Managing assets across multiple blockchains used to be a logistical nightmare in DeFi. In 2024, unified wallet solutions have flipped the script, giving users and developers a single, streamlined interface for cross-chain transactions. No more juggling seed phrases, switching between clunky browser extensions, or sweating over bridge protocols. Now, you can swap, lend, and manage assets from Ethereum, Solana, Bitcoin, and beyond, all in one place, all with a few clicks.

Why Unified Wallet Solutions Matter in 2024

The DeFi ecosystem has exploded with new blockchains, protocols, and tokens. But this growth came with a price: fragmentation. Liquidity pools, user bases, and dApps spread across dozens of chains, making it tough for even the most experienced traders to keep up. Unified wallet solutions are the answer to this fragmentation, driving a new era of chain abstraction UX where the underlying network becomes invisible to the user.

With unified wallets, you get:

- One interface for all chains: No more hopping between apps or wallets.

- Cross-chain swaps and transfers: Move assets between networks without manual bridging.

- Enhanced security: Advanced features like MPC (Multi-Party Computation) and self-custody models protect your funds.

- Lower fees: Optimized routing and gasless transactions slash costs.

The result? A cross-chain DeFi user experience so smooth it feels like magic, and it’s fueling record adoption across the space. For a deeper dive into how unified wallets are transforming asset management, check out this guide.

The 2024 Tech Stack: Key Players and Innovations

This year saw major leaps in unified wallet technology. Here’s a snapshot of the innovations setting new standards for seamless blockchain transactions:

- PUM Exchange’s Multi-Chain Wallet: Launched in July 2025, this wallet supports over 30 blockchains. It offers built-in swaps, native bridge routing, and a hybrid security model, making cross-chain asset management frictionless.

- 1inch’s Cross-Chain Swaps: In September 2024, 1inch rolled out atomic, intent-based swaps that pool liquidity across networks, no more clunky bridges or missed rates. Their Swap API is a game changer for DeFi traders.

- ALEX V2: By merging AMM with order book trading and integrating XLink for cross-chain liquidity, ALEX V2 lets users trade seamlessly across Bitcoin Layer 2s, no centralized exchange required.

- DeGate’s Intent-Based Trading: Express trading intents like “Buy SOL with USDC” and let solvers handle the rest. This innovation slashes manual steps and errors.

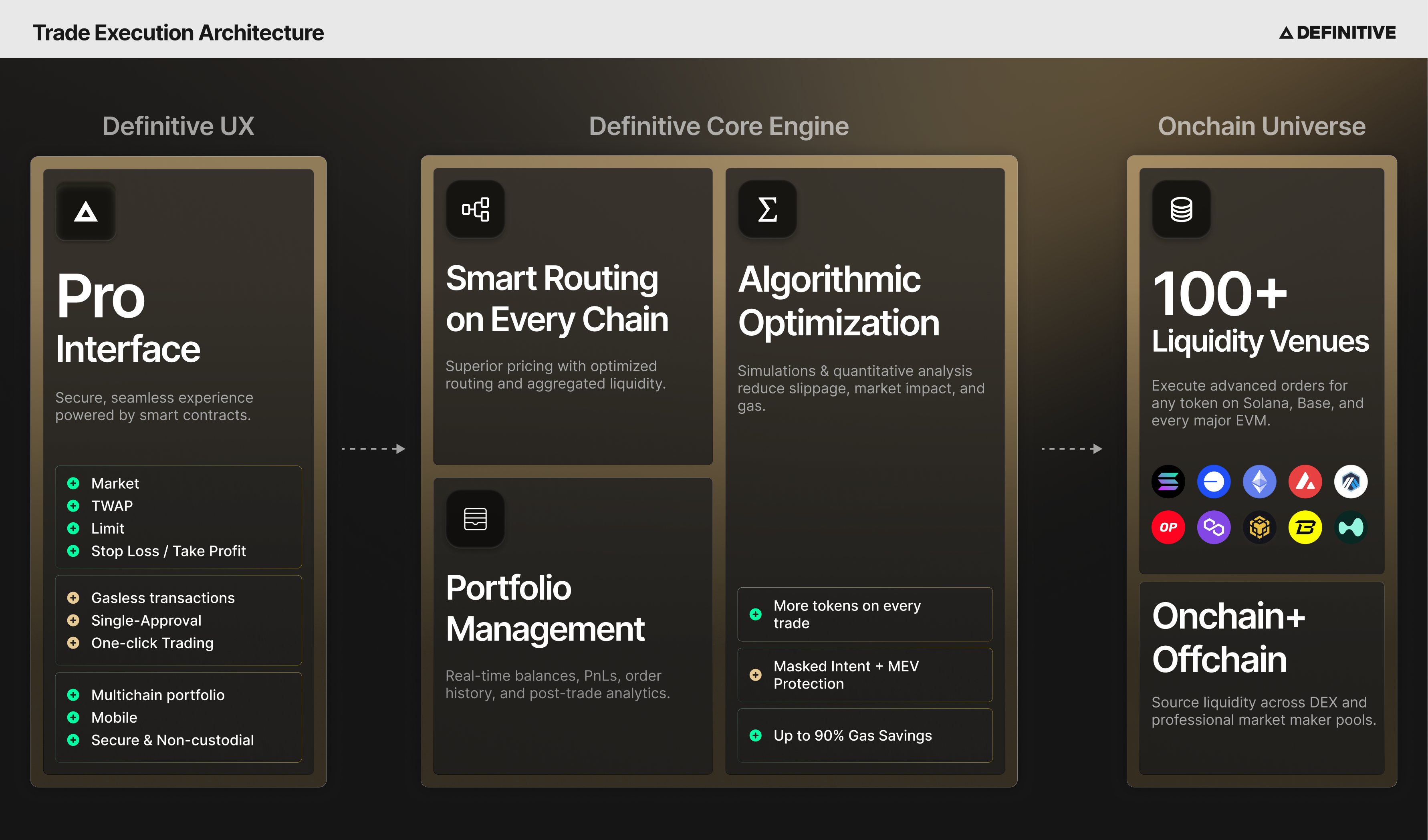

- Definitive’s Gasless Transactions: Starting August 2025, users can make cross-chain transfers with zero gas fees on Base, Solana, Avalanche, and BNB Chain, all through a unified interface.

How Chain Abstraction UX Powers Seamless Cross-Chain Transactions

The real magic behind these wallets is chain abstraction UX. Instead of forcing users to think about which network they’re on or which bridge to use, unified wallets abstract away the blockchain layer entirely. You simply choose what you want to do, swap tokens, transfer funds, stake assets, and the wallet handles the rest behind the scenes. This not only makes DeFi vastly more accessible but also unlocks new use cases for developers building cross-chain dApps.

The benefits are clear:

- No more network switching: The wallet auto-selects routes for you.

- Unified asset view: See all your tokens, NFTs, and DeFi positions in one dashboard.

- Fewer failed transactions: Smart routing and intent-based execution minimize errors and lost funds.

This is the foundation for a truly unified crypto ecosystem, one where your wallet is your passport to all of DeFi, no matter how many chains are under the hood. Want to see more on how this works in practice? Don’t miss our breakdown on seamless cross-chain UX.

Unified wallet solutions are now setting the pace for the next wave of DeFi adoption. The days of onboarding friction, network confusion, and asset fragmentation are fading fast. With the latest generation of multi-chain wallets, the user experience is finally catching up to the innovation happening under the hood. Let’s look at what this means for users, developers, and the broader DeFi ecosystem in 2024 and beyond.

Real-World Impact: From Power Users to Mainstream

For active traders, unified wallets mean faster execution and fewer missed opportunities. Imagine swapping from Bitcoin to Solana in seconds, or staking assets across networks without ever touching a bridge or worrying about gas fees. For newcomers, the onboarding process is dramatically simplified. You no longer need to learn the quirks of every blockchain, just download a wallet, connect, and go. This is chain abstraction UX in action: making the complex simple and the inaccessible available to everyone.

Top Unified Wallet Features Simplifying DeFi in 2024

-

PUM Exchange Multi-Chain Wallet: Supports 30+ blockchains (Ethereum, Solana, BNB Chain, Bitcoin) with cross-chain asset management, integrated swaps, and a hybrid MPC + self-custody security model.

-

1inch Cross-Chain Swaps: Leverage atomic, intent-based swaps across networks, pooling liquidity for efficient rates and lower fees—all without traditional bridges.

-

ALEX V2 Unified Trading: Combines AMM and order book trading with XLink cross-chain liquidity, enabling seamless swaps across Bitcoin Layer 2 networks.

-

DeGate Intent-Based Trading: Users express simple trade intents (e.g., “Buy SOL with USDC”), letting solvers execute trades directly on the target chain for frictionless execution.

-

Definitive Gasless Cross-Chain Transactions: Enables gasless transfers across networks like Base, Solana, Avalanche, and BNB Chain, streamlining DeFi with a unified, fee-free experience.

Developers are also reaping the rewards. Unified wallet SDKs and APIs make it easier to build dApps that work across chains from day one. Instead of siloed liquidity and fragmented user bases, projects can now launch with a global footprint and seamless asset interoperability. This is already fueling a new generation of DeFi apps that are more powerful, secure, and user-friendly than anything we’ve seen before.

Security and Trust: Raising the Bar

Security remains a top concern in DeFi, and unified wallets are meeting the challenge head on. Hybrid models like MPC plus self-custody ensure that users retain control while benefiting from institutional-grade protection. Features like intent-based execution also reduce human error, cutting down on failed transactions and lost assets.

Community sentiment is overwhelmingly positive, with many users celebrating how these wallets have changed their approach to DeFi entirely.

Still have questions about how this technology actually works? Here’s a quick FAQ to clear things up:

The Road Ahead: What’s Next for Unified Wallets?

The momentum behind unified wallet solutions is only accelerating. As more protocols adopt chain abstraction UX standards and integrate advanced routing algorithms, expect even greater efficiency and accessibility across the board. The next frontier? Full integration with NFT marketplaces, blockchain gaming platforms, and real-world payment rails, all managed from a single dashboard.

The bottom line: Unified wallets are not just another crypto trend, they’re the foundation for mass adoption across DeFi. By abstracting away complexity while boosting security and usability, these tools are unlocking new opportunities for everyone from day traders to first-time crypto users.

Ready to dive deeper into unified wallet solutions or see them in action? Explore our detailed guides on cross-chain asset management or seamless cross-chain UX. The future of DeFi is unified, and it’s already here.