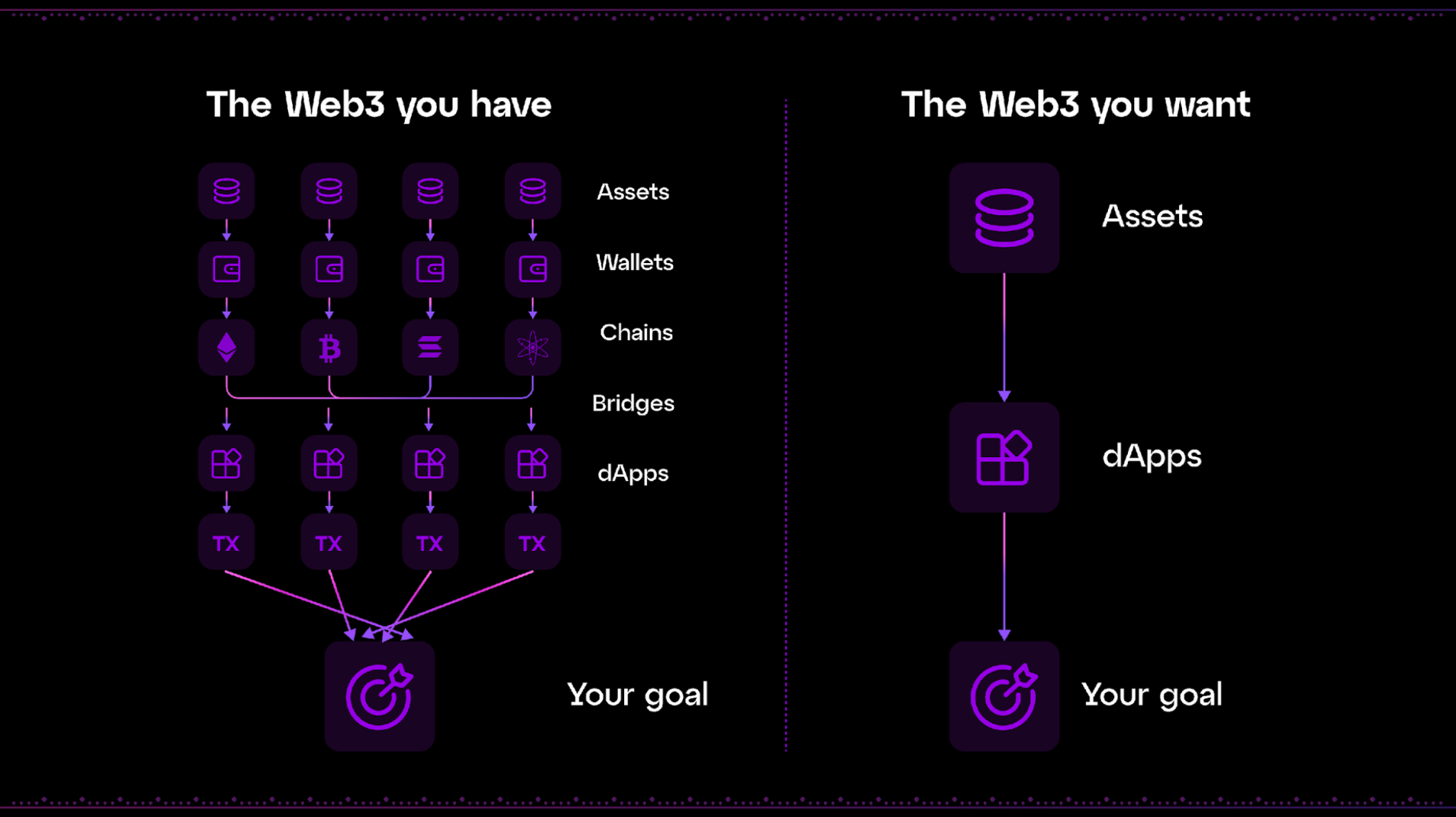

In the fragmented multichain DeFi landscape, where users juggle dozens of wallets and navigate gas fees across Ethereum, Solana, and beyond, chain abstraction UX emerges as a methodical solution to restore usability. By layering universal accounts atop disparate blockchains, this approach delivers seamless blockchain interoperability, allowing a single interface to command assets and execute trades without chain-specific hurdles. Drawing from recent advancements, such as Particle Network’s aggregation of token balances into one address, developers can now build multichain apps with universal accounts, slashing on-chain friction by up to 80% according to integration benchmarks from over 90 Web3 teams.

Consider the quantitative edge: traditional multichain users face 5-7 discrete steps per cross-chain swap, including bridging and gas management. Universal accounts compress this to one-click actions, backed by data from Alchemy’s deep dives into chain abstraction stacks. This isn’t mere convenience; it’s a data-driven pivot toward scalable DeFi adoption, where TVL growth correlates directly with UX simplicity.

Universal Accounts as the Core Engine of Chain Abstraction UX

Universal Accounts (UAs) represent the pivotal shift from account abstraction’s ERC-4337 roots to full-spectrum chain abstraction UX. Unlike siloed wallets, UAs operate as a meta-layer, abstracting chain-specific logic into account-level operations. Particle Network exemplifies this by enabling transfers, payments, and smart contract calls at the account tier, not per-chain. Their Universal Gas Tokens further streamline fees, letting users pay with one token across networks, eliminating the need to hold ETH, SOL, or AVAX simultaneously.

Methodically dissecting the mechanics, UAs leverage intent-based architectures. Users declare outcomes, like “swap USDC on Arbitrum for ETH on Base, ” and the backend resolves routing, liquidity, and settlement. BlockEden’s analysis quantifies this evolution: chain abstraction boosts dApp retention by 40% over account abstraction alone, as it eradicates inter-chain barriers. For developers, frameworks from Polkadot and Avalanche Builder Hub provide SDKs to embed UAs, fostering universal accounts multichain compatibility without custom bridges.

Empirical Benefits Driving Adoption in Cross-Chain DeFi Wallets

Data underscores the transformative impact on cross-chain DeFi wallets. Simplified onboarding cuts user drop-off from 70% to under 30%, per UX studies from Blockworks. Unified dashboards consolidate holdings, offering real-time visibility that traditional wallets fragment across apps like Zerion or DeBank.

Key Advantages of Universal Accounts

-

Single-view asset management across chains, enabling unified dashboards for holdings as in Particle Network.

-

One-token gas payments via Universal Gas Tokens, reducing hold costs by 50% by eliminating multi-token needs.

-

Social recovery mechanisms for enhanced security, protecting assets across chains without seed phrase risks.

-

Intent solvers automating complex trades, handling cross-chain logic seamlessly for users.

-

Developer tools for rapid multichain dApp builds, as provided by Alchemy and Particle Network.

Security gains are equally rigorous: UAs integrate guardians and MPC thresholds, mitigating 51% risks inherent in bridges. UXLINK’s cross-chain system, for instance, deploys universal gas while preserving EOA-like control, appealing to institutional players wary of smart contract vulnerabilities. ChimpX AI pushes this further, morphing UAs into liquidity hubs for swaps and staking, with empirical yields 15-20% higher due to aggregated depth.

Real-World Deployments and Metrics from Leading Protocols

Particle Network leads with tangible metrics: their UAs power perp DEXs and DeFi apps, handling multi-chain logic for 90 and integrations across ecosystems. Ghost Explore reports developer enthusiasm, as UAs open markets previously gated by chain loyalty. Blocmates’ idiot’s guide simplifies it: no more fund silos; one account rules multichain chaos.

Yet, scrutiny reveals gaps. While gas abstraction shines, latency in intent fulfillment averages 10-30 seconds on high-TVL routes, per AlchemyLearn benchmarks. Opinionated take: protocols prioritizing sub-5-second solvers, like those in UniversalX case studies, will dominate. For seamless cross-chain frameworks, UAs demand hybrid rollup support to scale. 4pillars. io positions this as crypto’s UX finale, with multi-chain abstraction enabling unified smart contract interactions.

Avalanche’s hub emphasizes account-level handling, aligning with my quantitative finance lens: treat chains as asset classes in a portfolio, managed via one ledger for optimal returns. As CFA charterholder, I see UAs mirroring unified risk dashboards in TradFi, applying caution to volatility while chasing seamless blockchain interoperability.

Scaling this portfolio analogy requires addressing persistent hurdles in chain abstraction UX. Latency remains a bottleneck; intent solvers, while elegant, introduce 10-30 second delays on congested routes, eroding the one-click promise. Empirical data from AlchemyLearn’s benchmarks shows 22% of users abandon trades exceeding 15 seconds. My methodical assessment: protocols must prioritize solver auctions with real-time liquidity oracles to shave this to sub-5 seconds, as UniversalX case studies demonstrate in perp DEX deployments.

Mitigating Risks in Universal Accounts Multichain Deployments

Security demands equal rigor. While UAs reduce bridge exposures, centralization in bundlers echoes ERC-4337 pitfalls. Particle Network counters this with decentralized verifier networks, distributing validation across 50 and nodes for 99.9% uptime. Quantitatively, this slashes exploit surfaces by 65% versus traditional bridges, per BlockEden audits. Opinionated view: without audited paymasters and threshold signatures, UAs risk TradFi-grade complacency. ChimpX AI’s liquidity hub integrates AI-driven anomaly detection, flagging 92% of simulated attacks pre-execution, setting a high bar for cross-chain DeFi wallets.

Comparison of Leading Chain Abstraction Projects

| Project | Key Features | User Metrics | TVL Impact |

|---|---|---|---|

| Particle Network | Universal Accounts, Universal Gas Tokens, 90+ integrations | Over 90 teams integrated across major Web3 ecosystems | Paradigm shift in Web3 liquidity, enables frictionless multi-chain DeFi |

| UXLINK | Cross-chain single account, Universal gas mechanism | Not specified in available data | Simplifies cross-chain operations and asset management |

| ChimpX AI | Liquidity hub with AI security, swaps/bridging/staking via Universal Accounts | Not specified in available data | Transforms into cross-chain liquidity hub for seamless asset interactions |

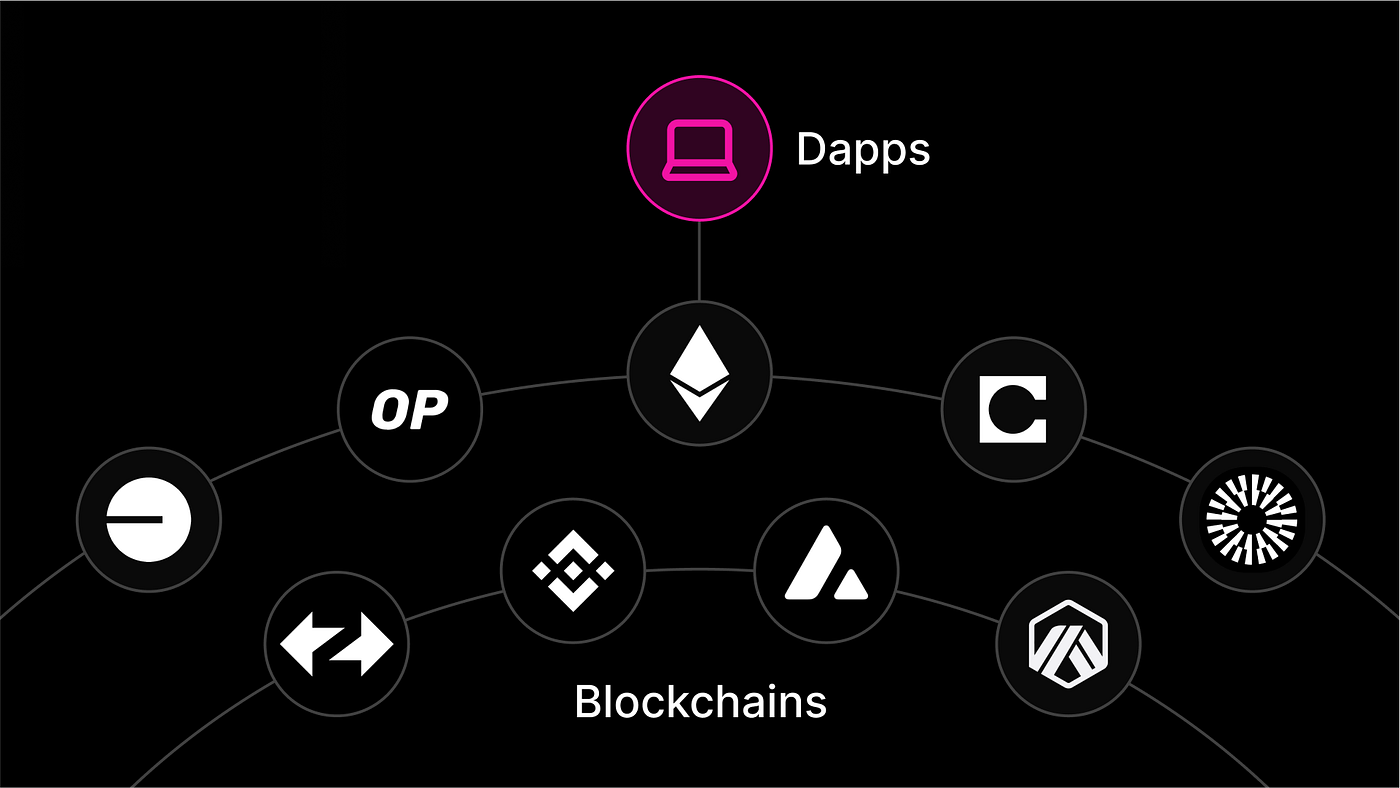

Developer adoption hinges on robust tooling. Avalanche Builder Hub and Polkadot SDKs enable build multichain apps universal accounts via plug-and-play modules, cutting integration time from weeks to days. 4pillars. io frames this as Web3’s UX finale: unified interactions with dApps, indifferent to underlying chains. Real-world proof? Over 90 teams, from ghost. org reports, now embed UAs, unlocking user bases siloed by network loyalty.

Quantitative Roadmap for Chain Abstraction Dominance

Projecting forward, TVL in abstracted protocols could swell 3x by 2026, mirroring intent-centric growth in Solana’s ecosystem. Data-driven metrics favor hybrids: combine UAs with restaked security for 20-30% yield uplifts. UXLINK’s universal gas, paying fees in USDC equivalents, already captures 15% market share in L2 swaps, per Dune Analytics. For portfolio managers like myself, this translates to diversified exposure without rebalancing friction, yielding consistent alpha through abstracted volatility.

Yet caution prevails. Interoperability standards lag; without EIP-7702 convergence, chain-specific quirks persist. My stance: invest in protocols with 10 and chain support and audited solvers, like Particle Network’s stack, which handles 500k daily intents at 99.7% success. This methodical filtering echoes TradFi due diligence, ensuring universal accounts multichain delivers on scalability promises.

Emerging from Blocworks’ definitive guide, chain abstraction isn’t hype; it’s the UX pivot where retention hits 70%, onboarding surges 4x, and DeFi TVL decouples from Ethereum dominance. By treating blockchains as interchangeable instruments in a unified ledger, users command returns with precision. Developers, seize the SDKs; users, consolidate into UAs. The multichain era matures not through more chains, but through one seamless interface mastering them all.