In the fragmented blockchain landscape, where assets are siloed across Ethereum, Solana, Bitcoin, and beyond, true interoperability has remained elusive. Traditional bridges, burdened by security vulnerabilities and convoluted user flows, have stifled mass adoption. NEAR Intents emerges as a beacon, enabling frictionless cross-chain asset transfers without bridges through chain abstraction UX. This intents-based architecture lets users declare outcomes – swap USDC on Ethereum for SOL on Solana – while the protocol orchestrates execution across 25 and chains, serving 1.6 million unique users and processing $5 billion in volume.

With NEAR trading at $1.02, down slightly by -0.0278% over the last 24 hours, the protocol’s momentum underscores a structural shift. From my vantage as a macro analyst, this isn’t mere hype; it’s the convergence of AI-driven routing and solver networks aligning with global economic cycles favoring decentralized efficiency.

Intents as the Keystone of Unified Wallet Experiences

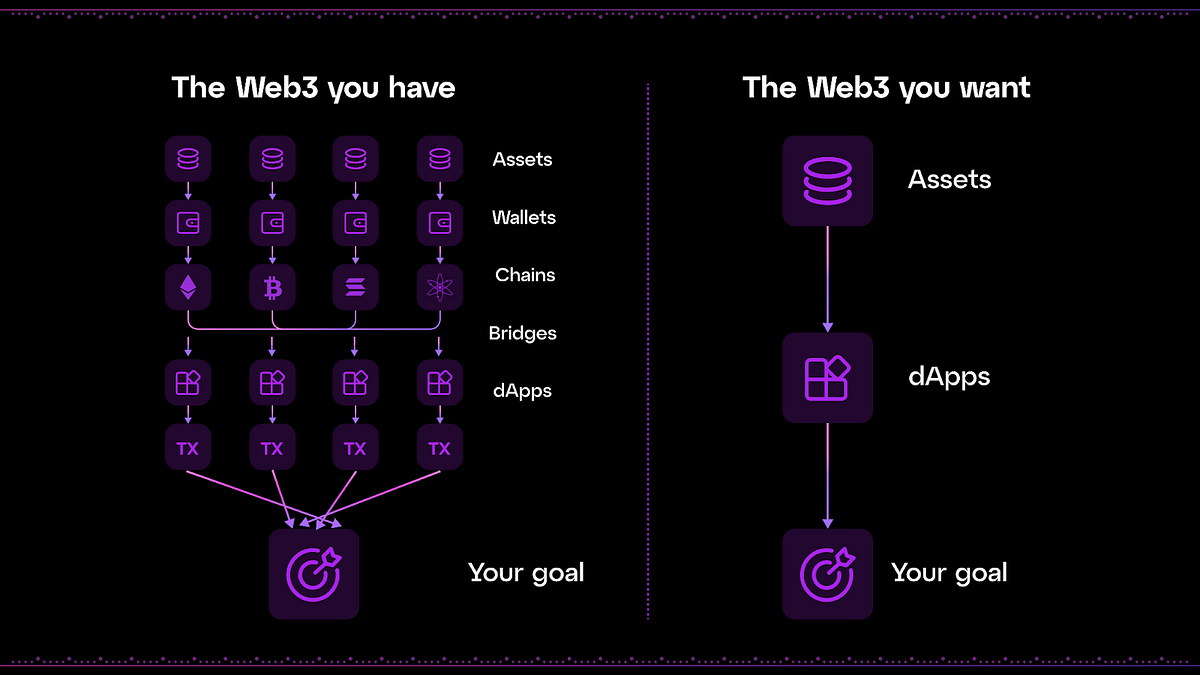

NEAR Intents flips the script on cross-chain UX. Users express high-level desires via a single account, akin to Web2 simplicity, without wallet switches or bridge risks. Powered by Chain Signatures, it verifies actions across chains securely, even for private assets, fostering unified wallet asset transfers. RHEA Finance’s cross-chain lending litepaper highlights how NEAR ecosystem apps leverage this for seamless protocols, while ERC-7683 standardization amplifies solver interoperability.

NEAR’s Chain Abstraction makes Web3 feel like Web2. Use one account to access apps across Ethereum, Bitcoin, and beyond, no bridges, no switching wallets.

This abstraction layer, expanded recently to Sui and Starknet, mitigates the $2 billion in bridge exploits since 2020. Solvers compete to fulfill intents optimally, routing through Omnibridge for atomic settlements. The result? Frictionless DeFi interoperability where complexity vanishes, empowering retail and institutions alike.

Architectural Edge: From User Intent to Cross-Chain Execution

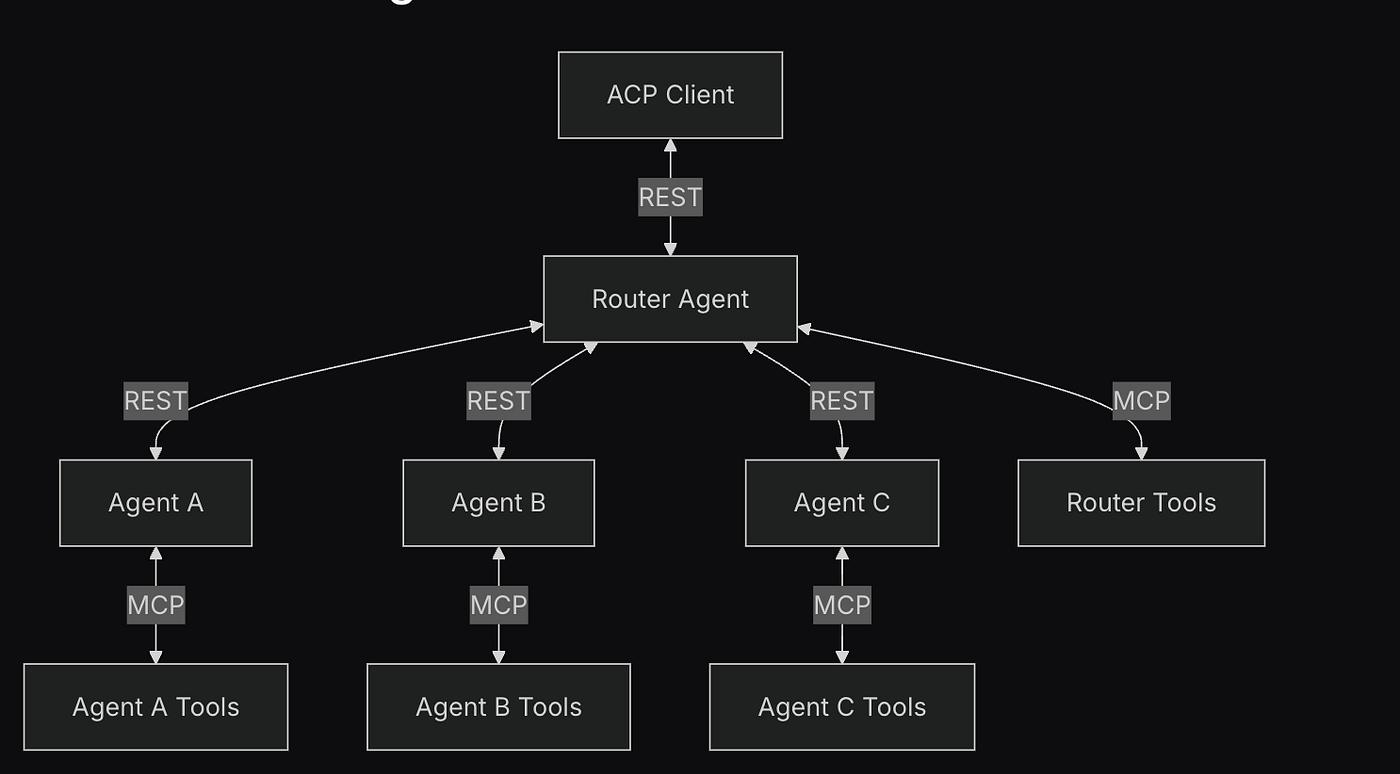

At its core, NEAR Intents decouples intent from mechanics. A user specifies “swap 100 USDT on Ethereum for NEAR on NEAR mainnet, ” and AI agents or solvers handle routing, liquidity aggregation, and settlement. This mirrors broader trends in intent-based cross-chain transactions, as discussed in industry panels with Anoma and Everclear experts.

NEAR’s integration with ERC-7683 unifies off-chain messages and on-chain contracts, lowering barriers for universal solvers. Projects on NEARCatalog demonstrate real-world use: token swaps, staking, even AI-orchestrated trades. With $5 billion processed, it’s proving chain abstraction’s viability, especially as NEAR holds steady at $1.02 amid market chop.

Zooming out, this positions NEAR at the nexus of commodities and crypto cycles. As fiat inflation persists, intents enable portfolio rebalancing across chains without friction, a macro tailwind for adoption.

NEAR Protocol (NEAR) Price Prediction 2027-2032

Forecast based on NEAR Intents chain abstraction growth, cross-chain adoption, and market cycles from 2026 baseline of $1.02

| Year | Minimum Price (Bear) | Average Price (Base) | Maximum Price (Bull) | YoY Growth % (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $1.20 | $3.20 | $6.00 | +214% |

| 2028 | $2.00 | $6.50 | $12.00 | +103% |

| 2029 | $4.00 | $10.00 | $20.00 | +54% |

| 2030 | $6.00 | $16.00 | $28.00 | +60% |

| 2031 | $10.00 | $24.00 | $45.00 | +50% |

| 2032 | $15.00 | $35.00 | $65.00 | +46% |

Price Prediction Summary

NEAR Protocol’s NEAR Intents innovation drives frictionless chain abstraction across 25+ blockchains, processing $5B+ in volume without bridges. Base case projects average price growth from $1.02 (2026) to $35 by 2032 (CAGR ~77%), with bull highs to $65 amid adoption surges and market bulls, bear lows reflecting corrections.

Key Factors Affecting NEAR Protocol Price

- Rapid adoption of NEAR Intents for seamless cross-chain UX (Ethereum, Solana, Bitcoin, Sui, Starknet)

- $5B+ cross-chain volume milestone, expanding to 1.6M+ users

- Alignment with standards like ERC-7683 for universal intents solvers

- Market cycles: Bullish 2027-2028 driven by interoperability demand

- Regulatory tailwinds for chain abstraction reducing bridge risks

- AI agent integration and ecosystem growth (RHEA Finance, etc.)

- Competition from L1s but NEAR’s UX edge positions for top-10 market cap potential

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

NEAR Chain Signatures: Securing Private Assets in a Multi-Chain World

Central to NEAR Intents is Chain Signatures, allowing threshold cryptography for cross-chain verifications without exposing private keys. This unlocks NEAR chain signatures private assets management, where users retain control while delegating execution. No more wrapped tokens or custody risks; intents settle natively.

Coupled with Omnibridge, it spans Bitcoin to Solana, processing intents in seconds. Recent NEARWEEK updates confirm 25 and chain support, with Reddit communities buzzing on intents’ DeFi impact. For developers, it’s a toolkit for building cross-chain UX without bridges, as seen in Propeller Heads’ explorations.

Developers gain low-level primitives to abstract chain-specific logic, slashing development time and unlocking novel applications like AI-driven portfolio management across chains. This isn’t incremental; it’s a paradigm where NEAR intents chain abstraction becomes the default for multi-chain DeFi.

Pioneering Intents Experts

-

Anoma: Intent-centric architecture enabling privacy-focused, solver-driven cross-chain execution without bridges.

-

Aethos: Advanced solver infrastructure optimizing fulfillment of complex cross-chain intents.

-

Everclear: Universal clearing layer for trust-minimized settlement of multi-chain intents.

-

Propeller Heads: UX innovators abstracting chain complexities via intuitive intent-based interfaces.

Industry voices, from YouTube sessions to NEARCatalog listings, affirm intents’ role in eliminating UX bottlenecks. Users specify outcomes; solvers, incentivized by fees, compete for efficiency. Aethos and Everclear integrations exemplify how this scales to lending and perpetuals without liquidity fragmentation.

Ecosystem Momentum: 1.6M Users and $5B in Cross-Chain Volume

NEAR Intents now spans 25 and blockchains, from Bitcoin’s UTXOs to Solana’s speed, serving 1.6 million unique users. That’s not abstract metrics; it’s tangible traction processing $5 billion in cross-chain volume. BlockEden reports highlight seamless swaps minus bridges, a direct antidote to crypto’s notorious UX woes.

Zooming out, this volume signals conviction amid volatility. With Binance-Peg NEAR at $1.02 and a 24-hour dip of -0.0278%, the protocol weathers corrections better than peers, buoyed by real utility. RHEA Finance’s litepaper positions NEAR as the cross-chain account hub, enabling lending protocols that span ecosystems seamlessly.

Key Advantages of NEAR Intents

-

No bridges or wallet switches: Use one account for seamless access across Ethereum, Bitcoin, Solana, and 25+ chains.

-

AI/solver optimized routing: Specify outcomes; AI agents and solvers handle efficient cross-chain execution.

-

Chain Signatures for private assets: Securely manage private keys and assets without exposure.

-

ERC-7683 compatibility: Aligns with the cross-chain intents standard for universal solver networks.

-

$5B volume across 25+ chains: Proven scale serving 1.6M+ users with real-world reliability.

Reddit threads dissect intents’ DeFi ripple effects: users define swaps or stakes, protocols execute atomically. This fosters frictionless DeFi interoperability, where liquidity pools unify without silos. Archetype Fund’s ERC-7683 analysis underscores solver UX gains, routing most intents to a universal network.

Macro Tailwinds: Aligning Cycles with Chain Abstraction

From my 20 years tracking financial cycles, NEAR Intents arrives at a pivotal juncture. Persistent fiat debasement drives capital to hard assets like Bitcoin and commodities, now accessible via intents without wrappers. Ethereum’s layer-2 sprawl meets Solana’s throughput, all under one NEAR account.

Recent expansions to Sui and Starknet, powered by Omnibridge, fortify this. A user on Ethereum intents a Bitcoin exposure shift; solvers aggregate via Chain Signatures, settling privately. Risks plummet; speed soars. As global liquidity cycles turn expansionary, protocols like these capture rebalancing flows, amplifying NEAR’s edge.

Cross-chain intents are user-defined outcome orders that let DeFi participants specify what they want to achieve, such as swapping tokens.

AMINA Bank’s report on NEAR’s AI-onchain push reveals intents enabling agentic finance: bots trade autonomously across chains. This isn’t sci-fi; it’s deployable today, positioning NEAR ahead of fragmented rivals.

Structurally, chain abstraction resolves crypto’s interoperability trilemma: security, speed, simplicity. Traditional bridges fail spectacularly; intents succeed through competition. With NEAR steady at $1.02, expect solver networks to proliferate, drawing institutional flows seeking seamless cross-chain DeFi.

The trajectory points to unified wallets as the norm, where unified wallet asset transfers erase network boundaries. Developers build once; users interact fluidly. In a multi-polar blockchain world, NEAR Intents doesn’t just connect chains; it redefines the ecosystem’s operating system, aligning technical innovation with enduring economic incentives.