The race to onboard the next million users into decentralized finance is intensifying as crypto markets mature and mainstream adoption edges closer. As of September 20,2025, Bitcoin (BTC) is trading at $115,489.00, reflecting a slight daily decline but underscoring the sector’s resilience and ongoing relevance. Yet, despite rising prices and growing institutional interest, the biggest bottleneck remains: user experience. The complexity of cross-chain interactions, onboarding friction, and wallet fragmentation still deter many potential users from engaging with DeFi platforms.

Why Cross-Chain UX Onboarding Matters in 2025

Today’s DeFi landscape is more fragmented than ever. Users routinely manage assets across Ethereum, Arbitrum, Base, Solana, and emerging L2s. This proliferation creates both opportunity and confusion. Seamless cross-chain onboarding has become the linchpin for mainstream DeFi adoption, a fact recognized by leading projects and researchers alike (source). Platforms that prioritize intuitive onboarding flows are seeing lower abandonment rates and higher retention.

Let’s break down five actionable strategies that are setting new standards for cross-chain UX onboarding:

Top Strategies for Mainstream Cross-Chain DeFi Onboarding

-

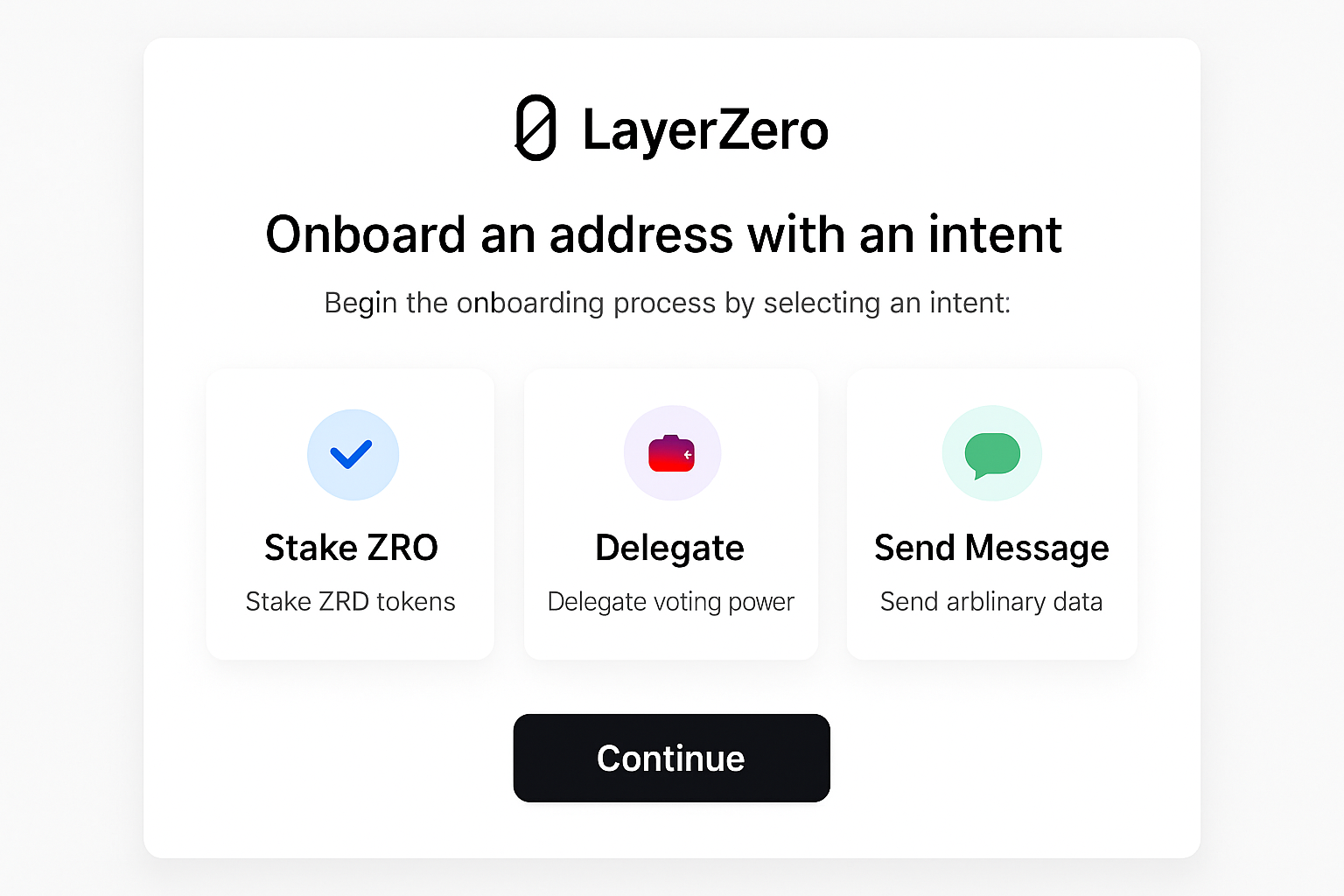

Integrate Intent-Based Onboarding Flows to Automate Cross-Chain Actions: Platforms are adopting intent-based UX frameworks, such as those enabled by LayerZero and Axelar, to let users specify their desired outcome (e.g., “swap ETH on Ethereum for USDC on Polygon”) and have the platform handle the technical steps behind the scenes. This significantly reduces user confusion and abandonment by automating complex, multi-chain operations.

-

Embed Fiat Onramps Directly into Cross-Chain Wallet Interfaces: By integrating fiat onramps like TransFi or Ramp Network directly into wallets, users can purchase crypto assets with debit cards or mobile payments without leaving the app. This seamless funding process removes a major barrier for mainstream users and increases conversion rates.

-

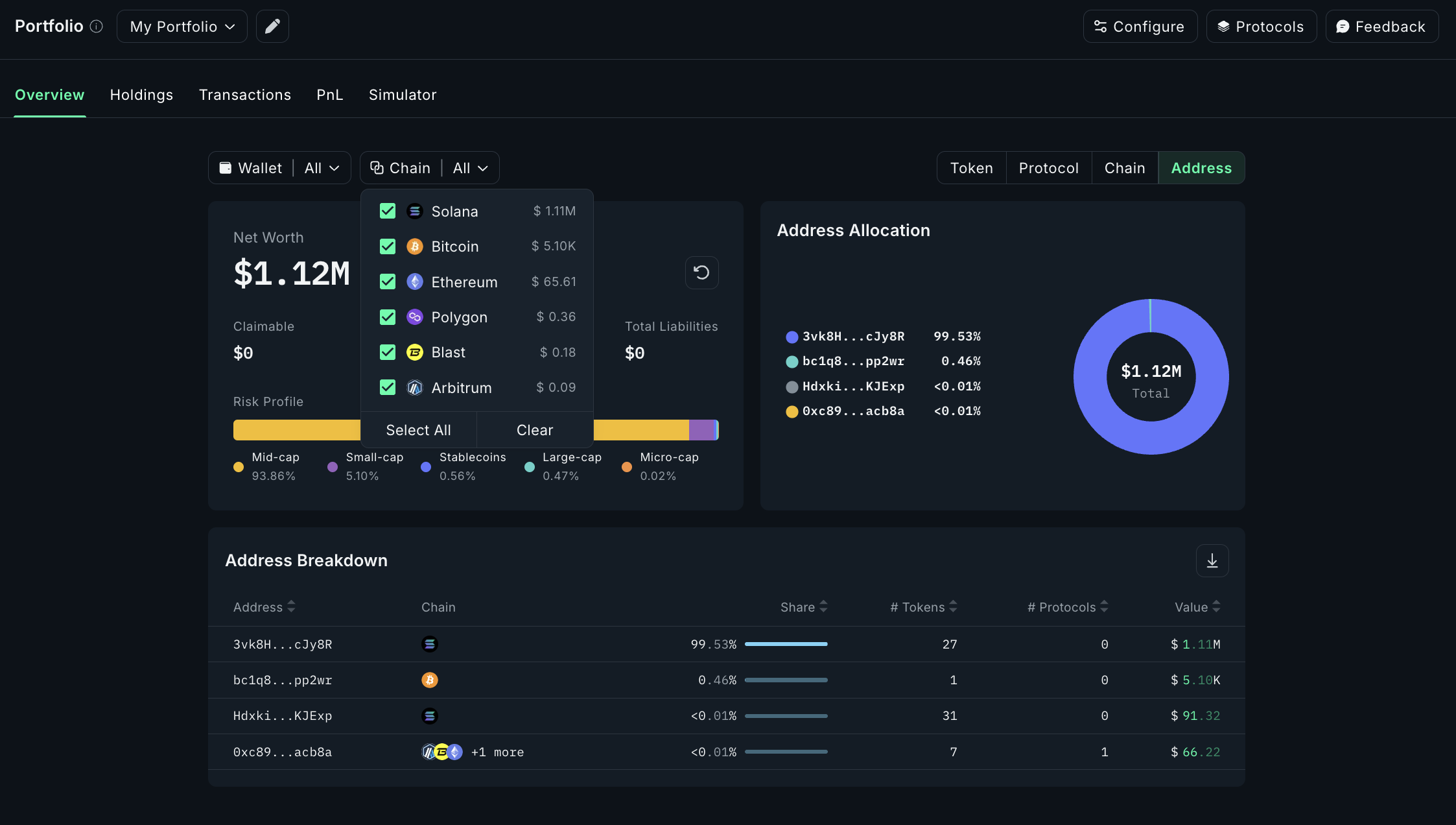

Leverage Unified, Chain-Agnostic Wallets for Seamless Asset Management: Solutions such as Rainbow and Zerion offer unified dashboards that aggregate assets across multiple blockchains. This allows users to view and manage their holdings in one place, simplifying the cross-chain experience and minimizing navigation friction.

-

Utilize Protocols like LayerZero and Axelar for Invisible Cross-Chain Messaging: These established interoperability protocols enable secure, behind-the-scenes messaging and asset transfers between blockchains. By abstracting away technical complexities, platforms can offer users a smooth, uninterrupted experience when moving assets or data across chains.

-

Implement Progressive Disclosure UX to Guide Users Through Complex Operations: By breaking down advanced cross-chain actions into simple, step-by-step flows—only revealing details as needed—platforms like Halaska Studio demonstrate how progressive disclosure reduces cognitive overload, builds user confidence, and decreases abandonment rates.

1. Integrate Intent-Based Onboarding Flows to Automate Cross-Chain Actions

Intent-based UX is revolutionizing how users interact with DeFi protocols by shifting focus from technical steps to user outcomes. Instead of requiring manual network switches or asset bridges, intent-based flows let users simply state what they want, such as “Swap USDC on Arbitrum for ETH on Base”: and the system orchestrates all underlying actions automatically (source). This approach reduces cognitive load and eliminates common errors associated with multi-step processes.

This paradigm shift not only accelerates onboarding but also builds trust by minimizing points of failure during initial user journeys. As a result, intent-driven interfaces are now considered foundational for any platform targeting non-technical audiences.

2. Embed Fiat Onramps Directly into Cross-Chain Wallet Interfaces

The ability to purchase crypto assets with fiat currency, without leaving the app, is a game-changer for user acquisition (source). Embedded fiat onramps streamline KYC checks and allow users to fund their wallets instantly using debit cards or mobile payments. This removes one of the most significant hurdles in crypto onboarding: the need to navigate external exchanges or custodians before interacting with DeFi.

Platforms like Transfi have demonstrated that embedding onramps directly within wallet interfaces can drastically reduce abandonment rates during registration and first-time funding events.

3. Leverage Unified, Chain-Agnostic Wallets for Seamless Asset Management

User retention increases dramatically when people can manage all their assets from a single dashboard without worrying about which blockchain they’re currently using (source). Unified wallets aggregate balances across chains, Ethereum, Solana, Base, and present them in a cohesive interface. This chain abstraction not only simplifies portfolio management but also reduces operational risk by minimizing accidental transactions on the wrong network.

The next generation of wallets goes further by integrating auto-network switching and context-aware prompts (e. g. , “You’re on Arbitrum; switching to Base for this transaction”). By hiding technical details behind smart automation, these solutions make crypto accessible to both newcomers and seasoned traders alike.

4. Utilize Protocols like LayerZero and Axelar for Invisible Cross-Chain Messaging

Behind the scenes, seamless cross-chain interactions depend on robust messaging protocols. LayerZero and Axelar have emerged as infrastructure leaders, enabling dApps to communicate across disparate blockchains without exposing users to technical complexity. For the end user, this means that bridging assets, swapping tokens, or executing DeFi strategies across networks feels as simple as a single click, no more copying contract addresses or worrying about which chain they’re on.

Invisible cross-chain messaging is especially crucial for onboarding mainstream users who expect instant results and minimal friction. By abstracting away the intricacies of consensus mechanisms and settlement layers, these protocols are helping to set new expectations for what a user-friendly crypto experience should look like. This is a core driver behind the reduction in abandonment rates during onboarding, as users no longer face daunting technical hurdles at their first point of contact.

5. Implement Progressive Disclosure UX to Guide Users Through Complex Operations

The final piece in effective cross-chain UX onboarding is progressive disclosure. This design principle involves revealing information and options only when they are relevant to the user’s current context. For example, rather than overwhelming a new user with advanced settings or jargon-laden explanations up front, platforms can introduce complexity gradually, prompting for additional details only when necessary.

This approach has proven especially effective in guiding users through multi-step processes like asset bridging or liquidity provision. By breaking down complex flows into bite-sized steps with clear feedback at each stage (such as time estimates or status updates), platforms can dramatically reduce anxiety and drop-off rates. The result: higher completion rates for critical onboarding actions and more confident, satisfied users.

The Road Ahead: From Fragmentation to Frictionless Onboarding

As Bitcoin remains above $115,000, signaling ongoing market maturity, the focus is shifting from speculation to sustainable growth through usability (source). The strategies outlined, intent-based flows, embedded fiat onramps, unified wallets, invisible messaging protocols, and progressive disclosure, are not just incremental improvements; they represent a paradigm shift in how DeFi platforms welcome new participants.

The winning platforms of 2025 will be those that treat cross-chain UX onboarding not as an afterthought but as a core product pillar. By lowering barriers at every stage, from wallet creation to executing sophisticated DeFi actions, developers can unlock the next wave of mainstream adoption.

Top Strategies to Reduce Abandonment in Cross-Chain DeFi Onboarding

-

Integrate Intent-Based Onboarding Flows to Automate Cross-Chain Actions: Platforms like LayerZero and Axelar enable intent-based UX, allowing users to specify their desired outcome (e.g., “swap ETH on Ethereum for USDC on Arbitrum”) and automating the necessary cross-chain steps. This reduces manual intervention and confusion, streamlining the onboarding process.

-

Embed Fiat Onramps Directly into Cross-Chain Wallet Interfaces: Integrating fiat onramps such as TransFi, Ramp, or MoonPay directly into wallet UIs allows users to purchase crypto assets with debit cards or bank transfers without leaving the app. This seamless experience reduces friction and abandonment during onboarding.

-

Leverage Unified, Chain-Agnostic Wallets for Seamless Asset Management: Solutions like Zerion, Rainbow, and MetaMask Portfolio offer unified dashboards that aggregate assets across multiple blockchains. This enables users to view and manage their holdings from a single interface, reducing confusion and drop-off rates.

-

Utilize Protocols like LayerZero and Axelar for Invisible Cross-Chain Messaging: By integrating interoperability protocols such as LayerZero and Axelar, platforms can abstract away the complexities of cross-chain communication. Users can interact with DeFi applications across chains without needing to understand the underlying mechanics, minimizing abandonment due to technical hurdles.

-

Implement Progressive Disclosure UX to Guide Users Through Complex Operations: Progressive disclosure—used by platforms like Halaska Studio—presents only the necessary information and actions at each onboarding step. This approach prevents users from feeling overwhelmed by complexity, guiding them smoothly through multi-step cross-chain operations.

If you’re building for mass adoption or simply want your protocol to thrive amid growing competition, now is the time to invest in these UX strategies. The next million users are waiting, and with the right approach, their journey into decentralized finance will be smoother than ever before.