Unified wallet solutions are rapidly redefining the decentralized finance (DeFi) user experience by abstracting away the complexity of cross-chain transactions. Traditionally, managing assets across multiple blockchains like Ethereum, Solana, and Bitcoin required users to juggle numerous wallets, interfaces, and bridging protocols. This fragmentation was a major friction point for both retail and institutional participants in DeFi. In 2025, unified wallets have emerged as a critical innovation, enabling seamless multi-chain asset management and fundamentally transforming how users interact with blockchain ecosystems.

Eliminating Fragmentation: The Power of Chain Abstraction

At the core of unified wallet solutions is chain abstraction: an architectural approach that allows users to interact with multiple blockchains through a single interface. Rather than manually switching networks or managing private keys for each chain, users gain a consolidated dashboard that aggregates balances and transaction histories from all supported networks.

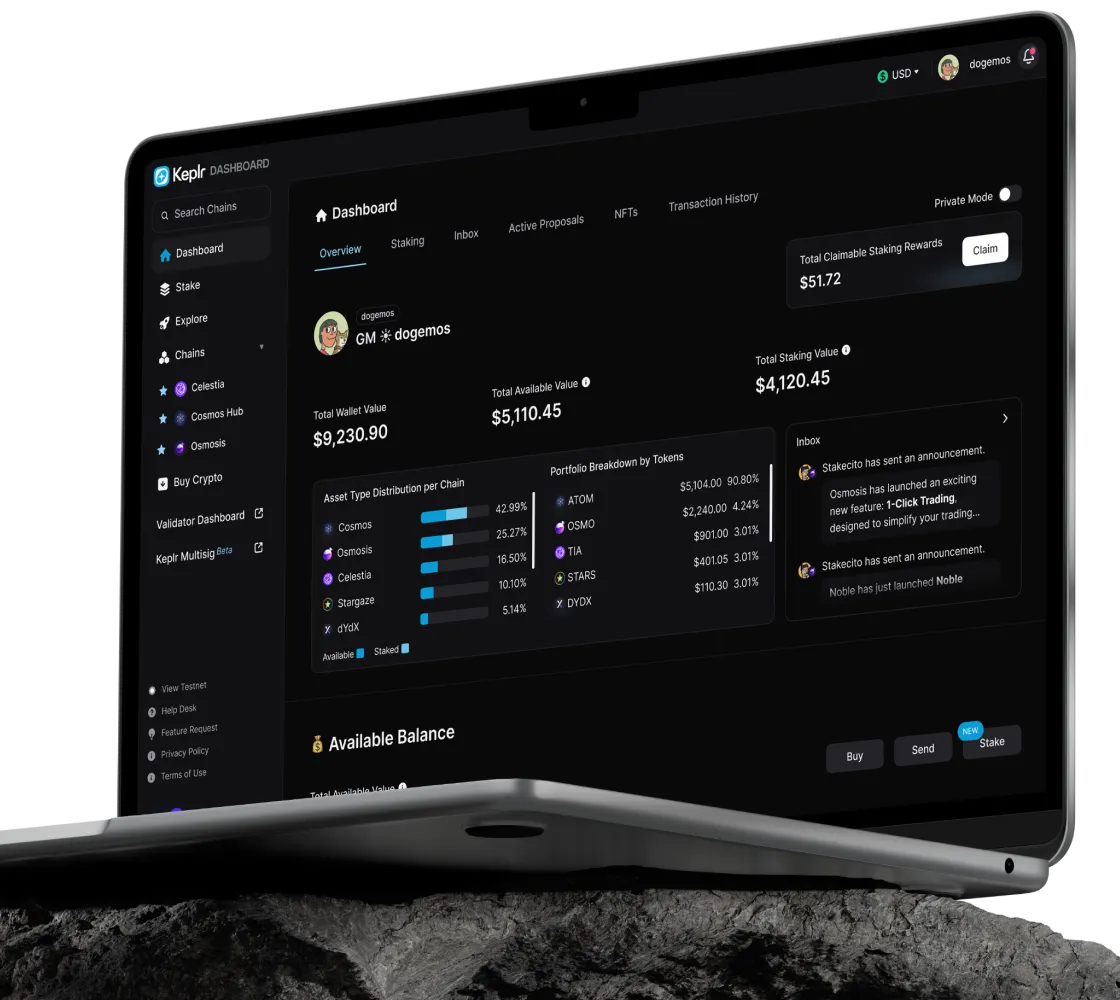

This paradigm shift is exemplified by platforms like PUM Exchange’s Unified Multi-Chain Wallet, which supports over 30 blockchains. Users can view their entire portfolio in one place, eliminating the overhead of maintaining separate wallets for each ecosystem. The result is improved transparency, reduced operational risk, and a far more intuitive DeFi workflow.

Integrated Swaps and Bridging: Frictionless Cross-Chain Transactions

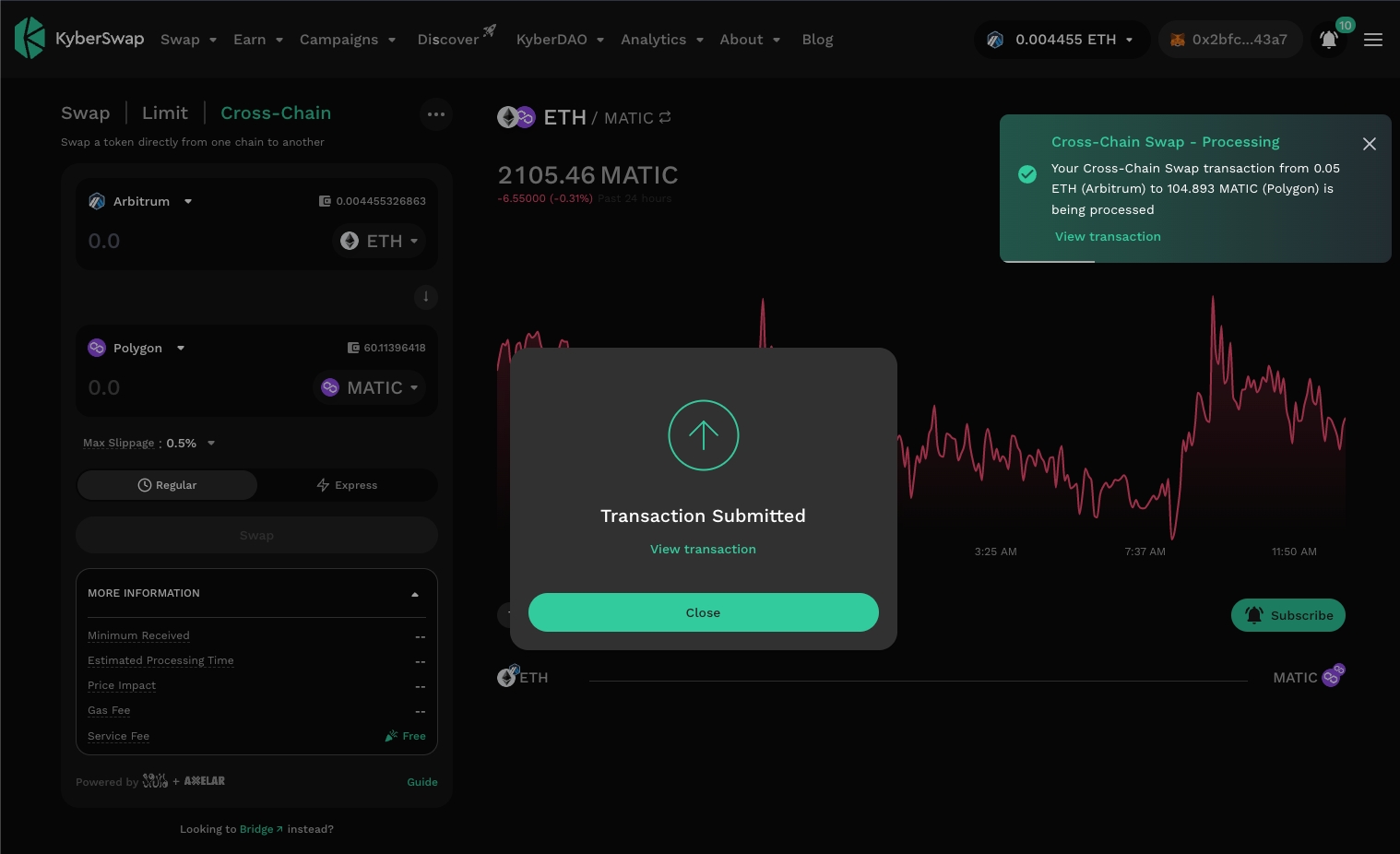

Unified wallets go beyond simple asset visualization by embedding advanced cross-chain swap and bridging functionalities directly into their interfaces. Instead of relying on third-party bridges or swapping protocols – each with their own security models and user experiences – these wallets integrate native routing algorithms that automatically identify the most efficient path for moving assets between chains.

For example, zkCross Network’s Super Accounts allow users to execute one-click cross-chain transactions without manual bridging or network switching. Similarly, PUM Exchange’s solution routes swaps natively across its supported blockchains using advanced algorithms designed for cost optimization and minimal latency (source). These advancements are driving unprecedented levels of capital efficiency in DeFi by unlocking liquidity previously siloed on individual chains.

Gas Fee Optimization and User-Centric Design

One persistent challenge in DeFi has been unpredictable gas fees – especially on high-demand networks like Ethereum and Solana. Unified wallets address this pain point by implementing automated gas fee management systems. These systems monitor real-time network conditions and recommend optimal fee levels for each transaction type. Users benefit from fewer failed transactions due to underpriced gas and avoid overpaying during periods of congestion.

The importance of a unified user interface cannot be overstated. By consolidating disparate blockchain interactions into a single workflow, these wallets dramatically reduce cognitive load for both new entrants and power users alike (docs.trails.build). This UX-centric approach accelerates mainstream adoption by making DeFi accessible without sacrificing the powerful features demanded by experienced traders.

Key Benefits of Unified Wallets for DeFi Users

-

Seamless Cross-Chain Asset Management: Unified wallets like PUM Exchange’s Unified Multi-Chain Wallet and zkCross Network’s Super Accounts allow users to view and control assets across 30+ blockchains from a single dashboard, eliminating the need for multiple wallets and simplifying portfolio oversight.

-

Integrated Cross-Chain Swaps and Bridging: These wallets enable direct, on-chain asset swaps and bridging between networks, leveraging advanced routing algorithms for optimal efficiency and cost savings—removing reliance on third-party bridges.

-

Automated Gas Fee Optimization: By dynamically recommending optimal gas fees based on real-time network conditions, unified wallets reduce transaction failures and unnecessary costs, especially on volatile networks like Ethereum and Solana.

-

Unified User Interface Across Blockchains: Users benefit from a consistent interface for all supported chains, streamlining the DeFi experience and reducing the learning curve associated with managing multiple blockchain-specific wallets.

-

Enhanced Security with Institutional-Grade Custody: Platforms such as Fordefi provide comprehensive MPC (Multi-Party Computation) wallets, ensuring secure self-custody and robust protection for private keys across multiple chains.

-

Comprehensive Portfolio Tracking: Solutions like 1inch Portfolio aggregate multiple wallets and chains, giving users a consolidated, real-time view of their holdings and transaction history.

This convergence of multi-chain asset management, integrated swaps, gas fee optimization, and intuitive design marks a significant leap forward for decentralized finance infrastructure.

Security remains a top priority as unified wallet solutions gain traction. Advanced platforms leverage institutional-grade technologies such as multi-party computation (MPC) and hardware-level isolation to safeguard private keys, even when interacting with dozens of blockchains. This is crucial, given the growing sophistication of cross-chain exploits and the need for robust validation of transaction requests from disparate sources. As highlighted by recent developments in wallet infrastructure (PUM Exchange, docs.trails.build), leading providers are integrating granular permission controls, biometric authentication, and real-time anomaly detection to mitigate emerging attack vectors.

Real-World Impact: Unified Wallets in Action

The shift toward unified wallet solutions is not merely theoretical, it’s being actively adopted across the DeFi ecosystem. Institutional users now leverage platforms like Fordefi‘s MPC wallet for secure self-custody and seamless dApp connectivity, while retail participants benefit from consumer-friendly dashboards that abstract away technical complexities. The net result is a democratization of multi-chain finance: anyone can access liquidity pools, lending protocols, or NFT marketplaces on networks like Ethereum, Solana, or ZetaChain without specialized knowledge or cumbersome setup procedures.

Consider ZetaChain’s UNISON upgrade, which consolidates asset management across 50 and blockchains into a single wallet interface, enabling both cross-chain swaps and unified portfolio analytics at scale. Similarly, 1inch Portfolio’s aggregation features empower users to monitor up to 10 wallets across multiple chains in real time (blog.1inch.com). These innovations underscore the competitive advantage of chain abstraction: enhanced capital efficiency, reduced friction for onboarding new users, and a foundation for scalable DeFi applications.

The Road Ahead: Towards Seamless Chain Abstraction

Looking ahead to late 2025 and beyond, unified wallets will likely serve as the primary gateway to decentralized finance. As protocols like CrossCurve MetaLayer and CCTP (Cross-Chain Transfer Protocol) continue to advance native interoperability and liquidity unification (source), expect further reductions in transaction latency and cost, alongside improvements in composability between DeFi primitives.

For developers and power users alike, this means building on top of a more resilient infrastructure layer where cross-chain messaging and asset transfers are handled natively by the wallet itself. For everyday users, it means a future where managing digital assets feels as seamless as using traditional fintech apps, no matter how many chains are involved under the hood.

The rise of unified wallet solutions signals a pivotal moment for DeFi’s maturation cycle. By removing barriers between blockchains through intuitive design, advanced security models, and integrated cross-chain functionality, these platforms position decentralized finance for mainstream adoption while preserving its ethos of self-custody and permissionless innovation.