Managing assets across multiple blockchains used to be a logistical headache for both retail and institutional crypto users. In 2024, that narrative began to shift dramatically as unified crypto wallet solutions matured, integrating seamless cross-chain asset management into a single, intuitive interface. These wallets are not just enhancing convenience; they’re fundamentally changing how users interact with decentralized finance (DeFi) by abstracting away the complexity of EVM and non-EVM chains.

Why Unified Wallets Matter for Cross-Chain Asset Management

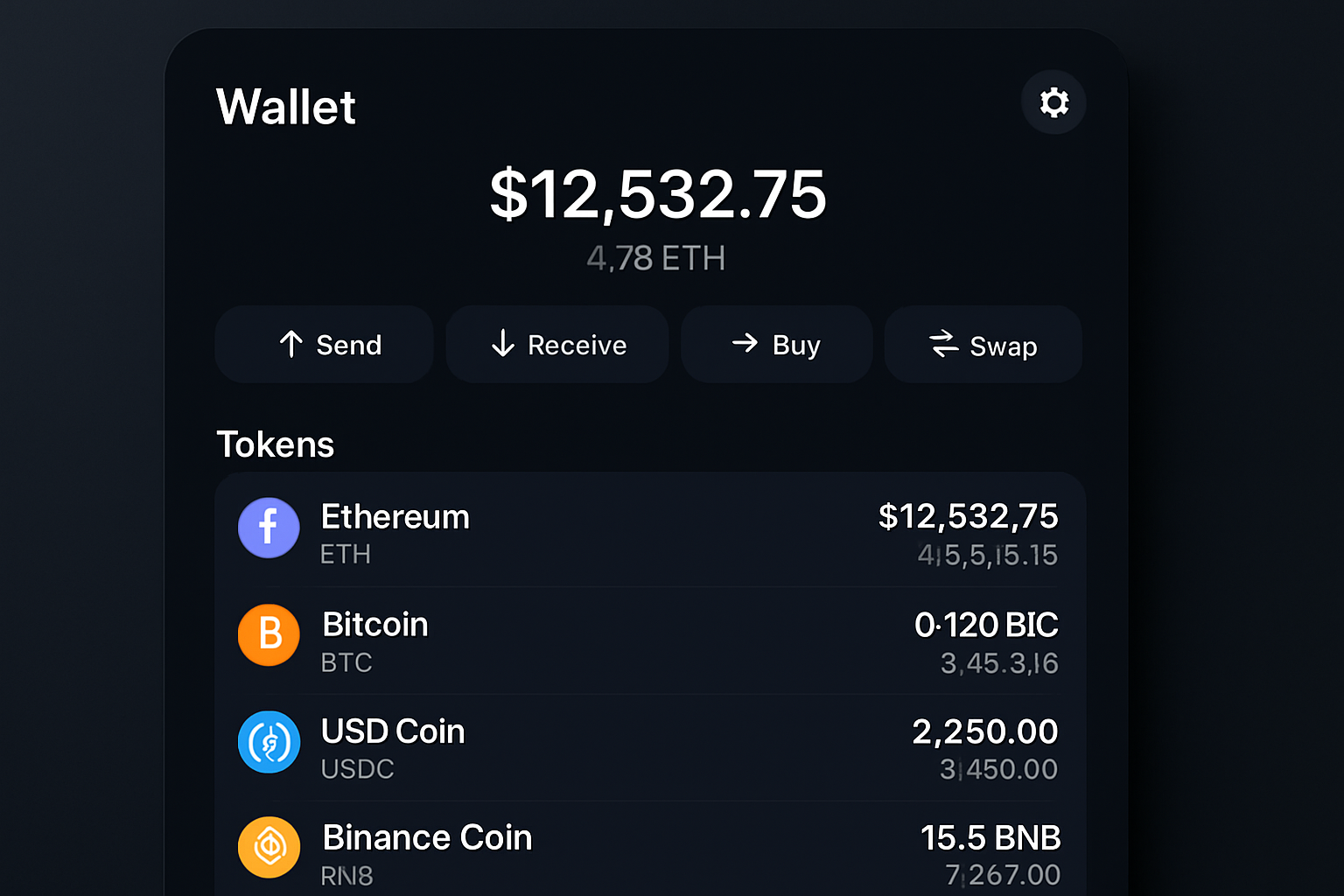

The growth of multi-chain ecosystems has introduced both opportunity and friction. Historically, users needed to juggle multiple wallets and interfaces, one for each blockchain. This fragmentation led to operational risk, higher fees, and missed opportunities. Unified crypto wallets in 2024 are addressing these pain points by providing a consolidated dashboard for assets, NFTs, and DeFi positions across dozens of chains, from Ethereum and Solana to Bitcoin and emerging networks.

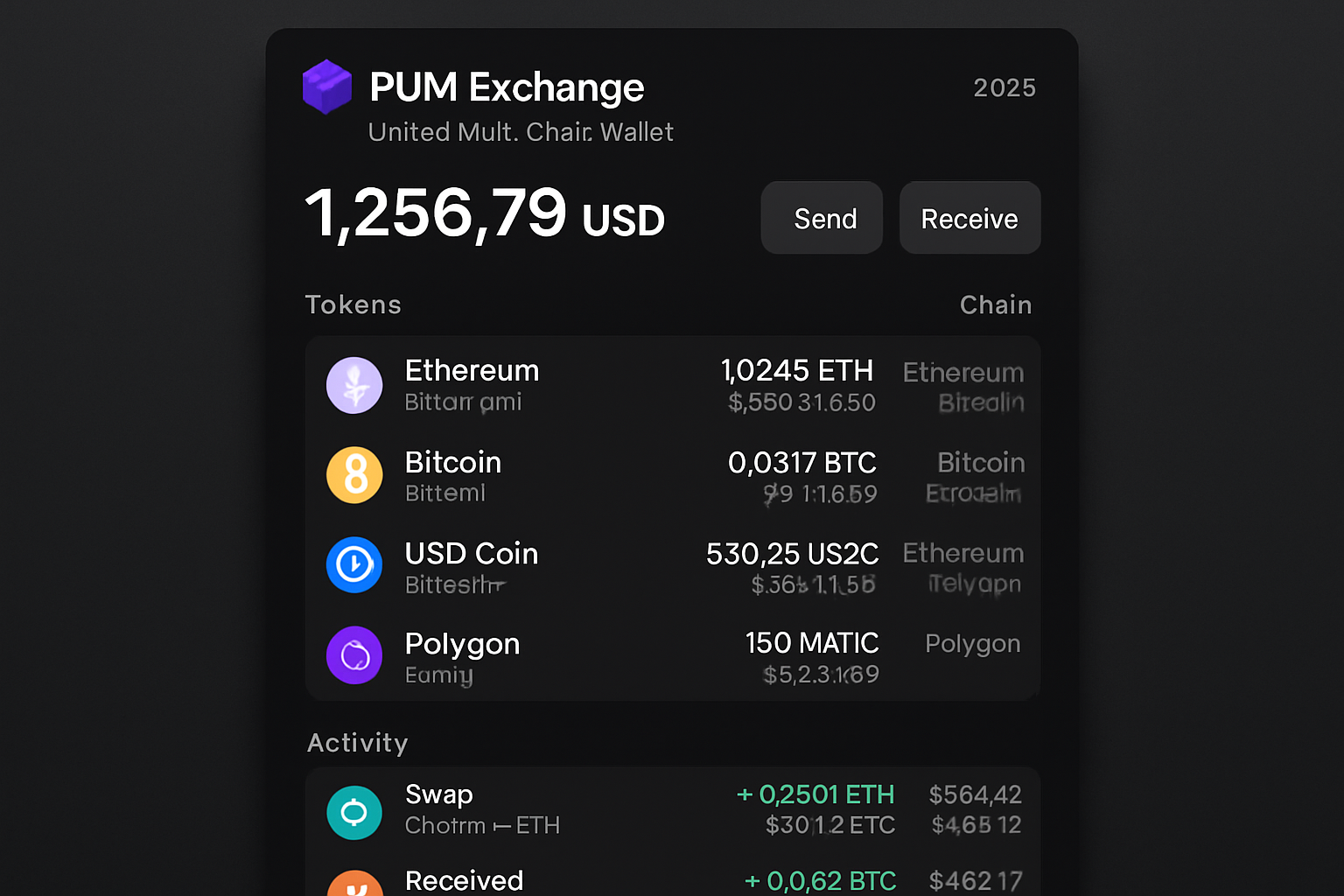

Consider PUM Exchange’s Unified Multi-Chain Wallet, launched in July 2025. It supports over 30 blockchains and enables native bridge routing, integrated swaps, and a hybrid security model that leverages Multi-Party Computation (MPC) alongside self-custody. This kind of innovation means users no longer need to manually bridge assets or worry about which network they’re operating on provides the wallet handles it behind the scenes.

Key Features Driving the Unified Wallet Revolution

Top Features Expected in Unified Crypto Wallets (2024)

-

Multi-Chain Asset Integration: Seamlessly manage assets from major blockchains like Ethereum, Bitcoin, Solana, and BNB Chain within a single wallet interface, eliminating the need for multiple separate wallets.

-

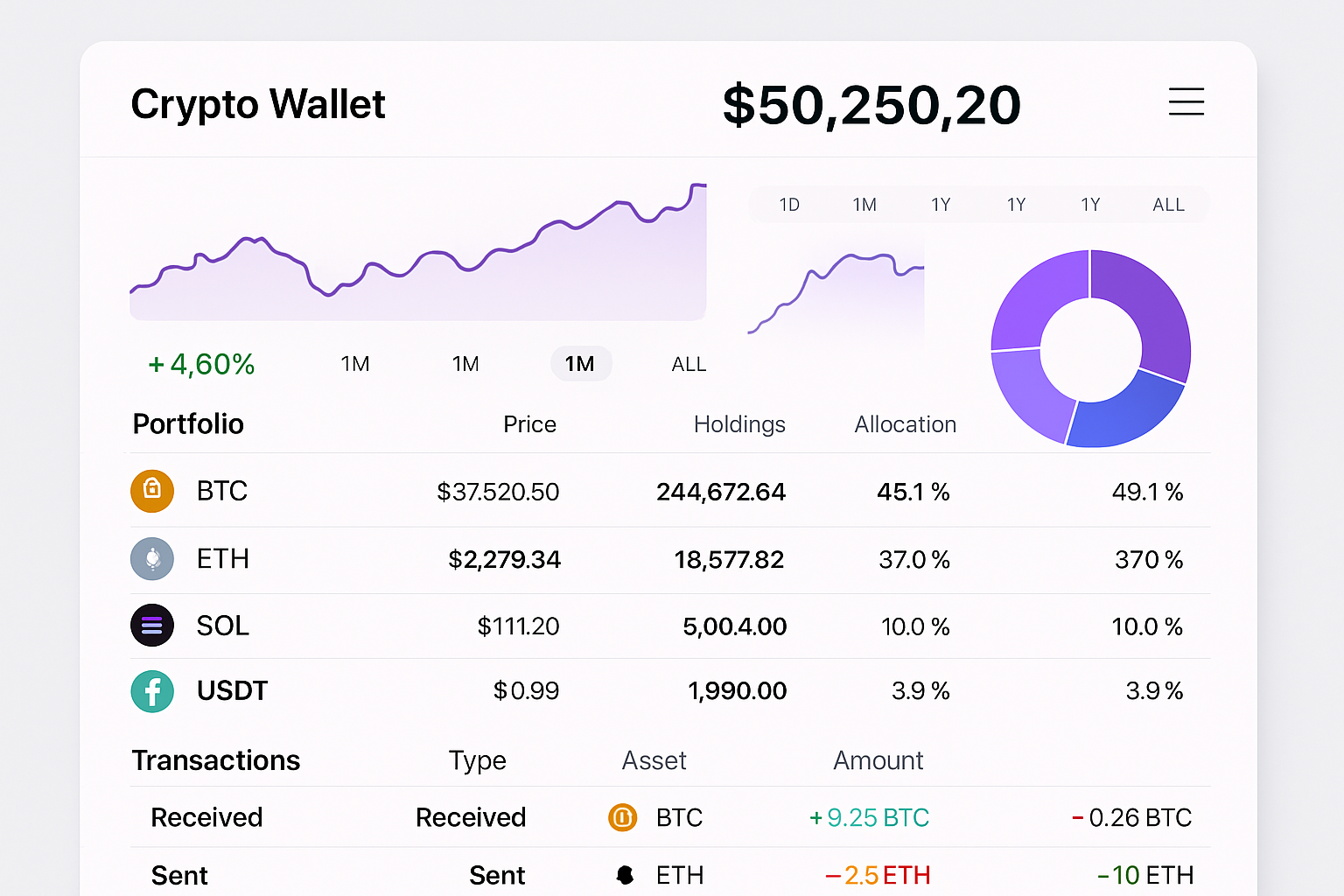

Unified Portfolio View: Access a consolidated dashboard that displays all tokens, NFTs, and assets across connected wallets and supported blockchains, as seen in Coinbase’s Unified Wallet App and 1inch Portfolio feature.

-

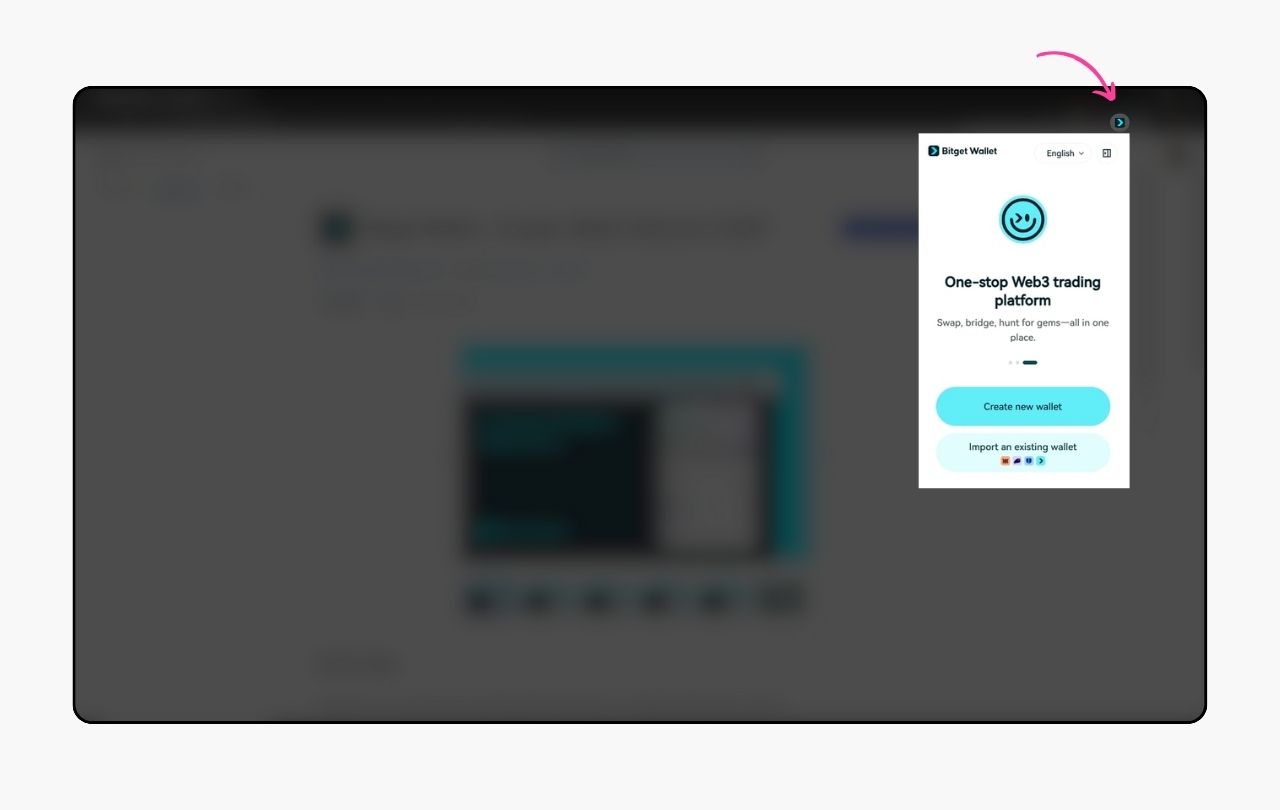

Integrated Cross-Chain Swaps: Swap tokens between different blockchains directly within the wallet using built-in bridges and protocols, such as Bitget Wallet’s HTLC-powered swaps and PUM Exchange’s native bridge routing.

-

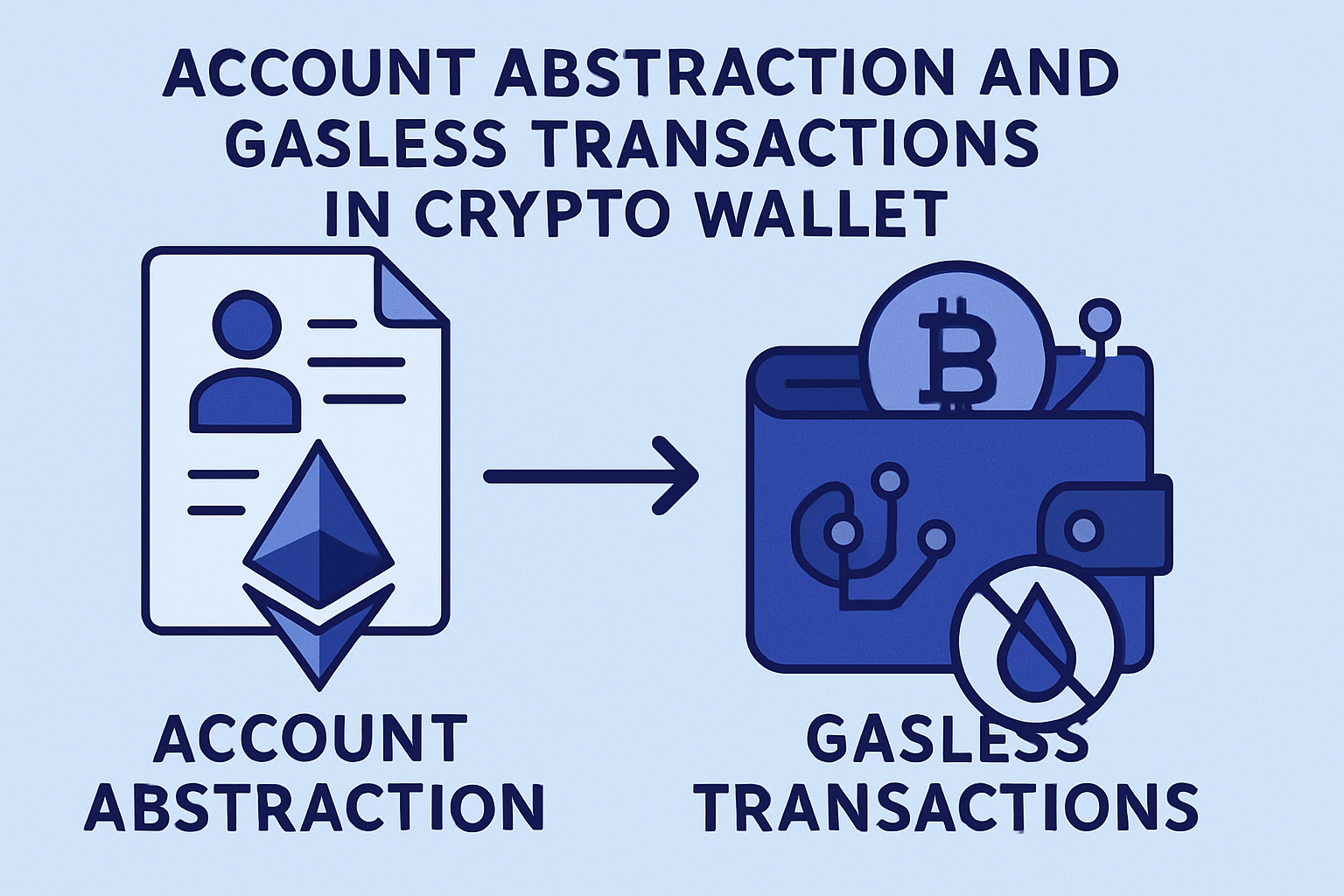

Account Abstraction & Gasless Transactions: Support for both EOAs and Account Abstraction wallets, enabling features like gasless transactions and simplified cross-chain operations, as offered by KryptoGO Universal Wallet.

-

Enhanced Security Models: Advanced protection through technologies like Multi-Party Computation (MPC), self-custody, and hybrid security frameworks, exemplified by PUM Exchange’s Unified Multi-Chain Wallet.

-

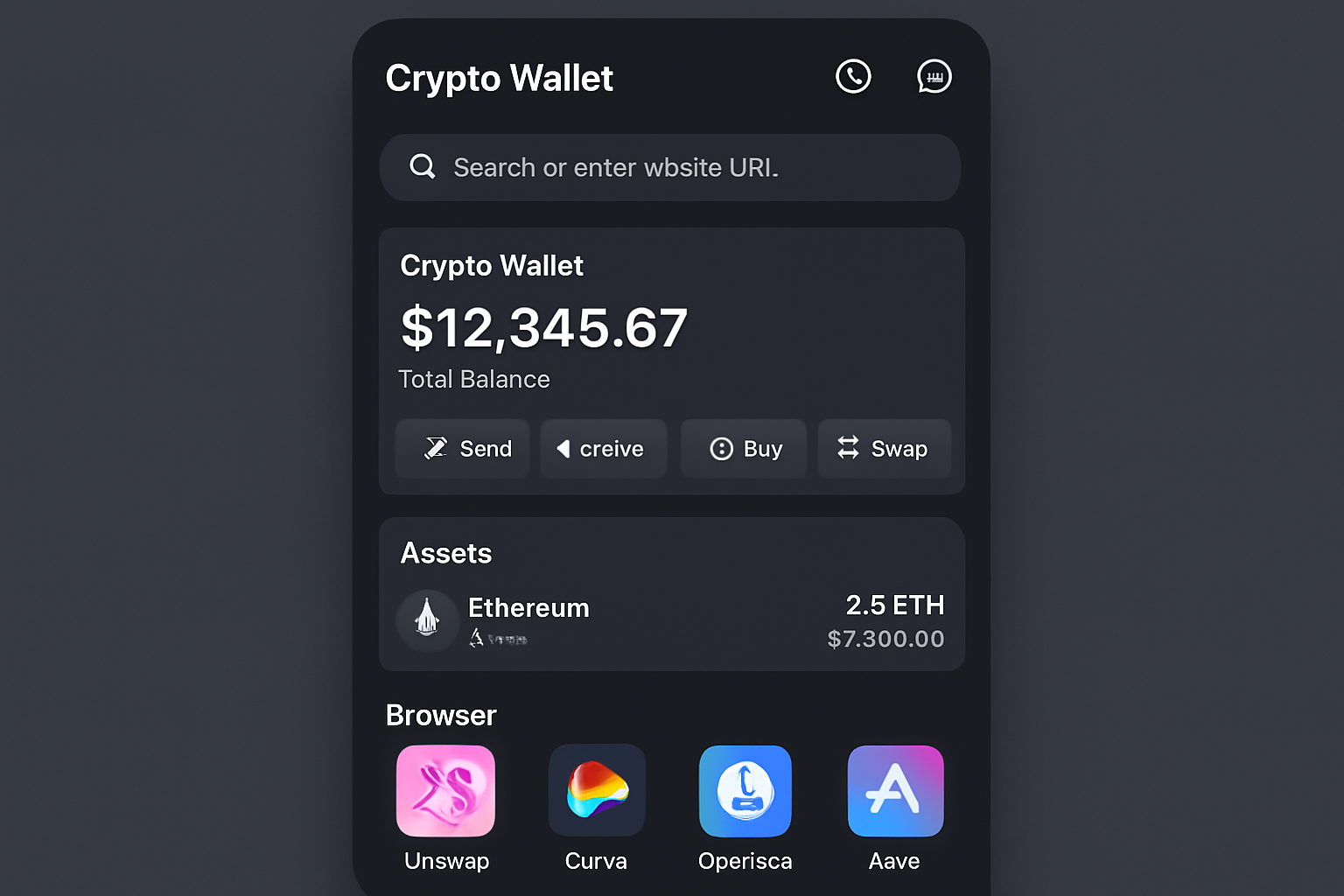

Direct dApp Access and Aggregation: Effortlessly interact with decentralized applications (dApps) across multiple chains from one wallet, with support for connecting popular wallets like MetaMask and Phantom (as in Coinbase’s Unified Wallet App).

-

Real-Time Asset Tracking and Notifications: Receive up-to-date portfolio analytics and alerts on transactions, price changes, and network events across all connected chains and wallets.

Unified wallets are more than just portfolio trackers. The latest generation incorporates features that previously required separate apps or even advanced technical knowledge:

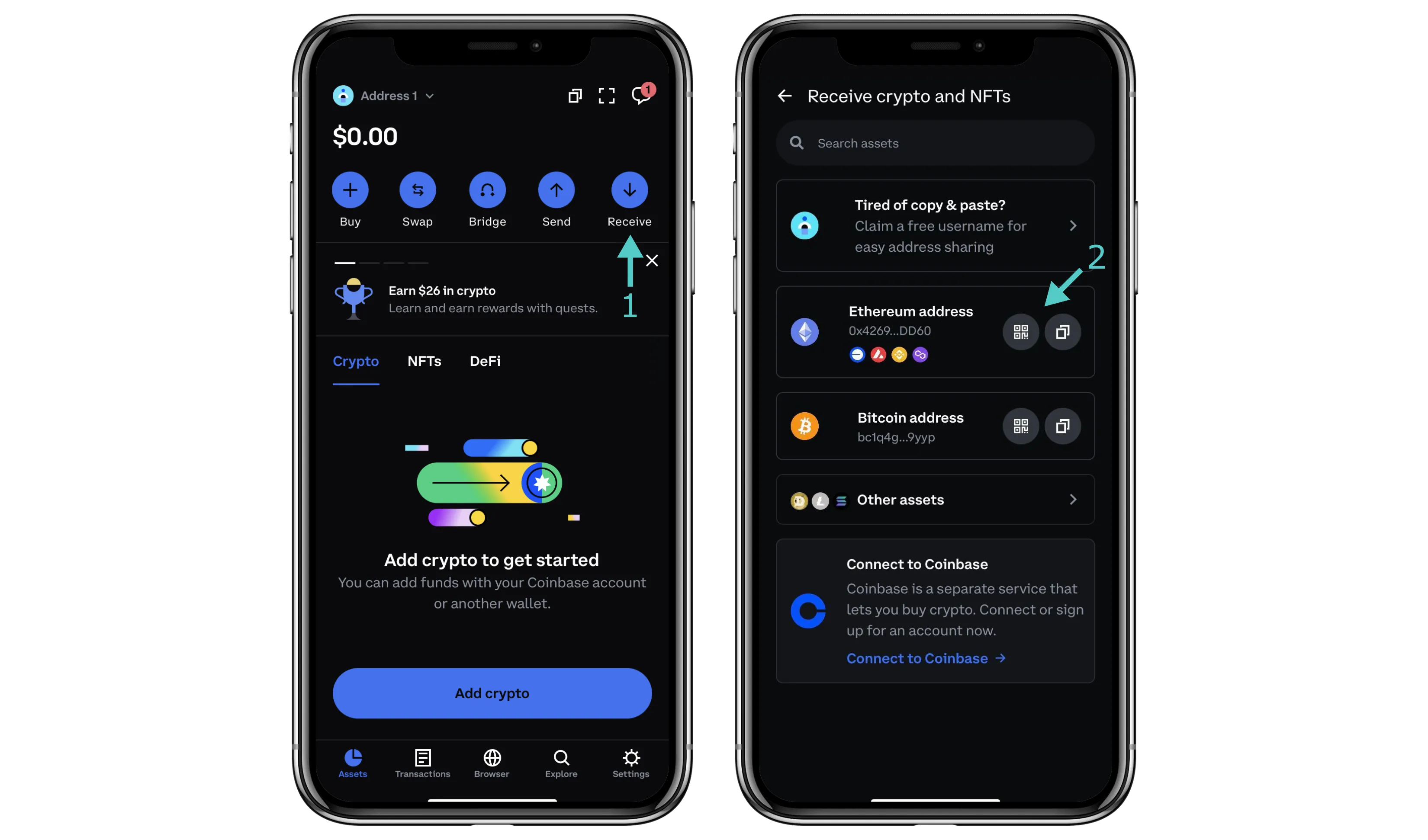

- Aggregated Asset Views: Coinbase’s Unified Wallet App lets users see all their tokens, over 2 million supported, across multiple self-custodial wallets like MetaMask and Phantom, in one place.

- Native Cross-Chain Swaps: Bitget Wallet integrates cross-chain swaps using Hash Time-Locked Contracts (HTLCs), allowing secure trades between networks without leaving the platform.

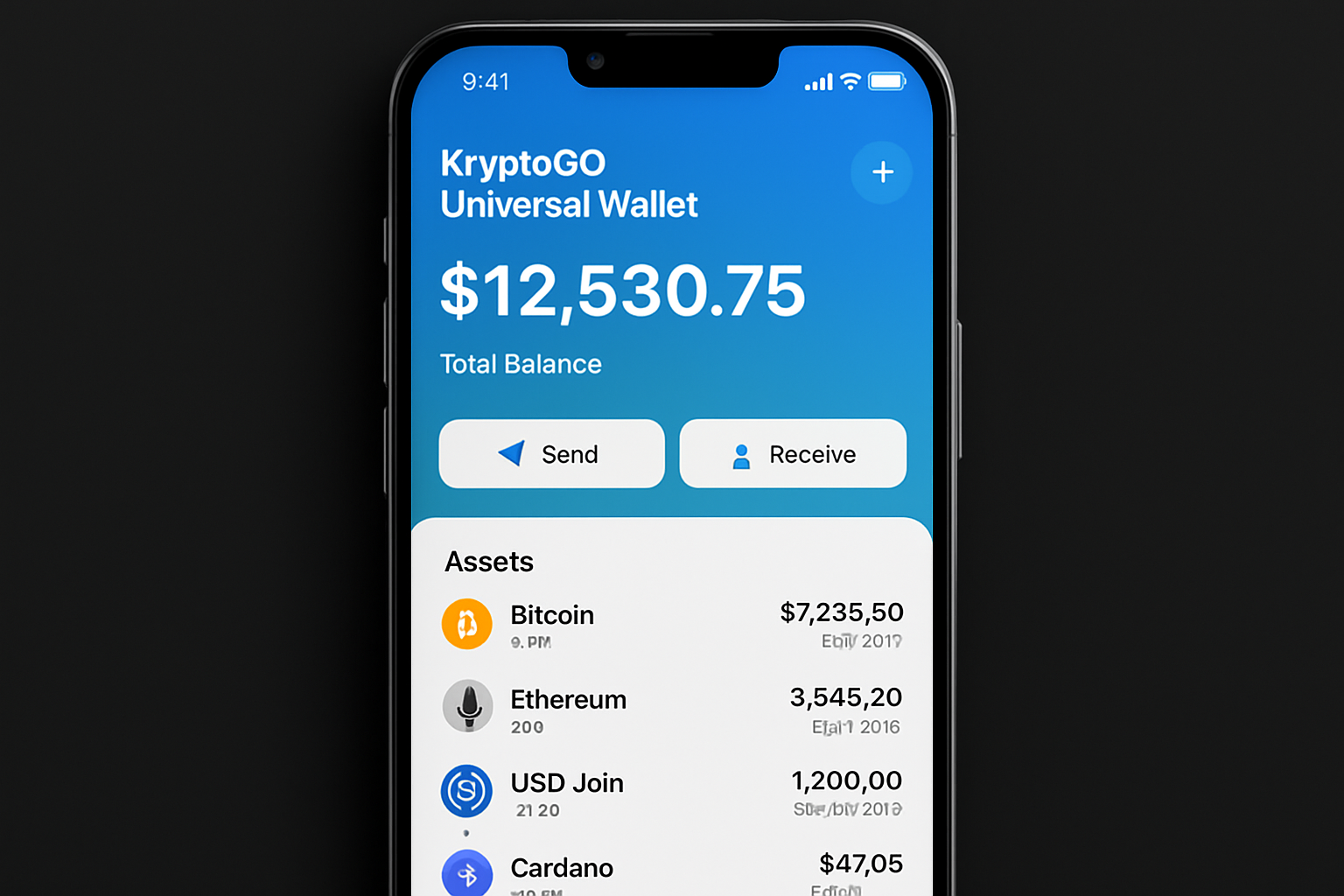

- Universal Account Models: KryptoGO’s Universal Wallet merges EOAs and Account Abstraction (AA) wallets, offering gasless transactions and universal swaps for a frictionless DeFi experience.

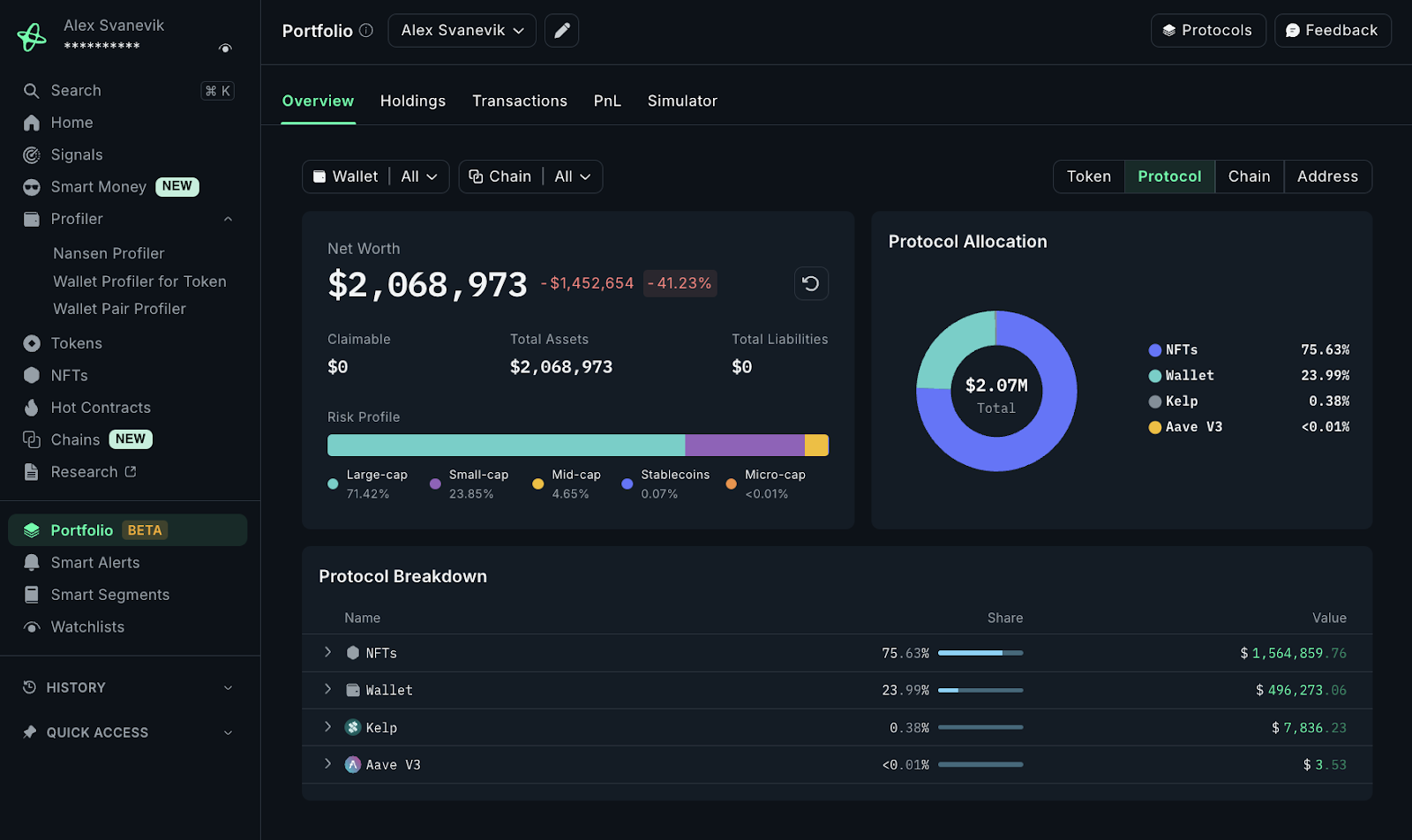

- Multi-Wallet Consolidation: 1inch’s portfolio feature consolidates up to 10 wallets across different chains, providing real-time tracking and compatibility with thousands of tokens on seven major blockchains.

These capabilities are not just about convenience; they directly impact user safety and efficiency. By reducing the need for manual bridging and eliminating the risk of sending assets to the wrong network, unified wallets are setting a new security standard in cross-chain asset management.

The Role of Chain Abstraction UX in DeFi’s Next Chapter

Chain abstraction UX is the driving philosophy behind these advancements. The goal is simple: make interacting with multiple blockchains as seamless as using a single network. This is being achieved through robust interoperability protocols, smart routing for swaps and bridges, and intuitive design that hides blockchain complexity from the end user.

For example, when a user wants to swap a Solana-based token for an Ethereum asset, a modern unified wallet can automatically select the optimal bridge, handle approvals, and execute the transaction with minimal input. The result is a DeFi experience that’s accessible to newcomers and powerful enough for professionals.

As these tools evolve, they’re not only making DeFi more approachable but also laying the groundwork for broader adoption of multi-chain strategies in both retail and institutional portfolios. The future of decentralized finance is being built on the foundation of seamless interoperability provides and unified wallets are at the center of this transformation.

Security remains a core concern as users entrust unified wallets with access to diverse assets across EVM and non-EVM chains. Innovations like hybrid security models, combining Multi-Party Computation (MPC) with self-custody, are becoming the norm. These approaches reduce single points of failure and empower users to retain control over their private keys, while still benefiting from the convenience of aggregated management. The adoption of Account Abstraction (AA) in wallets such as KryptoGO’s Universal Wallet also means that advanced features like programmable spending limits and social recovery can be implemented, making wallets both safer and more flexible for everyday use.

Interoperability is no longer just a buzzword. Real-world integrations, like the Uniswap and Solana interface, or Bitget’s all-in-one trading and staking experience, demonstrate that users can now move value, interact with dApps, and manage NFTs across chains without technical friction. These advancements are further supported by the development of robust crypto bridges, such as Eco Portal and Wormhole, which offer transparent fee structures and enhanced security protocols for cross-chain transfers.

For developers, unified crypto wallets and chain abstraction UX are unlocking new possibilities. Building dApps that can seamlessly interact with multiple blockchains is now less burdensome, opening the door for more complex, user-centric DeFi products. As a result, the DeFi landscape is evolving beyond siloed ecosystems into a fully interconnected web of financial services.

What’s Next for Unified Wallets and Cross-Chain Asset Management?

The trajectory for unified wallet solutions in 2025 points toward greater personalization, automation, and regulatory clarity. Expect to see AI-powered portfolio insights, automated rebalancing across chains, and more granular user controls. Furthermore, as regulatory frameworks mature, unified wallets will likely integrate compliance features that make them suitable for both retail and institutional adoption.

Another emerging trend is the convergence of DeFi and Web3 identity. Unified wallets are starting to incorporate decentralized identity (DID) standards, allowing users to interact with dApps, manage on-chain credentials, and participate in governance without juggling multiple logins or wallets. This convergence will further streamline the user experience and reduce onboarding friction for new entrants.

Top Unified Crypto Wallets & Protocols to Watch in 2025

-

PUM Exchange’s Unified Multi-Chain Wallet: Launched in July 2025, this wallet supports over 30 blockchains—including Ethereum, BNB Chain, Solana, and Bitcoin. It features integrated swaps, native bridge routing, and a hybrid security model combining Multi-Party Computation (MPC) with self-custody.

-

Coinbase Unified Wallet App: Introduced in July 2024, this app lets users connect self-custodial wallets like MetaMask and Phantom. It provides an aggregated asset view across multiple applications, supports over 2 million tokens, and enables direct trades from connected wallets.

-

KryptoGO Universal Wallet: This wallet merges Externally Owned Accounts (EOAs) and Account Abstraction (AA) wallets. It offers a unified asset overview, gasless transactions, and cross-chain universal swaps, streamlining complex cross-chain operations.

-

1inch Portfolio Feature: 1inch’s portfolio tool consolidates up to 10 wallets across various blockchains into a single interface. It provides real-time tracking and is compatible with thousands of tokens across seven blockchain networks.

-

Bitget Wallet: Bitget’s wallet offers built-in cross-chain swaps using Hash Time-Locked Contracts (HTLCs). Users can trade tokens, stake assets, collect NFTs, and monitor portfolios—all within one unified platform.

For users looking to optimize their cross-chain asset management, now is the time to explore unified wallet solutions. Whether you’re managing a diverse portfolio or simply want to interact with DeFi protocols more efficiently, these wallets are designed to meet the needs of an increasingly multi-chain world. Their impact is already being felt across the crypto ecosystem, driving higher engagement and setting new benchmarks for usability and security.

“The unified wallet experience is a game-changer. No more switching tabs or worrying about bridges, just seamless access to all your assets and dApps, regardless of the underlying chain. ”

As we move into 2025, unified crypto wallets will continue to lower barriers and expand what’s possible in decentralized finance. For a deeper dive into how these innovations are reshaping DeFi, explore our guide on how unified wallets simplify cross-chain asset management for DeFi users.