Decentralized finance is evolving rapidly, but the user experience for cross-chain activity remains one of its biggest hurdles. Historically, moving assets or executing strategies across multiple blockchains required a patchwork of bridges, manual wallet approvals, and an uncomfortable amount of technical know-how. This friction has stifled mass adoption and left even seasoned crypto users frustrated by fragmented liquidity and unnecessarily complex workflows.

Intent Layers: Abstracting Blockchain Complexity

Enter intent layers, a breakthrough abstraction that is fundamentally reshaping how users interact with DeFi. Rather than forcing individuals to micromanage every step, like swapping tokens on one chain, bridging to another, and staking in a third, an intent layer lets users simply declare their desired outcome. The protocol then orchestrates all necessary actions in the background.

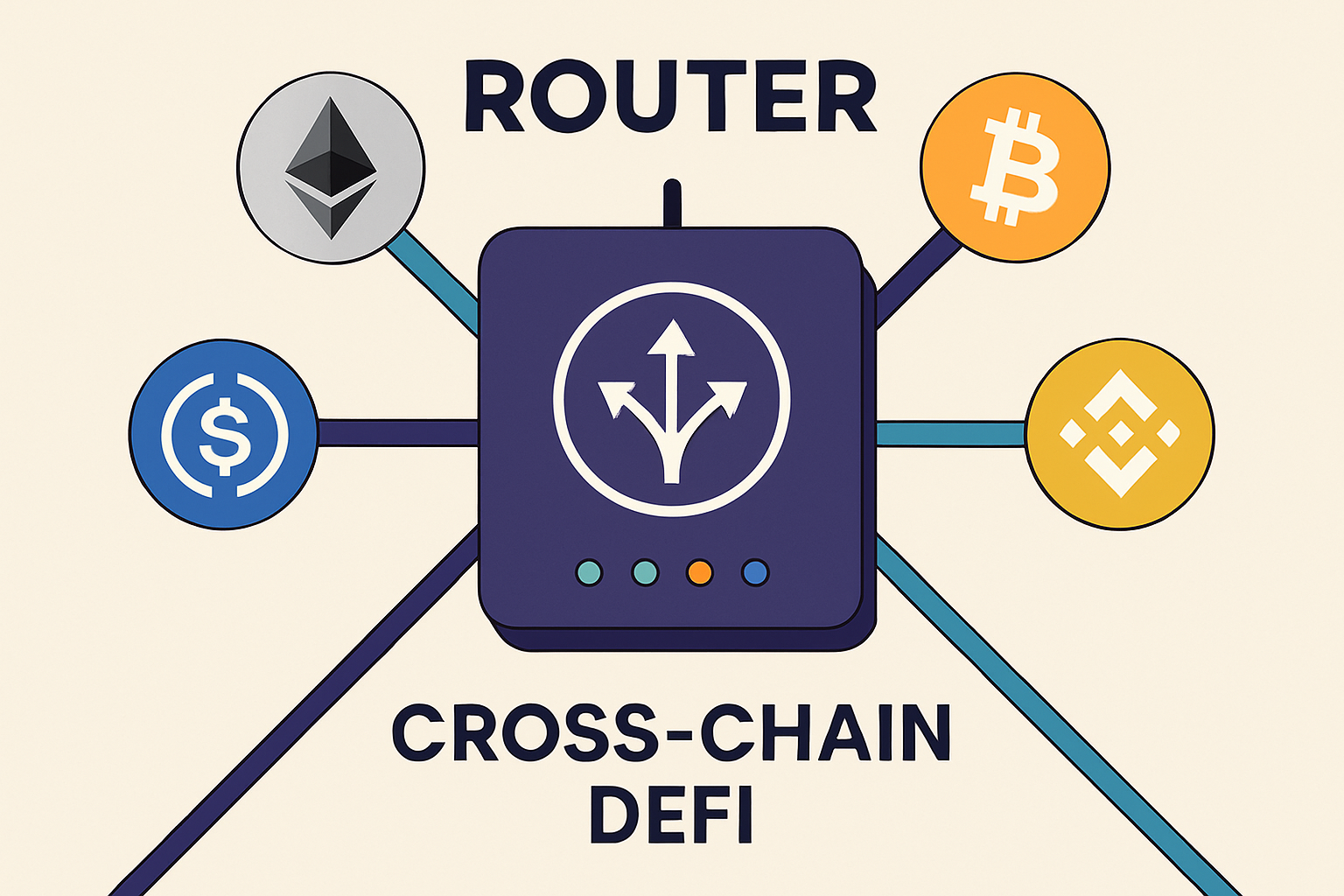

This approach is gaining momentum thanks to projects like Router’s Cross-chain Intent Framework (CCIF), which allows for single-click execution of multi-step workflows spanning several blockchains. Users can specify what they want, say, “swap USDC on Ethereum for SUI on Sui and stake it”: and the system handles the rest. This not only saves time but also minimizes exposure to bridge risks and failed transactions.

Frictionless Cross-Chain Access in Action

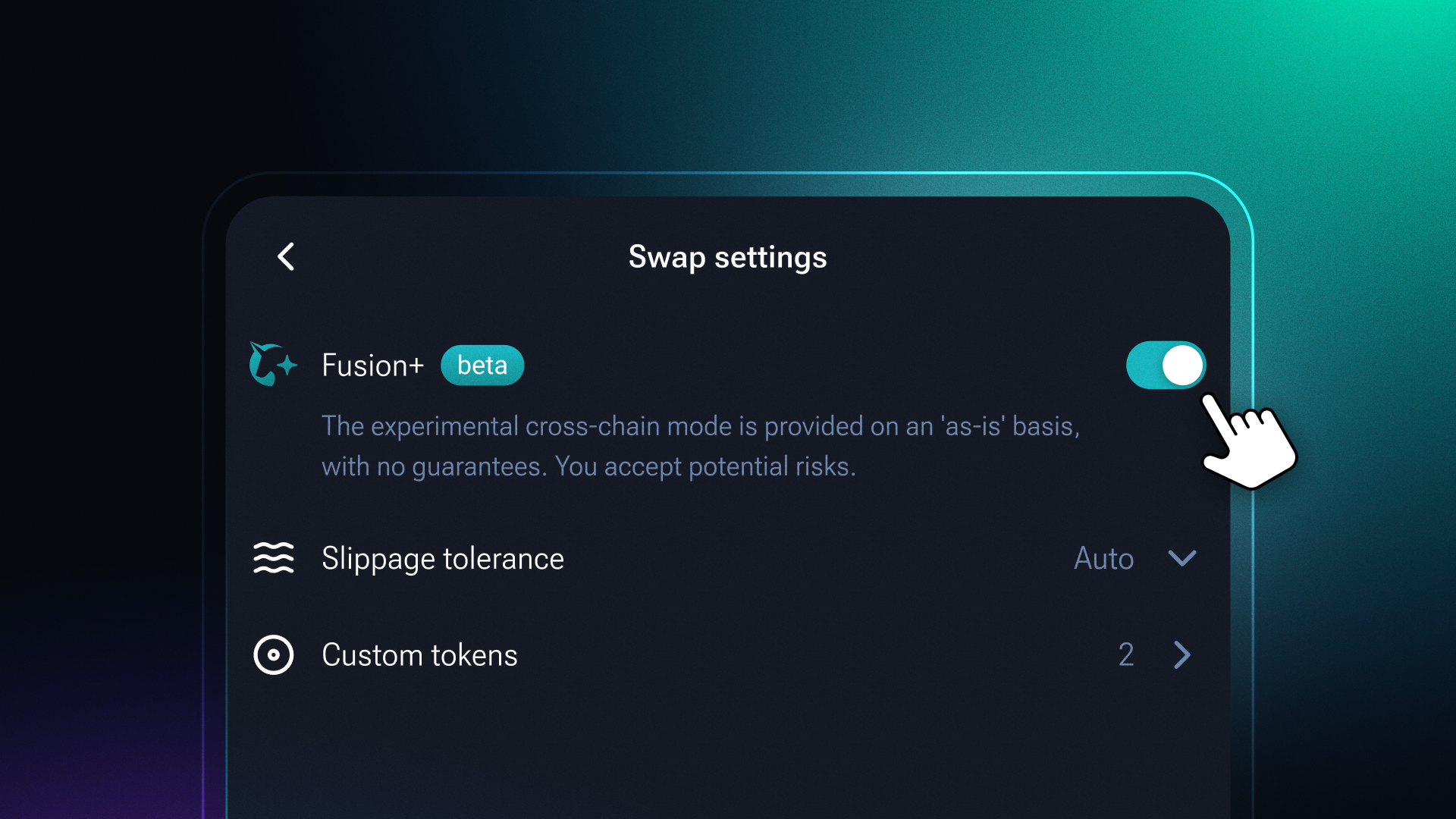

The new wave of intent-driven solutions has already started to eliminate much of the pain associated with cross-chain DeFi. For example, Router’s CCIF empowers users to execute sophisticated strategies without juggling multiple wallets or manually bridging assets between networks. Meanwhile, 1inch’s Fusion and leverages an intent-based system that removes reliance on traditional bridges altogether, a move that cuts costs and reduces security vulnerabilities (source).

The most compelling feature here is user-centric simplicity. Instead of confronting pop-ups for each signature or worrying about which network their assets reside on, users interact with DeFi as if all chains were seamlessly connected under one roof.

Top Intent Layer Protocols for Frictionless Cross-Chain DeFi

-

NEAR Intents: Powers lightning-fast, intent-driven cross-chain swaps—now integrated with Sui for seamless, bridge-free DeFi access across multiple ecosystems.

-

UniswapX: Uniswap Labs’ intent-based protocol enables users to execute cross-chain swaps and trades without manual bridging, leveraging a unified filler network for interoperability.

-

Router Cross-chain Intent Framework (CCIF): Automates complex multi-step DeFi actions—like swapping, bridging, and staking—across chains via a single, streamlined user intent.

-

1inch Fusion+: Employs an intent-based system for cross-chain swaps, removing the need for traditional bridges and reducing transaction risks and costs.

-

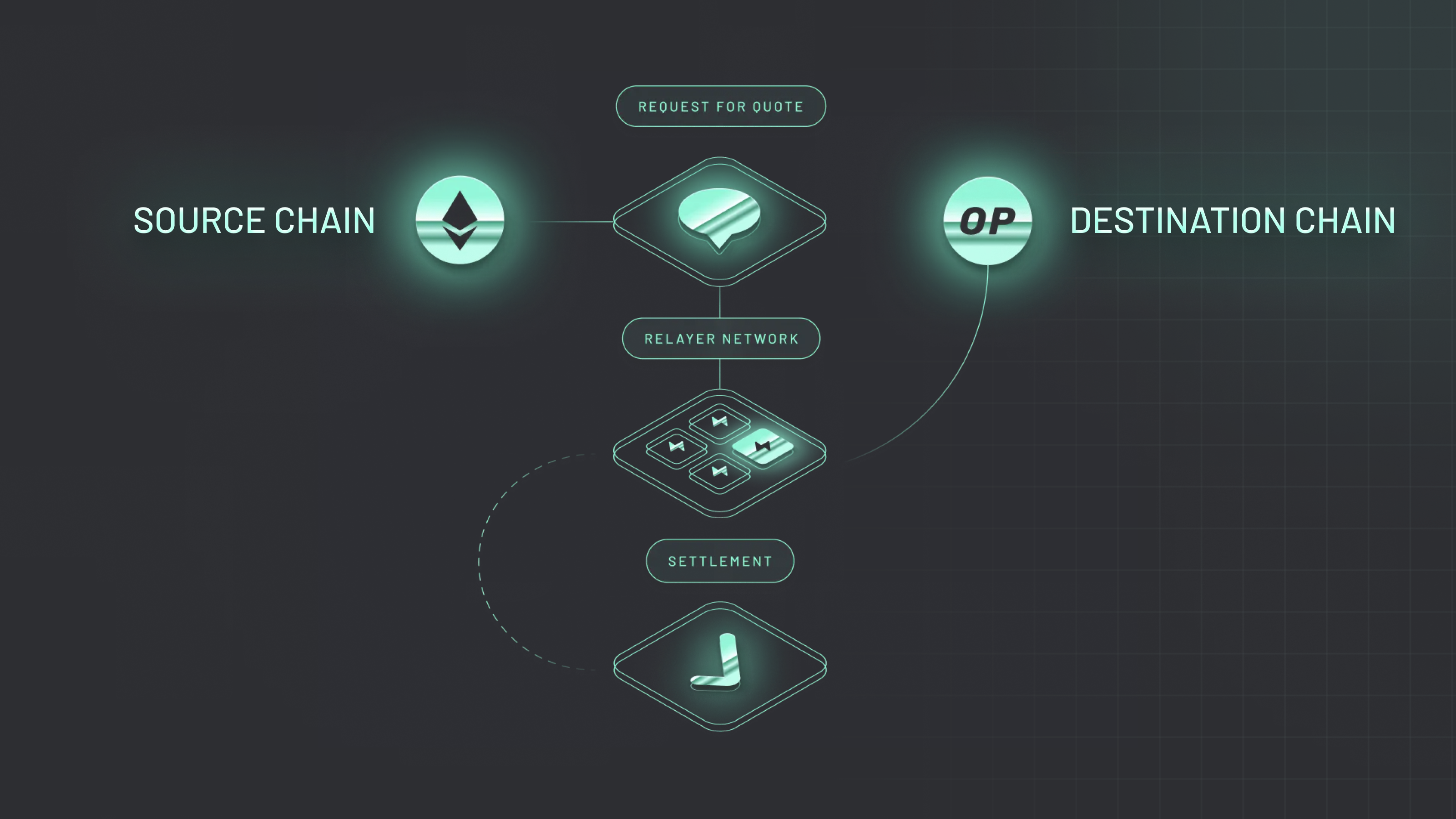

Across Protocol V3: The first intents-based interoperability protocol, enabling frictionless, natively interoperable dApps and eliminating user experience friction across chains.

-

Owlto Finance: Introduces omni-chain liquidity intent trading, facilitating efficient liquidity flow and seamless DeFi interactions across 50+ blockchains including Ethereum, Bitcoin, and Solana.

-

XY Finance SuperIntent: An omnichain AI-powered super app that combines intelligent portfolio management with seamless cross-chain operability and deep personalization for DeFi users.

Standardization: The Next Leap Toward Interoperability

The promise of intent layers is magnified when paired with robust standards. The proposed cross-chain intents standard from Uniswap Labs and Across Protocol aims to unify how different protocols interpret and fulfill user intents across networks. By creating a universal language for intents, and a shared filler network to execute them, this initiative could turn today’s patchwork ecosystem into a truly interoperable web of decentralized applications.

This movement toward standardization will benefit not just developers but also end-users, who will enjoy greater reliability and more intuitive interfaces across the entire DeFi stack.

Real-world adoption of intent layers is already reshaping the DeFi landscape. Projects like Owlto Finance are pioneering omni-chain liquidity intent trading, allowing users to move value efficiently across more than 50 networks including Ethereum, Bitcoin, and Solana. This approach directly addresses the liquidity fragmentation that has long plagued decentralized finance, making it possible to tap into opportunities wherever they arise without jumping through technical hoops. Across Protocol’s V3 further advances this vision by providing developers with native interoperability tools for building dApps that work seamlessly across chains, removing friction for both builders and end-users (source).

Personalization is another frontier being unlocked by intent-based systems. XY Finance’s SuperIntent leverages AI to tailor cross-chain portfolio strategies to individual preferences, blending intelligent allocation with deep interoperability. As these features become more widespread, we can expect DeFi interfaces to feel less like fragmented toolkits and more like unified financial platforms built around user goals.

What’s Next: Unified Cross-Chain UX and the End of Blockchain Silos

The trajectory is clear: as intent layers mature and standards solidify, the boundaries between blockchains will continue to blur. Users will increasingly interact with DeFi protocols in a chain-agnostic way, focusing on outcomes rather than processes or network specifics. This shift will not only lower barriers for mainstream adoption but also enable more sophisticated financial products, where liquidity and utility flow freely across ecosystems.

For developers and protocol designers, this evolution means new opportunities, and new responsibilities. Building on standardized intent frameworks ensures future-proof interoperability while reducing redundant infrastructure work. At the same time, security practices must evolve alongside these abstractions to prevent novel attack vectors at the intent orchestration layer.

Key Takeaways for DeFi Builders and Users

- Intent layers abstract away multi-step cross-chain operations into single workflows

- Standardization efforts like ERC-7683 are driving true interoperability between protocols

- User experiences are rapidly improving as friction from bridging, wallet management, and network switching fades

- Personalized AI-driven strategies will become commonplace as intent systems mature

- The future of DeFi is unified, where users interact with financial services across any chain as easily as using a single app

The momentum behind intent layers is undeniable. By abstracting blockchain complexity and championing frictionless cross-chain access, these innovations are setting a new bar for what’s possible in decentralized finance.