In 2025, the decentralized finance (DeFi) landscape is undergoing a radical transformation as chain abstraction redefines how users and developers interact with blockchain ecosystems. Gone are the days when navigating multiple networks meant juggling different wallets, manually bridging assets, or deciphering complex fee structures. Instead, a new paradigm has emerged: intent-driven, unified experiences that conceal the technical intricacies of cross-chain activity and unlock the next wave of mainstream DeFi adoption.

The End of Fragmentation: Unified Wallets and Seamless Interfaces

Historically, DeFi’s usability was hampered by fragmentation across chains. Each network required its own wallet configuration, token management, and transaction signing process. This fractured experience stifled both user onboarding and capital efficiency. In response, platforms like UniversalX have pioneered unified wallet solutions, leveraging technologies such as Particle Network’s Universal Accounts to consolidate user balances across disparate chains. Users can now trade assets natively, no more manual bridging or switching between networks, while behind the scenes, sophisticated routing protocols handle asset transfers and network selection automatically.

This shift is not just cosmetic; it fundamentally alters the DeFi value proposition by removing friction points that once deterred all but the most technically savvy participants. As a result, we’re seeing measurable increases in transaction volume and user retention on platforms embracing chain abstraction. For a deeper dive into how this design philosophy is reshaping cross-chain interactions, see how chain abstraction simplifies cross-chain wallet UX for DeFi in 2025.

Intent-Based Actions: The Rise of Outcome-Oriented UX

A defining feature of modern chain abstraction is the adoption of intent-based cross-chain actions. Rather than requiring users to specify every step (selecting bridges, choosing tokens on each network), platforms now ask only for the desired outcome, such as swapping USDC for ETH at best available rates, while solvers and aggregators determine optimal execution paths in real time.

This approach draws on advances from protocols like Across and CoW Protocol, which use sophisticated order routing mechanisms to maximize efficiency and minimize slippage. The result is an experience reminiscent of single-chain DeFi but powered by liquidity spanning dozens of networks. Notably, this model also improves security by reducing opportunities for user error during manual bridging or contract approvals.

The impact is tangible: according to recent analytics from leading multi-chain DEXs, over 60% of swaps in Q3 2025 occurred via intent-based flows, a stark contrast to less than 20% just two years prior.

Developer Productivity and Ecosystem Interoperability

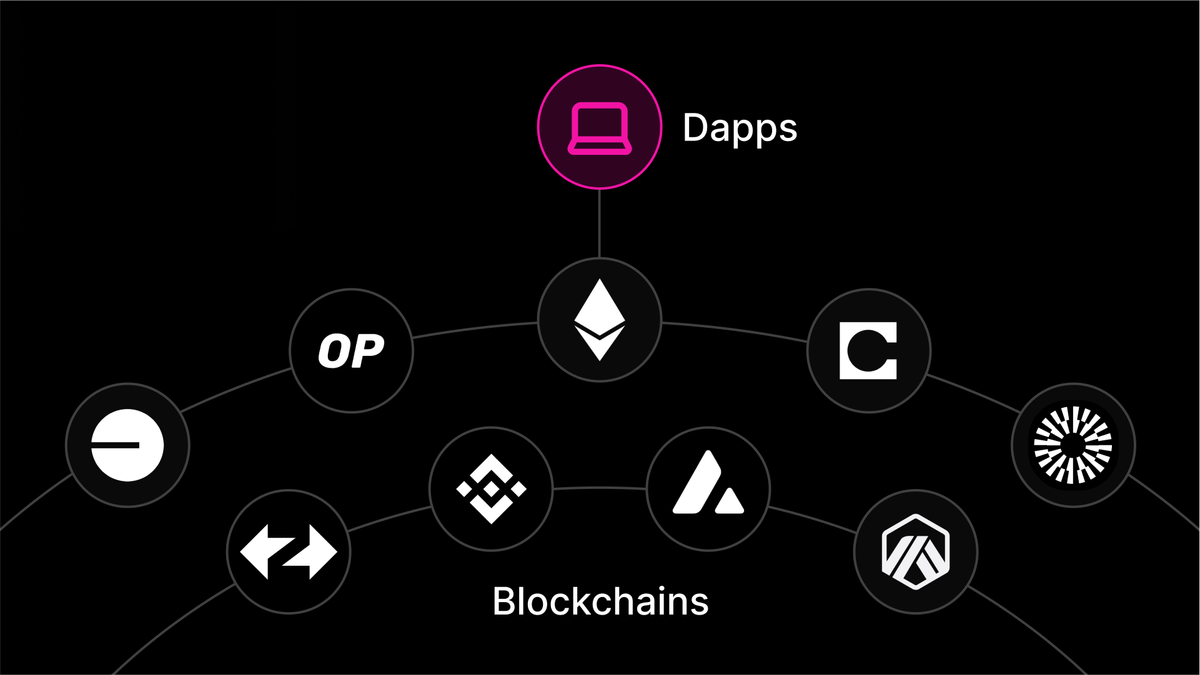

The benefits are not limited to end-users. For developers building in 2025’s multi-chain world, chain abstraction offers unprecedented efficiency gains. By enabling smart contracts to be chain-agnostic, teams can deploy dApps that seamlessly tap into liquidity pools across Ethereum, Cosmos, LayerZero-powered chains, and beyond, without maintaining separate codebases or infrastructure for each environment.

This composability unlocks new product designs that were previously infeasible due to siloed liquidity or incompatible standards. As highlighted in recent research from Altius Labs and Particle Network’s year-in-review report (see more here), projects utilizing chain abstraction frameworks have shipped features up to 40% faster compared to legacy approaches while reporting lower maintenance overhead.

Security, compliance, and transparency have historically been the Achilles’ heel of cross-chain DeFi. The complexity of bridging protocols and fragmented transaction histories raised the risk of exploits and regulatory scrutiny. In 2025, robust solutions like ABCTRACER are raising the bar for security by enhancing traceability across multi-chain transactions. Leveraging advanced event log mining and entity recognition, these tools provide bi-directional visibility that not only deters malicious actors but also streamlines compliance processes for institutional participants.

This evolution is especially critical as enterprises and larger capital allocators enter DeFi, demanding the same level of auditability and risk management they expect from traditional finance. Chain abstraction’s ability to unify compliance tooling is a game changer for onboarding this next wave of users.

Unlocking Liquidity: The Interconnected DeFi Ecosystem

The biggest macro impact of chain abstraction in 2025 is on liquidity flow. By removing artificial barriers between chains, protocols like LayerZero and Cosmos now enable assets to move frictionlessly, unlocking deeper markets and tighter spreads. The data tells the story: aggregate cross-chain liquidity has surged by more than 70% year-over-year according to SmartLiquidity. info, with intent-based protocols capturing a growing share of this volume.

For users, this means improved price execution, lower slippage, and access to a broader array of yield strategies without technical hurdles. For developers and liquidity providers, it creates new opportunities for market making across previously siloed ecosystems.

What’s Next? Challenges and Frontiers for Chain Abstraction

Despite its rapid progress, chain abstraction faces open challenges as adoption scales. Fee optimization remains an ongoing battle, while intent-based routing minimizes costs most of the time, network congestion or validator misalignment can still lead to suboptimal outcomes. Security remains an arms race as well; adversaries are targeting cross-chain infrastructure with increasingly sophisticated attacks.

Another hurdle is standardization: with multiple competing frameworks (Universal Accounts, LayerZero’s omnichain messaging, Cosmos IBC), interoperability between abstraction layers themselves is an emerging frontier. The winners will likely be those who can balance seamless UX with rigorous safety guarantees and broad developer support.

The direction is clear: unified interfaces are now table stakes for any serious DeFi protocol in 2025. As user expectations rise alongside mainstream adoption, projects that fail to deliver true chain abstraction risk obsolescence.

Key Takeaways for Teams Building in 2025

- User-centric design wins: Hide technical complexity behind intuitive flows; let solvers handle the rest.

- Embrace composability: Build with chain-agnostic smart contracts to maximize reach and minimize overhead.

- Prioritize security: Integrate advanced traceability tools like ABCTRACER from day one.

- Stay flexible: Monitor evolving standards around interoperability; don’t lock into closed ecosystems too early.

The future of decentralized finance depends on making cross-chain UX invisible, and chain abstraction is proving it’s possible at scale. For more practical frameworks and real-world examples shaping this movement, explore how chain abstraction makes cross-chain DeFi UX seamless.