The rapid proliferation of Layer 1 and Layer 2 blockchains has propelled decentralized finance (DeFi) into a new era, but it has also created a sprawling landscape of isolated liquidity pools and fragmented user experiences. For traders, developers, and institutions alike, the inability to move assets efficiently across chains is more than an inconvenience, it’s a structural barrier to growth and innovation. Layer 0 protocols like Analog are emerging as foundational solutions, architecting the bedrock for true blockchain interoperability and unified liquidity.

Why Cross-Chain Liquidity Fragmentation Persists

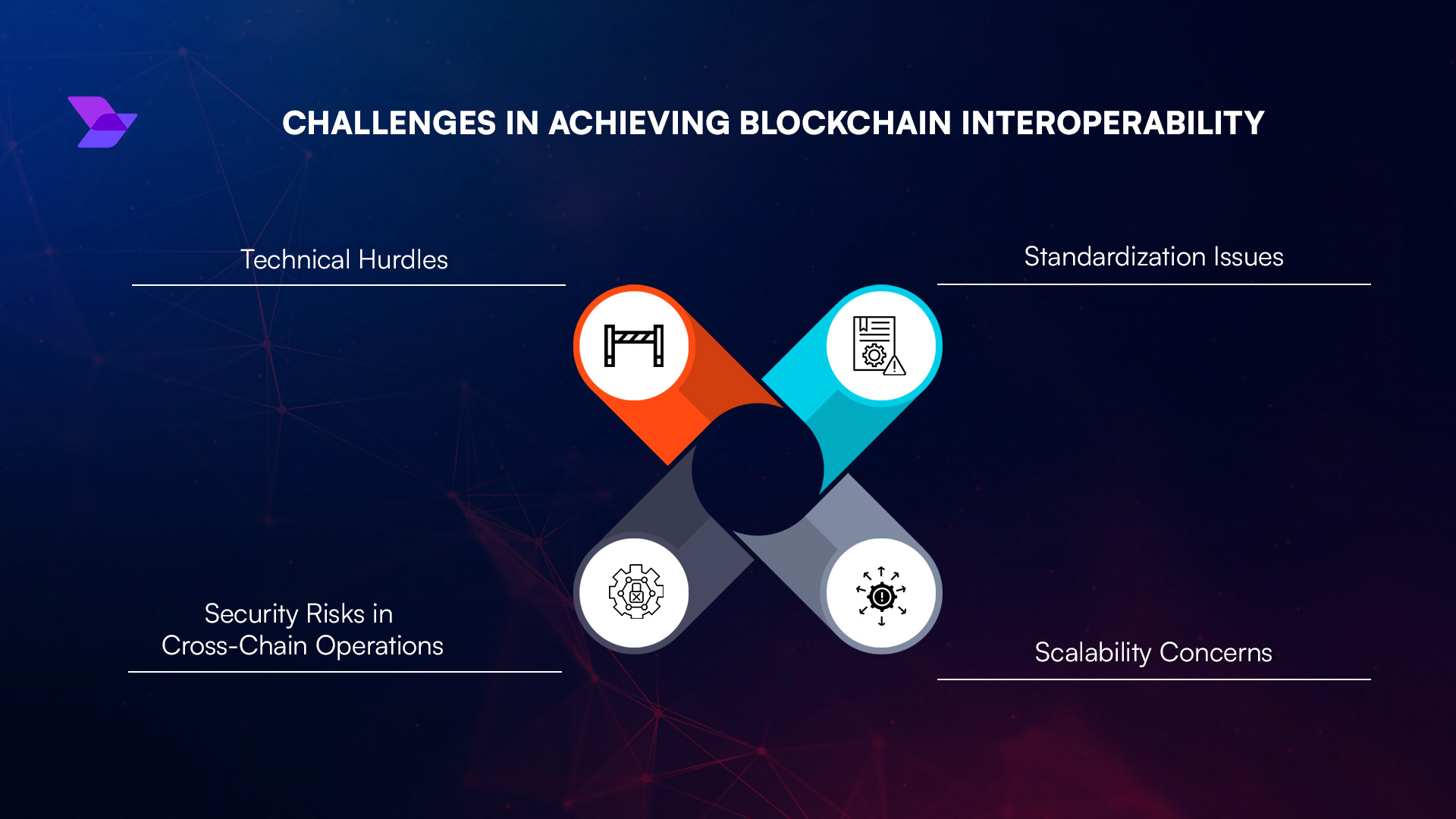

Liquidity fragmentation is a direct result of DeFi’s multi-chain expansion. Each new blockchain or rollup brings its own ecosystem, token standards, and liquidity pools. While bridges attempted to patch these silos, they introduced new risks, security vulnerabilities, inefficient routing, and capital inefficiency. According to recent research from Mitosis University, bridge exploits have cost users billions in lost funds since 2021.

What’s needed is not another patchwork solution but a robust infrastructure layer that enables native interoperability, allowing assets and data to flow freely between chains without sacrificing security or composability.

Layer 0 Protocols: The Infrastructure for Unified Liquidity

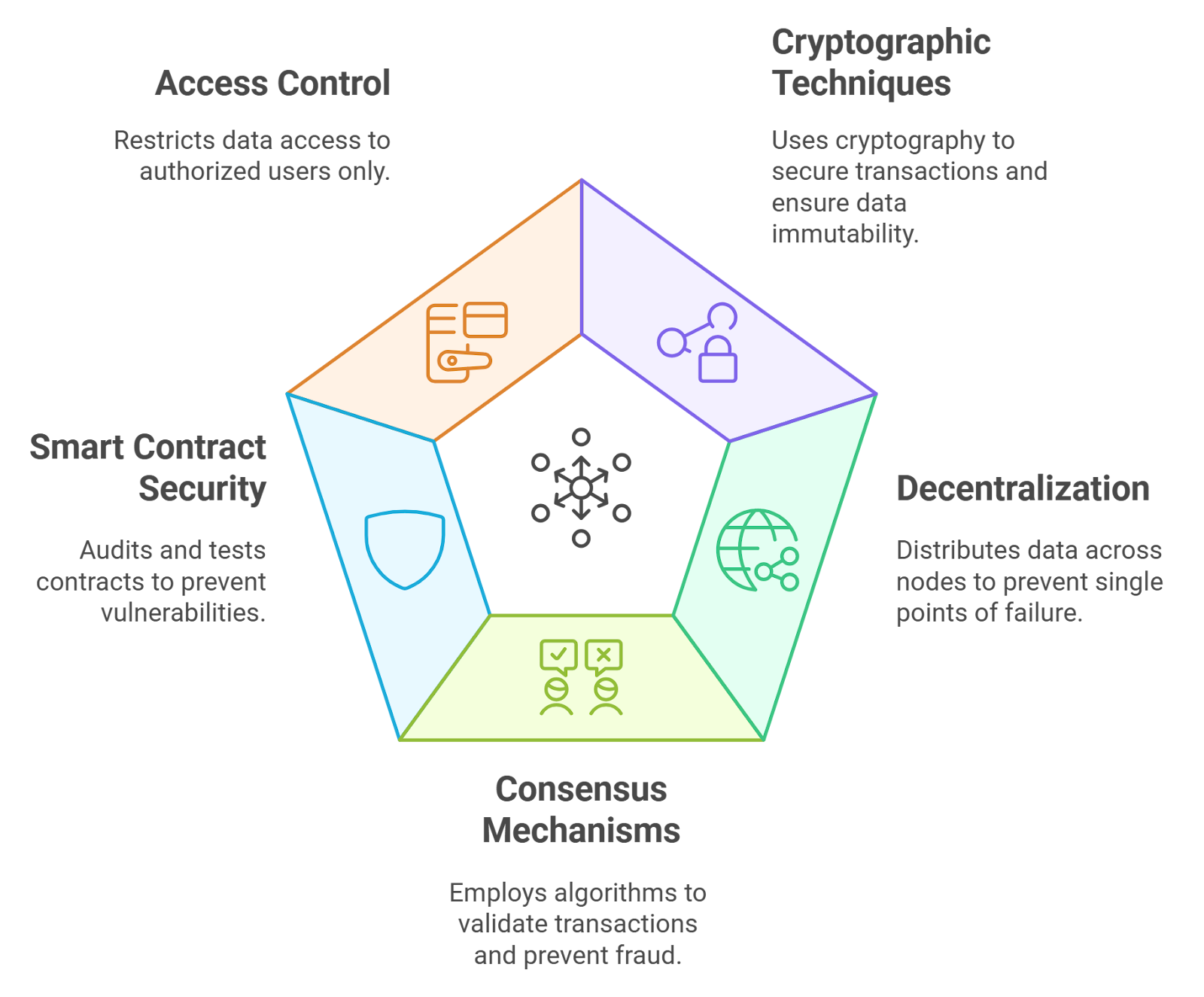

Layer 0 protocols operate beneath Layer 1 blockchains, providing the universal rails for cross-chain communication. Unlike traditional bridges that simply transfer tokens from one chain to another, Layer 0s like Analog establish trust-minimized messaging frameworks and consensus mechanisms that coordinate activity across networks in real time.

Notable examples such as Polkadot and Cosmos have pioneered this approach with relay chains and inter-blockchain communication (IBC). However, Analog introduces several innovations specifically designed for DeFi’s unique demands:

Key Features of Analog’s Timechain for Cross-Chain DeFi

-

General Message Passing (GMP): Analog’s GMP protocol enables secure, efficient, and trust-minimized communication between disparate blockchains, allowing seamless asset transfers and real-time data sharing across DeFi ecosystems.

-

Chronicle Nodes: Specialized nodes that monitor cross-chain activities, enabling dynamic liquidity allocation and cross-chain market making. These nodes help maintain synchronized liquidity pools and optimize capital flows across multiple networks.

-

Proof of Time (PoT) Consensus Mechanism: A hybrid consensus model combining Proof of Stake with a reputation scoring system, ensuring secure, scalable, and reliable cross-chain transactions for DeFi applications.

-

Omnichain Liquidity Hub: The Timechain serves as a foundational liquidity hub, unifying fragmented liquidity pools and supporting seamless movement of assets between Layer 1 and Layer 2 blockchains.

-

Real-World Asset (RWA) Integration: Analog’s infrastructure is designed to support the tokenization and cross-chain transfer of real-world assets, broadening DeFi’s reach and utility.

-

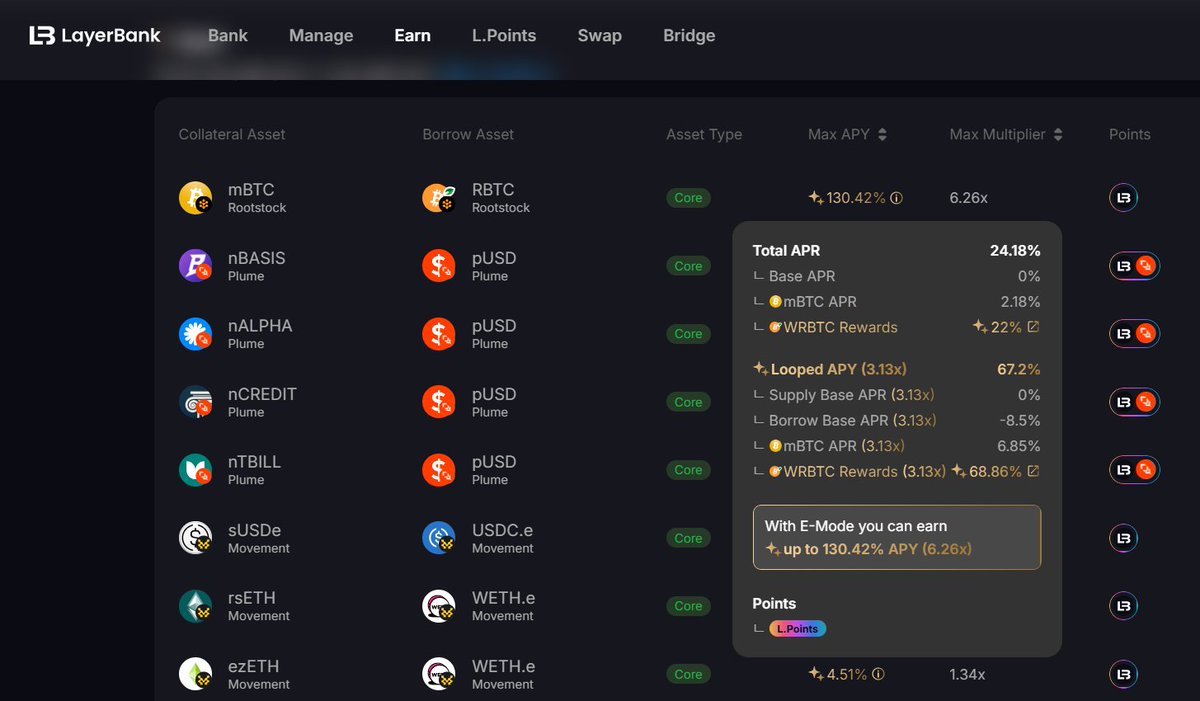

Cross-Chain Lending Protocols: By leveraging GMP, Analog enables users to deposit collateral on one blockchain and borrow assets on another, enhancing capital efficiency and user flexibility.

-

Strategic Partnerships: Collaborations with platforms like OKX Wallet expand access to decentralized applications and assets, reinforcing Analog’s role as a universal liquidity hub for the omnichain DeFi ecosystem.

The result is a unified liquidity layer where users can manage assets, execute trades, or deploy smart contracts across multiple chains as if interacting with a single network.

Analog’s Timechain: A Purpose-Built Omnichain Layer

At the core of Analog’s solution is its proprietary Timechain, a Layer 0 blockchain purpose-built for omnichain interoperability. The Timechain acts as an accountability layer for all cross-chain activity. Its architecture features:

- General Message Passing (GMP): Securely relays data and asset transfers between heterogeneous blockchains without relying on centralized custodians.

- Chronicle Nodes: Monitor real-time cross-chain events to facilitate dynamic market making and synchronized liquidity allocation.

- Proof of Time (PoT) Consensus: Combines Proof of Stake with reputation scoring to optimize scalability while maintaining robust security guarantees.

This approach eliminates the need for inefficient bridging infrastructure by enabling bridgeless cross-chain asset transfers. The implications are profound: users can deposit collateral on one chain while borrowing on another or execute arbitrage strategies across networks without manual intervention or added risk layers.

Paving the Way for Seamless DeFi UX

The practical impact of Analog’s architecture extends beyond technical elegance, it fundamentally transforms how users interact with DeFi protocols. Consider these real-world applications:

Key DeFi Use Cases Enabled by Bridgeless Cross-Chain Transfers

-

Cross-Chain Lending & Borrowing: Platforms can now allow users to deposit collateral on one blockchain and borrow assets on another without relying on risky bridges. Analog’s General Message Passing (GMP) protocol powers seamless asset movement, improving capital efficiency and reducing counterparty risk.

-

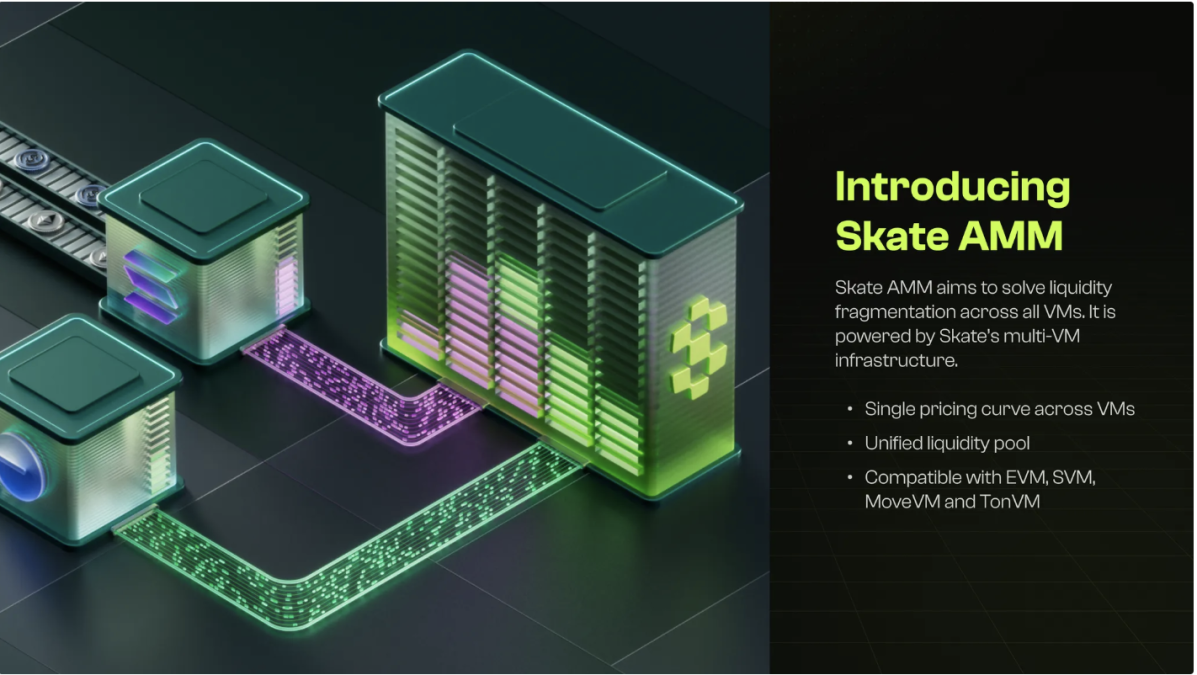

Unified Liquidity Pools: By leveraging Layer 0 protocols like Analog, liquidity can be aggregated across multiple blockchains into a single pool. This enables deeper markets, tighter spreads, and more efficient trading for users, without fragmenting assets across isolated chains.

-

Omnichain Yield Farming: Bridgeless transfers let users deploy capital to yield farms on any supported chain from a single interface, maximizing returns and minimizing manual bridging or swaps. This streamlines DeFi participation and supports dynamic allocation of funds.

-

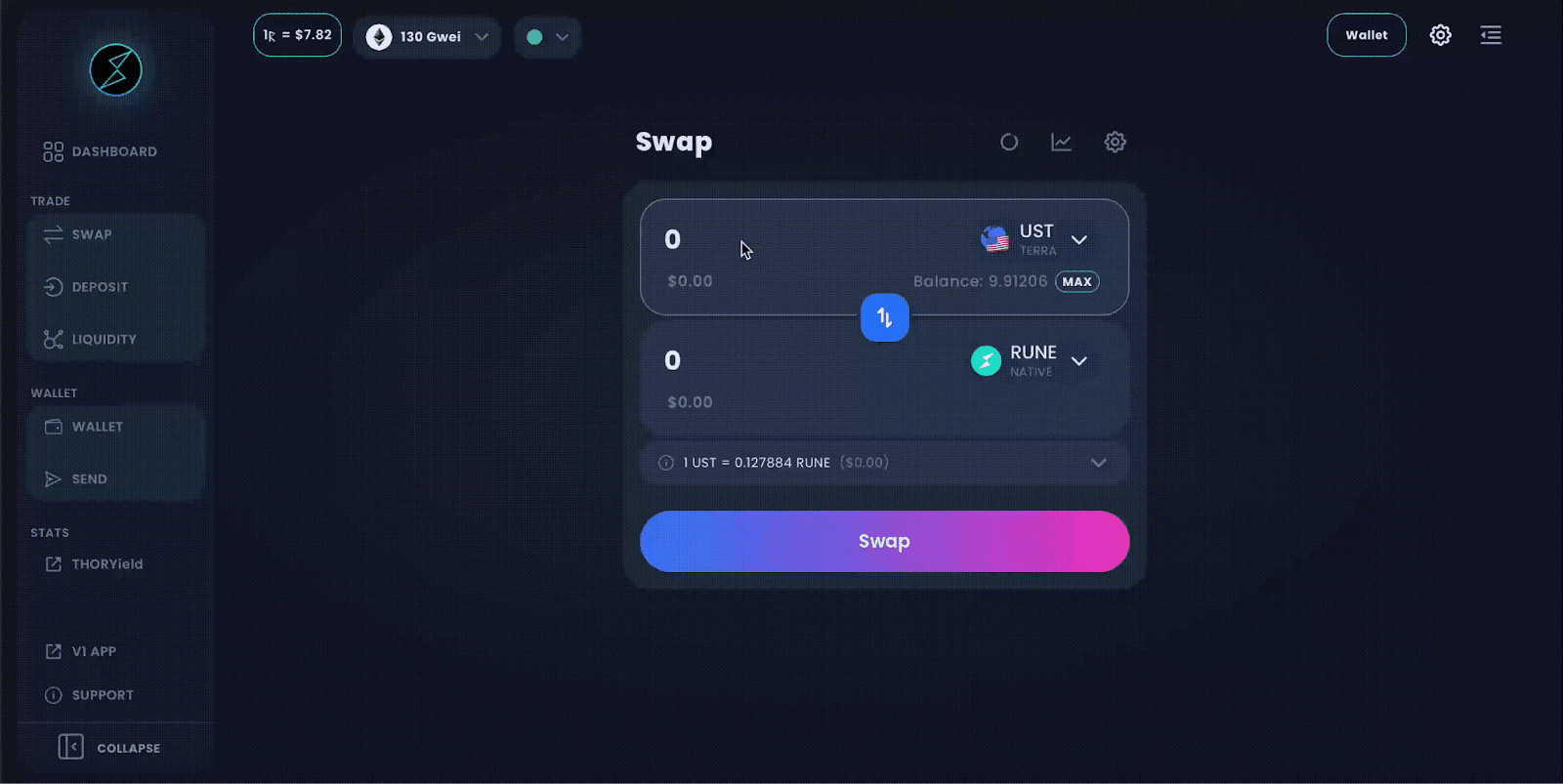

Cross-Chain Stablecoin Swaps: Secure, direct swaps of stablecoins (e.g., USDT, USDC) between different blockchains are now possible without using centralized exchanges or custodial bridges, reducing slippage and settlement risk.

-

Decentralized Cross-Chain Market Making: With Chronicle Nodes monitoring and synchronizing liquidity, market makers can operate across multiple blockchains, dynamically allocating assets to where they’re most needed and capturing arbitrage opportunities efficiently.

This shift toward seamless interoperability is already attracting developer attention. Programs like the Analog Launch Partners Program are nurturing projects that leverage Timechain as their foundational messaging protocol, further accelerating adoption across the DeFi landscape.

Crucially, these advances are not just theoretical. Analog’s General Message Passing (GMP) and Chronicle Nodes have already demonstrated utility in cross-chain lending protocols, where users can lock collateral on one network and borrow assets from another. This model eliminates the capital inefficiency endemic to fragmented liquidity pools and enables more sophisticated cross-chain strategies for both retail and institutional participants.

Developers are also leveraging Analog’s infrastructure to build unified dApps that abstract away the complexity of multiple chains. By using Timechain as the interoperability backbone, applications can offer a consistent user experience regardless of where assets originate or reside. This is a decisive step toward solving the persistent UX challenges that have hampered DeFi’s mainstream adoption.

Bridgeless Interoperability: The New Standard for DeFi Liquidity

Analog’s approach marks a paradigm shift from bridge-centric models to bridgeless cross-chain asset transfer. By synchronizing liquidity pools at the Layer 0 level and using robust consensus mechanisms like Proof of Time, Analog minimizes attack surfaces and drastically reduces settlement times compared to legacy solutions.

For market makers and protocols, this means access to deeper liquidity with fewer operational overheads. For end users, it translates into lower slippage, reduced transaction costs, and an interface that feels truly chain-agnostic.

Top Benefits of Bridgeless Interoperability for DeFi Users

-

Unified Liquidity Pools: Layer 0 protocols like Analog eliminate the need for fragmented liquidity across multiple blockchains, enabling users to access deeper and more efficient liquidity without relying on traditional bridges.

-

Reduced Security Risks: By removing complex bridge mechanisms, bridgeless interoperability minimizes exposure to common vulnerabilities such as bridge hacks, making cross-chain transactions safer for DeFi participants.

-

Seamless Cross-Chain Asset Transfers: Protocols such as Analog’s General Message Passing (GMP) allow users to transfer assets and data across blockchains instantly, streamlining user experience and reducing transaction times.

-

Improved Capital Efficiency: With bridgeless interoperability, users can leverage assets on one chain as collateral for loans or yield opportunities on another, as seen in cross-chain lending protocols powered by Analog.

-

Enhanced Access to Real-World Assets: Analog’s infrastructure supports the integration of real-world assets (RWA) into DeFi, allowing users to interact with a broader range of financial products across multiple blockchains.

-

Dynamic Liquidity Allocation: Chronicle Nodes within Analog’s ecosystem monitor and synchronize liquidity pools across networks, enabling more responsive and efficient cross-chain market making.

-

Scalable and Reliable Consensus: The Proof of Time (PoT) consensus mechanism combines Proof of Stake with reputation scoring, ensuring secure, scalable, and reliable cross-chain operations for DeFi users.

As highlighted by recent partnerships with major wallets such as OKX Wallet, Analog is positioning itself not just as a technical solution but as a unified liquidity hub. This role is critical as real-world assets (RWA) increasingly move on-chain, demanding reliable infrastructure for secure, compliant transfers across diverse networks.

The endgame is clear: Layer 0 protocols like Analog are dissolving the barriers between blockchains and enabling a new era of composable finance, one where innovation is limited only by imagination, not technical silos.

What Comes Next for Unified Cross-Chain Liquidity?

The momentum behind unified liquidity layers is accelerating. As more projects integrate with Layer 0 protocols and more assets become interoperable by default, we should expect:

- Greater capital efficiency: Liquidity will be dynamically allocated across chains in response to real-time demand.

- Simplified user journeys: Wallets will unify multi-chain management into a single interface.

- Enhanced protocol security: Reduced reliance on risky bridges lowers systemic risk across DeFi.

- Ecosystem-wide composability: Developers can combine primitives from any chain without friction.

This evolution isn’t just about technology, it’s about unlocking new business models and financial primitives that were impossible when liquidity was trapped in isolated silos. As Layer 0 adoption grows, so too will the possibilities for decentralized finance at scale.