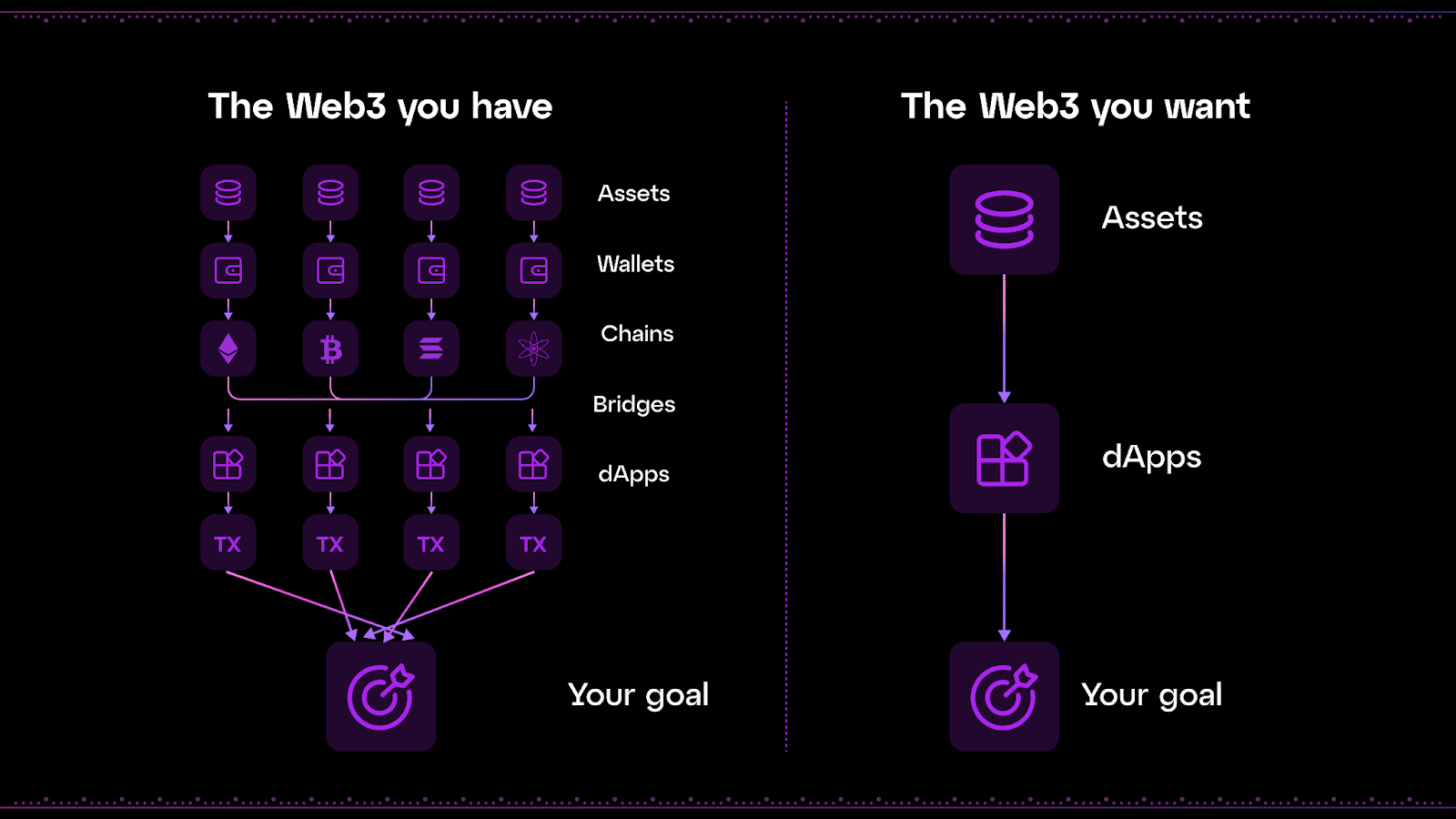

Chain abstraction is rapidly emerging as the foundation for the next generation of DeFi, where the user experience is not just improved but fundamentally reimagined. For years, blockchain’s promise of open finance has been hampered by fragmented liquidity, convoluted wallet management, and the constant headache of gas fees. Today, chain abstraction is dissolving these barriers, enabling gasless, zero-slippage cross-chain swaps that feel as seamless as using a single, unified platform. This is more than a technical upgrade – it’s a paradigm shift in how users interact with decentralized finance.

Chain Abstraction: The Engine Behind Seamless DeFi UX

At its core, chain abstraction unifies blockchain interactions, allowing users to manage assets and execute transactions across multiple chains through a single interface. Gone are the days of juggling multiple wallets or sourcing native gas tokens for each network. Instead, wallet abstraction provides a unified interface secured by a single private key, simplifying asset tracking and bolstering security. As detailed by zkcross-network, this approach brings both clarity and confidence to users navigating an increasingly complex DeFi ecosystem.

But the real game-changer lies in gas abstraction. By leveraging meta-transaction layers and relayer networks, platforms can automate gas fee payments, letting users transact without ever holding native gas tokens. This not only removes a major onboarding friction but also allows for one-click cross-chain swaps that feel instantaneous. As highlighted by Velora, gas fees can be bundled into trade quotes and settled automatically, making gasless transactions a reality rather than a distant aspiration.

Zero-Slippage Cross-Chain Swaps: Liquidity Without Limits

The second pillar of this transformation is zero-slippage cross-chain swaps. Traditionally, moving assets between chains meant wrestling with bridges, fragmented liquidity, and unpredictable pricing. Chain abstraction protocols are rewriting this script by aggregating liquidity across multiple DEXs and blockchains, optimizing trade paths for the best execution. Platforms like Synthr have pioneered omnichain liquidity layers and global debt pools, enabling atomic swaps that bypass traditional bridges entirely. This means users can swap assets across chains with confidence – no hidden costs, no slippage, and no exposure to MEV exploits.

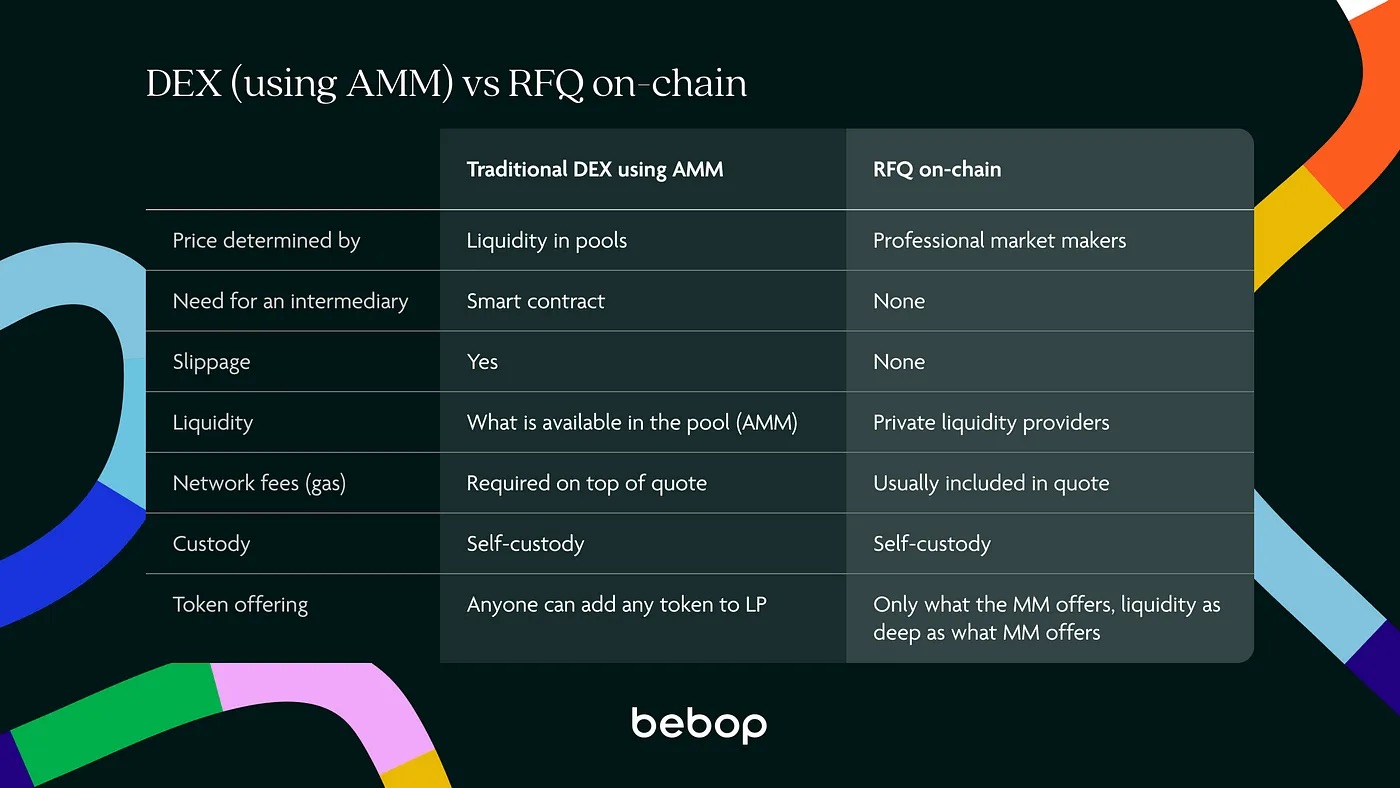

Hashflow’s request-for-quote (RFQ) model is another breakthrough in this space. By enlisting professional market makers to manage liquidity pools and provide off-chain pricing backed by cryptographic signatures, Hashflow delivers trades that are both zero-slippage and MEV-protected. For users, this translates into predictability and peace of mind – essential ingredients for mass adoption.

Leading Platforms Powering Gasless, Zero-Slippage Cross-Chain Swaps

-

Symbiosis Finance delivers gasless, zero-slippage swaps across 30+ chains, leveraging smart routing and liquidity aggregation to optimize user experience and minimize costs.

-

Hashflow enables bridgeless, zero-slippage cross-chain swaps using a request-for-quote (RFQ) model, with off-chain pricing by professional market makers and cryptographic signatures for MEV protection.

-

Synthr introduces omnichain liquidity and a global debt pool, allowing seamless, gasless swaps without bridging and ensuring users always get the quoted price—no slippage.

-

OMOSwap offers zero-slippage cross-chain token swaps by using native USDC as a central bridge, simplifying transactions and reducing exposure to price volatility.

-

LayerZero’s Gas Station provides gas abstraction for cross-chain NFT swaps, letting users move assets across chains without managing gas tokens, and integrating with platforms like Magic Eden.

-

ZeroSwap integrates gasless swaps and cross-chain DEX functionality, supporting direct trades with reduced or zero gas fees and plans for further gas abstraction enhancements.

Real-World Adoption: From Concept to User Reality

The promise of chain abstraction is already being realized by a new wave of DeFi protocols. OMOSwap leverages native USDC as a central bridge asset to enable truly zero-slippage cross-chain swaps. ZeroSwap’s integration of Base Chain Mainnet slashes gas fees and lays the groundwork for fully gasless transactions. Even NFTs are getting in on the action with LayerZero’s ‘Gas Station, ’ which abstracts away gas management for seamless NFT trading across chains.

This momentum is not just technical – it’s economic. As noted by Trikon and Symbiosis Finance, abstracting away gas fees and slippage unlocks new forms of composability and efficiency, making DeFi more accessible for both power users and newcomers alike. The economics of chain abstraction are beginning to reshape how value flows across networks, creating a unified liquidity layer that rivals centralized exchanges in usability while maintaining decentralized integrity.

As this new infrastructure takes hold, the implications for DeFi chain abstraction UX are profound. We are witnessing the emergence of a unified cross-chain wallet experience, where users can interact with protocols on any network without mental overhead. The friction of switching networks, sourcing gas, or worrying about slippage is fading into the background, replaced by a seamless, intent-driven interface that feels natural and intuitive.

Developers are now empowered to build dApps that tap into aggregated liquidity and composability without being locked into a single chain’s ecosystem. This interoperability is catalyzing a new wave of innovation, as projects leverage meta-transaction APIs, omnichain liquidity, and universal bridging protocols to deliver user experiences that rival the best of Web2 finance, without sacrificing the core tenets of decentralization.

Why Gasless, Zero-Slippage Swaps Matter for the Next DeFi Cycle

The strategic impact of chain abstraction gasless transactions cannot be overstated. By removing onboarding friction and technical hurdles, DeFi platforms are poised to onboard the next hundred million users. The ability to pay fees in any supported token, or have them abstracted entirely, means users can participate in DeFi regardless of their technical background or preferred chain. This is a critical leap toward mainstream adoption, as highlighted in the Trikon ecosystem analysis.

Moreover, the elimination of slippage through omnichain liquidity and professional RFQ models means that users and institutions alike gain access to predictable pricing and deep cross-chain markets. This is a fundamental requirement for serious capital to flow into DeFi, as it aligns with the reliability and transparency expected from traditional finance.

What’s Next: The Road to Unified Blockchain Interoperability

The trajectory is clear: seamless blockchain interoperability is no longer a distant vision but an unfolding reality. As more protocols adopt chain abstraction, the ecosystem will converge toward a unified liquidity layer, where users interact with DeFi as a single, borderless financial playground. The next wave of DeFi growth will be defined not by new chains or isolated protocols, but by the depth of integration and fluidity between them.

For users, this means the freedom to move assets, execute trades, and access new financial primitives, regardless of where liquidity resides. For builders, it opens a canvas for innovation unconstrained by network silos. And for the industry as a whole, it’s a structural shift that redefines what’s possible in open finance.

Key Benefits of Chain Abstraction for DeFi Users

-

Unified User Experience: Chain abstraction delivers a single interface for managing assets and interacting with dApps across multiple blockchains, eliminating the need for multiple wallets or switching networks.

-

Enhanced Security and Asset Management: Wallet abstraction allows users to control assets on multiple blockchains with a single private key, reducing security risks and simplifying portfolio management.

-

Seamless Cross-Chain NFT and Token Transfers: Solutions like LayerZero’s Gas Station and OMOSwap enable users to move NFTs and tokens across chains without manual bridging or gas management.

The bottom line: chain abstraction is not just a technical milestone, but a macro-level turning point for decentralized finance. It’s the connective tissue that will enable DeFi to scale from early adopters to global financial infrastructure, seamless, gasless, and without limits.