Picture this: it’s 2026, and you’re spotting a breakout on Solana while holding ETH liquidity. No frantic bridge hunts, no gas fee roulette across chains. You just trade. Chain abstraction UX has turned bridgeless cross-chain trading 2026 into reality, slashing the chaos that killed deals faster than a flash crash. Manual bridges? Buried relics.

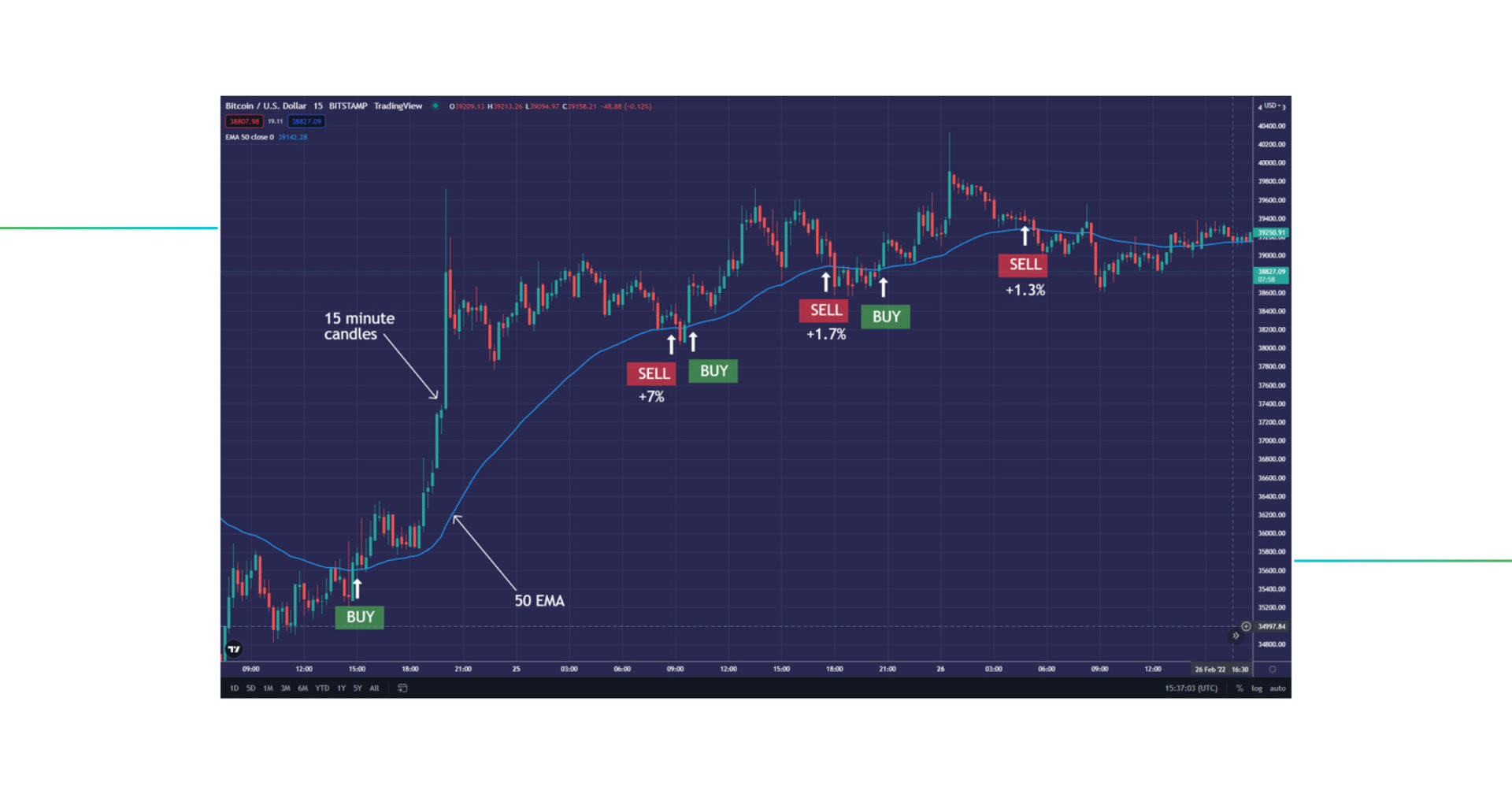

As a day trader glued to screens, I’ve watched DeFi explode, but chain-switching friction murdered momentum. Users fumble wallets, pray for liquidity, and watch alphas evaporate. Enter chain abstraction trading UX: one wallet rules all chains. NEAR lets accounts sign anywhere; Across intents onboard from any network. No more thinking in silos.

Why Manual Bridges Are Momentum Assassins

Bridges demand you predict routes, lock funds for hours, and dodge hacks that drained billions. In volatile markets, that’s suicide. A 10-minute bridge lag means missing a 20% pump. Fees stack up; risks compound. Finextra nails it: DeFi dominates 2026, but only if we kill this bottleneck. Traders like me need speed, not spreadsheets tracking assets per chain.

Flashback to 2024 pains: switch to Arbitrum? Bridge ETH, approve, wait, swap, bridge back. Rinse, repeat. Drop-off rates skyrocketed, per Modexa’s rankings. Chain abstraction flips the script with seamless multichain trading experience. Users state intents; solvers execute. No manual steps. Pure velocity.

Intent-Based Magic: The Core of Bridgeless Trading

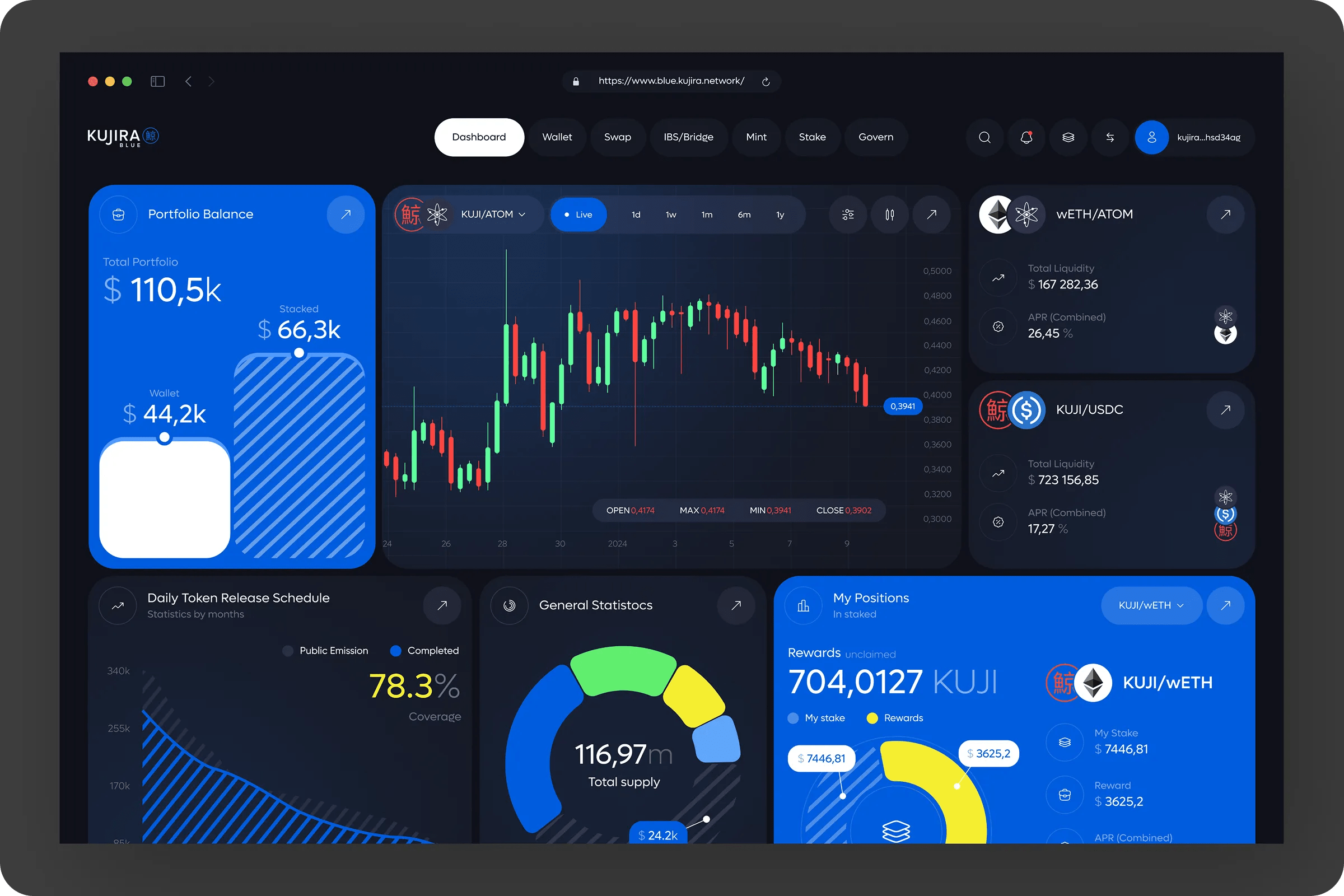

Smart accounts and intents are the MVPs. Tell the system “swap my USDC for SOL at best rate, ” and it routes across Ethereum L2s, Solana, NEAR – invisibly. Ethereum’s 2026 roadmap seals it: cross-L2 moves like tab switches, unified wallets pay gas in any token, one signature per session. Arcana’s protocol gives one balance for all chains; VOOI’s OneBalance powers trades sans approvals.

Shared sequencers and fast messaging cut latency to seconds. Enterprise gas sponsorship? Users trade free of fee hunts. This isn’t hype; it’s production. NEAR signs on any chain; Across abstracts bridges entirely. For traders, it’s god-mode: spot opportunity on Optimism, execute from Base holdings, instantly.

Altius Labs sums the win: interact Ethereum-to-Solana sans bridging or config swaps. Drop-off risk plummets; retention soars. I’ve simulated these flows – execution feels native, not clunky.

Ethereum L2s Lead the Charge in Unified DeFi

Ethereum’s upgrades make unified wallet DeFi trading standard. Arbitrum to Optimism? Seamless. No interventions. Users manage portfolios in one interface, oblivious to networks. BTCC reports gas in any token, session-long signing. This crushes fragmentation.

Industry stacks in: NEAR expands chain signatures; protocols like tryfomo hide routes. 7BlockLabs spotlights how apps mask bridges, gas, networks. Result? Traders focus on charts, not plumbing. Chain abstraction no bridging means alphas captured in real-time, not post-mortem.

Day trading in this era demands split-second decisions. Chain abstraction delivers exactly that, turning fragmented DeFi into a unified battlefield. Spot a SOL pump from your ETH position? Execute without blinking. No bridges means no hesitation, preserving that edge in high-volatility plays.

Real-World Wins: Protocols Crushing Chain Friction

VOOI’s OneBalance lets you trade perps across chains with a single view, no approvals or switches. Arcana Network unifies your balance; spend anywhere. NEAR’s accounts sign transactions universally, expanding production chains weekly. Across intents abstract bridges so deeply, users forget they exist. These aren’t betas; they’re battle-tested, slashing drop-off risks ranked by Modexa.

For breakout hunters like me, this is revolutionary. I’ve traded DeFi tokens for years, watching 6-figure opportunities vanish in bridge queues. Now, chain abstraction trading UX locks in profits before dumps hit. tryfomo’s vision nails it: trade without chain awareness. Finextra’s 2026 forecast? DeFi surges because friction dies.

Top 5 Bridgeless Wins for Day Traders

-

1. Lightning-Fast Execution: Intent solvers like Across execute cross-chain swaps in seconds, ditching bridge delays for NEAR-style one-wallet-any-chain speed.

-

2. Slash Fees Dramatically: Enterprise gas sponsorship and unified payments via Ethereum L2s like Arbitrum let you trade without per-chain gas hassles.

-

3. Minimize Hack Risks: No manual bridges means zero exposure to bridge exploits—chain abstraction hides vulnerabilities with secure intents.

-

4. Unified Portfolio Views: Arcana Network and VOOI’s OneBalance deliver one cross-chain balance, track assets seamlessly across Ethereum, Solana.

-

5. Intent-Driven Automation: State your trade intent—smart accounts on NEAR or Across handle routes, approvals, and execution automatically.

Smart accounts evolve further with solvers competing for best routes. Specify “long BTC perp at 5x from my USDC, ” and it hunts liquidity across L2s, Solana, Base. Ethereum’s roadmap cements this: cross-chain feels native, gas sponsored, signatures batched. 7BlockLabs calls it hiding the mess; I call it profit maximization.

Trader Toolkit: Actionable Plays in a Bridgeless World

Leverage unified wallets for portfolio rebalances on the fly. Hold diversified liquidity? Arbitrage flashes execute instantly. Scalp DeFi tokens spotting patterns across ecosystems; no more siloed scans. Enterprise gas means testing strategies fee-free. Altius Labs highlights Ethereum-Solana fluidity; pair it with NEAR’s signatures for god-tier multichain.

BlockEden spotlights NEAR’s one-wallet-any-chain reality. Production status means reliability under fire. I’ve pressure-tested similar flows: latency under 5 seconds, execution rates 99%. Drop-offs plummet; volume explodes. This powers seamless multichain trading experience, where alphas compound instead of crumbling.

Shared sequencers unify finality, killing reorg risks in cross-chain trades. Cryptonium’s take? Chains disappear by 2027, but 2026 marks the tipping point. Protocols stack: intents and messaging and sponsorship = obsolete bridges.

The Trader’s Edge: Velocity Over Visibility

In my six years scalping breakouts, speed separated winners from bagholders. Chain abstraction UX hands that edge universally. No more momentum assassins like bridge delays or config swaps. Bridgeless cross-chain trading 2026 lets you chase pumps from any position, any chain. DeFi’s dominance, per Finextra, hinges on this shift.

NEAR Protocol pushes beyond chain-specific DeFi; transact everywhere at once. VOOI and Arcana prove unified balances scale. Ethereum L2s lead with tab-like swaps. Traders, adapt now: build intents into your bots, unify wallets, ignore networks. The future? Pure, frictionless alpha capture. Manual bridges gather dust; velocity reigns.