In the sprawling multiverse of blockchains, where Ethereum’s Layer-2s tangle with Solana’s speed demons and emerging non-EVM chains vie for liquidity, users have long battled the tyranny of fragmentation. Enter chain abstraction wallets in 2026: the strategic linchpin for a chainless DeFi experience. These unified interfaces dissolve the barriers of manual bridging, gas juggling, and network hopping, delivering seamless multi-chain transactions that feel as intuitive as swiping a credit card. As a strategist who’s tracked crypto’s macroeconomic tides for nearly two decades, I see this not as hype, but as the maturation DeFi desperately needs to scale institutionally.

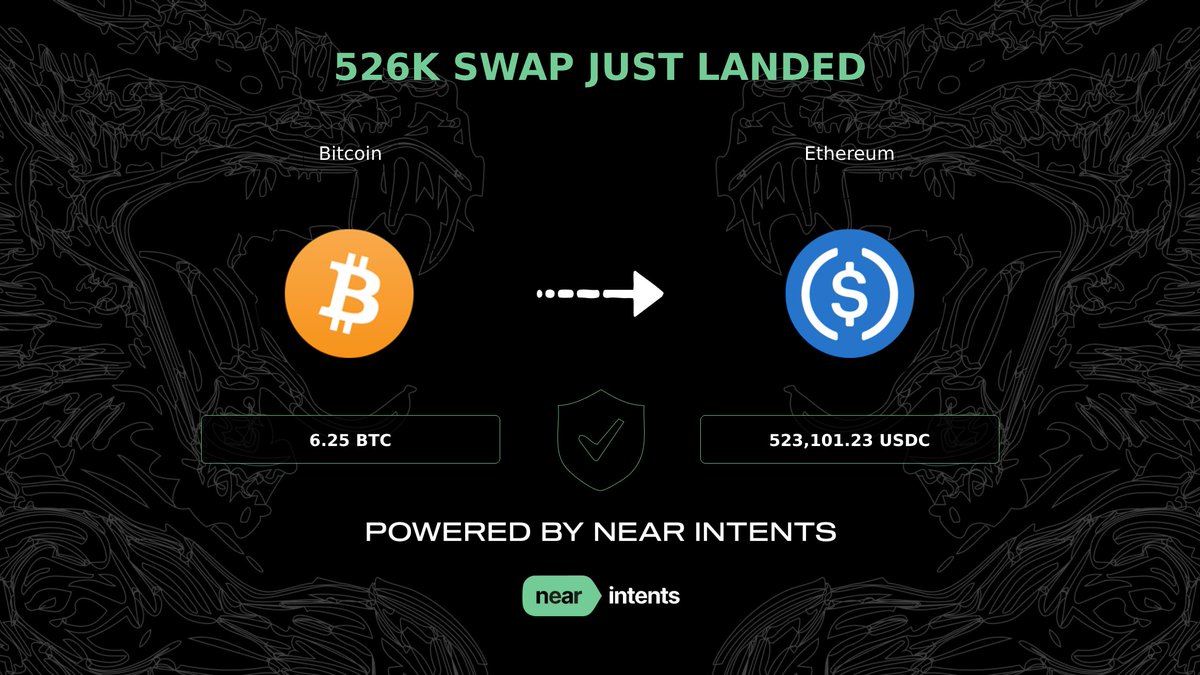

Chain abstraction reimagines how we interact with blockchains by abstracting away the underlying complexities. Instead of users micromanaging private keys per chain or fretting over bridge vulnerabilities, these wallets employ AI-driven routing, intents-based execution, and account abstraction to orchestrate actions across ecosystems. The result? A unified wallet chain abstraction layer that presents one balance, one signature, and one intent, while solvers and relayers handle the plumbing in the background. Drawing from recent advancements, protocols like NEAR Intents have already clocked over $5 billion in cumulative volume, proving this model’s viability for everyday and enterprise users alike.

Why Cross-Chain DeFi UX Demands Abstraction Now

DeFi’s promise of permissionless finance has been hobbled by its own success: liquidity splintered across 100 and chains, execution risks amplified by bridges, and user drop-off rates soaring past 70% mid-transaction. In 2026, cross-chain DeFi UX hits a tipping point, fueled by maturing Layer-2s and interoperability stacks. Institutions, as highlighted in analyses from Ancilar Blockchain Services, won’t touch protocols lacking high-volume throughput, sub-second finality, and native cross-chain execution. Chain abstraction wallets address this head-on, unifying liquidity pools and automating paths that minimize slippage and fees.

Key Advantages of Chain Abstraction Wallets

-

Faster Transactions: AI-optimized paths in Self Chain and NEAR Intents enable quick cross-chain execution with high-volume support and seamless routing, reducing latency for DeFi.

-

Reduced Gas Costs: Arcana Network eliminates gas fees across chains via abstraction protocols, optimizing costs for institutional-scale operations.

-

Enhanced Security via Intents: NEAR Intents and zkCross Network use AI-driven key management and encrypted processing for privacy-by-design, securing cross-chain actions without manual bridging.

-

Unified Asset Views Across 100+ Chains: Platforms like Self Chain and Arcana provide a single balance view over 100 EVM/non-EVM chains, solving fragmentation for frictionless DeFi UX.

Privacy upgrades further elevate the game. Cross-chain account abstraction now embeds encrypted transaction details and confidential smart contracts, shielding users from front-running while preserving composability. This isn’t mere convenience; it’s a risk-adjusted upgrade for portfolios navigating volatile markets.

Spotlight on 2026’s Trailblazing Chain Abstraction Wallets

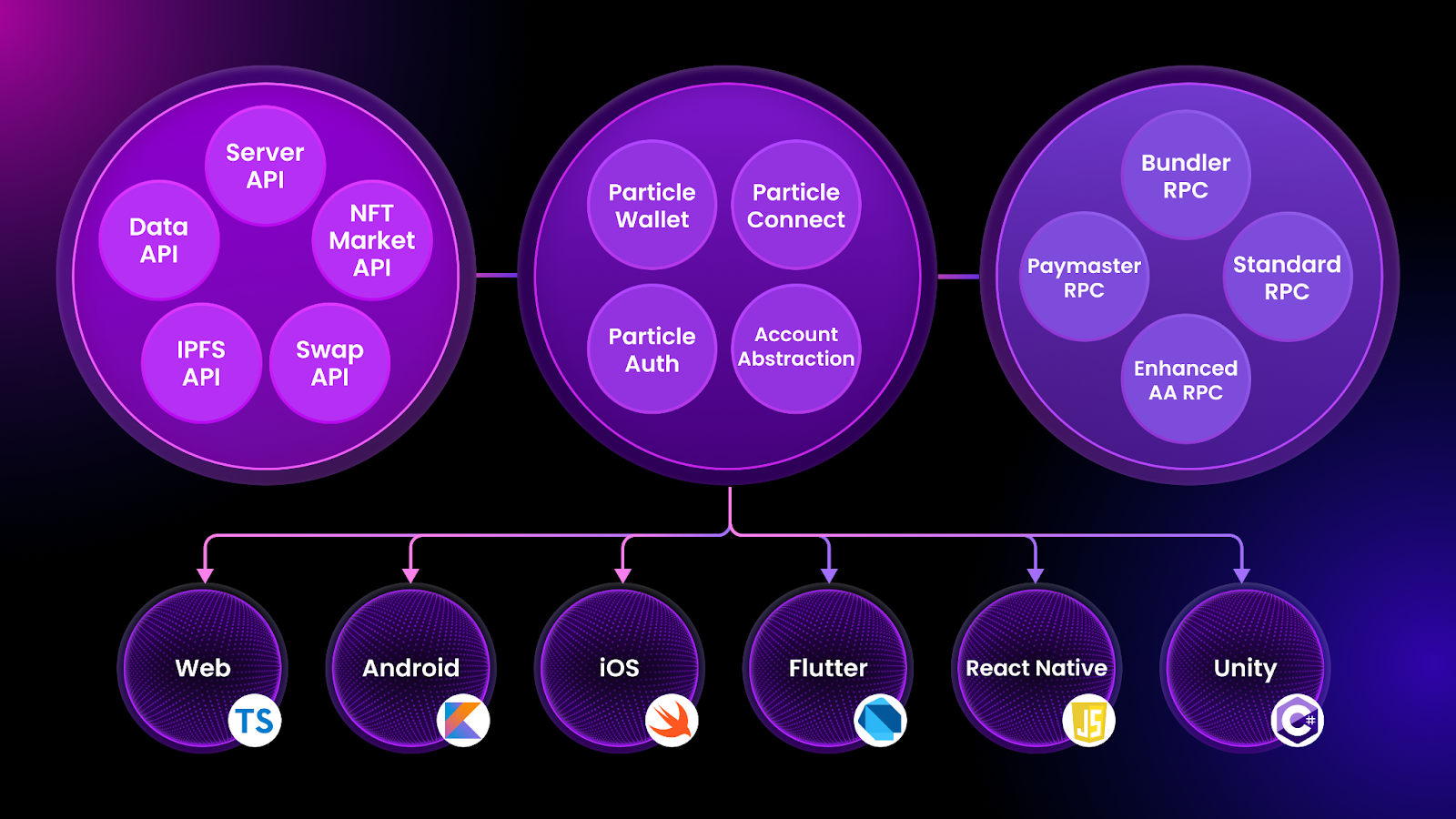

January 2026 marks a watershed, with projects like zkCross Network pioneering AI-driven key management. Users connect legacy wallets or spin up new ones, and the system intelligently maps addresses across chains, executing from the right origin without a whisper of manual input. Fiat onboarding integrates seamlessly, lowering barriers for normies dipping into DeFi.

Self Chain pushes boundaries with keyless, multi-chain account abstraction supporting over 100 EVM and non-EVM networks. Their AI-optimized liquidity paths eradicate gas token shortages and asset silos, delivering what feels like a single-chain wallet in a multichain world. Meanwhile, Arcana Network’s protocol unveils a unified funds balance drawable from any chain, obliterating gas fees entirely. Imagine spending your total portfolio value on Solana dApps using Ethereum collateral, all abstracted away.

Reown’s phased rollout and NEAR’s solver networks exemplify strategic layering: start with intent declaration, let decentralized actors compete for optimal fulfillment. This intents model, now embedded in native wallets, scales to billions in volume without users touching chain-specific UIs.

Strategic Implications for DeFi Portfolio Managers

For investors and developers, these wallets aren’t optional; they’re the bridge to enterprise adoption. QuickNode’s insights underscore how cross-chain abstraction unifies liquidity, enforces compliance rails, and polishes UX to Web2 standards. Standards for cross-chain account abstraction are emerging, enabling smart accounts that behave identically on Ethereum, Base, or zkSync. As NEAR Protocol advances outline, one account interacts universally, slashing cognitive load and error rates.

Read more on how chain abstraction simplifies multi-chain wallet UX for DeFi users. This evolution demands a rethink: position portfolios around abstraction-native protocols, hedge against legacy bridge risks, and prioritize intents for yield optimization across silos. The frictionless era isn’t coming; it’s here, reshaping DeFi’s risk-reward calculus profoundly.

Portfolio construction in this abstracted landscape favors protocols with embedded intents solvers and relayer networks, where competition drives efficiency. Traditional DeFi yield farming across chains now resolves to a single click, with AI routing capturing arbitrage while users sleep. Yet, success hinges on selecting wallets that balance innovation with battle-tested security; zkCross’s AI key management shines for retail-to-institutional transitions, but demands scrutiny of its oracle dependencies.

Comparison of Leading 2026 Chain Abstraction Wallets

| Wallet | Key Features | Supported Chains | Unique Edge |

|---|---|---|---|

| zkCross | AI-driven key management, fiat onboarding, multi-chain mapping | Multi-chain (AI address handling) | Seamless key abstraction across networks without manual intervention |

| Self Chain | Keyless AA, AI liquidity paths | 100+ EVM and non-EVM chains | Unified Web3 experience solving gas and asset access issues |

| Arcana | Unified balance, zero gas, any-chain spend | All blockchains | Single funds balance spendable on any chain, eliminating gas fees |

| NEAR Intents | Solver networks, embedded in wallets | $5B cumulative volume | Intent-based cross-chain coordination integrated into native wallets |

These tools don’t just streamline; they recalibrate DeFi’s macroeconomic dynamics. Unified liquidity vistas emerge, where Solana’s velocity meets Ethereum’s depth without the drag of manual swaps. For strategists, this means overweighting abstraction layers in allocations – think 20-30% tilts toward intents infrastructure over siloed L1s. Blockchain App Factory’s 2026 outlook aligns here: Layer-2 maturity amplifies cross-chain UX, but only abstraction wallets unlock the full interoperability quotient.

Navigating Risks in the Chainless Era

Abstraction’s allure tempts overconfidence, yet macroeconomic prudence demands vigilance. Bridge exploits linger in legacy systems, but intents-based execution sidesteps them by delegating to vetted solvers. Privacy, as DEV Community notes, embeds encryption natively – transaction intents obfuscate details mid-flight, thwarting MEV predators. Still, centralization risks in AI routing warrant diversified wallet usage; pair Self Chain’s breadth with Arcana’s gasless purity for resilient setups.

Institutions eyeing entry, per QuickNode’s enterprise bridge thesis, prioritize compliance hooks within these wallets. zkCross fiat ramps and Reown’s phased compliance layers provide KYC-optional paths, blending Web3 ethos with regulatory nods. My 18 years in capital markets underscore a timeless truth: superior UX compounds adoption exponentially, much like Bloomberg terminals democratized fixed income in the 80s. Chain abstraction wallets are DeFi’s terminal moment.

Developers, take heed – embed these wallets early. Quecko’s AI-cross-chain fusion previews one-click swaps via automated bridges, slashing fees 80% while preserving atomicity. For users, the shift to seamless multi-chain transactions means portfolios fluidly chasing yield: Ethereum stablecoin farms auto-roll into Solana perps when edges sharpen, all under one dashboard.

Positioning for 2026’s Unified Ecosystem

By mid-2026, expect cross-chain account abstraction standards to standardize smart accounts across Ethereum, Base, and beyond, per BlockEden’s mainstreaming forecast. NEAR’s $5 billion milestone isn’t anomaly; it’s harbinger. Crypto Council for Innovation nails it: abstraction unifies transactions, solving fragmentation at its root. Strategically, I advocate layering exposure – core holdings in unified wallet providers, satellites in solver networks.

Dive deeper into how chain abstraction wallets enable one-click cross-chain swaps for tactical playbooks. This isn’t evolution; it’s reinvention. DeFi sheds its chains, emerging as the frictionless force capital markets have awaited, empowering every investor from retail pioneer to institutional titan with a chainless DeFi experience. The multiverse converges; wallets lead the way.