For decentralized finance (DeFi) users, managing assets across multiple blockchains used to be a complex, time-consuming process. The rise of unified wallets is fundamentally transforming this landscape by offering streamlined, cross-chain asset management. Instead of juggling a patchwork of wallets and interfaces, users can now interact with their entire crypto portfolio in one place, regardless of the underlying network.

The Challenge: Fragmented DeFi UX in a Multi-Chain World

Before unified wallets, DeFi participants faced a fragmented experience. Each blockchain, Ethereum, BNB Chain, Solana, Bitcoin, traditionally required its own wallet and often separate browser extensions or mobile apps. Moving assets between these chains meant navigating third-party bridges or swaps, each with their own risks and learning curves. This friction not only discouraged new users but also introduced security vulnerabilities due to error-prone manual processes.

The rapid expansion of DeFi protocols across dozens of chains has only intensified the need for true chain abstraction solutions. According to recent market data, platforms like PUM Exchange now support over 30 blockchains within a single wallet interface (source: Chainwire). Meanwhile, ZetaChain’s UNISON upgrade has set an industry milestone by enabling unified wallet access across more than 50 blockchains (source: AInvest).

Simplified Asset Management With Unified Wallets

Simplicity is the new standard. Unified wallets aggregate all your digital assets, fungible tokens and NFTs alike, across supported networks into one cohesive dashboard. For example, PUM’s multi-chain wallet lets users view and organize holdings on Ethereum, BNB Chain, Solana, Bitcoin, and many more without switching apps or browser tabs. This is not just about convenience; it’s about unlocking operational efficiency for both power users and newcomers alike.

Key Benefits of Unified Wallets for DeFi Asset Management

-

Simplified Cross-Chain Asset Management: Unified wallets like PUM Exchange Unified Multi-Chain Wallet allow users to view and manage digital assets across 30+ blockchains (e.g., Ethereum, BNB Chain, Solana, Bitcoin) from a single interface, eliminating the need for multiple wallets or manual bridging.

-

Integrated Cross-Chain Transactions: Many unified wallets offer built-in swapping and bridging, letting users transfer assets between networks without leaving the wallet. For example, PUM’s wallet uses smart routing algorithms to find the most cost-efficient and fastest transaction paths.

-

Enhanced Security with MPC Technology: Leading unified wallets employ Multi-Party Computation (MPC) to protect private keys, ensuring they are never fully exposed or stored in one place. This delivers enterprise-grade security while letting users retain full control over their assets.

-

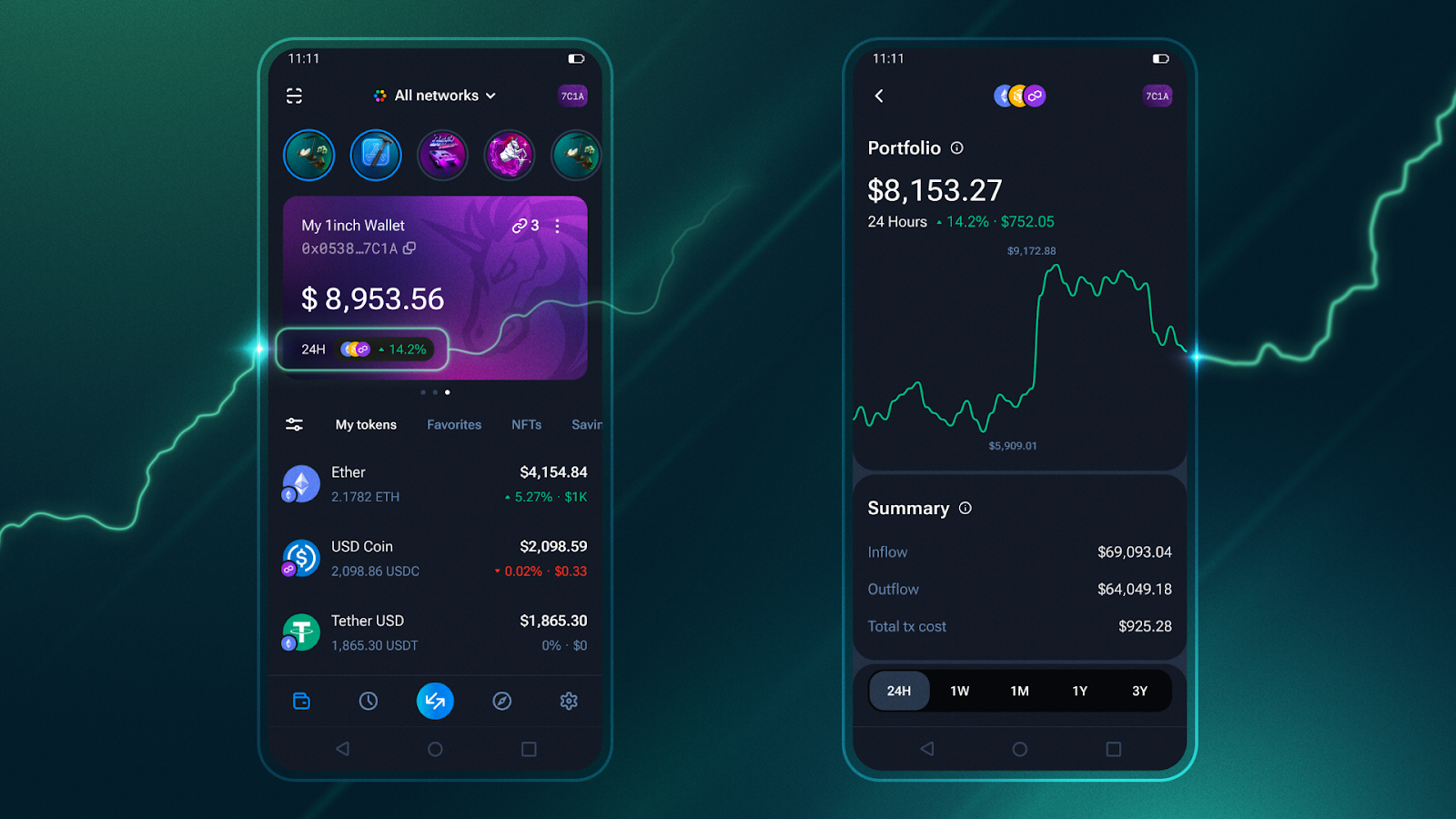

Comprehensive Portfolio Tracking: Solutions like 1inch Portfolio provide real-time tracking across up to 10 wallets and multiple blockchains, giving users a consolidated view of their entire DeFi portfolio.

-

Support for Diverse Digital Assets: Unified wallets support not just fungible tokens but also NFTs and other digital assets. For instance, PUM’s wallet enables users to view and transfer NFTs across various supported networks.

This approach also supports non-fungible tokens (NFTs), letting users view and transfer collectibles natively within the same interface. By abstracting away the complexity of network-specific standards (ERC-721 vs SPL vs BEP-721), unified wallets make NFT management as seamless as handling regular tokens.

Integrated Cross-Chain Transactions, and Why They Matter

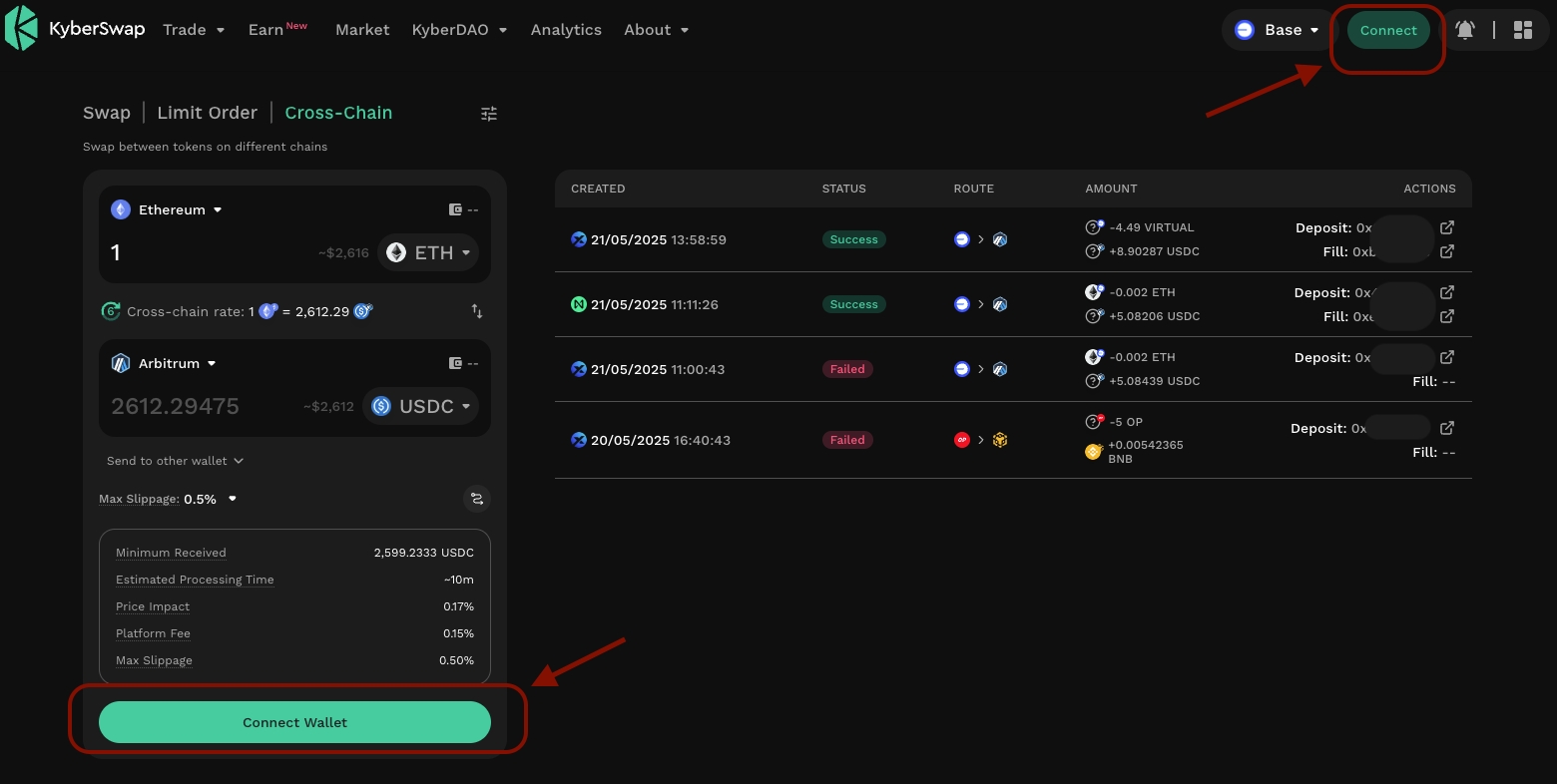

The best unified wallets go beyond passive portfolio display, they actively facilitate cross-chain transactions within the app itself. Features like on-chain swapping and cross-chain bridging are now built-in rather than bolted on. For instance:

- Smart routing algorithms: These detect the fastest and most cost-efficient path for bridging or swapping assets between networks in real time.

- No need for manual bridge selection: Users simply choose what they want to move, and where, and let the wallet handle the technical details behind the scenes.

- Unified transaction history: Every swap or bridge action is tracked in one place for improved transparency and tax reporting.

This level of integration marks a significant leap forward in cross-chain asset management UX. By reducing cognitive load and error risk while accelerating transaction speed, unified wallets are setting new expectations for DeFi user experience.

Security remains paramount as users entrust unified wallets with increasingly diverse and valuable portfolios. Modern solutions leverage Multi-Party Computation (MPC) and advanced encryption, ensuring that private keys are never fully exposed or stored in a single location. This approach is now standard for institutional-grade offerings like FORDEFI, but it’s also filtering down to consumer wallets, providing enterprise-level protection for everyday DeFi participants. The result: users retain full custody without compromising on safety or convenience.

Comprehensive portfolio tracking is another game-changer. Instead of manually reconciling balances across multiple wallets and blockchains, users can now access real-time overviews of all their assets, including staked tokens and NFTs. Platforms like 1inch Portfolio allow aggregation of up to 10 wallets from various chains into a single dashboard, making it easier to monitor performance, rebalance holdings, or identify opportunities for yield generation, all without leaving the unified interface.

Expanding Horizons: Interoperability and Ecosystem Growth

The impact of unified wallets extends well beyond individual asset management. By abstracting away chain-specific complexities, these solutions unlock deeper interoperability across the DeFi ecosystem. Developers can build dApps that interact with assets on any supported network through a single wallet connection, reducing integration overhead and accelerating innovation.

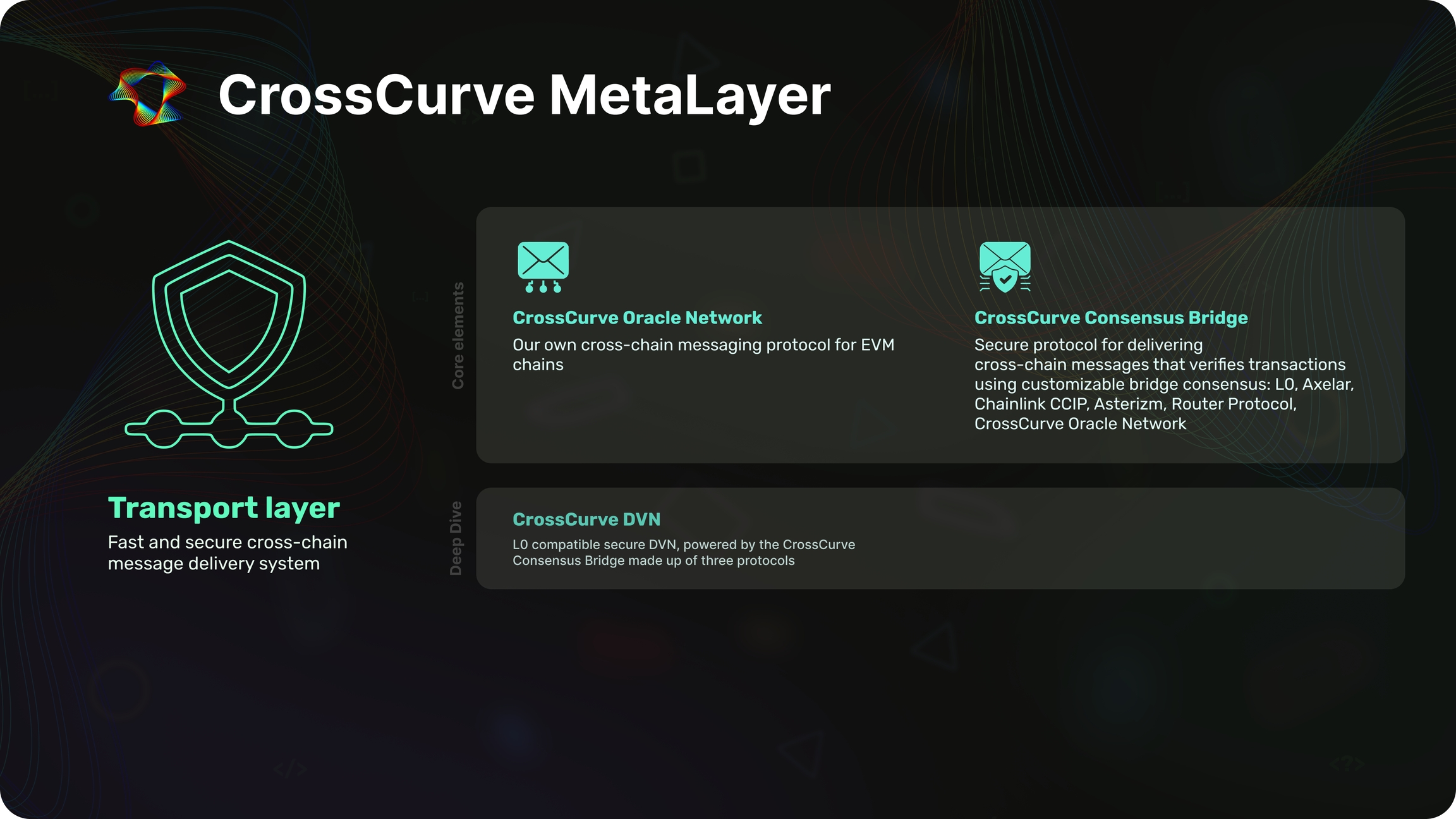

This interoperability is fueling the rise of meta-layers like CrossCurve MetaLayer, decentralized infrastructures designed to aggregate cross-chain liquidity and incentives. As more protocols adopt chain abstraction standards, users benefit from broader access to liquidity pools and financial products without ever needing to bridge assets manually or learn new interfaces.

Top Reasons Developers Integrate Unified Wallet APIs

-

Simplified Cross-Chain Asset Management: Unified wallet APIs, like those powering PUM Exchange’s Unified Multi-Chain Wallet, allow users to manage assets across 30+ blockchains—including Ethereum, BNB Chain, and Solana—through a single interface, eliminating the need for multiple wallets and manual bridging.

-

Integrated Cross-Chain Transactions: These APIs enable seamless swapping and bridging of assets across networks directly within the wallet. PUM Exchange and CrossCurve MetaLayer both offer smart routing for cost-efficient, real-time cross-chain transactions, enhancing user convenience.

-

Enterprise-Grade Security with MPC: Leading unified wallet APIs, such as those from FORDEFI, use Multi-Party Computation (MPC) to safeguard private keys, ensuring assets remain secure without exposing keys in a single location. This is critical for both end-users and institutional clients.

-

Comprehensive Portfolio Tracking: APIs like 1inch Portfolio allow users to track assets across multiple wallets and blockchains in real time, providing a unified, up-to-date view of their entire DeFi portfolio.

-

Support for Diverse Digital Assets: Unified wallet APIs increasingly support not just fungible tokens but also NFTs and other digital assets. PUM Exchange and ZetaChain’s UNISON Upgrade both enable users to manage NFTs across multiple networks from a single wallet.

-

Streamlined User Experience and Reduced Friction: By integrating a unified wallet API, developers can offer a seamless onboarding process, minimize the need for users to switch between apps, and reduce the risk of asset fragmentation—a key advantage highlighted by Rabby Wallet and Blockdaemon’s DeFi API.

The Road Ahead: What’s Next for Unified Wallets?

Unified wallet technology continues to evolve at a rapid pace. ZetaChain’s UNISON upgrade demonstrates how quickly support can expand, from 30 blockchains today (as with PUM Exchange) to over 50 in just a few months. Expect future iterations to bring even tighter integrations with decentralized identity (DID), real-world asset tokenization, and automated compliance tools, further lowering barriers for institutional adoption while keeping UX frictionless for retail users.

As competition intensifies among wallet providers, user experience will remain the primary battleground. Features such as one-click cross-chain swaps, gas fee optimization via smart routing algorithms, and granular permission controls are quickly becoming table stakes rather than differentiators.

The bottom line? Unified wallets are no longer optional: they’re essential infrastructure for anyone serious about participating in DeFi’s multi-chain future. By removing technical hurdles and centralizing control without sacrificing security or flexibility, they empower both new entrants and seasoned investors alike.

If you’re ready to explore more about how these innovations are shaping cross-chain swaps as well as asset management, check out our deep dive here: How Unified Wallets Simplify Cross-Chain Swaps for DeFi Users.