In the multi-chain world of blockchain, users face a daily grind of switching wallets, bridging assets, and juggling native tokens just to execute a simple trade or stake. This friction isn’t just inconvenient; it’s a barrier stifling mainstream adoption. Enter chain abstraction UX, paired with universal identity layers, promising a unified wallet experience where your identity travels seamlessly across EVM and non-EVM chains alike.

The pain points are real. Imagine holding ETH on Ethereum, SOL on Solana, and BTC on its native chain. To interact with a DeFi protocol spanning these networks, you need separate wallets, each demanding unique gas tokens and private key management. One wrong network selection, and your transaction fails, costing time and fees. This fragmented setup demands technical savvy most users lack, leading to errors, lost funds, and abandoned apps.

The Fragmented Reality of Multi-Chain Wallet Management

Current wallets force users into a patchwork of interfaces. Ethereum demands MetaMask with ETH for gas; Solana requires Phantom and SOL. Cross-chain ambitions mean bridges like Wormhole or LayerZero, each with their own risks of hacks and delays. Cross-chain identity layer solutions are emerging to fix this, but without a solid foundation, they falter.

Platforms like UXLINK demonstrate early wins with their cross-chain single account system, powered by account abstraction. Users operate across blockchains without swapping wallets, paying gas in preferred tokens via universal mechanisms. Yet, this hinges on robust identity portability. Without it, even abstracted chains revert to siloed experiences.

Chain Abstraction Unveiled: Beyond Bridges to True Interoperability

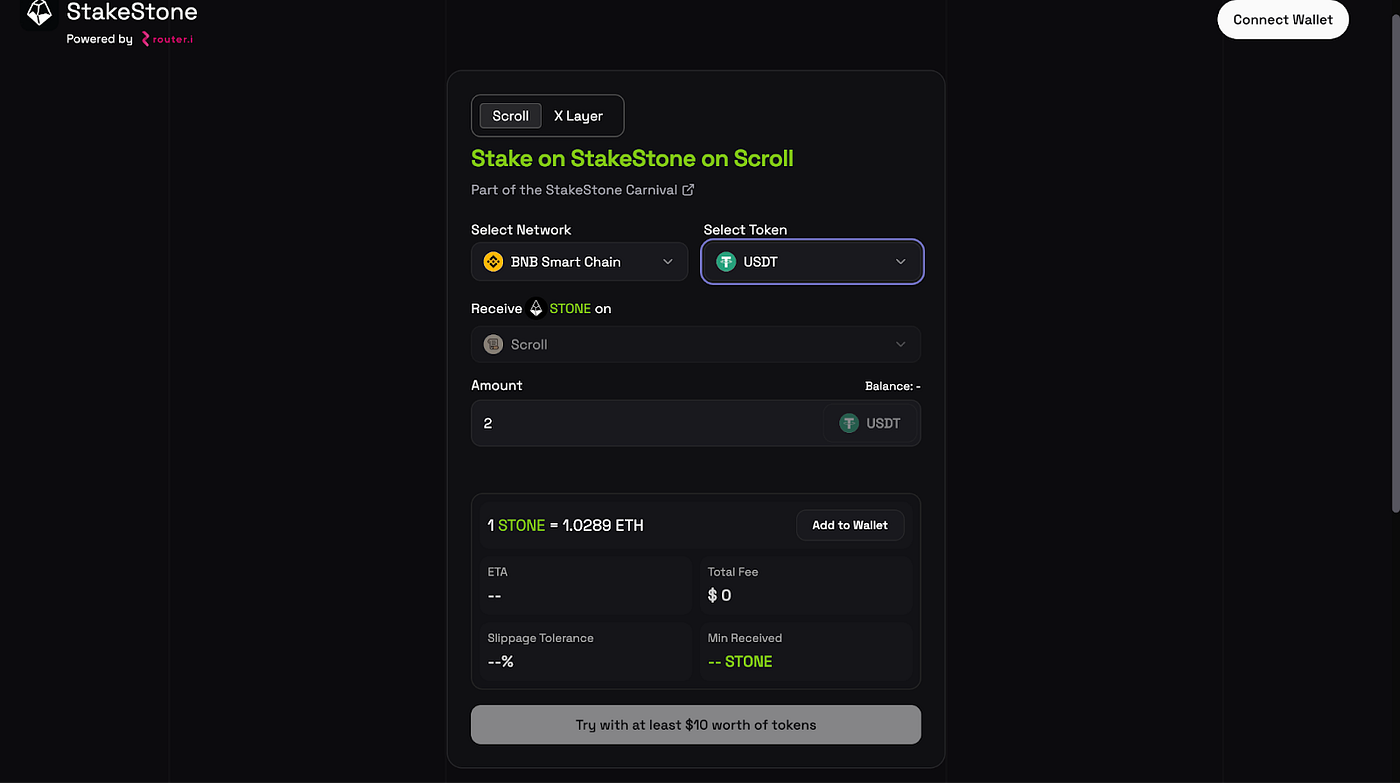

Chain abstraction strips away blockchain-specific hurdles, letting dApps run logic across chains without user intervention. Think intent-based execution: you declare “swap ETH for SOL, ” and solvers handle routing, gas, and settlement. Frameworks like CAKE outline layers – permission, solver, settlement – to orchestrate this ballet.

Self Chain takes it further with AI-powered abstraction, offering keyless wallets and optimized paths. But here’s the pragmatic view: abstraction alone creates a facade. Users still grapple with identity silos. A unified wallet identity is non-negotiable for persistence. Agoric’s universal accounts map this onto user flows, ensuring one identity spans chains, slashing the cognitive load.

Core Elements of Universal Identity

-

Single Account Access: Enables one unified account across EVM and non-EVM chains, eliminating multiple wallets. UXLINK powers seamless cross-chain operations.

-

Token-Agnostic Gas: Pay fees on any chain using a single token, reducing the need for native tokens per network. Supported by UXLINK‘s universal gas.

-

Automated Solvers: Intelligent solvers handle transaction execution across chains via the Solver layer in frameworks like CAKE, optimizing paths without user intervention.

-

Keyless Security: Secure access without private keys using intent-centric designs. Self Chain offers keyless wallets for simplified UX.

-

AI-Optimized Intents: AI enhances intent execution by optimizing routes, fees, and strategies across chains. Featured in Self Chain.

Nervos Network frames chain abstraction as importing Web2 UX into Web3, hiding multi-chain complexities. Protokol echoes this, boosting interoperability. CryptoEQ notes dApps executing multi-chain without network switches. Mokshya Protocol highlights abstracted wallets auto-accessing chains with any-token gas. Push Chain pushes unified UX abstracting chain differences.

Why Universal Identity Layers Are Non-Negotiable for Seamless UX

Universal identity layers act as the linchpin, providing a single point of control. UXLINK’s docs detail how these layers support smart contract logic for custom transactions in one go, spanning EVM and beyond. No more multi-wallet juggling; one account, multi-chain mastery. This blockchain identity portability reduces attack surfaces – manage one keyless setup via social recovery or biometrics.

Consider the flow: user intents trigger solvers that bundle operations across chains, settled atomically. Universal gas lets you pay with USDC everywhere, per UXLINK. Self Chain’s intent-centric design AI-tunes this, finding liquidity and minimizing fees. La Luot on Medium nails it: Web3 identity pain demands one wallet per chain no more.

Yet, opinionated take: many projects tout abstraction without identity depth. True seamless chain abstraction UX demands layers verifying ownership portably, resisting sybil attacks via social graphs or ZK proofs. 4pillars. io’s CAKE framework integrates this, but execution varies. For portfolio managers like myself, integrating cross-chain assets into diversified strategies requires this reliability – no friction means better allocation across volatile markets.

Execution matters more than frameworks. Projects succeeding in chain abstraction universal identity prioritize verifiable, portable ownership. Social graphs, as in UXLINK’s social-centric recovery, add sybil resistance without centralization. ZK proofs enable privacy-preserving verification across chains, ensuring your identity isn’t a weak link in diversified holdings.

Technical Pillars: Account Abstraction Meets Identity Portability

At the core lies ERC-4337 account abstraction, evolving into cross-chain variants. This lets smart contract wallets execute batched, intent-driven transactions. Layer it with universal identity, and you get programmable accounts that recognize you anywhere. Solvers interpret intents – “lend my USDC across Aave on Arbitrum and Morpho on Base” – bundling execution without bridges.

Pragmatically, trade-offs exist. Keyless setups via MPC or TSS reduce single points of failure but introduce coordination latency. AI, as in Self Chain, mitigates this by predicting optimal paths, but over-reliance risks black-box decisions. My FRM background screams for transparency: audit solvers, stress-test settlements. For commodities traders eyeing tokenized RWAs on multiple chains, this means hedging gold on Ethereum against oil on Polygon without UX drag.

Developers benefit too. dApps build once, deploy everywhere via abstracted interfaces. No chain-specific SDKs; one API call handles multi-chain state. This shifts focus from plumbing to innovation, accelerating DeFi primitives like perpetuals spanning ecosystems.

Yet, pitfalls loom. Interoperability standards lag. Without unified primitives for identity attestation, chains revert to oracles or bridges – yesterday’s vulnerabilities. Onchain Passport’s vision of one identity across blockchains aligns here, but adoption needs critical mass. Seamless cross-chain wallet UX demands ecosystem buy-in, from L1s to rollups.

Risk Management in Practice: Diversifying Across Abstracted Chains

As a CFA charterholder balancing stocks, crypto, and commodities, I view chain abstraction through resilience lenses. Volatility spikes? Rebalance BTC exposure to Solana yields instantly, no bridging delays. Universal identity ensures atomicity – all or nothing – minimizing slippage in turbulent markets.

Take a real portfolio tilt: 40% equities, 30% crypto (cross-chain DeFi), 20% commodities, 10% cash. Pre-abstraction, crypto meant siloed positions, blind to opportunities. Now, one dashboard aggregates yields from EigenLayer on Ethereum, Jito on Solana, and Babylon BTC staking. Gas? Paid in stablecoins universally. Identity? Persistent, recoverable via trusted contacts.

This isn’t hype; it’s operational alpha. Reduced cognitive overhead frees bandwidth for macro analysis – Fed pivots impacting tokenized treasuries across Base and Optimism. Projects nailing cross-chain identity layer integration, like those mapping universal accounts to flows, deliver measurable edge.

Challenges persist: regulatory scrutiny on identity portability could fragment progress. KYC mandates clash with pseudonymity, demanding selective disclosure via ZK. Scalability tests await as TVL surges. Still, momentum builds. Nervos, Agoric, and Protokol lay groundwork; UXLINK and Self Chain execute.

Forward thinkers integrate now. Testbeds like testnets for intent solvers reveal robustness. For innovators, this convergence of abstraction and identity heralds Web3’s mainstream pivot – wallets as simple as Venmo, portfolios as potent as hedge funds. Blockchain’s promise fulfills when friction vanishes, letting diversified strategies thrive unbound.