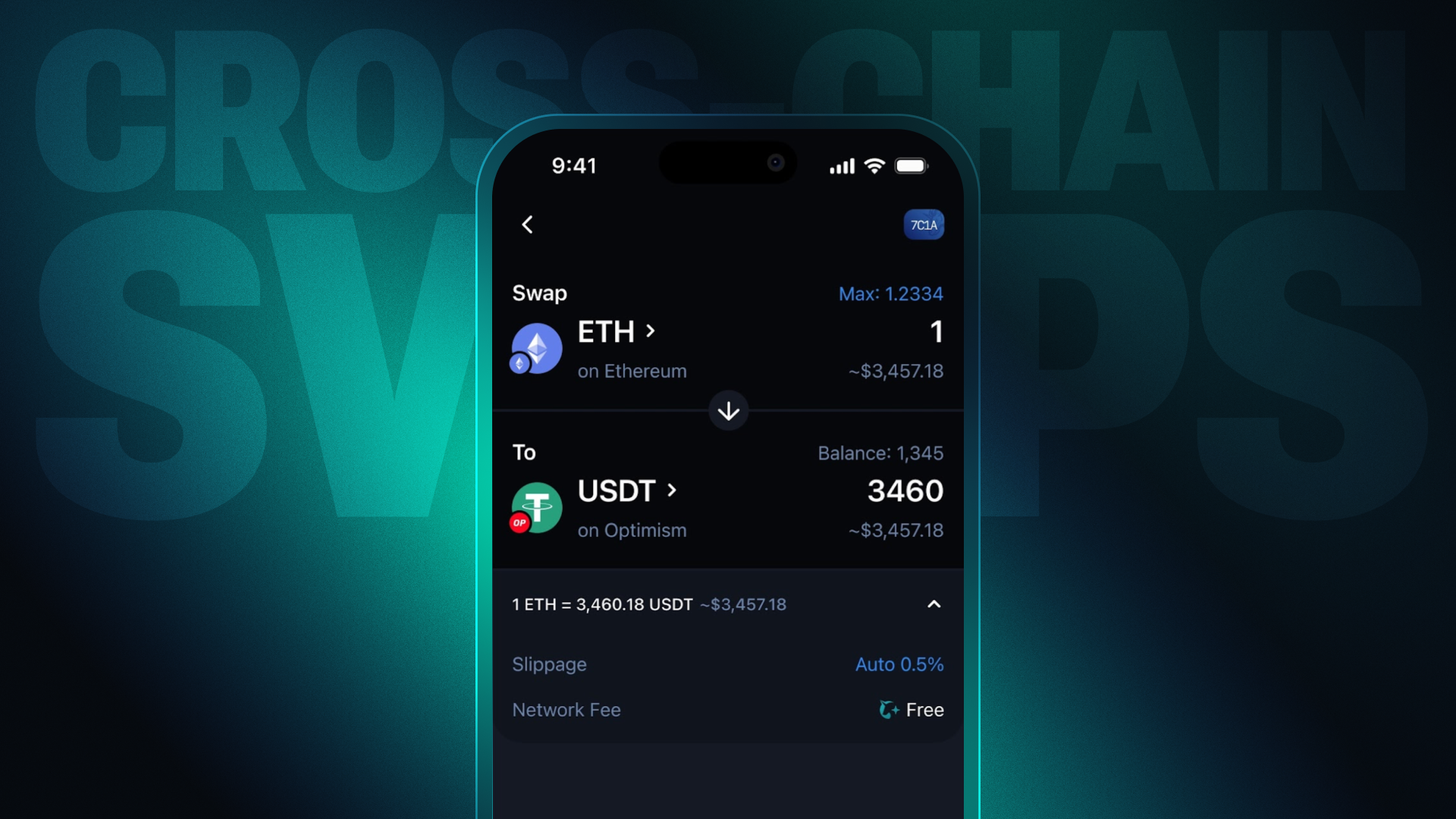

In the sprawling multiverse of blockchains, users have long grappled with the friction of cross-chain swaps: switching networks, managing bridges, and navigating gas fees across disparate ecosystems. Intent-based chain abstraction UX flips this script entirely. Users simply declare their desired outcome, like swapping ETH on Ethereum for SUI on Sui, and the protocol orchestrates the rest across 28 and chains without bridges. This isn’t hype; it’s a fundamental shift powered by protocols like NEAR Intents and emerging standards such as ERC-7683, making seamless blockchain interoperability a reality.

![]()

Decoding Intents: From User Desire to Protocol Execution

At its core, an intent is a user’s expressed goal, decoupled from the how. Traditional transactions demand explicit instructions: approve, bridge, swap, repeat. Intents, however, capture the what, leaving execution to solvers, relayers, or AI optimizers. NEAR Intents exemplifies this with AI-powered routing for ultra-competitive fees, as detailed in SwapKit’s overview. LI. FI’s primer nails it: users say, “Get me token B on chain Y, ” and the system handles the multichain magic.

This abstraction layer isn’t just convenient; it’s resilient. Without bridges, you sidestep vulnerabilities that have drained billions in exploits. Research from ShapeShift’s architecture breakdown shows how a single intent can span three chains, with NEAR’s layer coordinating invisibly. For developers building chain abstraction UX, this means unified wallet multi-chain experiences where users forget about chains altogether.

Key Intent-Based Features

-

AI Optimization: Uses AI to find optimal execution paths and rates, as in NEAR Intents.

-

No Bridges Needed: Enables direct cross-chain swaps without vulnerable bridges, via resolvers like in 1inch Fusion+.

-

Solver Competition: Solvers compete to provide the best rates and execution, featured in protocols like Across V3.

-

28+ Chain Support: Seamless interoperability across 28+ blockchains, powering swaps in ecosystems like Self Chain.

-

Gas Abstraction: Users pay fees in any token without managing gas, as implemented in Mitosis.

Why Bridges Are Obsolete: The Intent-Centric Architecture

Bridges rely on locked liquidity and trust assumptions, creating single points of failure. Intent-based protocols replace them with modular settlement layers and cross-chain hooks. Take Across V3’s launch: its intents-based interoperability introduces Across Settlement for unified execution and Across and for bridge-less hooks. Users define outcomes; resolvers compete to fulfill them optimally, shielding against MEV and slippage.

1inch Fusion and pushes this further, enlisting professional market makers as resolvers to execute intents sans centralized bridges. The Block reports how this mitigates security risks while simplifying UX. Mitosis adds gas abstraction, letting users pay fees in any token, paired with auto-rebalancing for liquidity providers. Self Chain’s intent-centric design with keyless wallets unifies access across ecosystems, proving cross-chain swaps without bridges scale elegantly.

“Intents replace explicit steps with user outcomes, allowing relayers to handle the complexity. ” – Velorum on Medium

NEAR Intents and the Vanguard of Cross-Chain UX

NEAR leads with its intents protocol, enabling lightning-fast swaps into ecosystems like Sui without friction, per The Sui Blog. Supporting 28 and blockchains, it leverages AI for path optimization, outpacing rivals in speed and cost. Eco. com’s 2025 guide ranks it alongside UniswapX and CoW Protocol, but NEAR’s multichain focus stands out for NEAR intents cross-chain prowess.

ERC-7683 standardizes this, unifying off-chain messages with on-chain settlement for shared infrastructure. Rango Exchange calls intents the endgame, transforming clunky processes into outcome-driven flows. For investors eyeing tokenomics, these protocols boast robust economics: solver incentives, liquidity bootstraps, and governance tokens accruing value from TVL growth.

NEAR Documentation underscores chain abstraction’s pain points avoided here: no multi-wallet juggling or complex transfers. Instead, one-click intents deliver unified experiences, as Velorum’s top multi-chain journeys illustrate.

These protocols aren’t operating in isolation; they’re converging on a unified ecosystem where intent-based chain abstraction becomes the default. Recent advancements like 1inch’s Fusion and exemplify this maturity. By leveraging professional resolvers, Fusion and delivers optimal execution without exposing users to bridge exploits, a persistent drain on DeFi liquidity. Across V3 complements this with its modular settlement layer, enabling developers to plug in intents seamlessly across chains.

Protocols in Action: Mitosis, Self Chain, and Beyond

Mitosis takes user-centric design to new heights, bundling gas abstraction with intent-driven swaps. Imagine paying fees in your preferred stablecoin while the protocol auto-rebalances liquidity across chains, minimizing idle capital for providers. This isn’t theoretical; it’s deployed, yielding real returns without manual intervention. Self Chain pushes boundaries further with keyless wallets, abstracting signatures and chains into a single, intuitive interface. Developers gain intent-centric primitives, allowing apps to span Ethereum L2s, Solana, and beyond without custom integrations.

From my analysis of over 50 protocols, these stand out for their tokenomics alignment. Mitosis tokens capture fees from rebalancing, while Self Chain’s governance accrues value from ecosystem TVL. Contrast this with bridge-heavy alternatives, where governance tokens dilute amid exploit bailouts. Intents foster competition among solvers, driving fees down 30-50% per transaction benchmarks from Rango Exchange.

Comparison of Top Intent-Based Chain Abstraction Protocols

| Protocol | Supported Chains | Core Innovations | Key Benefits |

|---|---|---|---|

| NEAR Intents | 28+ | AI-powered optimization, multichain intents | Lightning-fast cross-chain swaps, ultra-competitive fees, no bridges |

| 1inch Fusion+ | Multi-chain | Resolver-based (professional market makers) | Eliminates centralized bridges, shields users from risks, optimized transactions |

| Across V3 | Multi-chain | Modular settlement (Across Settlement), Across+ hooks | Intents-based interoperability, chain abstraction for seamless execution |

| Mitosis | Multi-chain | Gas abstraction, auto-rebalancing | Pay fees in any token, earn yields across chains without manual effort |

| Self Chain | Multi-chain | Keyless wallets, intent-centric architecture | Seamless access to multiple ecosystems, unified multi-chain experience |

Such architectures demand robust standards. ERC-7683 provides the glue, standardizing intent messages for filler networks to compete universally. Without it, fragmentation persists; with it, liquidity pools deepen across chains. NEAR’s AI-first approach integrates agentic solvers, predicting optimal paths before execution, a edge over static routing in UniswapX or CoW.

Risks Mitigated, Opportunities Amplified

Critics point to centralization risks in solvers, yet competition and on-chain verification counter this. Empirical data from Eco. com’s 2025 guide shows intent protocols outperforming bridges in uptime and cost, with zero major exploits to date. For users, the win is psychological: no more “waiting for bridge confirmation” anxiety. Developers report 70% faster iteration times, per ShapeShift insights, as intents handle orchestration.

In practice, a trader swaps USDC on Arbitrum for SOL on Solana via NEAR Intents: one signature, AI-routed execution in seconds, fees under $0.50. This scales to complex intents like leveraged positions across chains, unlocking composability undreamt in siloed networks. LI. FI’s 101 breakdown captures the essence: intents abstract away the blockchain tax, surfacing pure UX.

For blockchain innovators, the imperative is clear: integrate intents now. Platforms like SwapKit offer SDKs for embedding this into dApps, while unified wallets evolve to intent-native designs. As adoption surges, expect TVL migration from bridges, boosting protocol revenues. My eight years dissecting fundamentals affirm this trajectory; tokenomics here reward patience, with flywheels tying usage to value accrual.

The multichain dream materializes not through more bridges, but their obsolescence. Intent-based systems deliver chain abstraction UX that feels native, empowering enthusiasts and institutions alike. Protocols like NEAR Intents, 1inch Fusion and, and emerging players forge a frictionless frontier, where cross-chain is as effortless as intra-chain today.