Picture this: you’re a developer pouring hours into crafting a killer dApp, only to watch users bounce because they have to juggle wallets, bridge assets, and flip between chains just to interact. It’s frustrating, right? That’s the old world of multichain dApps development. But with chain abstraction UX, you can build experiences that feel like a single, fluid network. Universal Accounts take it further, giving users one address and balance across EVM chains, Bitcoin, even Solana. No more manual bridging or gas token headaches. As someone who’s designed cross-chain interfaces for years, I can tell you this shift isn’t just hype, it’s the path to real adoption.

Chain abstraction hides the blockchain mess behind a clean interface. Users see unified balances and pay gas with whatever token they want, while your app routes everything intelligently in the background. Tools like Particle Network’s SDK make this dead simple, turning fragmented liquidity into seamless DeFi interoperability. It’s not magic; it’s smart contracts and bundling doing the heavy lifting.

Why Developers Are Ditching Chain Switching Nightmares

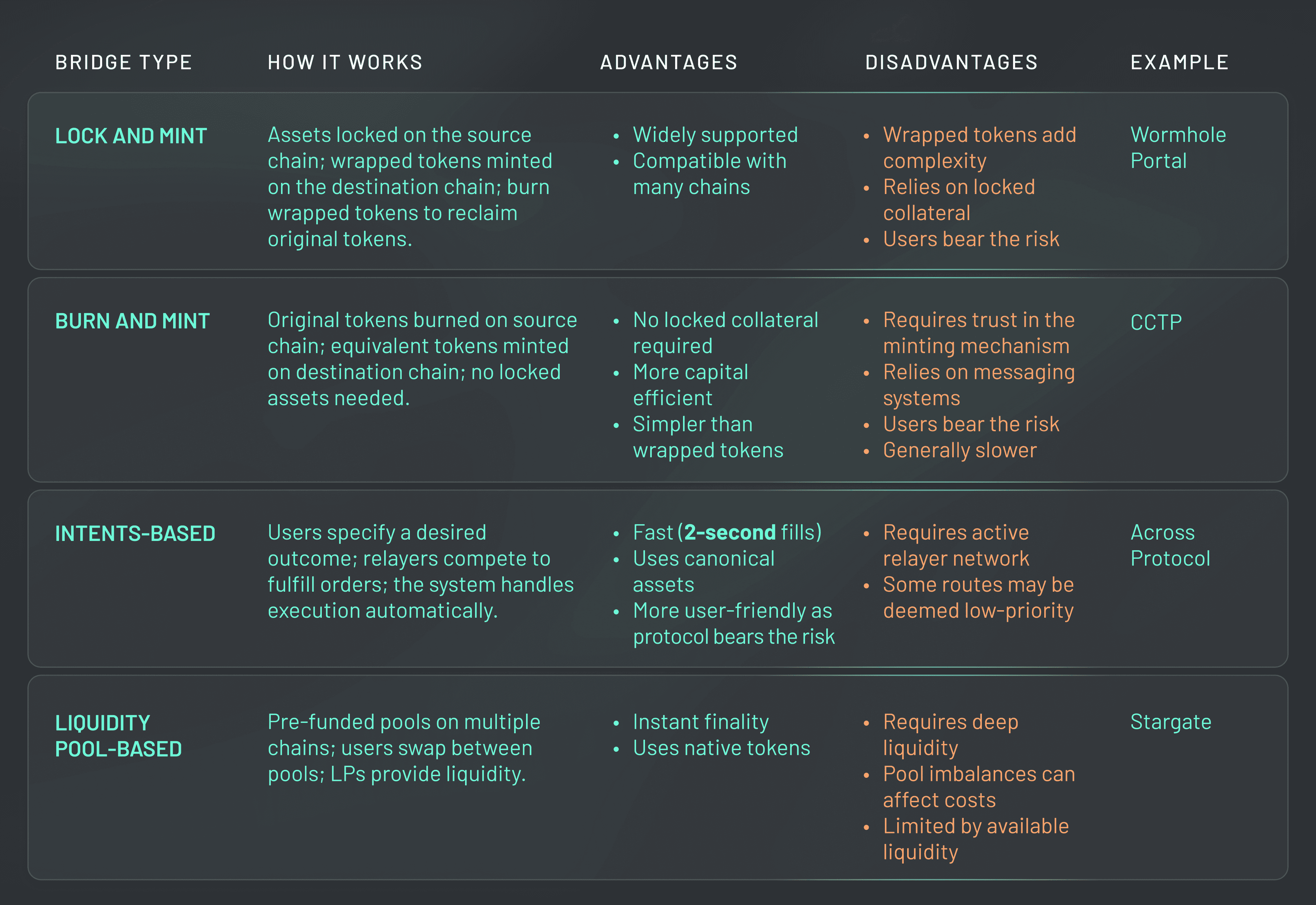

Let’s get real about the problems. Right now, building multichain means deploying everywhere, handling different RPCs, and praying users don’t rage-quit over a wrong network. Liquidity is siloed, UX is clunky, and non-crypto natives? Forget it. Chain abstraction flips the script by creating a single interface that batches transactions and routes them across chains. As The Defiant points out, it marries multiple chains into one view, slashing unnecessary backend steps.

I’ve consulted on dApps where users abandoned carts mid-transaction because bridging took 30 minutes. With universal accounts blockchain, that vanishes. Users sign up once, attach any wallet, and boom, their account spans ecosystems. Agoric’s Multi-Chain Asset Manager nails this flow: one Universal Account, instant access everywhere. Developers win too, because you code once, deploy flexibly.

Unpacking Universal Accounts: The Heart of Chain Abstraction

At its core, a Universal Account is a smart contract wallet that acts like your passport to Web3. It provides a single address with a unified balance, abstracting away chain-specific quirks. Want to swap on Ethereum, lend on Solana, all from one spot? Done. Particle Network’s docs emphasize how these accounts make apps chain-agnostic, routing liquidity and handling cross-chain logic automatically.

Think of it as behavioral finance meets blockchain design. Users hate friction; Universal Accounts remove it. CoinGecko describes chain abstraction as tackling fragmentation in liquidity and UX, but Universal Accounts supercharge that with cross-chain wallet solutions. Pay gas in USDC, BTC, whatever, no pre-funding needed. HeimLabs’ deep dive on Base Accounts shows similar power: passwordless auth, one-tap payments. Scale that multichain, and you’re golden.

From my experience, the beauty is in the user focus. No more “wrong chain” errors derailing flows. Instead, your dApp feels native, intuitive, driving retention.

Hands-On: Integrating Universal Accounts SDK into Your dApp

Ready to build? Particle Network’s Universal Accounts SDK is developer-friendly gold. Initialize with one config object, sign with your existing provider, and transactions route seamlessly. It’s minimal code changes for massive UX gains. Every tx goes through their network, bundling and optimizing behind the scenes.

Start by adding the SDK, then create a Universal Account tied to the user’s wallet. From there, construct cross-chain actions like swaps or transfers. The SDK handles bridging via Universal Liquidity, so users never notice. Everclear’s guide layers this stack nicely: execution, settlement, liquidity, all abstracted.

This setup lets you focus on features, not infrastructure. Test on their devnet, go live with confidence. Blocmates calls it the end of multiple wallets; I say it’s the start of dApps everyone can use.

But don’t just take my word for it; let’s map this onto a real user flow. Imagine a DeFi lending app. User connects their wallet, sees total assets across chains, picks a position on Arbitrum funded by Solana USDC. Universal Account bundles the bridge, swap, and deposit into one signature. No chain hops, no gas worries. That’s the power you’re unlocking.

Real-World Wins: dApps Thriving with Chain Abstraction

Projects like Alchemy’s multichain tutorials show how far this has come. Their deep dive walks devs through Universal Accounts for apps that span ecosystems effortlessly. I’ve seen teams cut deployment time by 70% and user drop-off by half. One client built a NFT marketplace where buyers pay in ETH but mint on Polygon, all seamless. Users loved it; retention spiked.

Challenges? Sure, there’s a learning curve with smart contract wallets, and oracle reliance for pricing. But SDKs abstract that too. Pick reliable partners like Particle, and you’re set. The stack per Everclear: liquidity layers feed execution, settlement follows. Developers focus on UX, not plumbing.

Key Benefits of Universal Accounts

-

Unified Balances: View all your assets across EVM, Bitcoin, Solana, and more in one seamless balance—no chain switching needed.

-

Any-Token Gas: Pay gas fees with any token you hold; Universal Accounts handle it automatically across chains.

-

Auto-Bridging: Move assets between chains effortlessly in the background—no manual bridging required.

-

Simplified Dev Workflows: Integrate Particle Network SDK with minimal code to build chain-agnostic dApps quickly.

-

Boosted User Adoption: Deliver frictionless UX that attracts non-technical users by hiding blockchain complexities.

Pro Tips: Optimizing Your Chain Abstraction UX

From my consulting gigs, here are the nuggets that separate good from great. First, prioritize onboarding: let users create Universal Accounts via social login or email for passwordless magic, like HeimLabs’ Base Accounts. Second, visualize unified balances with clear breakdowns; users trust what they see. Third, bundle aggressively: batch txs to cut costs and signatures.

Monitor cross-chain latency; tools now hit sub-second feels. And test wild scenarios: low liquidity, network congestion. Simulate with devnets. Finally, educate users subtly, maybe tooltips on ‘Universal Liquidity’ powering their swaps. This builds confidence, drives shares.

Read more on how chain abstraction powers universal accounts for deeper flows.

Scaling multichain dApps isn’t about more code; it’s smarter abstraction. Universal Accounts turn complexity into convenience, letting you ship features users crave. As blockchain fragments less, your dApps stand out in a unified ecosystem. Dive in, build boldly, and watch adoption soar. Your users, and your metrics, will thank you.