In 2024, the landscape of cross-chain trading is undergoing a radical transformation. The persistent friction points that once defined the user experience (UX) of decentralized finance (DeFi) are being systematically dismantled by a new wave of technical and design innovations. As blockchain interoperability matures, seamless asset swaps and unified wallet management are no longer aspirational, they are rapidly becoming table stakes for any platform seeking mass adoption.

Drawing from the latest Cross-Chain Interoperability Report 2024 and recent advances in intent-based architectures, this article identifies and analyzes the four most impactful UX breakthroughs driving down friction in cross-chain trading:

Top UX Innovations Reducing Cross-Chain Trading Friction in 2024

-

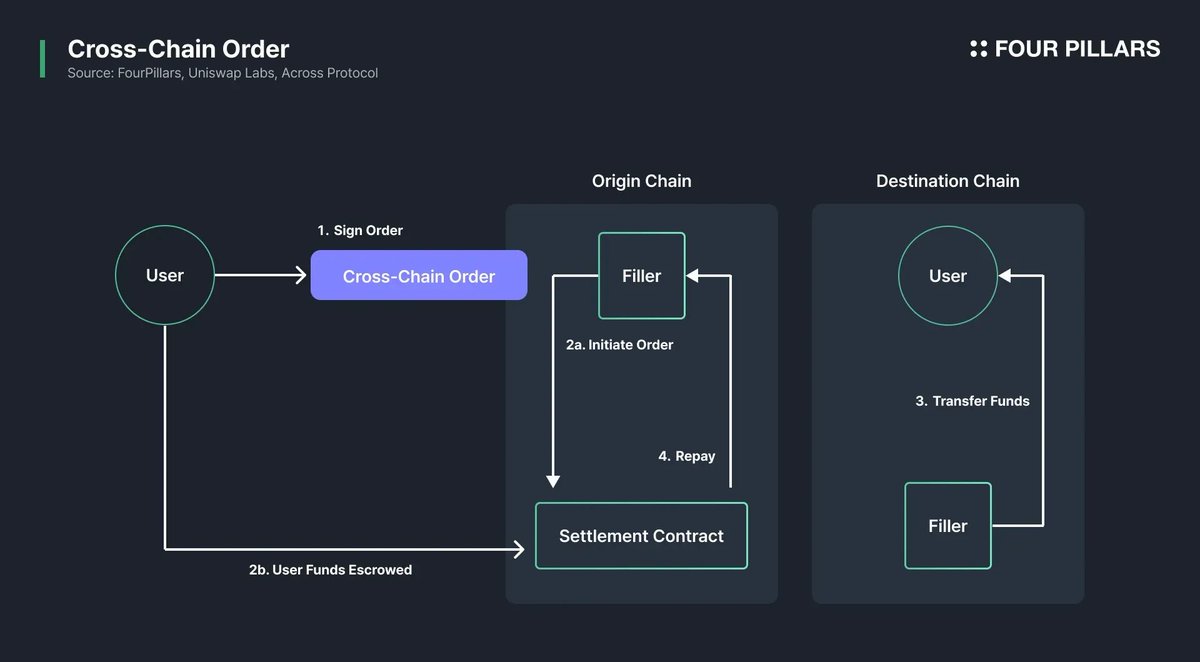

Single-Approval Cross-Chain Transaction Flows: Platforms like Across Protocol and UniswapX have pioneered intent-based architectures, enabling users to approve and execute multi-step cross-chain swaps with a single click. This innovation leverages standards such as ERC-7683 to abstract away complex execution paths, dramatically reducing user abandonment and streamlining the trading experience.

-

Unified Cross-Chain Trading Interfaces: Solutions such as Rango Exchange and LI.FI aggregate liquidity and bridge routes across multiple blockchains within a single, cohesive interface. This eliminates the need for users to navigate multiple dApps or wallets, providing a seamless, all-in-one trading environment.

-

Integrated Cross-Chain Gas Fee Abstraction: Projects like Mitosis and Socket have introduced gas abstraction layers that allow users to pay transaction fees in any supported token, regardless of the destination chain. This innovation removes a major pain point in cross-chain trading by simplifying fee management and enhancing accessibility.

-

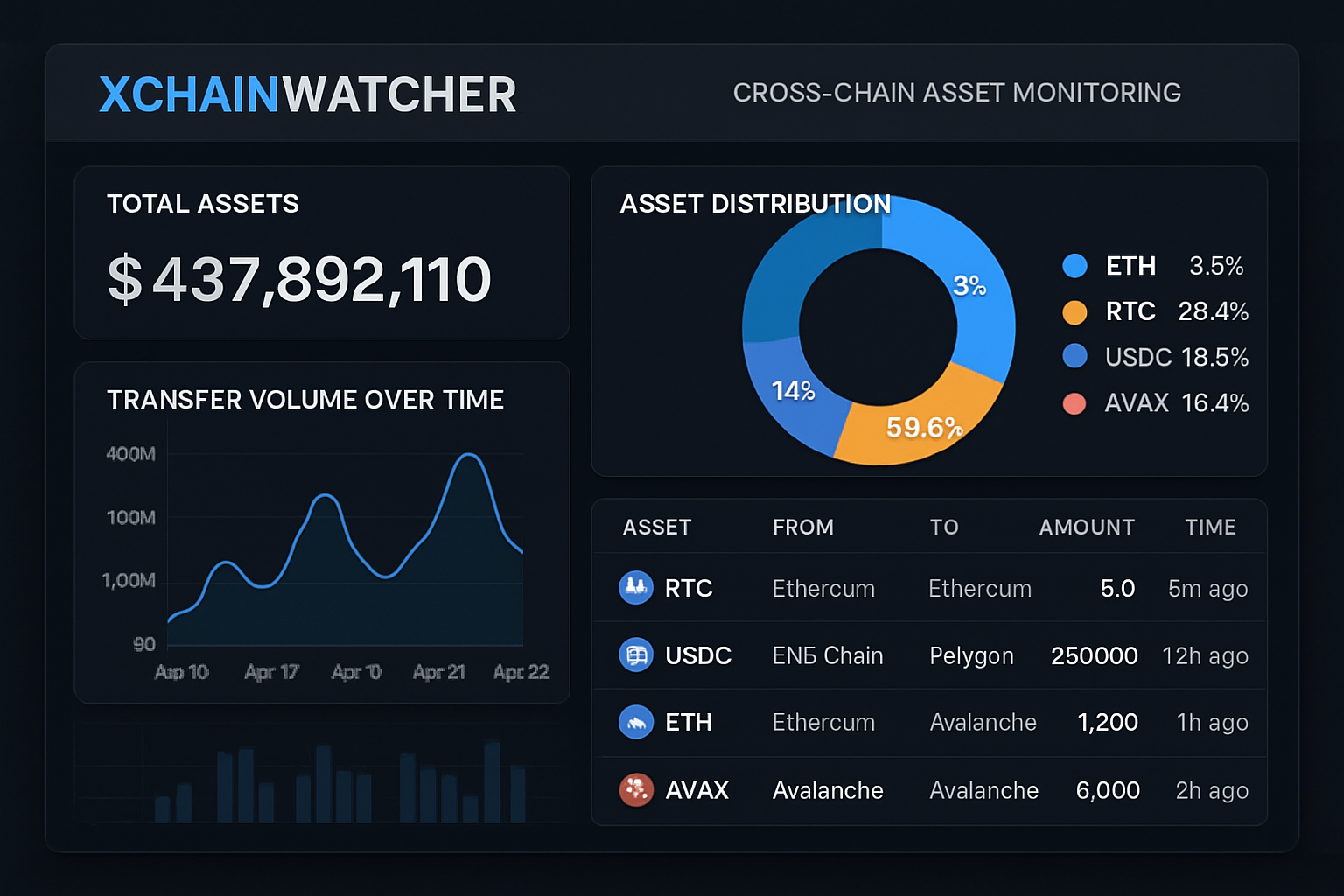

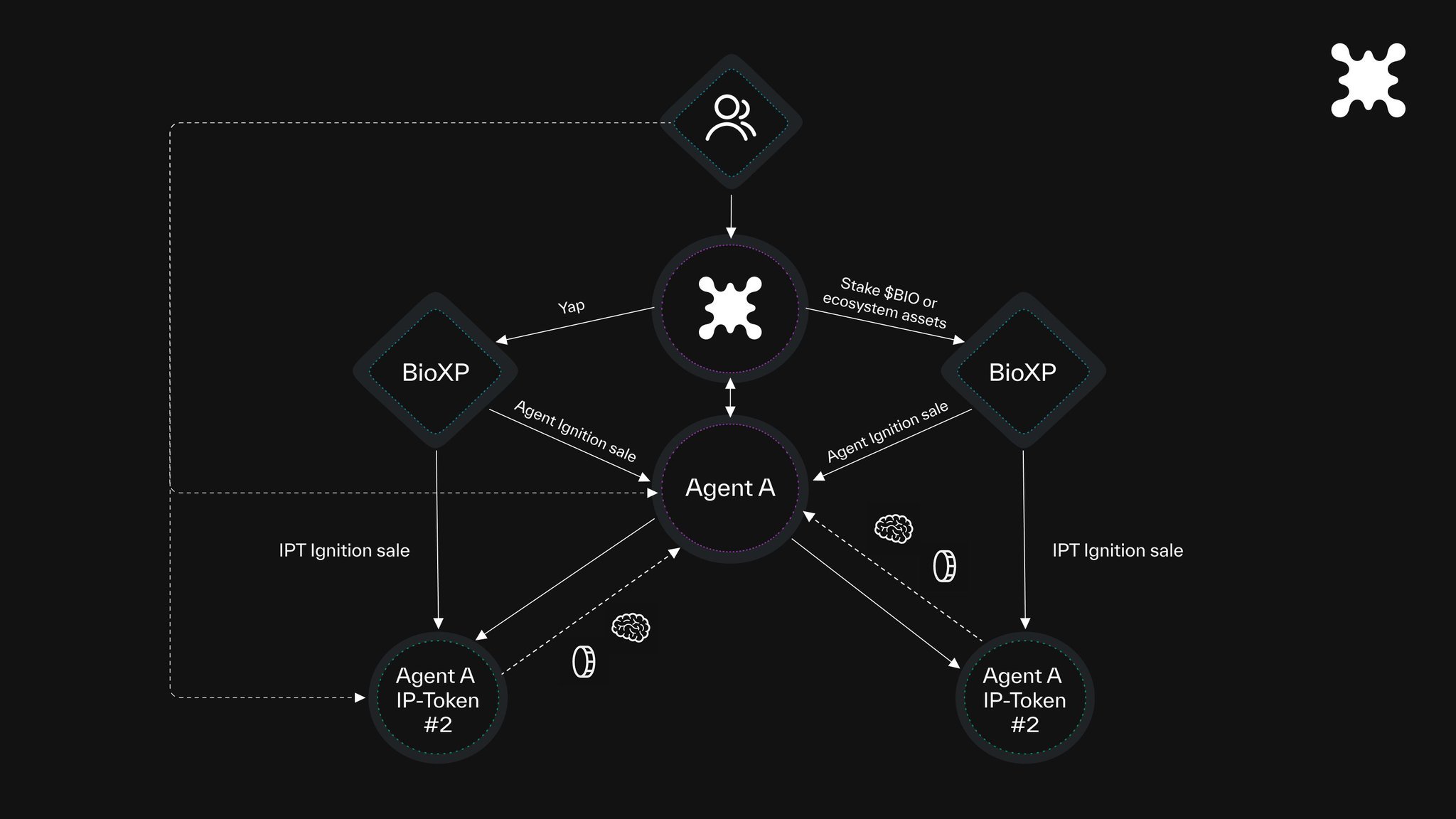

Real-Time Cross-Chain Asset Tracking and Notifications: Tools such as XChainWatcher provide real-time monitoring of cross-chain asset transfers and bridge security. Users receive instant notifications about transaction status and potential vulnerabilities, increasing transparency and trust in cross-chain operations.

Single-Approval Cross-Chain Transaction Flows

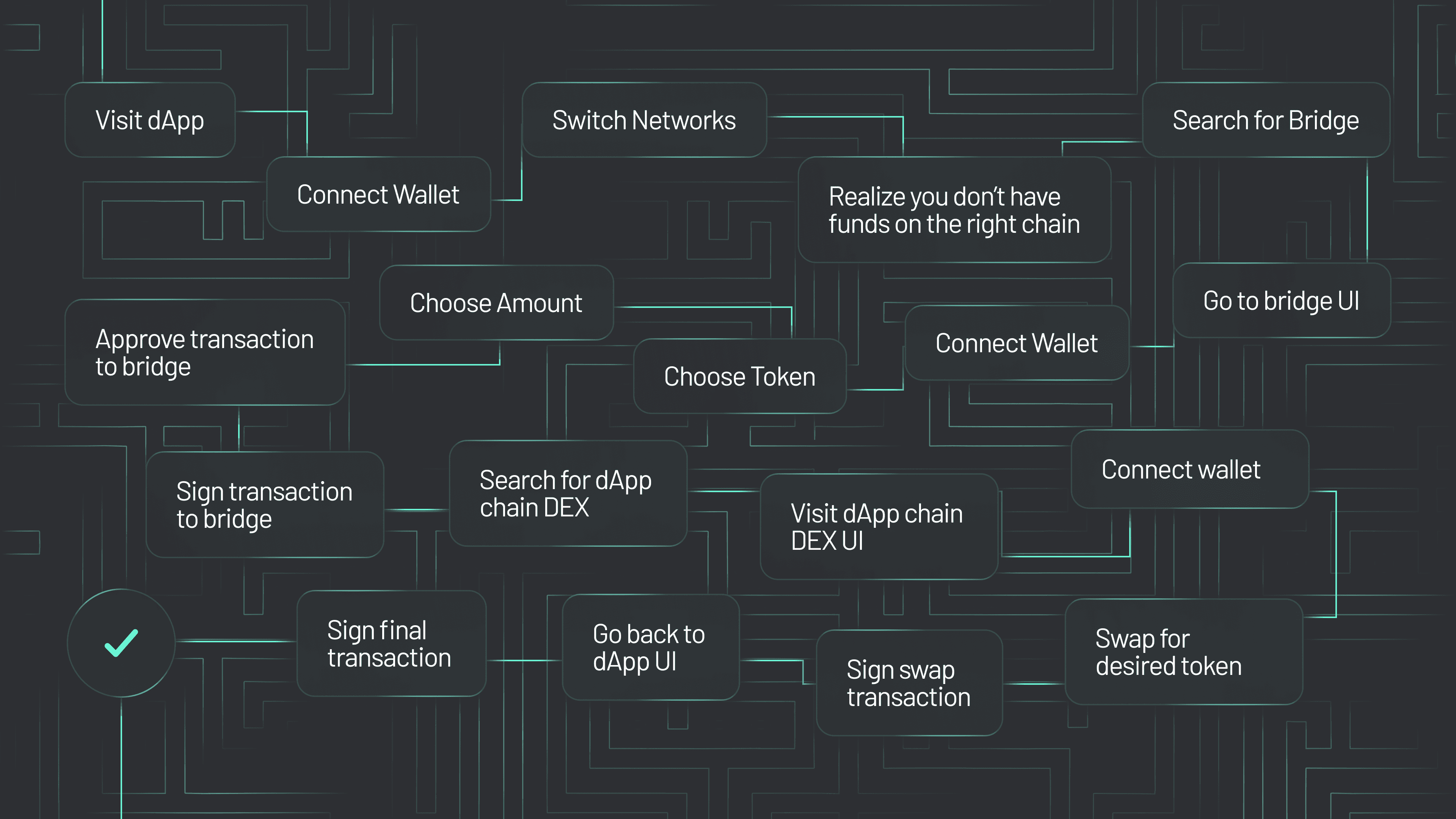

The traditional multi-step approval model for swapping assets across blockchains has long been a source of user frustration and abandonment. In 2024, single-approval cross-chain transaction flows are emerging as a game-changer. By leveraging intent-based protocols such as ERC-7683, users can now authorize complex multi-hop swaps with one click, eliminating repetitive confirmation dialogs and reducing cognitive load. Platforms like UniswapX and Across Protocol have already implemented these flows, reporting measurable drops in failed transactions and increased throughput.

This innovation is not just about convenience, it directly addresses security risks by minimizing the opportunities for phishing or mis-signing events during fragmented approval steps. The net result is a more intuitive, streamlined experience that appeals to both crypto veterans and newcomers alike.

Unified Cross-Chain Trading Interfaces

The proliferation of siloed blockchain networks brought with it fragmented interfaces, each with its own quirks, visual language, and learning curve. In response, developers have prioritized unified cross-chain trading interfaces that abstract away network complexity entirely. These interfaces aggregate liquidity sources, present consistent UI elements regardless of underlying chain, and allow users to execute trades without toggling between wallets or dApps.

According to the latest research on intent-driven architecture, such interfaces not only enhance usability but also reduce error rates associated with manual network switching, a key barrier identified in prior years’ UX audits. The real impact is seen in metrics like time-to-trade completion and user satisfaction scores, both of which show marked improvement on platforms deploying unified designs.

Integrated Cross-Chain Gas Fee Abstraction

One of the most persistent pain points in cross-chain swaps has been managing native token balances for gas fees on multiple chains. The mental overhead of calculating required ETH here, AVAX there, and ensuring you never run dry mid-swap, has historically deterred all but the most committed DeFi users.

This is changing rapidly thanks to integrated gas fee abstraction layers pioneered by projects like Mitosis. Users can now pay transaction fees using any supported token across chains; platforms handle conversion behind the scenes using standardized wrappers or liquidity pools (e. g. , miAssets). This not only reduces failed transactions due to insufficient gas but also increases capital efficiency by freeing up otherwise idle assets. For developers aiming at mainstream adoption, this is a non-negotiable feature going forward.

The Data Behind Friction Reduction

Recent academic research on Omnichain frameworks supports these trends: intent-driven execution combined with modular proof networks enables scalable UX improvements without sacrificing security or composability. As more protocols adopt these standards, expect further convergence toward truly chain-agnostic trading experiences.

Real-Time Cross-Chain Asset Tracking and Notifications

Transparency and timely information are fundamental to user confidence in cross-chain trading. In 2024, real-time cross-chain asset tracking and notifications are closing the information gap that once plagued DeFi participants. Modern platforms now offer in-dashboard, push, or even on-chain notification systems that alert users to every stage of their transaction lifecycle: from initiation, through bridging, to final settlement across disparate networks.

These systems leverage advanced monitoring tools, such as XChainWatcher, to continuously scan for transaction status updates or security anomalies. Users receive immediate feedback if a bridge is congested, if a swap is delayed, or if an unexpected event occurs on any participating chain. This not only reduces anxiety but also empowers users to take corrective action in real time, dramatically reducing the risk of lost funds due to outdated information or silent failures.

Key insight: According to recent industry data, platforms with comprehensive real-time notifications see up to 30% fewer abandoned transactions and significantly higher user satisfaction scores compared to those lacking this feature.

4 Key UX Innovations Reducing Friction in Cross-Chain Trading

-

Single-Approval Flows: Platforms like UniswapX leverage intent-based architectures (e.g., ERC-7683) to enable one-click cross-chain swaps, eliminating repetitive confirmations and streamlining user actions.Benefit: Reduces transaction abandonment and speeds up trades.

-

Unified Interfaces: Solutions such as Across Protocol and Mitosis offer consolidated dashboards for managing assets across multiple blockchains, minimizing the need to switch between different apps or networks.Benefit: Simplifies navigation and enhances user confidence.

-

Integrated Gas Fee Abstraction: Protocols like Mitosis allow users to pay transaction fees in any supported token, removing the complexity of acquiring native gas tokens for each chain.Benefit: Lowers barriers to entry and improves accessibility for new users.

-

Real-Time Tracking & Security Monitoring: Tools such as XChainWatcher provide live monitoring of cross-chain bridge transactions, detecting vulnerabilities and suspicious activities as they happen.Benefit: Enhances trust and safeguards user assets during cross-chain operations.

Looking Ahead: Metrics That Matter for Cross-Chain Trading UX

The success of these innovations will ultimately be measured by hard data: reduced transaction abandonment rates, increased trade volumes per user session, lower average time-to-completion for swaps, and improved Net Promoter Scores (NPS). Platforms that can deliver seamless experiences while maintaining robust security will define the next era of DeFi growth.

As the sector evolves toward chain abstraction and unified wallet solutions, continuous monitoring of UX performance metrics will be essential. Stakeholders should prioritize iterative testing, leveraging real user feedback, to refine flows further and address emerging pain points proactively.

The future of cross-chain trading hinges on relentless attention to design detail paired with technical innovation. By focusing on these four core UX pillars in 2024, and beyond, the industry can finally deliver on its promise of accessible, efficient decentralized finance for all participants.