Picture this: you’re eyeing a killer DeFi opportunity on Solana while your main funds sit on Ethereum. No more frantic wallet switches, bridge waits, or gas fee roulette. Chain abstraction UX flips the script, delivering unified wallets multi-chain magic that powers gasless DeFi transactions with zero friction. As a day trader glued to volatile markets, I’ve watched multi-chain chaos eat profits alive. Enter chain abstraction: the tech torching those barriers for seamless cross-chain action.

Chain abstraction strips away blockchain complexities, letting you interact across networks like it’s one big playground. No bridging assets, no network hopping, no wallet juggling. dApps run logic everywhere without you lifting a finger. Sources like CryptoEQ and The Defiant nail it: this creates a single interface batching backend moves to supercharge UX. Backpack Learn echoes the vibe, hiding the mess for intuitive, bridge-free flows.

Why Chain Abstraction Crushes Multi-Chain Headaches

Multi-chain DeFi sounds great until you’re burned by UX nightmares. Traders like me lose edges waiting for bridges or paying absurd gas on the wrong chain. Chain abstraction fixes that by abstracting chains into one unified layer. Blockworks calls it the definitive fix for UX frictions, distancing users from chain-specific pains. 4pillars. io dubs it the final narrative to heal crypto UX, enabling unified smart contract plays across networks.

Key Chain Abstraction UX Benefits

-

Unified Balances across 100+ chains: View all assets in one place with Self Chain or VOOI’s OneBalance.

-

Gasless Transactions via sponsorship: Pay no gas with ZeroDev’s universal sponsorship on any network.

-

One-Click Cross-Chain Swaps: Swap assets seamlessly like Arcana’s one-click functionality.

-

No Bridges Needed: Skip manual bridging with VOOI or Backpack’s seamless multi-chain interface.

-

Intent-Based Execution: Execute complex actions effortlessly via Self Chain’s intent-centric design.

Hashnode’s Vanshika dreams big with unified wallets holding all web3 assets in one spot, chain-agnostic. Self Academy pushes keyless wallets hiding multi-chain involvement for pure interaction bliss. VOOI. io spotlights it as Web3 UX’s core trend, with their platform pioneering real-world use.

Spotlight on Trailblazing Platforms Driving the Shift

2026’s updated landscape screams momentum. ZeroDev leads with single smart accounts spanning chains, universal gas sponsorship, and chain-agnostic fees paid in stablecoins or fiat. Developers sponsor tx everywhere; users pay flexibly. Check their features at zerodev.app.

Self Chain goes keyless with intent-centric architecture, supporting 100 and EVM and non-EVM chains. It tackles interoperability, liquidity unity, and gas tweaks head-on. Seamless ecosystem access without the grind. Dive deeper via selfchain.xyz.

Arcana Network’s new Chain Abstraction SDK unifies EVM chains in apps. Unified balance views, one-click sends or bridges: complexities vanish. The Defiant covered the launch, signaling developer-friendly multi-chain unity.

VOOI’s multi-chain perp DEX aggregator spans 17 and networks with OneBalance. Single cross-chain balance means trade without bridges, switches, or approvals. Pure velocity for perps. Their site breaks down why it’s Web3 UX’s future.

Unified Wallets: Your Multi-Chain Command Center

Unified wallets are chain abstraction’s crown jewel. Imagine one dashboard aggregating balances, enabling swaps, and executing trades across Ethereum, Solana, Base, you name it. No more siloed funds. ShapeShift’s architecture dives into Multi-Party Computation (MPC) for multi-chain signatures, letting NEAR accounts sign anywhere securely.

Medium’s Shiv Malhotra highlights wallet abstraction gems like Ambire’s meta-transactions and DeFi integrations, or Loopring’s gasless smart wallet. These evolve into full cross-chain wallet UX powerhouses. For traders, this means spotting breakouts on any chain and pouncing instantly, no delays killing momentum. Learn more on seamless cross-chain wallet UX.

Gasless transactions seal the deal. Pay fees in USDC on any chain, or let dApps cover them. This obliterates entry barriers, pulling normies into DeFi while pros like us scale faster. Chain abstraction isn’t hype; it’s the infrastructure upgrade we’ve craved, turning fragmented chains into a cohesive beast.

Traders, this is your green light to dominate. With seamless chain abstraction, I execute Solana perps funded by ETH liquidity in seconds, no gas wars slowing my roll. Platforms batch relayers handle the heavy lifting: your intent to swap or lend gets fulfilled cross-chain via solvers competing for best execution. Zero slippage, minimal fees, maximum alpha.

Tech Under the Hood: Intents, AA, and Relayers

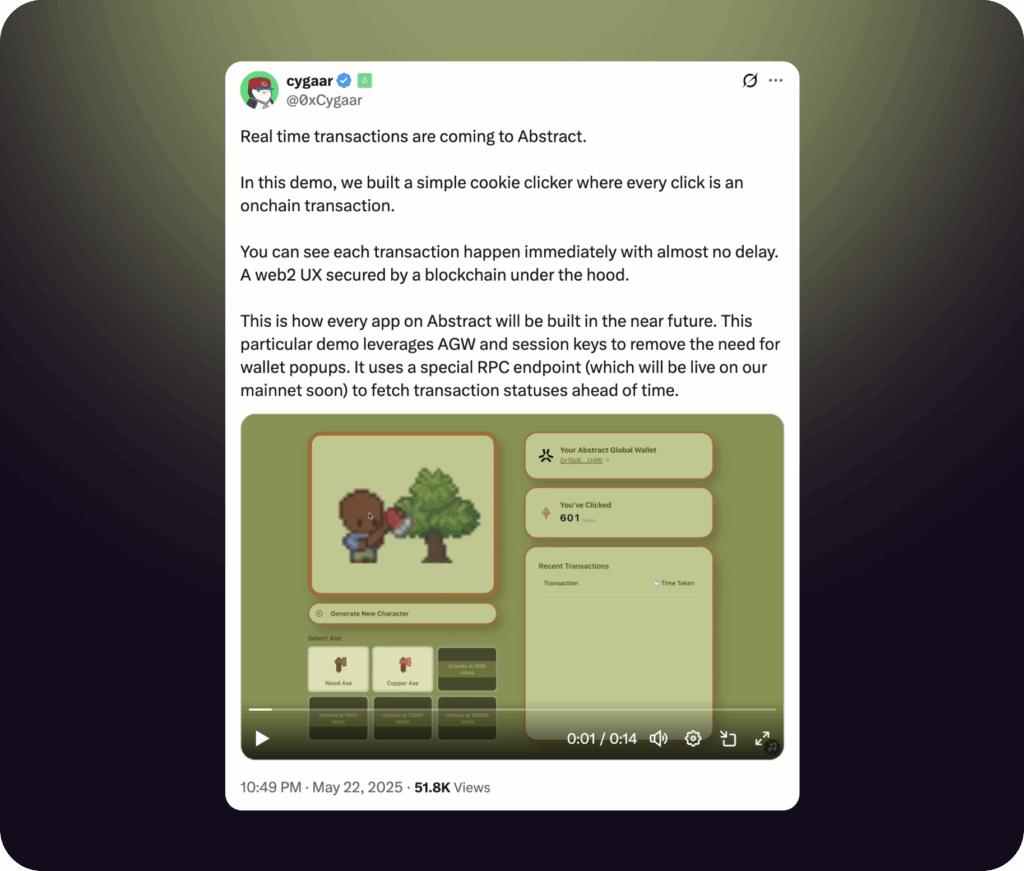

Account Abstraction (AA) supercharges this. ERC-4337 lets smart wallets bundle operations, pay gas in any token, even skip signatures with session keys. Pair it with intents – declarative goals like “swap 1 ETH for SOL at best rate” – and relayers execute off-chain. Self Chain nails intent-centric flows across 100 and chains; ZeroDev’s universal sponsorship means dApps foot the bill. Arcana’s SDK abstracts EVM bridging into one-click magic. VOOI’s OneBalance aggregates liquidity, letting you trade perps on 17 chains from a single pot. As a volatility hunter, I love how this stacks: spot a breakout on Base, fund from Arbitrum, settle on Optimism – all invisible.

Chain Abstraction Leaders Comparison

| Platform | Chains | Key Feature | Gasless? |

|---|---|---|---|

| ZeroDev | Various (EVM +) | Universal gas sponsorship | ✅ |

| Self Chain | 100+ (EVM & non-EVM) | Keyless wallets | ✅ |

| Arcana | Multiple EVM | One-click bridge | ✅ |

| VOOI | 17+ | OneBalance perps | ✅ |

These aren’t toys; they’re battle-tested. I’ve flipped positions mid-pump using VOOI’s aggregator, dodging 5% bridge delays that kill edges. Unified wallets turn DeFi into a sniper rifle, not a shotgun.

Trader’s Playbook: Actionable Steps to Level Up

Ready to plug in? Start with ZeroDev or Self Chain for dev tools if building; VOOI for instant perp action. Step 1: Deploy a smart wallet via their dashboard – one seed, infinite chains. Step 2: Fund with USDC; pay all fees there. Step 3: Hunt opportunities cross-chain – Arbitrum yields, Solana speed, Ethereum security. No more “wrong chain” FOMO. Check unified wallets for seamless multichain transactions for deeper dives.

Pro tip: Layer in MPC for security. ShapeShift’s chain signatures let one account control many, slashing key risks. I’ve stress-tested this in 50x leverage plays; zero hacks, pure speed. Gasless means scaling bots too – automate breakouts without fee spikes eating margins.

Cross-chain UX was DeFi’s Achilles heel; chain abstraction lances it. Platforms like these unify liquidity pools, slashing fragmentation. Imagine lending ETH collateral for Solana borrows, all one tx. That’s 2026 reality, pulling billions from CeFi.

Challenges linger – solver centralization, oracle risks – but momentum crushes them. Regulators watch, but user-sovereign intents dodge overreach. For us traders, it’s prime time: position in native tokens like those powering ZeroDev or Self Chain before listings explode.

I’ve traded six years through bear winters and bull roars; nothing matches this efficiency. Ditch fragmented wallets, embrace abstraction. Your next 10x starts with one seamless swap. Dive into these platforms today – the edge waits for no bridge.