Imagine swapping stablecoins from Solana to Ethereum, or moving your gaming assets from Polygon to Sui, all in a single click, without ever thinking about bridges, gas tokens, or which network you’re on. As of late 2025, this is no longer a DeFi fantasy but the new standard, thanks to rapid advances in chain abstraction. This paradigm shift is making cross-chain swaps as seamless as single-chain transactions, fundamentally redefining how users interact with blockchain ecosystems.

What Is Chain Abstraction and Why Does It Matter?

Chain abstraction refers to the technology layer that makes blockchains, and their complexities, invisible to end users. Instead of juggling multiple wallets, remembering which chain holds which asset, or worrying about gas fees in native tokens, users simply focus on what they want to do: swap assets, interact with dApps, and manage portfolios. The underlying magic abstracts away network differences while preserving decentralization and security.

This approach has become the backbone of next-generation DeFi. According to NEAR Docs and the Crypto Council for Innovation, chain abstraction unifies transactions across multiple networks and eliminates much of the friction that previously hindered mainstream adoption. In 2025’s landscape of modular blockchain infrastructure and intent-driven DeFi protocols, chain abstraction isn’t just a convenience, it’s essential for scaling Web3 beyond early adopters.

The State of Cross-Chain Swaps in 2025: A User-Centric Transformation

The evolution toward effortless cross-chain swaps is driven by both user demand and technical innovation. Let’s break down the most significant advancements shaping today’s seamless cross-chain UX:

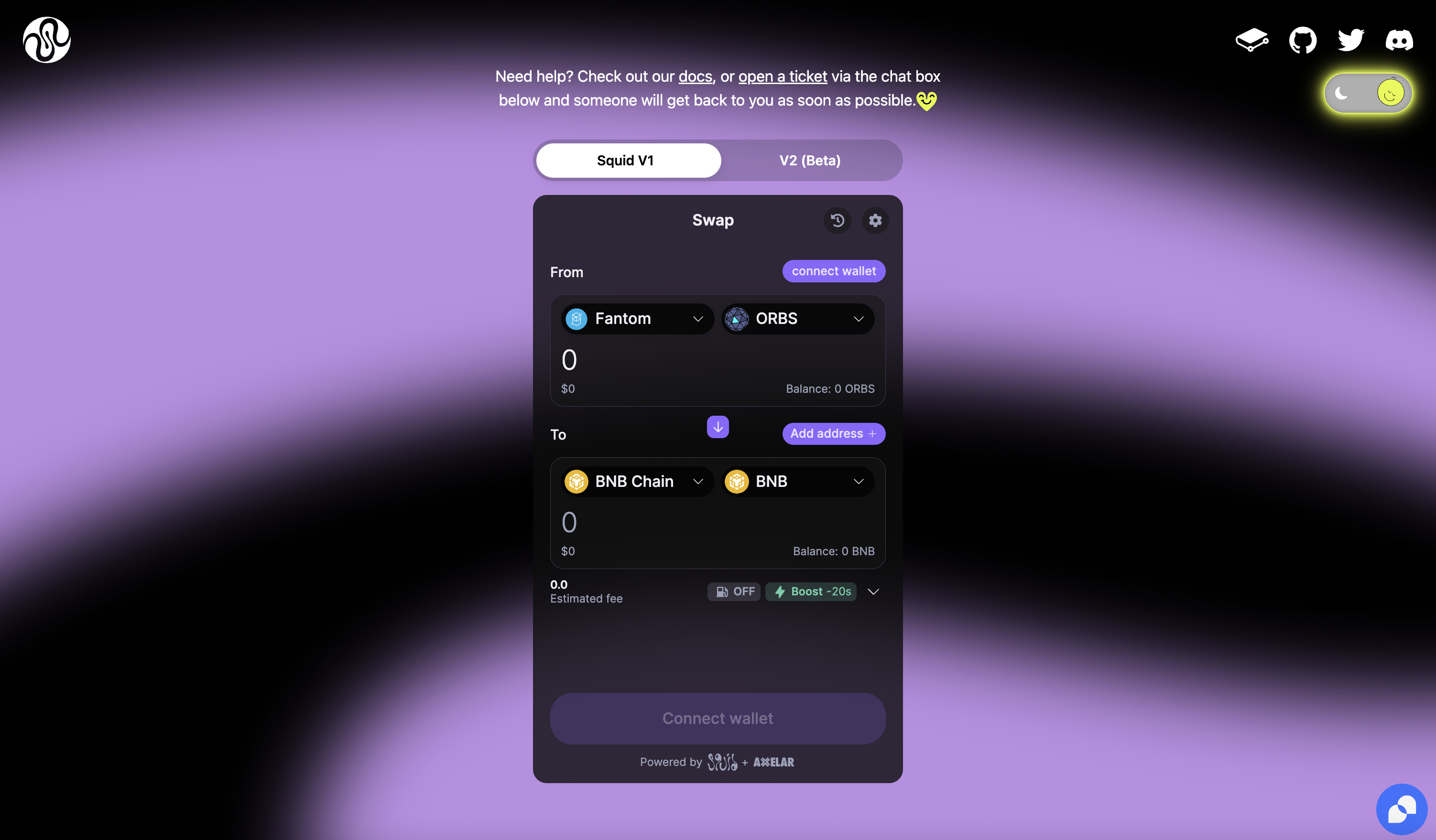

- Intent-Based Protocols: Platforms like Squid’s CORAL protocol introduced decentralized intent-based liquidity routing in December 2024. Users specify what they want (e. g. , swap USDC on Optimism for SOL on Solana), and CORAL engages liquidity providers via a request-for-quote (RFQ) system that optimizes execution, often with near-instant finality and minimal slippage.

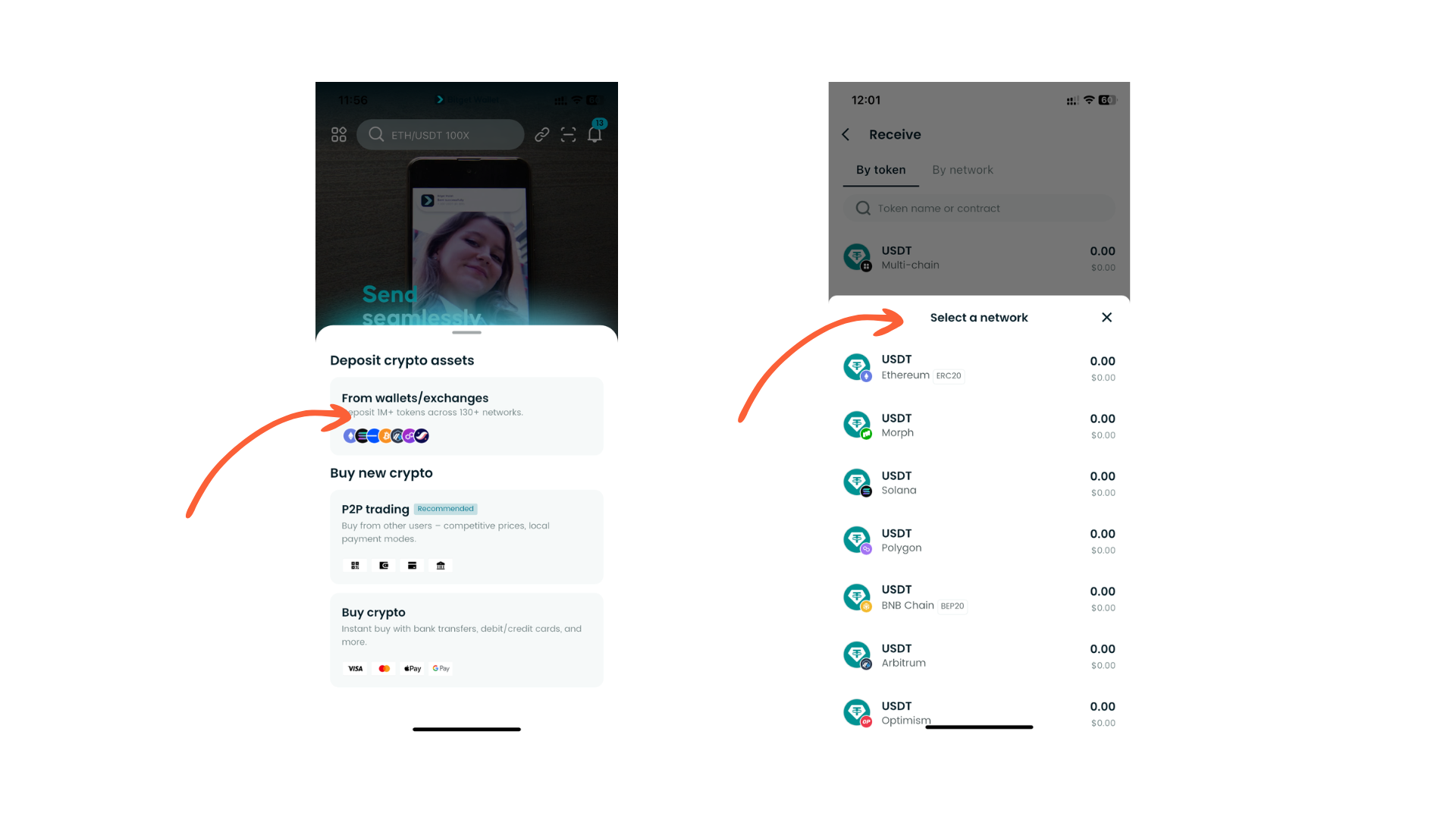

- Unified Wallet Experiences: Modern chain abstraction wallets aggregate balances across networks into a single dashboard. Whether your assets are on Tron, Ethereum L2s, or Cosmos chains, you see one unified balance, and can transact without switching networks manually.

- Gas Abstraction: Bitget Wallet’s October 2025 rollout lets users pay transaction fees in stablecoins like USDT or USDC across major chains. No more scrambling for native tokens just to cover gas, this removes one of DeFi’s most persistent pain points.

The result? Users now think in terms of assets rather than chains, a perspective shift echoed by CoW DAO’s recent launch and industry commentary from Altius Labs and QuickNode Blog. Liquidity flows freely between networks; compliance and security are handled under the hood; even enterprise adoption is accelerating as complexity drops away.

Pioneering Protocols Redefining Cross-Chain UX

The current wave of chain abstraction wouldn’t be possible without key infrastructure projects pushing boundaries:

- Squid CORAL: By leveraging an auction-based RFQ system for liquidity sourcing, CORAL has made it possible to execute complex cross-chain swaps with unprecedented efficiency (learn more here). Liquidity providers compete directly for user orders, minimizing costs while ensuring optimal routes across disparate ecosystems.

- Reown: Their phased approach integrates bridges and swap services behind a unified interface, tackling asset fragmentation and simplifying gas token management at the infrastructure level.

- Anyswap and ChainSwap: With support for non-EVM chains (like Solana and Sui), zk-proof verification for swap security, and integration with Chainlink CCIP for robust interoperability guarantees, these protocols are setting new standards for reliability in cross-chain interactions.

This modular approach doesn’t just benefit developers building new dApps, it empowers everyday users with a truly unified wallet experience. For those interested in diving deeper into how these innovations eliminate bridges and gas fees from the user journey, see our guide on eliminating bridges and gas fees.

What’s striking about 2025’s cross-chain landscape is how far we’ve come from the days of clunky bridges, failed transactions, and gas fee anxiety. Today’s chain abstraction protocols have absorbed these headaches into elegant background processes, giving users a frictionless experience that rivals centralized exchanges, without sacrificing self-custody or transparency.

How Chain Abstraction Delivers Effortless Swaps

Let’s walk through how a typical cross-chain swap now works under the hood:

Step-by-Step Cross-Chain Swap with Chain Abstraction (2025)

-

1. Access a Chain-Abstraction WalletBegin by logging into a chain-abstraction enabled wallet, such as Bitget Wallet or a similar platform. These wallets display your unified asset balances across multiple blockchains, eliminating the need to manage separate addresses or networks.

-

2. Select Assets and Destination ChainChoose the asset you wish to swap (e.g., USDT) and the target blockchain (e.g., from Ethereum to Solana). The wallet abstracts away network complexities, letting you focus on assets, not chains.

-

3. Initiate the Swap via a Unified InterfaceInput the desired amount and confirm the transaction. The wallet leverages protocols like Squid’s CORAL or ChainSwap with Chainlink CCIP to route your swap for optimal execution, engaging decentralized liquidity providers.

-

4. Gas Fees Paid with StablecoinsThanks to full gas abstraction (e.g., Bitget Wallet’s system), you can pay transaction fees using stablecoins like USDT or USDC—no need to hold native tokens of the source or destination chain.

-

5. Near-Instant and Secure SettlementThe swap executes with near-instant finality, utilizing security enhancements such as Chainlink CCIP and zk-proof verification (as per Anyswap’s roadmap), ensuring your assets arrive safely on the target chain.

-

6. Receive Unified Balance UpdateOnce complete, your wallet instantly reflects the new balance on the destination chain, maintaining a unified portfolio view—no manual tracking or network switching required.

First, you select the asset you want to send and the destination chain. The wallet interface handles all network selection and compatibility checks for you. Next, your intent (for example, swapping USDT on Polygon for SOL on Solana) is broadcast to an intent-based protocol like CORAL or ChainSwap, which routes your order to the best liquidity providers across all supported chains.

Behind the scenes, gas fees are calculated and can be paid in stablecoins, thanks to Bitget Wallet’s gas abstraction layer, so there’s no need to hold native tokens like ETH or SOL just for transaction costs. Security features such as zk-proof verification and Chainlink CCIP ensure your assets are transferred with maximum integrity and minimal risk.

Within seconds, your new asset arrives in your unified wallet dashboard. You never see a bridge address or worry about stuck transactions. Everything is confirmed transparently on-chain but feels as simple as moving money between accounts at a traditional bank.

Security, Compliance, and Enterprise Adoption

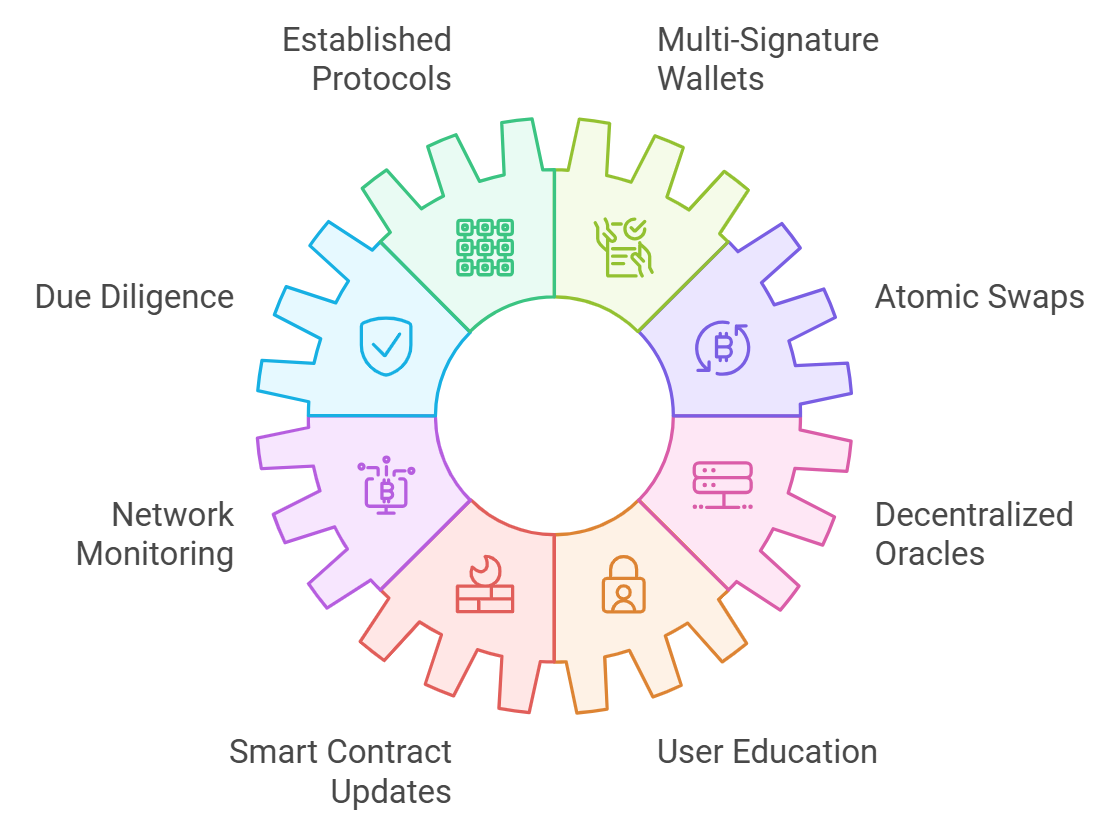

While user experience is front-and-center, security remains paramount. Modern chain abstraction protocols employ multi-layered safeguards:

- Automated compliance checks, integrated at the protocol level, help projects meet regulatory requirements without manual intervention.

- ZK-proofs and decentralized validation confirm that swaps are executed honestly across chains.

- Intent-based execution allows users to pre-define acceptable slippage or counterparty conditions before any assets move.

This robust foundation has helped unlock enterprise adoption at scale. As QuickNode Blog highlights, cross-chain abstraction is now bridging not just assets but also compliance frameworks, making it possible for institutions to participate in DeFi markets securely and efficiently.

What’s Next? The Road Ahead for Unified Wallets and Modular Infrastructure

The next frontier is deeper modularity and even more seamless integrations. Anyswap’s roadmap points toward universal support for emerging non-EVM networks like Aptos and Sui, along with Layer-3 rollups that can further compress transaction costs while boosting throughput. Expect wallets to become even smarter: automatically optimizing routes based on real-time liquidity data, surfacing actionable insights for users, and integrating with social platforms for peer-to-peer swaps.

If you’re ready to experience this new paradigm, or want tips on choosing the best unified wallet, explore our resources on how chain abstraction simplifies cross-chain swaps.

The Bottom Line: From Friction to Freedom

The era of thinking in terms of blockchains is ending. Thanks to advances in chain abstraction cross-chain swaps, DeFi users now enjoy a seamless cross-chain UX where assets move freely, securely, and instantly, no bridges required. With modular infrastructure maturing rapidly and unified wallet experiences becoming standard, 2025 marks the year when intent-driven DeFi finally feels intuitive enough for everyone.