Cross-chain liquidity fragmentation has long been a critical obstacle for decentralized finance. As blockchain ecosystems like Solana, TON, and Base proliferate, users and developers are forced to navigate a landscape of siloed liquidity pools, incompatible protocols, and risky bridging solutions. This friction not only hampers capital efficiency but also undermines the promise of a truly unified Web3 experience. Enter Layer-0 protocols like Analog, which are fundamentally reshaping how liquidity flows across chains by providing a trustless foundation for omnichain interoperability.

Why Traditional Bridges Fall Short

The prevailing methods for cross-chain asset movement typically rely on token bridges or wrapped assets. These approaches introduce security vulnerabilities and operational complexity. High-profile bridge hacks have resulted in billions of dollars in losses, while users face slow transaction times and elevated fees. Moreover, the fragmentation of liquidity across isolated chains means that even the most innovative DeFi protocols struggle to achieve optimal trading volumes and deep order books.

This is where Layer-0 protocol cross-chain liquidity solutions become transformative. By abstracting away individual chain differences at the foundational layer, Layer-0 protocols enable seamless communication between disparate networks without the need for custodial intermediaries or redundant asset representations.

The Analog Timechain: Proof-of-Time as a Unification Engine

Analog stands out as a pioneering Layer-0 blockchain leveraging its unique Proof-of-Time (PoT) consensus mechanism. The Analog Timechain acts as an omnichain ledger that securely records and verifies transactions across over 100 blockchains. Unlike traditional consensus models that focus on proof of work or stake, PoT introduces temporal fairness and efficiency, helping synchronize activity across multiple networks with minimal latency.

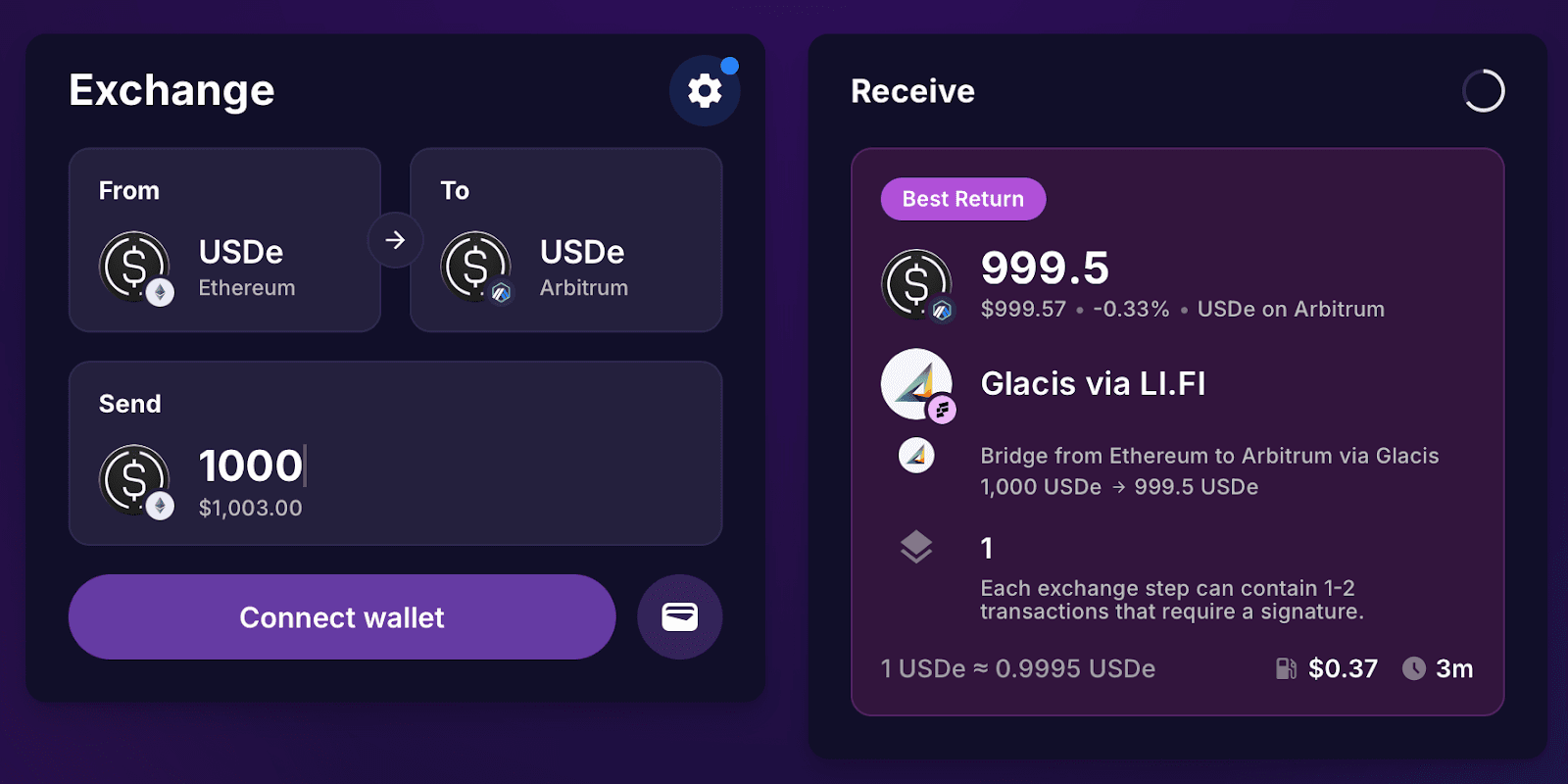

This innovation enables developers to build dApps that are truly chain-agnostic. For example, with Analog’s General Message Passing (GMP) protocol, decentralized exchanges can facilitate cross-chain order book trading without relying on wrapped tokens or risky bridges. Liquidity providers can pool assets from different blockchains into unified cross-chain pools, enhancing both capital efficiency and user experience.

Omnichain DeFi: Real-World Use Cases Powered by Layer-0 Infrastructure

The impact of Analog’s infrastructure is already being seen in live integrations. In partnership with NectarX, Analog’s GMP allows users to trade assets between chains directly from their wallets, eliminating manual transfers and reducing transaction times significantly. Cross-chain lending protocols built on Analog let borrowers move collateralized assets from one network to another in a single transaction, streamlining DeFi workflows previously plagued by multi-step processes.

This leap in functionality is underpinned by robust security guarantees inherent to the Layer-0 approach. By using its native token to secure the Timechain through PoT consensus, Analog minimizes attack vectors commonly associated with bridges while maintaining high throughput and low costs.

The Road Ahead: Funding Milestones and Ecosystem Growth

The market has recognized the potential of Layer-0 DeFi infrastructure. In January 2025, Analog secured an additional $5 million in funding, bringing its total raise to $21 million, to accelerate development of its GMP protocol and developer tools suite. This investment underscores growing confidence in Layer-0 as the architectural backbone for future-proof Web3 applications.

If you’re interested in learning more about how Layer-0 solutions like Analog are solving cross-chain liquidity fragmentation at scale, check out our deep dive at this resource.

What sets Analog apart is its focus on developer experience and composability. By providing intuitive SDKs and modular APIs, Analog lowers the barrier for teams seeking to build omnichain dApps that can tap into unified liquidity across diverse ecosystems. The GMP protocol, in particular, is designed to abstract away the intricacies of cross-chain messaging, allowing developers to focus on user-centric features rather than backend complexity. This shift is catalyzing a new era of DeFi protocols that are inherently interoperable, no longer confined by the limitations of their native chains.

Key Benefits of Layer-0 Cross-Chain Liquidity

-

Unified Asset Management: Layer-0 protocols like Analog enable users and dApps to manage assets across multiple blockchains from a single interface, eliminating the need for manual bridging or fragmented wallets.

-

Faster, Frictionless Transactions: Analog’s General Message Passing (GMP) protocol allows for rapid, secure cross-chain transactions—such as order book trading and liquidity pooling—without relying on slow or risky wrapped tokens.

-

Reduced Security Risks: By using a decentralized Timechain and Proof-of-Time consensus, Analog minimizes vulnerabilities common in traditional bridges, offering trustless and robust security for cross-chain asset transfers.

-

Improved Capital Efficiency: Cross-chain liquidity pools on Analog let liquidity providers deploy capital across multiple networks, maximizing yield opportunities and reducing idle assets for better capital utilization.

The implications for users are profound. Instead of juggling multiple wallets or navigating risky bridges, users can access a single interface to manage assets and interact with dApps regardless of the underlying blockchain. Liquidity providers benefit from deeper pools and more efficient capital allocation, while traders enjoy tighter spreads and improved execution on cross-chain order books.

Analog’s approach also addresses one of DeFi’s most persistent pain points: security. By eliminating bridge dependencies and leveraging PoT-based consensus, Analog reduces the attack surface for hackers while ensuring that all cross-chain interactions are validated by a decentralized network of timekeepers. This design not only inspires greater trust but also paves the way for institutional adoption where compliance and risk management are paramount.

Challenges Ahead and What to Watch

While the progress is significant, there are still hurdles to overcome as Layer-0 protocols scale. Interoperability standards must continue to mature so that new blockchains can be integrated seamlessly without compromising security or performance. Governance models will need to evolve as more stakeholders participate in omnichain networks, ensuring that upgrades and dispute resolution remain decentralized.

The competitive landscape is also intensifying as other Layer-0 solutions enter the market. However, Analog’s early mover advantage, bolstered by its PoT consensus and rapidly growing developer ecosystem, positions it as a leading force in bridge-free blockchain interoperability.

Looking Forward: The Path Toward Unified On-Chain Finance

The evolution from fragmented liquidity silos toward unified cross-chain markets is accelerating thanks to innovations at the Layer-0 level. As Analog continues to expand its integrations and attract both developers and institutional partners, we expect omnichain DeFi experiences to become standard rather than exceptional.

This paradigm shift promises not only greater efficiency but also a more inclusive Web3 landscape where capital flows freely across boundaries, unlocking new possibilities for financial products, governance models, and user empowerment.