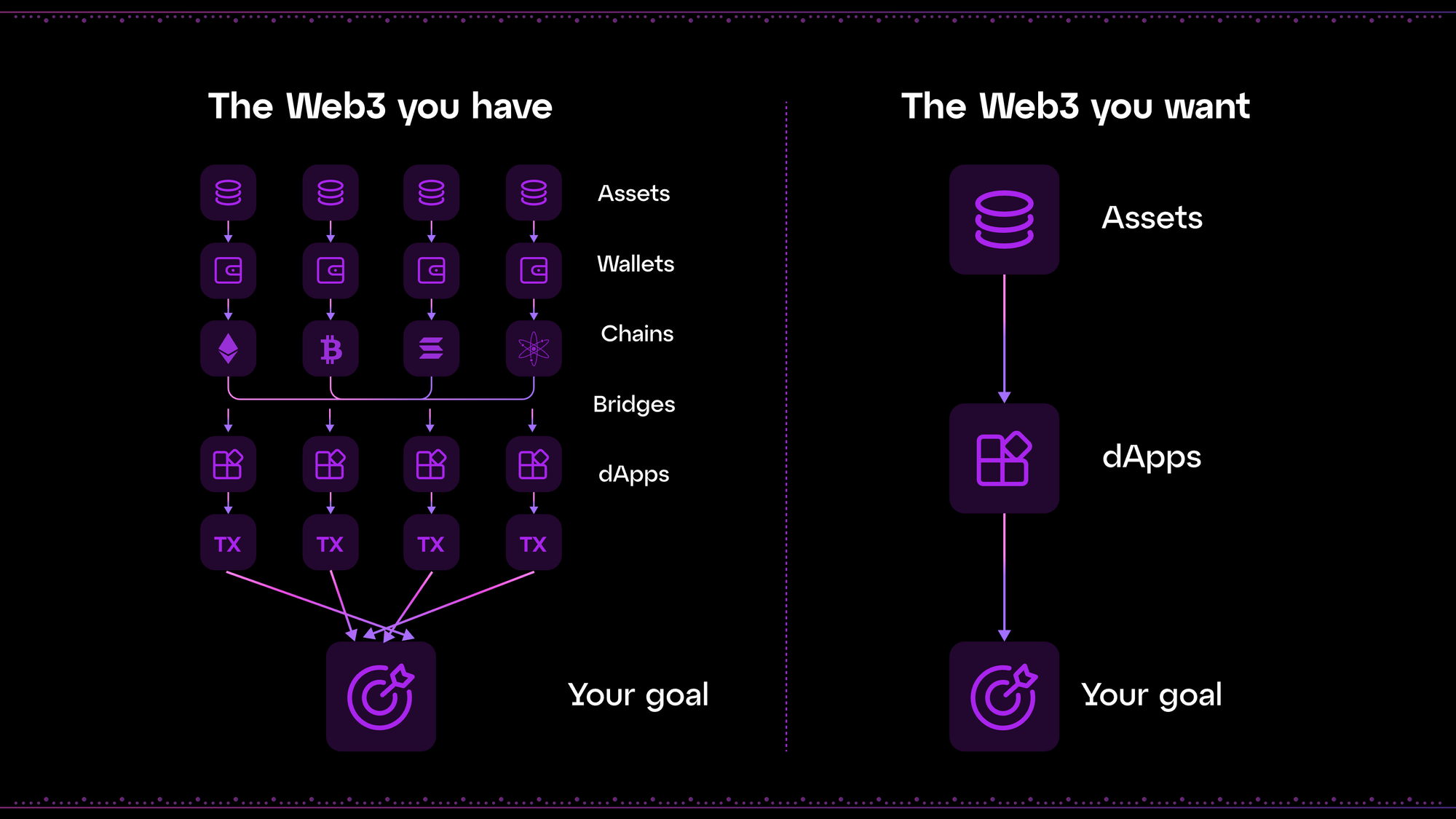

The rise of chain abstraction wallets marks a fundamental shift in how users interact with decentralized finance. In previous market cycles, DeFi was defined by friction: managing multiple wallets, holding native tokens for gas on every chain, and navigating labyrinthine bridges to move assets from one blockchain to another. Today, a new paradigm is emerging, one where the boundaries between chains fade into the background and cross-chain swaps become as simple as a single click.

The End of Fragmented DeFi UX

At the heart of this transformation is chain abstraction. By hiding the underlying complexity of different blockchains, chain abstraction wallets provide an intuitive, unified interface that lets users manage assets across dozens of networks without ever switching tabs or worrying about technical details. As highlighted by zkCross Network, these solutions eliminate the need for juggling multiple wallets and enable seamless access to DeFi protocols regardless of where your assets reside.

This leap forward is not just cosmetic. It fundamentally changes the economics and psychology of DeFi participation. With one-click cross-chain swaps, users can now:

Top Benefits of Chain-Abstraction Wallets for DeFi Users

-

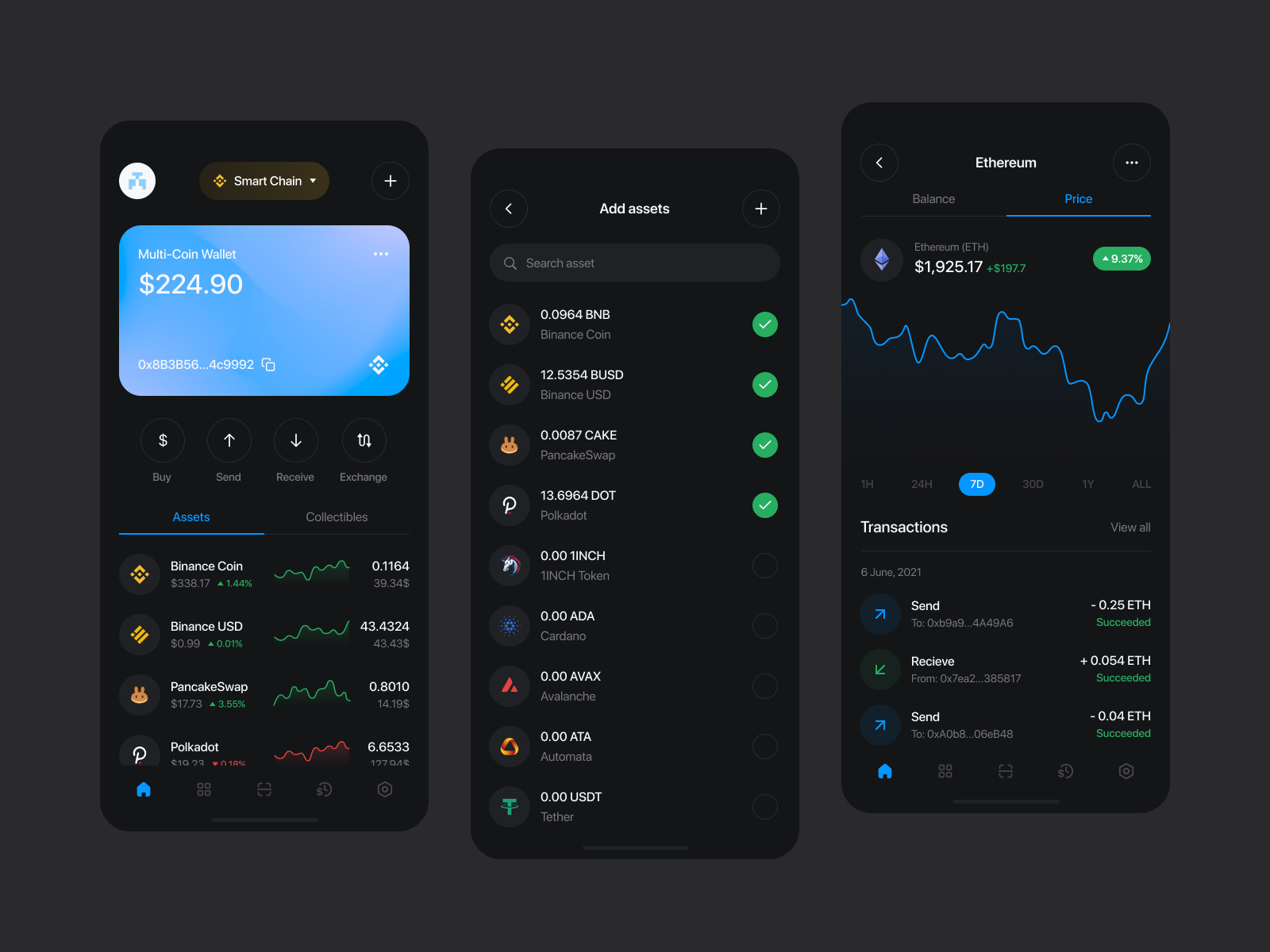

Unified Asset Management: Chain-abstraction wallets like zkCross Network and Omni Wallet allow users to manage assets across multiple blockchains from a single, intuitive interface, eliminating the need to juggle multiple wallets or switch networks.

-

One-Click Cross-Chain Swaps: By integrating liquidity from various DEXs and optimizing trade paths, these wallets enable seamless cross-chain swaps in just one click, reducing complexity and saving time for DeFi users.

-

Automated Gas Fee Management: Chain-abstraction wallets automatically handle gas fees across different blockchains, so users can transact without holding native tokens for each chain, making DeFi participation more accessible.

-

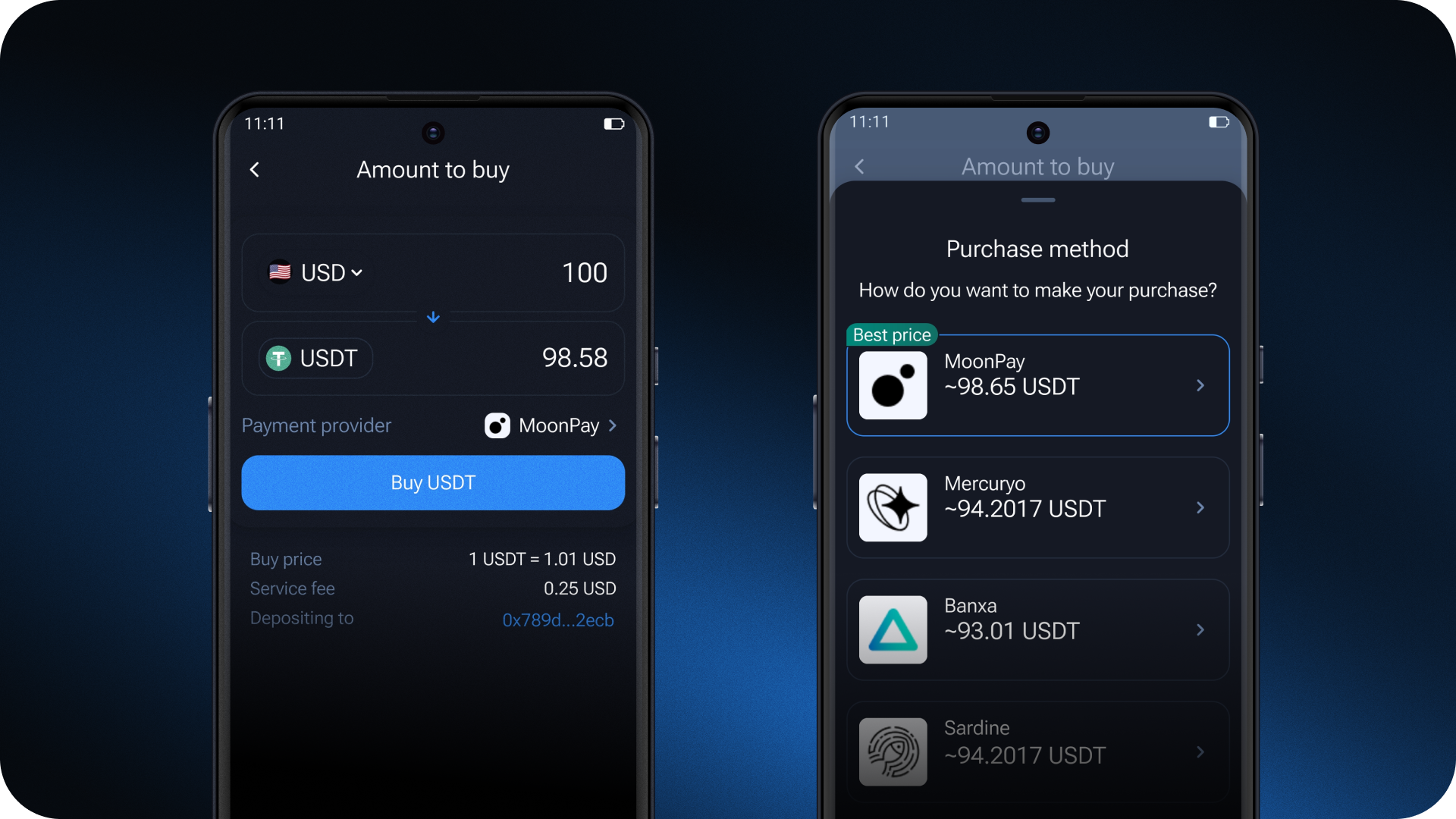

Integrated Fiat Onboarding: Some wallets, such as zkCross Network, offer built-in fiat-to-crypto services, streamlining the process of converting fiat currency to crypto directly within the wallet.

-

Enhanced Security and Efficiency: By abstracting away complex processes like bridging and swapping, these wallets reduce the risk of user error and improve transaction efficiency, helping users interact with DeFi protocols more safely and confidently.

Instead of orchestrating a multi-step process involving bridges, DEXes, and approvals on each network, everything is bundled into a single action. The wallet handles smart routing through liquidity pools and bridges behind the scenes, optimizing for speed, cost, and slippage.

How One-Click Cross-Chain Swaps Actually Work

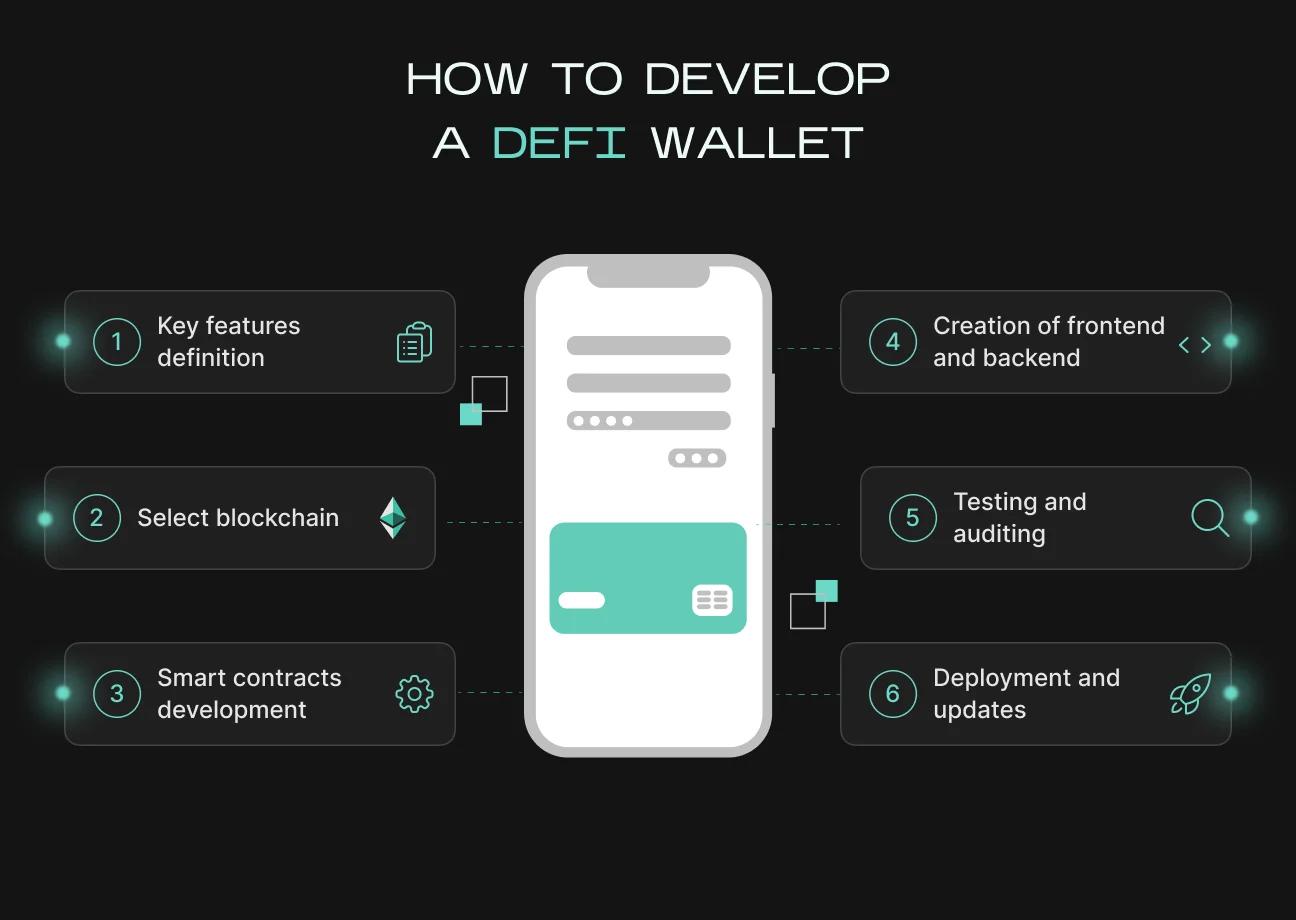

The magic comes from combining several innovations:

- Smart Routing Middleware: This technology dynamically scans available liquidity across integrated DEXes and bridges to find the optimal path for your trade.

- Automated Gas Fee Management: No need to keep small balances of native tokens like ETH or SOL on every chain. The wallet abstracts this away, sometimes even paying gas fees for you or allowing you to pay in any token you hold.

- Unified Wallet Interface: All your assets are visible in one place, with balances updated in real time across all supported blockchains.

The result is a user experience that feels more like Web2 fintech than traditional crypto, a critical step if DeFi is ever to reach mainstream adoption.

Pioneers in Unified DeFi Wallets

A number of projects are racing to define this new standard for frictionless DeFi trading. For example:

- zkCross Network: Offers infrastructure that unifies blockchain interactions and enables effortless asset management across chains.

- Omni Wallet: Supports over 27 blockchains with seamless bridging and swapping capabilities.

- Rhino.fi Wallet: Provides native bridging and swapping without requiring users to switch interfaces or handle technical details.

This surge in innovation has led to near-instant transactions, often under 20 seconds, and near-zero learning curve for new users. The days of paying unnecessary bridge fees or missing out on yield opportunities due to network silos are rapidly fading into history.

Why Seamless Cross-Chain UX Matters Now

The timing could not be more critical. As capital continues to flow into decentralized protocols and institutional interest grows, UX will be the ultimate gatekeeper for mass adoption. Chain abstraction wallets are not just smoothing over rough edges, they are redefining what it means to participate in an open financial system where value can move freely between platforms at internet speed.

For the first time, DeFi participants can focus on strategy and opportunity rather than technical hurdles. This is more than a convenience upgrade; it is a structural change that unlocks new composability between protocols, chains, and liquidity sources. By abstracting away the plumbing, chain abstraction wallets empower users to execute complex moves, arbitrage, yield optimization, multi-chain portfolio rebalancing, with the same ease as sending a single transaction.

Consider the implications for both seasoned traders and newcomers. Advanced users can now automate intricate workflows that previously required manual intervention across multiple platforms. Meanwhile, first-time DeFi explorers are no longer daunted by gas tokens or network selection, they simply see their assets and act.

Cross-Chain Liquidity Aggregation: The Next Frontier

The real engine behind this seamless experience is cross-chain liquidity aggregation. By integrating liquidity pools from across networks, these wallets ensure users get the best price with minimal slippage. Smart routing middleware constantly scans for optimal trade paths, sometimes splitting orders between DEXes or leveraging bridges only when necessary.

When you stop thinking about which chain you’re on and just focus on your next move, that’s when DeFi becomes truly global.

This aggregation does more than just save money; it creates a unified market where capital efficiency improves for everyone. Liquidity is no longer fragmented by blockchain boundaries but pooled into a deeper, more resilient ocean of opportunity.

Key Features Driving Adoption

Most Requested Features in DeFi Unified Wallets

-

Unified Multi-Chain Asset Management: Users want to view and manage all their crypto assets across multiple blockchains from a single, streamlined wallet interface, eliminating the need to juggle different wallets or apps.

-

1-Click Cross-Chain Swaps: The ability to swap tokens between different blockchains in a single transaction is highly sought after, reducing friction and saving time for DeFi users.

-

Automated Gas Fee Handling: DeFi users frequently request wallets that automatically manage gas fees across chains, so they don’t need to hold or manually acquire native tokens for every network.

-

Integrated Fiat On-Ramp: Seamless fiat-to-crypto onboarding within the wallet is a top priority, enabling users to purchase crypto assets directly without leaving the platform.

-

Native Bridging and Swapping: Built-in support for bridging and swapping assets between chains—without needing external dApps—remains a core demand for unified wallet users.

-

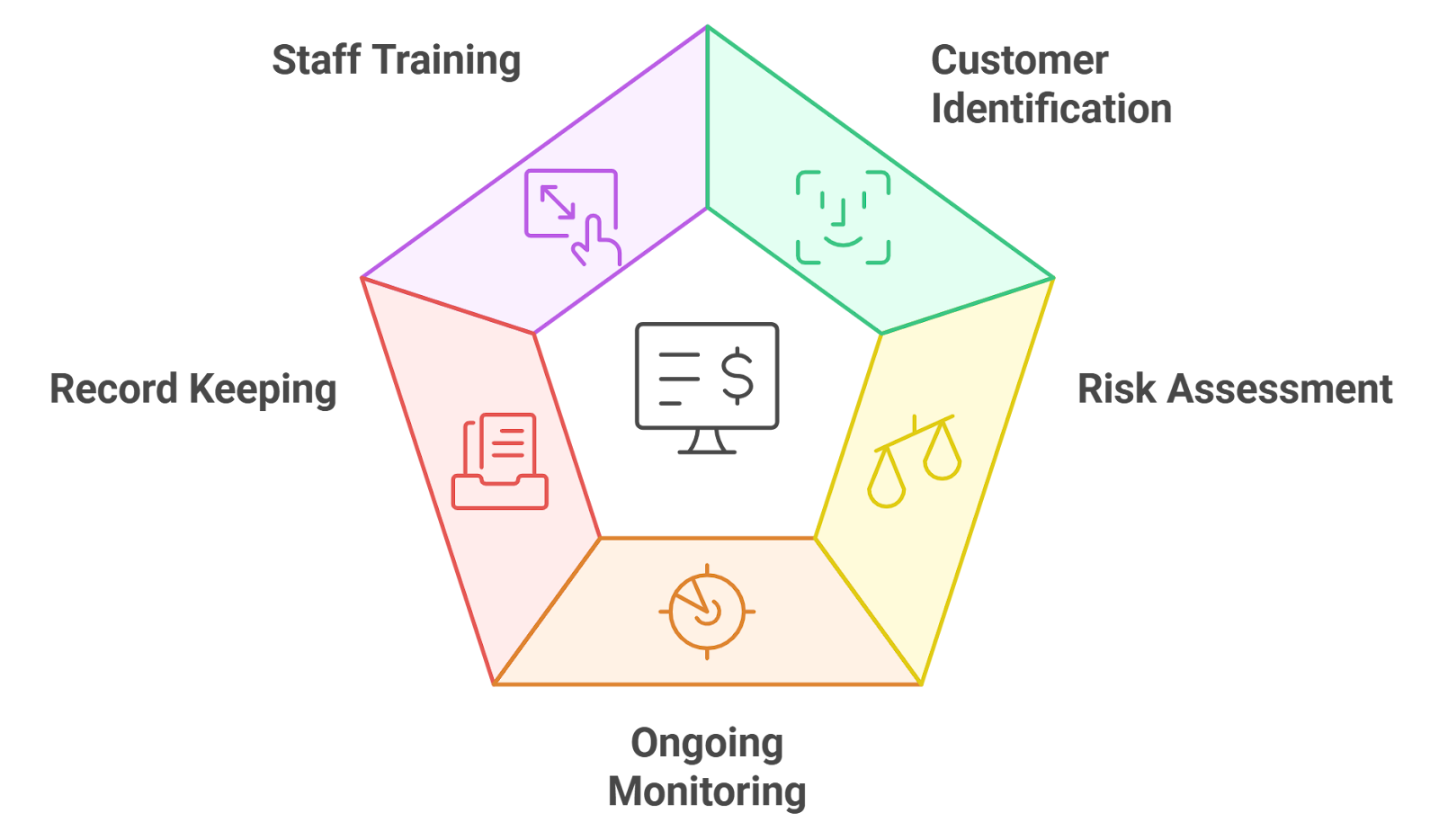

Comprehensive Security and Recovery Options: Users expect robust security features, including multi-factor authentication and easy wallet recovery methods, to safeguard their assets across all supported chains.

-

Access to Cross-Chain DeFi Protocols: Direct integration with major DeFi protocols on different blockchains allows users to interact with lending, staking, and yield platforms from one wallet.

The competitive landscape is evolving rapidly. As highlighted by zkCross Network, projects are racing to add support for new chains, integrate fiat ramps directly into wallets, and offer gasless transactions. Omni Wallet and Rhino. fi are pushing the envelope on UX simplicity and transaction speed, two factors that will define winners in this space.

The strategic question now shifts from “Which network has the best yield?” to “How do I access all opportunities with minimal friction?” Chain abstraction wallets provide that answer, and in doing so, they may become the default gateway not only for DeFi but for all crypto-native activity.

Zooming Out: The Big Picture

If we zoom out beyond today’s technical milestones, it’s clear that seamless cross-chain UX points toward a future where blockchain fades into infrastructure. Users will expect, and demand, the ability to move value anywhere instantly without understanding what happens under the hood. This transition mirrors previous waves of internet adoption: complexity recedes as new layers of abstraction unlock exponential growth.

The most successful DeFi unified wallet projects will be those that anticipate this shift and invest relentlessly in user-centric design, robust security models, and deep liquidity integration. The race is on, not just to capture market share but to define what financial sovereignty looks like in an interoperable world.