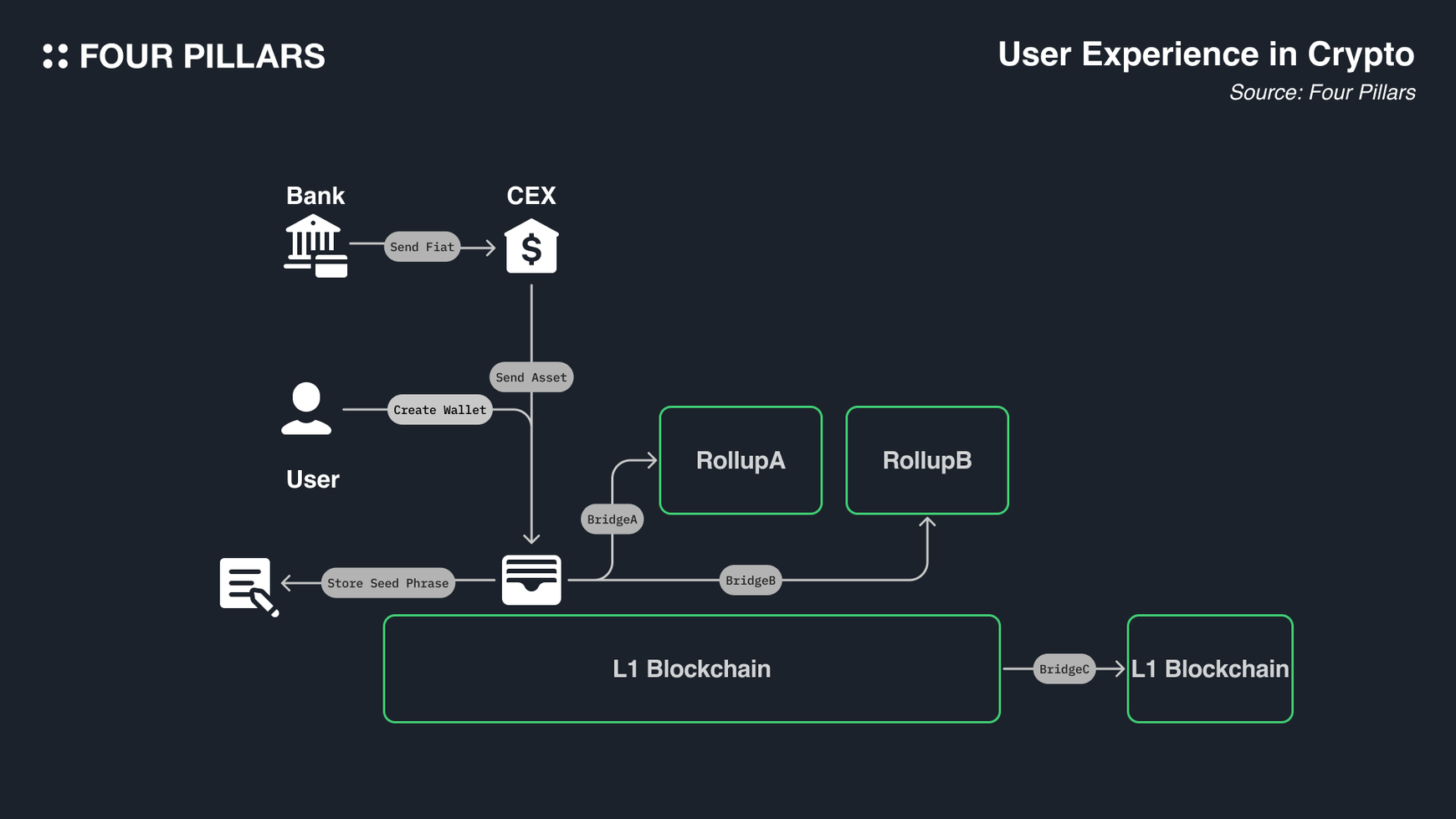

Decentralized finance (DeFi) has evolved rapidly, but interacting across multiple blockchains still presents significant hurdles for users and developers alike. Gas fees, liquidity fragmentation, and unpredictable slippage remain persistent obstacles. Chain abstraction is emerging as a transformative solution, enabling gasless cross-chain transactions and zero slippage swaps: two capabilities that are fundamentally reshaping the DeFi user experience.

Why Chain Abstraction Matters for DeFi

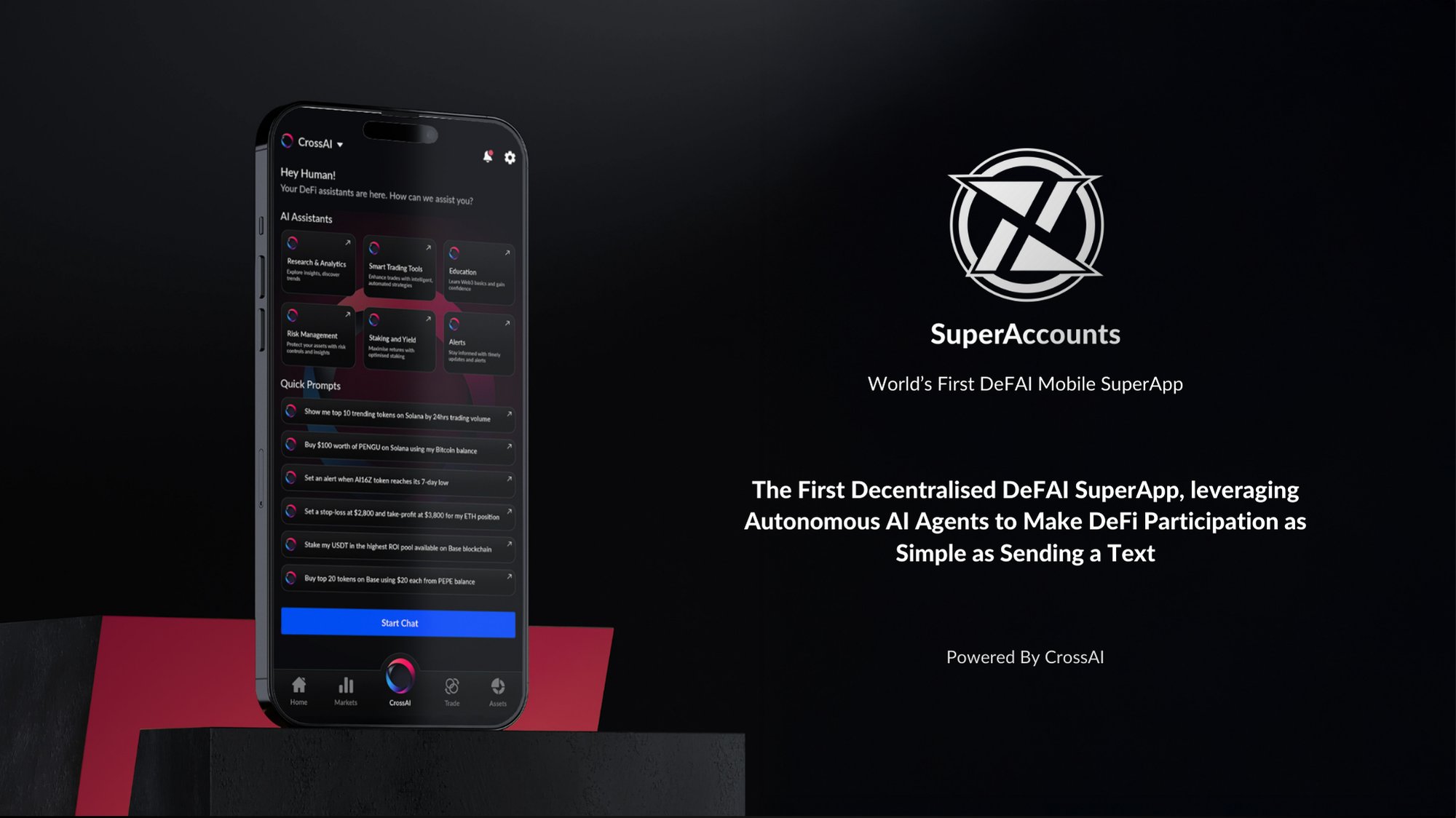

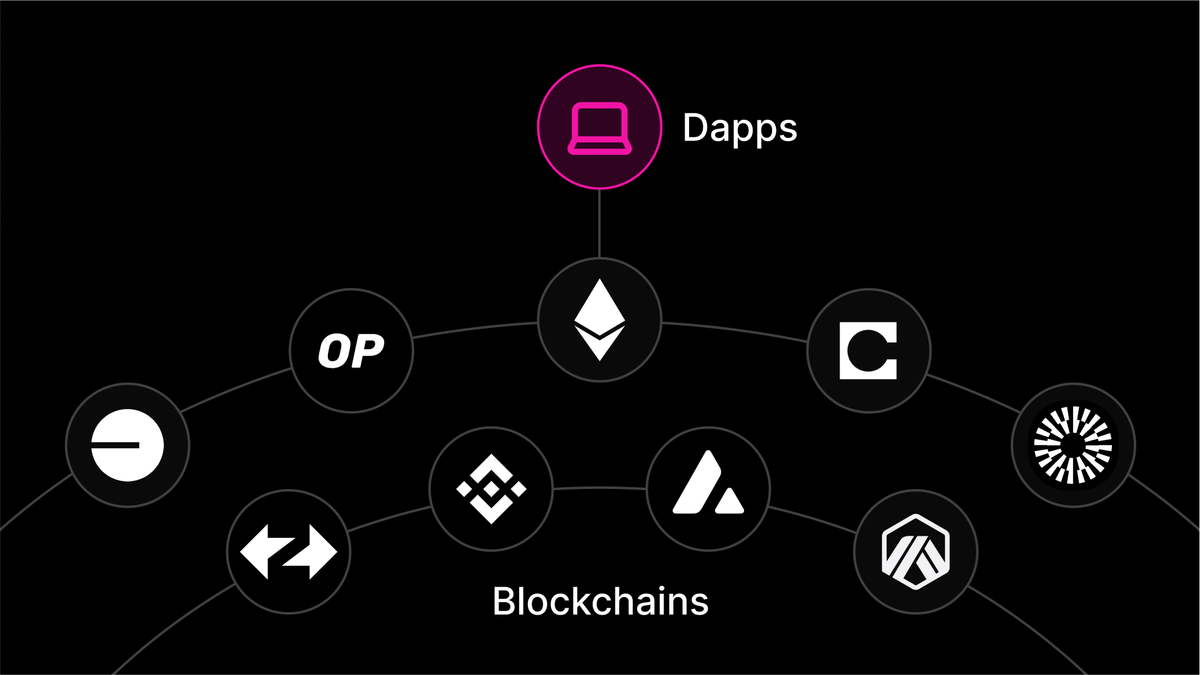

At its core, chain abstraction DeFi is about removing the technical and financial friction that comes with navigating multiple blockchain networks. Instead of juggling several wallets, sourcing native gas tokens, or worrying about price slippage during swaps, users interact through a unified interface. Platforms like zkCross Network and Arcana Network are at the forefront, offering wallet abstraction, gas abstraction, and aggregated liquidity layers that make DeFi truly accessible.

According to the zkCross documentation, chain abstraction integrates wallet management, gas fee handling, and cross-chain liquidity access into a single seamless experience. This is not just a theoretical upgrade, it’s already powering platforms where users no longer need to hold native tokens like ETH, BNB, or MATIC just to pay transaction fees. Instead, gas fees are managed behind the scenes via meta-transaction layers, relayer networks, and smart routing protocols.

Gasless Transactions: Making Blockchain UX Invisible

One of the most significant pain points for DeFi users is the need to acquire and manage gas tokens for every blockchain they interact with. Gas abstraction solves this by allowing users to pay fees in any supported token, or in some cases, skip gas fees entirely. Platforms like Jumper Exchange have already processed tens of thousands of gasless cross-chain swaps, moving millions of dollars in assets without friction.

This is achieved through a combination of meta-transactions, gas relayers, and smart contract logic that abstracts away the complexity. For example, a user swapping USDC on Ethereum for USDT on Polygon doesn’t need to hold ETH or MATIC. The platform handles gas payment, often subsidizing it or charging a small fee in the swapped asset itself. This approach not only lowers the barrier to entry but also makes DeFi more predictable and less intimidating for newcomers.

Key Benefits of Gasless Cross-Chain DeFi Transactions

-

Seamless User Experience: Gasless cross-chain transactions remove the need for users to manage multiple wallets or hold native gas tokens for each blockchain, enabling effortless asset transfers across networks through unified interfaces like zkCross Network.

-

Cost Efficiency: By eliminating gas fees, platforms such as Jumper Exchange allow users to move assets across chains without incurring unpredictable costs, making DeFi participation more affordable and accessible.

-

Slippage-Free Swaps: Chain abstraction frameworks aggregate liquidity and optimize trade routes, ensuring that cross-chain swaps on platforms like Symbiosis Finance are executed with minimal or no slippage, preserving expected asset values.

-

Unified Liquidity Access: Liquidity aggregation across multiple blockchains, as seen on Self Chain, enables users to tap into deeper liquidity pools, reducing fragmentation and improving trade execution.

-

Enhanced Security and Simplicity: Solutions like Arcana Network leverage account abstraction and intent-based architecture, minimizing manual steps and reducing risks associated with managing multiple private keys and gas tokens.

Zero Slippage Swaps: Aggregating Liquidity for Predictable Outcomes

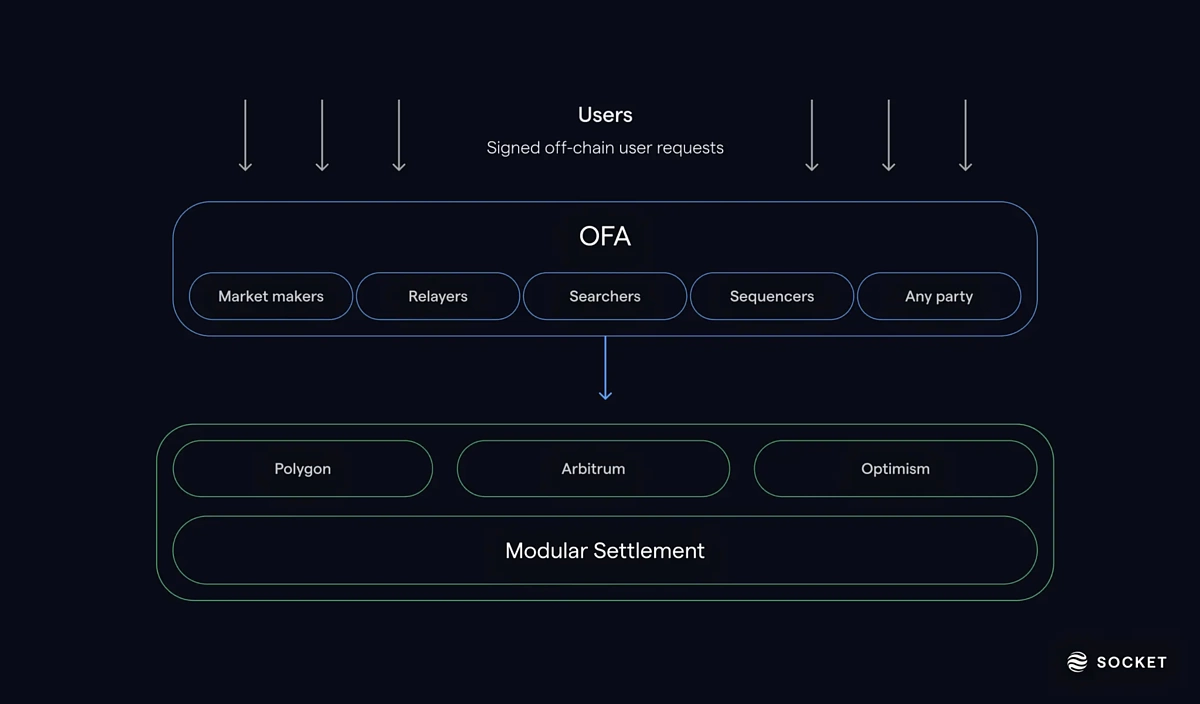

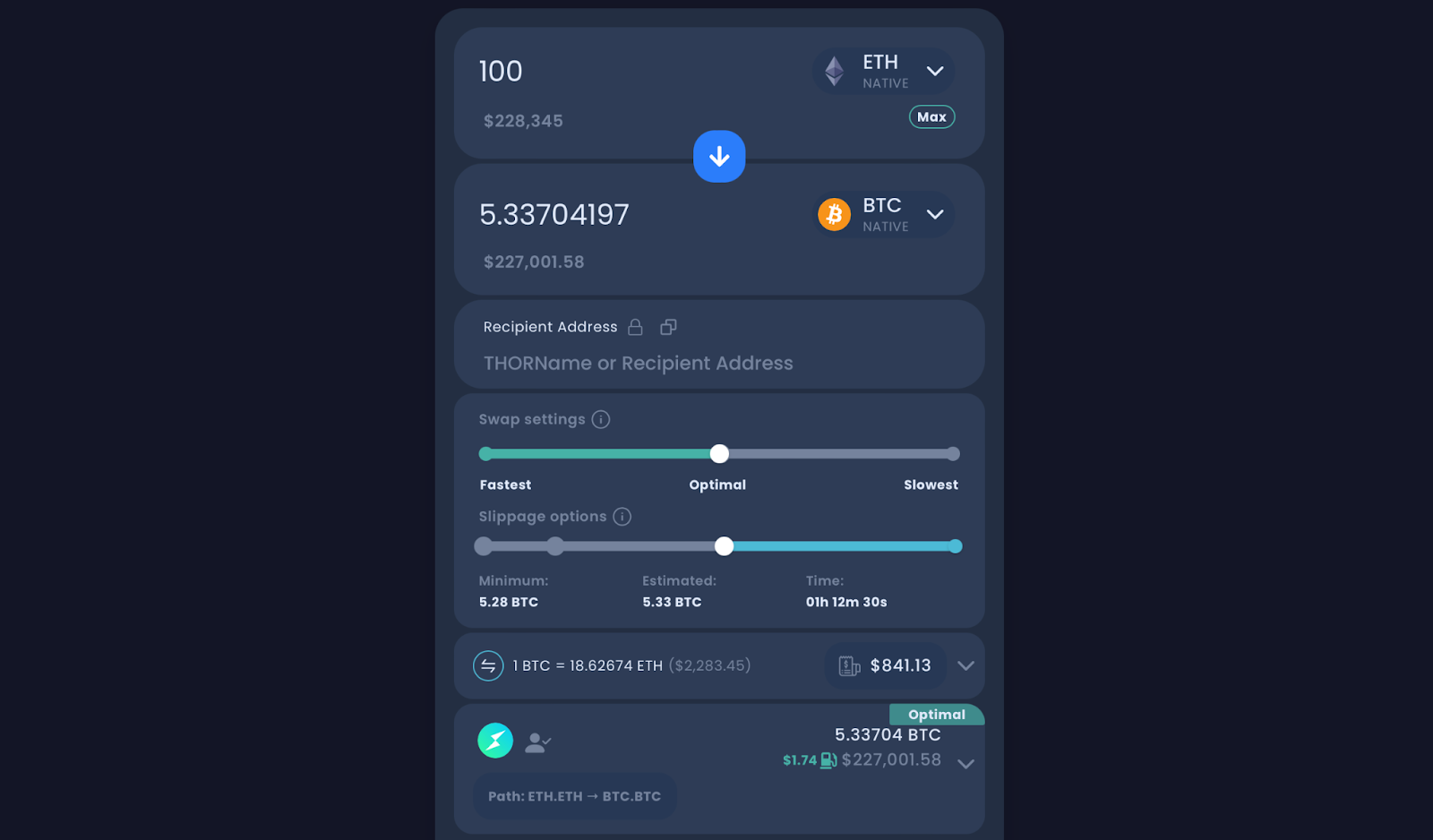

Slippage, the difference between the expected and actual price of a trade, can erode returns and introduce uncertainty, especially when moving assets across fragmented liquidity pools. Zero slippage swaps blockchain protocols address this by aggregating liquidity from multiple decentralized exchanges (DEXs) and chains, then optimizing trade execution for the best possible outcome.

Platforms like Symbiosis Finance and zkCross leverage unified liquidity layers and atomic swap technology. This ensures that trades are executed at the intended price, with no surprises due to market movements or insufficient liquidity. The result is a seamless blockchain UX: users can swap assets across 30 or more chains in a single click, confident that the amount they receive matches their expectations.

This unified approach is made possible by cross-chain messaging frameworks and intent-based swaps, which batch backend operations and execute them atomically. By doing so, the entire process becomes not only slippage-free but also highly efficient, removing the need for users to manually compare DEX rates or bridge assets themselves.

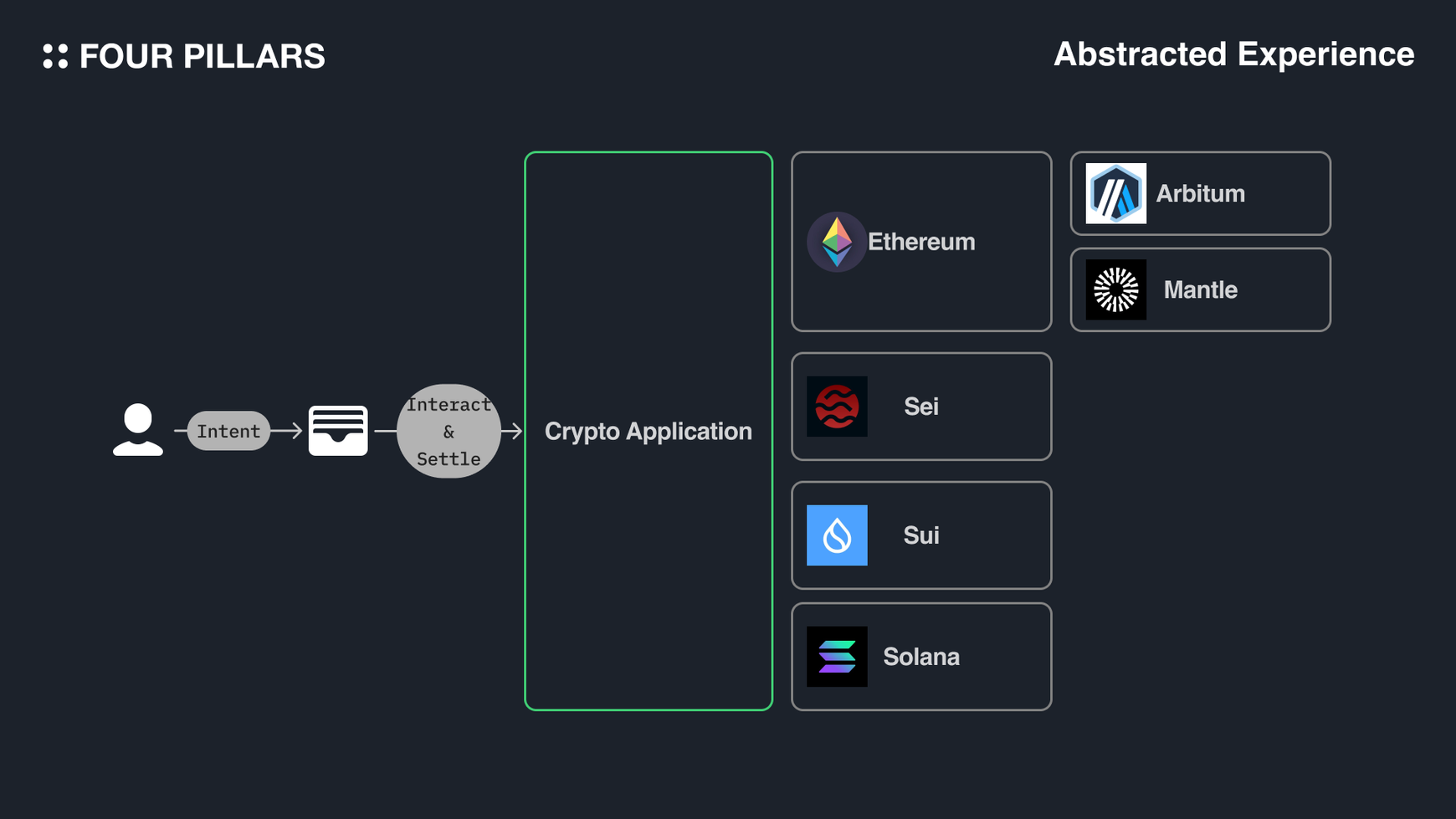

Real-world adoption of these innovations is accelerating. For instance, Arcana Network and Self Chain have demonstrated how intent-centric architecture and keyless wallets can create a genuinely seamless DeFi journey. By abstracting away the technical details, these platforms empower users to focus on strategy and value creation, not on navigating the underlying infrastructure.

Liquidity aggregation remains a crucial pillar. Instead of splitting liquidity across countless pools and bridges, unified liquidity layers allow users to tap into the deepest pools available across chains. This approach reduces fragmentation, a long-standing issue in DeFi, and helps ensure that even large trades can be executed without excessive slippage or failed transactions. The result is a more resilient ecosystem where capital efficiency is maximized, and users no longer have to compromise between convenience and execution quality.

How Developers Benefit from Chain Abstraction

For builders, chain abstraction offers a radically simplified development experience. Instead of integrating with multiple networks, handling diverse wallet standards, and managing gas logistics for each chain, developers can leverage unified SDKs and APIs. This not only reduces time-to-market but also unlocks new possibilities for cross-chain dApps that would have been prohibitively complex just a year ago.

Moreover, account abstraction (AA) protocols enable programmable smart accounts that can automate fee payments, signature management, and even transaction batching. This flexibility allows developers to design applications that are both secure and user-friendly, an essential combination for mainstream adoption.

Top Advantages of Chain Abstraction for DeFi Developers

-

Simplified Multi-Chain Development: Chain abstraction unifies interactions across multiple blockchains, allowing developers to build dApps that operate seamlessly on different networks without custom integrations for each chain. This streamlines development and reduces maintenance overhead.

-

Gasless Transaction Enablement: With gas abstraction, developers can offer users gasless transactions, removing the need to hold native gas tokens for each blockchain. This is achieved through meta-transaction layers and relayer networks, greatly enhancing user onboarding and retention.

-

Slippage-Free Cross-Chain Swaps: Liquidity aggregation and optimized trade routing within chain abstraction frameworks enable atomic, slippage-free asset swaps across multiple chains. This ensures predictable outcomes for users and simplifies the integration of cross-chain DeFi features.

-

Unified Liquidity Access: By aggregating liquidity from various decentralized exchanges and chains, chain abstraction allows developers to tap into larger, more efficient liquidity pools. This reduces fragmentation and improves capital efficiency for DeFi protocols.

-

Enhanced User Experience: Chain abstraction abstracts away the complexity of wallet management, gas fee handling, and cross-chain operations. Developers can deliver a more intuitive and accessible user interface, lowering barriers to entry for new users.

The Road Ahead: Toward a Unified DeFi Experience

The progress made by platforms like zkCross Network, Arcana, Self Chain, and Symbiosis Finance signals a broader shift in the blockchain landscape. As more protocols adopt chain abstraction, we can expect several trends to accelerate:

- Greater composability: Cross-chain dApps will interoperate more easily, creating new financial primitives and services.

- Reduced onboarding friction: Gasless transactions and unified wallets will lower barriers for non-technical users.

- Improved security: By minimizing manual bridging and asset transfers, risk exposure is reduced for end users.

- Expanded liquidity access: Aggregated liquidity will make DeFi markets deeper and less volatile.

Chain abstraction is not just about convenience, it’s about unlocking the full potential of decentralized finance by removing legacy limitations. As the technology matures, expect to see even more sophisticated features: real-time intent-based swaps, universal gas tokens, and AI-driven routing that adapts dynamically to market conditions.

The future of DeFi hinges on its ability to offer a seamless blockchain UX that rivals or surpasses traditional finance. With chain abstraction leading the charge, gasless cross-chain transactions and zero slippage swaps are no longer distant aspirations, they are rapidly becoming the new standard for decentralized finance.