features like biometric authentication and MPC key management, these improvements further lower the barriers to entry for mainstream users.

- Improved liquidity utilization: Aggregated balances enable users to deploy capital more efficiently across protocols.

- Reduced risk: By minimizing manual bridging steps and consolidating security layers, unified wallets help mitigate common attack vectors.

- User-friendly interfaces: Clean dashboards and customizable workflows make self-custody accessible to everyone, from seasoned traders to DeFi newcomers.

This evolution is not without its challenges. As more value flows through unified wallets, ensuring robust security practices remains paramount. The industry continues to invest heavily in audits, bug bounties, and open-source transparency to build user trust at scale.

Top Unified Wallet Projects Revolutionizing Cross-Chain DeFi in 2024

-

zkCross Network Super Accounts: Introduced on Stellar, Super Accounts unify user balances across all EVM and non-EVM chains, enabling one-click cross-chain transactions without manual wallet management or token swaps.

-

PUM Exchange Unified Multi-Chain Wallet: PUM Exchange’s wallet supports over 30 blockchains, offering integrated cross-chain asset management, on-chain swapping, and native bridge routing within a single secure platform.

-

1inch Cross-Chain Swaps: Leveraging Fusion+ technology, 1inch allows users to seamlessly swap assets across Layer 1 and Layer 2 networks without bridges or extra gas fees, greatly simplifying the DeFi experience.

-

Particle Network Universal Accounts: Universal Accounts aggregate assets from different chains into a single balance, letting users manage and transact cross-chain as if operating on one unified network.

The future of cross-chain DeFi UX is undeniably bright as wallet aggregation matures into full-featured chain abstraction platforms. For those looking to dive deeper into how these innovations work under the hood, or seeking practical guidance on getting started, explore our resource on how unified wallets simplify cross-chain swaps for DeFi users.