Imagine if using decentralized finance (DeFi) felt as easy as managing a single bank account, no matter how many blockchains your assets lived on. In 2025, that vision is finally within reach thanks to chain abstraction. This breakthrough is rapidly dissolving the friction that once plagued multi-chain user experiences, making DeFi more accessible and intuitive for everyone, from seasoned crypto traders to first-time wallet users.

Why Multi-Chain UX Friction Is Holding DeFi Back

The past few years have seen an explosion of new blockchains and DeFi protocols. While this diversity drives innovation, it also introduces complexity for users. Typical pain points include:

- Managing multiple wallets across chains like Ethereum, Arbitrum, and Solana

- Switching networks in wallets just to access dApps or assets

- Juggling different gas tokens, think ETH for Ethereum, MATIC for Polygon, AVAX for Avalanche

- Navigating bridges and swaps that feel clunky and error-prone

This fragmentation not only frustrates users but also creates barriers to onboarding the next wave of DeFi participants. As highlighted by industry leaders such as the Crypto Council for Innovation and Polkadot, simplifying these interactions is essential for mass adoption.

How Chain Abstraction Transforms Cross-Chain UX

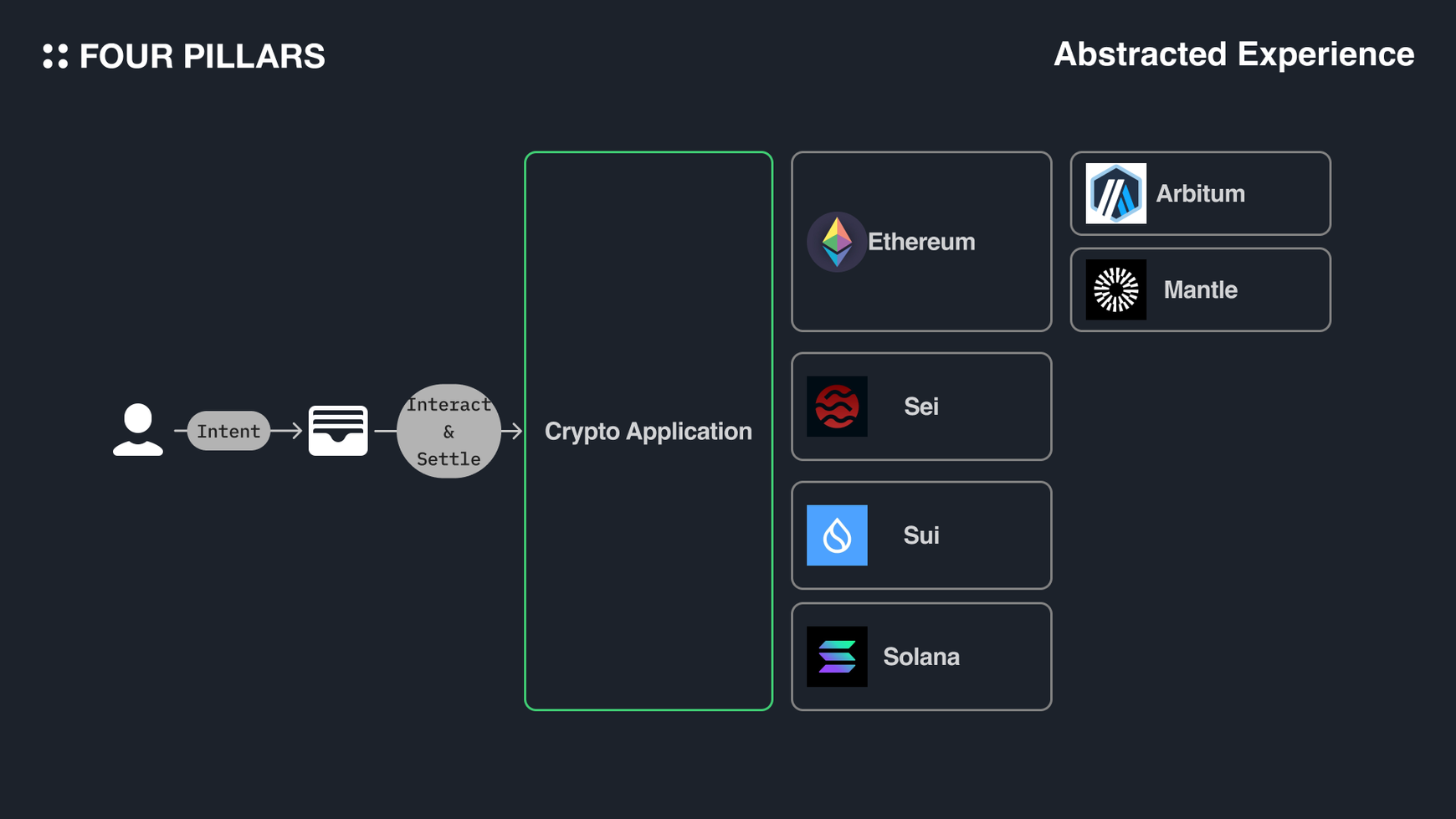

Chain abstraction flips the script by letting users interact with DeFi protocols without needing to know, or care, which blockchain is powering their transaction. Instead of dealing with network switching or manual bridging, users simply state their intent (such as swapping tokens or providing liquidity), and the abstraction layer handles everything behind the scenes.

This approach offers several key benefits:

- Unified balances: See all your assets in one place regardless of their underlying chains

- Simplified transactions: Initiate swaps or transfers without worrying about which network you’re on

- No more gas token headaches: Pay fees in your preferred token or let the system handle conversions automatically

- Enhanced security: Reduce risks from manual bridging and network confusion

The goal? To make cross-chain UX as seamless as single-chain interactions, removing technical hurdles so users can focus on what matters: maximizing yield, trading efficiently, or just exploring new dApps.

The Leading Projects Bringing Chain Abstraction to Life in 2025

A number of pioneering projects are already delivering on the promise of chain abstraction. Let’s spotlight two at the forefront:

- Connext Network: Provides developers with a toolkit to enable chain-agnostic transactions, users can interact with any dApp from any chain without contract changes or extra audits. Connext automates bridging, swapping, and gas acquisition in a single action.

- Mitosis: Abstracts away chain-specific logic so dApps can be built as if they exist on one unified blockchain. The result: dramatically reduced technical barriers for both developers and end-users.

This innovation isn’t just about convenience, it’s also helping solve liquidity fragmentation by enabling assets to flow freely across networks. For more on how chain abstraction is reshaping wallet design specifically, check out our deep dive on how chain abstraction simplifies multi-chain wallet UX for DeFi users.

What’s truly transformative about these solutions is how they recast the very nature of DeFi interactions. Instead of users thinking in terms of “which chain am I on?” or “do I have the right gas token?”, chain abstraction protocols make those concerns invisible. The technical complexity is absorbed by the infrastructure, letting users focus on their strategies, not the plumbing.

Real-World Impacts: From Fragmentation to Fluidity

The shift from fragmented, chain-specific experiences to a unified, abstracted UX is more than a technical upgrade, it’s a fundamental change in how people relate to decentralized finance. By enabling chain-agnostic transactions and unified balances, abstraction protocols are already unlocking new possibilities:

- DeFi newcomers can onboard with a single wallet and interact with any supported protocol, regardless of its native network.

- Seasoned traders enjoy faster execution and lower cognitive load, no more double-checking which network a dApp lives on or where assets are parked.

- Liquidity providers can allocate capital more efficiently across chains, as abstraction layers route funds seamlessly according to user intent.

This isn’t just theoretical. According to industry analysis, projects like Connext and Mitosis are already seeing adoption spikes as users gravitate toward tools that let them skip network gymnastics entirely. The net result: frictionless access, deeper liquidity pools, and higher transaction throughput across the DeFi ecosystem.

What’s Next for Chain Abstraction?

The road ahead is all about refinement and scale. As more protocols adopt chain abstraction frameworks, expect to see:

Upcoming Features Revolutionizing Chain Abstraction UX

-

Intent-Based Actions: Modern DeFi platforms like Connext Network are pioneering intent-based user flows, where users simply state what they want to achieve (like swapping or bridging assets), and the protocol handles all the complex cross-chain steps in the background.

-

Account Abstraction for Wallets: With solutions like Mitosis, account abstraction lets users manage multiple blockchain accounts through a single wallet, eliminating the need to juggle different wallets or remember various seed phrases.

-

Unified Notifications Across Chains: Projects such as Notifi Network are enabling real-time, unified notifications for DeFi activities across multiple blockchains, so users never miss important updates or transactions regardless of the network.

-

Improved Privacy Controls: Platforms like Aztec Network are integrating advanced privacy features into chain abstraction, allowing users to transact and interact across chains with greater confidentiality and control over their data.

-

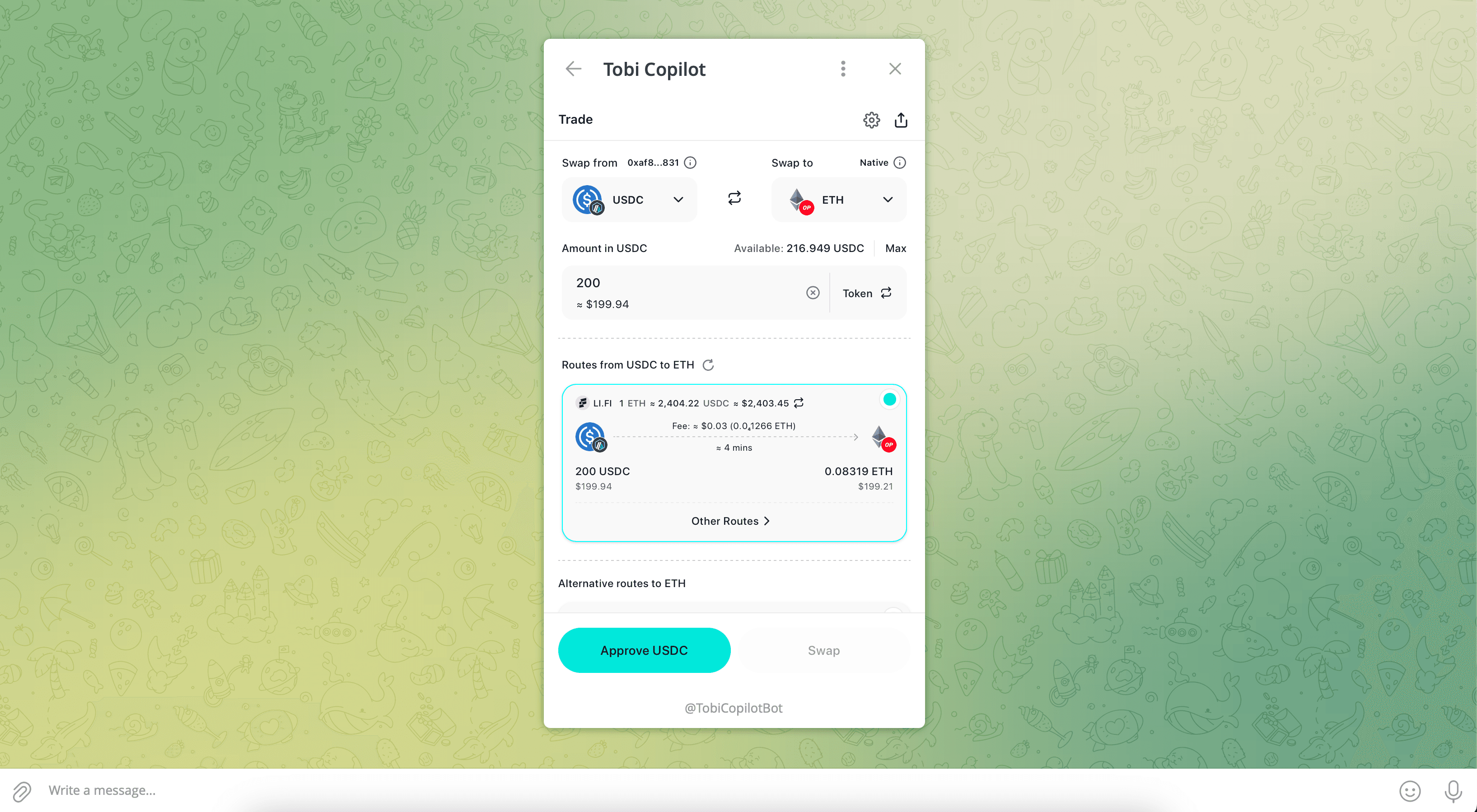

Seamless Cross-Chain Asset Management: Leading protocols such as LI.FI are providing one-click asset swaps and bridging across multiple networks, making it easier than ever to move assets without manual intervention or technical know-how.

Another major trend is the convergence of account abstraction with chain abstraction, where wallets become smart enough to handle fee payments in any token or automate complex multi-step transactions across different networks. This will further erode the old boundaries between blockchains and make DeFi feel as seamless as traditional fintech platforms.

The endgame? A world where you don’t need to know what blockchain your assets live on, just what you want to do with them. Developers can build for value and utility first, while users enjoy intuitive interfaces that put their intentions front and center.

Explore Further

If you’re curious how this technology translates into real-world wallet experiences or want a deeper dive into specific use cases like cross-chain swaps or intent-based transactions, check out our related guides:

- How Chain Abstraction Enhances Cross-Chain DeFi User Experience

- How Chain Abstraction Simplifies Multi-Chain Wallet UX for DeFi Users

- How Intent-Based Chain Abstraction Transforms Cross-Chain DeFi UX

The rise of chain abstraction marks a pivotal moment for crypto usability. As these technologies mature through 2025 and beyond, we’re moving closer than ever to true DeFi interoperability, and a future where anyone can access decentralized finance without ever worrying about chains again.