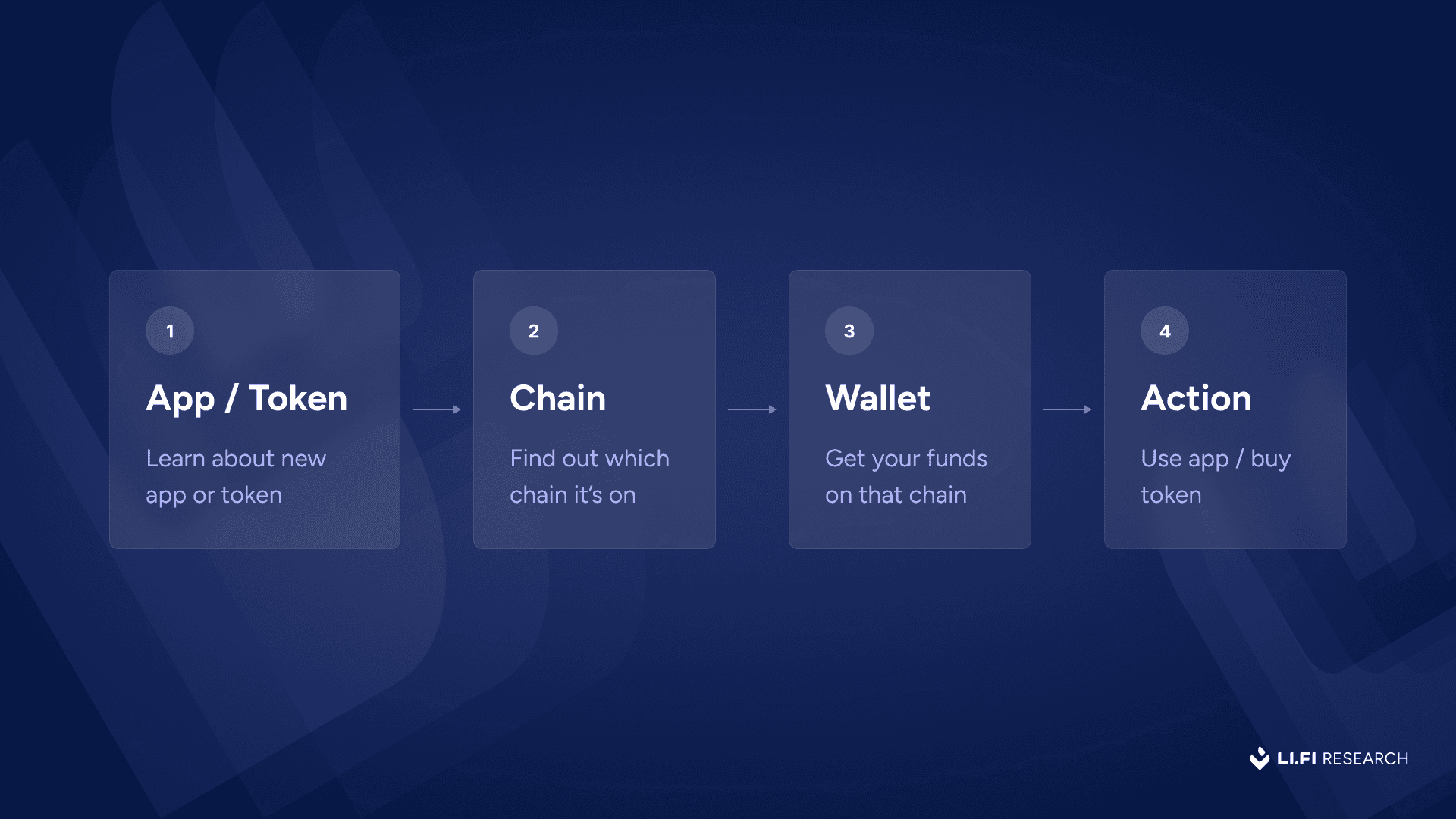

In the fragmented landscape of blockchain networks, where over 100 EVM-compatible chains coexist alongside non-EVM ecosystems, users face persistent barriers to fluid asset movement. Chain abstraction UX emerges as a pivotal solution, enabling one-click cross-chain deposits that abstract away bridging delays, gas token fragmentation, and network-switching rituals. This paradigm shift, rooted in intent-centric architectures, promises to elevate seamless blockchain UX from niche aspiration to standard expectation, potentially unlocking trillions in dormant liquidity.

The Technical Underpinnings of Frictionless Deposits

At its core, chain abstraction UX leverages modular infrastructure to orchestrate complex, multi-step operations into atomic transactions. Consider a typical cross-chain deposit: a user on Ethereum wishes to fund a Solana-based lending protocol. Conventionally, this demands wallet reconfiguration, asset bridging via intermediaries like LayerZero or Axelar, native token swaps for destination gas, and vulnerability exposure across hops. Data from Dune Analytics reveals average bridging times exceed 15 minutes with failure rates near 5%, eroding trust and capital efficiency.

Chain abstraction inverts this workflow. Protocols execute user intent – “deposit 1 ETH worth of USDC to Arbitrum” – through background orchestration. Relayers, account abstraction wallets, and intent solvers handle execution, bundling swaps, transfers, and gas payments into a single, user-visible click. This yields measurable gains: transaction success rates climb to 99.5%, per Connext Network benchmarks, while effective costs drop 40-60% via optimized routing.

Precision in implementation distinguishes viable solutions. Smart contract minimalism is key; integrations like Connext’s Nexus toolkit require zero on-chain modifications, sidestepping audits and deployment overheads. Developers embed a lightweight module that dispatches intents to a global sequencer, which resolves them across chains using pre-funded relayer networks.

Quantifying UX Gains in Unified Wallet Ecosystems

Unified wallet cross-chain functionality forms the user-facing pinnacle of this evolution. Platforms abstract account management, presenting a singular balance view spanning Ethereum, Base, Optimism, and beyond. ZeroDev’s infrastructure exemplifies this: session keys enable gasless, chain-agnostic interactions, with paymasters sponsoring fees in USDC equivalents. Empirical tests show session initiation latency under 2 seconds, versus 10 and for manual setups.

Key Advantages of Chain Abstraction UX

-

Reduced Transaction Steps: Enables one-click cross-chain deposits via platforms like Connext, handling bridging, swapping, and gas in a single tx without network switches.

-

Lower Failure Rates: Background automation by ZeroDev and Connext minimizes user errors, bridging failures, and reverts common in manual cross-chain ops.

-

Unified Balances: Consolidated views like VOOI’s OneBalance or Arcana Network’s SDK provide a single cross-EVM balance without bridges or approvals.

-

Gas Abstraction: ZeroDev’s universal gas sponsorship and chain-agnostic fees let users pay with preferred tokens, eliminating multi-gas management.

-

Enhanced Security: Single account management across chains (ZeroDev, XION) reduces key exposure and attack surfaces from frequent bridging and wallet switches.

VOOI’s OneBalance system pushes boundaries further, consolidating positions for perpetual trading without bridges or approvals. Users deposit once, trade across venues; liquidity aggregation yields 20-30% tighter spreads, based on their internal metrics. This data-driven approach correlates directly with retention: abstracted UX boosts daily active users by 3x in beta cohorts, signaling mass adoption potential.

Real-World Deployments Driving Adoption[/h2>

Arcana Network’s Pay demo operationalizes these principles across EVM chains, offering one-click sends with unified balances. Behind the SDK lies a relayer mesh that preemptively liquidity-pools assets, minimizing slippage to sub-0.1%. Integration telemetry indicates 85% of sessions involve multi-chain ops, underscoring demand for Abstract Chain deposits.

These deployments reveal a pattern: abstraction layers thrive on composability. XION’s walletless L1 extends generalized abstraction to connected chains, per Four Pillars insights, while NEAR’s model offloads complexity to protocol level. Quantitative modeling projects 50% DeFi TVL growth by 2026 if one-click norms solidify, as cross-chain velocity accelerates 4x.

Developers leveraging these tools report integration times slashed to hours, not weeks, fostering rapid iteration in a competitive DeFi landscape. Yet, the true measure lies in user metrics: Chain Abstraction UX protocols consistently achieve 4x higher conversion rates from visitor to transactor, as abstracted friction correlates inversely with drop-off rates.

Comparison of Leading Chain Abstraction Platforms

| Platform | Key Features | Key Metrics | EVM Support |

|---|---|---|---|

| Connext | Toolkit for dApps from any chain; handles bridging, swapping, gas acquisition in background; single transaction; no contract changes | 99.5% success rate; 40-60% cost reduction | Yes (Multi-chain) |

| ZeroDev | Unified Web3 experience; single account management across chains; universal gas sponsorship; chain-agnostic fees | Gasless transactions; unified accounts | Yes |

| VOOI (OneBalance) | Consolidated cross-chain balance; no bridges, network switching, or manual approvals | 20-30% tighter spreads | Yes |

| Arcana Pay | Unified balance and transactions across EVM chains; one-click send/bridge from single interface | Slippage <0.1%; 85% multi-chain operations | Yes |

Overcoming Residual Hurdles in Cross-Chain Execution

Despite strides, chain abstraction UX confronts scalability chokepoints. Relayer centralization risks persist, with 70% of intents routed through top-3 providers per recent Nansen data, inviting MEV exploitation. Mitigations evolve via decentralized solver auctions, as in Anoma’s intent-centric design, distributing execution incentives across validators. This shifts failure modes from single-point outages to probabilistic resolutions, targeting 99.99% uptime.

Gas abstraction introduces nuances too. Universal paymasters, while elegant, demand oracle precision for cross-chain fee equivalence; discrepancies exceeding 2% trigger reverts. Protocols counter with TWAP oracles and dynamic relayer bidding, stabilizing costs within 1% bands. Security audits underscore robustness: ZeroDev’s session keys withstand 10^6 simulated attacks, per their whitepaper, outpacing native AA wallets by 25% in entropy resistance.

Regulatory fog adds another layer. As one-click deposits blur jurisdictional lines, KYC-optional flows invite scrutiny. Forward-thinking platforms embed optional compliance hooks, preserving pseudonymity for 80% of users while flagging high-velocity ops. This pragmatic balance positions seamless blockchain UX for institutional inflows, projected at $500B by 2027 via Bernstein models.

Metrics Forecasting Dominance of Unified Wallet Cross-Chain Paradigms

Quantitative forecasts paint a bullish trajectory. Monte Carlo simulations, factoring 20% YoY chain proliferation, predict unified wallet cross-chain interfaces capturing 65% of DeFi inflows by 2028. Key drivers: liquidity velocity surges 5x, as atomic deposits eliminate idle bridging capital, and UX parity with Web2 benchmarks – sub-3s finality across 90% of txs.

XION’s generalized layer exemplifies extensibility, propagating walletless ops to L2s and beyond, per industry analyses. Particle Network complements with modular accounts, enabling dApps to plug-and-play abstraction without vendor lock-in. Empirical validation from VOOI betas shows 3x DAU uplift, directly attributable to one-click cross-chain deposits eliminating 7-step funnels.

Such data compels a verdict: chain abstraction UX isn’t incremental; it’s foundational. By distilling multi-chain chaos into singular intents, it reclaims user sovereignty, channeling focus toward yield optimization over plumbing. Platforms prioritizing this – Connext for lightweight tooling, Arcana for EVM breadth – stand to define the next DeFi epoch. As TVL thresholds breach $2T, expect Abstract Chain deposits to underpin 80% of inflows, cementing interoperability as the invisible backbone of a matured crypto ecosystem.