In 2024, the decentralized finance (DeFi) ecosystem reached a pivotal milestone: unified multi-asset wallets became the backbone of seamless cross-chain experiences. For developers and crypto enthusiasts alike, this shift is more than a technical upgrade, it’s a fundamental reimagining of how users interact with digital assets across an ever-expanding web of blockchains. No longer do investors need to juggle multiple wallet apps or navigate risky third-party bridges. Instead, unified crypto wallets now serve as secure, intuitive gateways to the full spectrum of DeFi opportunities.

From Fragmentation to Fluidity: The Rise of Unified Wallets

The status quo in early DeFi was defined by fragmentation. Managing assets on Ethereum, Solana, Bitcoin, and emerging L2s meant wrestling with incompatible interfaces and constant manual bridging. This complexity was not just inconvenient, it introduced significant security risks and hindered adoption.

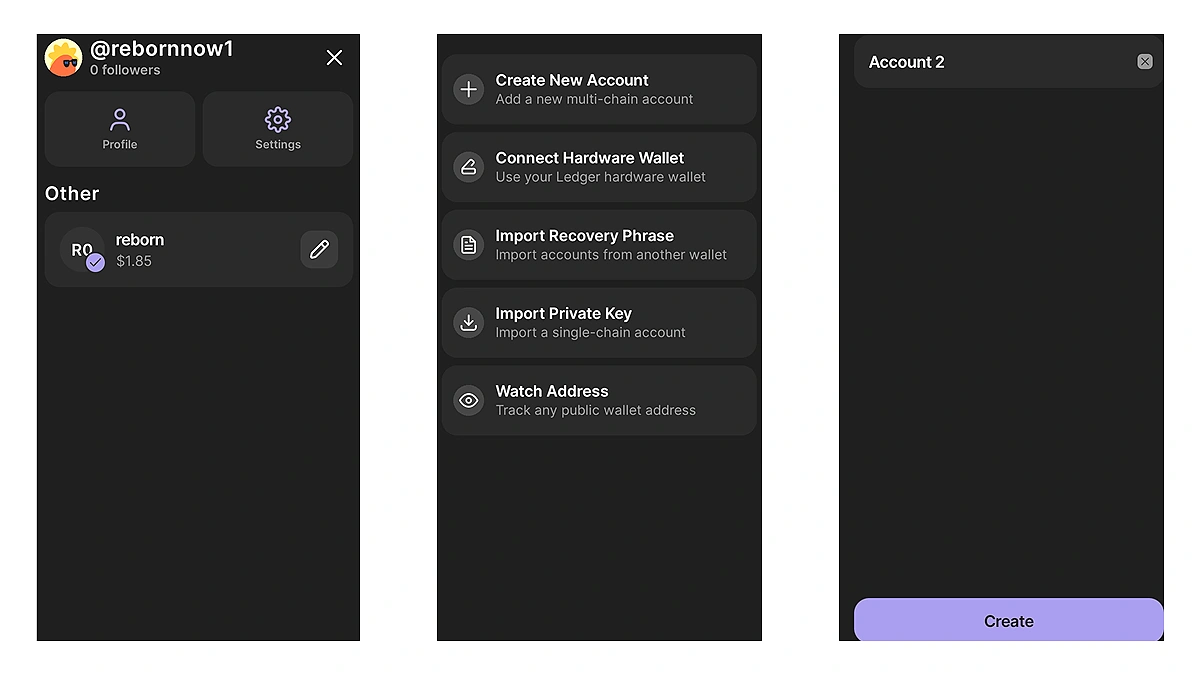

Today’s leading cross-chain DeFi wallets have turned this paradigm on its head. Solutions like PUM Exchange’s Unified Multi-Chain Wallet now support over 30 blockchains, including Ethereum, BNB Chain, Arbitrum, Optimism, Polygon, Tron, and Bitcoin, within a single application. Users can execute swaps or bridge assets natively without leaving the wallet or exposing themselves to third-party vulnerabilities.

Zypto App has taken this further by integrating real-world utilities such as bill payments and gift card purchases directly into its multi-chain wallet experience. Meanwhile, Ctrl Wallet’s support for over 2,500 blockchains, ranging from EVM networks to Cosmos and THORChain, demonstrates just how far interoperability has come in a short time span.

Security Without Compromise: Institutional-Grade Protection for All

Unified wallets are not just about convenience, they’re fundamentally about safeguarding user assets in an increasingly complex landscape. Advanced security architectures are now standard among top solutions:

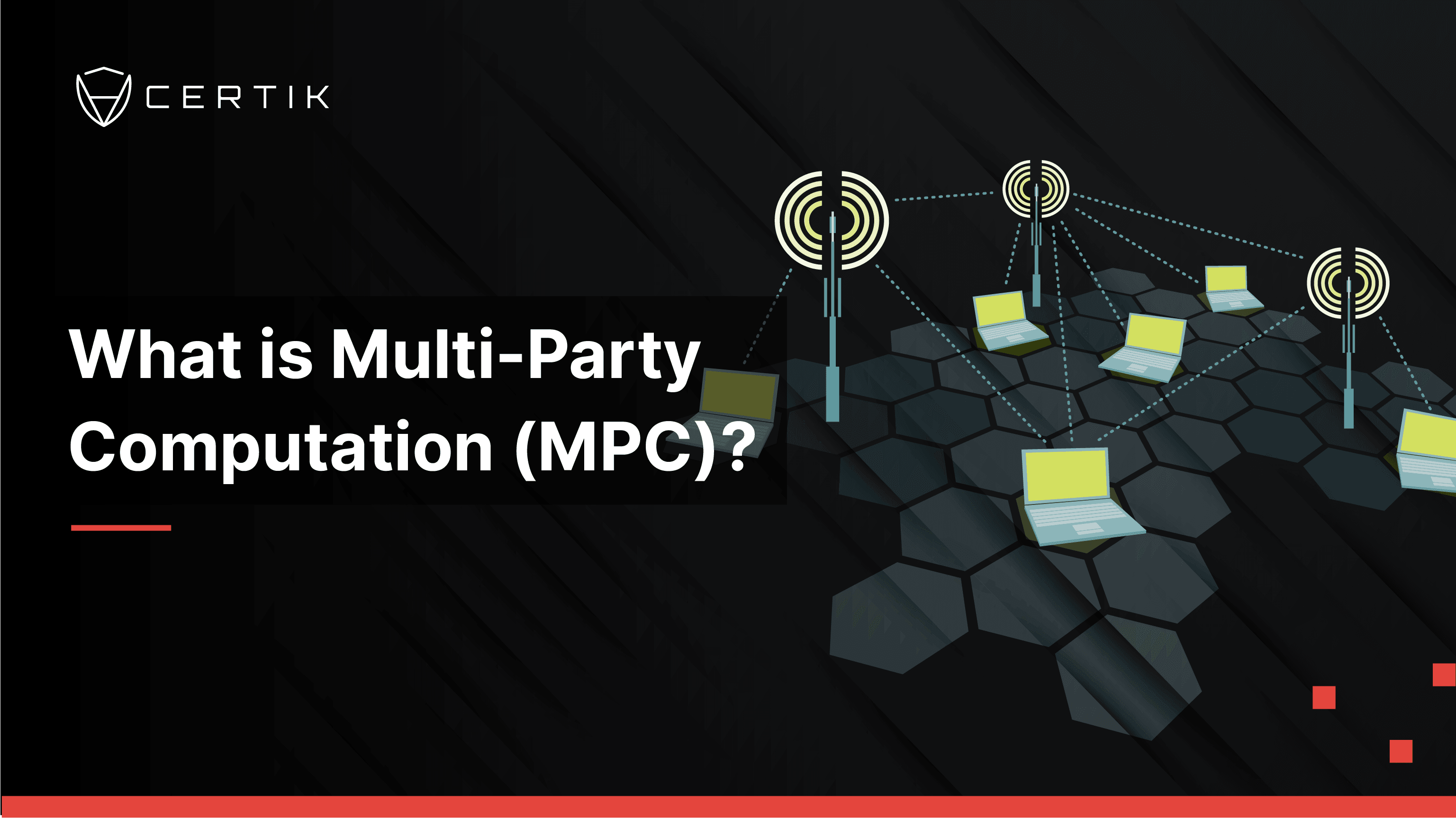

- Multi-Party Computation (MPC): Private keys are never fully exposed or stored in a single location; instead they are split between multiple parties for robust protection against compromise.

- Self-Custody and Hardware Integration: Optional cold storage tools like Zypto’s Vault Key Card add another layer of defense for users who demand maximum control over their funds.

- Biometric and Multi-Factor Authentication: Enhanced access controls ensure that even if one vector is attacked, user assets remain safe.

This focus on institutional-grade wallet security empowers both retail users and professional investors to engage confidently with cross-chain DeFi protocols, without sacrificing autonomy or accessibility.

Simplifying Cross-Chain Asset Management

The most tangible benefit of unified wallets is the radical simplification of asset management across networks. Instead of tracking balances in fragmented apps or spreadsheets, users can view their entire portfolio, including tokens from Ethereum, Solana, Avalanche, Tron, Base and more, in one consolidated dashboard.

This streamlined approach is complemented by features like Ctrl Wallet’s Gas Tank, a mechanism that lets users deposit USDC once and have gas fees automatically managed across major chains. No more scrambling for native tokens just to approve transactions; friction is minimized at every step.

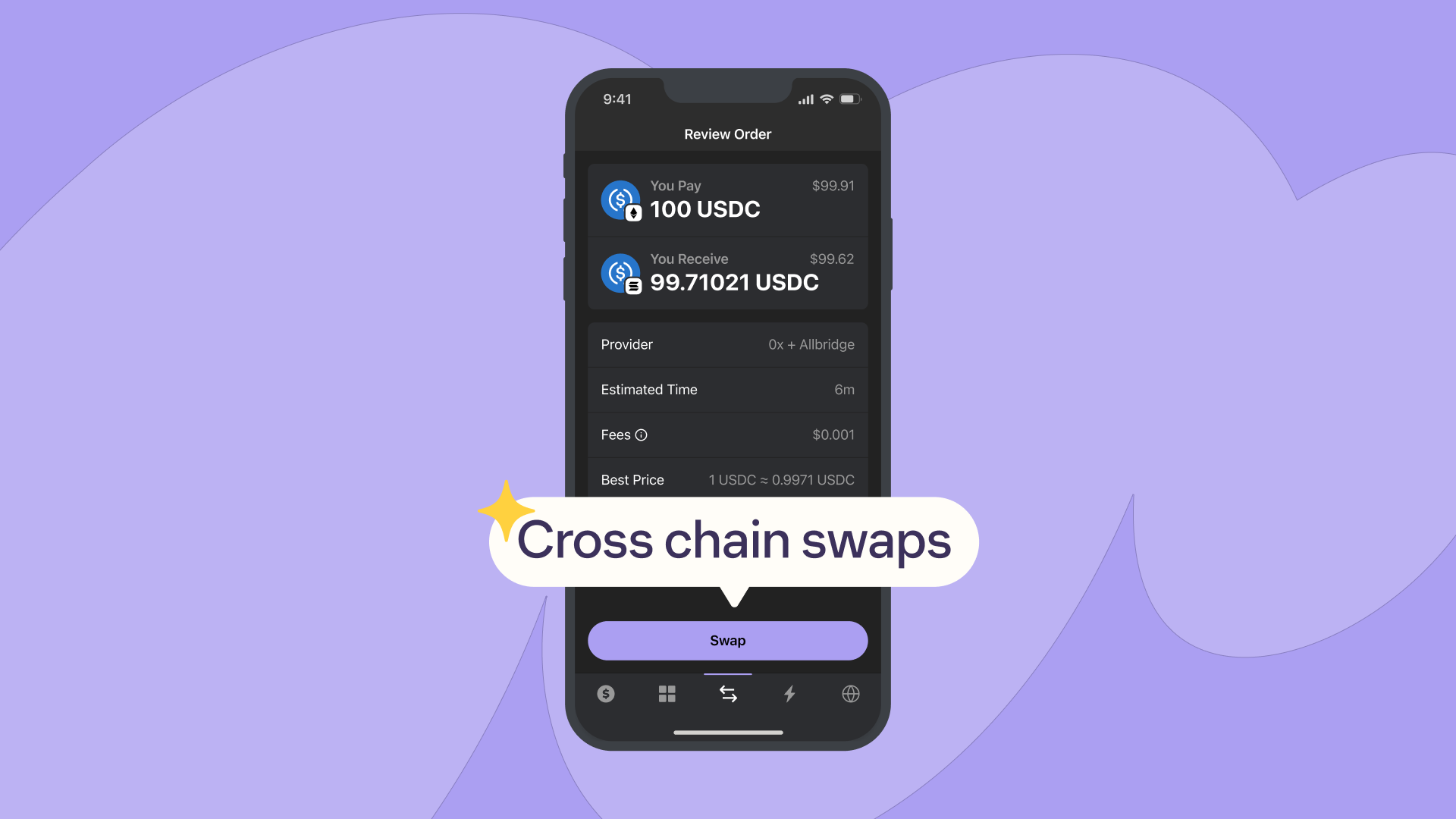

- Integrated Cross-Chain Swaps: Phantom Wallet’s Cross-Chain Swapper leverages APIs from OKX DEX and others to route trades across hundreds of DEXs and bridges for optimal pricing with minimal slippage.

- Real-Time Crypto Conversion: Users can seamlessly convert between assets without leaving their wallet environment, a vital feature as new protocols proliferate at breakneck speed.

This level of integration not only enhances transparency but also reduces operational risk, a crucial factor as DeFi matures into mainstream finance territory.

Unified multi-asset wallets are also unlocking a new era of accessibility. By abstracting away the technical hurdles of cross-chain activity, these wallets are empowering users to participate in DeFi regardless of their background or technical expertise. For example, Zypto’s built-in bill payment and mobile top-up features mean users can directly utilize their crypto assets for real-world needs, while Phantom’s intuitive bridging UI demystifies what was once a daunting process even for seasoned investors.

Essential Features of Top Unified Multi-Asset Wallets (2024)

-

Seamless Cross-Chain Asset Management: The best wallets, like PUM Exchange’s Unified Multi-Chain Wallet, allow users to manage and transfer assets across 30+ blockchains—including Ethereum, Solana, Polygon, Tron, and Bitcoin—via a single intuitive interface.

-

Integrated Native Swaps & Bridge Routing: Leading wallets feature built-in cross-chain swaps and bridge routing, enabling users to exchange tokens and move assets between networks without leaving the app or relying on third-party bridges. Phantom Wallet and Zypto App exemplify this with direct, optimized swaps across major chains.

-

Advanced Security Protocols: Security is paramount, with wallets like PUM Exchange leveraging hybrid Multi-Party Computation (MPC) and self-custody, and Zypto App offering hardware-based cold storage via the Vault Key Card. These measures ensure private keys are never fully exposed or stored in a single location.

-

Unified Portfolio & Real-World Utilities: Modern wallets provide a consolidated view of all assets and support real-world utilities such as crypto bill payments, gift cards, and mobile top-ups. Zypto App stands out for integrating these features into one application.

-

Automated Gas Fee Optimization: Innovative solutions like Ctrl Wallet’s Gas Tank let users deposit USDC to automatically cover gas fees across multiple blockchains, eliminating the hassle of maintaining native tokens for each network.

-

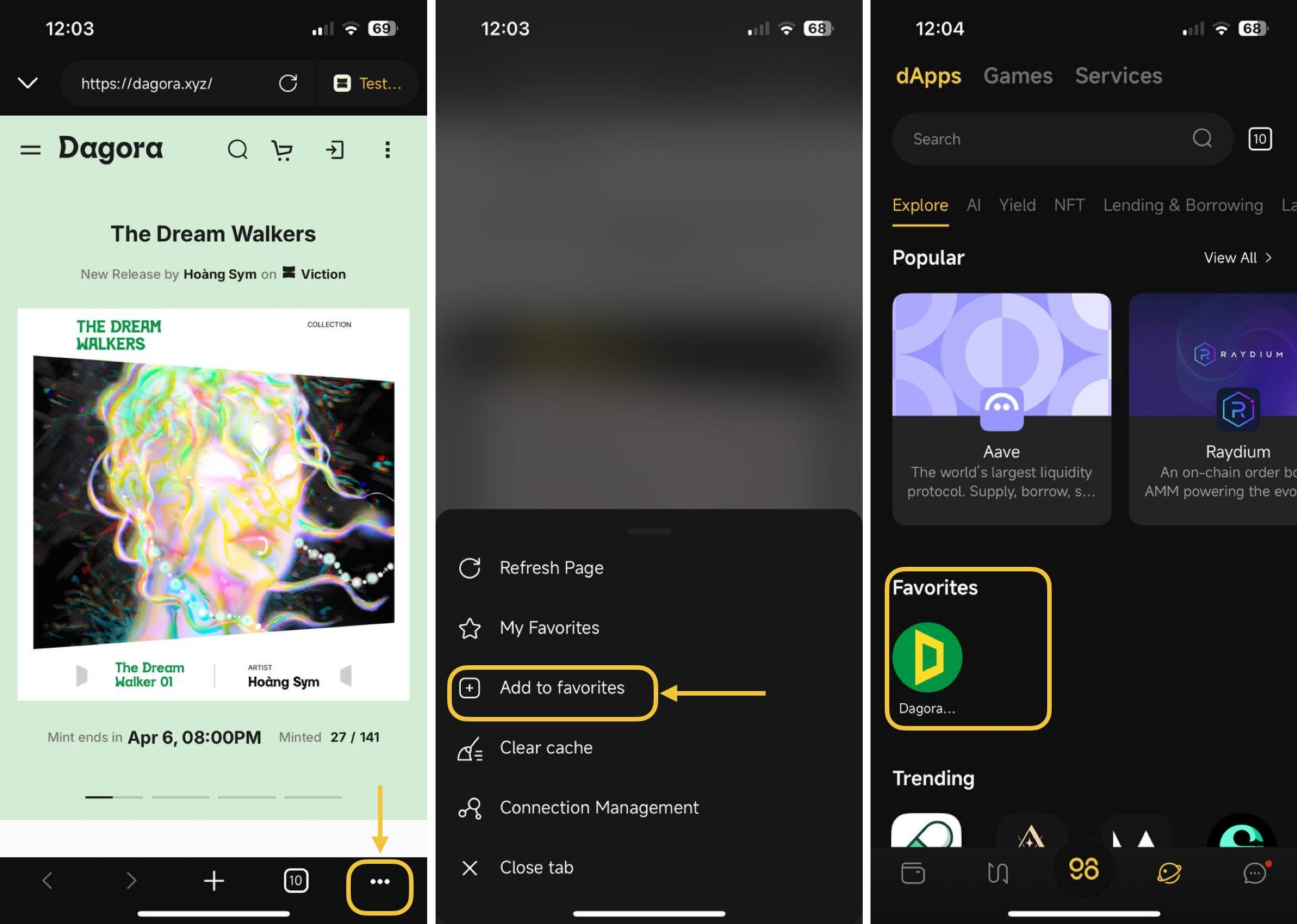

Extensive Multi-Chain & dApp Support: The top wallets, such as Ctrl Wallet, support thousands of blockchains and seamless dApp integration, empowering users to interact with DeFi protocols across EVM, Cosmos, Solana, Bitcoin, TRON, and more.

Developers, too, are reaping the benefits. The rise of intent-based execution models, pioneered by platforms like 1inch, enables smart routing and atomic swaps that minimize failed transactions and optimize user outcomes across chains. These innovations not only improve capital efficiency but also set a new standard for reliability in decentralized trading.

Meanwhile, compliance and risk management have become more robust through wallet-side monitoring tools and customizable spending limits. This is particularly relevant as institutional participation in DeFi accelerates. With enhanced visibility into portfolio exposures across multiple protocols and networks, treasury managers can make informed decisions without sacrificing security or operational flexibility.

What’s Next: The Road to Total Chain Abstraction

The trajectory is clear: as we look ahead to 2025 and beyond, unified crypto wallets will continue to push toward full chain abstraction, where users interact with applications and assets without needing to know which blockchain they’re using under the hood. Emerging standards like ERC-7811 are laying the groundwork for even deeper interoperability, promising seamless asset transfers and dApp interactions at a scale previously unimaginable.

Yet this evolution is not without its challenges. Security remains paramount as attack surfaces expand; wallet providers must remain vigilant against novel exploits targeting cross-chain infrastructure. User education will also be essential to ensure that new features do not inadvertently introduce complexity or risk.

The progress made in 2024 proves that chain abstraction is no longer a distant vision but an unfolding reality. Unified multi-asset wallets are at the heart of this transformation, empowering users with institutional-grade wallet security, frictionless cross-chain DeFi experiences, real-time crypto conversion, and access to AI-powered crypto tools all within a single interface.

For those eager to explore how these solutions are simplifying asset management further, our deep dives on unified wallet asset management and cross-chain transaction simplification offer practical insights into leveraging these advances safely and efficiently.

The future belongs to those who embrace interoperability, and as unified wallets mature, every user stands to benefit from a more secure, accessible, and empowering DeFi landscape.