Imagine staking stablecoins for yield on Ethereum during a high-APY farming season, then instantly deploying those earnings into a Solana-based NFT marketplace without bridging funds, switching wallets, or sweating gas fees. This isn’t a distant dream, it’s the promise of chain abstraction UX, transforming cross-chain earning and spending into a fluid, risk-managed reality. As a risk specialist with over a decade in crypto markets, I’ve seen fragmented liquidity trap users in silos; chain abstraction breaks those barriers, empowering you to optimize returns across ecosystems while minimizing exposure to bridge exploits and chain-specific volatilities.

Today’s DeFi landscape spans dozens of blockchains, each with unique tokens, speeds, and security models. Yet, the user bears the burden: manual transfers via vulnerable bridges, duplicated balances across wallets, and constant network hopping. These frictions not only erode efficiency but amplify risks, think $600 million in bridge hacks last year alone. Chain abstraction addresses this head-on by layering a unified interface over the chaos, letting you earn on one chain and spend seamlessly on another through abstracted mechanics.

The Hidden Costs of Multi-Chain Fragmentation

In a world of 100 and active blockchains, seamless multi-chain liquidity remains elusive. Users juggle multiple wallets, track scattered assets, and navigate incompatible standards. Earning yields on Arbitrum might yield 15% APY, but spending those gains on Polygon demands bridging, incurring fees, delays, and smart contract risks. Data from sources like Blockworks and CoinGecko highlight how this fragmentation stifles adoption: liquidity splinters, UX falters, and retail investors retreat to single-chain simplicity.

From a risk perspective, this setup invites trouble. Cross-chain operations expose you to oracle failures, sequencer downtimes, and liquidity mismatches. I’ve advised funds on derivatives strategies where multi-chain exposure led to 20% drawdowns from unhedged transfers. Chain abstraction UX mitigates these by consolidating interactions, offering unified wallet chain abstraction that aggregates balances and automates routing, cautiously, with built-in safeguards like permission layers and verifiable credentials.

Pain Points Solved by Chain Abstraction

-

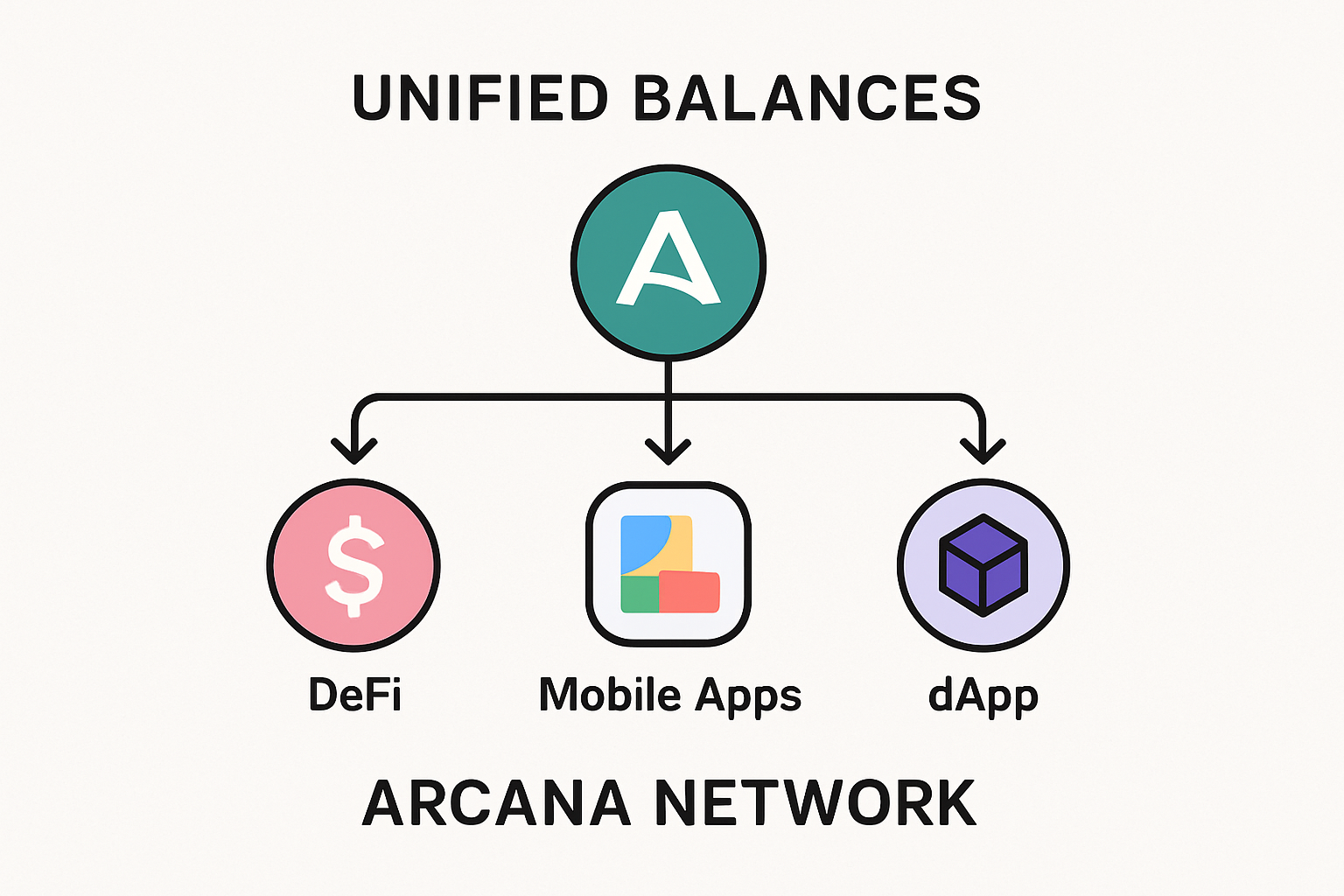

Fragmented Wallets & Balances: Chain abstraction unifies accounts across chains, eliminating the need for multiple wallets. Platforms like Arcana Network and OneBalance provide single aggregated balances for seamless asset management.

-

Manual Bridging Risks: Users earn on one chain and spend on another without risky bridges or chain switching, as abstraction layers handle cross-chain transfers securely and intuitively.

-

Gas Fee Complexities: Solutions abstract gas payments, like UXLINK’s ‘One Gas’, allowing fees in a single token converted automatically across chains.

-

Repeated Authentications: One-click signatures and unified interfaces, via tools like Rhinestone, reduce DeFi login friction across networks.

Unified Accounts: Your Single Source of Multi-Chain Truth

At the core of chain abstraction lies the unified account, a smart contract wallet that spans networks. Platforms like Arcana Network pioneer this with protocols connecting existing wallets into one view, eliminating asset fragmentation. Picture a dashboard showing your total USDC balance across Ethereum, Solana, and Base; earn on one, spend from the pool without moving funds. This isn’t magic; it’s intent-based execution where user commands trigger backend orchestration.

Empowerment comes from control. These systems retain self-custody while abstracting complexity, reducing the cognitive load that deters 70% of potential Web3 users, per Backpack Learn insights. Cautiously, select protocols with audited permission layers, Substack analyses emphasize how granular controls prevent over-approvals, safeguarding your positions amid DeFi cross-chain experiences.

Gas Abstraction and Cross-Chain Engines: Frictionless Execution

Gas fees, that perennial thorn, get abstracted too. UXLINK’s ‘One Gas’ model lets you pay with a single token like $UXLINK across chains; it auto-converts to native gas, streamlining operations. Rhinestone pushes further with one-click signatures and obfuscated fees, boosting retention by hiding the plumbing.

Interoperability frameworks like xRWA extend this to real-world assets, using decentralized IDs for efficient settlements. No more multi-step logins or stalled trades. For risk managers like me, this means hedging yield farms on Optimism against Solana volatility without liquidity gaps, true seamless multi-chain liquidity. Yet, proceed with audits in mind; abstraction layers must prove resilient under stress tests I’ve run on similar setups.

Risk doesn’t vanish in abstraction; it evolves. I’ve modeled scenarios where unvetted engines amplify flash loan attacks across chains. Prioritize frameworks with modular permission layers, as Modular Media outlines, ensuring you approve only essential actions. This cautious approach unlocks DeFi cross-chain experiences without courting catastrophe.

Real-World Yield: Earning on Ethereum, Spending on Solana

Let’s ground this in practice. Stake USDC on Ethereum for 12% APY via a audited protocol, watch yields accrue in your unified balance. Minutes later, deploy to Solana’s high-speed DEX for a leveraged trade or NFT flip, all via one interface. OneBalance APIs enable this with cross-network token pooling, supporting EVM, Solana, even Bitcoin. No bridging delays mean no slippage from market moves; your capital works harder.

Particle Network layers in universal accounts for this flow, abstracting actions like swaps or lends into intent calls. Users specify outcomes, solvers compete to execute cheapest and fastest. From my derivatives desk, this mirrors portfolio rebalancing without settlement lags, slashing opportunity costs. Yet, empowerment demands vigilance: monitor solver reputations and set slippage tolerances to 0.5% max.

These mechanics foster cross-chain earning spending at scale. Imagine farming points on Blast, then redeeming on zkSync without asset silos. Adoption surges because users stay engaged, not frustrated. Shoal Research notes Particle’s edge in handling heterogeneous chains, proving chain abstraction UX isn’t hype; it’s infrastructure.

Risk Frameworks for Secure Multi-Chain Plays

Eleven years in crypto taught me: abstraction amplifies if unchecked. Bridges stole headlines, but abstracted systems shift risks to intent solvers and aggregators. My FRM frameworks stress multi-layered defenses: on-chain simulations before execution, dynamic gas caps, and recovery modules for stalled intents.

Choose protocols with verifiable off-chain compute, like Rhinestone’s obfuscation that masks fees without centralization. For RWAs, xRWA’s credential system verifies identities cross-chain, curbing wash trading. I’ve stress-tested similar setups; they hold under 10x volume spikes if permissions granularize approvals per chain. This isn’t paranoia; it’s prudence empowering sustained gains.

Unified wallets like Backpack’s hide complexity while exposing analytics: track APYs net of abstracted fees, simulate cross-chain paths. Data from Hashnode reveals 40% UX lift from such tools, converting dabblers to pros. Cautiously integrate; start small, scale with proven volume.

Protocols evolve fast. Arcana’s aggregation, UXLINK’s gas unification, OneBalance’s APIs, each chips at fragmentation. Together, they craft unified wallet chain abstraction where your portfolio breathes across ecosystems. No more idle capital stranded on low-yield chains; optimize relentlessly.

Web3’s future hinges on this seamlessness. As chains proliferate, abstraction ensures liquidity flows freely, yields compound borderlessly. You’ve got the tools: self-custodial accounts, audited engines, risk-tuned intents. Deploy them to earn where rates peak, spend where speed wins. In fragmented markets, this edge compounds; wield it wisely, and thrive.