For years, cross-chain DeFi has been a maze of bridges, network switching, and wallet juggling. The promise of a unified crypto economy was undermined by the reality of fragmented user experiences, high friction, and security risks. But a new paradigm is emerging: intent-based chain abstraction. This approach is not just incremental UX improvement – it’s a structural shift that redefines how users interact with the multi-chain world.

From Fragmentation to Unified Experience: The Rise of Intent-Based Chain Abstraction

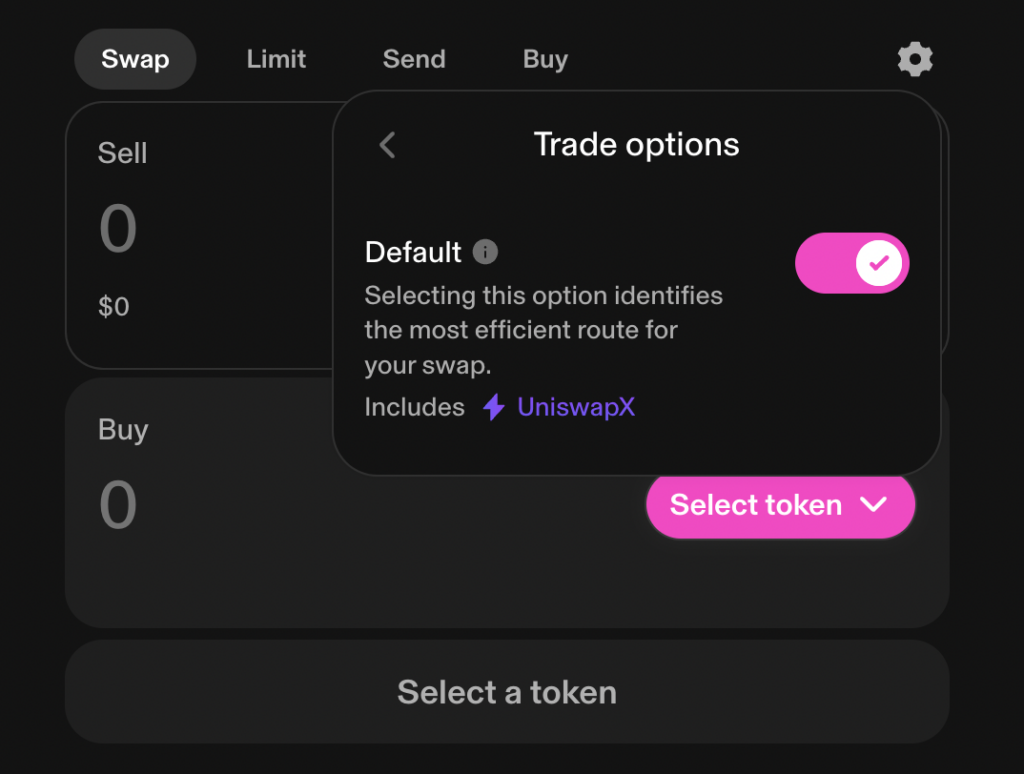

Chain abstraction technology is built on a simple but powerful idea: users should be able to express what they want to achieve, and the system should handle the rest. Instead of manually bridging assets, selecting networks, or worrying about gas fees, users simply state their intent – for example, “Swap 1 ETH on Arbitrum for at least 3,000 USDC on Solana. ” The backend orchestrates the optimal path, sourcing liquidity, routing through multiple chains, and abstracting away the technical complexity.

This intent-based model is rapidly gaining traction, with platforms like UniswapX, Mitosis, and Biconomy leading the charge. The result? A multi-chain user experience that feels as seamless as interacting with a single blockchain – no more context switching or fragmented wallets.

The Core Building Blocks: Intents, Solver Networks, and Account Abstraction

How does intent-based chain abstraction actually work? Let’s break down the architecture:

Key Components of Intent-Based Chain Abstraction

-

User Intents: Users specify their desired outcomes (e.g., “Swap 1 ETH on Arbitrum for at least 3,000 USDC on Solana”), enabling the system to abstract away technical steps and focus on the end goal.

-

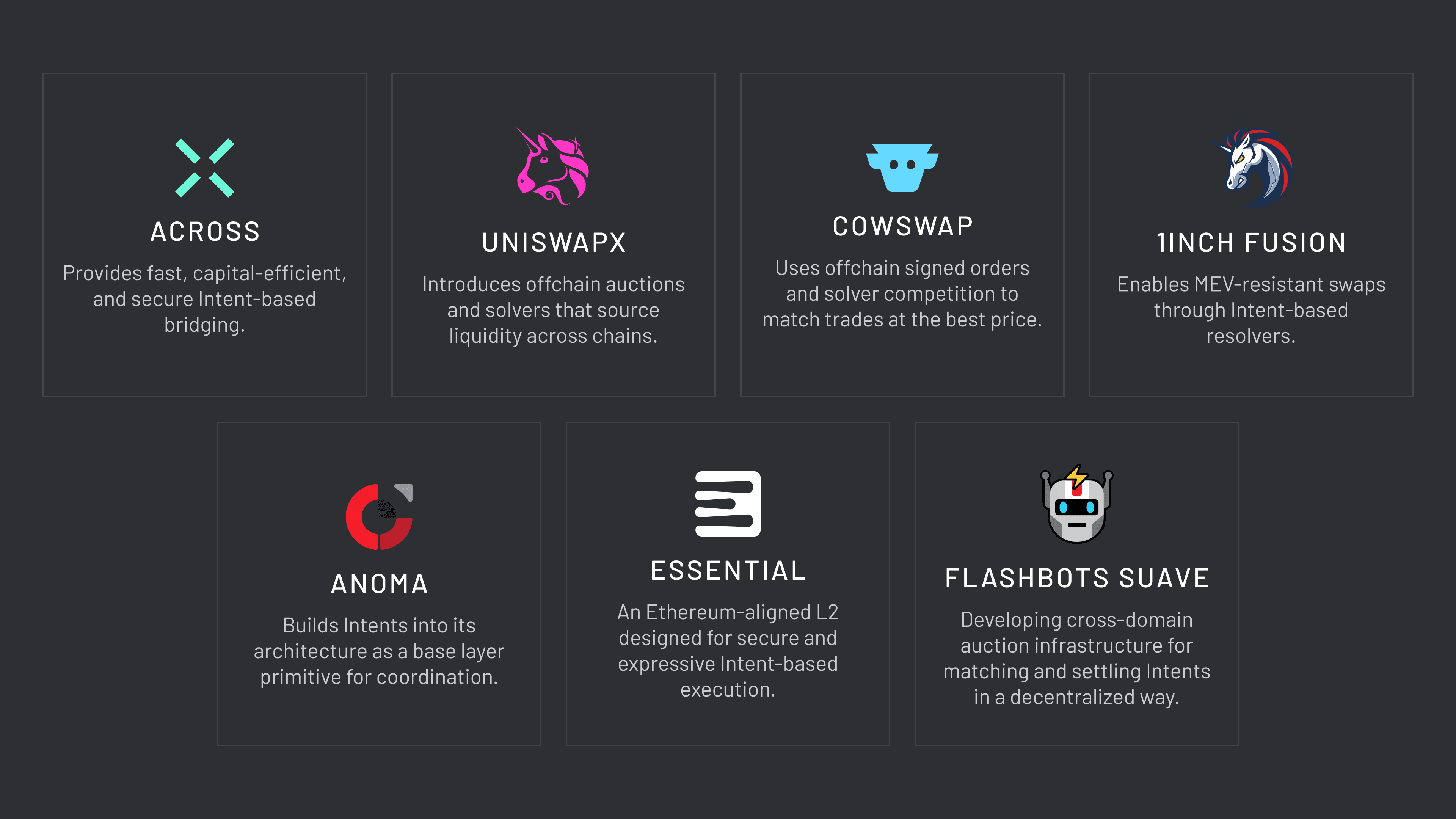

Solver Networks: Specialized solvers compete to fulfill user intents by determining efficient execution paths, leveraging both on-chain and off-chain liquidity to optimize results.

-

Account Abstraction: This enables users to interact across multiple blockchains through a single interface, removing the need to manage multiple wallets or gas tokens.

-

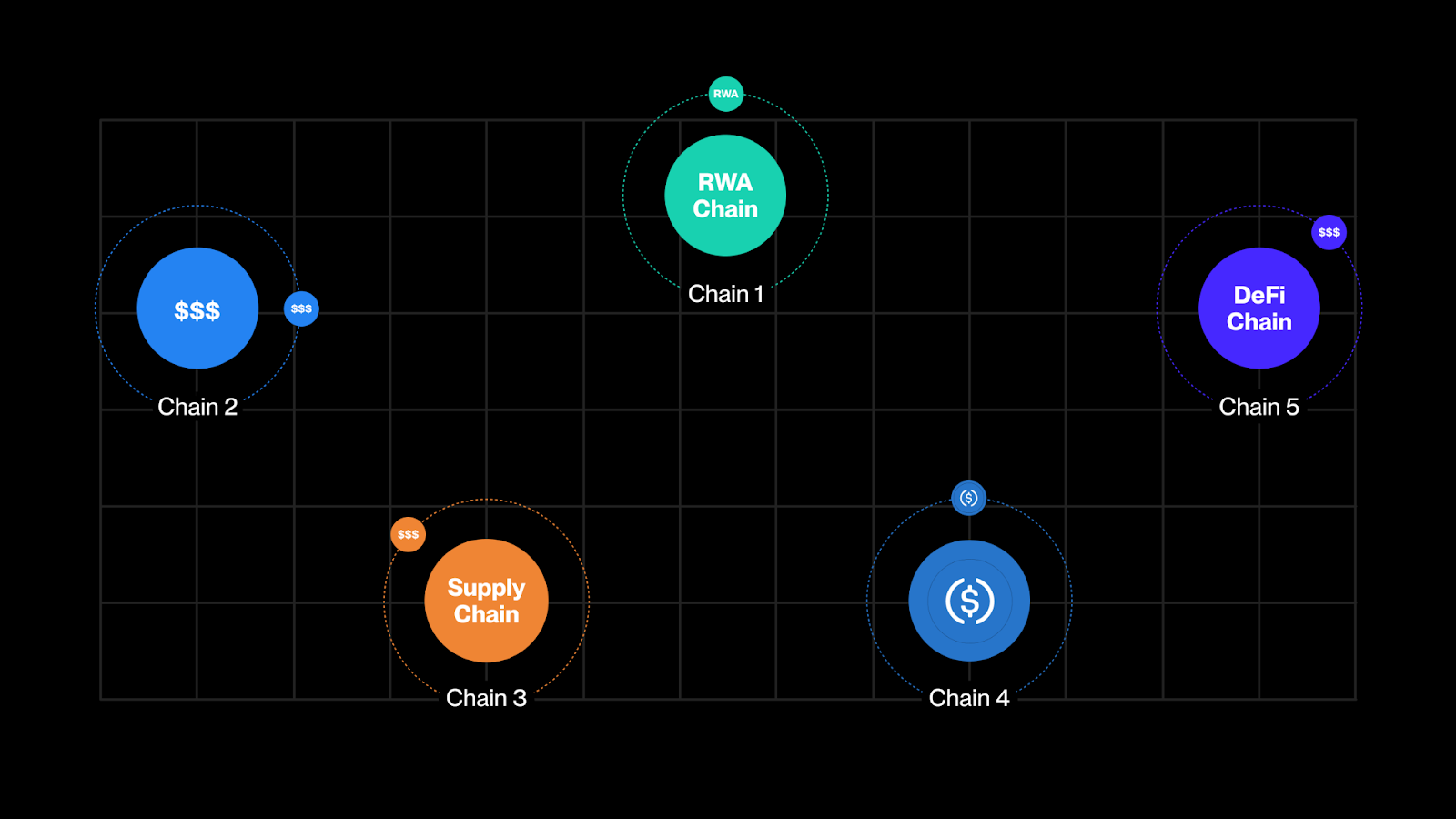

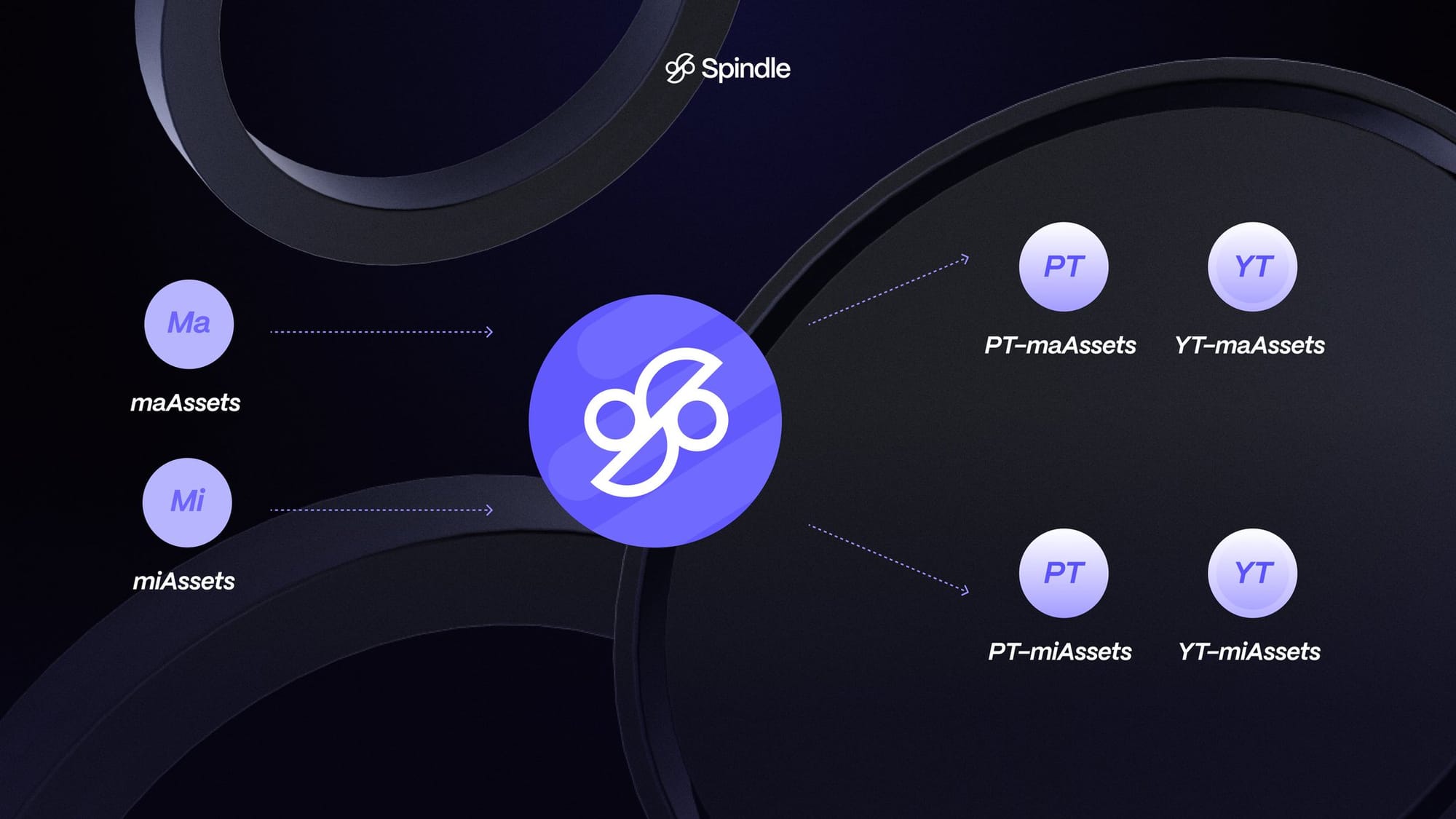

Unified Liquidity Layer: Platforms like Mitosis aggregate liquidity from various chains, ensuring efficient and low-slippage transactions.

-

Cross-Chain Standards: Initiatives like UniswapX and Across Protocol are establishing frameworks for intent-based cross-chain actions, promoting interoperability and a seamless user experience.

-

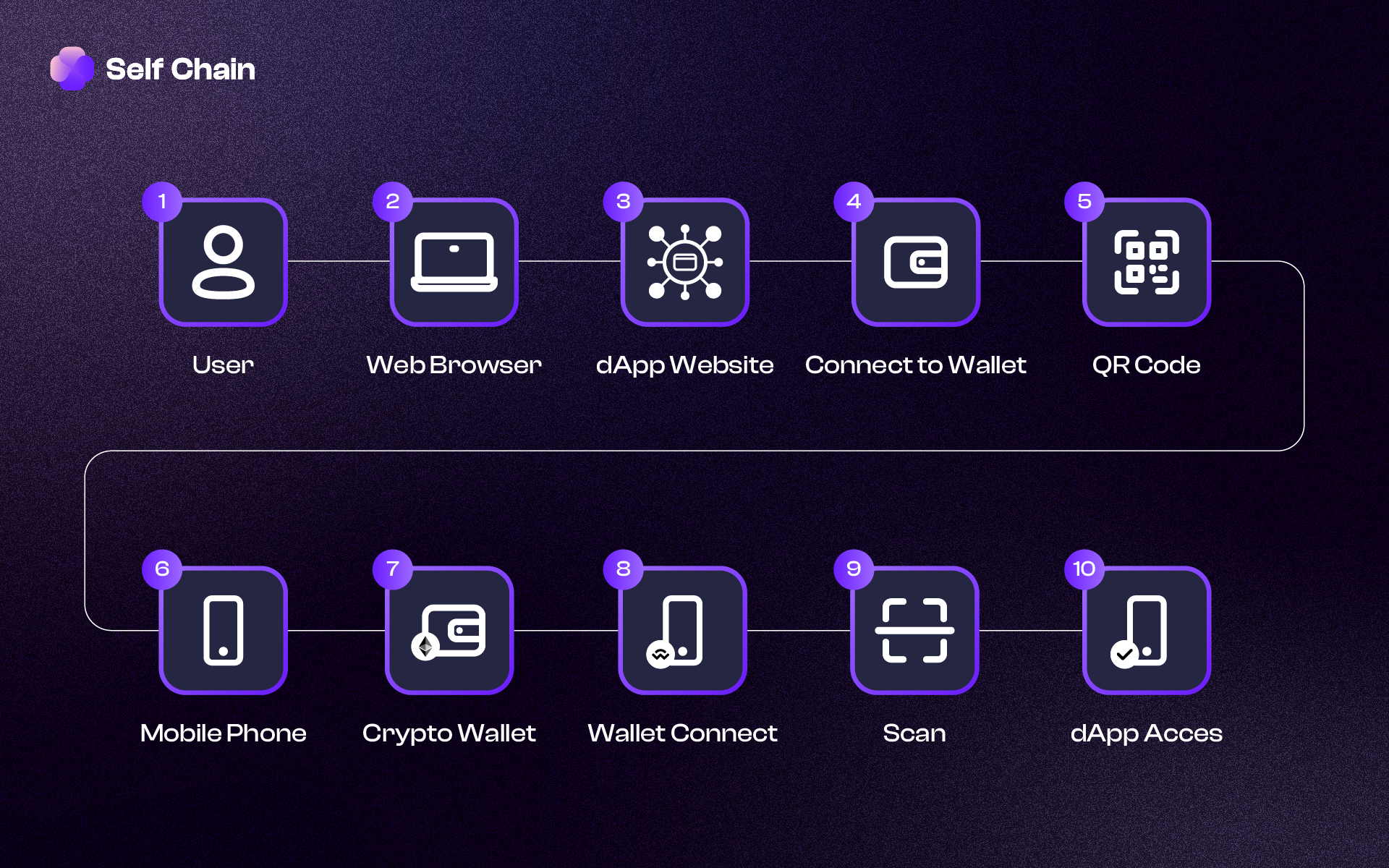

Secure Execution Layers: By abstracting complex processes and using secure infrastructure, platforms reduce user errors and enhance transaction safety, as seen in solutions like SelfChain.

User Intents: The user expresses a goal in natural language or a simple interface. This could be a swap, transfer, or complex DeFi strategy that spans multiple chains.

Solver Networks: Specialized entities (solvers) compete to fulfill user intents in the most efficient way possible. They aggregate on-chain and off-chain liquidity, optimize routes, and minimize costs and slippage. This competitive dynamic drives efficiency and better outcomes for users.

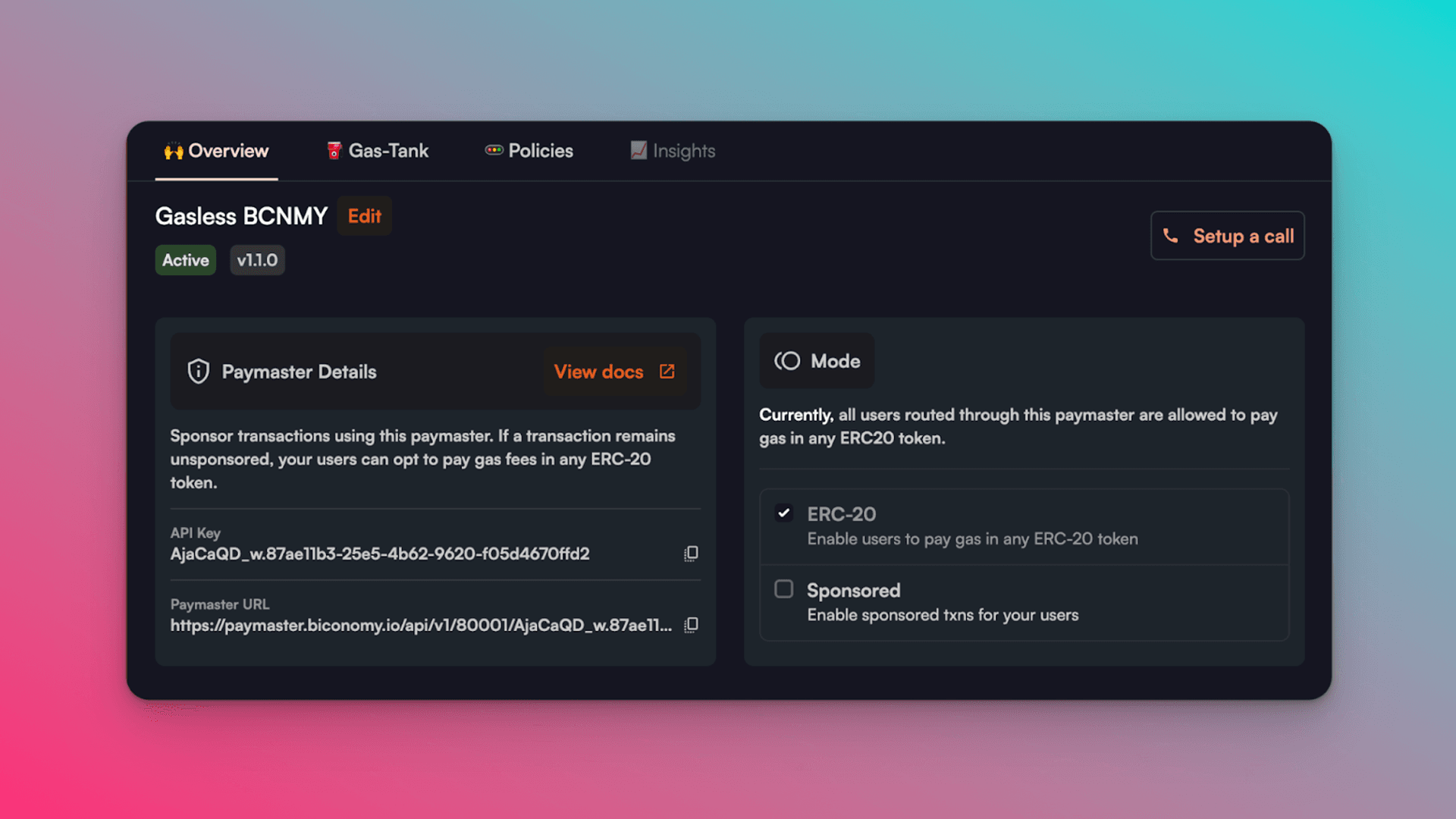

Account Abstraction: No more managing multiple wallets or gas tokens. Account abstraction enables a unified crypto wallet that can operate across chains and pay gas in any token, further simplifying the UX. This is a game-changer for onboarding new users into DeFi.

Why Intent-Based Chain Abstraction Is a Game-Changer for Cross-Chain DeFi UX

The benefits are immediate and profound:

- Simplified User Experience: Users focus on outcomes, not process. No need to learn about bridges, networks, or gas tokens.

- Gasless Blockchain Transactions: With account abstraction and solver networks, users can pay gas in any token – or have it abstracted away entirely.

- Enhanced Security: By reducing manual steps and error-prone processes, intent-based systems lower the risk of user mistakes and lost funds.

- Optimized Liquidity: Solvers route transactions through the most efficient paths, tapping into global liquidity and reducing costs.

Platforms like Biconomy and Mitosis are already demonstrating these advantages in production. For developers and enterprises, this unlocks new possibilities for building cross-chain apps without UX tradeoffs.

Real-World Impact: Leading Protocols and Enterprise Adoption

The practical impact of intent-based chain abstraction is evident in the latest wave of DeFi innovation. Protocols are adopting standards for cross-chain intents, enabling unified liquidity and seamless execution across networks. Enterprises are beginning to explore how chain abstraction can simplify compliance and unlock new business models that require multi-chain interoperability.

Would you trust a unified wallet to manage your assets across all blockchains?

Intent-based chain abstraction is making it possible to use a single wallet for all your DeFi activities, removing the need to juggle multiple wallets, networks, and gas tokens. With this seamless experience, would you feel comfortable letting one wallet handle your assets on every chain?

The direction is clear: as intent-based chain abstraction matures, the barriers between chains will dissolve. Users will no longer care which network they are on, only that their goals are achieved efficiently and securely. This is the foundation for true mass adoption in DeFi – and it’s happening faster than many realize.

But what does this mean for the future of DeFi? The implications go far beyond incremental improvements. By decoupling user intent from the underlying infrastructure, chain abstraction technology is transforming both the developer and user experience. Developers can focus on building rich financial products, rather than wrestling with the idiosyncrasies of different blockchains. Users, meanwhile, gain access to a frictionless, unified crypto wallet that finally delivers on the promise of Web3 usability.

Unlocking New Possibilities: The Next Phase of DeFi Chain Abstraction

Intent-based chain abstraction is already reshaping the competitive landscape. Protocols that integrate these systems are seeing higher engagement and retention, as users flock to platforms that offer true one-click cross-chain swaps and gasless blockchain transactions. The days of DeFi being reserved for power users are ending; now, anyone can interact with complex, multi-chain strategies as easily as they would send a single-chain transaction.

Enterprise adoption is accelerating as well. For institutions, unified compliance, reporting, and liquidity management are essential. Chain abstraction frameworks enable these capabilities, making it possible to build enterprise-grade DeFi services that meet regulatory requirements without sacrificing user experience. As standards for cross-chain intents mature, expect to see a wave of new products targeting both retail and institutional markets.

What’s Next? The Road to Mass Adoption

Looking ahead, the next frontier is composability. As more DeFi protocols and applications adopt intent-based models, users will be able to chain together complex actions, like multi-step yield strategies or cross-chain lending, through a single, unified interface. This will unlock entirely new categories of financial products and services, driving further innovation and adoption.

For the ecosystem to reach its full potential, continued investment in user education and security is critical. As with any powerful abstraction, risks remain if users are not aware of the implications of their actions or if solver networks are not properly incentivized and audited. The industry must prioritize transparency, open standards, and robust security practices to ensure that the benefits of chain abstraction are realized by all.

Top 5 Real-World Benefits of Intent-Based Chain Abstraction in DeFi

-

Unified Wallet and Account Management: Thanks to Biconomy and similar solutions, users interact with multiple blockchains through a single interface, eliminating the need to manage multiple wallets or gas tokens across networks.

-

Optimized Transaction Costs and Execution: Solver networks, as seen in Mitosis and Across Protocol, compete to fulfill user intents, routing transactions for the best price and lowest slippage, while minimizing gas costs.

-

Enhanced Security and Reduced User Error: By abstracting complex processes, intent-based systems like SelfChain and UniswapX help prevent costly mistakes, such as sending assets to the wrong chain or address, and leverage secure execution layers to protect user funds.

-

Broader Access and Mainstream Adoption: By making DeFi more accessible and user-friendly, intent-based chain abstraction encourages wider participation from both retail and institutional users. Projects like UniswapX, Biconomy, and Mitosis are paving the way for mainstream DeFi adoption.

Ultimately, intent-based chain abstraction stands as a pivotal shift for the industry. The convergence of solver networks, account abstraction, and unified wallet UX is not just a technical upgrade, it’s a reimagining of what’s possible in decentralized finance. As more users demand seamless experiences and as enterprises seek robust multi-chain solutions, this technology will underpin the next wave of DeFi growth.

To explore how these advances can transform your DeFi experience or product, see our deep dives on one-click cross-chain swaps and unified wallet UX. The future is not just multi-chain, it’s abstracted, intuitive, and ready for everyone.