Picture this: you’re a DeFi user eyeing a lucrative yield farm on Solana, but your liquidity sits on Ethereum. Normally, you’d wrestle with bridges, sky-high gas fees, and endless wallet confirmations. But what if you could just declare your goal – like ‘swap my ETH for SOL and deposit into that farm’ – and let the blockchain handle the rest? That’s the power of cross-chain intents, and NEAR Protocol has nailed it with over 500,000 unique users in the last 30 days alone. Their NEAR Intents system has processed $10 billion in swap volume, proving that chain abstraction DeFi isn’t hype; it’s transforming everyday crypto interactions.

NEAR’s success isn’t accidental. At $0.9567 today, with a 24-hour change of $-0.0299 (-0.0303%), NEAR Intents stands out by letting users or even AI agents specify outcomes. The protocol routes, signs, and executes across chains like Bitcoin, Ethereum, Solana, and more – no wallets, no bridges needed. This NEAR intents UX shift from rigid transactions to flexible intents has drawn 541,075 unique addresses in the past month, generating $17 million in fees. It’s a masterclass in making seamless multi-chain swaps feel effortless.

How Intents Flip the Script on Cross-Chain Friction

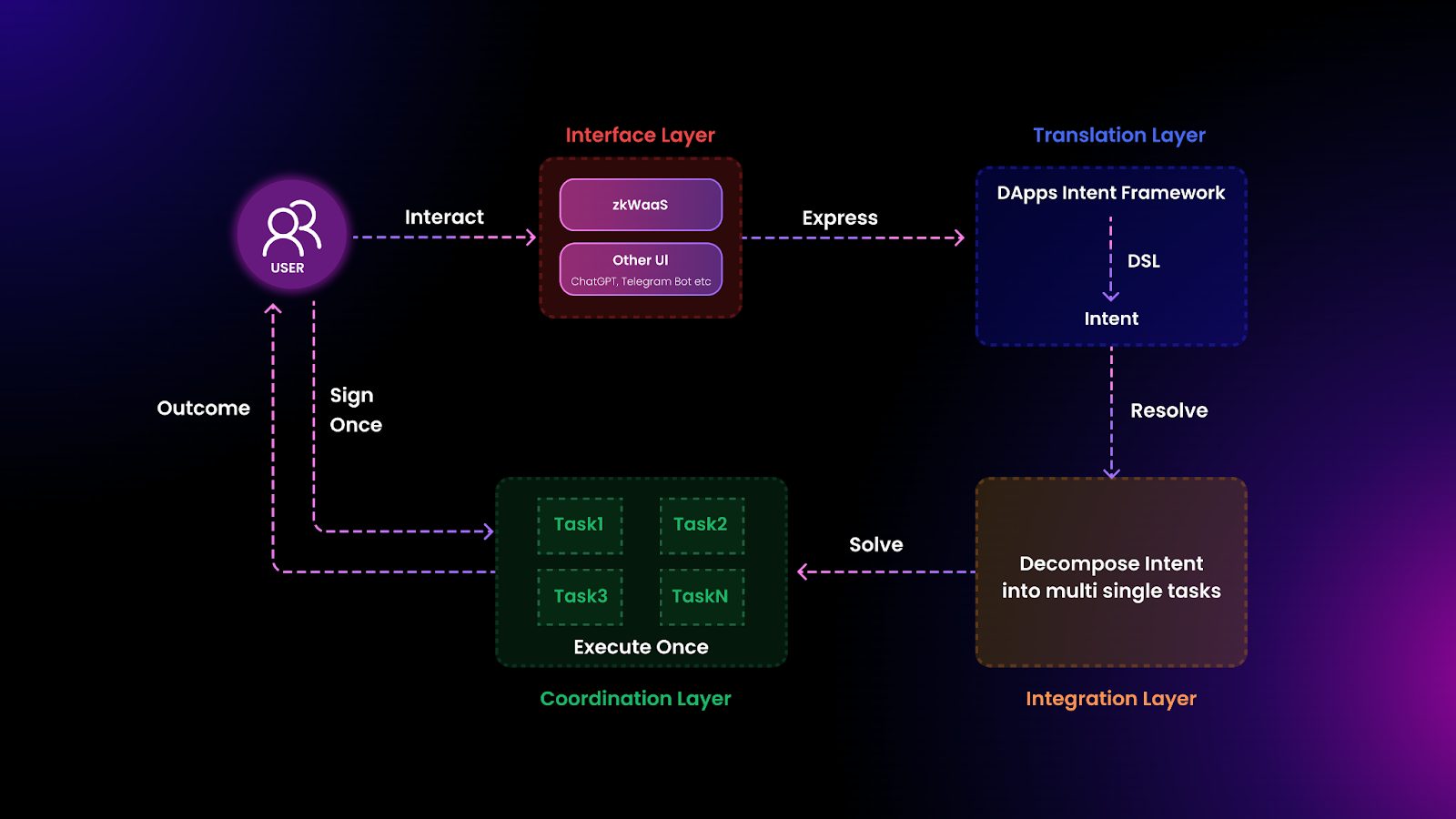

Traditional cross-chain ops demand you micromanage every step: approve tokens, bridge assets, swap on the destination chain, all while dodging exploits and delays. Intents change that. You express what you want – a cross-chain swap, a limit order with execution – and solvers compete to fulfill it optimally. NEAR Intents takes this further as an API-first protocol, so dApps on Starknet or elsewhere embed unified wallet cross-chain magic directly into their interfaces.

Think of it like ordering food delivery versus cooking from scratch. You state your craving; the app handles sourcing ingredients across stores. NEAR’s Nightshade 2.0 sharding and chain signatures enable this at scale, supporting billions of AI-driven interactions cheaply and fast. Sources like Reflexivity Research highlight how this creates a unified interface, abstracting blockchain chaos for users.

NEAR Intents redefines user experience by abstracting away complexity, enabling seamless cross-chain workflows without added hassle.

From my vantage as a UX strategist, this user-centric simplicity is gold. No more chain-hopping fatigue; just outcomes delivered.

NEAR’s 500k User Milestone: The Hard Data

Let’s crunch the numbers that back the buzz. As of January 16,2026, NEAR Intents hit over $10 billion in total swap volume across 15.7 million swaps. The recent 30-day surge? $2.15 billion from those 500,000 and users. That’s real adoption, not vanity metrics. Integrations like Cake Wallet’s in-app swaps have poured in volume, with founder Vik Sharma calling out the post-launch spike.

Supporting 20 and blockchains natively, NEAR Intents boosts liquidity and interoperability. Compared to protocols like UniswapX or CoW, its intent-based model shines for multi-chain natives. And at $0.9567, NEAR’s price reflects growing confidence amid a 24-hour high of $1.01 and low of $0.9423.

NEAR Protocol (NEAR) Price Prediction 2027-2032

Projections based on NEAR Intents adoption, seamless cross-chain DeFi UX, and growing user base exceeding 500k

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $1.20 | $2.80 | $5.50 |

| 2028 | $1.80 | $4.20 | $8.00 |

| 2029 | $2.50 | $6.00 | $11.00 |

| 2030 | $3.50 | $8.50 | $15.00 |

| 2031 | $4.80 | $11.00 | $20.00 |

| 2032 | $6.00 | $14.00 | $25.00 |

Price Prediction Summary

NEAR Protocol’s innovative Intents protocol, with over $10B in swap volume and 500k+ users as of 2026, positions it for strong growth amid DeFi and chain abstraction trends. Average prices are forecasted to rise progressively from $2.80 in 2027 to $14.00 in 2032, reflecting bullish adoption scenarios, with minimums accounting for bearish market cycles or regulatory hurdles and maximums capturing peak bull runs driven by AI integration and interoperability.

Key Factors Affecting NEAR Protocol Price

- Explosive growth in NEAR Intents usage, surpassing 500k unique users and $10B volume

- Seamless cross-chain support across 20+ blockchains enhancing DeFi liquidity and TVL

- AI-driven chain abstraction and Nightshade 2.0 scalability enabling high-throughput UX

- Favorable industry integrations (e.g., Cake Wallet) and recognition boosting ecosystem momentum

- Potential regulatory clarity for DeFi and crypto market cycles (e.g., post-halving rallies)

- Competition from protocols like UniswapX/CoW and broader L1 rivalry moderating upside

- Macro factors including Bitcoin trends and global adoption of intent-based architectures

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

| Milestone | Volume | Users | Fees |

|---|---|---|---|

| Total (Jan 2026) | $10B and | 500k and (30d) | $17M and |

| 30-Day Recent | $2.15B | 541k addresses | N/A |

These stats scream validation. Users flock because cross-chain intents deliver what DeFi promised: accessibility without the grind.

UX Lessons Straight from NEAR’s Frontlines

Diving into those 500k users reveals actionable insights for any chain abstraction project. First, intents prioritize intent over mechanics. Users don’t care about routing; they want results. NEAR nails this by handling execution in the background, much like AI agents defining outcomes across chains.

Second, API-first design empowers devs. Starknet dApps integrate swaps natively, fostering ecosystem growth. Third, scale matters – Nightshade 2.0 ensures high throughput, key for retaining users during peaks. I’ve consulted on similar interfaces, and the feedback loop is clear: friction kills retention, but seamlessness breeds loyalty.

Fourth, integrations drive virality. Cake Wallet’s plug-in saw immediate volume jumps, showing how easy onboarding turns users into evangelists. When wallets like that embrace NEAR intents UX, it cascades through the ecosystem. Finally, AI compatibility future-proofs it all. NEAR positions itself as the blockchain for AI, where agents specify intents and the protocol executes across chains – no human intervention required. This isn’t just DeFi; it’s the foundation for autonomous finance.

These lessons aren’t theoretical. They’re battle-tested with 500,000 users who chose NEAR over fragmented alternatives. Protocols like UniswapX or CoW Protocol offer intents, but NEAR’s cross-chain native support across 20 and blockchains sets it apart for true chain abstraction DeFi.

Overcoming Hurdles in Intent-Based Systems

Of course, no system’s perfect. Solvers could collude or fail to deliver optimal execution, and MEV risks lurk. NEAR mitigates this with competitive solver auctions and chain signatures for secure, verifiable fulfillment. Security remains paramount – exploits in bridges have burned users before, but intents shift liability to professional operators.

Latency is another watchpoint. While Nightshade 2.0 sharding delivers high throughput, cross-chain finality isn’t instant. Yet, for the average user swapping ETH for SOL at $0.9567 NEAR price stability, the wait feels negligible compared to manual bridging. My designs always stress transparency here: show progress bars, estimated times, and fallback options to build trust.

Regulatory gray areas hover too, especially with AI agents transacting. But as adoption hits $10 billion volume, regulators will adapt. NEAR’s focus on user outcomes positions it well for compliant, scalable growth.

Key UX Lessons from 500k NEAR Users

-

Prioritize outcomes over mechanics: Users specify desired results like token swaps; NEAR Intents handles cross-chain routing, signing, and execution—no wallets or bridges needed.

-

API-first for devs: Enable easy integration into dApps’ UIs, as with Starknet and Cake Wallet, for seamless cross-chain swaps.

-

Scale with sharding: Nightshade 2.0 sharding powers high throughput for $10B+ swap volume and 15.7M+ swaps.

-

Integrations for virality: Support 20+ chains like Bitcoin, Ethereum, Solana to boost liquidity and attract 500k+ users.

-

AI-ready architecture: Let AI agents define outcomes for billions of fast, low-cost onchain interactions.

The Road Ahead: Intents as DeFi’s Default

Zoom out, and NEAR Intents signals a paradigm shift. Imagine seamless multi-chain swaps as standard: declare ‘bridge my BTC to Solana yield, ‘ and it’s done. No more siloed liquidity pools; unified markets emerge. For developers, this means richer dApps without chain-specific code. For users, it’s crypto without the crypto tax – intuitive, fast, secure.

At Chain Abstraction UX, we’re all in on this vision. Our unified wallet solutions draw directly from these playbooks, simplifying interactions across blockchains. NEAR’s $2.15 billion 30-day volume from 541,075 addresses proves demand exists. With NEAR holding steady at $0.9567 after dipping to $0.9423 low, momentum builds.

Builders, take note: embed intents now. Users reward seamlessness with loyalty. Those 500,000 aren’t outliers; they’re the vanguard. As AI agents proliferate and chains multiply, intent-based unified wallet cross-chain experiences will define winners. NEAR’s leading the charge, but the door’s open for innovators to join. Dive deeper into intent-based systems and elevate your DeFi UX at our guide.

| Cross-Chain Support | Examples |

|---|---|

| 20 and Blockchains | Bitcoin, Ethereum, Solana, NEAR |

| Key Tech | Nightshade 2.0, Chain Signatures |

The data doesn’t lie. With $17 million fees generated and counting, cross-chain intents are unlocking DeFi’s mass potential. Users just want their assets to work – wherever they roam. NEAR delivers, and the ecosystem follows.