Imagine wanting to swap Bitcoin for Solana tokens without bridges, gas fees on multiple chains, or exposing your wallet to a dozen networks. That’s the dream chain abstraction promises, and NEAR Protocol is delivering it through NEAR chain signatures and chain abstraction intents. As NEAR trades at $1.06 with a 24-hour gain of and $0.0500 ( and 0.0497%), its innovations are gaining traction in a market hungry for seamless chain abstraction UX.

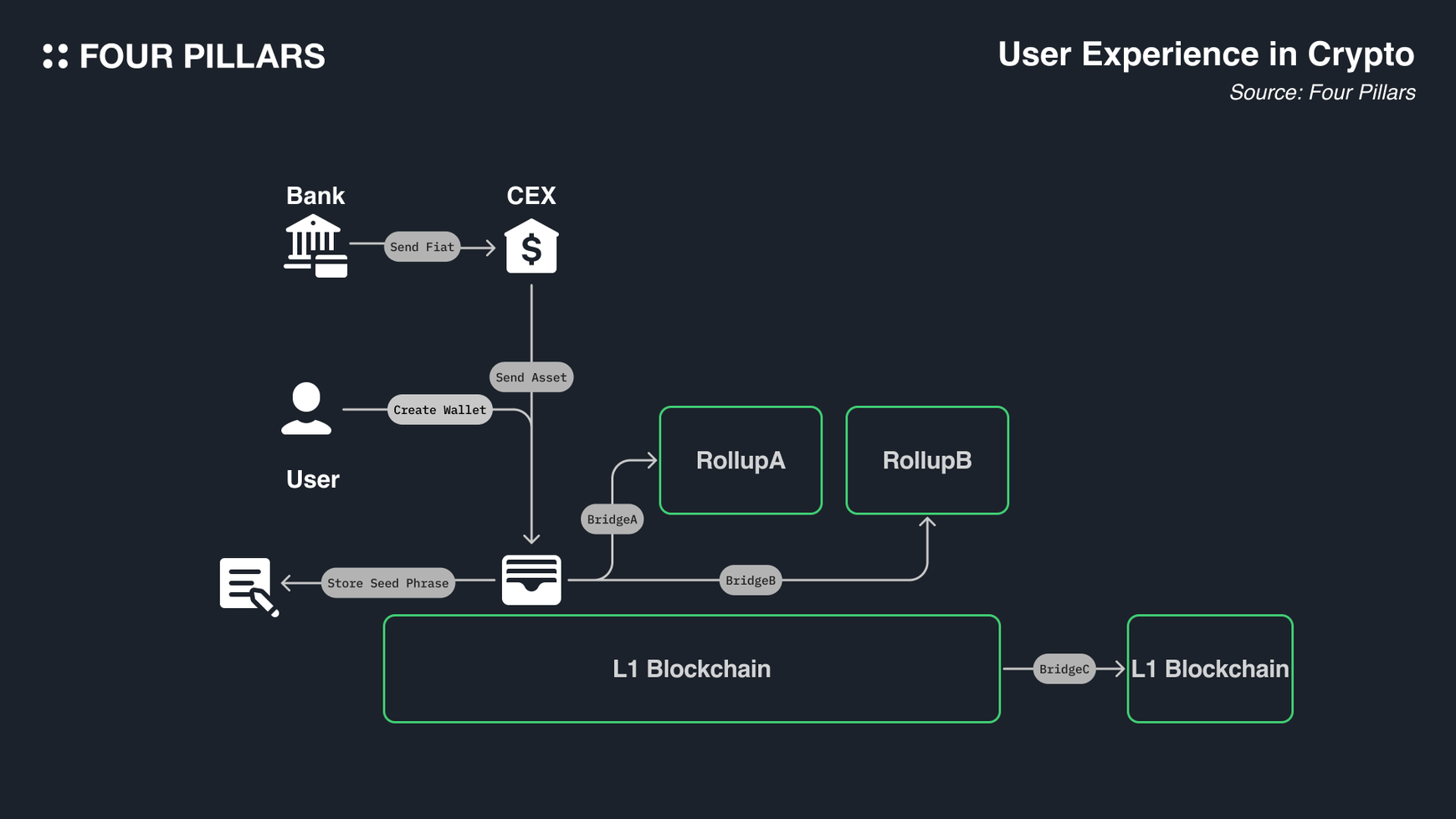

I’ve spent years designing wallets that hide blockchain complexity, and NEAR’s approach feels like a breath of fresh air. No more juggling accounts per chain or trusting centralized bridges that scream ‘hack me. ‘ Instead, one NEAR account signs actions across Bitcoin, Ethereum, Solana, and beyond. Let’s break down how this works for frictionless private cross-chain asset transfers.

Chain Signatures: Your Universal Signing Key

At the heart of NEAR’s toolkit are chain signatures, a decentralized multi-party computation (MPC) network that lets NEAR accounts – even smart contracts – sign transactions on other blockchains. Picture this: your NEAR wallet generates a signature verified natively on Ethereum or Bitcoin. No wrapped tokens, no intermediaries. NEAR docs highlight how this enables execution across protocols, while projects like RHEA Finance use it for direct cross-chain swaps.

Why does this matter for users like you? Traditional cross-chain meant bridges vulnerable to exploits – think Ronin or Wormhole draining billions. Chain signatures flip the script with permissionless key management. A single NEAR signature executes on other chains via intents-based relays, acting as bridge replacements. Blockworks calls it ‘multichain DeFi draws near, ‘ and they’re spot on. It’s secure because MPC distributes key shards, ensuring no single point of failure.

Chain signatures enable NEAR accounts, including smart contracts, to sign and execute transactions across many blockchain protocols. – NEAR Documentation

In practice, this powers AI-driven finance. Solvers compete to fulfill your intent, verifying signatures on-chain with support for ECDSA, EdDSA, and more. As a UX strategist, I love how it unifies wallets for bridge-free asset transfers, letting you focus on outcomes, not ops.

NEAR Intents: Outcome-First Transactions

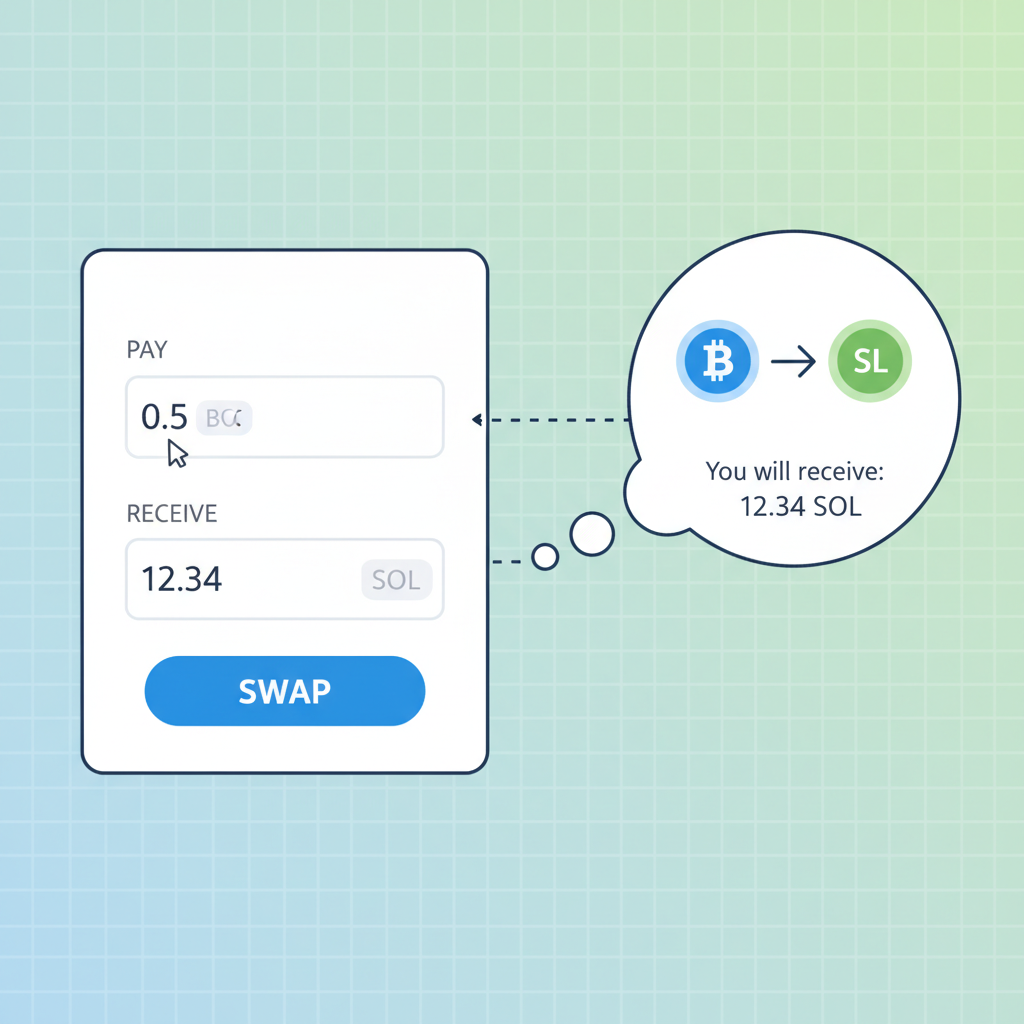

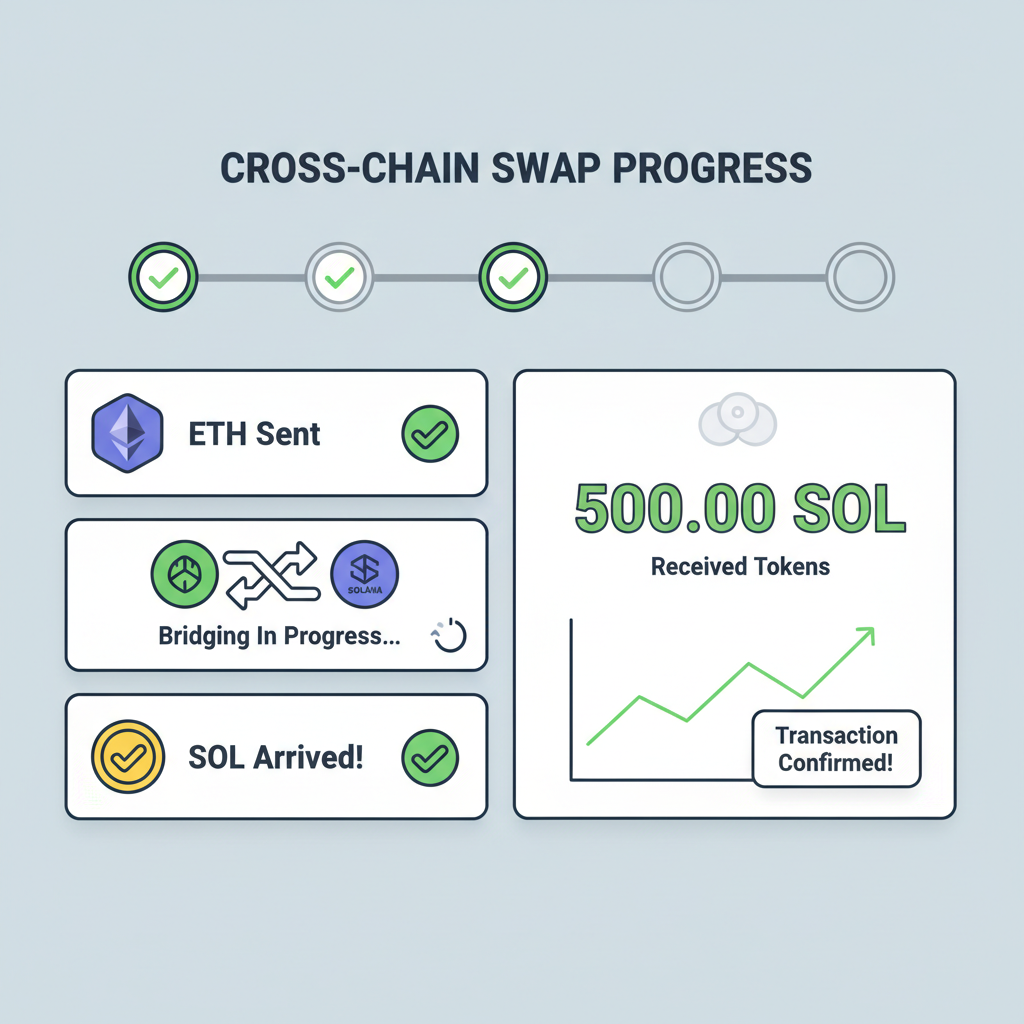

Signatures alone are powerful, but pair them with NEAR Intents, and you get true abstraction. Intents let you declare what you want – ‘swap 1 BTC for SOL at best rate’ – then AI agents or solvers handle the how. No manual oversight, no chain-switching. Messari’s Q3 2025 report notes NEAR Intents as a live multichain protocol for users and AI defining outcomes like asset swaps.

This isn’t just theory. Plasma integrated NEAR Intents for cross-chain stablecoin swaps, proving real-world chops. Reflexivity Research praises NEAR’s unified interface simplifying interactions. For developers, it’s a framework where AI automates execution across chains securely. Users? Pure magic – one signature, private execution via competition among solvers.

Privacy shines here. Intents don’t broadcast full details; solvers see only what’s needed, and MPC keeps keys private. In a world of MEV bots front-running your trades, this levels the field for cross-chain private assets.

NEAR Protocol (NEAR) Price Prediction 2027-2032

Bullish outlook from current $1.06 (2026), driven by Chain Signatures and Intents for seamless cross-chain asset transfers

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.20 | $2.50 | $5.00 | +136% |

| 2028 | $2.00 | $4.50 | $10.00 | +80% |

| 2029 | $3.00 | $6.50 | $14.00 | +44% |

| 2030 | $4.00 | $9.00 | $20.00 | +38% |

| 2031 | $5.50 | $12.50 | $28.00 | +39% |

| 2032 | $7.00 | $17.00 | $35.00 | +36% |

Price Prediction Summary

NEAR Protocol’s innovations in Chain Signatures and Intents position it as a leader in chain abstraction and cross-chain DeFi, enabling frictionless private asset transfers. From $1.06 in 2026, predictions forecast progressive growth with average prices climbing to $17.00 by 2032 amid adoption surges, market cycles, and AI integration. Minimums reflect bearish scenarios like regulatory delays, while maximums capture bullish adoption peaks.

Key Factors Affecting NEAR Protocol Price

- Adoption of Chain Signatures for secure, decentralized cross-chain signing on BTC, ETH, SOL

- NEAR Intents framework for AI-driven, outcome-based multichain transactions

- Increased DeFi liquidity and user experience via interoperability

- Post-2028 Bitcoin halving market cycle boosting altcoins

- Regulatory developments favoring chain abstraction technologies

- Competition from other L1s and potential macroeconomic downturns influencing min/max ranges

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Privacy Meets Speed in Cross-Chain Transfers

Combining signatures and intents creates unified wallet cross-chain bliss. Want to move assets privately? Define an intent on NEAR, sign once, and solvers execute atomically across chains. No liquidity pools exposed prematurely, no signature replay risks. AMINA Bank spotlights how this pushes smart UX onchain alongside user-owned AI.

Developer DAO explains chain abstraction as signing on multiple chains with one NEAR account, ditching per-chain hassles. For innovators, it’s a playground: build dApps that feel native everywhere. I’ve consulted on similar interfaces, and NEAR’s stack reduces cognitive load dramatically – key for mass adoption.

Recent market context underscores momentum. With NEAR at $1.06, up from a 24-hour low of $1.00, investors eye these tools driving interoperability. Integrations like RHEA’s lending via chain signatures show DeFi evolving beyond silos.

These advancements aren’t locked in ivory towers; they’re live and scaling. Take RHEA Finance’s cross-chain lending, where chain signatures verify operations across ecosystems, enabling McA contracts to handle ECDSA and EdDSA seamlessly. It’s the kind of permissionless innovation that makes me optimistic about DeFi’s next phase.

Bringing It Home: A NEAR Intents Tutorial for Users

As someone who’s prototyped countless wallet flows, I can tell you the real test is ease. NEAR Intents shine in practice, turning complex swaps into simple declarations. Here’s how you, a crypto enthusiast with a unified wallet, can leverage them for bridge-free asset transfers.

That flow abstracts away the grit: no Ethereum gas juggling, no Solana account setup. Solvers bid competitively, executing your intent privately. With NEAR holding steady at $1.06 after climbing from a 24-hour low of $1.00, tools like this fuel the price resilience we see today.

Privacy remains paramount. Intents reveal minimal data, MPC shards keys across nodes, and atomic execution prevents partial failures. It’s a far cry from public mempools where bots snipe opportunities. For cross-chain private assets, this setup ensures your positions stay yours alone until settled.

Listening to experts like Kendall Cole reinforces why this matters. Uniting silos via signatures isn’t hype; it’s technical unification paving roads for AI agents to thrive. NEAR’s push, as AMINA Bank notes, blends chain abstraction intents with user-owned AI, handling surges in activity without UX sacrifices.

The Road Ahead for Seamless Chain Abstraction UX

Zoom out, and NEAR’s stack redefines unified wallet cross-chain experiences. Developer DAO nails it: one account, multi-chain power. No more siloed liquidity or chain-specific quirks. Projects like Plasma’s stablecoin swaps via intents show adoption accelerating, with solvers optimizing routes in real-time.

From my vantage in behavioral finance, this hits adoption sweet spots. Users hate friction; NEAR erases it. Developers gain robust primitives for dApps that feel universal. And with market eyes on NEAR’s $1.06 price – up $0.0500 in 24 hours to a high of $1.06 – interoperability bets are paying off.

Intents-based relays, per Blockworks, replace bridges entirely. A lone NEAR signature triggers actions elsewhere, verified natively. Reflexivity Research highlights the seamless interface, while Messari confirms Intents’ live status for outcome-driven trades. It’s not incremental; it’s a paradigm shift toward autonomous, private cross-chain flows.

Challenges linger, sure – solver centralization risks, MPC latency tweaks – but NEAR’s momentum addresses them head-on. As integrations proliferate, expect NEAR chain signatures to underpin lending, perpetuals, even NFT trades across realms. For you, it means commanding assets fluidly, privately, without the old headaches.

NEAR Protocol isn’t just building tech; it’s crafting the UX layer crypto desperately needs. With prices reflecting growing confidence at $1.06, now’s the time to explore these tools. Dive in, sign once, and let intents handle the rest – your cross-chain future awaits.