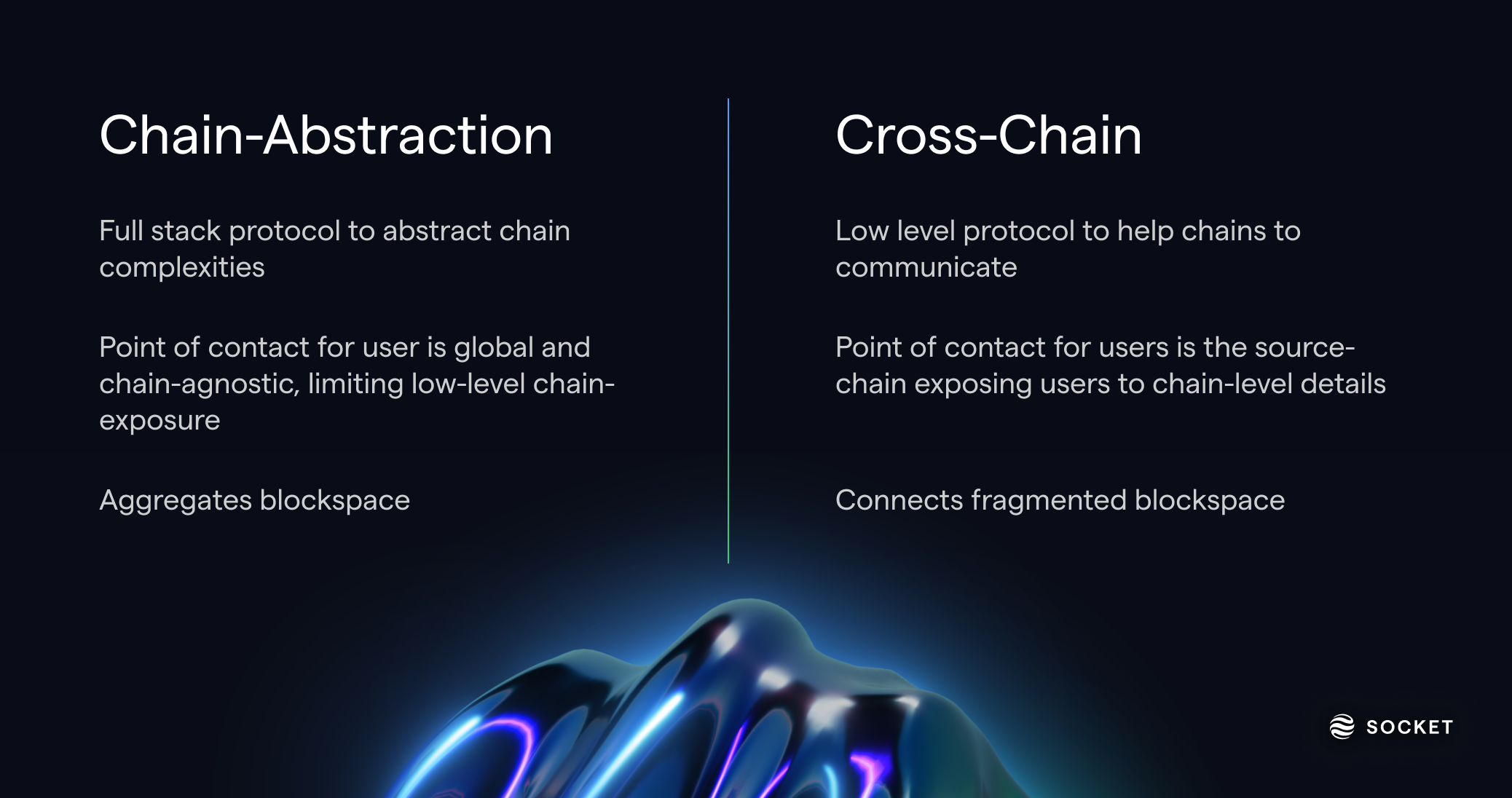

For years, the promise of decentralized finance (DeFi) has been hindered by the siloed nature of blockchain networks. Each chain operates its own ecosystem, liquidity pools, and wallet standards, forcing users and developers to juggle multiple wallets, bridge assets manually, and navigate a fractured user experience. The rise of chain abstraction protocols marks a pivotal inflection point for DeFi: by making cross-chain interactions seamless and invisible to end users, these protocols are eliminating the friction that once defined multi-chain operations.

Socket Protocol: Architecting Seamless Multi-Chain DeFi

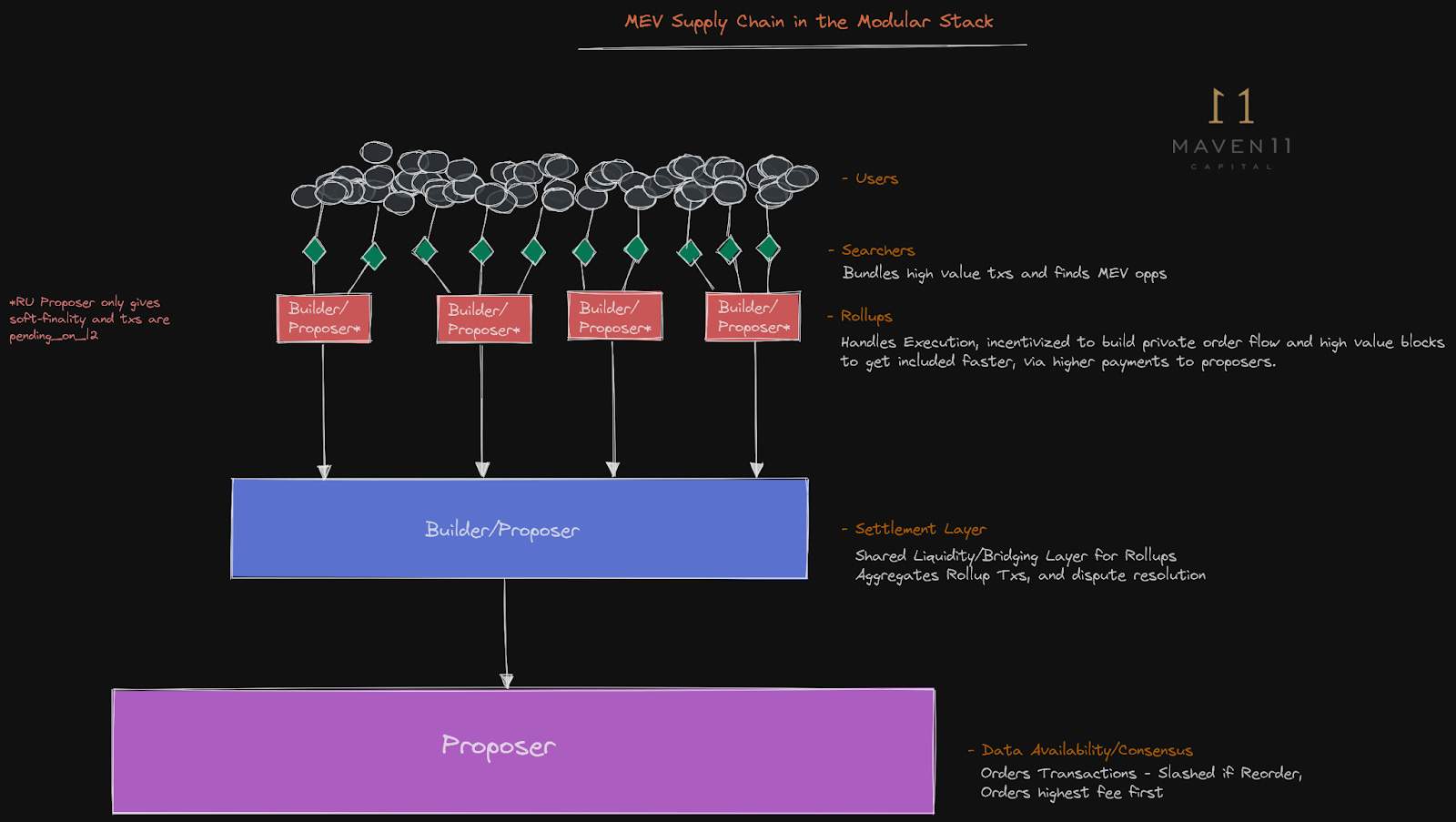

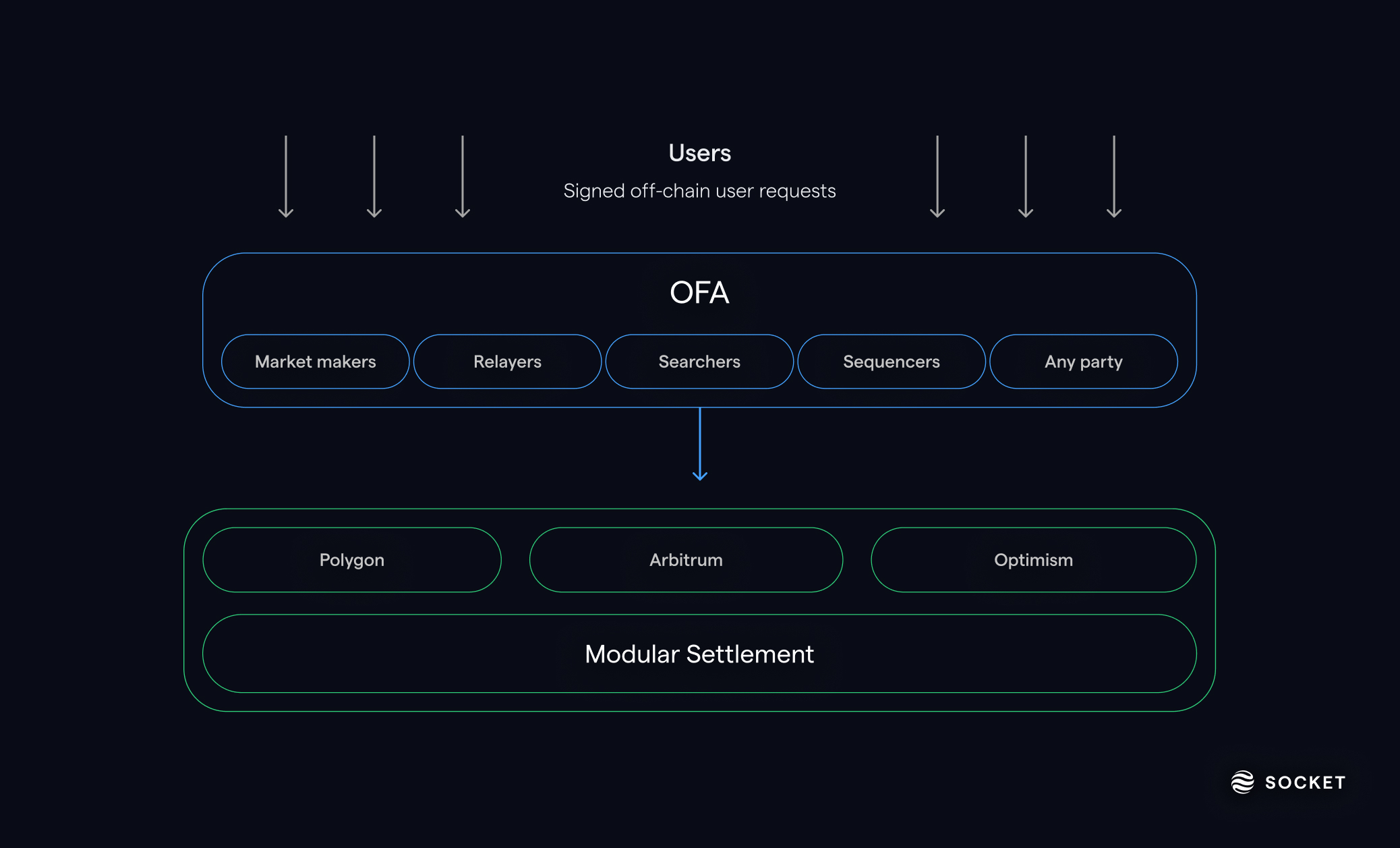

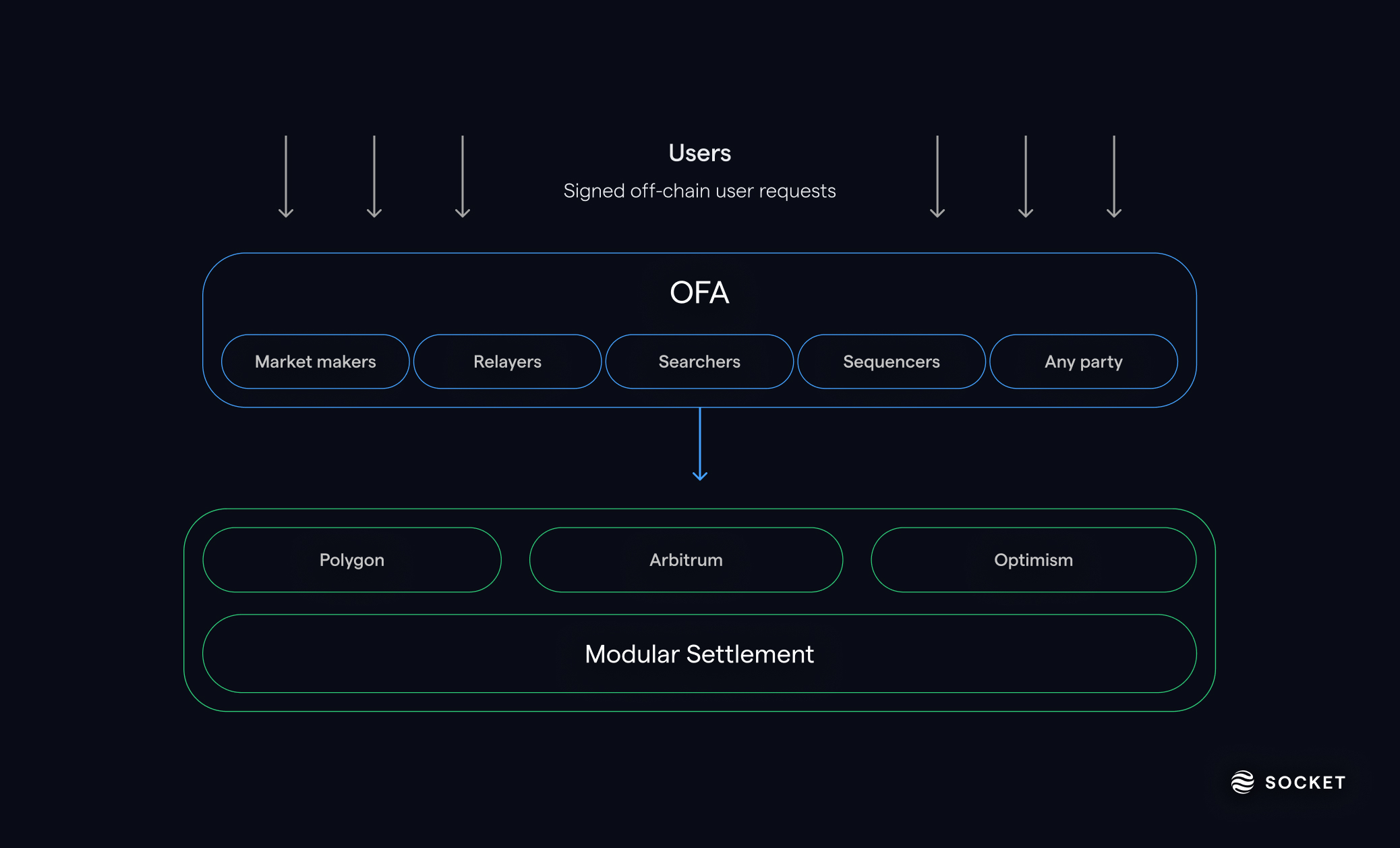

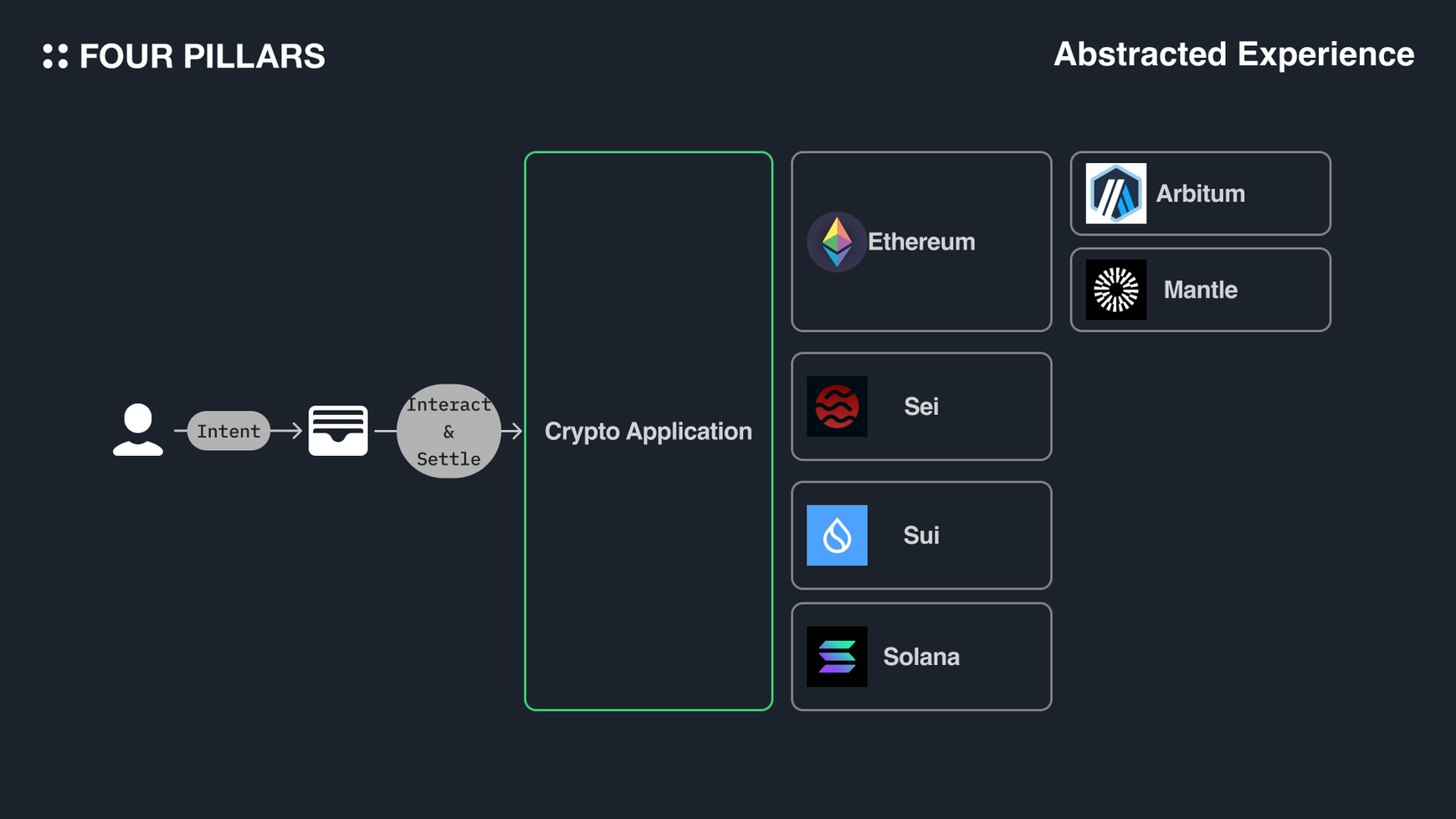

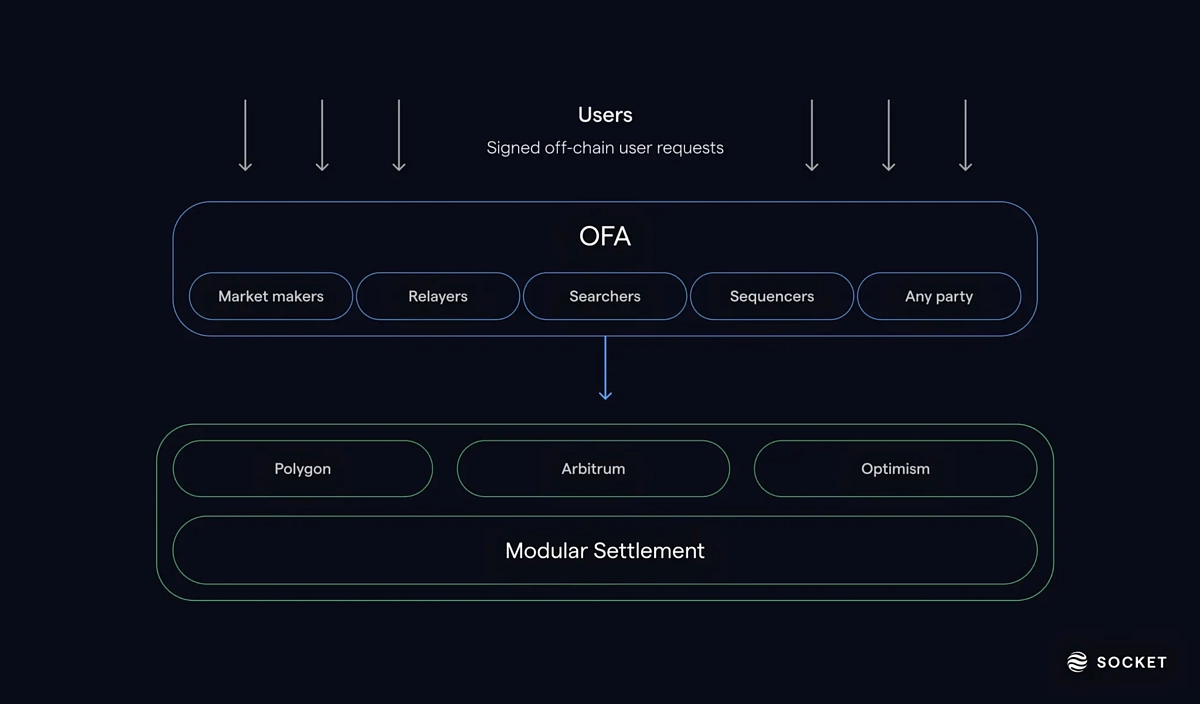

SOCKET Protocol is at the forefront of this transformation. Billed as “the first chain-abstraction protocol, ” SOCKET enables developers to build applications that interact with multiple blockchains through a unified interface. The protocol’s core innovation is its Modular Order Flow Auction (MOFA), which creates an open marketplace where specialized agents compete to execute user intents across any supported network. This modularity not only optimizes transaction execution but also abstracts away the complexity of cross-chain messaging and liquidity routing.

This architecture allows dApps built on SOCKET to treat all connected chains as a single liquidity layer. Whether a user holds assets on Ethereum, Polygon, or another supported chain, they can transact anywhere without worrying about gas tokens or manual bridging. By leveraging MOFA, users benefit from optimal pricing and execution across chains – all while interacting with a familiar interface.

Key Features Powering Chain Abstraction

Key Features of SOCKET Protocol for Seamless Multi-Chain DeFi

-

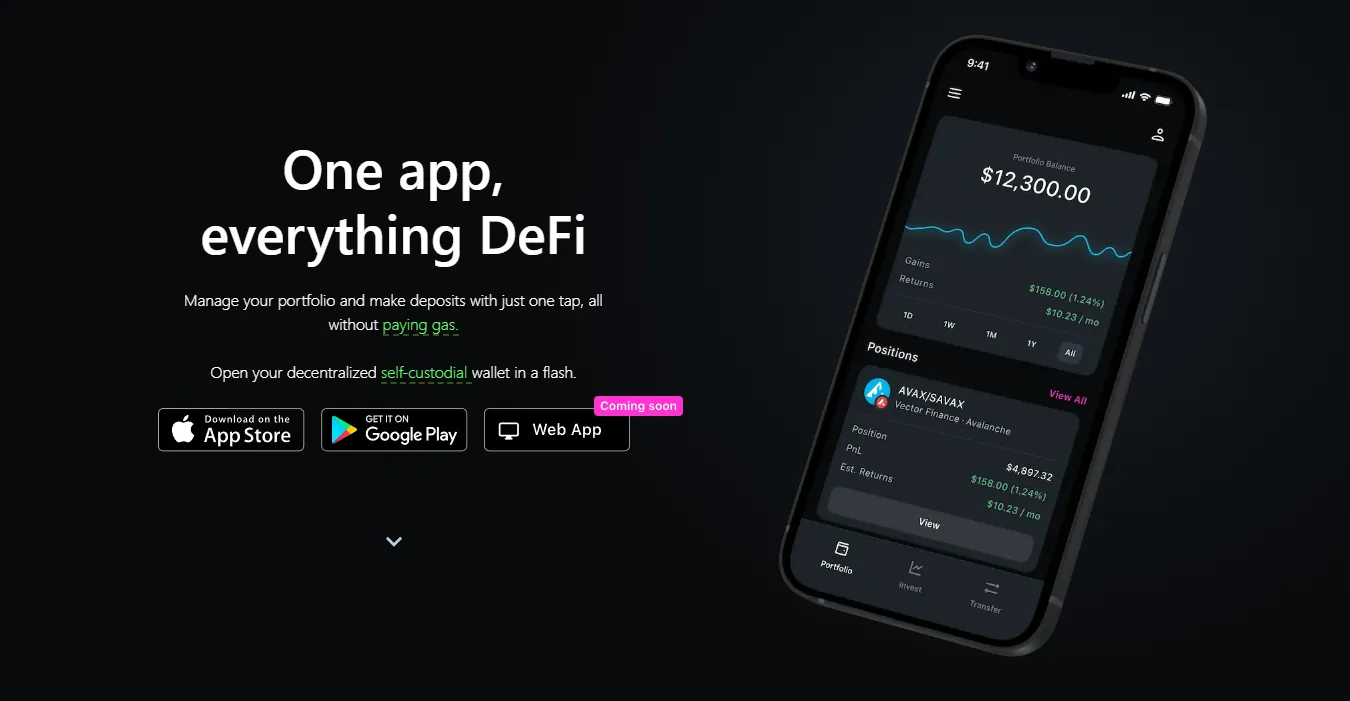

Chain Abstraction: SOCKET enables the creation of chain-agnostic applications, allowing users to interact with dApps across multiple blockchains without managing different wallets or understanding underlying infrastructure.

-

Modular Order Flow Auction (MOFA): Utilizes a competitive marketplace where execution agents (transmitters) vie to fulfill user requests, ensuring optimal transaction execution across supported networks.

-

Seamless Cross-Chain Interaction: Users can access applications on any supported blockchain without manual bridging or handling multiple gas tokens, streamlining the DeFi experience.

-

Chain-Abstracted Accounts: Maintains unified user balances across different chains, enabling transactions on any network without manual asset transfers or bridges.

-

Chain-Abstracted Swaps: Facilitates asset swaps across various blockchains without manual bridging, simplifying trading and enhancing liquidity access.

-

Chain-Abstracted Governance: Allows token holders to participate in protocol governance from any supported chain, promoting decentralized and inclusive decision-making.

The technical leap provided by SOCKET lies in its ability to offer:

- Chain-Abstraction: Developers can build truly chain-agnostic apps that operate across ecosystems without custom integrations for each chain.

- User Intent Infrastructure: Users simply express what they want to do (swap, transfer, participate in governance), and SOCKET handles the rest – selecting optimal routes and execution paths behind the scenes.

- Unified Account Experience: Users maintain a single balance view and transact across chains without manual asset transfers or worrying about gas token management.

- Composable Liquidity: By aggregating liquidity from multiple chains into one interface, users gain access to deeper markets and better pricing.

This intent-based approach is already reshaping how both retail users and institutions interact with DeFi protocols. For example, instead of bridging USDC from Ethereum to Arbitrum manually (incurring fees and delays), SOCKET enables an intent-driven swap that abstracts away all underlying steps – delivering assets directly where they’re needed.

“Chain abstraction is transforming how we interact with crypto by making complex multi-chain operations invisible to users. ”

The Real-World Impact: Unified Accounts and Cross-Chain Swaps

The practical advantages of chain abstraction go well beyond developer convenience. For end-users, the most tangible benefit is in unified account management and effortless cross-chain swaps:

- Chain-Abstracted Accounts: Users see their balances aggregated across all supported networks. They can initiate transactions on any chain without needing to bridge funds or manage separate wallets (source).

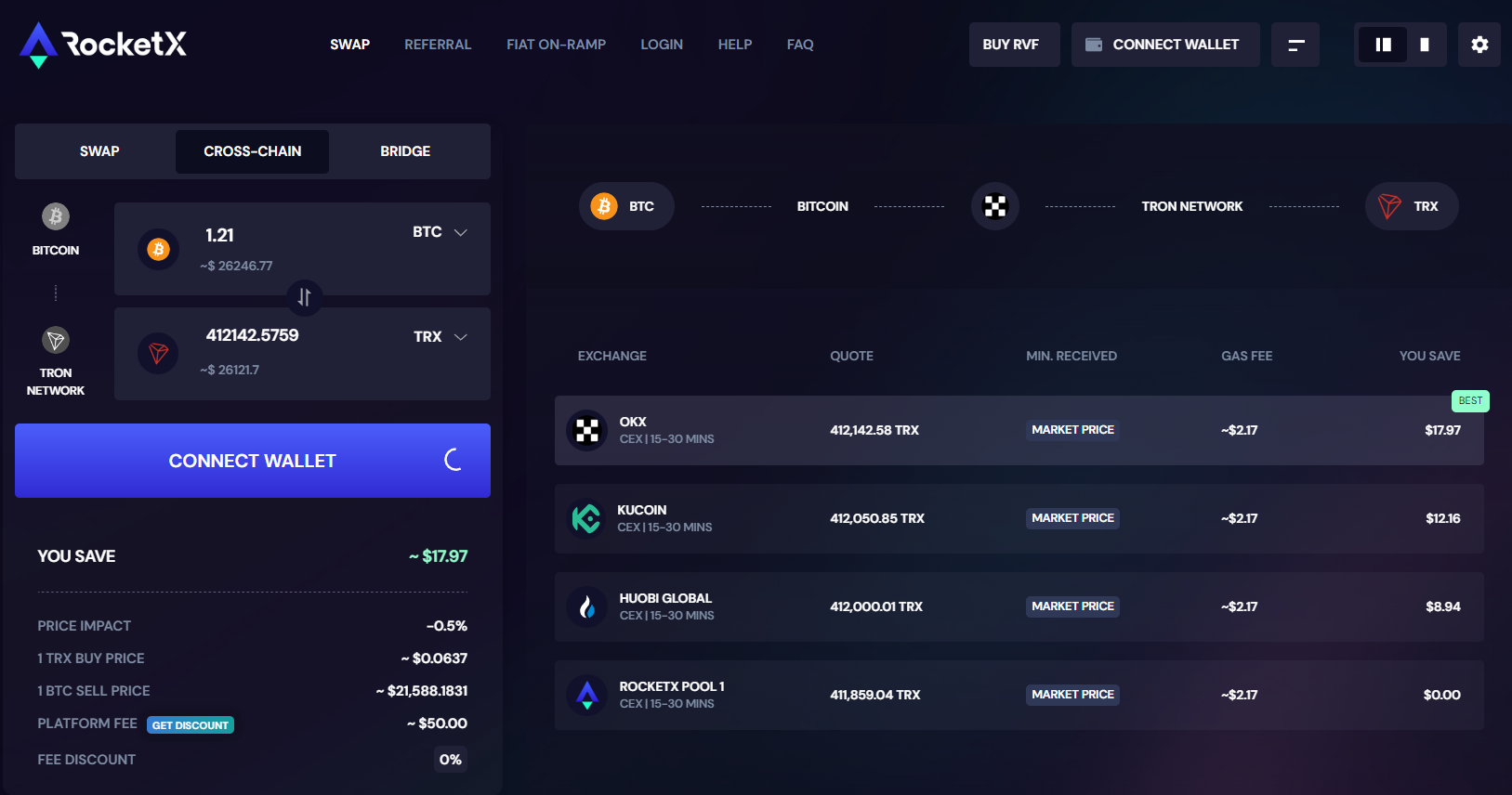

- Cross-Chain Swaps: Asset swaps between chains are executed natively within one interface – no more manual bridging or switching networks (source).

- Decentralized Governance: Token holders can vote on protocol upgrades regardless of where their tokens reside – fostering more inclusive participation (source).

This transformative UX unlocks new possibilities for both everyday DeFi participants and sophisticated traders seeking fast access to cross-chain liquidity.

Looking at the broader ecosystem, the proliferation of chain abstraction protocols like SOCKET is catalyzing a new paradigm for multi-chain DeFi. The days of fragmented liquidity and convoluted bridging workflows are being replaced by unified APIs and intent-based UX, where users interact with decentralized finance as a single, composable layer. This not only improves capital efficiency but also dramatically lowers the technical barrier to entry for both developers and end-users.

Security, Composability, and Future-Proofing DeFi

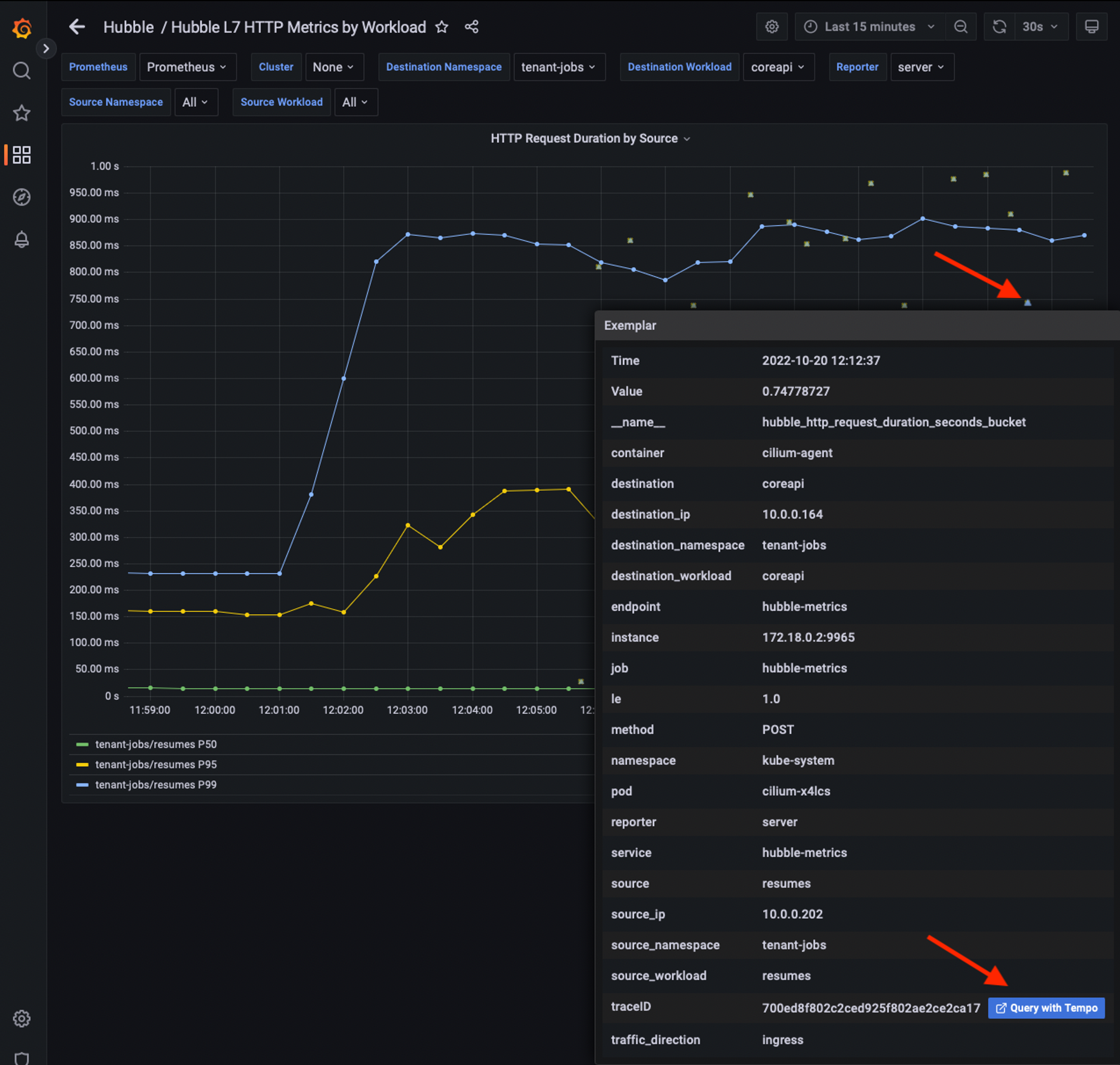

One of the most critical considerations in cross-chain design is security. SOCKET addresses this by leveraging modular architecture and robust execution incentives within its MOFA system. Competing transmitters are incentivized to route transactions optimally while adhering to strict security protocols, mitigating risks associated with traditional bridges. As highlighted by chainabstraction.dev, this approach ensures that user funds remain secure even as assets move seamlessly across disparate networks.

Another key advantage is composability. With SOCKET’s unified middleware layer, developers can compose novel DeFi primitives, such as cross-chain lending markets or intent-based asset management strategies, without reengineering integrations for each chain. This flexibility accelerates innovation and enables rapid deployment of new financial products.

Real-World DeFi Use Cases Enabled by SOCKET Protocol

-

Chain-Abstracted Accounts: SOCKET enables users to maintain a unified balance across multiple blockchains, allowing seamless transactions on any supported network without manual bridging or asset transfers. This dramatically improves capital efficiency and user experience for DeFi participants.

-

Cross-Chain Asset Swaps: With SOCKET’s chain abstraction, users can execute asset swaps across different blockchains in a single transaction, eliminating the need for multiple bridges or handling various gas tokens. This unlocks deeper liquidity and simplifies DeFi trading.

-

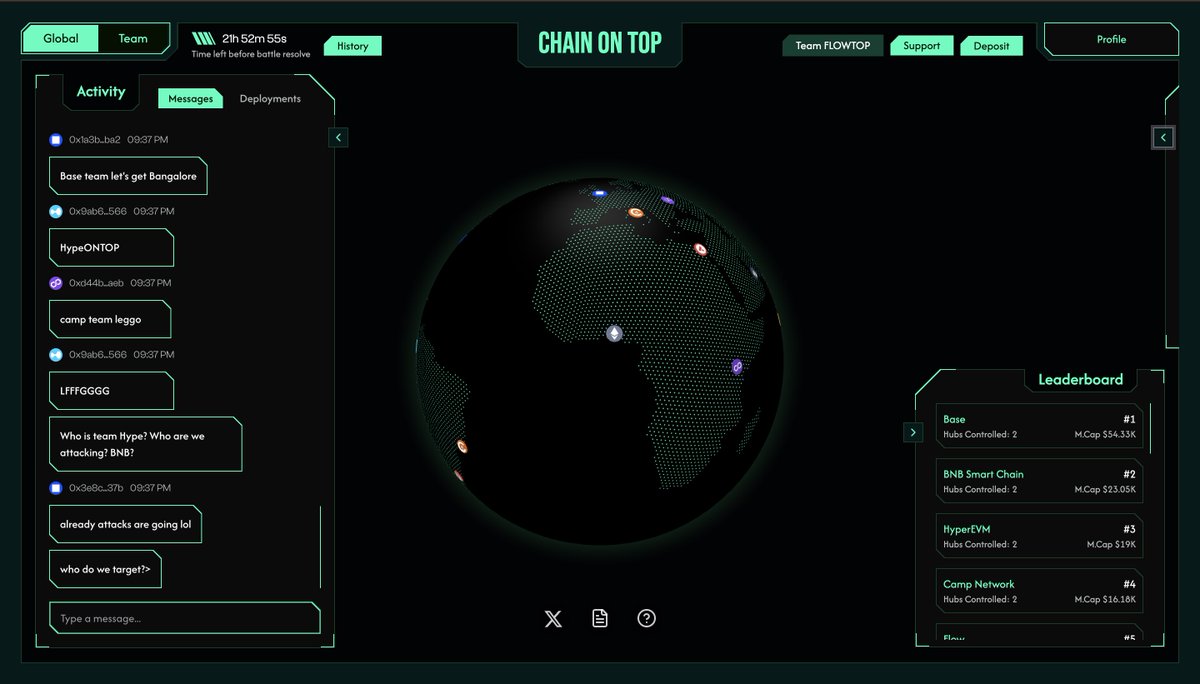

Unified Multi-Chain Governance: SOCKET allows token holders to participate in protocol governance on any supported chain, regardless of where their assets are held. This fosters more decentralized and inclusive decision-making for DAOs and DeFi protocols.

-

Composable Cross-Chain DeFi Applications: Developers can build DeFi apps that interact with multiple chains as a single backend using SOCKET’s Modular Order Flow Auction (MOFA), enabling complex strategies like yield aggregation and lending across ecosystems without added user friction.

-

Seamless User Onboarding Across Chains: SOCKET abstracts away the complexities of managing multiple wallets and gas tokens, allowing new users to onboard into DeFi ecosystems on any chain with a single, chain-agnostic account.

From an industry perspective, these advances are already influencing how liquidity providers, DAOs, and institutional players approach cross-chain strategy. By treating all supported chains as one logical execution environment, protocols can maximize TVL (total value locked) efficiency and offer users best-in-class pricing, regardless of their network of origin.

The Road Ahead: Intent-Based DeFi and Rollup Composability

The next phase for chain abstraction will likely focus on deeper intent infrastructure and rollup composability. As more Layer 2s and app-specific rollups emerge, the challenge will be not just bridging assets but also enabling arbitrary smart contract calls across chains in a trust-minimized way. SOCKET’s architecture is well-positioned for this evolution: its modular design allows for seamless integration with new chains and rollups as they gain traction in the market.

For developers considering building on top of a unified API blockchain protocol like SOCKET, the benefits are clear: faster time-to-market, reduced maintenance overhead, and access to a rapidly expanding pool of cross-chain liquidity. For users, it means interacting with any dApp or asset without ever thinking about which chain they’re on, a true realization of Web3’s promise.

Top Cross-Chain Assets Integrated via SOCKET Protocol

-

USDC (USD Coin): A leading stablecoin, USDC is natively supported across multiple blockchains such as Ethereum, Polygon, and Arbitrum. SOCKET enables seamless transfers and swaps of USDC between chains, eliminating manual bridging and reducing transaction friction for DeFi users.

-

ETH (Ethereum): As the foundational asset of the Ethereum ecosystem, ETH benefits from SOCKET’s chain abstraction by allowing users to interact with ETH liquidity and dApps on various EVM-compatible chains without complex bridging steps.

-

WBTC (Wrapped Bitcoin): WBTC brings Bitcoin liquidity to DeFi by wrapping BTC on Ethereum and other chains. Through SOCKET, users can move WBTC across supported networks, unlocking cross-chain yield opportunities and streamlined trading.

-

DAI: The decentralized stablecoin DAI is integrated via SOCKET, enabling permissionless, cross-chain lending, borrowing, and swaps. This enhances capital efficiency for DeFi participants who rely on DAI’s stability across ecosystems.

-

LINK (Chainlink): LINK powers decentralized oracle networks and is widely used in DeFi protocols. SOCKET integration allows LINK holders to utilize their tokens across multiple chains for staking, collateral, and governance without manual asset transfers.

“Chain abstraction is not just a UX upgrade, it’s foundational infrastructure that will define the next generation of decentralized finance. ”

The momentum behind chain abstraction protocols signals that seamless multi-chain DeFi is no longer aspirational, it’s quickly becoming standard practice. As adoption accelerates through 2025 and beyond, expect to see more projects embrace unified accounts, intent-driven swaps, and composable governance frameworks powered by platforms like SOCKET Protocol.