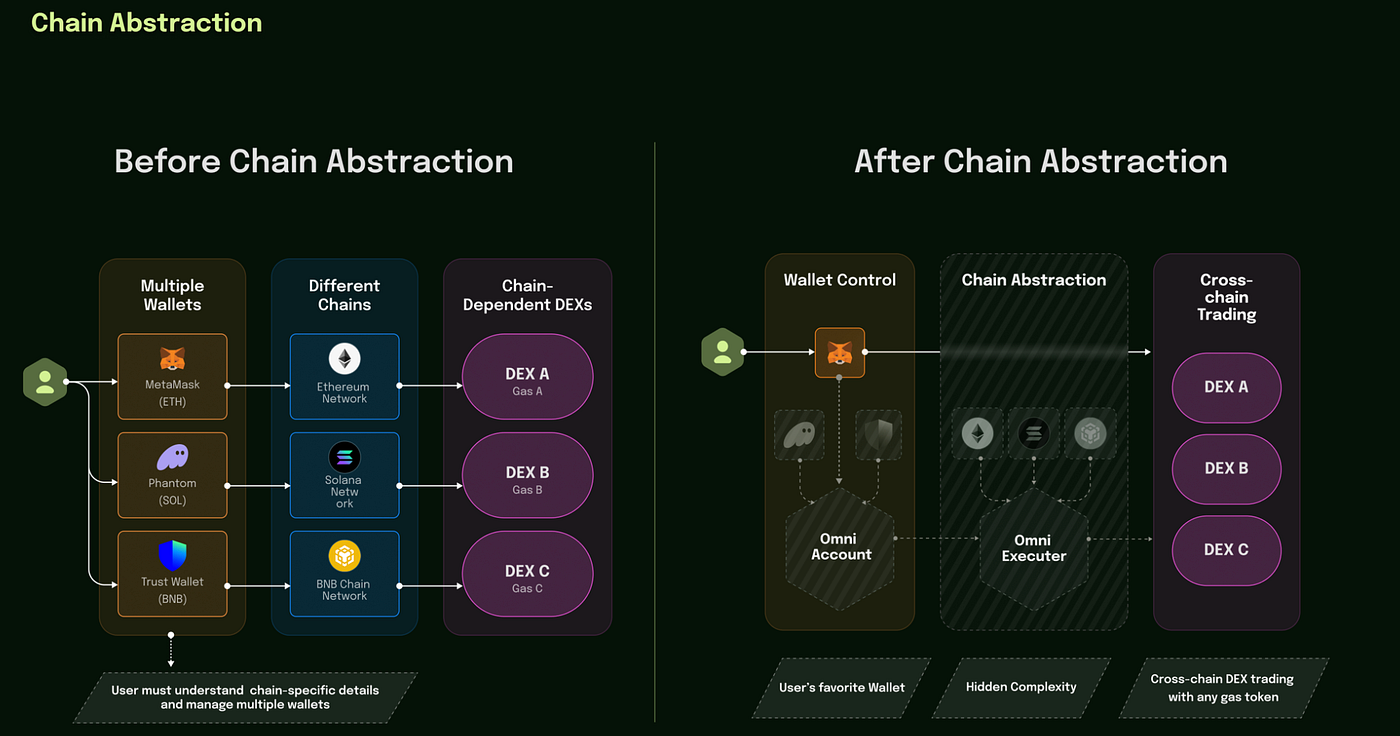

Picture this: you’re eyeing a lucrative arbitrage opportunity between Ethereum and Solana, but the usual hurdles, multiple wallets, bridge waits, and gas fee nightmares, stop you cold. Enter unified liquidity access in chain abstraction wallets, the breakthrough that’s turning cross-chain trading into a breeze. This isn’t just tech jargon; it’s your ticket to seamless blockchain interoperability without the headaches.

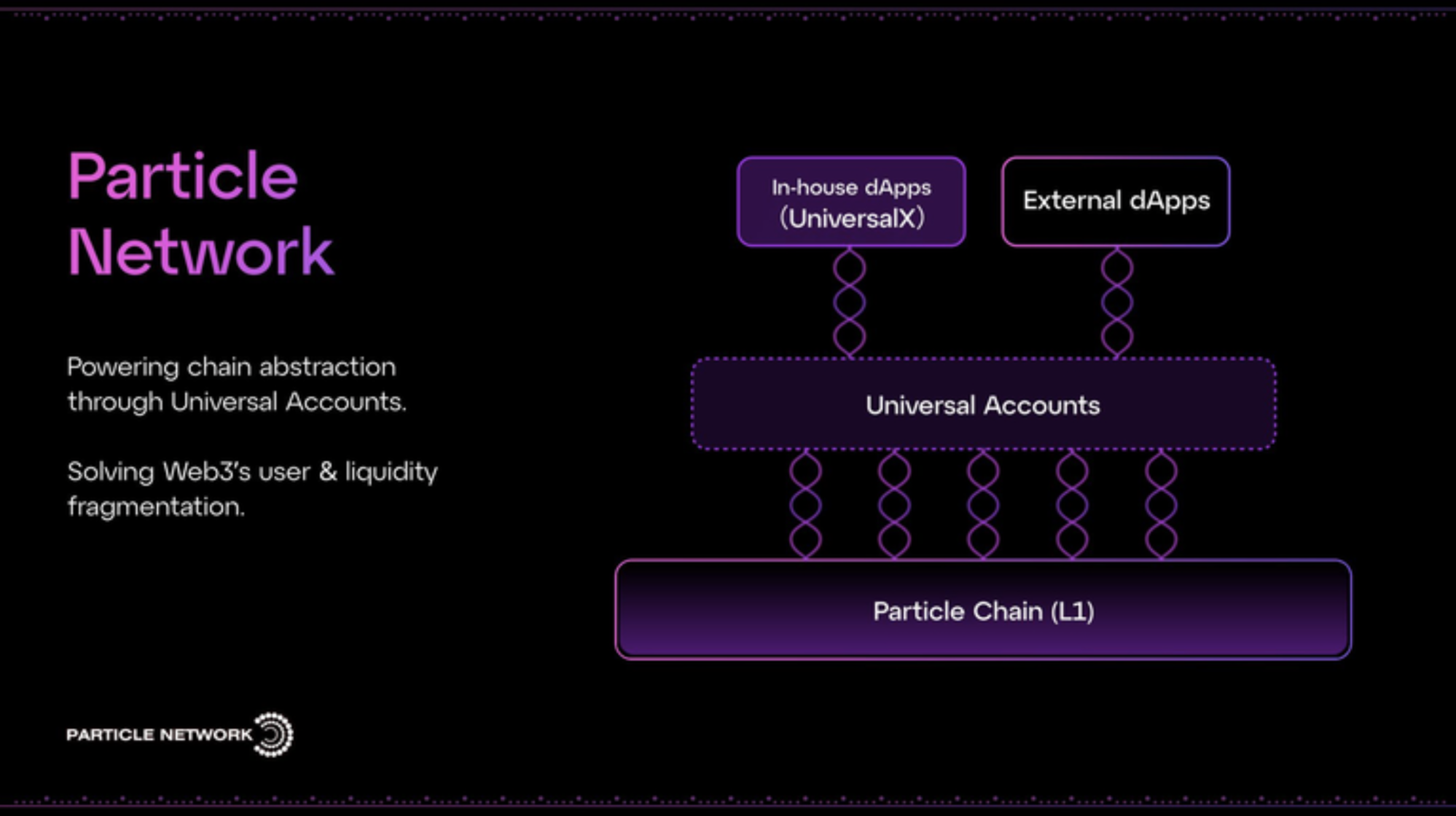

At its core, chain abstraction masks the chaos of multi-chain worlds. As Chainlink puts it, it’s a user experience framework unifying fragmented networks into one interface. Think of it as a universal remote for blockchains, letting you swap, lend, or stake assets fluidly. Platforms like zkCross Network are leading the charge, bundling wallet management, gas abstraction, and liquidity routing into a single view. No more hunting for tokens on isolated DEXes or praying bridges don’t glitch.

Why Unified Liquidity Feels Like Magic for Traders

Traditional DeFi demands you split attention across chains, fragmenting your liquidity and exposing you to risks like impermanent loss or failed txs. Chain abstraction flips the script with multi-chain wallet support. One account governs all: deposit USDC on Polygon, trade it for SOL on Solana, all via intent-based execution. zkCross, for instance, routes trades through aggregated liquidity pools, optimizing for price and speed behind the scenes.

I’ve consulted on enough wallet UIs to know users crave simplicity. Here, solvers handle the backend plumbing, batching transactions, paying gas in native tokens, even abstracting signatures. The result? Cross-chain DeFi UX that rivals CeFi apps. Arcana Network takes it further with bridgeless swaps, making instant cross-chain moves feel native.

Key Benefits of Unified Liquidity

-

Single wallet for all chains: Manage assets across blockchains like Ethereum and Polygon from one interface, as in zkCross Network—no more multi-wallet hassle.

-

Gasless trades via abstraction: Execute swaps without paying gas fees upfront, thanks to abstracted handling in platforms like Arcana Network.

-

Aggregated liquidity for best prices: Tap into pooled liquidity from multiple chains for optimal rates, unifying fragmented markets seamlessly.

-

Reduced slippage across pools: Minimize price impact by routing through the deepest liquidity sources across chains, improving trade efficiency.

-

Intent-driven execution for strategies: Define trade intents (e.g., swap X for Y at best price), and let solvers handle complex cross-chain execution.

Breaking Down the Tech Powering Seamless Swaps

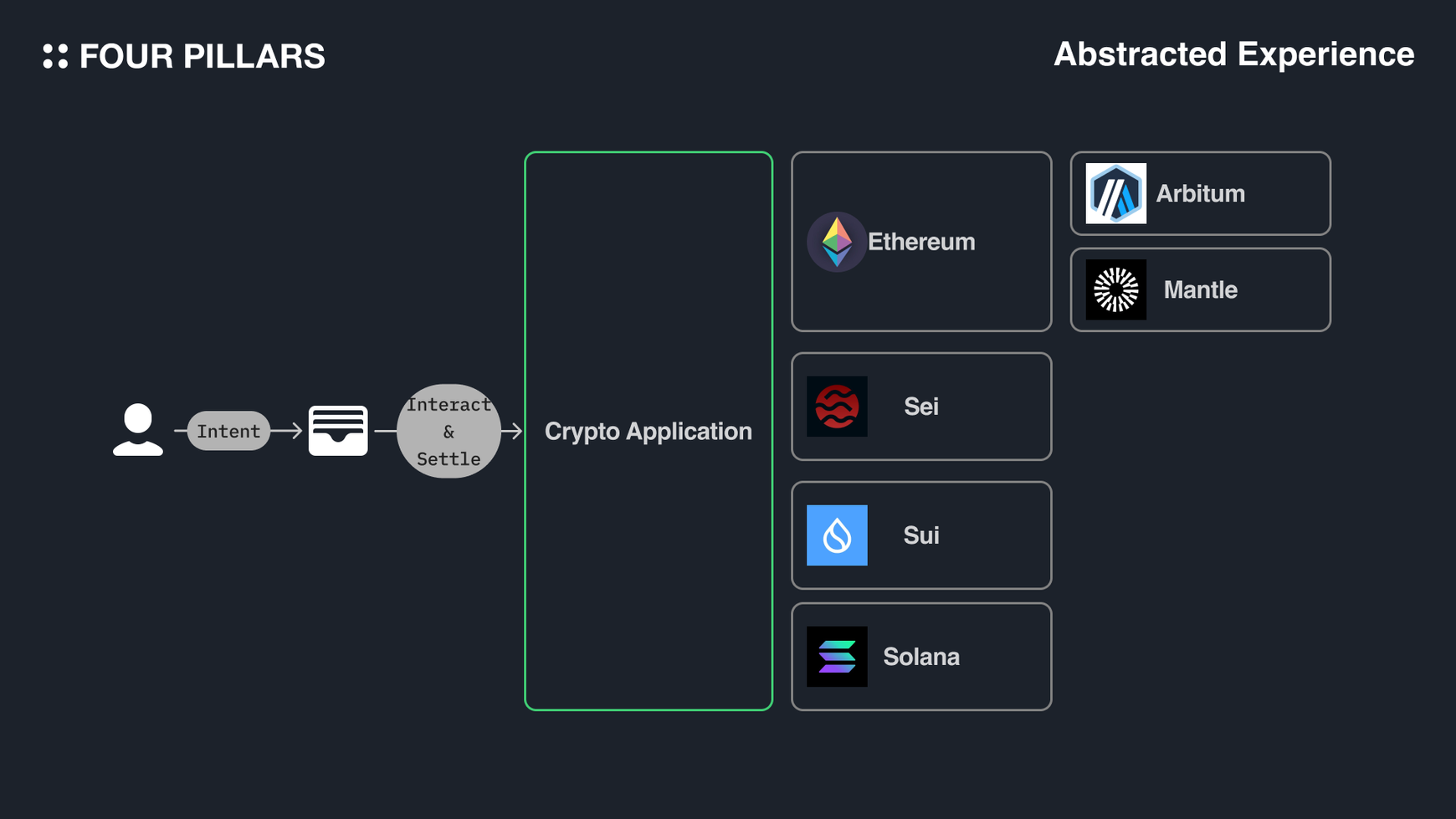

Dive deeper, and you’ll see chain abstraction decouples user intent from chain specifics. Blockworks nails it: it enables seamless dApp interactions across chains by batching backend ops. Want to swap ETH for AVAX? Express the intent; the system finds the optimal path, maybe via a zk-rollup for privacy or a liquidity layer for depth.

Take one-click cross-chain swaps: your wallet interprets the trade, queries unified pools, and executes atomically. No manual bridging. UXLINK highlights multi-chain compatibility as a killer feature, one account, zero complexity. Self Chain even weaves in AI for predictive liquidity routing, spotting opportunities before they peak.

“Chain abstraction creates a single interface that marries multiple chains. ” – The Defiant

This unification tackles real pain points. Remember the 2023 bridge exploits? Abstraction minimizes exposure by avoiding persistent liquidity in vulnerable spots. Instead, it dynamically taps pools on-demand, blending security with efficiency.

Real-World Wins: From Fragmented to Fluid Trading

Users on early chain abstraction platforms report 70% faster trades and halved costs, per Web3Auth insights. Imagine managing a diversified portfolio: BTC on Bitcoin, stables on Arbitrum, memecoins on Base, all viewable and tradable in one dashboard. Nervos Network describes it as masking multi-chain complexities, and that’s spot on for retail traders dipping into DeFi.

For developers, it’s a boon too. Build once, deploy everywhere with unified APIs. QuickNode Blog calls cross-chain abstraction the bridge for enterprise, unifying liquidity and compliance. As someone who’s designed these flows, I argue it’s not hype, it’s the path to mass adoption. Check how unified pools explain the mechanics; they’re game-changers for unified wallet cross-chain trading.

But let’s get practical. Setting up starts with a compatible wallet like those from zkCross or Arcana. Connect once, and liquidity from dozens of chains aggregates instantly. No seed phrase roulette across apps.

From there, discovering the best rates across chains happens automatically. Your dashboard shows aggregated prices from Uniswap on Ethereum, Orca on Solana, and beyond, all in one spot. This unified liquidity chain abstraction means spotting a dip in ETH-USDT on Arbitrum while holding funds on Optimism? Swap executed in seconds, no fuss.

Mastering Your First Cross-Chain Trade

Let’s walk through what makes this tick for everyday users. Intent-centric design lets you say, “Swap 100 USDC for SOL at best rate, ” and solvers compete to fulfill it optimally. Eco. com emphasizes how it addresses cross-chain asset management, and I’ve seen it firsthand in prototypes: users complete trades 3x faster than bridging manually.

Security layers impress too. zkCross employs zero-knowledge proofs for private routing, ensuring your positions stay hidden from front-runners. Arcana’s bridgeless tech skips the lock-and-mint vulnerabilities plaguing traditional bridges. As a UX strategist, I push for these features because they build trust, turning skeptics into daily traders.

Advanced traders love the composability. Chain strategies like leveraged yield farming across chains? Now viable without portfolio splits. Web3Auth notes improved DevEx, but for you, it’s cross-chain DeFi UX that feels intuitive, like browsing a single Netflix library instead of juggling streaming apps.

Overcoming Hurdles: What to Watch in Unified Wallets

No tech is flawless. Centralization risks lurk if solvers dominate, so opt for decentralized networks like those zkCross builds on. Gas abstraction shines, but during congestion, native payers cover spikes transparently. The Defiant points out batched transactions cut noise, yet always review solver fees, typically under 0.1%.

Regulation looms too. QuickNode Blog spotlights compliance in cross-chain abstraction, vital for institutions eyeing entry. Retail users benefit indirectly through audited protocols. My advice: start small, verify wallet audits on sites like DefiLlama, and scale as confidence grows. This seamless blockchain interoperability isn’t a free lunch, but the trade-offs crush legacy DeFi pains.

Looking ahead, AI integrations like Self Chain’s predictive tools will forecast liquidity droughts, auto-rebalancing portfolios. Imagine your wallet nudging, “Shift to Solana pools before the rush. ” That’s the horizon, blending behavioral finance insights with blockchain smarts for truly proactive trading.

Developers, take note: APIs from these platforms let you embed unified liquidity into dApps effortlessly. Check resources on seamless cross-chain wallet UX in DeFi to integrate today. For enthusiasts, it’s liberating, one interface ruling them all.

Platforms evolve fast. zkCross just rolled out gas sponsorships for new users, Arcana hit 50-chain support. Dive in, experiment with small positions, and watch how multi-chain wallet support reshapes your strategy. The multi-chain maze? Conquered. Your edge in DeFi awaits, fluid and fierce.