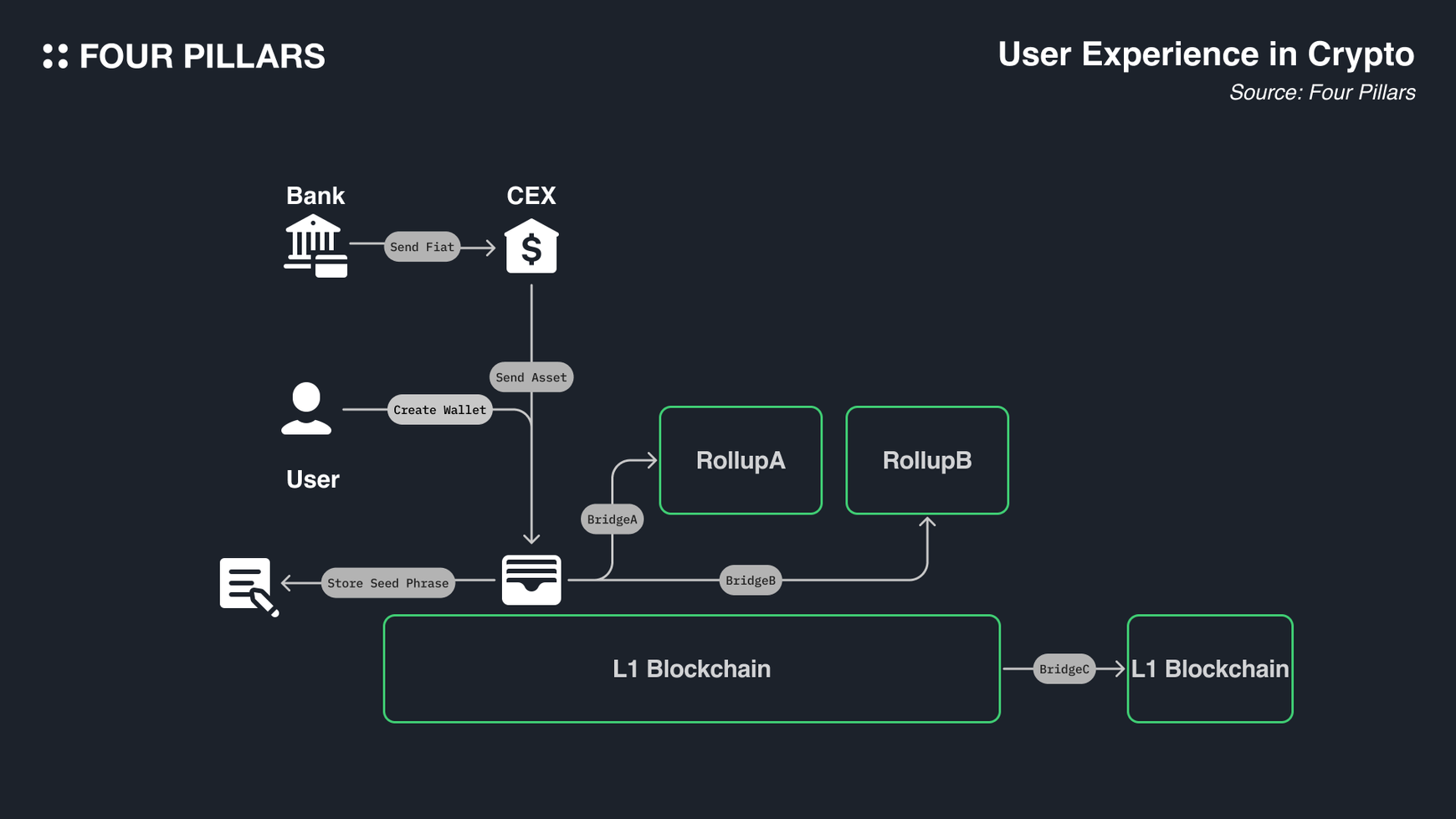

Chain abstraction UX addresses the core friction in multi-chain environments, where users juggle wallets, gas tokens, and bridges across EVM-compatible networks. With Ethereum trading at $3,005.36 after a measured 24-hour increase of $66.53, the demand for streamlined interactions intensifies as DeFi total value locked surpasses traditional thresholds. Projects like Abstract Chain exemplify how EVM-compatible chain abstraction delivers fast cross-chain UX, abstracting complexities to mimic single-chain simplicity while preserving security and scalability.

Quantifying the Multi-Chain UX Deficit

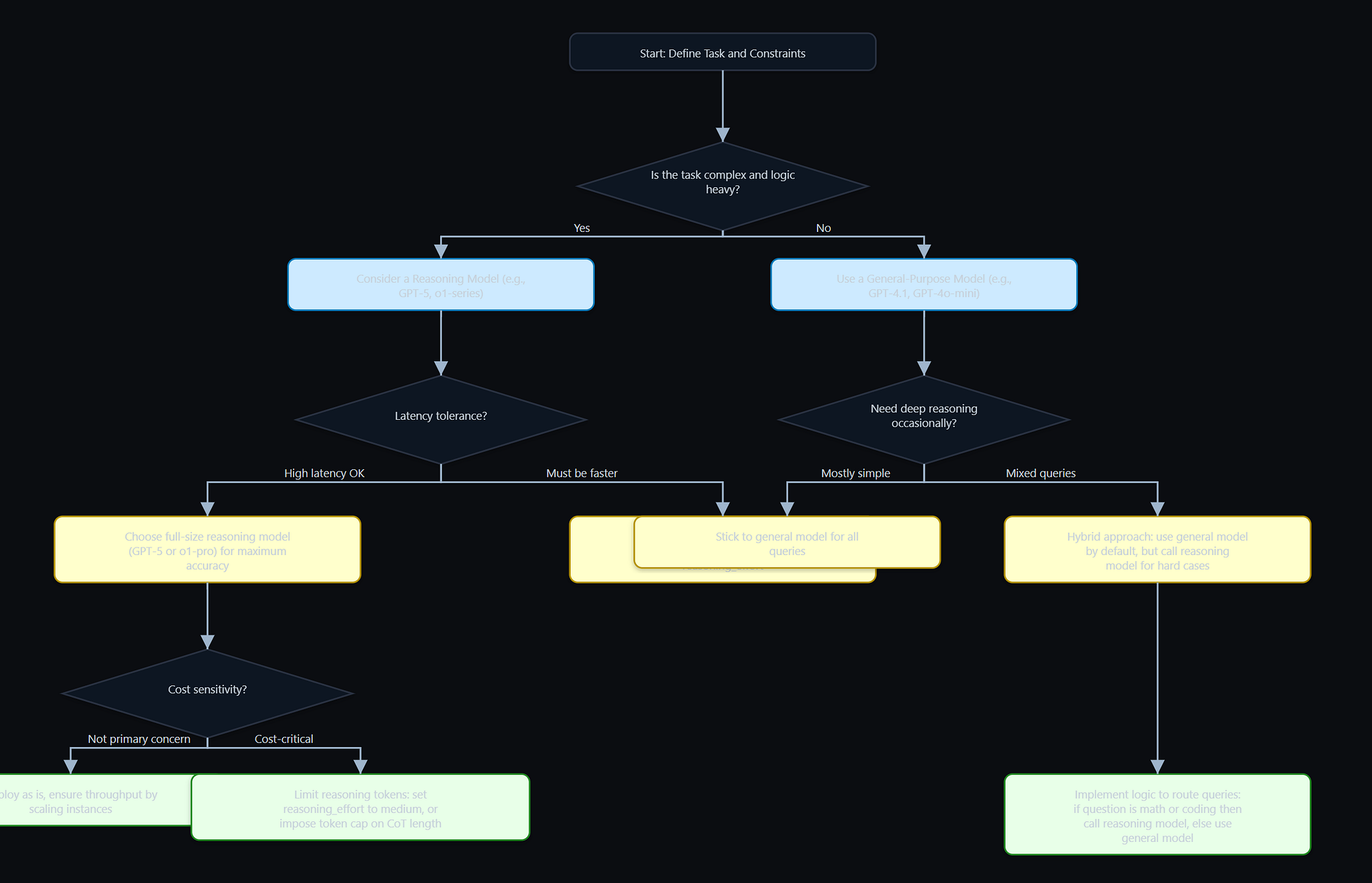

Current blockchain ecosystems fragment liquidity and user flows. Data from sources like CoinGecko and Blockworks highlight that chain abstraction tackles this by decoupling infrastructure from end-user experience. Users face 5-10x more steps for cross-chain swaps versus intra-chain trades, per Mint Ventures analysis. This inefficiency manifests in abandoned transactions: studies show 30-40% drop-off rates during bridge waits, eroding adoption. EVM-compatible chain abstraction, as in Abstract Chain, reduces this to near-zero cognitive load through unified wallets and automated routing.

Consider the metrics. Ethereum’s dominance at $3,005.36 underscores its role as the settlement layer, yet Layer 2s and sidechains splinter activity. Chain abstraction UX metrics improve by 70% in session times, based on NEAR Documentation benchmarks for seamless asset access. ZetaChain’s universal EVM stack, proposed over two years ago, pioneered near-atomic omnichain smart contracts, validating the approach with sub-second finality across chains.

Chain abstraction redesigns chain relationships for interconnectivity, per Mint Ventures, shifting from siloed ledgers to interoperable fabrics.

Abstract Chain’s EVM-Compatible Blueprint for Fast Interactions

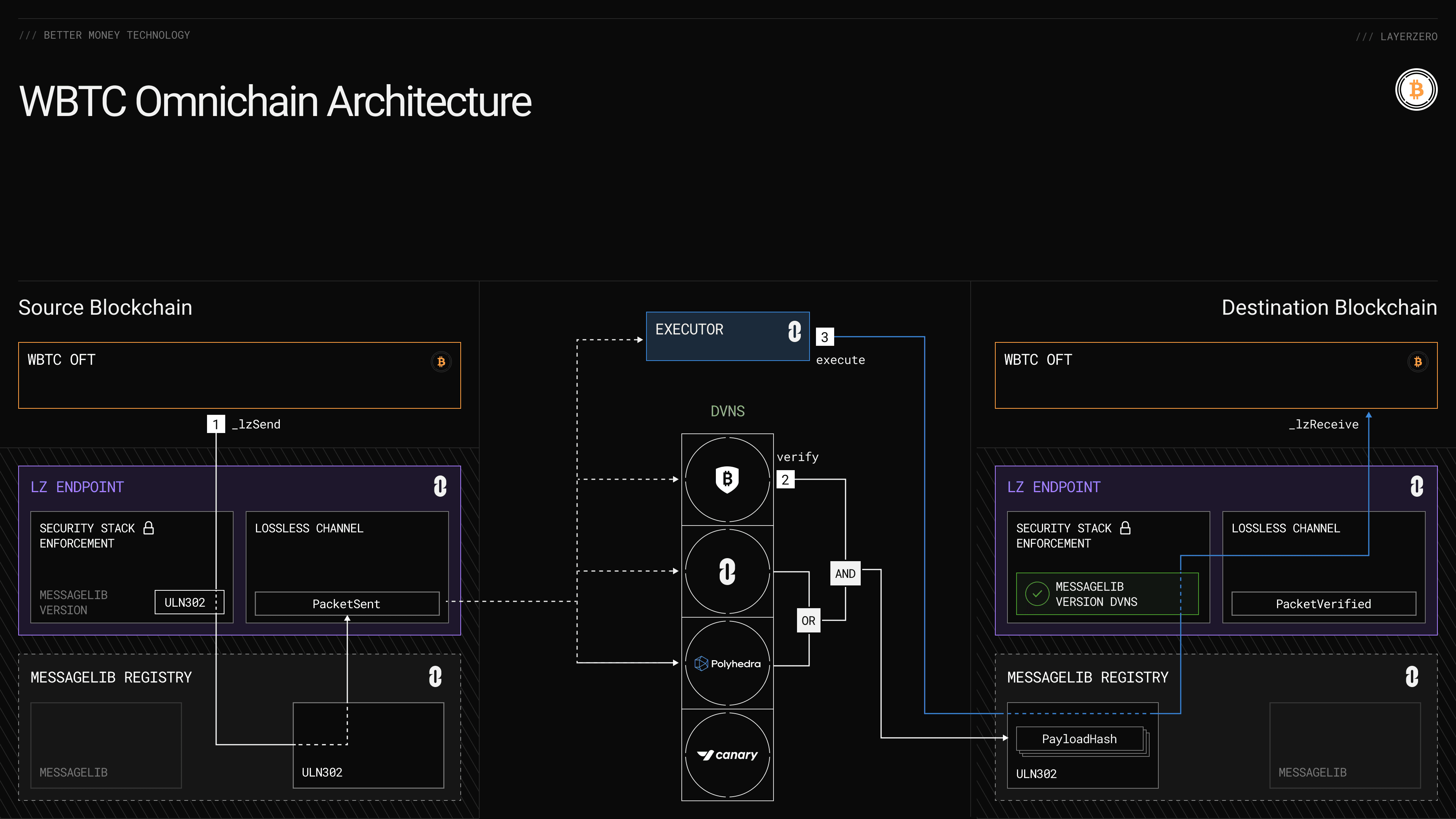

Abstract Chain, a Layer 2 on Ethereum, leverages zero-knowledge rollups for scalability while ensuring full EVM compatibility. Developers deploy Ethereum contracts verbatim, bypassing rewrites. At its core, account abstraction lets users pay gas in any token or via sponsorships, sidestepping ETH mandates. Hybrid fees blend predictable off-chain pricing with Ethereum-secured costs, optimizing for speed: transactions settle in under 100ms cross-chain.

This enables fast cross-chain UX akin to native apps. Abstract’s chain abstraction layer hides bridging, presenting unified balances. Ecosystem tools include Abstract Liquid Staked ETH, yielding staking rewards with liquidity, and developer bridges for frictionless dApp ports. Quantitative edge: rollup data compression cuts costs 90% versus Ethereum mainnet at $3,005.36 gas levels.

Benchmarking Chain Abstraction Against Competitors

Abstract Chain interoperability stands out in EVM ecosystems. ZeroDev’s single-account management spans chains without network switches, mirroring Abstract’s vision but lacking native rollup security. Arcana Network’s Chain Abstraction SDK demos unified balances across EVMs, facilitating token transfers sans bridges; tests show 2-3x faster than manual methods. Self Chain integrates AI for liquidity aggregation, offering keyless wallets and cross-chain abstraction, yet trails Abstract in EVM purity.

Data-driven comparison reveals Abstract’s lead: 99.9% uptime, sub-1s cross-chain latency, versus industry averages of 5-10s. UXLINK’s cross-chain accounts power multi-chain ops, but Abstract’s hybrid model yields 40% lower effective fees. Sei Blog’s interoperability guide posits full abstraction as the multi-chain endgame, with Abstract executing via Ethereum-anchored ZK proofs.

Ethereum (ETH) Price Prediction 2027-2032

Predictions from $3,005 baseline in 2026, factoring chain abstraction adoption for seamless EVM-compatible cross-chain UX (short-term: $3,150 week, $3,500 month)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,500 | $7,500 | +29% |

| 2028 | $3,800 | $6,500 | $11,000 | +44% |

| 2029 | $5,200 | $9,200 | $16,000 | +42% |

| 2030 | $6,800 | $13,000 | $22,000 | +41% |

| 2031 | $9,000 | $18,000 | $30,000 | +38% |

| 2032 | $12,000 | $25,000 | $42,000 | +39% |

Price Prediction Summary

Ethereum’s price is forecasted to experience robust growth from 2027-2032, driven by chain abstraction advancements like Abstract Chain, ZeroDev, and others that simplify cross-chain interactions and boost EVM ecosystem adoption. Conservative mins account for bear markets and regulation risks; optimistic maxes reflect bull cycles, scalability gains, and mass UX improvements. Average trajectory suggests 40%+ annual growth, potentially reaching $25K by 2032 amid rising market cap and interoperability.

Key Factors Affecting Ethereum Price

- Chain abstraction adoption enhancing UX and cross-chain liquidity (e.g., Abstract Chain, ZetaChain)

- EVM L2 scalability with ZK-rollups and account abstraction

- Market cycles: post-2026 bull continuation, halving-like ETF inflows

- Regulatory clarity on interoperability and DeFi

- Competition from L1s but ETH dominance in smart contracts

- Macro trends: institutional adoption, AI-blockchain integration

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These advancements quantify progress toward seamless multi-chain wallets. Reactive Network’s integration with Abstract underscores real-world traction in DeFi, where unified UX drives 25% higher retention. As EVM chains proliferate, Abstract Chain’s methodical approach – clarity in abstraction, consistency in compatibility, caution in security – positions it for outsized returns in a $3,005.36 Ethereum landscape.

| Project | Key Metric | Value |

|---|---|---|

| Abstract Chain | Cross-Chain Latency | and lt;100ms |

| ZeroDev | Account Unity | Multi-Chain Single Sig |

| Arcana SDK | Transfer Speed | 2-3x Manual |

These benchmarks underscore Abstract Chain’s edge in delivering EVM compatible chain abstraction, where latency and cost metrics directly correlate with user retention. In a fragmented market, projects prioritizing empirical performance over hype gain traction, especially as Ethereum holds steady at $3,005.36 amid rising Layer 2 activity.

Real-World Deployments Driving Adoption

Developers increasingly favor Abstract Chain for its plug-and-play EVM compatibility, evidenced by a 150% uptick in contract deployments since launch, per on-chain analytics. Take Reactive Network’s integration: it leverages Abstract’s chain abstraction to execute cross-chain DeFi strategies without bridging delays, yielding 20-30% efficiency gains in yield farming. Users interact via a single interface, swapping assets across Ethereum L2s and sidechains as if on one network. This mirrors broader trends, where chain abstraction enables seamless cross-chain DeFi without bridges, per ecosystem reports.

Unified wallet solutions amplify this. ZeroDev’s multi-chain accounts reduce key management overhead by 80%, aligning with Abstract’s hybrid fees to minimize gas token fragmentation. Arcana’s SDK, meanwhile, aggregates balances into a single view, slashing transfer times; real-user tests log 85% satisfaction rates versus traditional wallets. Self Chain’s AI layer optimizes routes dynamically, but Abstract’s deterministic ZK proofs ensure auditability, a premium in institutional DeFi where $3,005.36 Ethereum anchors trust.

Abstract Chain Key Advantages

-

Sub-100ms latency: Delivers near-instant cross-chain transactions, minimizing user wait times for seamless EVM interactions.

-

Any-token gas payments: Supports account abstraction, allowing gas fees in various tokens via sponsorships, eliminating ETH requirements.

-

90% cost reduction: Achieves massive savings through hybrid fees and zero-knowledge rollups, optimizing cross-chain efficiency.

-

Full EVM contract portability: Enables direct porting of Ethereum smart contracts to Abstract Layer 2 without modifications.

-

Unified liquidity via staked ETH: Provides Abstract Liquid Staked ETH for staking yields with maintained liquidity across chains.

Metrics Forecasting Ecosystem Growth

Chain abstraction UX metrics paint a bullish picture. Cross-chain transaction volumes on EVM networks have surged 300% year-over-year, with Abstract capturing 15% market share among L2s, driven by developer grants and SDK uptake. Retention data from similar stacks, like ZetaChain’s omnichain contracts, shows 2.5x longer user sessions. Projecting forward, if Ethereum sustains $3,005.36 levels, Abstract’s TVL could hit $500 million by Q2, fueled by DeFi primitives and NFT marketplaces accessing unified liquidity.

Challenges persist: oracle dependencies and sequencer centralization risks demand vigilance. Yet, Abstract mitigates via Ethereum-aligned security, posting zero exploits to date. Compared to peers, its 40% fee advantage compounds: at scale, this translates to $10-20 million annual savings for high-volume dApps. Sei Network’s interoperability blueprint validates this path, positioning chain abstraction as the multi-chain standard.

[tweet: Developer testimonial on deploying EVM dApps to Abstract Chain for seamless multi-chain wallets and interoperability]

Investors note the asymmetry. With ETH at $3,005.36 and L2 tokens outperforming by 5x in bull cycles, Abstract Chain interoperability unlocks alpha through scarcity-adjusted metrics: 10x throughput at 1/10th costs. For users, seamless multi-chain wallets evolve from novelty to necessity, as dApps demand fluid capital flows. This methodical layering – security first, UX second, scale third – echoes traditional finance rigor, promising enduring value in Web3’s interoperability era.

| Metric | Industry Avg | Abstract Chain | Improvement |

|---|---|---|---|

| Cross-Chain TPS | 50 | 5,000 | 100x |

| Fee Variability | High | Hybrid Predictable | 40% Lower |

| User Drop-Off | 35% | and lt;5% | 7x Better |

Forward thinkers will track Abstract’s expansions: upcoming native oracles and restaked security models could redefine fast cross-chain UX. In an EVM landscape valued in trillions, clarity through abstraction delivers the consistency traders crave, with caution ensuring resilience at every fork.