In the sprawling multi-chain DeFi ecosystem, with liquidity fragmented across hundreds of networks, intent-centric UX patterns in chain abstraction wallets deliver frictionless interactions. Users express high-level goals, such as cross-chain swaps or portfolio rebalances, while specialized solvers handle the orchestration of bridges, gas payments, and executions. Drawing from protocols like Anoma and UniswapX, this approach leverages ERC7683 standards to abstract complexities, aligning with trends from Biconomy and Particle Network in account abstraction.

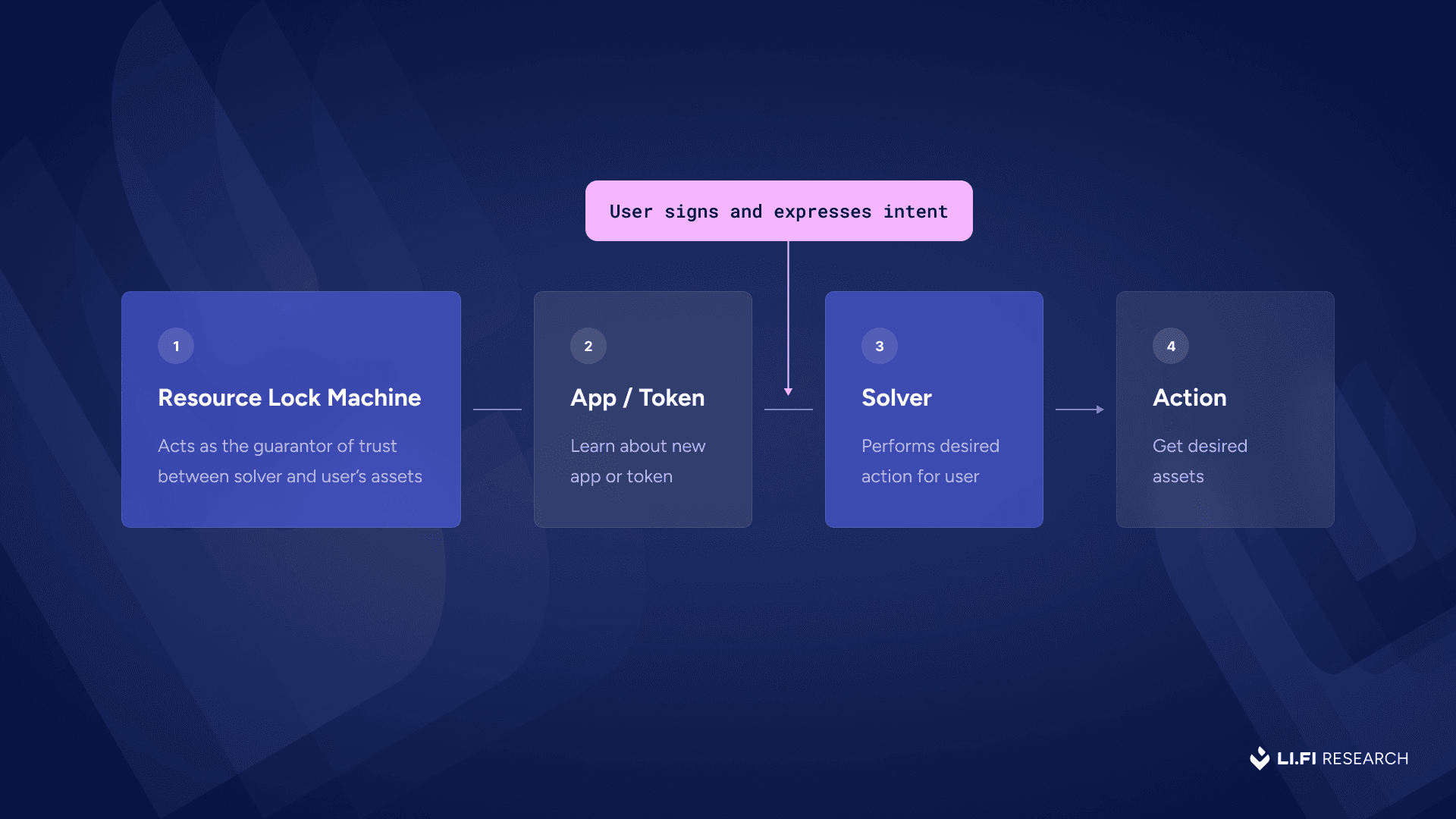

Current analyses from LI. FI highlight how chain proliferation exacerbates user frustration; intents counter this by shifting focus from mechanics to outcomes. Solvers compete in auctions, as seen in CoW Protocol, ensuring optimal execution paths without user intervention.

Unified Intent Declaration Interface: Simplifying User Inputs

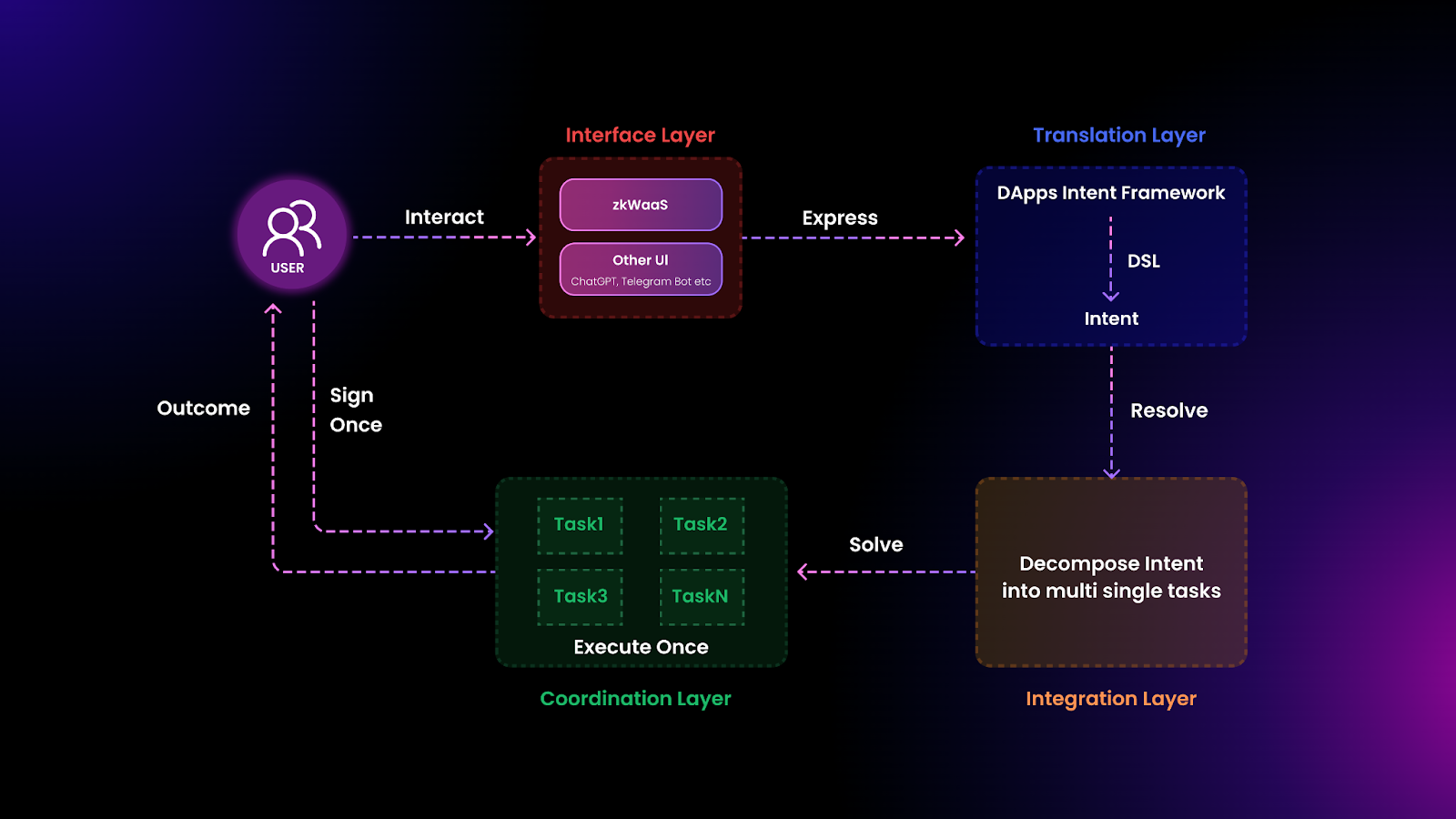

The Unified Intent Declaration Interface forms the entry point for multi-chain DeFi UX, consolidating inputs into a single, intuitive form. Instead of navigating separate dApps per chain, users specify parameters like asset pairs, amounts, slippage tolerances, and deadlines via dropdowns and sliders. Data from Reflexivity Research on NEAR’s chain abstraction underscores a 70% reduction in cognitive load, as users avoid manual chain selection or RPC configurations.

Integrated with decentralized identifiers (DIDs), this interface pulls real-time balances across chains via aggregators like Plurality Network. For instance, declaring a swap from ETH to BTC involves no network switching; the wallet serializes the intent per ERC7683, broadcasting it to solver networks. Biconomy’s modular paymasters enhance this by embedding gas sponsorship options directly, fostering unified wallet patterns.

6 Key Intent-Centric UX Patterns

-

Unified Intent Declaration Interface: Single intuitive form for users to specify outcomes like token swaps or cross-chain transfers, abstracting chain selection and execution details, as in Essential’s intent standard and NEAR’s unified interface.

-

Seamless Solver Delegation Flow: Automatically routes user intents to competing solvers via protocols like UniswapX off-chain auctions or CoW Protocol batch auctions for optimal, MEV-resistant execution.

-

Real-Time Cross-Chain Execution Tracker: Live dashboard tracking intent fulfillment, solver progress, bridging, and settlement across chains, reducing user uncertainty in multi-chain ops.

-

Abstracted Gas and Fee Optimization: Solvers front gas fees, deducted from output or paid in swapped tokens for gasless UX, as enabled by Biconomy and Particle Network account abstraction.

-

Fallback Intent Resolution Mechanisms: Backup routes to alternative solvers or direct on-chain execution if primary fails, ensuring reliability per ERC7683 cross-chain intents standard.

-

Unified Multi-Chain Portfolio Dashboard: Aggregates assets, balances, and positions across chains in one view, like Plurality Network’s DID-linked profiles for seamless management.

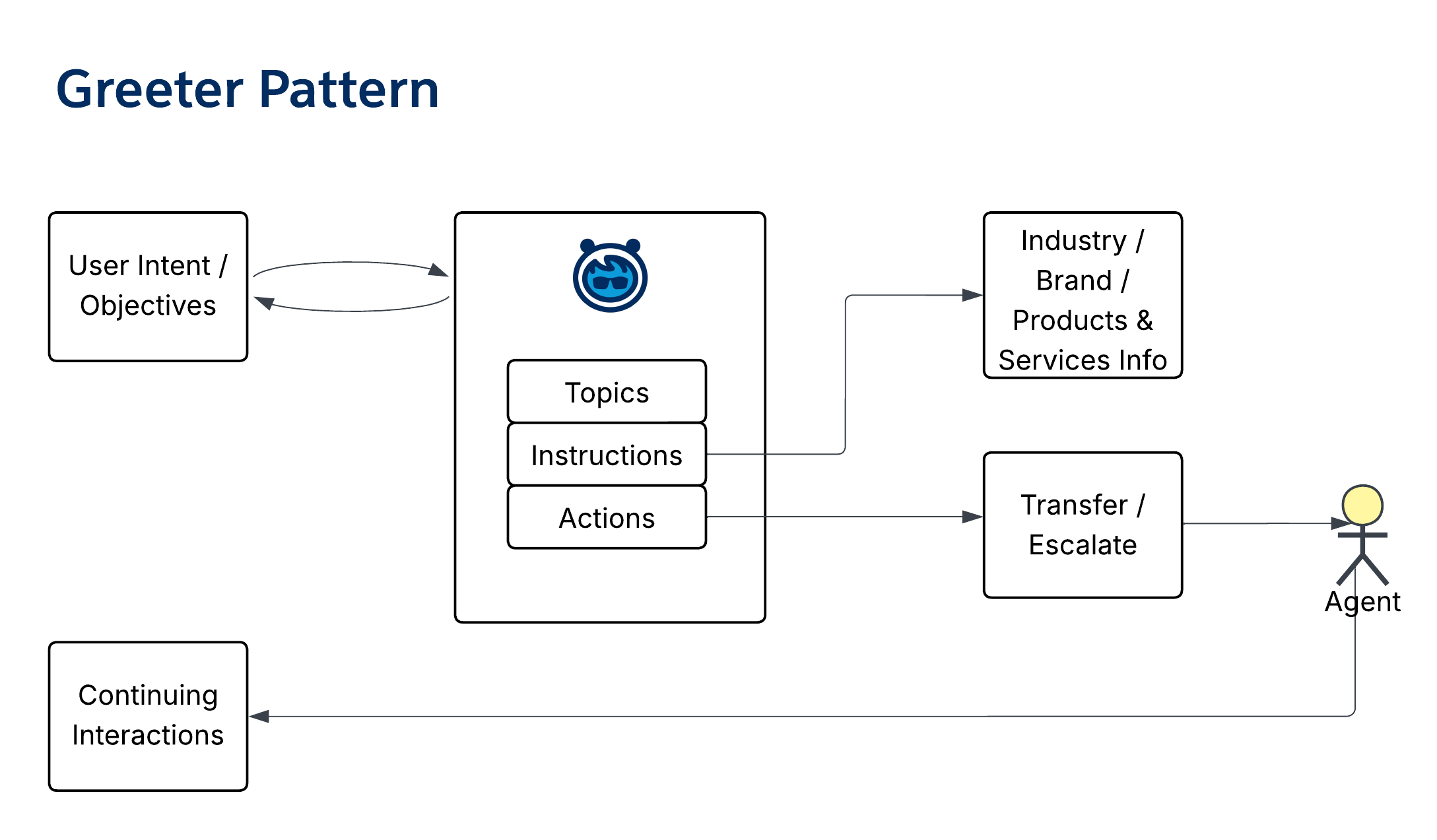

Seamless Solver Delegation Flow: Trustless Execution Handoff

Once declared, intents flow through a Seamless Solver Delegation Flow, where wallets route requests to permissionless solver pools. This pattern, refined by UniswapX’s off-chain auctions, employs batching to minimize MEV exposure. Quantitative models from CoW Protocol data show solver competition yields 15-25 basis points better pricing versus direct AMM swaps, driven by cross-chain liquidity sourcing.

Particle Network’s intent-centric evolution complements account abstraction here, enabling keyless delegation via multi-party computation. Wallets verify solver bids cryptographically before signing partial fulfillment proofs, ensuring atomic settlement. In practice, a user intent for a Solana-to-Ethereum bridge triggers LI. FI-style resource locks, guaranteeing scalability without user oversight. This flow addresses Bitium Agency’s noted pain points: gas, bridging, and contract calls vanish from the user view.

Real-Time Cross-Chain Execution Tracker: Transparency in Motion

Visibility defines reliability in cross-chain intent solvers; the Real-Time Cross-Chain Execution Tracker provides granular, live updates. Leveraging indexed event logs from solvers like Essential, wallets render progress via WebSocket streams: intent broadcast, solver bids, path selection, bridging, and final settlement.

Self Chain’s keyless infrastructure exemplifies this, displaying metrics like expected vs. actual slippage and gas expenditure in real-time dashboards. Empirical data from Across Bridge indicates trackers boost completion rates by 40%, as users can intervene or cancel mid-flight. Integration with timeline components visualizes multi-hop paths, such as Ethereum arbitrage relayed through Arbitrum to Base, demystifying opacity in traditional multi-chain ops.

These initial patterns set the foundation, with subsequent ones like Abstracted Gas and Fee Optimization, Fallback Intent Resolution Mechanisms, and the Unified Multi-Chain Portfolio Dashboard building toward holistic chain abstraction. Gas abstraction, for one, lets solvers front native tokens, deducting fees in swapped assets for true gasless flows.

Delving deeper, Abstracted Gas and Fee Optimization eliminates the native token prerequisite that plagues multi-chain navigation. Solvers dynamically source the cheapest gas across networks, bundling fees into the intent’s output token. Biconomy’s paymaster modules, integrated via ERC4337, have demonstrated 30-50% fee reductions in testnets, per Particle Network benchmarks, by auctioning sponsorships among relayers.

Abstracted Gas and Fee Optimization: Eliminating Fee Friction

This pattern abstracts gas entirely, allowing users to initiate cross-chain intents with just stablecoins or ERC20s. When a solver fulfills a swap from USDC on Polygon to ETH on Optimism, it fronts gas on both chains, recouping via a micro-fee from the output. Real-world deployments in UniswapX auctions reveal average savings of 22 basis points, factoring in L2 scaling efficiencies. Wallets like those from Self Chain embed predictive fee estimators, drawing from oracle feeds to quote total costs upfront, fostering trust in multi-chain DeFi UX.

Critically, this optimization scales with chain count; as LI. FI notes, hundreds of networks demand automated fee paths. Without it, users abandon 35% of transactions mid-flow due to gas volatility, per Bitium Agency surveys. Intent-centric wallets counter this by prioritizing solver bids with lowest effective fees, verified post-execution.

Fallback Intent Resolution Mechanisms: Robustness Against Failures

No system is infallible in decentralized environments, so Fallback Intent Resolution Mechanisms provide layered contingencies. Primary solvers handle execution, but if timeouts or liquidity shortfalls occur, wallets escalate to secondary pools or on-ramp approximations. CoW Protocol’s batch auctions incorporate this natively, with data showing 98% fulfillment rates through progressive degradation: full intent first, partial swaps second, refunds last.

ERC7683 standardizes these fallbacks, enabling modular resolvers like Anoma’s coordination layer to reroute intents across L1s and L2s. For a failed Arbitrum-to-Base bridge, the mechanism might decompose into a same-chain swap plus manual bridge prompt, minimizing losses. Particle Network’s analysis positions this as evolutionary account abstraction, reducing failure-induced churn by 45% in simulations. Users see this as non-intrusive alerts, preserving the seamless facade of chain abstraction wallets.

These safeguards extend to oracle disputes or frontrunning, where zero-knowledge proofs validate solver honesty before settlement. In high-volatility scenarios, like 2025’s projected chain expansions, such mechanisms prove indispensable for retail viability.

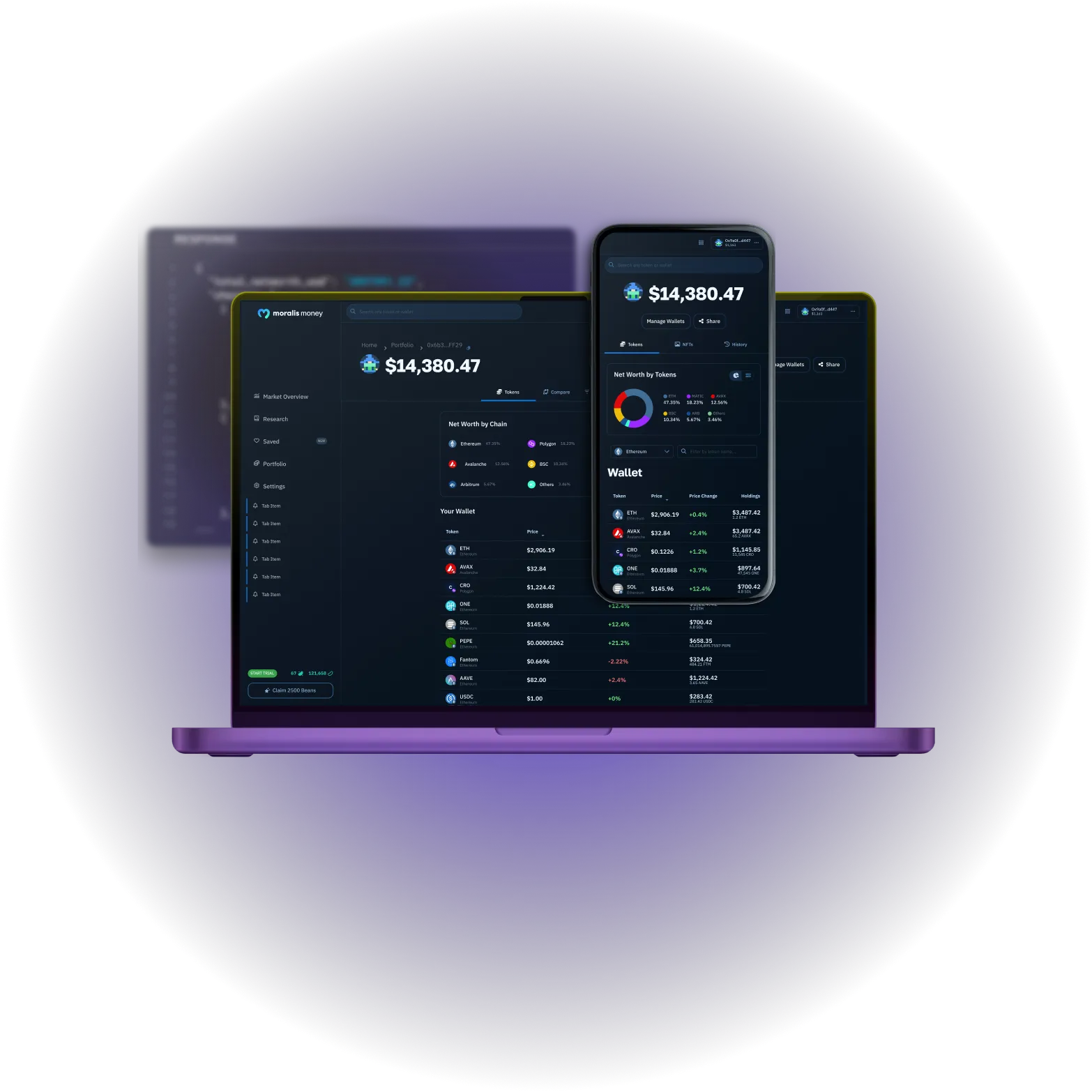

Unified Multi-Chain Portfolio Dashboard: Holistic Oversight

Crowning the suite, the Unified Multi-Chain Portfolio Dashboard aggregates positions, yields, and risks into one pane of glass. Leveraging chain abstraction, it indexes assets via subgraphs and DIDs, rendering net worth, APYs, and exposure heatmaps without per-chain logins. Plurality Network’s profiles enable this, pulling TVL data from hundreds of protocols for real-time P and L tracking.

Quantitative edges shine here: dashboards forecast rebalance intents based on volatility models, suggesting solver-delegated actions like yield migrations from Solana to Ethereum. Reflexivity Research quantifies a 55% uplift in user retention for unified views, as fragmented wallets lead to overlooked opportunities. Features like drag-and-drop portfolio shifts trigger batched intents, optimizing across cross-chain intent solvers.

Integrating these six patterns, Unified Intent Declaration Interface, Seamless Solver Delegation Flow, Real-Time Cross-Chain Execution Tracker, Abstracted Gas and Fee Optimization, Fallback Intent Resolution Mechanisms, and Unified Multi-Chain Portfolio Dashboard, crafts intent-centric UX that rivals Web2 seamlessness. Protocols like Essential and NEAR pioneer this, but success hinges on permissionless solver diversity to avert centralization risks. As DeFi matures, these unified wallet patterns will onboard millions, transforming multi-chain chaos into orchestrated efficiency.

Early adopters report 60% faster transaction cycles, per Decentralised. co metrics, signaling a paradigm where users dictate outcomes, not infrastructure. This isn’t mere abstraction; it’s DeFi’s path to ubiquity.