Managing your crypto portfolio used to mean juggling multiple wallets, browser extensions, and network settings, an experience that felt more like IT troubleshooting than financial empowerment. But the rapid evolution of cross-chain wallets is flipping that script, promising seamless crypto management and a truly unified blockchain experience. As we move into late 2025, these innovations are not just theoretical: they’re live, user-tested, and reshaping how both newcomers and power users interact with digital assets.

Why Network Switching Was a UX Nightmare

If you’ve ever tried to swap tokens on Ethereum and then bridge them to Solana or Polygon, you know the friction: endless confirmations, pop-up warnings about switching RPCs, and the constant anxiety of whether your assets might get lost in translation. The root problem? Traditional wallets are siloed by chain. Each network brings its own rules, address formats, and transaction flows, forcing users to become accidental blockchain experts just to move their money.

This fragmentation has been a major barrier for mainstream adoption. According to recent insights from Halaska Studio, a confusing multi-chain UX can drive away even seasoned DeFi participants. The promise of cross-chain wallets is simple: let users manage all their assets without ever thinking about what network they’re on.

Automatic Network Detection and Unified Dashboards

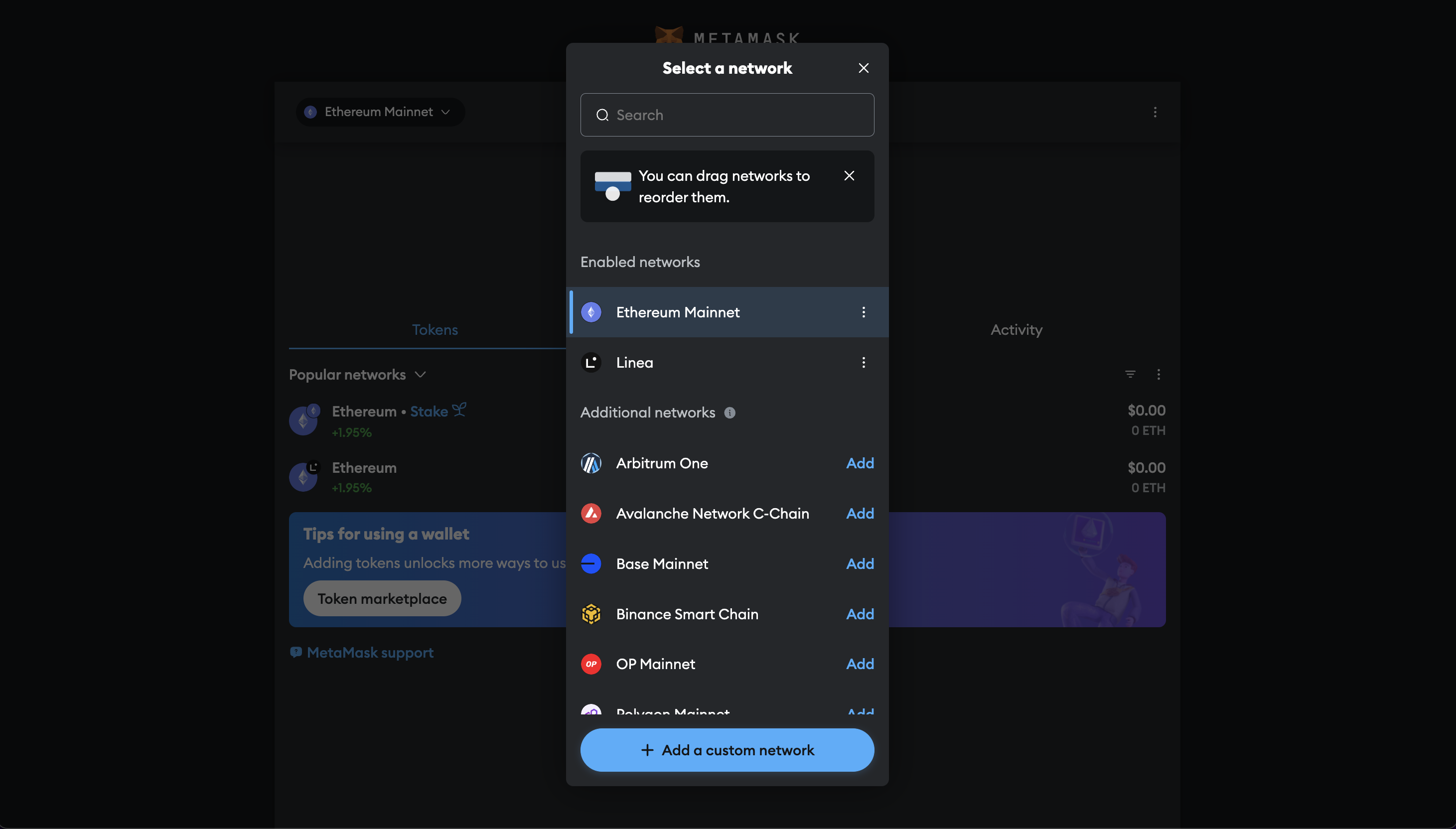

The first big leap in chain abstraction UX is automatic network detection. Modern cross-chain wallets now recognize which blockchain a dApp or asset belongs to, and switch networks under the hood without any manual intervention from the user. For example, if you initiate a transaction on Arbitrum while viewing your Ethereum holdings, the wallet simply handles the context switch for you, often with an unobtrusive notification explaining what’s happening.

This level of automation not only reduces cognitive load but also preserves workflow continuity, a key ingredient for satisfying digital experiences. No more frantic Googling or Discord troubleshooting when MetaMask throws an RPC error; instead, users see all their assets in one place thanks to consolidated dashboards with optional chain filters. This unified view is rapidly becoming table stakes for any serious multi-chain wallet solution.

Simplified Cross-Chain Transactions: Bridges Built In

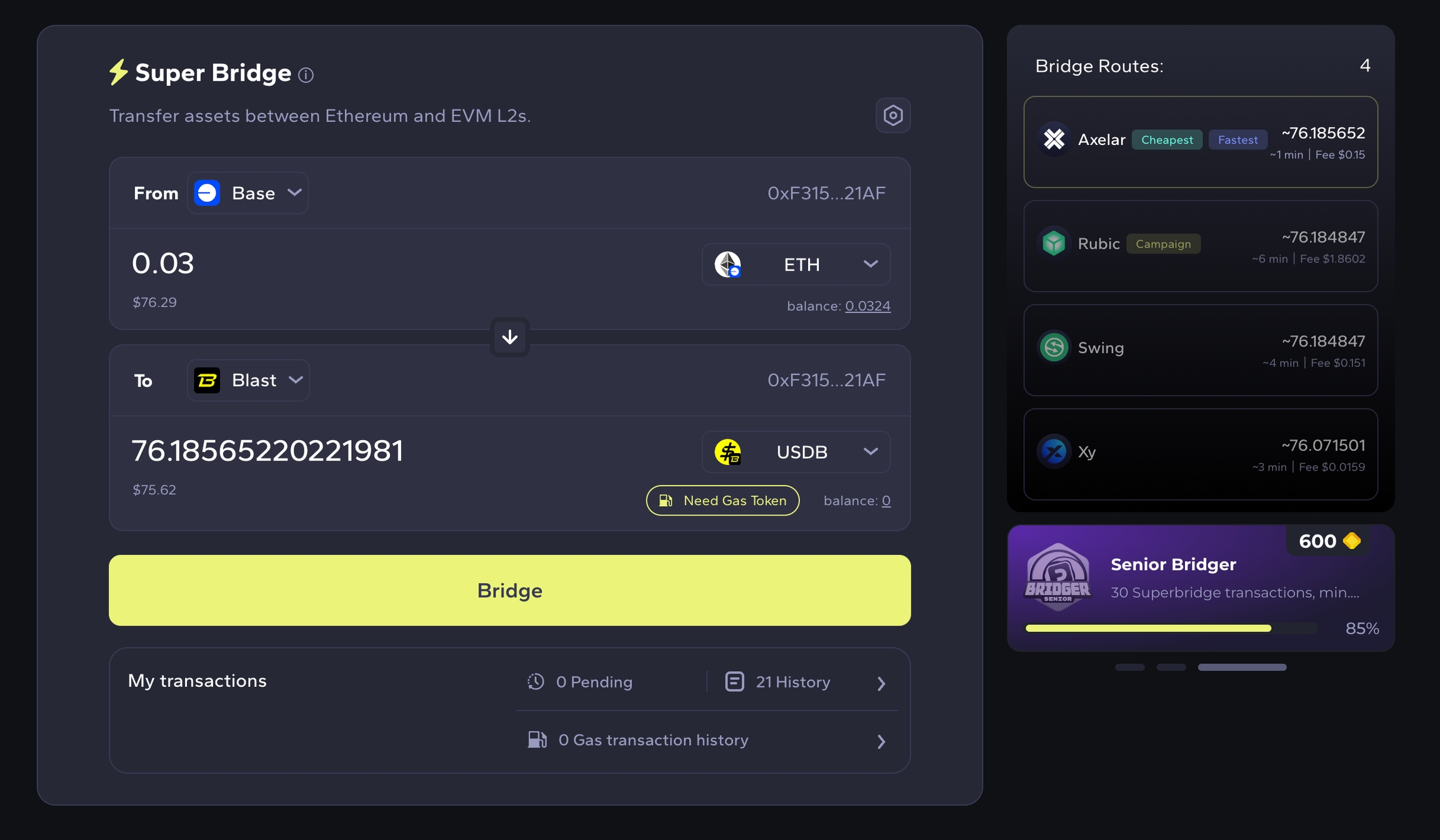

The second wave of innovation comes from integrating bridges directly into wallet interfaces. Rather than sending users off to third-party protocols (and hoping they don’t fall victim to phishing or misconfiguration), top wallets now guide users through moving assets between chains inside the same app.

Key UX Features Powering Seamless Cross-Chain Wallets

-

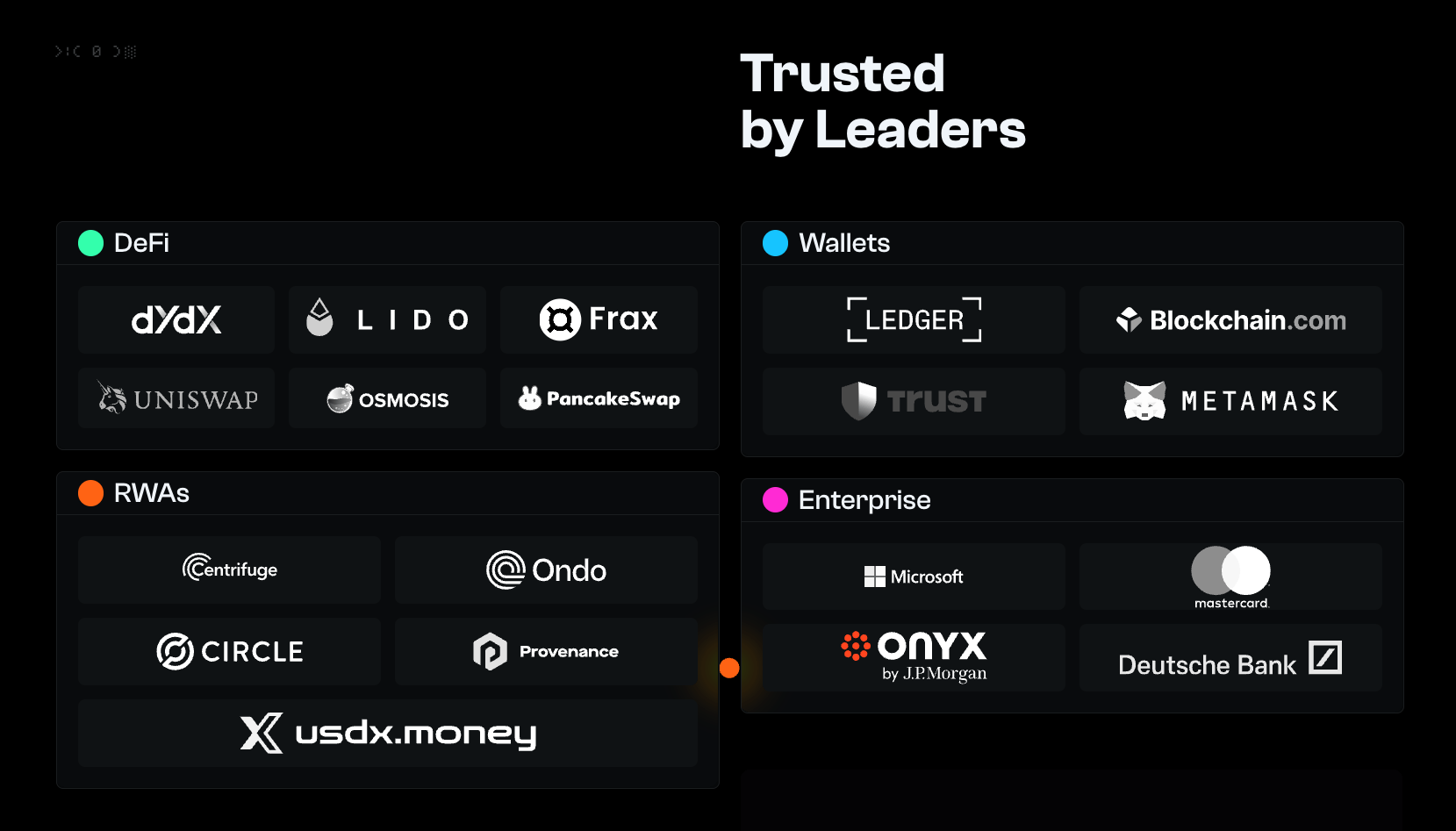

Automatic Network Detection & Switching: Leading wallets like MetaMask and Blocto can automatically detect the blockchain network required for a transaction and switch networks in the background, minimizing manual steps and confusion for users.

-

Unified Asset Management Dashboard: Platforms such as Trust Wallet and Blocto offer a consolidated view of assets from multiple blockchains, letting users monitor and manage their entire portfolio without toggling between networks.

-

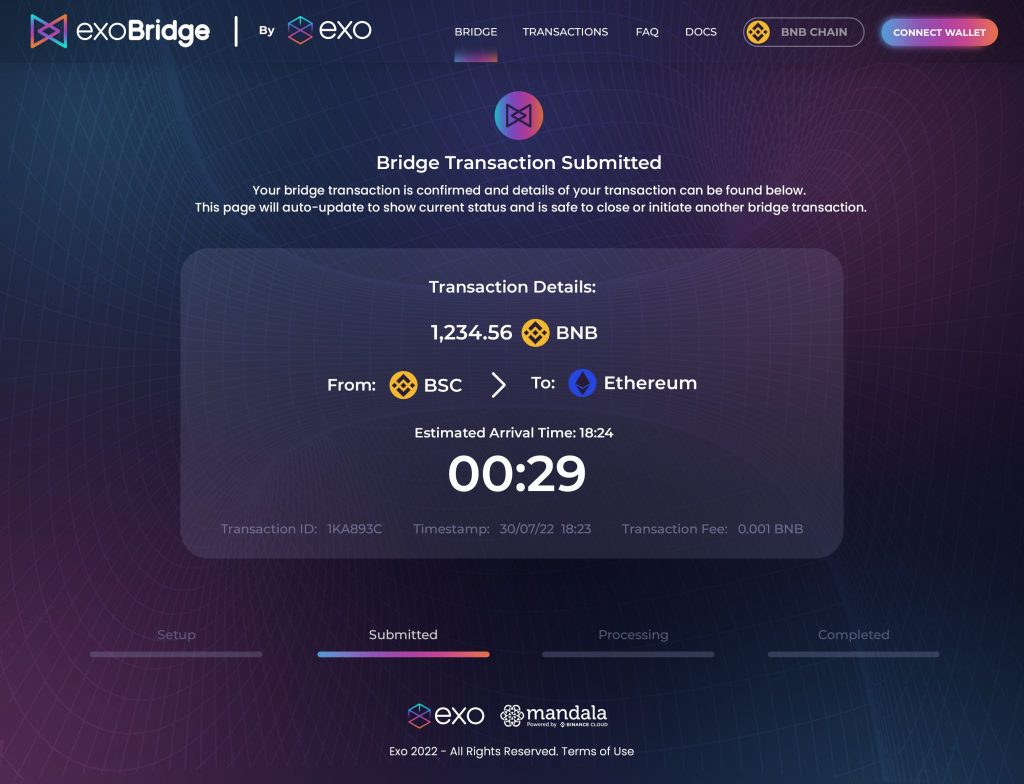

Integrated Cross-Chain Bridge Functionality: Wallets like OKX Wallet and Blocto embed cross-chain bridges directly into their interfaces, allowing users to transfer assets between chains with clear source/destination info and transaction previews.

-

Enhanced Security with MPC & Biometric Authentication: Solutions such as Safe (formerly Gnosis Safe) and Blocto implement Multi-Party Computation (MPC) and biometric authentication, eliminating seed phrases and reducing key compromise risks while streamlining onboarding.

-

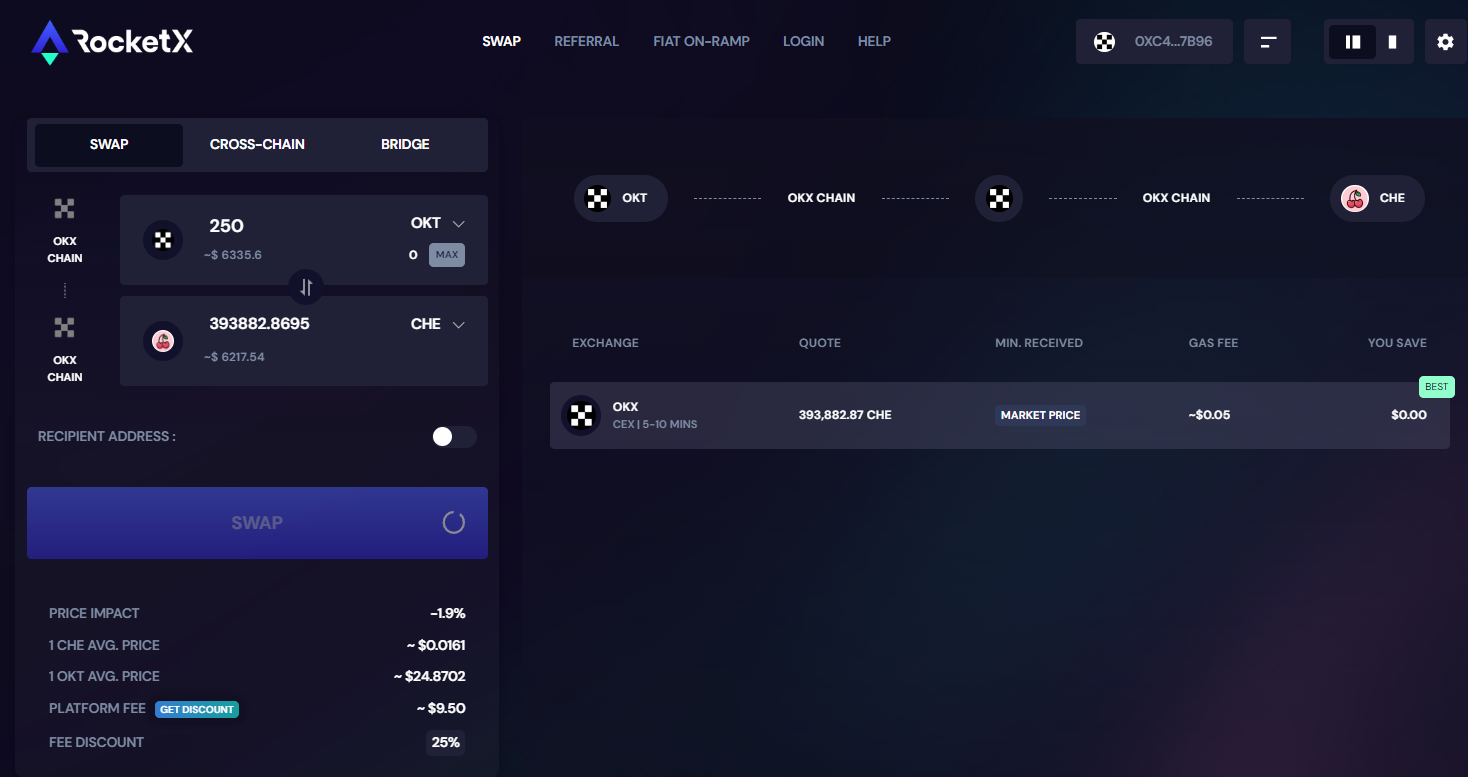

Intent-Based Transaction Models: Innovative platforms like UniswapX and 1inch Fusion adopt intent-based transactions, letting users define their desired outcomes (e.g., best price, fastest route) while the wallet abstracts away technical steps for seamless cross-chain execution.

-

Chain Abstraction for Unified Experience: Projects such as Li.Fi and Socket provide chain abstraction layers, enabling wallets to interact with multiple blockchains as if they were one, greatly simplifying the user journey.

This typically includes:

- Clear source/destination chain selection: Users always know where their funds are coming from and going.

- Estimated fees and time: Transparent previews reduce anxiety about costs and delays.

- Transaction previews: Before clicking confirm, users see exactly what will happen, no more blind signing.

The result? Moving value across ecosystems feels as easy as sending an email, no matter how many blockchains are involved behind the scenes.

The Security Layer: MPC and Intent-Based Models

No discussion of DeFi wallet UX is complete without addressing security innovations that underpin this new simplicity. Multi-Party Computation (MPC) technology now distributes private key fragments across multiple devices or nodes, dramatically reducing single points of failure without sacrificing speed or control. Some wallets have even eliminated seed phrases entirely in favor of biometric authentication and multi-factor login flows.

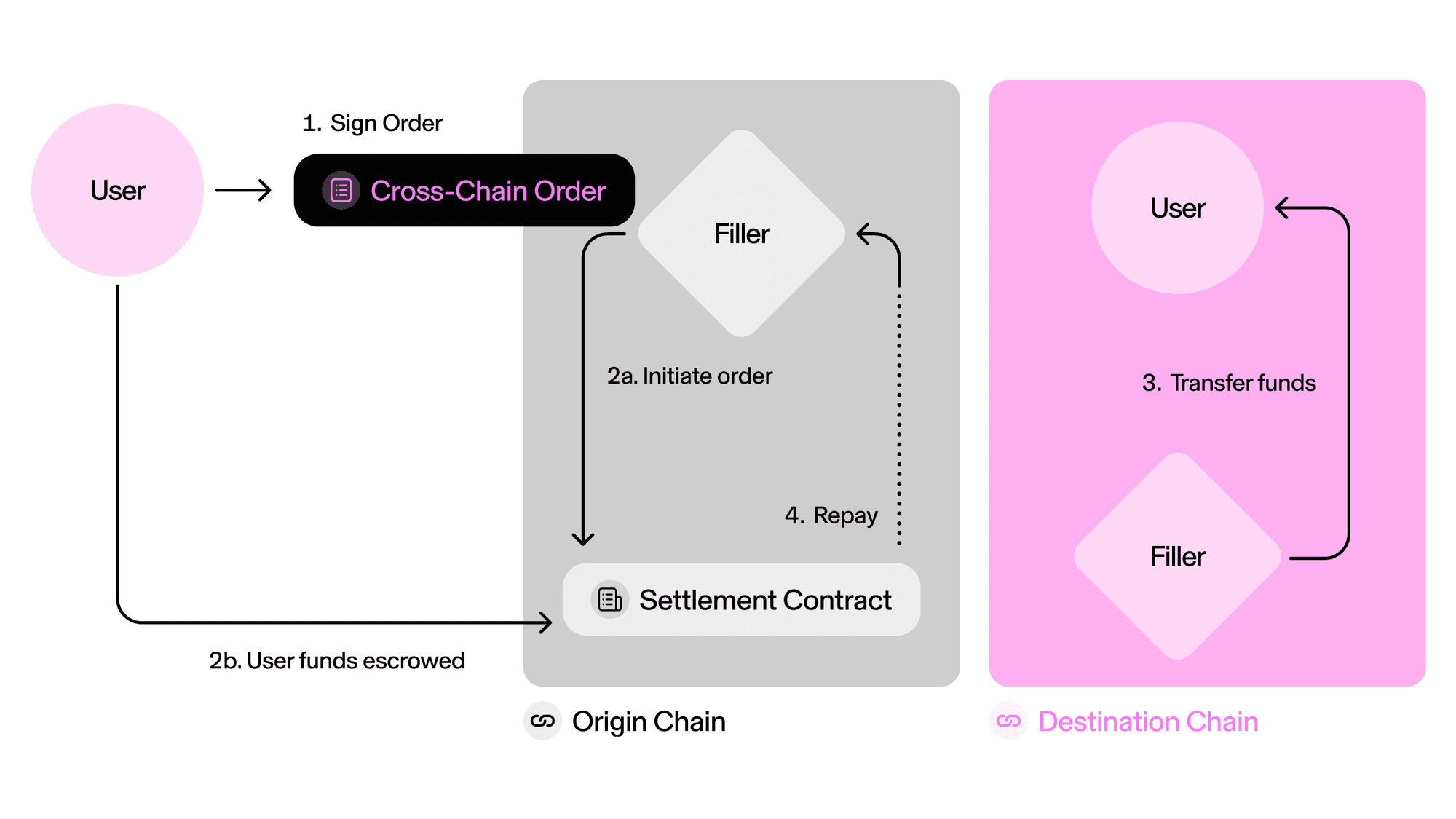

The next frontier is intent-based transactions: instead of specifying every technical step (which bridge? which route?), users simply declare their goal (“swap ETH for SOL at best rate”) and let smart routing algorithms handle execution behind the scenes. This abstracts away complexity while optimizing outcomes, a win-win for usability and efficiency (learn more here).

These advances are not just theoretical upgrades – they’re fundamentally reshaping the expectations for cross-chain user experience. When users no longer need to memorize recovery phrases or double-check contract addresses for every transaction, the psychological barrier to engaging with DeFi drops dramatically. The new standard is clear: safety and simplicity must go hand in hand.

Wallets like Blocto and OneBalance are pushing this intent-based paradigm even further, offering one-click cross-chain swaps and parallelizing multiple transaction steps. This means users can initiate a bridge, swap, and stake – all within a single unified flow. As these patterns become more widespread, we’re seeing a shift from fragmented workflows to an almost invisible backend logic that lets users focus on outcomes, not process.

Chain Abstraction: Toward a Unified Blockchain Experience

The concept of chain abstraction is the linchpin of this transformation. Instead of treating each blockchain as an isolated island, abstraction layers allow wallets to present the entire crypto ecosystem as a single, interoperable platform. Users interact with assets and dApps without ever needing to understand which chain is handling what behind the scenes.

This approach doesn’t just improve convenience – it’s also fostering new types of interoperability. For example, intent-based routing can optimize for best execution across liquidity pools on different chains or even aggregate staking rewards from multiple networks into one payout. As noted by Push.org, abstracting chains is key to breaking down silos and unlocking true composability in DeFi.

What’s Next? UX Challenges on the Horizon

While these innovations mark major progress, there are still real UX challenges ahead. Fee transparency remains an ongoing concern – especially as gas prices fluctuate unpredictably across networks. Some users still report confusion when bridging large amounts or interacting with novel L2 solutions that have unique withdrawal times or finality rules.

Another frontier is accessibility: How do we ensure that non-English speakers or those new to crypto aren’t left behind by technical jargon? The next wave of wallet UX will likely focus on richer in-app education, clearer feedback loops for failed transactions, and even AI-driven support for troubleshooting.

Top Cross-Chain Wallet UX Pain Points in 2025

-

Fragmented Fee Structures: Users face inconsistent and sometimes opaque fees when moving assets between chains. Even with wallets like Blocto or Rabby Wallet, understanding total costs across networks remains a challenge.

-

Security Risks with Bridges and Protocols: High-profile exploits of cross-chain bridges (e.g., Wormhole hack) have made users wary. Even wallets with advanced security (like Safe or Ledger) must contend with risks outside their direct control.

-

Limited dApp Compatibility Across Chains: While wallets such as MetaMask and OneBalance support multiple networks, not all decentralized applications (dApps) are fully interoperable, forcing users to juggle wallets or browser extensions.

-

Incomplete Chain and Token Coverage: Even leading wallets like Trust Wallet and Coinbase Wallet may not support every blockchain or token standard, leaving gaps for users with diverse portfolios.

-

Confusing Transaction Confirmations and Statuses: Cross-chain operations can involve multiple steps and confirmations. Users often struggle to track progress or understand errors, even with improved notifications in wallets like Blocto or Rabby Wallet.

-

Onboarding and Recovery Complexity: While seedless and biometric solutions are emerging (e.g., Coinbase Wallet), the onboarding and account recovery process can still be daunting, especially for newcomers.

Why This Matters for Mainstream Adoption

The stakes couldn’t be higher. For crypto to reach billions of users, we need more than just better blockchains – we need experiences so seamless that the underlying technology fades into the background. Cross-chain wallets are leading this charge by making network switching obsolete and giving users confidence that their assets are always accessible and secure.

If you’re building in DeFi or simply want less friction in your daily crypto life, now’s the time to embrace these multi-chain wallet solutions and demand chain abstraction as table stakes. The era of network anxiety is ending; what comes next is true digital ownership without borders.