In the sprawling multiverse of blockchains, users wrestle with a maddening reality: your USDC on Ethereum can’t easily fuel a Solana DeFi play without bridges that feel like medieval toll roads. This cross-chain deposit UX friction isn’t just inconvenient; it erodes trust and stalls adoption. Enter chain abstraction, the strategic linchpin transforming multi-chain wallets into seamless portals for one-click cross-chain deposits. As Bitcoin holds steady at $89,901.00 and Ethereum at $3,004.37 amid a maturing market, these innovations signal a pivot from fragmented chaos to unified elegance.

The Hidden Costs of Multi-Chain Mayhem

Picture this: you’re eyeing a high-yield opportunity on Arbitrum, but your liquidity sits idle on Base. First, switch networks. Then, hunt for a bridge. Swap for gas tokens if needed. Pray the transaction confirms without exploits or delays. Repeat for every chain hop. These steps aren’t mere annoyances; they’re retention killers. Data from Praxen’s analysis highlights seven pivotal cross-chain UX decisions, like intuitive chain selection and gas abstraction, that dictate whether users return or rage-quit.

Fragmentation breeds complexity. Users juggle EOAs across ecosystems, track native tokens for fees, and navigate liquidity silos. Blockworks’ definitive guide nails it: chain abstraction distances end users from these burdens, abstracting blockchains into a single, fluid interface. Yet, without it, DeFi’s promise of permissionless finance rings hollow. In my 18 years bridging TradFi and crypto, I’ve seen how poor UX mirrors the dot-com bust’s usability pitfalls; today’s wallets risk the same fate unless they prioritize unified wallet interoperability.

Chain Abstraction: Demystifying the Magic

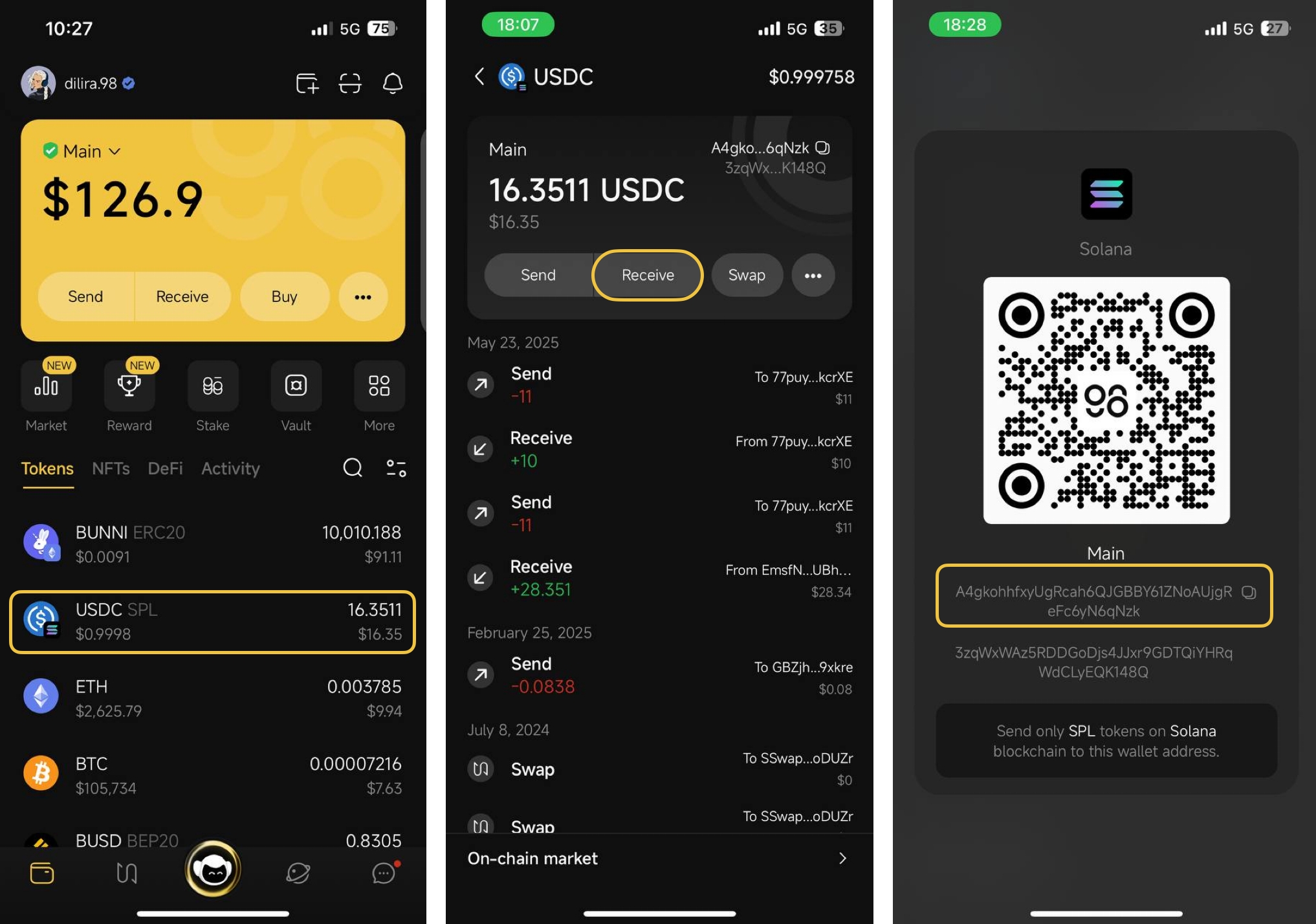

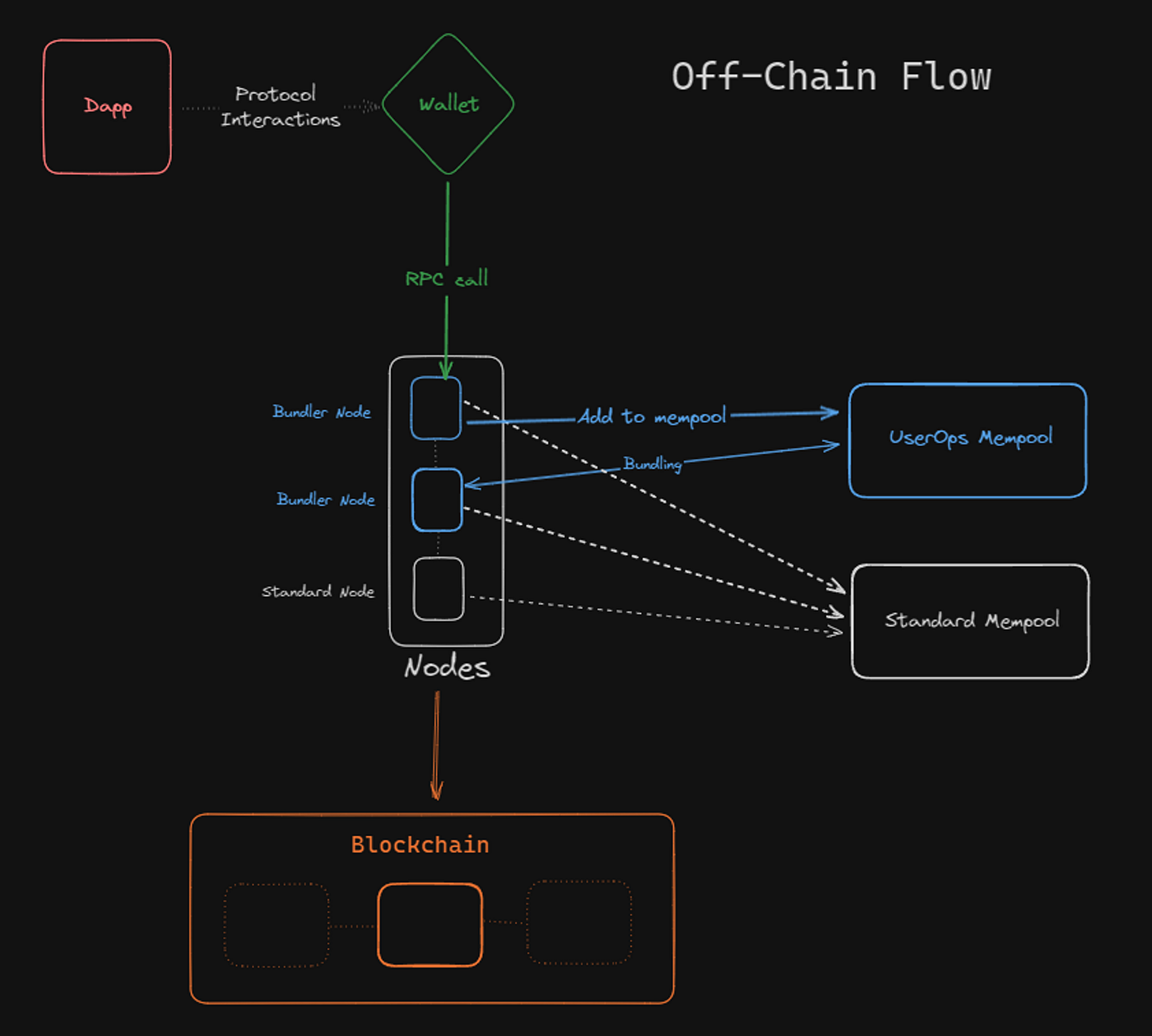

At its core, chain abstraction layers smart contracts, intents, and solvers to orchestrate cross-chain actions behind the scenes. Think of it as a universal translator for blockchains: you declare an intent, like “deposit USDC into this vault from any chain”: and the system handles routing, swaps, gas, and settlement. Circle’s unified USDC balance via Gateway exemplifies this, letting developers craft apps where users see one balance, oblivious to the EVM-non-EVM dance underneath.

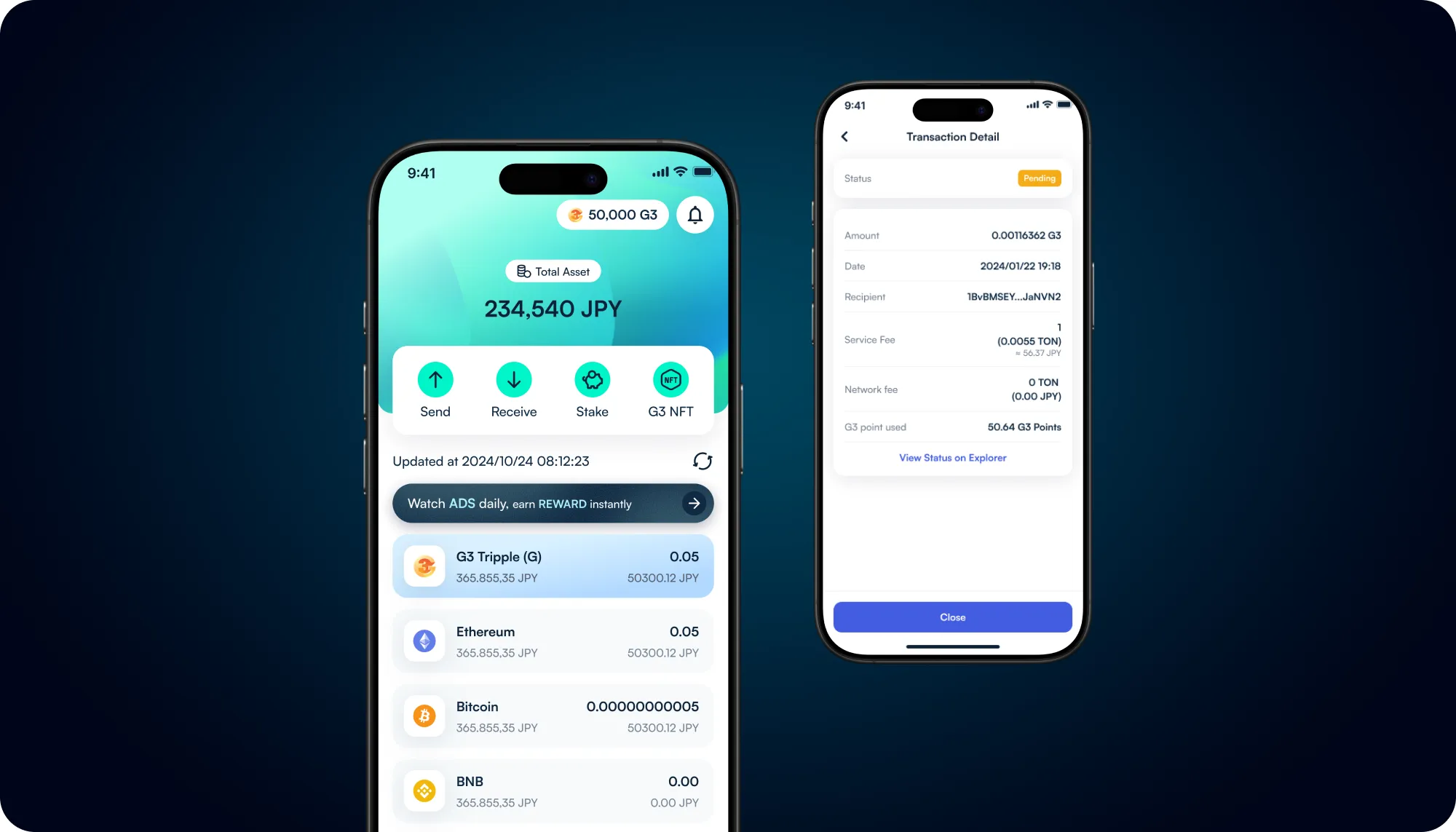

Enso Network’s Cross-chain Widget pushes it further, enabling one-click asset moves and DeFi entries. Across Protocol bids farewell to bridging with intents-based 1-click actions embeddable in dApps. Pair this with account abstraction, as Etherspot details, and you get smart accounts that batch transactions, pay gas in USDT, and auto-top-up balances. Blocmates’ idiot’s guide cuts through hype: it’s about taming multi-chain fund management woes. Strategically, this isn’t optional; it’s the moat for protocols capturing the next wave of retail inflows, especially as BTC tests $90,000 highs.

Trailblazers Delivering One-Click Reality

2026’s landscape brims with executors turning abstraction into product. Unifold’s API abstracts wallets, compliance, and settlement across Ethereum, Solana, Bitcoin, spawning auto-addresses and smart routing for frictionless deposits. AbstraX’s non-custodial smart wallet spans EVM and beyond, letting any asset cover gas while executing cross-chain ops.

Arcana Wallet Beta pioneers EOA-based chain abstraction, unifying spends across Ethereum, Base, Polygon, Arbitrum, Optimism. OKX Wallet’s Smart Account slashes swaps and stakes to one click via USDT/USDC gas. Ether. fi’s Enso-powered vaults accept deposits from anywhere, no token preconditions. River’s satUSD system mints omni-chain stables sans bridges, turbocharging liquidity.

These aren’t hypotheticals; they’re live, boosting retention as Decentralised. co explores. Developers, heed Praxen’s call: offer one-click top-ups. For investors, this ecosystem signals sustainable growth, where UX drives TVL over gimmicks. As Ethereum stabilizes at $3,004.37, expect abstraction to fuel the next leg up.

Bitcoin (BTC) Price Prediction 2027-2032

Projections driven by chain abstraction adoption enabling seamless cross-chain UX and broader DeFi integration

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $85,000 | $120,000 | $165,000 | +20% |

| 2028 | $105,000 | $155,000 | $210,000 | +29% |

| 2029 | $130,000 | $200,000 | $280,000 | +29% |

| 2030 | $160,000 | $260,000 | $380,000 | +30% |

| 2031 | $200,000 | $350,000 | $500,000 | +35% |

| 2032 | $250,000 | $450,000 | $650,000 | +29% |

Price Prediction Summary

Bitcoin is poised for sustained growth from its current $89,901 level in 2026, reaching an average of $450,000 by 2032, fueled by chain abstraction innovations like one-click deposits reducing UX friction and accelerating mainstream adoption. Bullish scenarios reflect peak adoption and market cycles, while minimums account for potential regulatory hurdles or corrections.

Key Factors Affecting Bitcoin Price

- Chain abstraction advancements (e.g., Enso, Across, Ether.fi) enabling seamless multi-chain interactions

- Regulatory clarity boosting institutional inflows

- Halving cycle effects and ETF momentum continuation

- Macroeconomic factors like interest rates and global adoption

- Competition from altcoins but BTC dominance via network effects

- Technological upgrades improving scalability and interoperability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Yet, integration demands nuance. Protocols must balance solver centralization risks with speed, ensuring robust oracles and MEV protections. My view: prioritize intent-centric designs early; they future-proof against L2 proliferation. Check deeper dives on one-click transactions and seamless wallet UX.

Intent-centric architectures shine here, as Agoric demonstrates with Fast USDC on Noble Express, proving one-click cross-chain DeFi viable today. Developers embedding these tools sidestep L2 sprawl, focusing on user intents over chain specifics. The payoff? Retention surges, mirroring how TradFi apps like Robinhood hooked millennials with frictionless flows.

Developer Playbook: Embedding Chain Abstraction Seamlessly

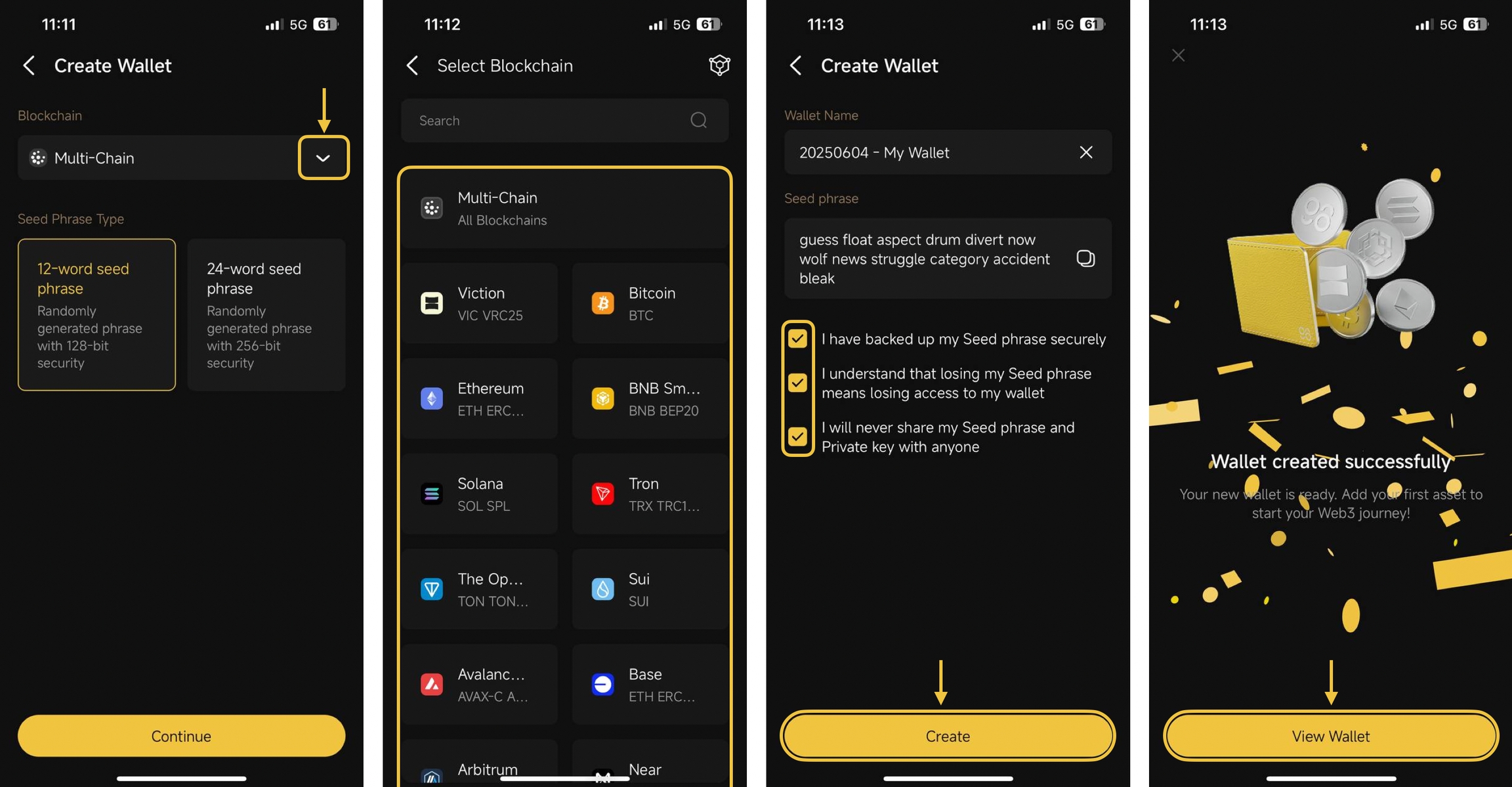

Building seamless multi-chain wallets starts with picking the right primitives. Enso’s widget or Across’ intents integrate via simple SDKs, handling swaps, gas, and routing. For wallets, AbstraX-like smart accounts abstract fees to any token, while Arcana’s EOA evolution preserves key control without key rotation headaches.

Praxen’s 7 UX Decisions

-

1. Chain Selection: Guide users to optimal chains via smart defaults and liquidity checks, as in AbstraX‘s unified platform.

-

2. Gas Abstraction: Let users pay gas with any asset, like OKX Wallet‘s USDT/USDC fees.

-

3. One-Click Top-Ups: Auto-fund low balances seamlessly, powering Ether.fi‘s Enso vaults.

-

4. Auto-Swaps: Execute necessary token swaps behind-the-scenes for frictionless actions, featured in Enso Network’s widget.

-

5. Unified Balances: Display aggregated assets across chains, like Circle’s chain-abstracted USDC via Gateway.

-

6. Error Recovery: Implement resilient retries and fallbacks to handle failed txs without user intervention.

-

7. Onboarding Flows: Simplify first-time multi-chain entry with guided, abstracted experiences like Arcana Wallet Beta.

Layer in account abstraction for batched txs and social recovery, as OKX executes with USDC gas. Test rigorously: simulate low liquidity, oracle failures, chain reorgs. My strategic lens, honed over 18 years, insists on composability; choose stacks where abstraction plugs into existing infra without rip-and-replace. River’s collateral-to-omni-stable flow shows capital efficiency gains, minting satUSD cross-ecosystem without wrappers. Protocols ignoring this risk TVL leakage to abstraction-native rivals.

Unifold rounds it out with compliance baked in, auto-generating deposit addresses for fiat ramps across chains. This isn’t gadgetry; it’s infrastructure moats. As Bitcoin lingers near $89,901.00, watch protocols with deep abstraction integrations outperform, capturing inflows chasing yield anywhere.

Investor Lens: Backing the Abstraction Wave

From a portfolio view, chain abstraction redefines risk-reward. Early movers like Ether. fi, blending Enso for one-click vaults, exemplify execution over hype. Retention metrics tell the tale: Etherspot quantifies how abstraction lifts repeat usage 3x, curbing churn from bridge fatigue. With Ethereum at $3,004.37, L2 fees plummet, but UX lags risk alienating newcomers.

Strategic allocations favor unified protocols. Prioritize those with solver diversity to mitigate centralization, audited intents, and omnichain liquidity proofs. Avoid pure bridgers; they’re dinosaurs in an abstraction era. My CAIA-framed thesis: this tech layer compounds adoption like TCP/IP did the internet, unlocking trillions in idle capital. Explore network-switching eliminations for deeper UX evolutions.

Challenges persist, sure. Solver auctions invite MEV predation, oracle dependencies breed single points of failure. Yet, innovations like ZK proofs for cross-chain state and threshold signatures fortify resilience. Users benefit most: one-click deposits mean DeFi as intuitive as Venmo, minus the custodian. Developers gain distribution edges; investors, asymmetric bets on UX primitives.

Bitcoin’s stability at $89,901.00 underscores market maturity, rewarding protocols that abstract away complexity. Ethereum’s $3,004.37 perch positions it as the settlement hub for abstracted flows. The multichain future arrives not through more chains, but fewer mental models. Chain abstraction delivers that unity, propelling unified wallet interoperability from vision to daily driver. Protocols and portfolios adapting now will thrive in tomorrow’s fluid ecosystem.