For DeFi traders, navigating the expanding universe of blockchains has often meant juggling multiple wallets, tracking native tokens for gas fees, and enduring the friction of manual network switching. As decentralized finance matures, these pain points have become roadblocks to mass adoption. Enter chain abstraction UX: a transformative approach that hides inter-chain complexity behind a seamless interface, unlocking true cross-chain DeFi user experience.

Chain Abstraction: The End of Fragmented DeFi Experiences

At its core, chain abstraction is about unifying the way users interact with different blockchains. Instead of forcing traders to manage separate accounts and assets on Ethereum, Solana, Avalanche, or Layer 2s individually, chain abstraction leverages smart routing and unified account infrastructure. This means users can access all their assets through one interface, no more scrambling for native tokens or switching RPC endpoints mid-trade.

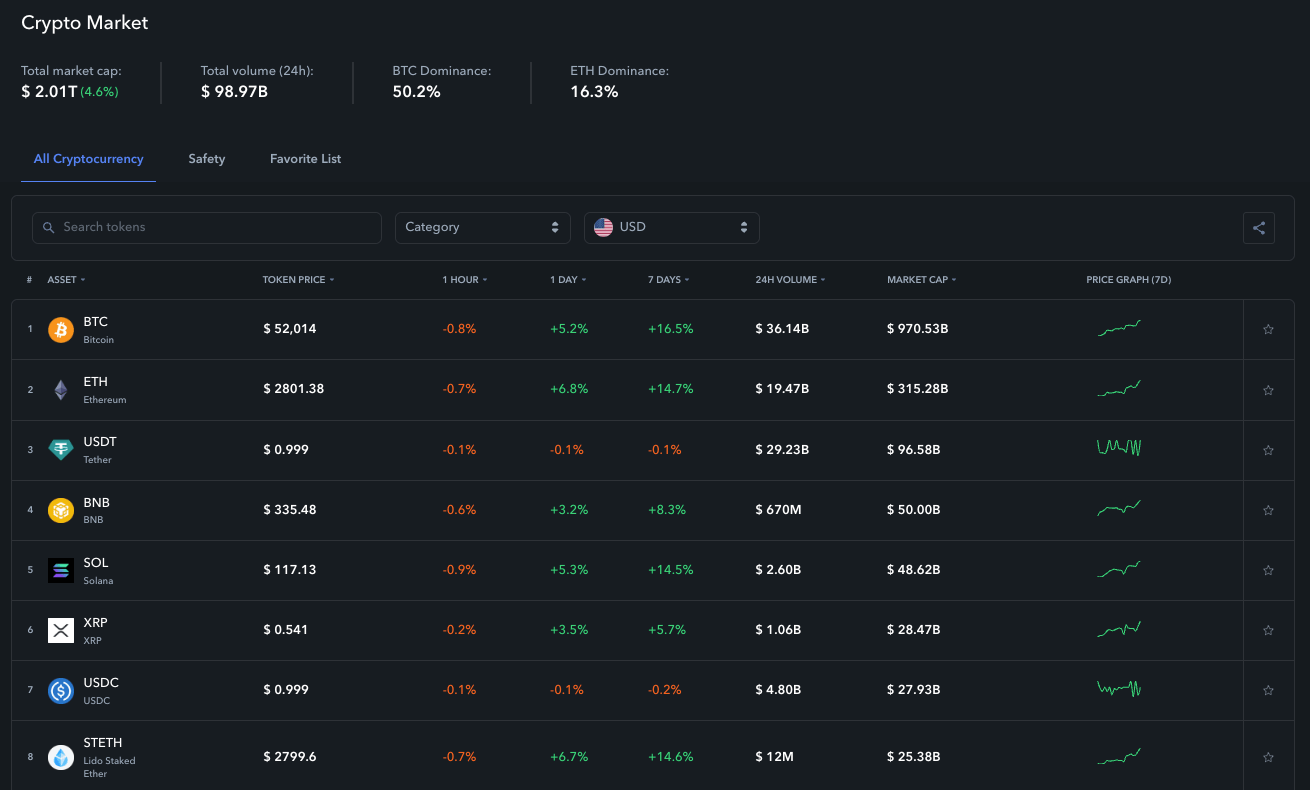

The current market reflects this evolution. As of October 2025, Ethereum (ETH) trades at $4,078.85, underscoring the growing value locked in multichain ecosystems and the urgency for interoperable solutions. According to zkCross Network, AI-driven chain abstraction now routes transactions via the most efficient and cost-effective paths behind the scenes, so traders can focus on strategy rather than technical logistics.

Gas Abstraction: One-Click Cross-Chain Transactions Without Native Tokens

One of the most persistent pain points in DeFi is gas management across chains. Traditionally, every network requires its own token to pay transaction fees, forcing users to maintain small balances of ETH, AVAX, MATIC and more just to move assets or execute trades.

Gas abstraction flips this paradigm. Platforms like Velora have begun fronting gas fees for users and incorporating those costs into trade quotes directly. This means you can initiate trades across networks using your chosen asset without ever touching native network tokens, a game changer for accessibility and speed.

- CAB (Chain Abstracted Balance): Instantly view and manage your entire portfolio across chains in one place.

- CAA (Chain Abstracted Account): Log in once to access all supported networks with unified authentication.

- No more bridging delays: Chain abstraction eliminates manual token bridging during user operations (Demex example): resulting in faster settlement times and lower risks.

The Rise of Unified Cross-Chain Wallet Solutions

The days of juggling MetaMask networks or writing down seed phrases for each ecosystem are numbered. Modern cross-chain wallet solutions leverage chain abstraction to present a single dashboard for all your DeFi activity, assets on Ethereum ($4,078.85), Cosmos zones, Layer 2s and beyond are consolidated visually and functionally.

This shift not only streamlines trading but also expands access to liquidity pools across chains without extra steps or technical know-how. For developers building dApps or protocols, chain abstraction means less time spent on complex integrations and more focus on delivering value-added features that attract users from any ecosystem.

Chain abstraction also paves the way for one-click cross-chain transactions, a feature that is rapidly becoming the gold standard in DeFi UX. As more protocols adopt this model, traders gain the ability to move capital between networks, access new opportunities, and arbitrage across fragmented liquidity, all without ever leaving their primary wallet or interface. The removal of traditional token bridges and network switching not only reduces friction but also enhances security by limiting exposure to bridge vulnerabilities.

Security is further bolstered by the concept of a chain abstracted account (CAA). Rather than maintaining separate private keys or authentication mechanisms for every chain, users can leverage a single digital identity across all supported networks. This not only simplifies onboarding but also mitigates risks associated with managing multiple credentials and wallets. As highlighted by Nadcab Labs, this unified identity approach is quickly becoming essential for Web3 innovation and user trust.

How Chain Abstraction Empowers DeFi Traders

The impact of chain abstraction is most evident in the daily workflows of active DeFi participants. Consider these tangible benefits:

Key Advantages of Chain Abstraction for DeFi Traders

-

Faster and More Secure Cross-Chain Settlements: Chain abstraction eliminates the need for traditional token bridges, enabling instant and secure cross-chain transactions. Platforms like zkCross Network use AI-driven routing to optimize transaction speed and reduce settlement risk.

-

Unified Asset Management Across Multiple Blockchains: With chain abstraction, traders can manage assets from various blockchains in a single wallet without switching networks or juggling multiple wallets. Demex exemplifies this by supporting seamless trading and asset management across networks.

-

Integrated Gas Fee Abstraction: Platforms such as Velora front gas fees for users, incorporating costs into trade quotes. This removes the need to hold multiple native tokens for transaction fees, making cross-chain trading more accessible.

-

Comprehensive Unified Analytics and Risk Controls: Chain abstraction enables consolidated analytics and risk management tools that span multiple blockchains. This unified view allows traders to monitor portfolio performance and manage risk more effectively across all connected networks.

-

AI-Driven Automation and Personalization: The integration of AI with chain abstraction, as seen on zkCross Network, automates complex trading strategies and provides personalized insights—from discovering high-yield pools to executing trades based on user-defined parameters.

Unified analytics dashboards are emerging as a direct result of these innovations. Traders can now analyze their portfolio performance across Ethereum ($4,078.85), Layer 2s, Cosmos zones, and other ecosystems without exporting data from multiple sources or reconciling balances manually. This holistic view is invaluable for both casual investors and professionals seeking to optimize strategies in real time.

For those concerned with risk management, a critical consideration as capital flows into multichain strategies, chain abstraction enables more robust controls. Automated AI agents can monitor positions across networks, execute stop-losses or rebalance portfolios based on predefined rules, all while abstracting away underlying technical complexity. The evolution toward what zkCross calls “DeFAI” signals a new era where machine intelligence and seamless interoperability work hand-in-hand to empower users (learn more).

What’s Next: Chain Abstraction as the Foundation for Open Finance

The trajectory is clear: as market leaders like Demex and Velora double down on chain abstraction UX, expect even greater convergence between blockchains, fueled by AI-driven automation and universal wallet experiences. The next wave of decentralized applications will likely be built with interoperability at their core rather than as an afterthought.

This shift will continue to erode barriers between ecosystems while making DeFi accessible to mainstream audiences who demand convenience without sacrificing security or control. For developers and traders alike, embracing chain abstraction means staying ahead in an industry defined by rapid change, and unlocking the true potential of open finance.