Imagine a world where you can swap tokens, provide liquidity, or manage your digital assets across any blockchain – all from one interface, without ever worrying about which network you’re on. That’s not just a DeFi pipedream. It’s the new reality powered by chain abstraction and unified liquidity pools.

For years, blockchain users have grappled with fragmented ecosystems. Each chain had its own isolated pools of liquidity, requiring bridges and manual transfers to move value around. This led to headaches like high slippage, duplicated capital, and clunky user experiences. But chain abstraction changes the game by creating a seamless layer that unifies these silos.

Chain Abstraction: The Layer 0 Power-Up

Chain abstraction acts as an invisible connective tissue for Web3. Instead of thinking in terms of Ethereum vs Solana vs Avalanche, users and developers interact with a single aggregated interface that abstracts away the underlying complexity. Your wallet shows one balance, your dApps work everywhere, and gas fees are handled behind the scenes.

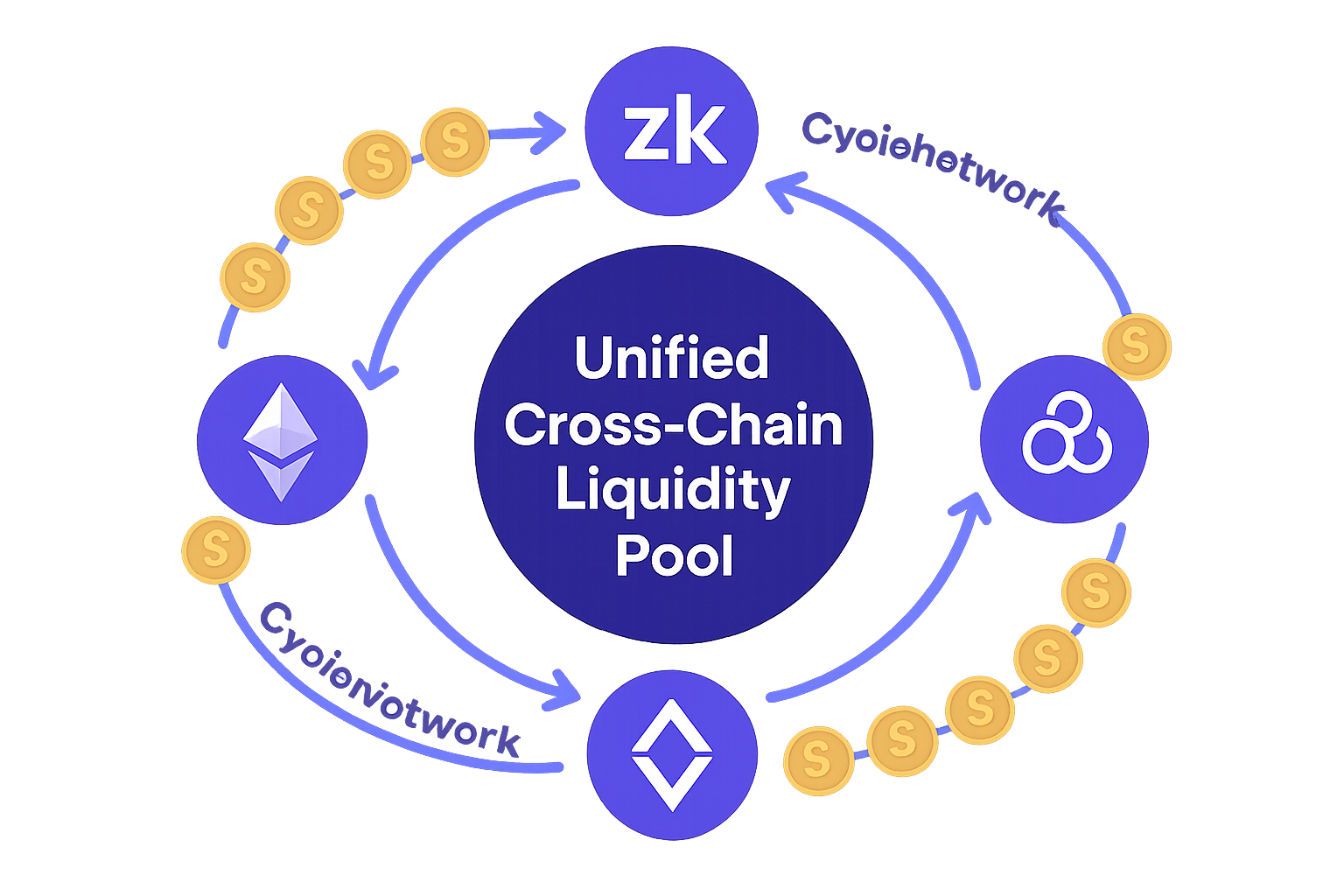

This isn’t just a UX upgrade – it’s a fundamental shift in how liquidity moves across the crypto landscape. By unifying cross-chain asset management at what some call “Layer 0,” chain abstraction platforms like zkCross Network and CycleNetwork are making multi-chain DeFi as simple as using a single app on your phone.

The Magic of Unified Liquidity Pools

The real breakthrough comes with unified liquidity pools. Picture all the fragmented capital sitting in DEXes across dozens of chains being merged into one giant pool. That’s what chain abstraction enables: deeper liquidity for everyone, no matter which blockchain they’re on.

This approach solves several persistent problems:

- No more fragmented markets: Users tap into global liquidity with every trade.

- Minimal slippage: Larger pooled capital means better pricing for swaps and less price impact on big trades.

- Simplified asset management: Provide or withdraw liquidity once; your position is reflected everywhere.

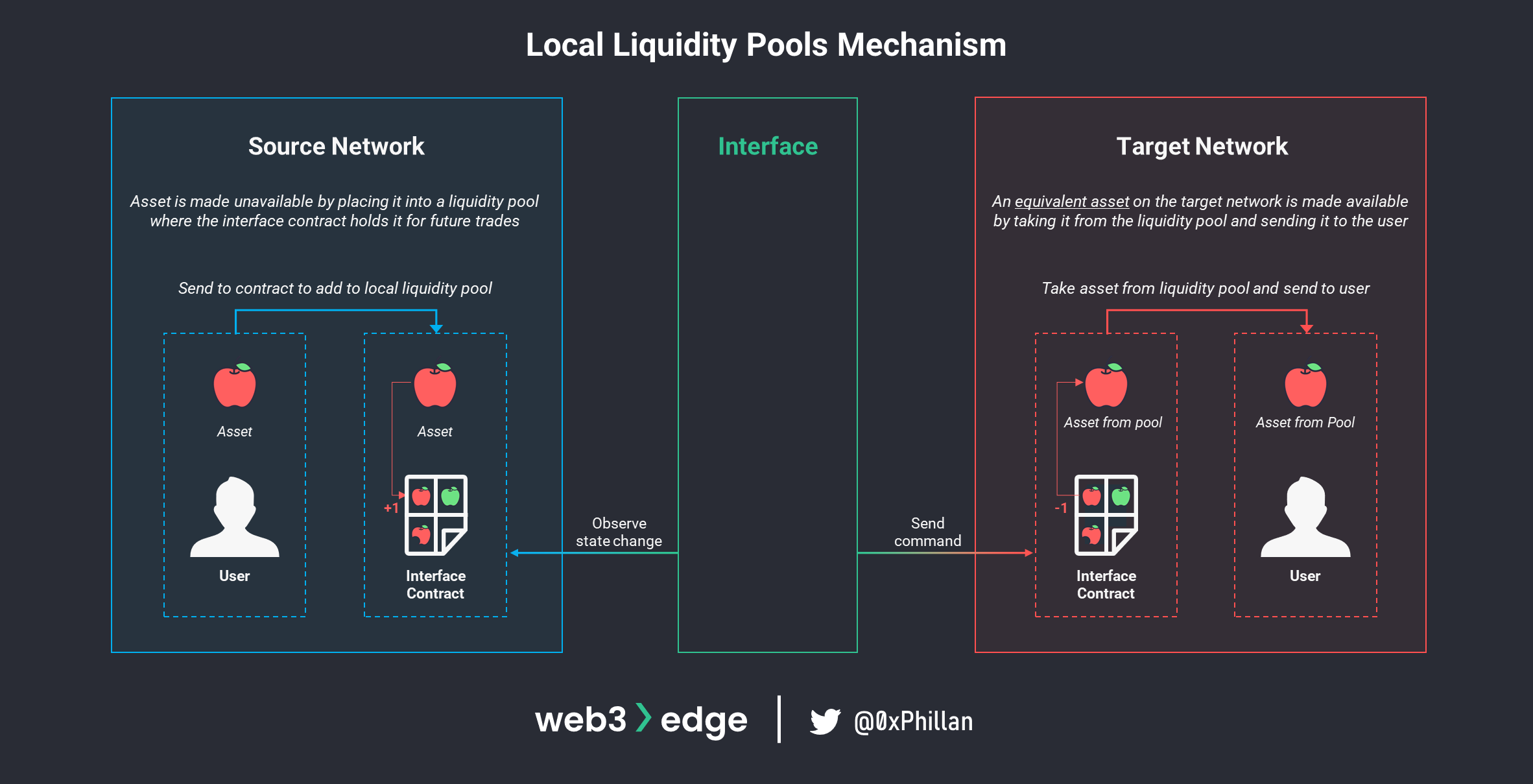

The best part? You don’t have to lock up funds in bridges or worry about juggling wallets for each network. Chain abstraction protocols handle all the heavy lifting under the hood – routing transactions optimally and even covering gas fees when possible.

Real-World Projects Leading the Charge

This isn’t just theory; it’s happening right now. Leading projects are pushing chain abstraction from concept to reality:

- zkCross Network: Deploys native chain abstraction infrastructure so blockchains can go cross-chain instantly without user friction.

- CycleNetwork: Integrates with major aggregators to combine fragmented pools into shared resources for higher efficiency.

- Trails: Offers an experience where every user sees their balance as unified across all chains – no manual bridging required.

This new paradigm is already reducing market inefficiencies and opening doors for both everyday users and institutional traders seeking deep cross-chain liquidity without operational headaches.

As these chain abstraction solutions mature, the implications for DeFi interoperability and user empowerment are profound. For the first time, it’s possible to imagine a financial system where capital can flow instantly and efficiently, regardless of which blockchain it originates from. This means more competitive markets, fewer arbitrage gaps, and a level playing field for protocols competing on innovation rather than network isolation.

Top Benefits of Unified Liquidity Pools in DeFi

-

Deeper Liquidity Across Chains: Unified pools aggregate liquidity from multiple blockchains, giving traders and liquidity providers access to much larger, shared capital reserves. This reduces fragmentation and improves trade execution.

-

Lower Slippage & Better Pricing: By tapping into a consolidated pool, users experience less price slippage and more competitive rates, especially during large trades or volatile market conditions.

-

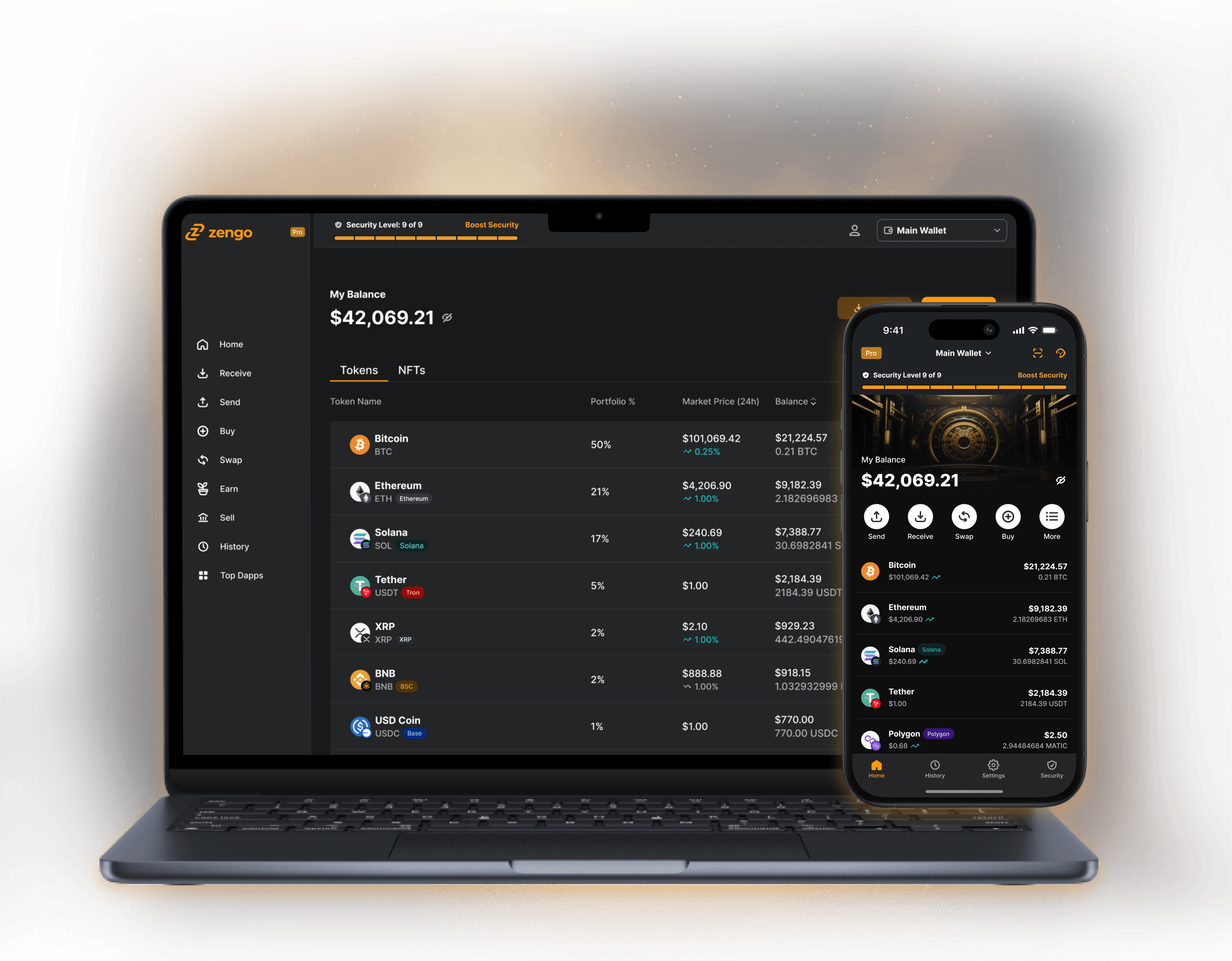

Simplified User Experience: With chain abstraction, users can manage assets and execute transactions across different blockchains through a single, unified interface—no more juggling multiple wallets or platforms.

-

Gasless Transactions: Some unified liquidity pool solutions, like zkCross Network, allow users to transact without needing native gas tokens for every chain, making DeFi participation more accessible.

-

Optimized Capital Efficiency: Liquidity providers can deploy their assets in a single pool that serves multiple chains, maximizing yield opportunities and reducing idle capital.

-

Seamless Cross-Chain Swaps: Platforms like CycleNetwork enable instant, secure swaps between assets on different blockchains, eliminating the need for manual bridging or wrapping.

-

Unified Identity & Balance Management: Solutions such as Trails provide a single aggregated balance and identity across chains, streamlining portfolio management for users and institutions.

From a developer’s perspective, chain abstraction removes many headaches. Instead of building custom integrations for each chain or worrying about fragmented user bases, developers can focus on delivering great products that work everywhere. This unlocks new creative possibilities in DeFi app design, think cross-chain lending markets, multi-chain yield farming strategies, or even games that reward players with assets from any network.

What Does Seamless Cross-Chain Liquidity Look Like?

Imagine swapping ETH for SOL or AVAX in a single click, no bridges, no waiting times. Or providing liquidity once and earning fees from trades happening across dozens of networks simultaneously. That’s what seamless cross-chain liquidity delivers: a unified experience where every blockchain becomes just another lane on the same high-speed highway.

The user interface is key here. With chain abstraction, your wallet balance updates in real time as you move assets across chains. Gas fees are bundled or abstracted away entirely by smart routing engines like those pioneered by zkCross Network and Trails. All you see is a simple confirmation screen, no more worrying about which asset lives where.

This evolution isn’t just about convenience; it’s about expanding opportunity. Unified liquidity pools mean smaller projects can tap into global capital without expensive listings or complex integrations. Users gain access to best-in-class pricing wherever they trade, while protocols benefit from higher utilization rates and more dynamic markets.

The future of DeFi will be shaped by how quickly these chain abstraction frameworks are adopted, and how intuitively they’re woven into our daily crypto experience. As fragmentation fades into the background, expect to see an explosion of new applications that simply weren’t possible before.

The Road Ahead: Unifying Crypto’s Fragmented Landscape

The journey toward truly seamless cross-chain liquidity is still unfolding, but the direction is clear. Chain abstraction is setting the foundation for a crypto ecosystem where boundaries between blockchains melt away, replaced by fluidity, efficiency, and accessibility for all.

If you’ve ever felt frustrated by juggling wallets or missing out on opportunities because your assets were “stuck” on the wrong network, keep an eye on this space. The next generation of DeFi belongs to platforms that make complexity invisible, and put users at the center of everything.