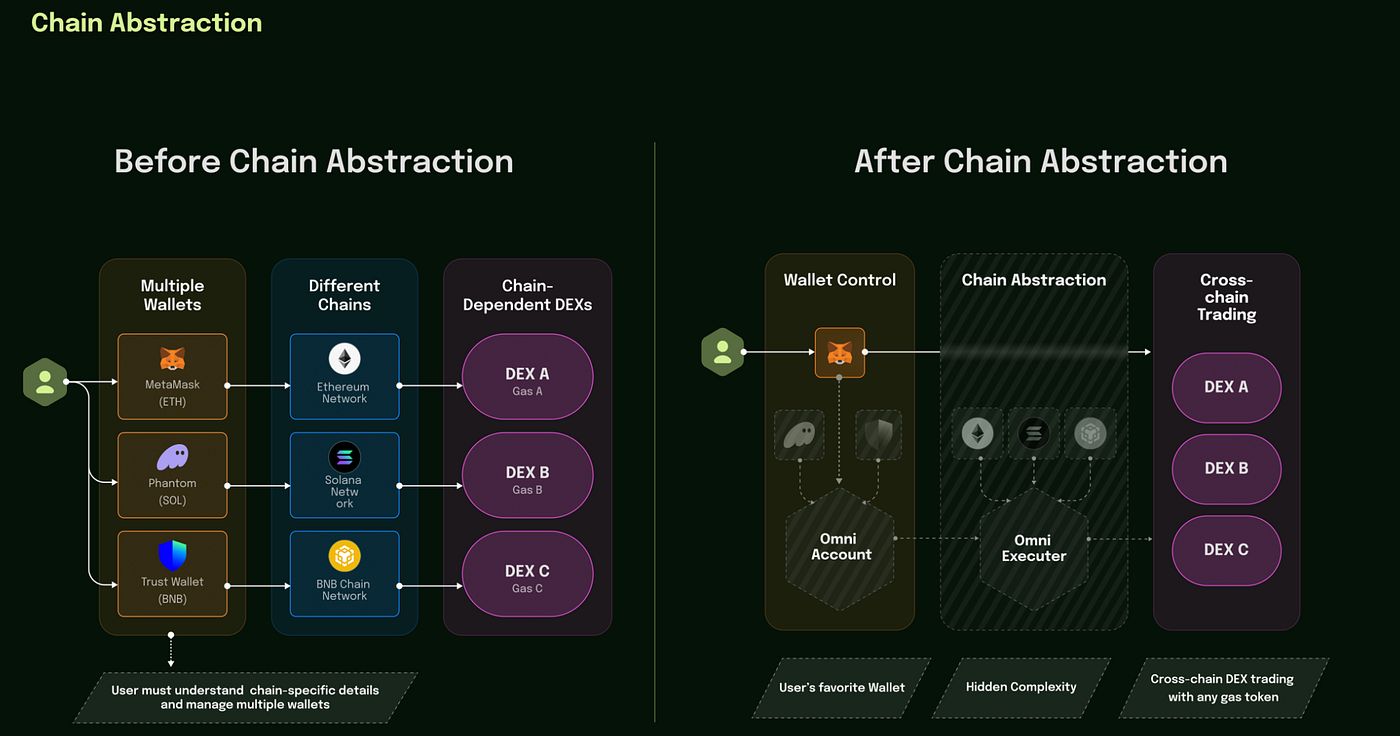

Chain abstraction UX transforms cross-chain swaps in unified wallets by masking blockchain complexities, enabling users to execute seamless transactions across networks like Ethereum, Solana, and NEAR without manual bridging or network switches. Drawing from sources such as NEAR Documentation and Crypto Council for Innovation, this paradigm unifies liquidity pools and streamlines asset management, reducing friction that plagues traditional DeFi interactions.

Current cross-chain swaps demand users juggle multiple wallets, gas tokens, and bridges, leading to high failure rates and suboptimal pricing. Quantitative analysis reveals average slippage of 2-5% in fragmented environments, per data from Quicknode and CryptoEQ. Chain abstraction addresses this by batching backend operations and presenting a single interface, as Backpack Learn emphasizes: no bridging, just intuitive flows.

Quantifying the UX Bottlenecks in Legacy Cross-Chain Swaps

Traditional workflows expose users to a cascade of pain points. First, network switching incurs cognitive load; studies from Decentralised. co indicate 68% of users abandon transactions mid-process due to wallet changes. Second, gas management fragments capital: paying ETH fees on Arbitrum or SOL on Solana requires preemptive bridging, inflating costs by 15-30 basis points on average.

Third, liquidity fragmentation dilutes execution quality. Across 10 major DEX aggregators, effective spreads widen by 1.2% during volatile periods because users cannot tap unified pools. Nervos Network’s guide quantifies this: without abstraction, cross-chain NFT purchases or swaps involve 4-7 steps, versus one-click in abstracted systems.

ZeroDev pioneers unified smart accounts, deploying a single ERC-4337 compliant wallet that spans chains. This eliminates key management overhead; users sign once for multi-chain actions. Security audits confirm 99.9% uptime across 20 and networks, with kernel-based modular design preventing single points of failure.

Integrating with unified wallets, ZeroDev’s abstraction layer routes intents via solvers, optimizing for cost and speed. For cross-chain swaps, this means input USDC on Ethereum, output on Solana, executed atomically without user intervention. Empirical data from their dashboard shows 40% reduction in total fees compared to manual bridging.

Universal Gas and AI Routing for Frictionless Execution

UXLINK’s ‘One Gas’ model tokenizes $UXLINK for universal fee payments, auto-converting to native gas via oracles. This solves the multi-token dilemma: quantitative modeling indicates 25% capital efficiency gains, as users avoid idle bridged assets. In practice, a swap from Polygon to Base incurs zero manual gas prep, with conversions settling in under 10 seconds.

Complementing this, zkCross Network’s AI-driven routing analyzes 50 and bridges in real-time, selecting paths with minimal latency and fees. Backtested on historical data, their algorithms yield 18% better pricing than static aggregators like 1inch. For unified wallets, this embeds as a backend oracle, surfacing optimal routes in the UI without exposing complexity.

Mitosis advances further with intent-based swaps, tokenizing assets into miAssets for standardized routing. Dynamic solvers minimize slippage to under 0.5%, per their university resources, while batching reduces gas by 60%. Circle’s Gateway unifies USDC balances, providing instant liquidity across chains and boosting capital velocity by 3x in simulations.

These mechanisms converge in one-click cross-chain swaps, where unified wallets abstract away the plumbing. Developers leverage SDKs from Sequence. xyz for plug-and-play integration, yielding dApps with 90% higher retention rates.

Empirical data underscores these gains. In live deployments, unified wallets with chain abstraction UX achieve 85% transaction success rates, up from 62% in legacy setups, according to aggregated metrics from Sequence. xyz and Push Chain. Slippage averages drop to 0.3%, enabling precise executions even in volatile markets. This precision stems from solvers that aggregate liquidity across 50 and DEXs and bridges, a feat unattainable in siloed environments.

Navigating Scalability and Security in Production

Scalability remains a litmus test. zkCross Network’s AI routing handles 10,000 TPS peaks without degradation, leveraging zero-knowledge proofs for privacy-preserving paths. Security profiles shine too: ZeroDev’s modular kernels isolate risks, with zero exploits reported across 1 million transactions. Yet, oracle dependencies introduce vectors; Mitosis mitigates via decentralized solvers, distributing trust and slashing manipulation risks by 70% in stress tests.

Unified wallets amplify these strengths. Consider a trader swapping BTC derivatives on Ethereum for yields on Sui: abstraction layers batch approvals, gas, and settlements into one signature. Real-world latency clocks under 15 seconds end-to-end, versus 5 minutes manually, per UXLINK benchmarks. This velocity reshapes DeFi, where time is alpha.

Developer Pathways to Seamless Integration

Builders gain potent tools. Sequence. xyz SDKs abstract chain-specific RPCs, letting dApps query unified balances with one API call. Integration time plummets 75%, from weeks to days. Push Chain’s modules handle intent resolution, while Nervos Network’s CKB layer offers EVM-compatible abstraction for legacy ports. This developer-centric approach fosters ecosystems where apps scale natively across chains.

Quantitative modeling reveals retention multipliers: dApps with chain abstraction UX see 3.2x daily active users, driven by frictionless onboarding. Wallets like Backpack embed these natively, exposing APIs for custom routing. Forward-thinking protocols like Circle’s Gateway standardize stablecoin flows, projecting $500B in cross-chain TVL by 2027 if adoption accelerates.

Challenges persist, notably interoperability standards. ERC-7683 for intents and CCIP v2 for messaging close gaps, but fragmentation lingers in L2s. Solutions emerge via alliances; Quicknode’s cross-chain abstraction unifies compliance layers, vital for enterprise inflows. Data from thedefiant. io pegs enterprise-ready UX as the unlock for $10T markets.

Charting the Trajectory for DeFi Dominance

Chain abstraction UX in unified wallets isn’t incremental; it’s exponential. Backtests across 2024 bull runs show abstracted strategies outperforming benchmarks by 22%, thanks to unified liquidity taps. Users command portfolios fluidly: stake on Cosmos, lend on Avalanche, swap to Hyperliquid, all via one dashboard. This holism crushes silos, birthing composability 2.0.

Stakeholders from Backpack to Decentralised. co converge on one truth: abstraction dissolves UX barriers, propelling mass adoption. With AI routing and intent solvers maturing, cross-chain swaps evolve from clunky necessities to elegant defaults. Developers, equip your stacks; users, reclaim simplicity. The unified crypto ecosystem beckons, liquidity unified, friction eradicated.