The explosive growth of decentralized finance (DeFi) has led to a sprawling ecosystem of independent blockchains, each with its own liquidity pools and protocols. While this innovation has catalyzed new financial primitives, it has also introduced a persistent challenge: cross-chain liquidity fragmentation. As assets and users scatter across Ethereum, Solana, Cosmos, and emerging L2s, capital becomes siloed, resulting in inefficient markets and suboptimal user experiences. Unified lending aggregators are emerging as the critical infrastructure layer to address these inefficiencies by pooling liquidity across disparate networks and abstracting away the complexity for end users.

What is Cross-Chain Liquidity Fragmentation?

Liquidity fragmentation refers to the dispersion of crypto assets across multiple blockchains that do not natively interoperate. For example, a user with collateral on Avalanche may find it cumbersome to borrow against that position on Arbitrum without costly bridging or exposure to wrapped assets. This isolation leads to several systemic issues:

- Reduced capital efficiency: Idle assets sit unused on one chain while demand for borrowing or lending spikes elsewhere.

- Higher transaction costs: Bridging funds between chains typically incurs fees and exposes users to smart contract and bridge risks.

- Poor DeFi lending UX: Users must juggle multiple wallets, interfaces, and token standards just to access basic lending services.

The result is a fractured DeFi landscape where opportunities are missed due to technical hurdles and fragmented liquidity. According to research from Mitosis University, each chain’s isolated ecosystem leads directly to increased competition for liquidity rather than collaboration or aggregation.

The Rise of Unified Lending Aggregators

Unified lending aggregators represent a paradigm shift in omnichain liquidity solutions. Rather than forcing users to manually bridge assets or interact with multiple protocols, these platforms abstract away the complexity by offering a single interface that sources liquidity from many chains simultaneously. The core innovations powering this movement include:

Key Features of Leading Unified Lending Aggregators

-

Cross-Chain Liquidity Layer: Platforms like Aave V4 introduce a unified liquidity layer, enabling users to borrow and collateralize assets across both EVM and non-EVM chains. This significantly improves capital efficiency by consolidating liquidity and reducing fragmentation.

-

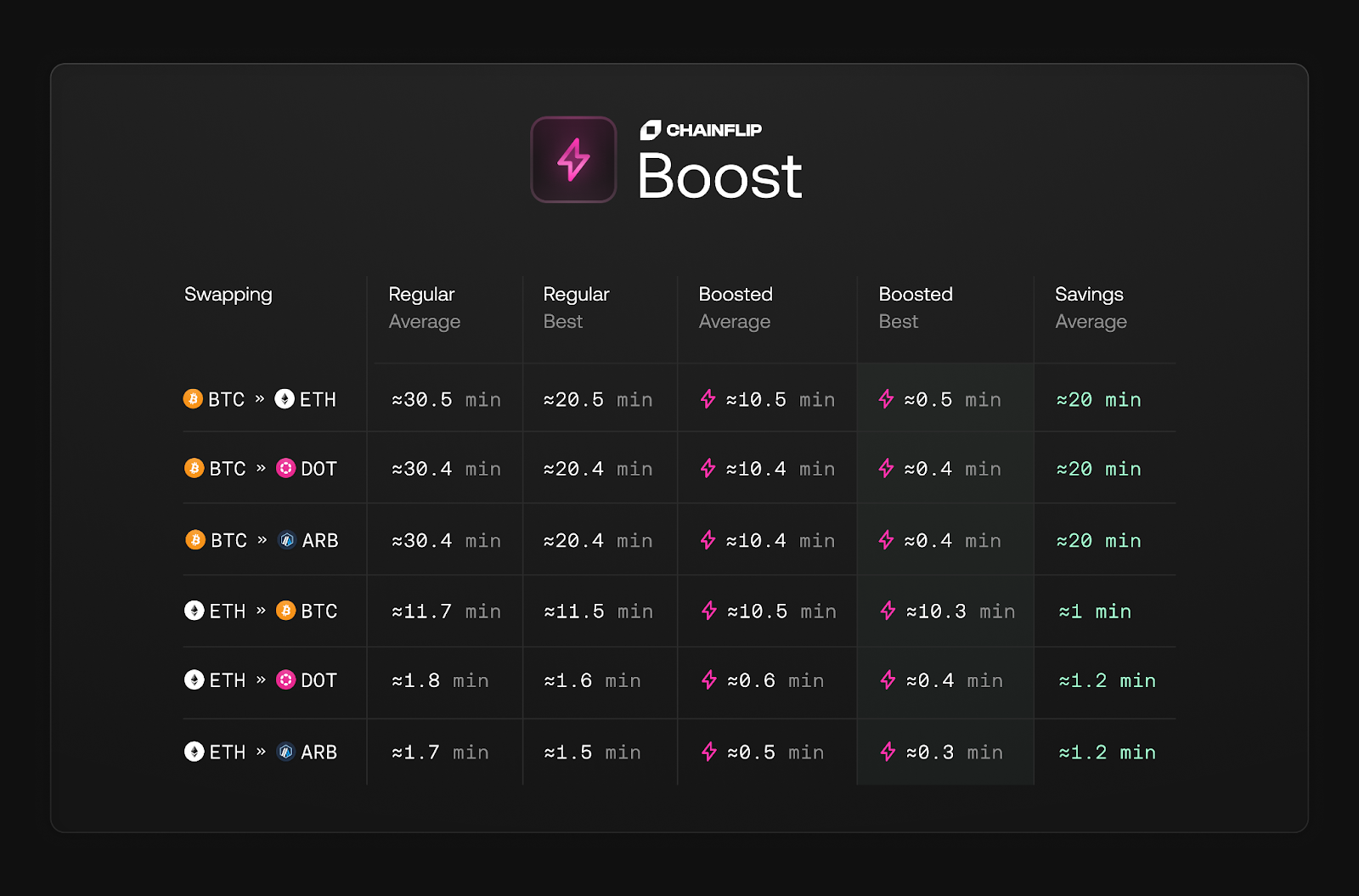

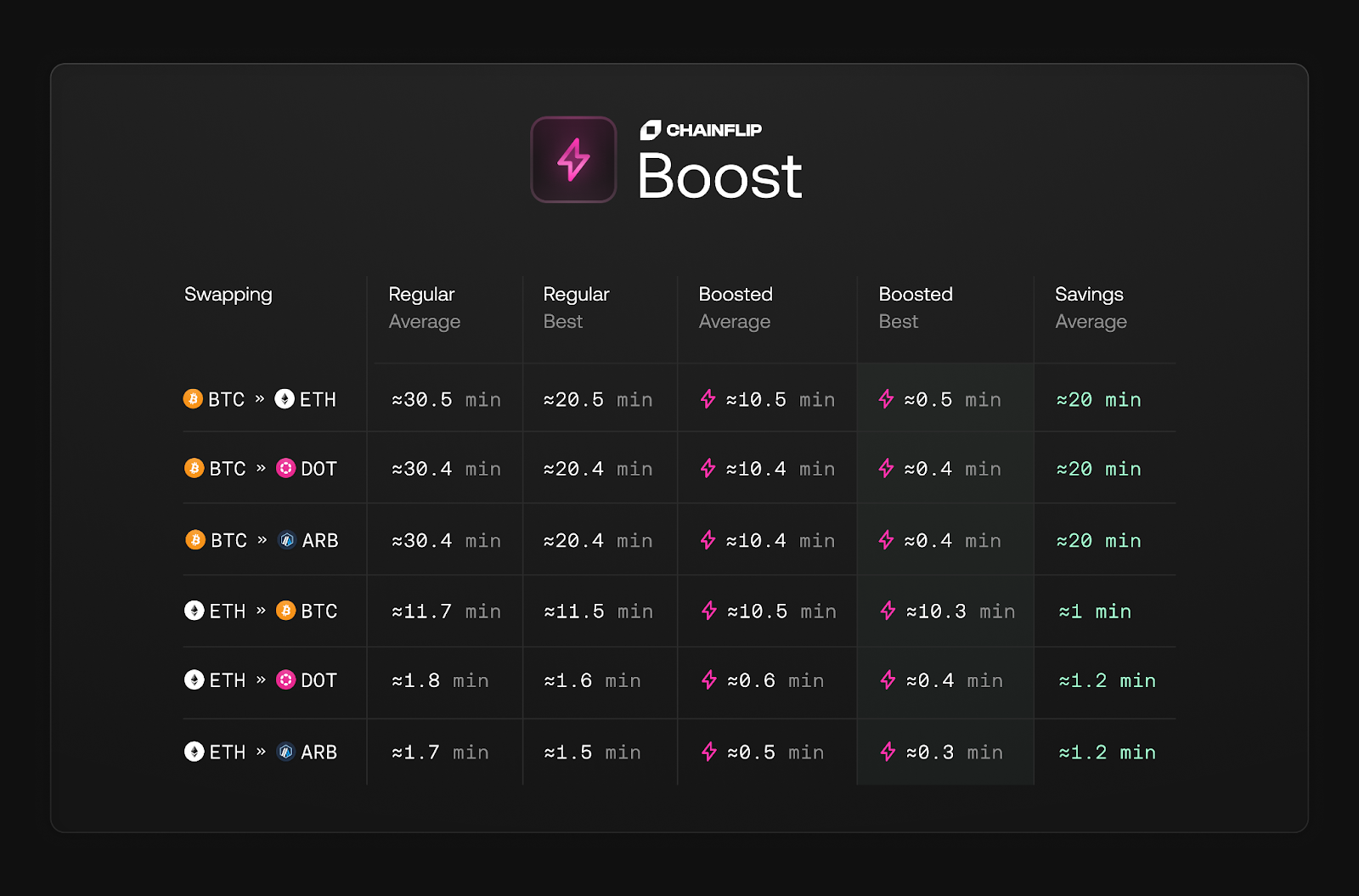

Native Asset Lending Without Wrapping: Chainflip supports permissionless lending and borrowing of native assets such as Bitcoin, eliminating the need for wrapped tokens or centralized intermediaries. This approach enhances security and broadens cross-chain lending opportunities.

-

Interoperability via Protocol Integration: Mitosis leverages interoperability protocols like Cosmos IBC and LayerZero, utilizing features such as Ecosystem-Owned Liquidity (EOL) and Matrix Vaults to enable seamless liquidity flow and governance across multiple blockchains.

-

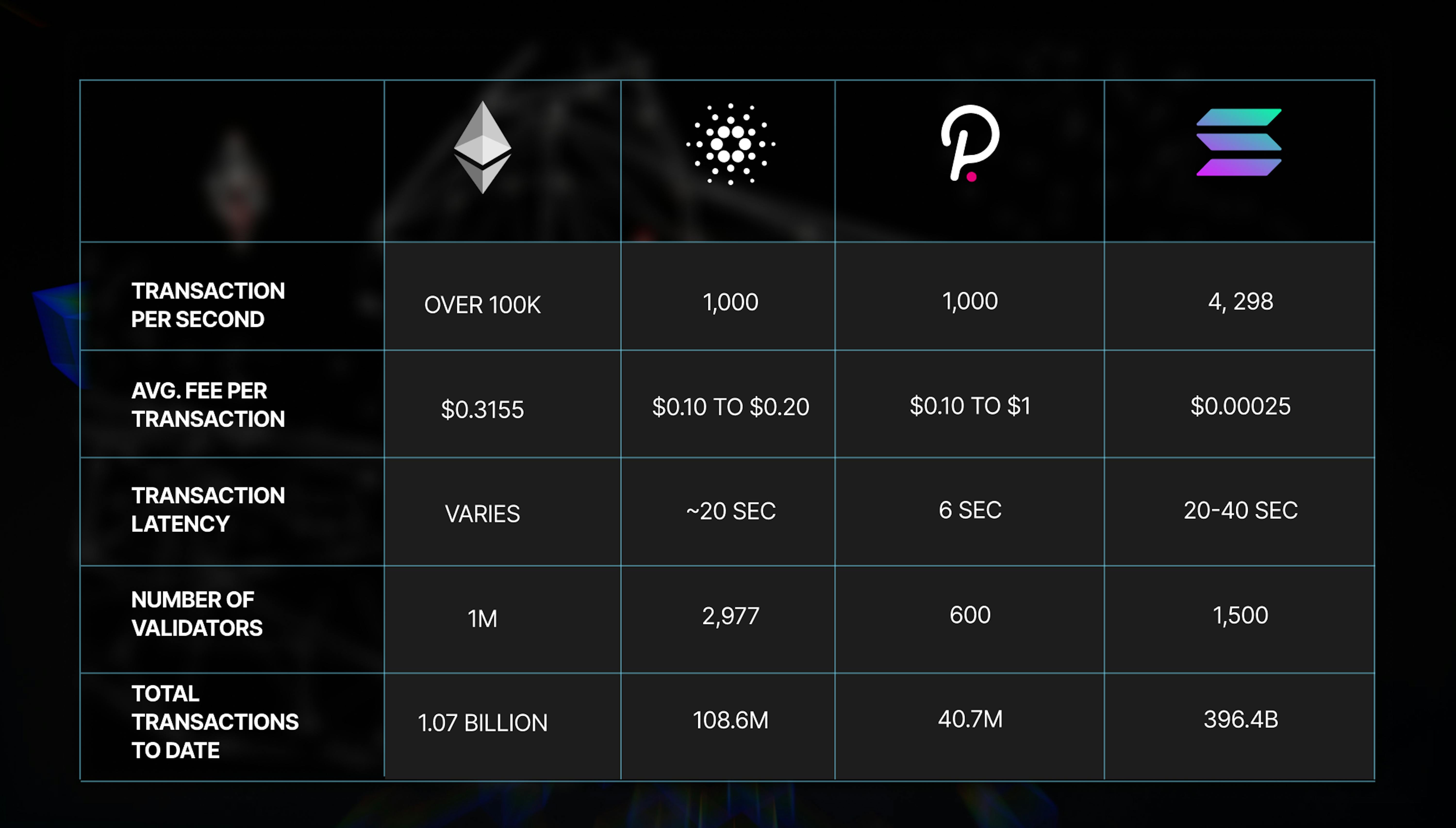

Universal Smart Contracts for Multi-Chain Execution: ZetaChain offers universal smart contracts capable of atomic, multi-hop trades across Bitcoin, Ethereum, Solana, and more. This removes the need for third-party bridges and eliminates wrapped token fragmentation, resulting in a truly unified liquidity experience.

This model delivers several measurable benefits:

- Simplified user flow: Deposit collateral on one chain, borrow on another – all in one transaction.

- Pooled risk management: By aggregating risk profiles across chains, platforms can offer more stable interest rates and higher utilization ratios.

- Composability: Developers can build dApps that leverage truly global liquidity without being locked into any single network’s limitations.

A notable example is Radiant Capital’s integration with LayerZero, which enables seamless cross-chain money markets by unifying fragmented pools into a universal order book (Gate.com). Similarly, Soul Protocol’s aggregator rails have already served over 100K users without interruption by abstracting away multi-chain complexity (Alchemy). These advances signal an industry-wide trend toward true capital mobility regardless of underlying blockchain architecture.

Pioneering Protocols in Omnichain Lending

The competitive landscape is evolving rapidly as protocols race to deliver frictionless cross-chain experiences. Several leading projects are setting new standards for unified liquidity aggregation:

- Aave V4 (Q4 2025): Introducing a Cross-Chain Liquidity Layer that will unify lending across EVM/non-EVM networks (ainvest.com). Users will be able to collateralize assets on one chain while borrowing against them elsewhere – all managed through Aave’s familiar interface.

- Mitosis: Leveraging IBC and LayerZero for seamless interoperability via ecosystem-owned liquidity (EOL) vaults (Mitosis University). This approach reduces fragmentation by making miAssets available everywhere at once.

- ZetaChain Universal Smart Contracts: Enabling atomic multi-hop trades across Bitcoin, Ethereum, Solana and more – no bridges or wrapped tokens required (ZetaChain Blog). This direct interaction model eliminates the need for trusted intermediaries entirely.

Together these initiatives are laying the groundwork for a future where DeFi lending UX is chain-agnostic – users simply deposit once and access global borrowing power instantly.

Despite these advances, the path to a truly unified lending aggregator ecosystem is not without technical and operational hurdles. The underlying infrastructure must guarantee atomicity, security, and real-time settlement across heterogeneous chains. In practice, this has meant integrating advanced interoperability protocols like LayerZero and Cosmos IBC, as well as developing robust cross-chain messaging standards that can handle the complexity of multi-chain collateralization and liquidation events.

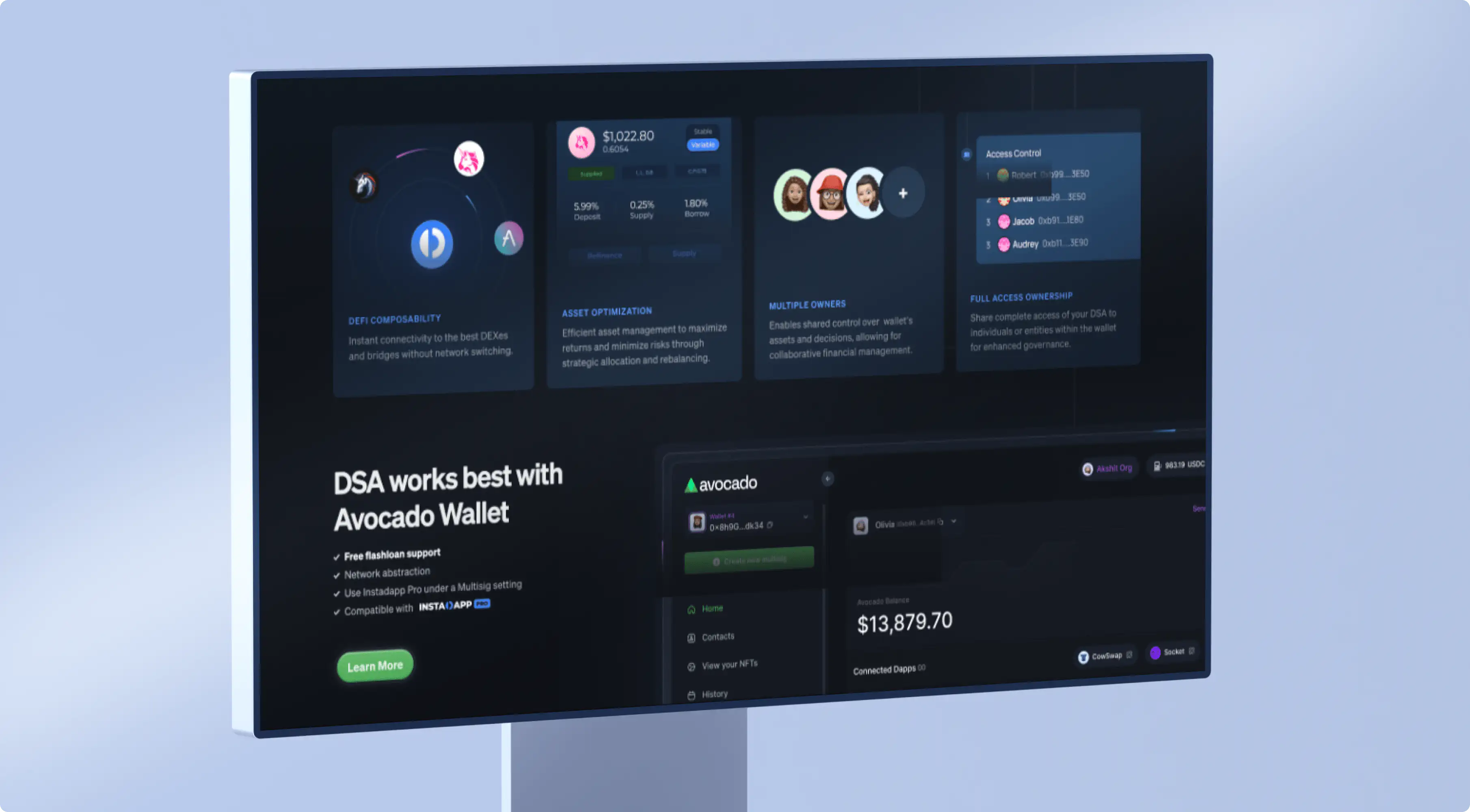

For end users, the impact is profound. No longer do they need to track wallet addresses or token standards across multiple blockchains. Instead, they interact with a single interface that abstracts away the underlying complexity, delivering a cohesive DeFi lending UX that rivals traditional fintech platforms in terms of usability and reliability.

Real-World Applications and User Benefits

Unified lending aggregators are already demonstrating tangible benefits for both retail users and institutional capital allocators. By consolidating liquidity from previously siloed sources, these protocols can offer:

Top User Benefits of Unified Lending Aggregators in DeFi

-

Seamless Cross-Chain Asset Utilization: Unified lending aggregators, such as Aave V4 and Chainflip, enable users to borrow, lend, and collateralize assets across multiple blockchains from a single interface. This eliminates the need for manual bridging and significantly streamlines the user experience.

-

Lower Transaction Costs and Reduced Fragmentation: Unified lending aggregators minimize the need for multiple transactions and cross-chain bridges, which are often costly and introduce security risks. This consolidation leads to lower fees and a safer lending environment.

-

Access to Native Asset Lending: Innovations such as Chainflip’s native BTC lending provide users with permissionless access to lending and borrowing of native assets (e.g., Bitcoin) across chains, without reliance on wrapped tokens or centralized intermediaries.

-

Improved User Experience and Accessibility: By offering a unified dashboard and abstracting away cross-chain complexities, platforms like Aave V4 and ZetaChain make DeFi lending more intuitive and accessible to a broader range of users, including those less familiar with blockchain infrastructure.

For example, Chainflip’s introduction of native BTC lending eliminates the need for wrapped tokens or centralized custodians, users can borrow against Bitcoin directly while accessing liquidity on other chains (Cointelegraph). Similarly, protocols like Soul have demonstrated that unified rails can serve over 100K users without downtime or fragmentation risk, providing a blueprint for future scalability (Alchemy).

Challenges Ahead: Security and Standardization

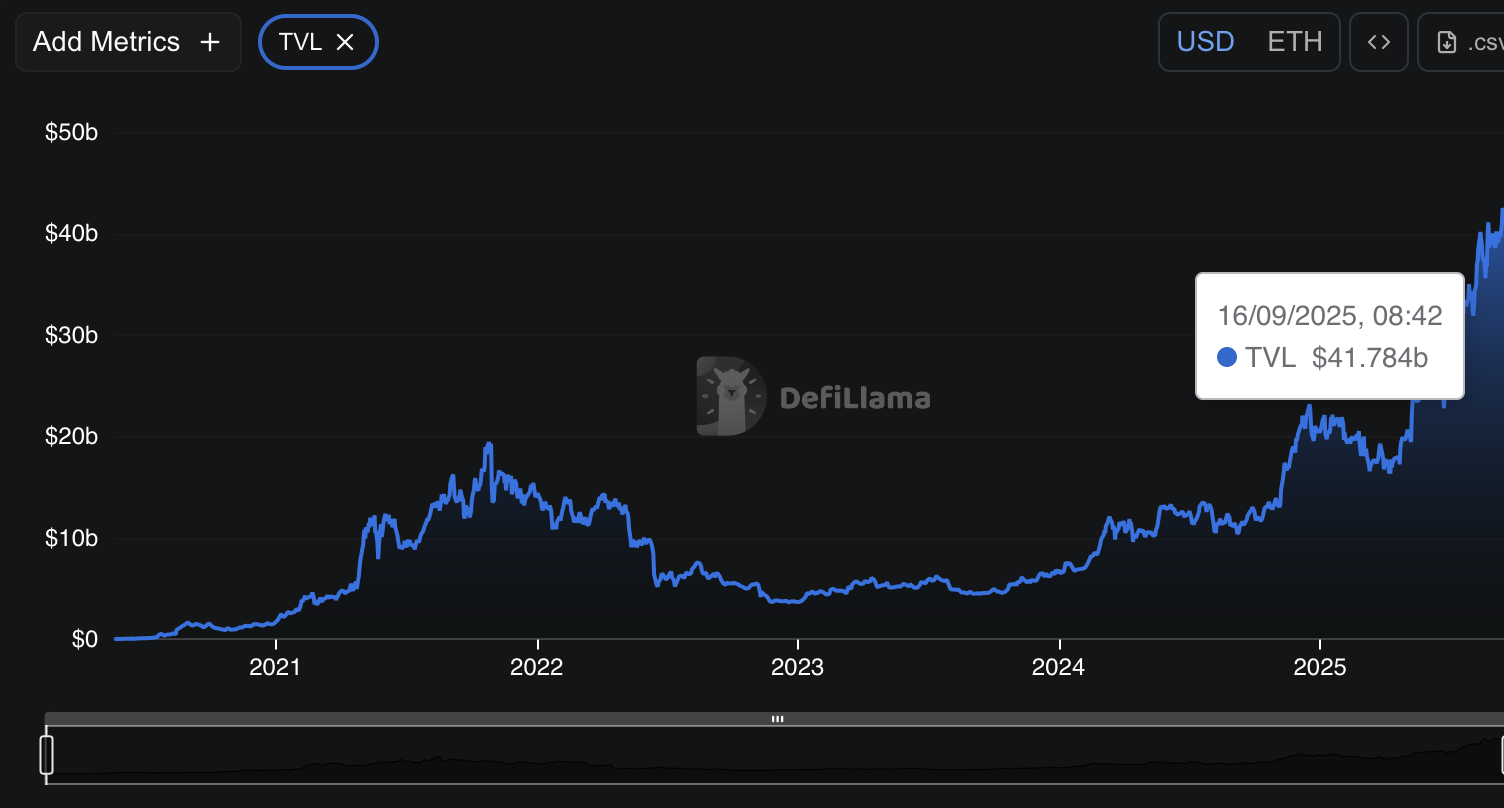

While unified lending aggregators unlock new capital efficiencies, they also introduce novel risks. Cross-chain bridges remain attractive targets for exploits due to their complexity and large TVL (total value locked). Protocols must therefore invest heavily in security audits, formal verification of smart contracts, and real-time monitoring systems to mitigate attack vectors.

Additionally, industry-wide standardization efforts will be crucial. As more chains adopt non-EVM architectures or experiment with custom consensus mechanisms, interoperability layers must adapt quickly to prevent renewed fragmentation at the protocol level.

The Road Ahead: Toward Omnichain Capital Markets

The trajectory is clear: unified lending aggregators are evolving into the backbone of omnichain liquidity solutions. As more protocols integrate universal smart contracts (like ZetaChain) or ecosystem-owned vaults (as pioneered by Mitosis), DeFi will move closer to realizing seamless capital mobility across any chain.

This transformation is not just technical, it’s fundamentally reshaping incentives within crypto markets. Liquidity providers gain access to broader yield opportunities without being locked into one network; borrowers enjoy lower rates thanks to deeper aggregated pools; developers can compose new financial primitives atop global liquidity rails without worrying about chain-specific limitations.

The takeaway: Unified lending aggregators are dissolving historical barriers between blockchains. Their continued innovation will determine how quickly DeFi matures into a truly global alternative financial system, one where fragmented liquidity is a relic of the past rather than an ongoing challenge.