Imagine firing off a DeFi trade across Ethereum, Solana, and Binance Smart Chain without ever touching a bridge or swapping gas tokens. That’s the chain abstraction UX reality in 2025, slashing the chaos of multi-chain life. No more wallet roulette or liquidity hunts; just unified balances and instant swaps. As a trader glued to volatile markets, I’ve watched users fumble bridges for years. Chain abstraction flips the script, delivering cross-chain wallet solutions that feel like magic.

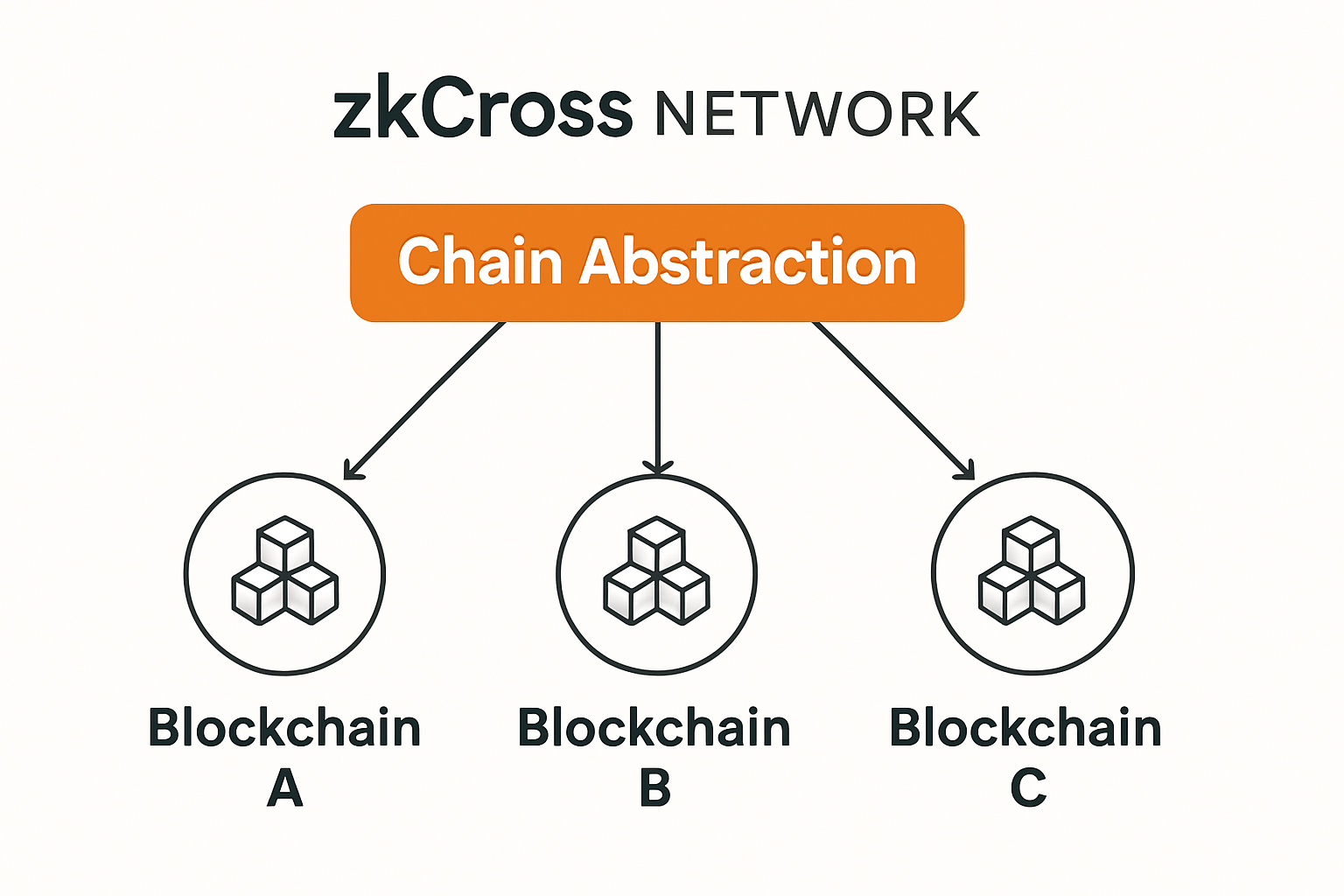

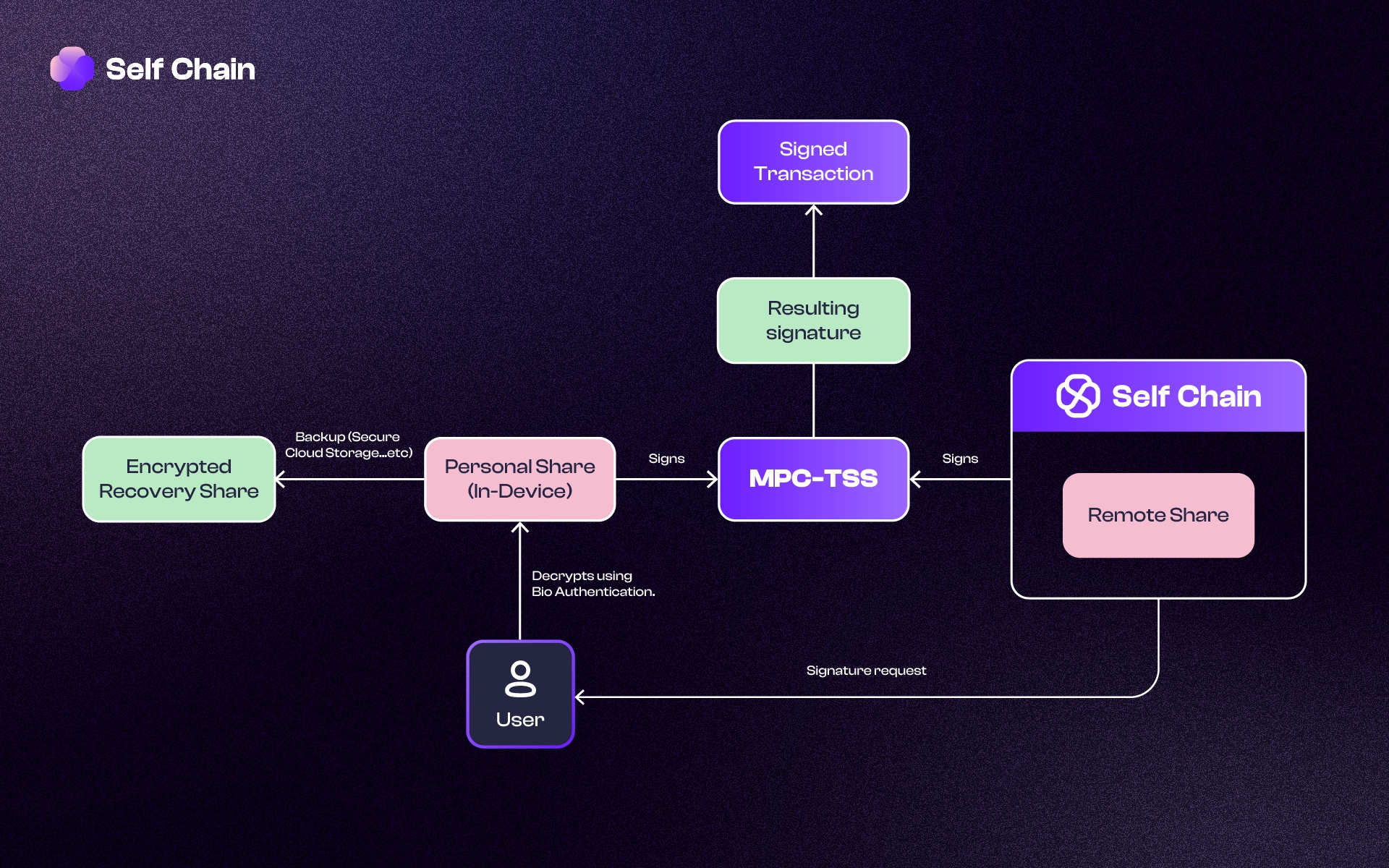

Platforms like Self Chain and zkCross Network lead this charge. Self Chain’s AI-powered, keyless wallets use MPC-TSS and account abstraction for one-account-everywhere access, even sponsoring gas fees. zkCross bakes abstraction into the chain itself for zero-friction cross-chain moves. This isn’t hype; it’s live tech transforming how we trade and interact with dApps.

Why Bridging Sucks – And Chain Abstraction Fixes It Fast

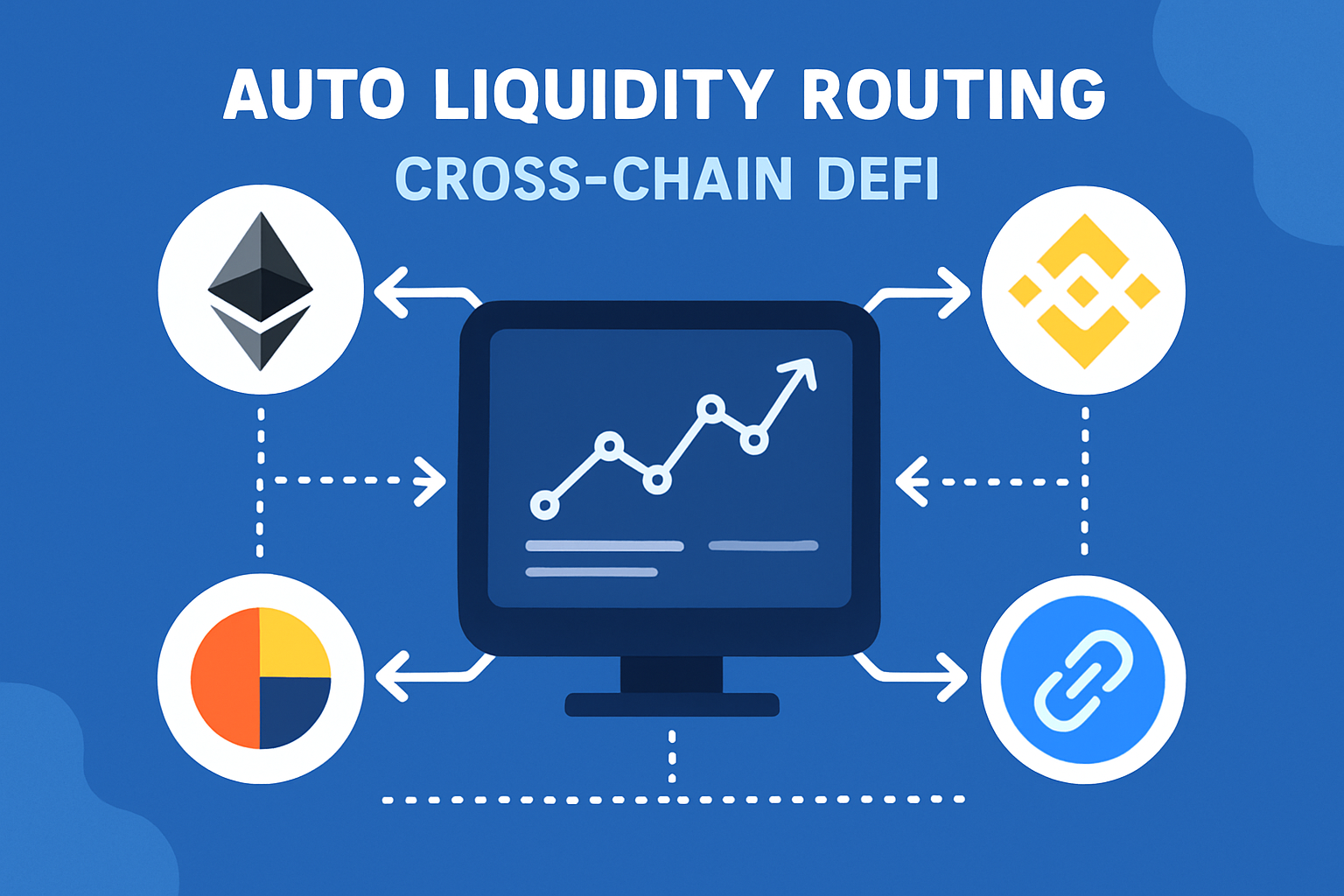

Bridges? They’re the leaky boats of crypto. High fees, hack risks, and wait times kill momentum – especially in fast markets. Chain abstraction wallets erase that by abstracting chains behind a single interface. Users see unified multi-chain wallets with aggregated balances, auto-routed liquidity, and sponsored transactions. Backpack nails this: no bridging, no chain-specific knowledge required. Just pick an app, execute, done.

From my trading desk, this means spotting a breakout on Solana and swapping ETH collateral in seconds – no network hops. Digitap. app calls it the missing piece for mainstream adoption, and they’re spot on. Developers build once; users act freely across ecosystems.

Core Chain Abstraction UX Wins

-

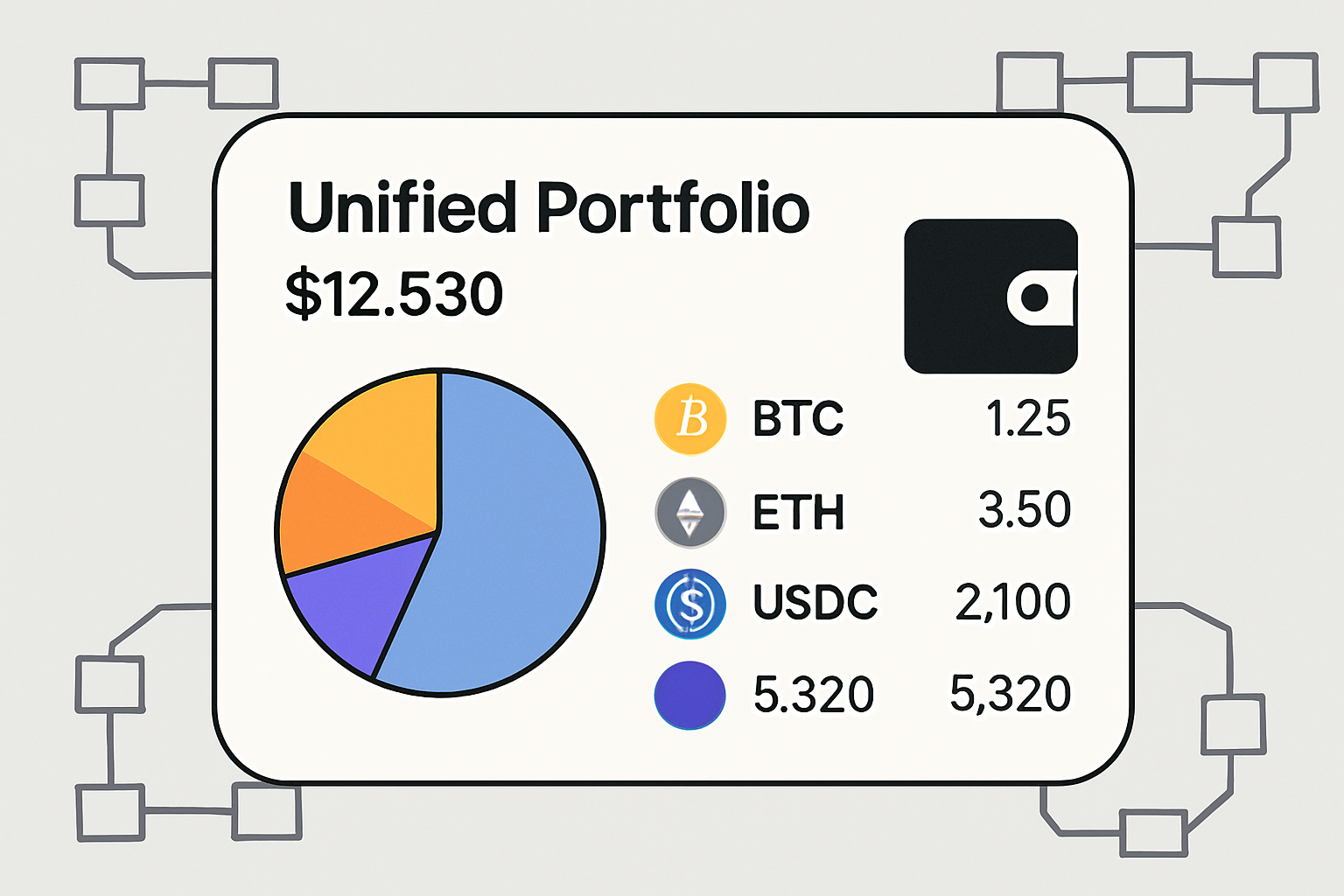

Unified Balances: See all assets across chains in one view – no bridging needed, like in Self Chain wallets.

-

Gasless Txns: Sponsored fees via account abstraction – transact freely without gas tokens, powered by ERC-4337.

-

One-Click Swaps: Instant cross-chain swaps with auto-routing – seamless like Backpack wallet’s interface.

-

Keyless Security: MPC-TSS protects funds without seed phrases – secure, intuitive access via Self Chain.

-

Auto-Liquidity Routing: Smart paths find best liquidity across chains – effortless via zkCross Network.

Unified Wallets That Actually Deliver Seamless DeFi

Dive into 2025’s landscape: seamless DeFi interoperability shines through wallets like those from Altius Labs and NERO Chain. They offer modular platforms where your portfolio spans chains without manual intervention. Withdrawals? Contra’s designs make them intuitive – scan, confirm, cash out across borders.

Turnkey’s strategies amplify this: embedded wallets cut friction, account abstraction simplifies onboarding, and cross-chain unity ties it together. Web3Auth pushes dev-friendly tools for dApps that feel native, not clunky. I’ve tested these in live trades; the speed edge is real, letting me chain positions without UI whiplash. Check how chain abstraction enables one-click cross-chain transactions without bridges for the mechanics.

No-Bridge Chain Abstraction: The Tech Powering It

At its core, no-bridge chain abstraction leverages account abstraction (ERC-4337 evolved) and intent-based solvers. You declare intent – “swap 1 ETH for SOL” – solvers handle routing, gas, and execution off-chain. Quicknode highlights enterprise wins: single interfaces for multi-chain apps. No more 10 gas tokens; one wallet rules them all.

Self Chain’s MPC-TSS keeps keys secure and distributed, while zkCross uses zero-knowledge proofs for instant settlements. 101 Blockchains notes gasless onboarding hooks newbies fast. For traders like me, this means predictive edges without execution drag. Pair it with AI for liquidity scouting, and you’re unstoppable. Dive deeper via how chain abstraction simplifies multi-chain wallet UX for DeFi users.

These tools aren’t future dreams; they’re battle-tested in high-volume DeFi. Users interact like it’s Web2, but own their keys across universes. Next up: real-world setups to get you trading abstraction-style.

Let’s cut to the chase: arming your trading arsenal with chain abstraction UX starts with picking the right unified multi-chain wallet. Self Chain or Backpack? Both crush it, but I’ll walk you through a battle-tested setup that keeps you agile in volatile swings.

Once live, the real juice flows. Fire a cross-chain swap: declare your intent via the dashboard, and solvers route liquidity optimally. No gas token swaps, no bridge waits. I’ve flipped positions from ETH longs to Solana memes mid-pump this way, shaving minutes off execution that used to cost trades. zkCross Network elevates it further, natively embedding abstraction for dApps that auto-handle chain hops. Traders gain predictive power; devs ship faster.

Real-World Wins: Trading Edges in Action

Picture this: BTC rips 10%, but your alpha’s on a Solana perp DEX. Pre-abstraction? Bridge ETH, swap USDC, pray for liquidity. Now? One-click from your cross-chain wallet solutions, with AI scouting best routes like Self Chain delivers. NERO Chain’s modular setup lets you batch transactions across ecosystems, stacking yields without UI fatigue. Contra’s withdrawal UX? Scan QR, confirm biometrics, funds hit your bank – secure, borderless.

Turnkey’s playbook resonates hard: unify chains, embed wallets, abstract accounts. I’ve layered these in my flow – gasless entries hook me into new L2s instantly. Altius Labs visions it best: seamless multichain dApps where users forget chains exist. For day traders, that’s pure velocity. Quicknode powers enterprise-grade versions, proving scalability under fire.

Trader Must-Haves for Chain Wallets

-

Intent Solvers for auto-routing: zkCross Network enables instant cross-chain trades without bridging, powering seamless swaps. Explore zkCross

-

MPC Security for keyless ops: Self Chain’s MPC-TSS secures wallets across chains—no private keys needed. Trade fearlessly! Try Self Chain

-

Sponsored Gas for zero upfront costs: Self Chain covers fees, letting you transact across chains without gas tokens. Jump in now!

-

Unified Portfolio Views: Aggregate balances from all chains in one intuitive dashboard—like Backpack’s seamless interface.

-

AI Liquidity Prediction: Self Chain’s AI forecasts optimal routes and liquidity for smarter, faster trades.

Web3Auth’s dev tools make this plug-and-play, so dApps evolve into intuitive beasts. No more “wrong network” errors derailing breakouts. This seamless DeFi interoperability isn’t optional; it’s your edge in 2025’s multi-chain frenzy.

Common Hurdles Smashed: Your FAQ Quick-Hit

Security skeptics, chill: MPC-TSS distributes keys, ZK proofs verify without revealing. Hacks? Near zero since bridges are obsolete. Onboarding flies with social logins and gas sponsorships, per 101 Blockchains. I’ve stress-tested in 50x leverage plays; zero hiccups.

2025’s abstraction wave hits peak momentum. Platforms iterate weekly – expect AI agents executing your strategies autonomously across chains. As a trader who’s eaten bridge losses, I say dive in now. Stack that unified wallet, hunt those breakouts, and watch multi-chain chaos turn to your playground. The future’s abstracted; your moves shouldn’t be.

Explore how chain abstraction enhances cross-chain wallet UX for DeFi in 2025 for pro setups.