DeFi’s promise of decentralized finance hinges on fluidity across blockchains, yet today’s reality fragments that vision into silos of Ethereum, Solana, and beyond. Developers building cross-chain wallets confront a core tension: users crave simplicity amid complexity. Chain abstraction UX redefines this landscape, layering intelligent protocols atop disparate networks to forge unified wallet solutions that mask the chaos. From my vantage as a macro analyst tracking blockchain’s structural shifts, this isn’t mere UX polish; it’s the infrastructure pivot enabling mass adoption in a multi-chain world.

Consider the economic cycles we’ve witnessed: Bitcoin’s halving rhythms, Ethereum’s upgrades, and now the interoperability surge. Chain abstraction aligns with this maturation, abstracting away multi-chain DeFi UX frictions like network switches and token swaps. Sources from Chainlink to Blockworks underscore its essence: a unified protocol distilling cross-chain data and value exchanges into intuitive interactions.

Navigating Today’s Cross-Chain Friction

Users today juggle wallets per chain, each demanding unique gas tokens and configurations. ZetaChain’s guide nails it: poor UX stems from incessant switching, eroding trust and retention. In enterprise contexts, Quicknode highlights how this stalls adoption; developers waste cycles bridging liquidity gaps rather than innovating dApps.

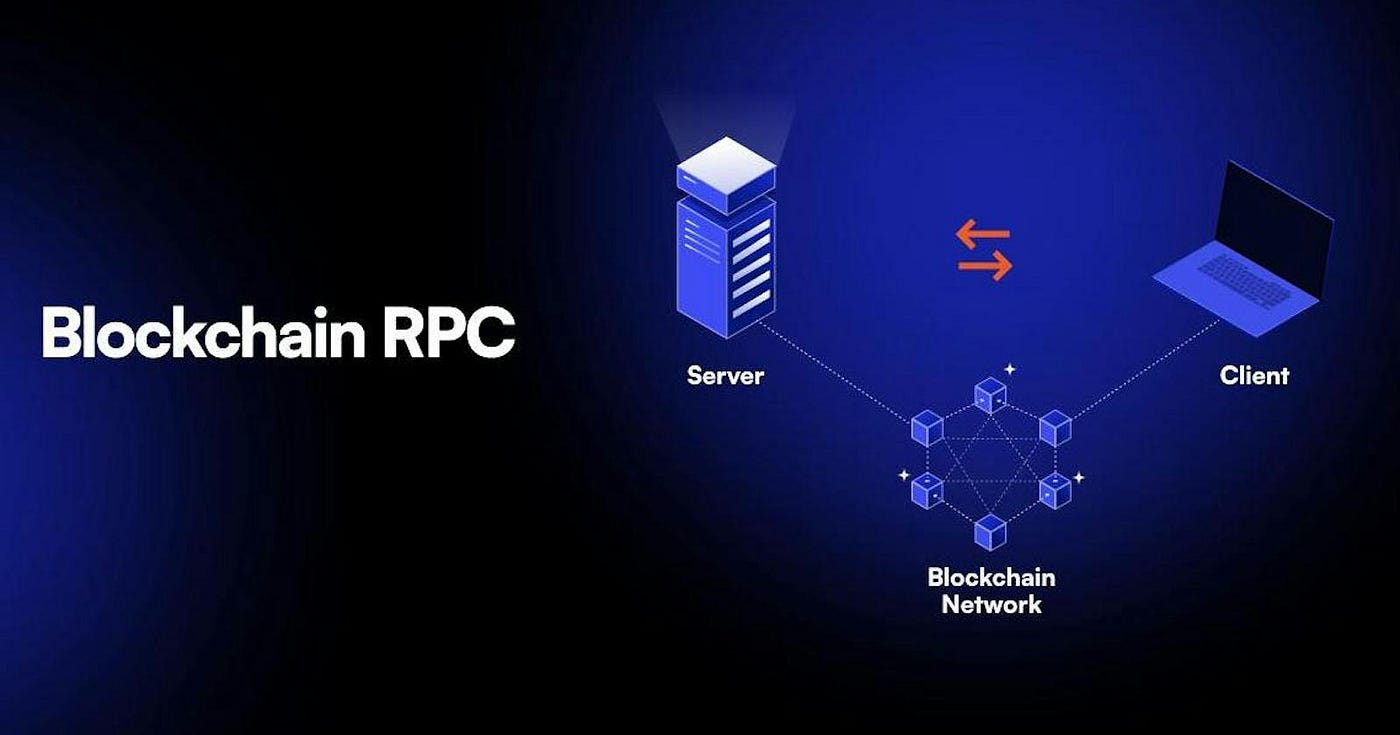

Zoom out, and the pattern emerges. Blockchain interoperability, per Sei Blog, demands communication, data sharing, and atomic transactions. Yet without abstraction, it’s a developer’s nightmare: custom RPC endpoints, bridge vulnerabilities, and fragmented liquidity. The Defiant breaks it down succinctly; chain abstraction batches backend noise, presenting a single interface that marries chains seamlessly.

Core Multi-Chain DeFi UX Pain Points

-

Network Switching Overhead: Users must manually switch networks for each dApp interaction, causing workflow disruptions and confusion across chains like Ethereum and Solana.

-

Diverse Gas Fee Management: Managing multiple gas tokens (e.g., ETH, SOL) with varying fees per chain burdens users without native holdings on every network.

-

Liquidity Fragmentation Across Bridges: Assets locked in silos require inefficient bridges, leading to fragmented liquidity and high slippage in cross-chain swaps.

-

Wallet Proliferation Per Chain: Need for chain-specific wallets (e.g., MetaMask for EVM, Phantom for Solana) fragments user assets and identities.

-

Security Risks in Manual Transfers: Manual cross-chain operations expose users to bridge exploits, phishing, and lost funds without atomic guarantees.

This friction compounds in bull cycles, where capital flows demand speed. Developers intuit the fix: seamless blockchain interoperability via abstraction stacks, as Sergey’s Substack outlines in the multichain infrastructure guide.

Chain Abstraction’s Foundational Layers

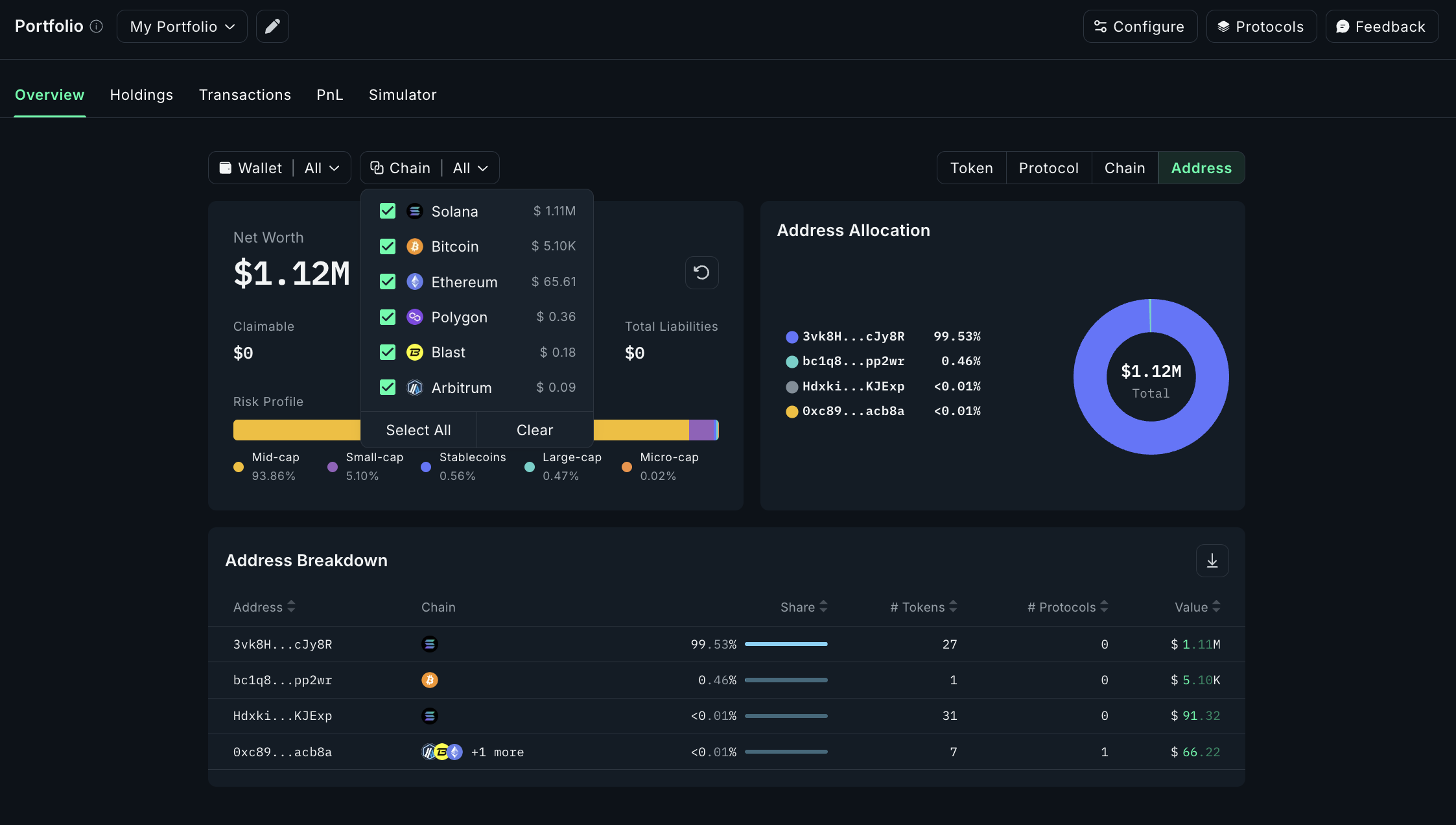

At its core, chain abstraction per Crypto Council for Innovation unifies transactions across networks, distancing users from blockchain specifics. HackerNoon explores it as complexity removal for multi-protocol interactions. Recent 2026 updates amplify this: Arcana Network’s Unified Wallet consolidates assets, sidestepping per-chain accounts. Their SDK abstracts gas fees, letting users transact sans native tokens.

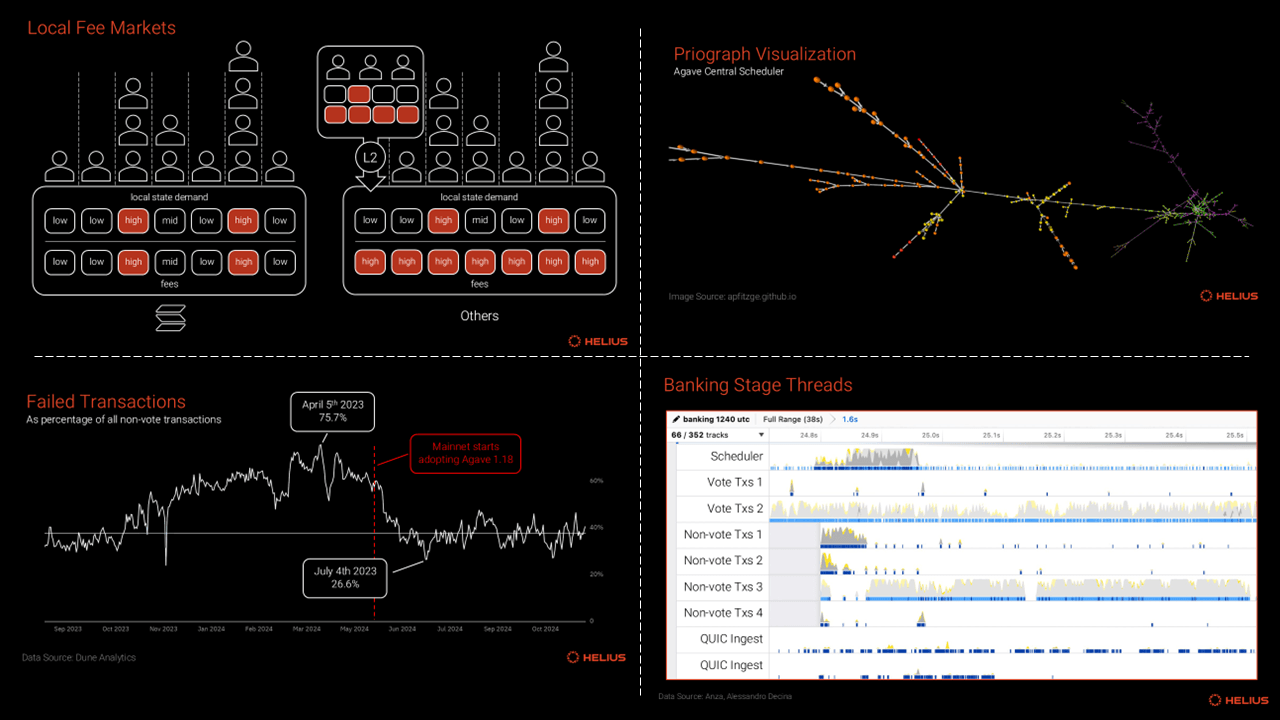

Intent-based architectures elevate this further. Anoma and Ethereum’s Open Intents Framework let users declare outcomes; solvers orchestrate cross-chain execution. LayerZero and Axelar handle messaging, ensuring decentralized speed. Modular blockchains with shared sequencers enable atomic operations, per emerging analyses.

For cross-chain wallet development, these layers form a stack: communication protocols first, then liquidity routers, capped by UX abstractions. Across Protocol’s guide affirms: interoperability fosters unified ecosystems for asset exchanges.

Strategic Tools for DeFi Developers

Building DeFi developer tools demands pragmatic choices. Start with cross-chain messaging like LayerZero for reliable data relay. Integrate gas abstraction SDKs to normalize fees; Arcana exemplifies this on Base. Unified interfaces, as in DroomDroom’s project roundup, consolidate views across chains.

Opinionated take: prioritize intent solvers over rigid bridges. They adapt to economic shifts, batching for efficiency. Blockworks’ definitive guide positions this as UX revolution, eliminating multi-wallet drudgery. Developers embedding these gain a moat; users flock to frictionless flows. Explore seamless implementations here.

The macro view reveals chain abstraction as DeFi’s interoperability inflection. It doesn’t just solve UX; it unlocks liquidity loops spanning ecosystems, priming for the next adoption wave. As protocols mature, wallets evolve from chain-tethered tools to omnipotent portals.

Operationalizing this pivot requires developers to embed chain abstraction directly into wallet architectures, transforming theoretical stacks into deployable realities. From LayerZero’s messaging to shared sequencers in modular chains, the toolkit is ripe for cross-chain wallet development. My two decades tracking market cycles affirm: those who master these integrations will capture the liquidity tides reshaping DeFi.

Blueprint for Unified Wallet Solutions

Constructing a unified wallet solution starts with selecting foundational primitives. Prioritize intent-centric designs over legacy bridges; they future-proof against protocol churn. Anoma’s framework, echoed in Ethereum’s OIF, lets users specify “swap ETH for SOL at best rate, ” with the system resolving cross-chain paths atomically. This shifts developer focus from plumbing to user delight.

Each step compounds resilience. Gas abstraction, as Arcana demonstrates on Base, normalizes fees using account abstraction; users pay in stablecoins or USDC universally. Liquidity routers then aggregate pools via protocols like Across, minimizing slippage in volatile markets. Zoom out: this blueprint mirrors commodity supercycles, where efficient pipelines unlock latent value.

Security demands vigilance. Cross-chain messaging protocols must verify proofs rigorously; LayerZero’s omnichain standards mitigate oracle risks. In my analysis, vulnerabilities here echo 2022 bridge exploits, costing billions. Developers embedding relayer networks gain trust, essential for retention amid economic expansions.

Code Essentials for Multi-Chain DeFi UX

Hands-on implementation reveals the elegance of abstraction. A typical integration marries wallet state with intent execution, batching backend calls for seamlessness. Consider LayerZero for messaging: endpoints abstract chain IDs, exposing simple APIs. This distills multi-chain DeFi UX to one-click actions.

LayerZero Cross-Chain Messaging: Endpoint Setup, Send, and Verification

LayerZero’s cross-chain messaging unlocks true chain abstraction by enabling reliable, permissionless communication between EVM chains. Strategically, this powers wallet features like unified balances and automated bridging without fragmented UX. The following React component demonstrates endpoint contract interaction, precise fee quoting to mitigate failures, payload encoding, message dispatch, and simulated delivery verification—complete with thoughtful error handling and user feedback loops.

import React, { useState } from 'react';

import { ethers } from 'ethers';

// Note: Use @layerzerolabs/lz-evm-sdk-js or equivalent for production

const CrossChainMessenger = ({ signer, sourceEid = 30112, dstEid = 30101, dstAddress }) => {

const [status, setStatus] = useState('idle');

const [receipt, setReceipt] = useState(null);

const [error, setError] = useState(null);

const sendCrossChainMessage = async () => {

try {

setStatus('quoting');

setError(null);

// Initialize LayerZero Endpoint (simplified; use SDK in prod)

const endpointAddress = '0x6D3B72F42C532BfD4B5C207cF6E754349F2E82eF'; // Example Sepolia endpoint

const endpointAbi = [

'function quote(uint32 _dstEid, bytes calldata _to, bytes calldata _payload, bytes calldata _options) external view returns (uint256 _nativeFee, uint256 _lzTokenFee)',

'function send(bytes calldata _options, uint32 _dstEid, bytes calldata _to, bytes calldata _payload) external payable returns (bytes32 _guid)'

];

const endpoint = new ethers.Contract(endpointAddress, endpointAbi, signer);

const payload = ethers.utils.defaultAbiCoder.encode(['string'], ['Hello from source chain!']);

const options = '0x00010000000000000000000000000000000000000000000000000000000000030d40'; // Simplified options

// Quote fee strategically to avoid underpayment

const quote = await endpoint.callStatic.quote(dstEid, dstAddress, payload, options);

setStatus('sending');

// Send message

const tx = await endpoint.send(options, dstEid, dstAddress, payload, {

value: quote[0],

});

const sendReceipt = await tx.wait();

setReceipt(sendReceipt);

setStatus('sent');

// Verify delivery (in prod, poll LayerZero Scan or use webhooks)

setStatus('verifying');

// Simulated verification

await new Promise(resolve => setTimeout(resolve, 3000));

setStatus('delivered');

} catch (err) {

console.error('Cross-chain messaging error:', err);

setError(err.message || 'Transaction failed');

setStatus('error');

}

};

return (

Status: {status}

{error && - {error}}

{receipt && (

)}

);

};

export default CrossChainMessenger;

This implementation thoughtfully balances immediacy with reliability, using status updates to guide users through the asynchronous nature of cross-chain ops. In a production wallet, extend with LayerZero’s indexer for real-time receipts, gas optimization via dynamic options, and fallback routing—elevating DeFi UX from chain-siloed to seamlessly omnichain.

Extend this with Arcana’s SDK for gas handling: wrap transactions in paymasters, shielding users from native token hunts. Opinionated advice: shun monolithic bridges; favor modular composability. Blockworks positions this as the UX paradigm shift, batching noise into silence. Dive into unified wallet case studies.

Testing across forks simulates real-world stress. Modular blockchains amplify this; shared sequencers ensure ordering consistency, per recent insights. Developers iterating here build moats against competitors tethered to single chains.

Navigating Risks in the Abstraction Era

No transformation lacks pitfalls. Intent architectures introduce solver centralization risks; counter with decentralized networks like Anoma’s. Liquidity fragmentation persists if routers overlook L2s; comprehensive scanning mitigates. From a macro lens, regulatory scrutiny looms as interoperability scales, demanding compliant designs.

Yet opportunities dominate. Chain abstraction fosters network effects: unified interfaces draw dApp liquidity, virally expanding ecosystems. ZetaChain’s interoperability vision materializes here, dissolving silos into fluid capital flows. Developers prioritizing these elements position wallets as DeFi’s neural hubs.

Envision 2027: wallets preempt user needs, routing via AI-optimized paths amid trillion-dollar TVL. Quicknode’s enterprise bridge underscores this; abstraction layers solve communication-to-UX holistically. As cycles turn bullish, frictionless tools accelerate adoption, echoing internet’s browser unification.

This guide equips you to lead. By layering protocols thoughtfully, you craft not just wallets, but portals to DeFi’s unified future. The structural shift is underway; developers acting now shape its contours. See enhanced UX strategies.